In this post, I'll explain to you whether you can use the Sigma Bank loan despite residual debt discharge granted and how I come to my assessment. In the official Credit requirements of the bank, you only receive general information on the granting of credit, such as "No current insolvency proceedings, no wage garnishment/assignment" and "No entry in the Central Enforcement Court". Why is it possible to deduce that you will most likely not be granted the Sigma Bank* Credit despite residual debt discharge will there be?

Short summary: Does Sigma Bank grant credit despite residual debt discharge?

What you can learn here

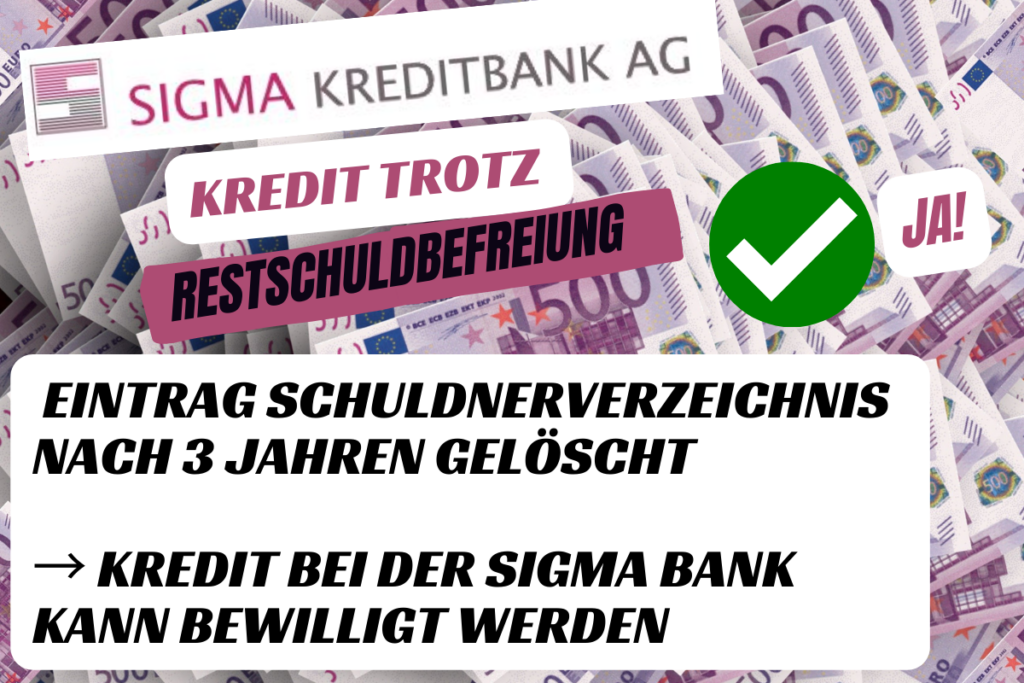

- Since entries in the debtors' register are deleted after 3 years and a discharge of residual debt also takes 3 years, you will receive credit from Sigma Bank despite discharge of residual debt.

- With the discharge of residual debt, it will be much easier for you to repay a new loan.

- Other banks consult the Schufa or other credit agencies before granting credit. The loan can then only be granted 6 months (if only the Schufa is retrieved) or 3 years (if other credit agencies are requested) after residual debt discharge has been granted.

(request free of charge via Maxda)

Why Sigma Bank gives you credit despite residual debt discharge

Even if the insolvency court grants a discharge of residual debt, a loan is not immediately within reach. This is because the Schufa entry remains in place for 6 months longer. The Sigma Bank* Checks in contrast to other banks none Schufa or similar files before granting credit. Instead, the Sigma Bank only has insight into the Debtor register.

Sigma Bank can use the debtors' register to check whether there are any outstanding claims by other creditors. However, an entry in the debtors' register is automatically deleted again after 3 years. Thus, the deletion of the entry in the debtors' register coincides with the granting of residual debt discharge, if the latter was applied for in time. If you have received a discharge of residual debt, the entry in the debtors' register has also already been deleted.

That means: The debtors' register no longer contains any entries after the discharge of residual debt, as the 3-year retention period has expired. The residual debt discharge is then only still visible in the Schufa, which is not retrieved by Sigma Bank, however. Thus the Sigma Bank* grant a loan despite residual debt discharge, as they does not check Schufa entry.

What has changed with the "Sigma Bank loan despite residual debt discharge

The shortened residual debt discharge in 3 years has only been possible since October 1, 2020. Prior to this, the period of good conduct until the granting of residual debt discharge was 6 years and debtors had further requirements such as the assumption of procedural costs and a necessary repayment of debts of more than 35 percent.

Nevertheless, also in the past the entry in the debtor's record was deleted after 3 years. A loan via Sigma Bank was therefore also possible in the past and no Reason for refusal for Sigma Bank. However, it was much more difficult for debtors to repay this on time, as old debts still burdened debtors for the remaining 3 years of the good conduct phase.

Due to the shortened discharge of residual debt, it has now become much easier to obtain credit from Sigma Bank despite discharge of residual debt.

Credit despite residual debt discharge soon also with other banks?

Since March 2023, a Credit after residual debt discharge already within reach. Since then, the Schufa deletes the note "granted residual debt discharge" already 6 months after the debt discharge was granted. Before that, the deletion from the Schufa only took place after 3 years. Other credit agencies, such as Crif or Creditreform, continue to delete the entry only after 3 years.

This period may be generally shortened to six months. Only the ruling of the Federal Court of Justice will provide clarity (VI ZR 225/21).

Thus, you are not only completely debt-free after 3 years, but also After 3.5 years also creditworthy again. Before 01.10.2020 it took 6 years until the residual debt discharge and 3 years until the note was deleted from the Schufa. Thus, you were only creditworthy again after 9 years.

Only 3.5 years after an entry has been made in the debtors' register, you are already considered fully creditworthy again by many banks since March 2023. Check via Smava* where you can get the best conditions.

What does discharge of residual debt mean?

When a discharge of residual debt has been granted, it means that a person has paid off their Liabilities successfully paid or has reached a settlement with the creditors. After a discharge of residual debt, the remaining outstanding debts waived. The debtor therefore has no further payment obligations for the outstanding debts after a discharge of residual debt.

A discharge of residual debt can be applied for after 3 years

Since the 1.10.2020 obtain private debtors the Residual debt discharge already After 3 years. Unlike in the past, debtors do not have to have already paid a certain amount of debt. There are also no procedural costs for the discharge of residual debt. Once discharge of residual debt has been granted, there is a Blocking period of 11 years. This means that a renewed discharge of residual debt can only be applied for after 11 years (§ 287a para.2 no.1 alt.1 InsO). In addition, a second discharge of residual debt 5 years instead of 3 years.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.