Why are Swiss loans so popular with Germans? In contrast to most German credit institutes Swiss banks the loan according to other rules of the game. Loans from Switzerland can also with a negative Schufa entry, a "poor credit rating" be given. In addition, at one Credit from Switzerland also no entry at the Schufa. The name Swiss credit comes from the fact that the credit without Examination used to be offered by banks in Switzerland. In 2021 there will also be credit bureau-free loans from Liechtenstein.

Unfortunately, it is also the case with German banks stable financial circumstances for self-employed, Pensioner, students, trainees or People with a negative Schufa entry not easy to get a loan. are aimed at this clientele Swiss credit for Germans: wealthy peoplewho can service the loan but fall through the cracks of German banks for various reasons. The Swiss loan for Germans can with instant confirmation be given.

Swiss credit for Germans - A credit without SCHUFA

What you can learn here

- Swiss credit for Germans - A credit without SCHUFA

- Swiss credit for Germans without Schufa

- As a German, what amounts can I apply for a Swiss loan?

- Swiss credit: the requirements

- Which documents are required for a Swiss loan

- When the Swiss loan is not approved

- For whom a Swiss loan in Germany is suitable

- Swiss credit without proof of income

- Swiss credit without intermediaries

- Swiss credit without upfront costs or prepayment

- Is there a Swiss loan without a credit check?

- Questions and answers on Swiss credit for Germans

People with a bad Schufa score are not uncommon with both feet firmly on the ground. Your financial situation is due to one permanent jobs With regular income stable. In connection with a good payment practices there is no problem one construction financing or one car loan to use. The self-employed and freelancers often have no problem paying the loan installments. Nevertheless, many German banks require a permanent position with compulsory social security for a loan.

Now there is another factor at German banks, which is one for loan applicants nervous ordeal can be. We're talking about Credit bureau score. A similar article explores the question “Which banks grant a loan despite negative credit bureau" or granted in the case of poor creditworthiness. In the linked guides are the banks or credit intermediaries: Cashper, Ferratum, Vexcash and Smava called. All four also forgive at bad Schufa score another loan. In the Swiss credit ranking On the other hand, you will find credit intermediaries and banks that do not work with Schufa at all. Therefore, you can grant a loan without Credit Bureau according to different rules.

Loans from Switzerland are therefore another option credit in difficult cases to get.

Because just because in earlier times a negative entry was obtained from the Schufa, people still fall through an automated check at most banks years later. Of the Swiss credit for Germans can be a way out of this quandary - if the conditions are loans from Switzerland way out of the crisis.

Swiss credit for Germans without Schufa

In Switzerland there is the protection association for general loan default protection - better known under the abbreviation Schufa. That Wiesbaden company Schufa is a credit agency for the German market. A Swiss loan is therefore granted in accordance with Swiss law without a Schufa.

On the one hand However, the Schufa is not bad per se. It protects the borrower from further borrowing, which can encourage a debt spiral. Debt counseling studies show that a significant proportion of people in Germany are threatened by the debt trap. For the banks, to which the Schufa is traditionally closer, the Schufa has the advantage that they should be protected against a loan default.

on the other hand Schufa has often saved negative entries that stem from people's difficult financial times. Not infrequently, however, the financial circumstances have improved, but the Schufa entries remain in place for 3 years even after the debts have been settled. The Schufa then no longer depicts a realistic picture. Nevertheless, people with a negative Schufa entry in Germany then hardly get a loan.

| Pros and cons of Schufa | |

|---|---|

✔️ Benefits ✔️ protects the bank from loan defaults | ✗ Cons ✗ Negative entries are difficult to get rid of |

Other procedures of the Schufa are even more difficult to understand. Thus, relocations are interpreted as negative regardless of their background. Even the neighbors are included in the Schufa score. Anyone who lives in a neighborhood that is considered “bad” is devalued. In addition, the calculation of the Schufa score is not published. Only the Schufa itself knows how individual factors ultimately affect the score.

Swiss credit for Germans without Schufa

credits until 7,500 euros in difficult cases💰

No Schufa query 📄

Fast payout 💨

Intransparency of the Schufa

This lack of transparency haunts many people Fear of the Schufa a. Even if the fear is understandable, it is actually not necessary. Everyone has the right once a year free self-disclosure of the Schufa to apply. Although it is not yet clear how the Schufa score is calculated, you can have obviously wrong entries removed. But sometimes the Schufa is not as bad as I feared: By getting information from my Schufa, I found that there were two or three checking accounts did not have a negative effect on the score I had already read this statement numerous times on the Internet.

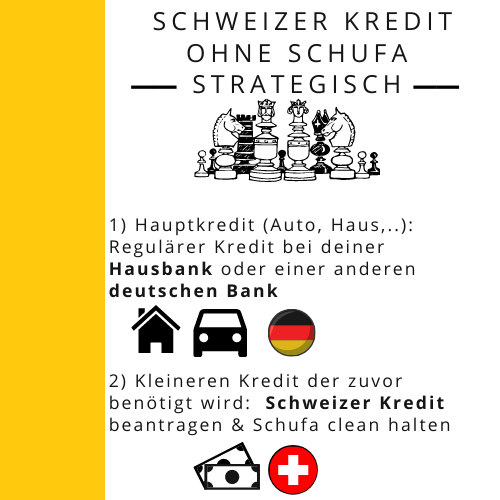

Use Swiss credit as a side loan

Next to one bad credit but there are still negative entries at the Schufa more reasons why a Swiss loan without Schufa is advantageous. Who in the near future a larger credit for the Financing a property plans to record should have a credit bureau that is as clean as possible. Ideally, the Schufa score before requesting real estate financing is 95 % or higher. Therefore, in such a situation one can consider whether to combine other consumer goods such as a loan-financed car with a Swiss credit financed past the Schufa. A loan that has already been taken out usually has a bad effect on the real estate loan. A Swiss credit for Germans without Schufa is a practical solution before buying a property, even if the credit rating is good or very good.

Use Swiss credit as a side loan: Job here your request at Credimaxx.de if you are planning a larger loan for a property soon!

independence

Another reason as a German to take out a Swiss loan without Schufa is that independence. While German banks usually immediately dismiss the self-employed with less than two or three years of verifiable income, the loan without Schufa from Switzerland is the last resort for some freelancers and self-employed people who are new to the business.

As a German, what amounts can I apply for a Swiss loan?

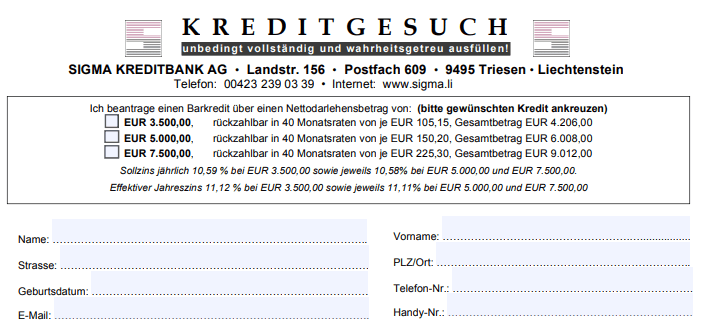

A Swiss loan is granted up to a loan amount of maximum €7,500 forgive. However, smaller sums such as 3.500€ and 5.000 € widespread. For the respective sums, a minimum income above the garnishment exemption limit required. Depending on the provider, the minimum income for loans from Switzerland is approximately €1,180 for the 3rd mortgage.500 € credit, at €1,600 for the €5,000 loan and at €1,800 for the €7,500 loan.

In order to take out a loan of €5,000 or €7,500, a 3-year permanent position is required. With a €3,500 loan, a one-year permanent position is sufficient, which can be proven by means of an income tax certificate or the December payslip. The table summarizes the inclusion of different loan amounts and their requirements:

| Loan | Monthly rate | income | Solid employment |

|---|---|---|---|

| 3.500,00 € | Monthly rate: approx. 105 € at 40 monthly installments | At least €1,180 net per month | permanent position for at least one year |

| 5.000,00 € | Monthly rate: approx. 150 € at 40 monthly installments | At least €1,600 net per month | permanent position for at least three years |

| 7.500,00 € | Monthly rate: approx. 225 € at 40 monthly installments | At least €1,800 net per month | permanent position for at least three years |

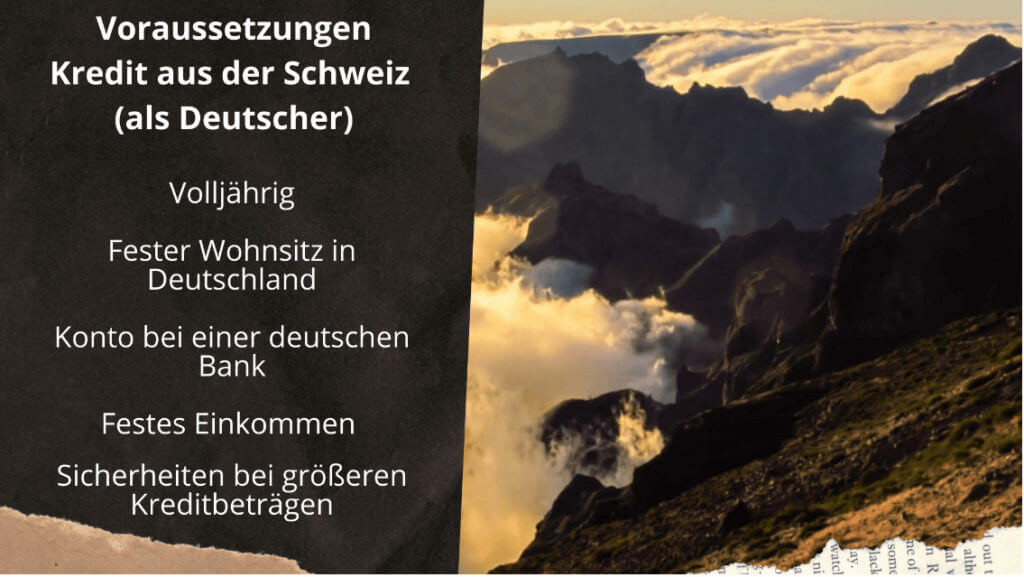

Swiss credit: the requirements

For the Swiss loan you need some requirements fulfill. What they are is listed here:

of legal age

To get a Swiss loan as a German, you have to of legal age be. In Switzerland, as in Germany, you reach the age of majority or majority at the age of 18.

Permanent residence in Germany

Another requirement to take out a Swiss loan is a Permanent Address in Germany.

Account at a German bank

To get the Swiss loan paid out as a German is a German account Precondition.

income

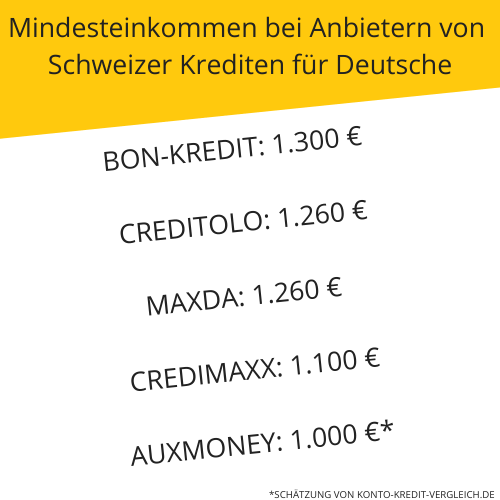

To get a Swiss loan you should have an income of at least 1,000 euros have a month. The providers of Swiss loans require the following income:

- Receipt credit: €1,300 net per month

- Creditolo: €1,260 net per month

- Maxda: €1,260 net per month

- credimaxx: €1,100 net per month

- Auxiliary: €1,000 net per month (fixed income not required, minimum income depends on other factors)

Persons with an income of less than €1,100 cannot apply for a Swiss loan. This makes many Loans are very difficult for low earners, housewives, students, part-time workers and pensioners to obtain. But the post "Which bank gives credit for low income?“ shows how and from which bank you can still get a loan as a low earner. And if the credit is not granted, you can still find it at the end of the linked article 7 alternatives, how you can get access to money despite a small income

collateral

For loans over 7,500 euros, collateral such as a Vehicle letter or something similar is often unavoidable. For small amounts, however, collateral is not a prerequisite for obtaining a loan from Switzerland.

Which documents are required for a Swiss loan

If you meet all the requirements for the Swiss loan, you can start applying. For this you need the following documents:

- The last two payslips with associated statement of account

- Account holder and receipt of wages must be visible

- copy of identity card

- copy of Income tax certificate; Alternatively, annual payslip or December payslip

are self-employed income tax assessments the latest two or three years as well as a current one Business Evaluation (BWA) alternatively required.

If the loan application for a Swiss loan is not approved, you can apply for one second applicant or bring in guarantors. Submit your loan request now here*.

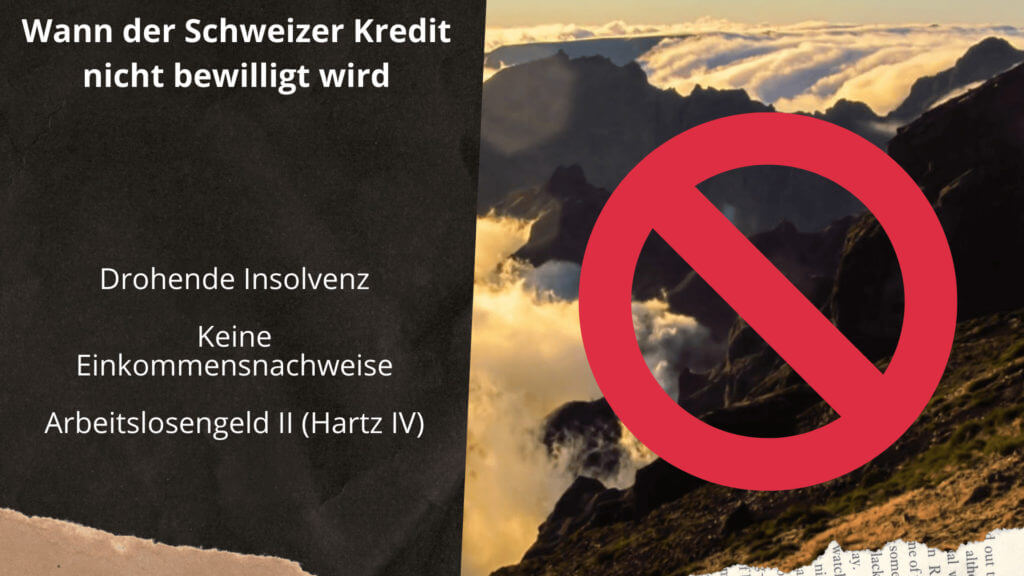

When the Swiss loan is not approved

Even if the Swiss credit a credit without query is will a certain credit rating is required. Understandably, banks from Switzerland and Liechtenstein also have an interest in the loan being repaid.

The following reasons can cause the Swiss loan to be rejected:

Impending bankruptcy

If insolvency is imminent or has already occurred, you should refrain from a Swiss loan. Reputable credit brokers like Credimaxx.de* will no longer provide you with a loan in this situation. Because the loan only makes your situation worse. In order not to be taken in by loan sharks, it is better to go to a debt advice center in your area in the event of bankruptcy. Because they are common Debt counseling better than its reputation.

No proof of income

If you do not have your own income, you should also take out a Swiss loan dispense. If you have no income temporarily or have lost your proof of income, you can get a Loan without proof of income to help somebody out of a bad situation.

Income only from transfer payments (e.g. ALG 2 as income)

Recipients of social benefits have little chance of getting a Swiss loan for consumption due to their low income. But there is a better way anyway: As a recipient of social benefits, you can apply for a free loan from the Employment Agency. The prerequisite is that there is an unavoidable need (e.g. replacement of a defective refrigerator).

If a loan from the Employment Agency is not an option for various reasons, the unemployed can the Swiss loan for Germans together with one co-applicant Requests. There are good chances if the co-applicant subject to social insurance is busy.

Should this not be the case, there is still the possibility of a small loan from cashper* to complete. When Income and expenses within the framework and have a total income of €600 or more, it should also be for recipients of unemployment benefit 2 with a small loan of cashper* Valves.

For whom a Swiss loan in Germany is suitable

In the previous section, we explained some of the conditions under which a Swiss loan is granted. It was also explained that there are clear cases in which a Swiss loan is not approved. In this chapter we look at who a Swiss credit in Germany suitable.

Swiss credit for Germans

The Swiss loan can be taken out by anyone in Germany. Provided the aforementioned conditions such as Age of majority, German account, income of at least 1,000 euros and permanent residence in Germany are fulfilled.

Swiss credit for Germans without Schufa

Even if there are banks that despite a bad Schufa score grant a loan, in Germany the Schufa and other credit bureaus decide whether the loan will be granted or not. If you have a bad credit rating due to negative entries, you have bad credit with a loan.

A bad Schufa score can make it difficult to get a loan from a German bank despite a good income. The Schufa classifies people as unworthy of credit after payment problems. This negative–entries remain stored in the Schufa file for three years after settlement of the claim (starting from the end of the calendar year).

But also self-employed, Freelancer, Pensioner and students find it difficult to apply for a loan even with a good credit bureau. The banks prefer well-funded clientele secure and regular income – A requirement that represents an insurmountable hurdle for these target groups.

The Swiss loan for Germans without Schufa offers a way out of the situation - provided the applicants are not "bankrupt vultures". With a processing time of less than 20 minutes, the mediator Credimaxx.de Worth a look.

Use a Swiss loan without Schufa strategically

We have already discussed above that a loan without Credit Bureau can also be used strategically: if you Keep Schufa clean must. If you have one soon construction financing or car financing but you still need a smaller loan for another thing beforehand, it makes sense not to bother the Schufa about the second loan. This improves your conditions on the first loan.

Swiss credit for the self-employed

It has always been difficult for the self-employed to get a loan from a German bank. Because with the banks, a good income alone is not enough. become multiple Proof of income for the last two or three years required. In individual cases, up to 4 years self-employment in connection with current income tax assessments and also business evaluations (BWA) required.

You should bring the following documents with you Swiss credit for the self-employed have ready:

- income tax assessments from which your income of the last two or three years emerges.

- An actual Business Evaluation (BWA)

- The offering of collateral is an award criterion, especially for amounts of €7,500 or more.

- Optional: If the loan application is not approved, you can apply second applicant or bring in guarantors.

If you are unable to provide these documents as a self-employed person, an alternative is to look for a loan that requires fewer proofs of income. I have compiled the requirements for proof of income here.

| Offerer | requirement | valuation |

|---|---|---|

Auxiliary* | If the credit rating is correct, the loan is possible from a private person and without proof of income or proof of salary. | Simple requirement for self-employed |

ferratum* | If the creditworthiness is good, the loan is possible without proof of income or proof of salary. | Simple requirement for self-employed |

bon credit* | Income tax assessments showing your income for the last two or three years. | Medium requirement for self-employed |

Maxda* | Income tax assessments showing your income for the last two or three years. In individual cases, annual financial statements and income tax assessments for the last three to four years are required. | Medium requirement for self-employed |

credimaxx* | Income tax assessments showing your income for the last two or three years. | Medium requirement for self-employed |

Creditolo* | Self-employment of 4 years or more: Income tax assessments from which income and current business evaluation (BWA). Self-employment shorter than 4 years: Additional collateral is required. Suitable collateral is, for example, pension, life insurance, building society contracts or savings. The security must correspond approximately to the loan amount. | Strict requirement for self-employed |

Swiss Credit for pensioners

In the guide to Credit for pensioners we have recorded some conditions when a loan for pensioners is approved. A Pensioner credit is possibly even with low pension or basic security possible if the terms are kept short and the credit repaid in full before the age of 75 will. With a Swiss loan for pensioners the situation is similar. If your pension is over 600 euros and you can conclude the loan with a second applicant, your chances of loan approval are good. If possible, keep the loan term below 36 months - then nothing stands in the way of applying for a Swiss loan for pensioners.

You can find recommended providers and procedures for pensioner loans in the guide: >> Credit for pensioners <<

Swiss loan for house purchase

if you your Schufa for an upcoming house purchase, but still need a new used car at short notice, you can use a Swiss loan for this. Even if the Swiss loan is not used to buy a house in this constellation, its use is related to it.

If you are about to buy a house, it makes sense not to bother the Schufa about the short-term further credit requirements. This improves your home loan conditions.

However, it is not possible to use a Swiss loan directly to buy a house. Swiss loans are granted in amounts below €10,000. They are therefore too small to finance a property. There is also a construction financing also much better deals.

Swiss credit for the unemployed

credit for the unemployed

Borrow €1,000 from €600 income 🔥

Co-applicant increases the chances 🧑 🤝 🧑

To the provider:Smava.de

The unemployed have a hard time because of their low income Swiss credit for Germans to get. But there is a better way anyway: As a recipient of social benefits, you can apply for a free loan from the Employment Agency. The prerequisite is that there is an unavoidable need (e.g. replacement of a defective refrigerator).

Credit for the unemployed: If you receive Hartz 4 or ALG 2, you can get a free loan from the employment agency.

If a loan from the Employment Agency is not an option for various reasons, the unemployed can the Swiss loan for Germans together with one co-applicant Requests. There are good chances if the co-applicant subject to social insurance is busy.

If no co-applicant with a fixed income is available, there is still the possibility of one Small credit from Cashper, Vexcash or Ferratum to complete. When Income and expenses within the framework it should also work for recipients of unemployment benefit 2 with a loan. At least €600 of income should be available for two. at Smava* lending is already possible with an income of €600.

Swiss credit without proof of income

A "Swiss credit" without proof of income is from ferratum* from Malta. A loan without proof of income is available to you at Ferratum up to 1.000 € to disposal. However, without proof of income means not without income. Because even in Ferratum, an Eincome of at least €1,100 required to get a loan. You just don't have to prove your income with proof of income. This works online with a loan without proof of income digital account check. The provider also pays attention to bookings such as return debits on the bank statement, which worsen the chance of a loan.

Loan without proof of income: Borrow €1,000 immediately ✅

with express payment! ✅

without guarantor! ✅

from €1,100 income! ✅

without paperwork! ✅

To the provider:Ferratum.de

The providers mentioned in this article offer the Swiss loan from one income from €1,000 or more. If you don't Income of €1,000 or more you can no credit from Switzerland receive. In addition, you should neither when taking out a Swiss loan in debt still insolvent be.

Swiss credit without intermediaries

There are 2 ways to apply for a Swiss loan without an intermediary

1) Swiss loan without intermediary from Ferratum Bank

You can do a "Swiss credit" without an intermediary directly from the Ferratum Bank* in Malta. Here, the credit application runs completely online. A maximum of € 3,000 can be borrowed. More information about Ferratum Bank can be found in the article about the loan without proof of income.

2) Swiss credit without intermediaries from Sigma Bank

The second option one Swiss credit to submit an application through Sigma Kreditbank, based in Liechtenstein, without intermediaries. Sigma Bank grants non-Schufa loans in the following denominations: €3,500, €5,000 and €7,500.

For loans from Sigma Bank, a minimum income of €1,180 is required for a €3,500 loan, €1,205 for a €5,000 loan and €1,290 for a €7,500 loan.

The application can be made directly through Sigma Bank without an intermediary. To do this, you must download and print out the form on the bank's website and then post it to Liechtenstein Sigma Credit Bank AG; Landstrasse 156, 9495 Triesen, Liechtenstein send.

Alternatively, you can apply for a Swiss credits from Sigma Bank also on the PC, smartphone or tablet the online form provided by Maxda apply for.

To the provider:Sigma bank

via maxda

Swiss credit without upfront costs or prepayment

With a loan from Switzerland, dubious providers charge upfront costs. No way you should before completing the credit check to speed up the process or similar strange reasons to pay preliminary costs for foreign loans. rely on reputable providers arrange or grant Swiss loans without upfront costs or advance payment. A Swiss credit without upfront costs - we could also Loan from abroad without upfront costs say – is available at:

- bon credit

- Creditolo

- Maxda

- CrediMaxx

- Auxmoney (personal loan)

- Ferratum (from Malta)

- Sigma Bank (from Liechtenstein)

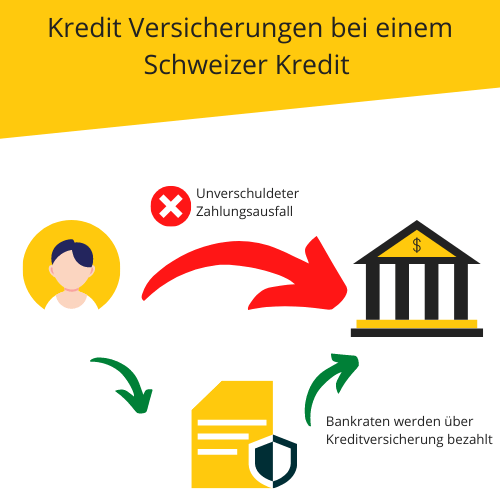

The scam with credit insurance at loans from abroad

Lenders often require one when taking out a Swiss loan without a credit bureau credit insurance. Lenders can use this to minimize their risk of default. If the borrower suddenly becomes unemployed, the insurance company will step in.

What initially sounds like a good idea is common in practice disproportionately expensive. Before taking out a Swiss loan for Germans, ask whether the loan can be taken out with or without credit insurance. You should also find out about the costs associated with credit insurance.

Credit insurance is expensive

Credit insurance is usually very expensive. The Finanztip portal had offers made for credit insurance and received offers of between 6 and 13 percent of the payout amount. With a credit of 10,000 euros, an additional €675.95 to €1,320.41 had to be paid for credit insurance. In a 2014 case, the Nuremberg Regional Court considered fees of 15.6 % to be "worrisomely high" (judgment of April 7, 2014, Az. 6 O 754/14).

The financial tip example also shows that credit insurance can quickly become more expensive than the interest on the loan, which was between €550 and €1490 from the same providers. It is therefore good to choose a provider that does not offer unnecessary insurance. If additional products such as insurance are avoided, that is a good sign!

The provider Credimaxx pursues a 1 product strategy and avoids unnecessary costs such as credit insurance

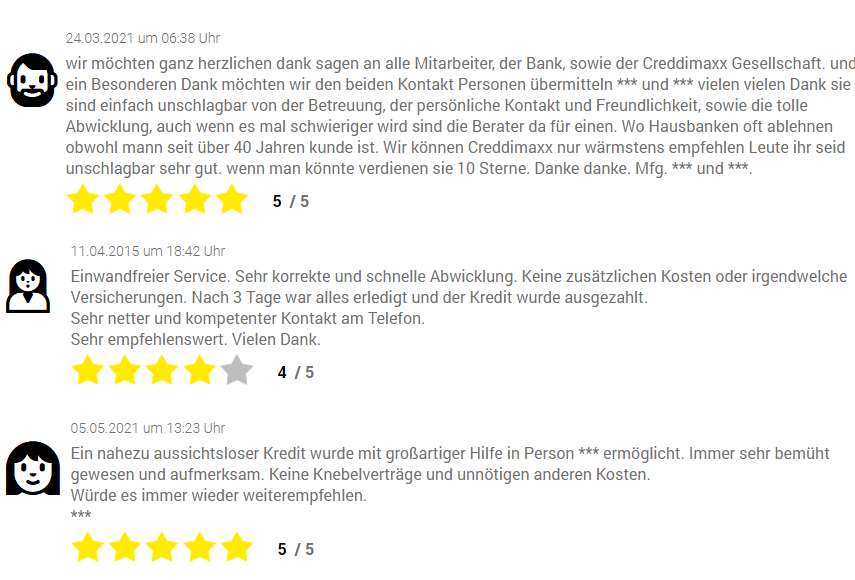

Numerous positive reviews prove that the customers are very satisfied. Additional products such as insurance were not offered.

credimaxx.de

Is there a Swiss loan without a credit check?

A Swiss loan is applied for without querying the Schufa. Nevertheless, banks from abroad also have an interest in knowing who they are doing business with. This is what banks ask about a Credit check Celebration. Since banks in Switzerland or Liechtenstein only determine the creditworthiness of the customer via the pay slip, the probability of a loan default is higher.

The banks try to compensate for this risk with a higher interest rate (risk premium). The price of the credit bureau-free loan from Switzerland with its very simple credit check is therefore the higher interest for the borrower.

Questions and answers on Swiss credit for Germans

Which foreign bank grants loans to Germans?

In 2021 only one foreign bank will grant loans to Germans: Sigma Bank from Liechtenstein. However, Sigma Bank is still a little behind when it comes to digitization. The foreign bank handles all loans to Germans only by post. It's more comfortable there credit intermediary to be consulted, where the foreign loan can also be taken out via smartphone, tablet or PC. A loan to Germans can also be arranged with these credit intermediaries via Sigma Bank:

1. Bon credit

2. Creditolo

3. Maxda

4. CrediMaxx

5. Auxmoney (Personal Loan)

6. Ferratum (from Malta)

A credit broker can often arrange a cheaper loan from Germany for you despite a negative Credit bureau entry. You can find an overview of foreign banks that grant loans to Germans in the Swiss credit ranking. Another advantage of a credit broker is that he can arrange a suitable - and therefore cheaper - loan even with good credit bureau information:

Where can you get a Swiss loan without proof of income?

The "Swiss loan" without proof of income is issued by ferratum* awarded from Malta. You can get a loan without proof of income from Ferratum up to 1.000 € to disposal. However, without proof of income means not without income. Because even at Ferratum is a Income of at least €1,100 required to get a loan. However, you can easily prove your income online with a digital account check. Proof of income such as salary slips or tax certificates are superfluous. Providers also pay attention to the account check return debits and suspects Postings on the account statement, which worsen the chance of getting a loan.

Will the loan from Switzerland be granted despite insolvency proceedings or personal bankruptcy?

Applying for a Swiss loan despite insolvency can jeopardize ongoing insolvency proceedings. Taking out another loan can lead to existing ones debt not forgiven will. If you borrow again, your creditors may suspect that you are not in control of your spending. In addition, the granting of a Swiss loan is subject to Swiss law prohibited in case of over-indebtedness leads (Art. 3 KKG). You should therefore refrain from taking out a loan from Switzerland. In the event of an upcoming insolvency, it is better to have one debt advice ask for help near you.

*Affiliate link: If you get to a provider via one of these links from my website, I may receive a commission. This does not result in any additional costs for you. ❤️ THANK YOU for using these links! ❤️

Disclaimer: This is well researched but non-binding information.