If you receive sick pay, your credit rating is weakened. It is therefore particularly difficult to cover your credit needs in the event of a prolonged illness for which you receive sick pay. Many banks will withdraw from a loan despite sick pay. That's because sick pay for banks not like regular income impounded can be. Seizure of sick pay is possible, but banks shy away from the additional effort and costs. Due to these regulations, many people are faced with the question "Which bank gives credit despite sick pay?"

Because banks often do not grant a loan if sick pay the only source of income is. Thus, honest and reliable debtors face a problem when they need credit. However, there are still many options, one Credit despite sick pay to obtain.

The table shows information on credit despite sick pay from 10 banks and credit intermediaries. These providers also award reduced income, such as sick pay with a high probability of a loan. This is also the contribution "Where can you really get a loan despite negative Schufa?“ enlightening.

#1: Receipt credit  4,9/5 (eKomi) Interest charges: approx. 8 % at €10,000 & 72 months Loan Amount: 100 to 300,000€ Minimum income: €1,300 net per month Duration: 12 to 120 months To the provider: Bon-kredit.de | |

#2: Smava  4,9/5 (eKomi) Interest charges: -0.4 % at €1,000 Loan Amount: 500 till 120.000€ Minimum income: €601 net per month Duration: 12 to 120 months  To the provider: Smava.de | Speed Costs Smava undercuts offers from other providers with the "You can't get cheaper than this" guarantee seriousness To the provider: Smava.de |

#3: Vexcash  5/5 (eKomi) Interest charges:approx. 14.8 % pa rms. Loan Amount: €100 to €3,000 Minimum income: €700 net per month Duration: 15 - 90 days To the provider: Vexcash.de | Commitment probability Inaccurate data on commitment probability Speed Costs Smart option too expensive To the provider: Vexcash.de |

#4 Auxmoney 4,8/5 (eKomi) Interest charges:approx. 5.24 % pa rms. at €13,300 & 84 months Loan Amount: €1,000 to €50,000 Minimum income: €1,000 net per month Duration: 12 to 84 months To the provider: Auxmoney.de | |

#5 Sigma Kreditbank 4,8/5 (eKomi/Maxda) Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months To the provider: Sigma credit bank | Commitment probability Refusal, without permanent employment Speed Costs Interest expensive To the provider: Sigma credit bank |

#6 Creditolo  4,3/5 (trust pilot) Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months To the provider: Creditolo.de | Commitment probability Refusal, without permanent employment Speed Costs Interest expensive To the provider: Creditolo.de |

#7 Ferratum  4,7/5 (eKomi) Interest charges:10,36 % + installment option Loan Amount: €50 - €1,000 for new customers €50 - €3,000 for existing customers Minimum income: €1,100 net per month Duration: 30 days - 180 days To the provider: Ferratum.de | Commitment probability Inaccurate data, for commitment probability Speed At the end of 2022 there are unfortunately delays in payment up to 48 hours Costs Interest expensive To the provider: Ferratum.de |

#9 DSL Bank  4,5/5 (Proven Expert) Interest charges:4,40 % Loan Amount: 5000 € - 50.000 € Minimum income: unknown Duration: 48 - 120 months Installment loan despite negative Schufa: To the provider: DSLBank.com | Commitment probability Inaccurate data, for commitment probability Speed Costs Favorable interest rates construction financing despite negative Schufa: To the provider: DSLBank.com |

#10 Maxda  4,8/5 (eKomi) Interest charges:8.9 % (for 2/3 of customers at €10,000) Loan Amount: 1.500 € - 250.000 € Minimum income: 1.260 € Duration: 12 - 120 months To the provider: Maxda.de | Commitment probability Inaccurate data, for commitment probability Speed Costs Caution: In some cases, insurance is taken out before the loan is concluded seriousness To the provider: Maxda.de |

#11 Credimaxx  4,8/5 (eKomi) Interest charges:7.9 % (for 2/3 of customers at €4,000) Loan Amount: 500 € - 80.000 € Minimum income: 1.100 € Duration: 12 - 120 months To the provider: Credimaxx.de | Commitment probability Chance of success lower than with other providers Speed Costs seriousness To the provider: Credimaxx.de |

#12 Cashper  4,7/5 (eKomi) Interest charges:0 % for new customers Loan Amount: 100 € - 1.500 € Minimum income: 700 € Duration: 30 - 60 daysTo the provider: Cashper.de | Commitment probability Chance of success very high Speed Costs Free application for new customers To the provider: Cashper.de |

#13 TF Bank  4,4/5 (trust pilot) Interest charges:0 % for up to 51 days Loan Amount: 0 - 10.000 € Minimum income: not known Duration: no limit To the provider: TFBank.com | Commitment probability Chance of success: medium Speed Costs Free of charge for up to 51 days, but high interest thereafter seriousness |

#14 Advanzia  4,5/5 (trust pilot) Interest charges:0 % for up to 7 weeks Loan Amount: 0 - €20,000 for long-term customers. Maximum limit of €2,000 after application, €3,000 after three months and €5,000 after eight months. Minimum income: No minimum income required - application without salary certificates Duration: no limit To the provider: Advanzia.com | Commitment probability Chance of success: good Speed Costs Free of charge for up to 7 weeks, but high interest thereafter seriousness |

#15 Consors Finance  4,3/5 (trust pilot) Interest charges:2,99 % Loan Amount: 500 € - 50.000 € Minimum income: 650 € net per month Duration: 6 - 120 months To the provider: About Consors Finance | Commitment probability Inaccurate data, for commitment probability Speed Costs Very favorable interest rates seriousness To the provider: About Consors Finance |

An alternative to cover credit needs in the event of illness policy and Mortgage Loan. But also one guarantor can often enable a loan despite sick pay. When it comes to car financing, there are even more options to get a loan despite sick pay. These include one Financing through car dealershipsright or alternatives like that Leasing despite poor credit rating or that Car subscription without Schufa.

Which bank grants a loan despite sick pay?

What you can learn here

- Which bank grants a loan despite sick pay?

- Credit despite sick pay – often unavoidable, even for middle-income earners due to the high costs

- What else you can do to get a loan despite sick pay

- Received a loan from Targobank despite sick pay?

- Credit despite negative credit bureau and sick pay

- The best 6 options and alternatives for credit needs despite sick pay at a glance

If you need a loan despite sick pay due to a long-lasting illness, many banks will refuse you. This is because sick pay is only legally recognized as a benefit in certain circumstances attachable income is applicable. If the borrower defaults on the loan installment, it is much more difficult for the bank to get the money. Therefore, banks often generally refrain from lending when receiving sick pay. However, many honest people are unjustly punished by the banks. Out of necessity, people often search for "Which bank gives credit despite sick pay?".

Get credit despite sick pay in difficult cases

Which bank grants a loan despite sick pay? – If you receive more than €1,300 sick pay, many banks can grant you a loan. The loan despite sick pay is then granted by Bon-kredit, Smava, Sigma Kreditbank, Creditolo, Ferratum, Maxda, Credimaxx, Auxmoney or Cashper or Vexcash. The provider bon credit* is often best suited in difficult credit cases such as sick pay and a bad credit bureau score. We therefore recommend the provider if you have an urgent need for credit while receiving sick pay.

However, they are Conditions at Smava often better. In addition, you will receive several loan offers at the same time from Smava. In the case of a bon loan, on the other hand, only one. Therefore, if your credit rating is at least mediocre, it is better to inquire with both providers. If you get a loan from Smava, it's probably the better offer. The chances of rejection are high Smava* but higher, which is why in difficult credit cases bon credit* is preferable. However, an inquiry from both providers does not do any harm and does not affect the Schufa or your creditworthiness (keyword: Schufa-neutral condition request).

Small loans are often easier to grant despite receiving sick pay

The providers Cashper, Vexcash and Ferratum have made a name for themselves for smaller loans despite sickness benefit or with little sickness benefit. The Berlin provider Vexcash awards it Loans in less than 1 hour despite negative credit bureau entries. Ferratum, on the other hand, grants a loan even if you cannot or do not want to provide proof of income. The loans are also between on low incomes 500-700 euros and have comparatively short terms of between 15 and 90 days.

This Mini loans are usually granted directly by the banks without much fanfare - However, debtors have to support the unproblematic lending despite poor creditworthiness and negative credit bureau cashper*, Vexcash* and ferratum* pay with slightly higher interest and fees. If you do without extras such as the 2-rate option or the immediate payment, these short-term loans will be granted on reasonable terms. They are therefore suitable as a credit alternative to obtain a loan in the event of illness.

Credit despite sick pay – often unavoidable, even for middle-income earners due to the high costs

Sickness benefit is an income that is subject to social security contributions. It is regulated in the Social Security Code and corresponds to 70 percent of gross income according to § 47 SGB. In addition, sick pay is capped at 90 percent of your net income.

The sick pay amounts to 70 percent of the regular wages and income earned, insofar as it is subject to the calculation of contributions (regular wage). The sick pay calculated from the wages may not exceed 90 per cent of the net wages calculated when paragraph 2 is applied accordingly

Social Code – Section 47 Amount and calculation of sick pay

Therefore, receiving sick pay means a loss of income. With a gross salary of 2,200 euros, the net sick pay is around 1,253 euros or 41.78 euros per day. Sickness benefit is paid on the basis of calendar days and not monthly.

The example shows that even with a middle income it is not easy to cover the running costs for housing, car and groceries in addition to the often additional costs for medication and medical aid facilities in the event of illness. A loan despite sick pay from a provider like bon credit* can often provide relief. However, the loan installments also increase the monthly expenses and you must be able to cover them.

What else you can do to get a loan despite sick pay

Proof of speedy recovery with a medical certificate or expert opinion

To further facilitate borrowing, it helps if you can estimate that you will soon be able to work again. In the best case you have over your speedy recovery a medical certificate that you can present to the bank if you have any questions. A medical certificate or an expert opinion is suitable for this, in which a doctor assesses your health performance.

If you can go back to work soon, the chances of a loan approval are slightly better. Yet it is bon credit* possible to get a loan if you continue to receive sick pay. However, you should keep in mind that a loan will continue to burden your income with the loan installment despite sick pay. You should therefore first determine how much credit you can afford with an income and expenditure calculation.

With a guarantor, the approval also works for sick pay

Also relieved one guarantee borrowing if your income is only sick pay. Persons who are employed subject to social security contributions and earn a net monthly income of €1,300 or more are suitable as guarantors. In addition, there should be no negative entries in the guarantor's Schufa file. If someone close to you vouches for you, that person is also liable for the loan you have taken out. Nevertheless, the loan installments are disputed by yourself. Only if you are no longer able to pay will the guarantor step in. If you take out a loan together with a guarantor, you must still be able to pay the loan installments yourself. So you should have one in this case too household bill set up. With this you can determine yourself how much monthly loan installment you can afford at all with the sick pay available to you. You have the following options with the provider bon credit* High chances of a low-interest loan if you receive sick pay.

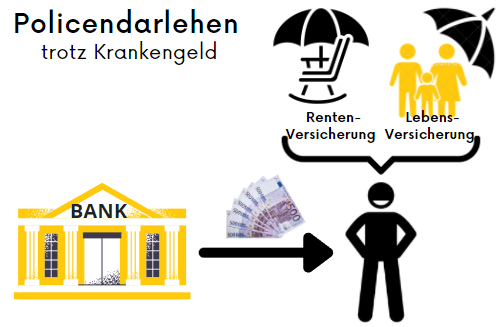

Enable credit despite sick pay with a policy or mortgage loan

If you have a pension insurance or life insurance you can also have one policy loan record, tape. The surrender value of the policy should be at least 1,000 euros be. You use this value as security for your loan. With the policy loan, your pension or life insurance loaned and serves as security for the bank. Due to the security, the bank can do without a Schufa query. A recommended provider for policy loans is the SWK bank*. Other options are mortgage loans, where you buy your property through a real estate financing lend

If you need money for a car, there are other options for getting a loan despite sick pay

When it comes to financing a new one Cars despite sick pay there is also the option of financing through a car dealership. in the post Which car dealership finances despite negative credit bureau 5 car dealerships are listed that will finance your car directly and without a bank even if you have a poor credit rating due to sick pay. In addition, there are alternative options if the credit rating is weak Leasing without Schufa or one Car subscription without Schufa by Finn is an option. at Finn* In addition to low prices, you will also receive an all-round carefree package for your car.

Received a loan from Targobank despite sick pay?

If you have a solvent guarantor on hand, the chances of getting a loan from Targobank despite sick pay are good. Even if your sick pay is more than €1,300, there is a realistic chance that Targobank will approve the loan despite sick pay. However, if you do not have a solvent guarantor and have less than €1,300 sick pay per month, borrowing from Targobank is not promising. In this case, your chances of getting a loan are increased despite sick pay bon credit* significantly better.

If your sick pay is more than €1,300 or you have a solvent guarantor, you can use the Loan Comparison Calculator send an inquiry to Targobank. You can use the methods mentioned in this article to further increase the chance of a loan approval from Targobank despite sick pay. Due to the higher requirements of Targobank, it is not part of our list of banks that still grant loans despite sick pay. Grant credits.

Credit despite negative credit bureau and sick pay

If you not only receive sick pay, but also have a negative Schufa entry, taking out a loan is particularly tricky.

The amount of your sick pay plays a decisive role in the loan despite negative credit bureau and sick pay. If you have €1,000 or more a month at your disposal, a loan is realistic despite negative credit bureau and sick pay. In the table in the section Which bank grants a loan despite sick pay? above you will find the required minimum income of the credit providers. If you alternatively or additionally have other collateral such as life insurance with a value of more than €1,000, the chances of a loan approval are good despite negative Credit bureau. This is because the bank can now dispose of the life insurance, and the Schufa information is therefore rather irrelevant for the bank.

Should it be car loan act, you will find a little further up more alternatives for a loan despite negative Schufa and sick pay.

The best 6 options and alternatives for credit needs despite sick pay at a glance

If your income is no longer as high due to prolonged illness and sick pay, you have the following options to still get a loan:

- in section Which bank grants a loan despite sick pay? you will find many providers who specialize in Loans in difficult cases have specialized. This is how a loan application works via bon credit* Often problem-free even when receiving sick pay. But other banks are also available to you for your loan needs despite sick pay. However, you have to for this

- an early one re-entry into the profession provide credible evidence (e.g. with a medical certificate)

- The credit together with one guarantors to graduate

- A loan with a Insurance policy as security complete (policy loan). For example, the SWK bank*.

- With a Mortgage Loan mortgage your property

- If you want to buy a new car with the loan, you can at some car dealerships request a car dealership direct financing. These are alternatives Leasing despite negative credit bureau or a Auto subscription despite negative credit bureau about Finn*

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

1 thought on “Kredit trotz Krankengeld – Beste Optionen (10+ Anbieter)”

Comments are closed.