if you a P accountIt is worth checking whether you can increase the tax-free amount. While the Conversion of the account according to the law must be made within four business days, such a deadline does not exist for the increase of allowances. Therefore, many corrected rightly ask "How long does it take the P-Konto Allowance to increase?". Normally, however, the increase of the allowance on the P-Konto occurs within three to four banking days. But sometimes you wait more than 20 days until the bank has increased the allowance.

However, customers are not entitled to a quick increase in the allowance, because there is no legally prescribed maximum duration of the increase in the P-Konto allowance.

Often, banks do not process the application for an increase themselves. Instead, service providers are used for this purpose. If the increase of the allowance on the P-Konto has worked, you will not receive a separate notification. You can find out whether your request for an increase in the allowance has been approved in the account information in Online Banking. If you do not have a Pfändungsschutzkonto yet, your money will be at risk in the event of a garnishment and may flow unprotected to the creditors. In the article Open P-Konto - Which Bank? you will find the best P accounts to protect your money from seizure.

What you can learn here

- P-Konto Increase allowance - How long does it take?

- Fastest processing of P-Konto allowance increase so that it does not take long time

- P-Konto Increase allowance online free of charge

- So what can you do to still increase P-Konto allowance free online?

- How long is the increase valid?

- Where can I have the allowance increased?

- For whom do I receive additional allowances on my P-Konto?

- When does the money in the P account go to the creditor?

- When is the money available if the P-Konto allowance has been exceeded?

- What happens when double salary is received on the P-Konto in one month?

- What happens with too much money in the P account?

- When will the account be free again once the garnishment is paid?

- Bottom line, "How long does it take to increase the P-Konto allowance?"

P-Konto Increase allowance - How long does it take?

pay center - 3 to 4 days

P-Konto Increase allowance - How long does it take at Paycenter? – pay center* processes the application for an increase in the P-Konto allowance within three to four bank working days. You can then check the status in online banking. If you want to know whether the increase in the allowance on your account was successful, it is advisable to check the status yourself in online banking or to ask the bank.

In contrast to other banks, you can find the documents for the increase of the tax-free amount directly in the online banking at Paycenter. In order to increase the P-Konto tax-free amount, you can fill in and submit the tax-free amount increase form in accordance with section 903 (1) of the German Code of Civil Procedure (ZPO).

The Pfändungsschutzkonto can be activated in a few minutes in the logged in online area. The basic allowance will be automatically saved from this moment and your checking account cannot be garnished above this amount. In order to additionally increase the exempt amount, you can submit the certificate for the increase of the exempt amount (according to section 903 (1) of the Code of Civil Procedure on the exempt amounts pursuant to sections 902 and 904 of the Code of Civil Procedure) filled in. You can find the certificate in your logged-in online area under P-Konto.

Savings Bank - 3 to 4 days

P-Konto Increase allowance - How long does it take at the Savings Bank? - On the Sparkasse-P-Konto the increase in the exempt amount takes about three to four bank working days. As an account holder, you will not receive a notification of the successful P-Konto conversion. Instead, you have to see the status in online banking yourself.

The savings bank hands over increases in the allowance on the P-Konto to a service partner. This means that the savings bank accepts the form to increase the P-Konto allowance and sends the form directly to the service partner. It usually takes 3-4 days for the increase to reach our system.

Employees on the duration of the P-Konto tax-free allowance increase at the Sparkasse

postal bank - 3 to 20 days

P-Konto Increase allowance - How long does it take at Postbank? - Also at Postbank P account the increase in the allowance takes less than a week. You can assume approximately three to four bank working days until your allowance on the P-Konto has been increased. In individual cases, however, it can take up to 20 days or longer at Postbank.

As the account holder, you will not receive notification of the successful P-Konto conversion. Instead, you must check the status yourself in online banking.

German Bank - 3 to 4 days

P-Konto Increase allowance - How long does it take at Deutsche Bank? - Also with one Deutsche Bank P account the increase in the exempt amount is quick. You can expect approximately three to four bank working days until your allowance has been increased on the P-Konto. As an account holder, you will not receive a notification of the successful P-Konto conversion. Instead, you have to see the status in online banking yourself.

People's Bank - 3 to 4 days

P-Konto Increase allowance - How long does it take at the credit union? – The Volksbank usually processes the application for an increase in the P-Konto allowance within the usual period of three to four bank working days. As an account holder, however, you will not receive any notification of the successful P-Konto conversion from the Volks and Raiffeisen banks either. Instead, you have to check the status yourself in online banking or ask the bank.

Commerzbank - 3 to 4 days

P-Konto Increase allowance - How long does it take at Commerzbank? - At the Commerzbank P account the application for an increase in the allowance is processed within three to four bank working days. As with the other banks, you will not receive any notification from Commerzbank that your application has been successfully implemented. If you want to know whether the increase in the allowance on your account was successful, it is advisable to check the status yourself in online banking or to ask the bank.

Fastest processing of P-Konto allowance increase so that it does not take long time

All banks take about the same amount of time to increase the P-Konto allowance, according to my surveys. In addition, minor differences in processing time between branches are to be expected.

How long it takes to increase the P-Konto allowance also depends on how quickly you can submit the documents. Since the increase of the P-Konto allowance depends on certificates of the family insurance fund or a lawyer, you should take care of appointments as soon as possible.

But even if the increase in all banks at about the same rate, it remains to note that the pay center* is the only provider to offer the P-Konto certificate directly in online banking. This shows the provider's experience with garnishment protection accounts.

P-Konto Increase allowance online free of charge

In order to ensure garnishment protection on the P–Account to increaseyou must have an official body certify that you are entitled to the increase. The P-Konto allowance increase is currently only available online from some law firms. However, these law firms are well remunerated for the online service: For the certification of the increased need for the P-Konto allowance, the online law firms charge about 15 Euro fees. Non-profit debtor and insolvency counseling agencies do not offer the P-Konto allowance increase online, but their service is free.

So what can you do to still increase P-Konto allowance free online?

You can increase the P-Konto allowance free of charge by downloading and filling in the relevant certificate online. Afterwards you can get the increase of the tax-free amount from Job center, social welfare office or the family insurance fund certify free of charge. This method is the fastest of all options due to the already pre-filled form. Moreover, it is the only free method to increase the allowance on the P-Konto.

How long is the increase valid?

In principle, an increase in the P-Konto allowance applies indefinitely. However, your bank may request a current certificate. It is therefore advisable to enter into a dialogue with the bank so that you can easily receive your personal allowance.

Where can I have the allowance increased?

You can submit your request for an increase in the allowance to one of the following offices:

- Family benefits office, job center or other benefit-granting agency

- Non-profit debtor and insolvency counseling center

- Employer

- Lawyer / tax advisor / commercial debt counseling service

- Enforcement court / enforcement agency

While the family benefits office issues certificates free of charge, lawyers usually charge a small fee. On the other hand, the waiting time with lawyers is usually shorter. Especially if you have P-Konto Certificate online can be issued. You can find more information about this at the Consumer Center.

Unlike lawyers, the employer, or debt counseling services have Job Center, Social Welfare Office and Family Welfare Office the obligation to issue the P-Konto certificate for the increase of the allowance free of charge.

For whom do I receive additional allowances on my P-Konto?

Besides the basic allowance you can submit additional personal allowances on the Pfändungsschutzkonto. This will allow you to increase the protected amount. In total, you can submit five additional allowances. You can submit a request to increase the garnishment exemption limit for the following persons:

- your spouse,

- minor, natural as well as dependent children,

- but also for adult biological children in training or studies and

- Persons who are in a community of need with ALG 2 can also receive further allowances

Registered life partners, on the other hand, do not count as dependants. Therefore, registered life partners cannot be taken into account when increasing the garnishment limit. However, life partners can be included if social benefits are received on the account and there is a community of need. Then you can apply for an additional allowance even though you are not married.

When does the money in the P account go to the creditor?

When the money goes to the creditor depends on whether it is moratorium amounts under §900 ZPO or takeover amounts under §899 ZPO. In either case, the money goes at different times to the creditor. The list in the article shows you when the money goes to the creditor. P-Konto: When does the money go to the creditor?

When is the money available when the P-Konto Allowance exceeded was?

If you receive more money in a month than the garnishment exemption allows, you exceed the P account exemption. Now the bank moves the money above the garnishment exemption to a disbursement account and blocks it for the current month. In this case, the bank usually releases the money on the first banking day of the following month. You can find an illustrated explanation of this in the article: "P-Konto Exemption amount exceeded: When is the money available?"

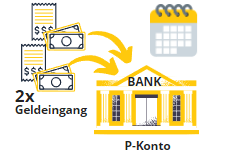

What happens when double salary is received on the P-Konto in one month?

at two salary receipts in one month on the P-Konto As a debtor, you will still have disadvantages through no fault of your own in December 2021 despite the amendment to the law. This is because the bank will initially block the money above the garnishment allowance and it will not be available to you again until the following month. In the following month you can again have full control of the money, but it is now your responsibility to do so. Because if you don't use up all of the money transferred to the following month or withdraw it, the bank transfers it again. However, after 3 transfers, the money flows out to the creditors. The situation regarding twice the salary in one month on the P account is regulated in §899 ZPO in the second paragraph.

What happens with too much money in the P account?

If you receive more money than the P-Konto allowance in one month, the money will first be credited to both parties in the following month on the disbursement account blocked. Only when the amount on the distribution account exceeds the allowance, the money goes to the creditor. There are several cash flows here, which are described in the article "What happens with too much money in the P account?" are explained with illustrated instructions.

When will the account be free again once the garnishment is paid?

Regardless of whether it's a savings bank, Volksbank, Postbank, Deutsche Bank, Targobank or other banks: direct and personal inquiries with your bank will always help you the most. The processing times in individual cases can only be generalized approximately. For example, at banks with advanced digitalization, such as Commerzbank or ING, the account can usually be activated in one to two days. Other banks, such as Deutsche Bank, often need more like a week for activation. The times given refer to the point in time when the creditor's confirmation of payment is received by the bank.

When the Account is free again after paid garnishment, but also depends on whether:

- You have paid the debt in full

- You have settled the debt directly through a fornular (often through online banking) or through parallel means.

Direct settlement of debts is recommended and eliminates the need for proof of payment from the creditor. Therefore, this way is also often much faster.

Conclusion: "How long does it take to increase the P-Konto allowance?"

While the Conversion of the account According to the law, this must take place within four business days, but there is no comparable period when increasing the allowances. At the banks pay center*Sparkasse, Deutsche Bank, Volksbank and Commerzbank, the increase in the allowance on the P-Konto takes place within three to four banking days.

Longer processing times were reported to us by Postbank customers. According to one report, a customer waited over 3 weeks for the allowance to be credited to the Postbank P account was increased.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.