"Philipp, you credit rocket!"The endless Smava ads on YouTube can sometimes trigger a gag reflex and the short-circuit reaction "Hands off Smava". We therefore examine today whether you can trust the provider Smava, or whether it is better to keep your hands off Smava.

Anyone who wants to take out a loan has certainly passed the provider Smava and knows the advertising in which Philipp financed a huge barbecue station with a super cheap loan from Smava. No wonder, because with 600 employees Smava is one of the largest German credit brokers.

However, there are also negative points about Smava. The provider came into disrepute through aggressive advertising ("If credit then Smavaaa"), as well as a Email and SMS flooding of its customers. But also loans with minus interest (-0.4 %) is rated negatively by consumer advocates and relevant financial forums. This is because Smava actually awards these Loans in reality namely rarely. Often Smava then says instead "Due to your creditworthiness, we submit the following alternative offer ..." and you suddenly hold a much more expensive offer in your hands. So it's high time to take a close look at the negative sides of Smava.

For this purpose, we play the Advocatus Diaboli in this article and look for the dark downsides of Smava. So what are the reasons against Smava?

Despite Schufa a loan?

Smava works together with DSL Bank, the Targobank and many other banks togetherwhich, even with a poor credit rating Grant credits can. Therefore I recommend Smava* in the guide "Which bank gives credit despite negative credit bureau". In addition, in a study of evaluations from the Smava backend, I was able to determine that the provider in more than half of the cases really get a loan despite negative Schufa forgives

Finger weg von Smava? - Negative Smava credit experience

What you can learn here

Whether it is better to keep your hands off Smava or not, the swarm intelligence of different Smava customers who have been accepted or rejected knows best. Therefore I have 652 Smava credit experience from Google, Finanztip, Finanzfluss, Truspilot, Erfahrungenscout and Reddit evaluated to determine my own experience with Smava to substantiate.

1) Finger away from Smava, because the provider intrusive is?

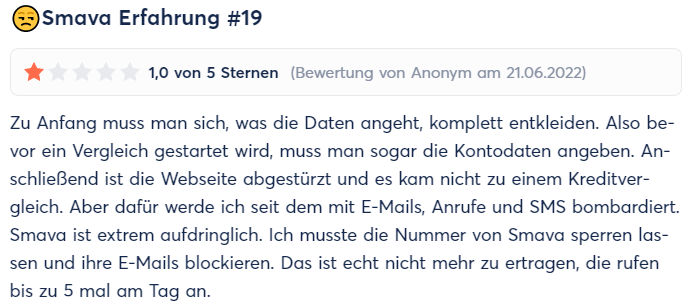

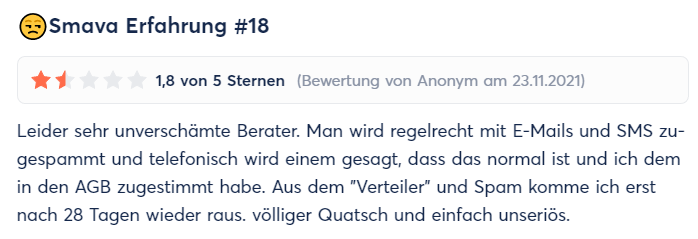

Of all the analyzed Smava loan experiences, one is frequent criticism the intrusive approach of the provider. How to write frustrated customers on financial flow from too many emails and SMS from the provider:

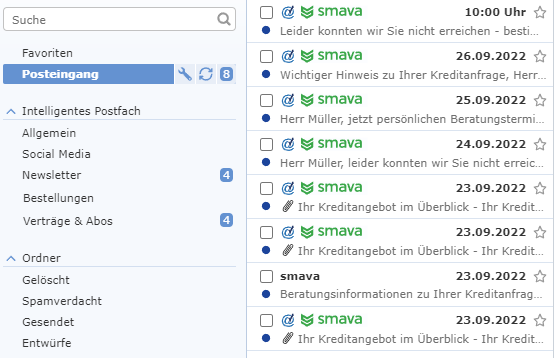

Partly Smava actually sends Several e-mails in one day. In addition SMS and Calls of the provider of Berlin telephone numbers (area code 030).

The purpose of contacting you is to complete the loan application if you cancel before. If your application is already complete, Smava wants you to complete the loan. Because Smava receives for each completed loan a Commission. If it remains with a credit comparisonthe provider comes away empty-handed. This explains the motivation behind Smava's aggressive approach.

How bad is it really and what can I do?

So, should you now keep your hands off Smava because the provider is pushy? - In a test request to the provider sent me Smava 8 emails within one week. In addition I received 2 Phone calls from Smava, since I have the credit comparison but did not apply for a loan. You should therefore expect that Smava will contact you several times after entering the data.

Tip 1: If it's too much for you, you can have all your data deleted at Smava. All you need to do is send a short email to the provider. After all, the provider is obliged by the GDPR to delete all data upon request.

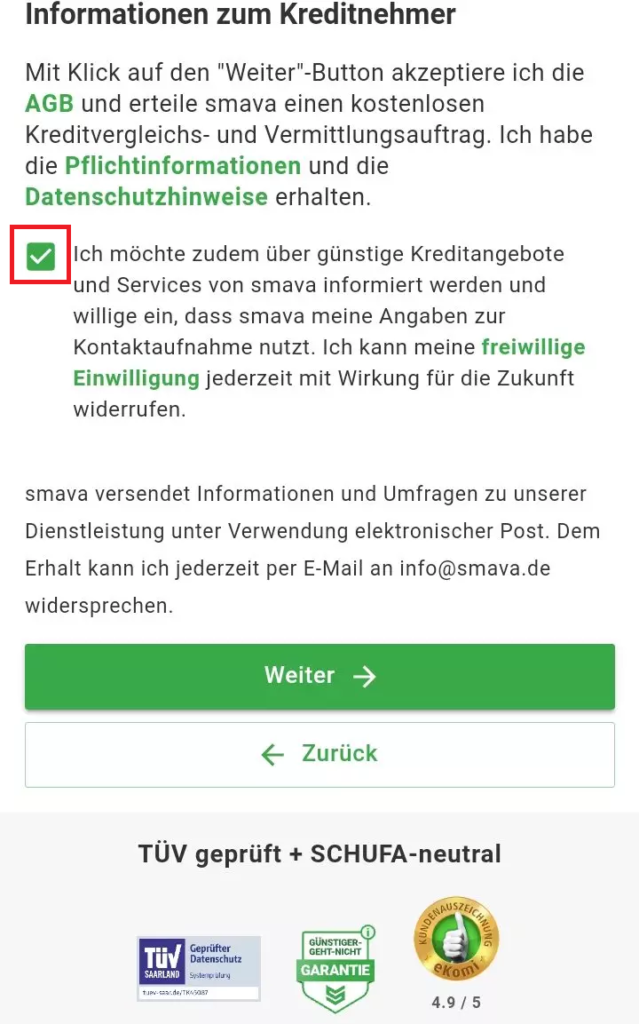

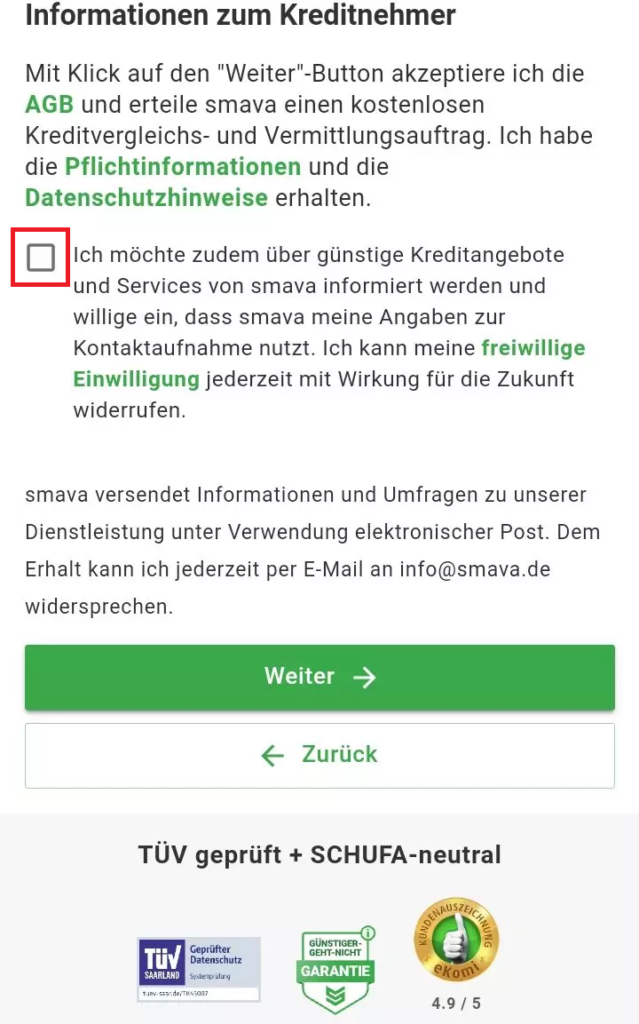

Tip 2: If you are annoyed by advertising e-mails, you can ask the Smava credit application* Remedy this by removing the following check mark:

2) Polarizing YouTube advertising

Smava's YouTube ads are very intrusive and are played out frequently. Many potential Smava customers are already so annoyed by these polarizing ads that they swear to keep their hands off Smava. Here are a few examples of annoyed Smava customers on Google My Business:

- One customer reports he has had to watch SMAVA's ads on YouTube at least 100 times and is so annoyed by them that he describes the condition as "completely sick" titled.

- Another reviewer even speaks of the fact that the Smava advertising "Terror" be.

- Smava's advertising is displayed on Google as so "creative like dogs under shoe“.

- "Unbelievably annoying" is the Smava advertisement, reports a reviewer who has no interest in a loan.

- Another reviewer is so triggered by the Smava advertising that he would not even consider Smava if he received a better loan offer. He finds the financing for the grill station "ridiculous“.

- Another user vomit even in the beam when he gets the ads displayed on YouTube.

- Another user concludes from the annoying ads that the store can only be suitably bad.

If you haven't seen the Smava ad yet, here's a link. Does this also trigger you so hard that you immediately leave Smava alone?

The video is embedded by Youtube and only loaded when the play button is clicked. The apply Google Privacy Policy.

3) Smava negative interest rate experience

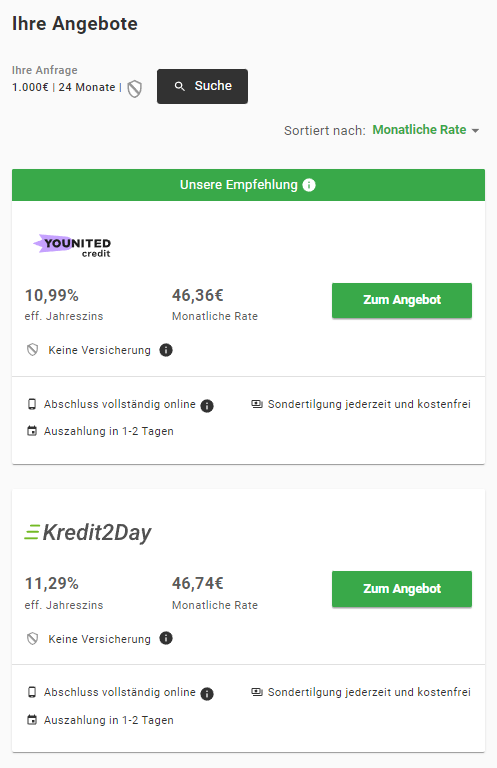

At the Credit with minus interest the question arises, what Smava gets out of giving money to its customers. The fact that Smava books the costs for the negative interest rates under the heading of marketing initially makes one wonder. Anyone who inquires about a loan with negative interest rates quickly realizes that there are a lot of alternative offers after the loan inquiry. The interest rates are then often completely different.

It looks like this: If you have made a loan request, Smava then sends you often several Credit offers matching your creditworthiness to. These often have little to do with negative annual interest rates. I have the Smava minus interest with a neat Net salary of € 4,000 tested and received even with it, only loans with 11 % interest, which is above other 1000 € mini loans From for example cashper* lies.

As a consumer, you have to be aware that the Smava negative interest rate is a Marketing campaign trades. You will not necessarily receive the offer. Through the request, however, the comparison portal receives not only Name and address, but also information about Occupation, income, expenses, property, tenancy, and even relationship status.. This is data with high value. This is because providers can use this data to send out suitable credit offers in the follow-up.

According to some reviews and my own experience, the Smava negative loan is often a Fake. One often does not get a loan at these conditions. Instead, you get expensive credit offers from Younited, Kredit2Day and others. Banks from home and abroad.

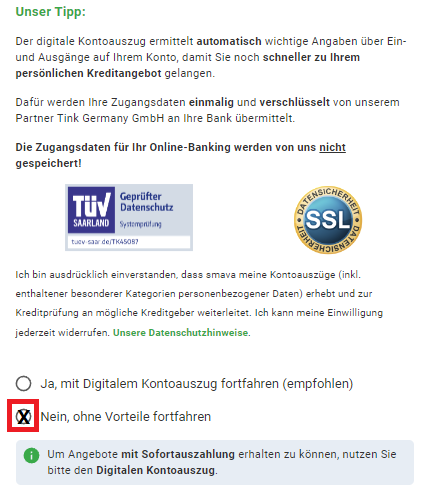

Own experience with Smava negative interest: Insight into the account is not necessary!

My own experiences with the Smava negative interest rate largely coincide with those of complaints. In a test request, instead of negative interest, I was offered high annual interest rates in the double-digit percentage range as an alternative. What is not correct, however, is the fact that you have to give Smava insight into all account transactions in order to receive a credit offer. If you do not want the digital account statement, select the option digital account statement by clicking on "No, proceed without benefits" simply off.

4.) Pre-filled credit applications with higher amounts by mail.

Last but not least, reviewers complain that they have prefilled Credit applications received that contained higher amounts than the credit amounts originally requested. This also changed the terms and conditions of the loan. Instead of the advertised negative interest rates, inquirers thus often received alternative offers at significantly worse conditions.

Is Smava a Rip-off or scammer from whom it is better to keep your hands off?

So far, we have put Smava in a very negative light. After all, that's the point of posts like this. You should be informed about any downsides of the provider before you make a decision for or against the provider. However, one should not forget with such a one-sided negative view that Smava also has many positive sides, which are still to be considered for a final judgment for or against Smava:

- Thus one saved by a Loan comparison through Smava* more than one third of the costs. This is the result of a survey in which the average interest rates of the Bundesbank was compared with the loans brokered by Smava.

- Unlike other providers, Smava has a, fully digital comparison process. This means that you receive several credit offers directly after you have entered your data. With other credit comparison portals, you only receive a credit offer after manually checking the data, which delays the application by one or two days.

- Smava works with most reputable banks, and can therefore often offer a Credit with bad credit convey.

- Smava has the highest score on the rating portals Google, Finanztip, Finanzfluss, Truspilot, Erfahrungenscout countless 5-star ratings. The bad reviews are definitely the exception rather than the rule.

Is Smava a rip-off? - My opinion

If you include these points in the overall picture, you can't say that Smava is a rip-off or scam artist that you're better off staying away from. Even if Smava's advertising gets on your nerves, it is advisable to at least have a Comparison offer about the provider to avoid paying too much interest over several years.

Still unsure about sharing your data?

Those who are afraid for their data can use services like 10 minutes mail and Vsim Card use to not to leave traces. These are email and SMS services that you can download from the browser. If you close the window, you will not receive any more messages. However, you should be aware that Smava cannot determine your creditworthiness with fake data without problems. Therefore, you will receive with your real data possibly significantly better interest rates.

Conclusion - Finger weg von Smava - Ja oder Nein?

If you're thinking about applying for a loan and don't want to have multiple providers over one credit comparison individual inquiries, Smava, as a credit comparison portal, offers you the possibility, without much effort, to find a Credit at best conditions come. In fact, loans brokered via Smava are in fact about a third cheaper, than the national average. This was the result of an investigation by Smava in 2021.

In addition, unlike other credit intermediaries, Smava has a fully digital application route. This makes the comparison with other providers for you simple, paperless and fast. Because through this you get immediately a credit offer and not by e-mail on the next banking day or the day after, as is the case with other providers.

Furthermore, Smava has countless top ratingswhich by no means convey the image that you should keep your hands off the portal. In addition, due to the integration of various banks and the P2P platform auxmoney* one Lending even with poor credit rating possible. But also with negative Schufa entries stand the chances of credit with Smava good. Therefore, the provider is also listed in the article "Which bank gives credit despite negative credit bureau?" recommended.

35 % more favorable, immediate comparison offer, award of Credit with bad creditSmava also has many advantages!

In summary, Smava is definitely a serious platform. Smava has over 600 employees and is based in the heart of Berlin Friedrichshain.

However, you should use the Working method of Smava in credit mediation and the associated trade-off. For example, Smava offers excellent terms for persons with credit needs in different credit ratings.

The price you pay is your data. You have to allow the provider, you by e-mail, SMS and phone to contact you.

Many appreciate this All-round servicebut it also annoys some people. If you get involved with Smava, you should therefore be aware of the Trade-off good interest rates against your data and occasional emails and text messages. be known.

So if you know what you're getting yourself into with Smava, the initial question "Hands off Smava?" can be answered with a clear no. The frequent contact of the provider, namely allows Smava to arrange high loan volumes and thus negotiate first-class conditions for its customers.

Smava has been brokering loans for over 15 years and has now established itself as one of the biggest players. Since the credit comparison of Smava is free, you have except a few mails, no disadvantages to you about Smava a free comparison offer*. You should not miss this at all, so as not to overpay for your loan for many years.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

BIW AG made me a bank master number together with Smava and managed an account there. The information I received from Smava was a jumble of notes without any comprehensible information, from which nothing could be taken. A third-party email address was then stored with the credit requests. Nothing was clarified. I find it all more than dubious.

Could it be that Smava is going down the drain so slowly? Can remember an application there a few years ago where everything went smoothly. My last application a few weeks ago was rejected for virtually no reason. This development is also reflected on rating portals.

No, I see it differently. Because there are definitely some reasons for Smava. See the last chapter.