Your loan was declined at the bank? You may belong to a group of people who consider banks to be difficult cases designate. If you need a loan as: Trainee, student, during the probationary period, in the case of a fixed-term employment contractas an unemployed person, as a self-employed person, as a single parent, as a Pensioner, on maternity leave, with negative credit bureau or in general bad credit need, it is difficult to get a loan from a bank to get. In particular the Credit despite debts has it all. In this article, you'll learn how and where you can still get a credit in difficult cases you receive. But also with the Credit for cases that seem almost hopelessYou need a plan how you will pay the installments with your income: Otherwise, unfortunately, there is no chance of credit. Because there is of course no such thing as a loan without a rejection.

There is no such thing as a loan for hopeless cases without a rejection. If you want to take out a loan in difficult cases, you should not borrow more than your 15 times net income as a loan. At €1,000 net per month, a maximum of around €15,000 in credit is therefore possible. At €2,000 net, you will be granted up to €30,000 in credit. Do not fall for dubious providers who promise you any loan for hopeless cases without conditions.

Secondary in many cases is what you want to use the money for. Whether it is needed to pay off other debts, to replace a car or to refurnish a home rarely makes much difference. On the other hand, it is much more important that you Loan installments from your net income can afford.

In particularly difficult cases usually just stand Loans without Schufa from Switzerland or Liechtenstein available. However, this is often not necessary and a conventional installment loan can be used. It is important that you do this when you apply for a loan keep both options open so as not to pay too much for the significantly more expensive Swiss credit to pay. You will find a separate chapter for this at the end of this article.

What you can learn here

- Get credit in difficult cases

- How to get a loan as an apprentice or student

- How to get a loan despite a probationary period

- How you can get a loan with a fixed-term employment contract

- How to get credit as a pensioner

- How the self-employed succeed in borrowing

- How Austrians get a loan in difficult cases

- How the unemployed get a loan in difficult cases

- How to get a low income loan

- At which bank a loan is possible despite sick pay

- Which bank gives credit despite debts?

- The loan in (particularly) difficult cases from Switzerland

- Providers like Sigmabank grant a loan even in particularly difficult cases

- With credit from Switzerland, caution is advisable, especially in difficult cases

- Credit for hopeless cases

- Take out a loan despite Hartz 4 – also a hopeless case?

- Requirements for the Swiss loan in difficult cases

- The identification of loans in difficult cases from Switzerland is carried out using the German Postident procedure

- The reason for borrowing does not interest the lender

- The Credit Bureau-free loan from Sigmabank is only for permanent employees

- In many difficult cases, a Swiss loan can be increased by a loan rescheduling

- Which bank helps in difficult cases?

Get credit in difficult cases

The “difficult cases” usually include those people who, due to lack of collateral or not sufficient creditworthiness did not get a loan offer. Often these are exactly the same people who need the loan most urgently. This includes young people such as trainees and students, but also the self-employed or pensioners with basic security. These people often have no secure income. Since they have to make numerous purchases at the same time, only one remains here Credit for low earners as a way out. Loans are brokered in difficult cases without collateral and only with a shortened credit check.

How to get a loan as an apprentice or student

trainees and students belong to a risk group when lending. This is due to the fact that both groups do not yet have a stable income situation. At the same time, students and trainees need one due to numerous purchases Credit for low earners. Therefore, trainees and students in particular are dependent on a loan.

Therefore a Credit for trainees be necessary to finance a cheap car. Many trainees cannot do without it because they drive to work. Nevertheless, the loan to be able to come to work is often not approved with a reference to the lack of wages. Furthermore, a loan for the master school may also be necessary for trainees.

At the end of the article you will find 11 cheap and reliable Cars under 5000 euros. The text link will take you there directly

A credit for students can be considered if the BAföG is not enough and the parents cannot cover the costs either. Except Part-time job or scholarship comes in too student loan in question. This can either be awarded by KFW on favorable terms. If a loan rescheduling is pending as a student, however, private providers must be used

provider like bon credit* are at Loans in difficult cases also for trainees and students more flexible than most banks. The provider also offers the possibility of a loan if life is not yet on the right track. The loan request from Bon-kredit is free of charge. The loan is therefore ideal for young people: if the request for a loan for low earners is rejected, you will not incur any costs.

A loan in difficult cases is not possible if your household surplus at the end of the month is not sufficient for the loan installments. provider like bon credit* specialize in difficult cases and add child benefit to income. However, lending is not possible if child benefit is the only source of income.

like you one Credit despite probationary period can get

Banks classify the probationary period as uncertain. Therefore, most banks refuse to grant a loan during the probationary period. Young people in particular urgently need money during their probationary period. Life circumstances often change during the probationary period: moving to an apartment or a car are required to reliably get to work.

For the Credit despite probationary period a regular income of at least €1,100 is required. Consent to the credit check is optional, but is advisable due to the improved interest conditions on the loan despite the probationary period. The loan despite the probationary period is granted by providers who specialize in loans in difficult cases. This includes, for example, the provider bon credit*. Bon-kredit specializes in lending to people with poor credit ratings. This includes people in the probationary period if their acceptance is not regulated in writing in the employment contract.

You can usually find out in a few minutes from online providers whether the loan can be granted during the trial period. If the loan cannot be granted during the trial period, you will not incur any costs with reputable providers such as Bon-kredit.

If your request has been rejected, you can find it in the guide to Credit with bad credit rating 3 options how a loan can still be granted. In the same guide you will find tips on how to do yours Improve Schufa score can if you due negative Schufa characteristics were rejected.

Bon-kredit.de

like you one Loan with fixed-term employment contract can get

Similar to the probationary period, there is little chance that the loan will be approved in a temporary employment relationship with banks. Most banks only lend money to people who are employed on a permanent basis. A Credit, with temporary employment contract, is only granted by many banks against collateral such as a property or the car title. Nowadays, however, many employees face the problem of not being able to obtain a permanent position. This means that applying for a loan is only possible to a limited extent. Those who need a loan with a fixed-term employment contract can find a solution with providers such as bon credit* an unproblematic alternative to the house bank. This provider also helps people with fixed-term employment contracts to get a loan. If you can pay the loan installments from your net income from the temporary job, you will be bon credit* and similar providers do not put obstacles in their way.

How to get credit as a pensioner

A Credit for pensioners can make many wishes come true in old age. Pensioners with a good credit rating and a pension of more than 1,100 euros can take out a regular one installment loan apply for. If you are over 70 years old, banks often charge Credit Collateral. For this are suitable for pensioners younger guarantors or second applicant. Alternatively, the Vehicle registration or one land charge on the property as security that is readily accepted by the banks. This collateral can make loan rescheduling possible even in difficult cases. provider like bon credit* represent a good alternative to the conservative savings bank for pensioners with low income, basic security or a lack of collateral. bon credit* also helps older people such as pensioners to get a loan largely without problems and without depositing collateral.

How the self-employed succeed in borrowing

The self-employed face the problem that banks only recognize your proof of income after three or four years of business activity. Self-employed people, on the other hand, usually need capital right from the start of their self-employment. After all, the start-up phase is characterized by numerous purchases to get the business up and running.

A good loan for the self-employed therefore requires Proof of income only for a short period of 6 to 12 years months. provider like Auxiliary* or ferratum* have the fewest hurdles when applying for the self-employed. In the following table are the Requirements for the business activities of different providers for credit for the self-employed contrasted. This should also make borrowing possible as a self-employed person.

| Offerer | requirement | valuation |

|---|---|---|

Auxiliary* | If the credit rating is correct, the loan is possible from a private person and without proof of income or proof of salary. | Simple requirement for self-employed |

ferratum* | If the creditworthiness is good, the loan is possible without proof of income or proof of salary. | Simple requirement for self-employed |

bon credit* | Income tax assessments showing your income for the last two or three years. | Medium requirement for self-employed |

Maxda* | Income tax assessments showing your income for the last two or three years. In individual cases, annual financial statements and income tax assessments for the last three to four years are required. | Medium requirement for self-employed |

credimaxx* | Income tax assessments showing your income for the last two or three years. | Medium requirement for self-employed |

Creditolo* | Self-employment of 4 years or more: Income tax assessments from which income and current business evaluation (BWA). Self-employment shorter than 4 years: Additional collateral is required. Suitable collateral is, for example, pension, life insurance, building society contracts or savings. The security must correspond approximately to the loan amount. | Strict requirement for self-employed |

How Austrians get a loan in difficult cases

In Austria, the rules are similar to those in Germany. What the Schufa is for us, it is in Austria credit protection association KSV. In Austria, too, comparable criteria must be met in order to receive a loan. If the credit rating is poor due to negative KSV entries, banks will reject most applications. The situation in the Alpine country is also problematic in difficult cases such as the unemployed, the self-employed, students and schoolchildren. Fortunately, there are also various institutions in Austria that still allow you to get a loan if the KSV is bad. On the website Tarifgiant.at you will find 4 ways like you one Credit in difficult cases in Austria get. These possibilities are personal loans, Loan with guarantors, mini loans despite KSV entry, such as Loans without KSV from Switzerland. All providers can be found under the link. If you are Austrian, the best way to see how Austrians can get a loan in difficult cases is to click on the link.

How the unemployed get a loan in difficult cases

The situation on the credit market is very difficult for unemployed ALG II or Hartz 4 recipients. Since the Hartz 4 standard rate is lower than the garnishment exemption, banks cannot pledge anything. Therefore, they completely refrain from granting loans to the unemployed in Hartz 4. Swiss loans are also not granted to the unemployed because of low income. But there are still a few ways to get a loan despite Hart4.

At the Credit despite Hartz 4 the following options are available:

1. Credit despite Hartz 4 from the job center

The cheapest way to get a loan despite Hartz 4 is the free loan from the job center. The interest-free loan can be applied for informally at the job center. The premise is that it is necessary. The job center states the necessary credit requirements "Inevitable need“. Unavoidable needs must not be rejected. An unavoidable need is a broken washing machine, a broken refrigerator or a broken car. The loan is approved for these purchases. The loan is not approved for a new TV, replacement of a broken dishwasher or dryer.

2. Credit despite Hartz 4 from relatives, friends and acquaintances

In addition, relatives, friends and acquaintances can grant 4 credit despite Hatz. Asking for money from people you know is easy and can be done without complicated forms. However, you should keep in mind that if you have payment difficulties, the relationship with the lender will be strained.

3. Credit despite Hartz 4 with a creditworthy guarantor

A third possibility to get a loan with Hartz 4 is the Credit jointly with a guarantor apply with good credit. The guarantor is jointly liable for the loan, which enables good conditions with a good credit rating. However, defaults on loan installments can put a strain on the personal relationship with the guarantor. Because the bank collects the money from the guarantor in case of doubt.

4. Credit despite Hartz 4 with mini credit

Another possibility Credit despite Hartz 4 to get ask mini loans These are loans of up to €1,000 and a term of one to six months. With providers like that Ferratum Bank* Unemployed people with Hartz 4 can still get a loan of up to €1,000 for one to six months, even in difficult cases. In order to get the Ferratum loan as cheaply as possible, you should repay the money within 30 days. Expensive but optional additional services are also not recommended.

Hartz IV top-up with a permanent job and the unemployed the ALG 1 usually have significantly better chances of getting a loan - also with many German banks. As an ALG 1 recipient, you can start a request for an installment loan in a Schufa-neutral manner. You can find many cheap providers in the credit comparison.

like you one Credit with low income receive

People on low incomes often have a painful experience when applying for a loan: the more someone needs a loan because of their personal finances, the more difficult it is to apply. The "credit paradox" does Loans are very difficult for low earners, housewives, students, part-time workers and pensioners to obtain. But the post "Which bank gives credit for low income?“ shows how and from which bank you can still get a loan as a low earner. And if the credit is not granted, you can still find it at the end of the linked article 7 alternatives, how you can get access to money despite a small income. If you have little or no income, you may also be interested in these 4 ways to get a loan with no income to obtain.

At which bank a Credit despite sick pay is possible

If you have one Credit despite sick pay due to a prolonged illness, this is also a difficult case. This is because sick pay is only legally considered attachable income under certain circumstances. If the borrower defaults on the loan installment, it is much more difficult for the bank to get the money. Therefore, banks often generally refrain from lending when receiving sick pay. However, many honest people are unjustly punished by the banks.

Credit despite sick pay from special banks and credit intermediaries

However, there are some banks and credit intermediaries who grant a loan at slightly higher interest rates despite sick pay. This includes the provider bon credit*, which allows credit even in this difficult case. To further facilitate borrowing, it helps if you can estimate that you will soon be able to work again. In the best case you have over your speedy recovery a medical certificate that you can present to the bank if you have any questions. Also relieved one guarantee borrowing if your income is only sick pay. Nevertheless is at bon credit* a loan despite sick pay is often possible without these measures.

Credit despite sick pay as a policy or mortgage loan

If you have a pension insurance or life insurance with a buyback value of at least 1,000 euros, you can also policy loan record, tape. This will be yours pension or life insurance loaned and serves as security for the bank. Due to the security, the bank can do without a Schufa query. A recommended provider for policy loans is the SWK bank*. Other options are mortgage loans, where you buy your property through a real estate financing lend

If you need money for a car, there are other options for getting a loan despite sick pay

When it comes to financing a new one Cars despite sick pay there is also the option of financing through a car dealership. in the post Which car dealership finances despite negative credit bureau 5 car dealerships are listed that will finance your car directly and without a bank even if you have a poor credit rating due to sick pay. In addition, there are alternative options if the credit rating is weak Leasing without Schufa or one Car subscription without Schufa by Finn is an option. at Finn* In addition to low prices, you will also receive an all-round carefree package for your car.

Which bank gives credit despite debts?

If your bank won't lend you money because of debts, you can get Smava*, Auxiliary* and credimaxx* often another Credit despite debts give. The banks' offers are often very appealing to debtors, as they want to attract you as a new customer. A rescheduling of the old loans is often particularly worthwhile here.

Nevertheless, debtors with pre-existing debts should act prudently when borrowing to avoid getting into a debt spiral. When the risk of debt spiral is particularly large, you can find out in the guide "Which bank gives credit despite debts?“.

The loan in (particularly) difficult cases from Switzerland

A credit without is the only way to get the desired money quickly and easily in particularly difficult cases. The advantage of a Swiss loan is that German credit agencies such as Schufa have no say in the award. Therefore, the loan can also be granted despite negative credit bureau entries. Nonetheless, one will Swiss credit without Schufa only awarded if there is sufficient solvency. When you apply for a loan, the bank will check whether your credit rating is sufficient to repay the loan.

The creditworthiness check is carried out at the Swiss credit without Schufa significantly easier than with German banks. This means that foreign banks are less likely to refuse Swiss loans without Schufa. However, this also means that loans without Schufa default more frequently. The banks put these costs and charge higher interest rates for loans without a credit history.

Often you don't need an expensive loan without a Schufa, instead you can use a loan from a German bank. For this it is important that you contact an intermediary of your choice when you apply for a loan keep both options open so as not to pay too much for the significantly more expensive Swiss credit to pay.

Providers like Sigmabank grant a loan even in particularly difficult cases

Loans without Schufa come almost exclusively from Sigmabank, which is surprisingly based in Liechtenstein Has. The Liechtenstein Sigmabank is the successor to the Fidium Finance from the Swiss town of St. Gallen. In the past, this granted the loan without Schufa. Even today, the name Swiss credit is a well-known term if a credit without is meant.

At Sigma Kredit Bank, customers can apply for up to 7,500 euros without Schufa Rent. The credit bureau-free loan is somewhat more expensive in terms of interest rates due to the simple allocation. The effective annual interest rate is just over eleven percent.

You can request the Swiss loan without Schufa from Sigmabank by post. To do this, the form on the bank's website must be filled out, printed out and signed. An online application for the loan without Schufa at Sigmabank is over bon credit* or the one provided by Maxda online form* possible.

At the Credit from Switzerland caution is advised, especially in difficult cases

Reputable providers of loans without Credit Bureau from Switzerland and Liechtenstein are keen to help borrowers get back on their feet. Not so good and dubious providers of Swiss loans, on the other hand, drive customers deeper into debt. Since financial problems usually already exist before the Swiss loan is taken out, hidden costs can arise credit insurance, Commissions to be paid in advance or expensive cash on delivery fees break the neck of some financially. Therefore, you should make inquiries about credit in difficult cases from Switzerland only with providers who do not charge any fees in advance.

Credit for hopeless cases

If your credit case is not particularly difficult but hopeless appears, you should refrain from taking out the loan. A loan is hopeless if that income is not sufficient to pay the loan installments.

Here is an example: If your disposable income after deduction of all costs is 100 €, you can get a loan of about 4,400 € with a term of 4 years. For a term of 6 years, 6.600 € credit and with a 10-year term, €10,000 is possible.

According to another rule of thumb, you can do something like this 15x your monthly net take on credit. At €1,000 net, around €15,000 credit is possible, at €2,000 net you get around €30,000 in credit.

A desperate case loan is a loan that is taken out even though there is no disposable income to service the loan installments. Most loan providers do not grant credit in hopeless cases. Because the repayment is highly uncertain and unlikely if there is no income.

If you receive a loan offer even though you cannot repay the loan installments, you should reject it!

If you still accept the loan, over-indebtedness is almost inevitable. Get a better overview of your disposable net income at the end of the month or get help from debt counseling.

Take out a loan despite Hartz 4 – also a hopeless case?

Loans despite Hartz 4 are – as described above – basically possible. What works well here is applying for the loan together with a guarantor with a good credit rating. Another possibility mini loans These are loans of up to €1,000 and a term of one to six months. With providers like that Ferratum Bank* unemployed people with Hartz 4 can still get a loan up to 1,000 € for 6 months or shorter, even in difficult cases. Thereby this Lightning loan despite poor credit rating best applied without express option or 2 installments fee.

Requirements for the Swiss loan in difficult cases

Just as with lending within Germany, some basic requirements must also be met for a Swiss loan. However, the requirements are not comparable to those of German banks. All you have to do is submit the following:

- The last two payslips with associated statement of account

- Account holder and receipt of wages must be visible

- copy of identity card

- copy of Income tax certificate; Alternatively, annual payslip or December payslip

are self-employed income tax assessments the latest two or three years as well as a current one Business Evaluation (BWA) alternatively required.

The identification of loans in difficult cases from Switzerland is carried out using the German Postident procedure

Similar to domestic lending, foreign lenders also require identity verification. The identity is checked using the Postident procedure. Since the procedure is the same as domestic, it also takes about the same time. Identification can take place online immediately. Lending for a Swiss loan therefore takes no longer than for a regular installment loan from Germany. Credit intermediaries like bon credit* provide fast and unbureaucratic online processing for lending. So you are not only spared a personal audition in the branch - the process is also significantly faster than with many German branch banks.

The reason for borrowing does not interest the lender

A Swiss loan will without collateral forgive. The lender is usually not interested in whether you are using the loan for a move, a car or something else entirely.

The Credit Bureau-free loan from Sigmabank is only for permanent employees

Instead, the lender tries to minimize the risk of non-repayment through other options. The Sigma Bank loan is therefore only granted to permanent employees. As a self-employed person, you will bon credit* and Co. mediated to other banks. This way you can still get a loan.

In many difficult cases, a Swiss loan can be increased by a loan rescheduling

If you already have a Swiss loan, you can increase it even in difficult cases. A similar article describes how to increase from Loans in difficult cases with debt restructuring succeed. In particular, in many cases debt restructuring works smoothly if you have already repaid a significant part of the existing loan on time and regularly. Of course, the income to cope with the higher loan rates must also be high enough. With €100 of disposable income at the end of the month, you can afford an additional loan of €1,500. With a free income of €200, it is twice as much.

Even in difficult cases, only a few documents are required to reschedule an existing loan. If you apply for a loan from the same intermediary or the same bank as the borrower, the lender already knows that you are reliable when it comes to repaying the installments. Therefore, the approval goes a credit top-up or even one Credit rescheduling in difficult cases in most cases uncomplicated and fast. In the next article you will learn what to consider when rescheduling a loan, so that you can quickly and easily get a loan. payout can obtain. Whether you use the loan for a car repair, a move or a new washing machine is up to you and usually changes little in the conditions.

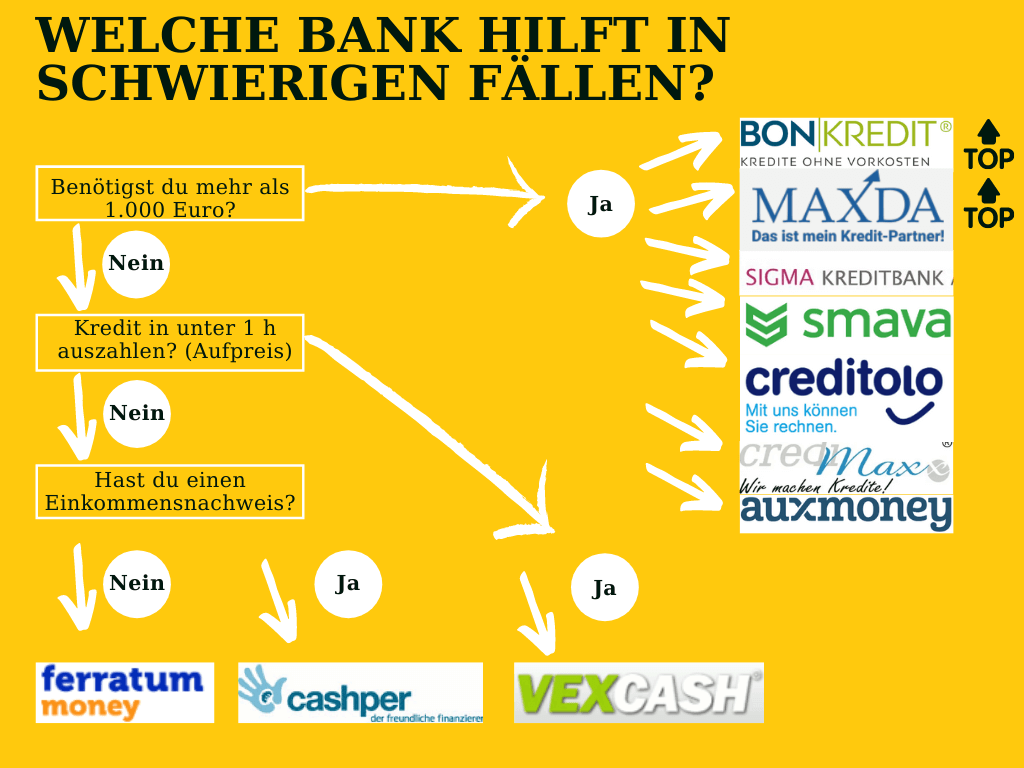

Which bank helps in difficult cases?

provider like bon credit,* Maxda,* or the Sigma bank* help you refinancing & faster loan disbursement of all your loans in difficult and very difficult cases. The credit intermediaries have a portfolio of European banks that enable lending in difficult cases, which is not available to private individuals without intermediaries.

But also the provider Smava* can still arrange loans with mediocre creditworthiness. In addition, Smava only requires a minimum income of €600.

When it comes to amounts below €1000 suitable are also the providers Vexcash*, ferratum* and cashper* recommended in difficult cases. In many difficult cases, these mini loan providers approve the loan – even with negative credit bureau entries. Vexcash offers instant payouts in under an hour. At Ferratum, lending is also possible without proof of income.

Alternative installment loans are often more expensive via a car dealer, despite negative credit bureau

If you want to buy a car with the loan, the following could be interesting for you: In the article Buy a car on installments despite negative credit bureau we have the interest and fees for financing through the car dealer with financing over bon credit* compared. We found out that you bon credit* almost always get cheaper car financing than with financing directly from the car dealerships. As a website dealing with credit busy we may not be entirely neutral here. However, the interest and fees then speak a clear language.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

1 thought on “Kredit in schwierigen Fällen: 10 hoffnungslos anmutende Fälle”

Comments are closed.