People on low incomes often have a painful experience when applying for a loan: the more someone needs a loan because of their personal finances, the more difficult it is to apply. The "credit paradox" does Loans are very difficult for low earners, housewives, students, part-time workers and pensioners to obtain. But this article shows how and from which bank you can still get a loan as a low earner. And if the credit is not granted, you can still find it at the end of the article 7 alternatives, how you can get access to money despite a small income.

We are aimed at people who Credit with an income of 1000 euros, a Credit with 900 euro income or one Credit with an income of 600 euros require. If you need a loan as a low-income earner for a purchase and want to know: "Which bank gives credit for low income?" is Smava* a recommendation. You get there with an income of only 600 euros a loan. With a small credit requirement Vexcash* a suitable provider to borrow a maximum of 3000 euros. The Berlin provider of mini and short-term loans also lends money to people with low incomes. Only 500 € are required for income from Vexcash.

If your income is reduced due to a prolonged illness and receipt of sick pay, there is the possibility of a Credit despite sick pay to get. By consulting a guarantor or a positive medical certificate about your state of health, your chances improve significantly. There is also the option of receiving a small income or sick pay policy loan about the SWK Bank* to complete.

Which bank gives credit for low income?

What you can learn here

- Which bank gives credit for low income?

- Credit for low earners: rejections are the order of the day

- Which bank gives credit for low income? → What is possible

- An overview of the risks associated with the question “Which bank gives credit for low incomes?”

- Important bank requirements for the loan to be granted on low incomes

- Alternatives if the bank does not give a loan with low income

- 1.) Credit alternative for low income: the overdraft facility

- 2.) Small or mini loans are another alternative for low income

- What is the best low income mini loan?

- 3.) Pay up to 59 days later with a low-income credit card

- 4.) Get a low-income loan with a guarantor

- 5.) If you have a low income, you can also borrow money from private individuals instead of from the bank

- 6.) A low-income loan is granted through additional collateral

- 7.) Borrow items

- Conclusion on credit alternatives with low income

| bank or intermediary | minimum income | Interest charges* | Duration | loan amounts | Possible loan at €450 income | Possible loan at €600 income | Possible loan at €800 income | To the provider | |

|---|---|---|---|---|---|---|---|---|---|

| #1: Smava 5/5 (eKomi) |  | merit:€600 net per month | Interest and fees:approx. 2.5 % to 4 % | Duration: 6-144 months | Total: 1000 € - 100.000 € | Loan with €450 income: Together with a guarantor with an income of €600, up to €6750 is possible | Loan with €600 income: up to €9,000 | Loan with €800 income: up to €12,000 | To the provider: Smava.de |

| #2: Vexcash 4,7/5 (eKomi) | merit:€500 net per month | Interest and fees: 14,82 % | Duration:15 - 90 days | Total: €100 - €1,000 for new customers and €100 - €3,000 for existing customers | Loan with €450 income: not possible | Loan with €600 income: €100 - €1,000 for new customers and €100 - €3,000 for existing customers | Loan with €800 income: €100 - €1,000 for new customers and €100 - €3,000 for existing customers | To the provider: Vexcash.com | |

| #3: Barclay card 3,5/5 (critical investors) |  | merit: Must be sufficient for repayment | Interest and fees: up to 59 days 0 %; After that 18.38 % | Duration:up to 59 days free of charge | Total: Credit dependent. Low earners around €500 | Loan with €450 income: about 500 € | Loan with €600 income: about 500 € | Loan with €800 income: about 500 € | To the provider: Barclays.de |

| #5: Receipt credit 4,9/5 (eKomi) |  | merit:€1,300 net per month | Interest and fees:approx. 8 % at €10,000 & 72 months | Duration: 12 to 120 months | Total: 100 to 120,000€ | Loan with €450 income: Not possible | Loan with €600 income: Not possible | Loan with €800 income: Not possible | To the provider: Bon-kredit.de |

| #5: Cashper 4,7/5 (eKomi) |  | merit:€700 net per month | Interest and fees: Loan amount under €600: 0 % from 600 € loan amount: 99 € for the mandatory 2 installment options | Duration: 0-600 € : 30 days €600-1500: 60 days | Total: 100 € - 1.500 € | Loan with €450 income: not possible | Loan with €600 income: 100 € - 1.500 € | Loan with €800 income: 100 € - 1.500 € | To the provider: Cashper.de |

| #6: Credimaxx 4,9/5 (eKomi) |  | merit:€1,100 net per month | Interest and fees:approx. 7.9 % pa eff at €4,000 & 72 months | Duration: 48 to 120 months | Total: €500 to €300,000 | Loan with €450 income: Not possible | Loan with €600 income: Not possible | Loan with €800 income: Not possible | To the provider: Credimaxx.de |

| #7: Ferratum 4,6/5 (Trustpilot) |  | merit:€1,100 net per month | Interest and fees:10,36 % + installment option | Duration: 30 days - 180 days | Total: €50 - €1,000 for new customers €50 - €3,000 for existing customers | Loan with €450 income: Not possible | Loan with €600 income: Not possible | Loan with €800 income: Not possible | To the provider: Ferratum.de |

At interest rates are here no advertising promises, which anyway almost no one gets specified, but the more realistic 2/3 interest. 2/3 of the customers receive this. Status 09/21. More information from the provider | |||||||||

Credit for low earners: rejections are the order of the day

For the question "Which bank gives credit for low income?’ People on low incomes are often rejected. With a small wage packet, it is advisable to Smava* Inquire for credit requirements from €1,000. For this, you or a guarantor need an income of €600 or more. If, on the other hand, you only need a bridging loan for one month, you can get this on favorable terms Vexcash* apply for. The provider only requires a minimum income of €500, which is less than all other mini loan providers.

Another alternative to getting a low income loan is to get a free credit card as the Barclaycard* to use. In this case, the money will only be paid on end of the month after next debited from your account. This gives you a free loan for up to 7 weeks. Barclaycard does not have a minimum income. If you have little or no income, you may also be interested in these 4 options credit without income to obtain.

However, you should be able to pay the loan installments from your disposable income. Ideally, you will have the money to repay the loan amount in your account at the end of the month after next. This way you avoid the expensive monthly partial payment. If this is the case, you can also work with a low income, e.g. as a Student with part-time job apply for a Barclaycard. You will currently receive one for applying for the free credit card Bonus of €50. The provider can give this bonus because Barclaycard earns a lot of money with the partial payment function. In order to avoid unnecessary costs, however, you should refrain from using the partial payment function.

Which bank gives credit for low income? → What is possible

As a low-income earner, it is generally difficult to get a loan. The low monthly income makes banks doubt whether you can service the loan. So you have to convince the bank that you a good credit rating have. The best way to do this is to follow the tips and advice on this page on low-income loans. If your credit rating is bad, I refer you to the guide “Which bank grants loans with bad creditworthiness?" and "Which bank grants loans despite negative credit bureau?“.

But with a low income, it is not only generally more difficult to get a loan. The possible sums are also included Low-income credit severely limited. The table above gives an indication of which loan amounts are possible with which providers and income. You can consider about 15 times the monthly net wage as the maximum value for the low-earner loan. What you should keep in mind if you are looking for a bank that will give you a low income loan:

As a low-income earner, you are a fairly high risk for banks because of your low income.

- at installment loans In a way, you are pledging your future monthly income. Your income serves the bank as security. The lower this security is, the more the interest rate increases. In this way, banks compensate for the risk of default.

- Unfortunately, this balance means that people who need the loan the most find it difficult to get it.

The number of banks that grant low-income loans is limited.

- Most banks require an income above the garnishment exemption limit. Without children, an income of 1260 euros and more is necessary in 2021. Low earners who apply for a loan with an income of 1,000 euros or less are rejected by many institutes.

- Credit intermediaries who grant loans below the seizure limit are: Smava*, Vexcash*, cashper*, ferratum* or credimaxx*. However, if you have a small income, you should not burden yourself with excessively high credit rates. To avoid a loan rejection, note:

The loan amount for the low-income loan is limited to around 15 times the monthly net

- at 1000 euros net so you can 15,000 euros credit arecord at 2000 euros net are about 30,000 euros credit possible.

- Not only the net income is limiting here, but that discretionary income, which can be used to repay the loan. A 15,000 euro loan with a term of 10 years can be had for about 150 € per month. With a 30,000 euro loan, you have to be able to raise around 300 euros per month.

An overview of the risks associated with the question “Which bank gives credit for low incomes?”

What is a low wage?

Legal is the term "low wage" clearly defined. Hereafter are low earners Apprentices whose monthly salary is €325 does not exceed. For these people, the employer has to pay the social insurance alone. The latter does not play a major role in classifying the risks in the question “Which bank gives credit for low incomes?”. It is only to be understood as additional information.

However, the term Low earners in everyday life much broader. Expanding the definition also makes sense for loans for low-income earners. For the banks, you are already considered a low-income earner if you do not have an attachable salary. This is the case for incomes of €1,260 or less. Therefore, many banks do not care whether you earn € 1,100 or € 325. Since both are below the garnishment exemption limit is located, finding a bank that will give you a low-income loan is similarly difficult.

Therefore, it makes sense in the credit system to expand the term low-income earners. We understand under Loans for low earners therefore also Loans for part-time workers, Financing with 450 euros jobs such as Loans with €500 or €600 income. I even go one step further here: In this article, we all include loans with income below the garnishment exemption limit (2021-2023: €1,260) as low-income loans. Because all these people have a hard time getting a loan from banks. A low-income loan is by the way nothing to be ashamed of. About 22 % of the total population earn less than the garnishment exemption limit like that IW Cologne found out. The fact that you are in “good company” as a low-income earner in Germany does not necessarily help you when applying for the loan – but it may take away any shame you may have.

Who needs a loan despite a small income

Of the 22 % low-income earners in Germany, the following people are particularly likely to be looking for answers to the question "Which bank gives credit for low incomes?":

- students

- Students have many options when it comes to the student loan like the low-interest KFW loan. However, you can apply for a student loan as a student even without a KFW.

- trainees,

- mini-jobber,

- part-time employees,

- housewives and househusbands with extra income,

- Pensioner,

- Pensioners with a good credit rating can obtain a Pensioner credit apply for

- Lending is granted up to around 75 years of age

- Retirees often have collateral. This is an award of the Pensioner loan despite basic security or negative Schufa entries possible.

What all groups have in common is that they only have one very low income feature. So leads an unplanned expense such as an additional payment for the utility bill or the repair of a defective household appliance usually leads to an insurmountable financial bottleneck. A loan is usually unavoidable without preparation for such cases further fees by reminders to avoid. But many banks block low-income lending away.

Why banks are reluctant to lend to people on low incomes

When looking for banks, which even with low income. Grant creditsyou will probably have experienced it yourself: The path to credit as a low earner is rocky and difficult. Banks shy away from the risk of lending to people without attachable income. What is perhaps understandable from the point of view of the bank makes life difficult for low earners. If you ask the wrong banks, you will be turned down even if you have enough discretionary income. This is the gap between your monthly salary and your current expenses. So exactly the money that you have available for the repayment of the loan.

If this gap is small, the more unforeseen the risk is that you will borrowed Total not repay including interest can. In such a case, the bank usually tries to seize the money to get their money back. However, this is not possible for low-income earners below the garnishment exemption limit. The bank may not garnish income. Therefore, banks are reluctant to grant loans to people with low incomes.

However, some banks still lend small four-digit amounts to people with low wages. You can find a clue in the table above. The numbers mentioned there are as upper house number to understand. This gives you a quick overview of which banks will give you the maximum loan for low income.

If you can still borrow significantly more from a provider, you should extremely careful be. Although is at Swiss loans for Germans From an income of 1,100 euros, a lot is possible, like this one Ranking you can see, but a little caution never hurts. You should always keep in mind that Offers that are too good to be true are mostly dubious.

What is recognized as income when borrowing from banks?

Be recognized when borrowing Wage and salary from an employed activity. Also recognized are the Salaries or pensions for civil servants and Pensions from the pension insurance when borrowing. However, they also count as recognized income when lending rental income or recurring Interest payments from bonds.

Low earners also often receive money from the following sources, most of which are from banks not recognized as income when lending will:

- BAföG

- ALG I and ALG II

- child support

- housing benefit

- burden allowance

However, these people usually have other options such as loans from the job center or subsidized KFW loans. You can find out more about this in the article on the subject credit in difficult cases obtain.

Conclusion on the risks of loans with low income & as a low earner

- Legally, low-income earners are people who earn less than 325 euros income have a month.

- Because banks below 1260 € income no wages may garnish you block the lending.

- Social and transfer payments such as unemployment benefits 1 and 2 or BAföG are not recognized as income. Despite their low income, these people still have the opportunity to get a loan from the job center or KFW.

- This makes it very difficult for people on low incomes to get a loan from a bank.

- in the Ranking of the best loan providers for low earners you will find at the beginning of this page Answers to the question "Which bank grants loans to people with low incomes"

Important bank requirements for the loan to be granted on low incomes

1.) Compensate for a small income with a good Schufa score

If you earn little, you have to convince the bank that you can manage your money well, in an exemplary manner. Your Schufa file is therefore all the more important if you have a low income. Ask the Schufa one free information and check the entries for correctness.

If there is already a problem with the Schufa, you should be aware that lending at Bad credit loans with a significant interest premium he follows. Instead, you could also wait until the Schufa entry is deleted after about 3 years and a regular one installment loan apply for.

2.) Choose the loan amount to match your income

in the Ranking of the best loan providers for low earners at the beginning of the article, the maximum possible amounts for low incomes are listed. the limit of 15 times the monthly net income as a low-income earner, you should never exceed the maximum loan amount. This limit is not just a harassment by the banks towards low-income people. Ultimately, this limit protects you from excessive debt, which can aggravate your financial situation.

If you actually need all of your income to live on now, you should have a good plan for how you will then pay the loan installments later. If borrowing leads to bad Schufa records due to default, you're certainly not doing yourself any favors. A ruined credit score will quickly lead to spiraling debt. When the risk of debt spiral is particularly large and which providers can then still help, you can find out in the guide "Which bank gives credit despite debts?“.

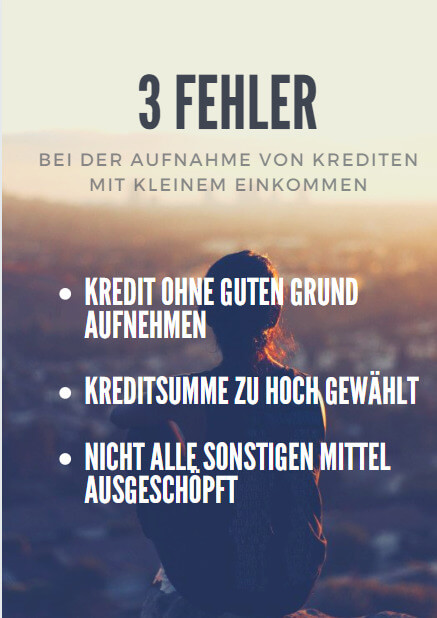

Therefore, even if you get a low-income loan, you should be careful and avoid the following mistakes:

- So don't take credit lightly for no good reason on.

- Choose the Loan amount not too high, to avoid excessive rates.

- Before you take out a loan, you should check whether you really all other means exhausted have.

Actually, these errors are obvious. However, they are not always taken into account, which is why I would like to emphasize them again:

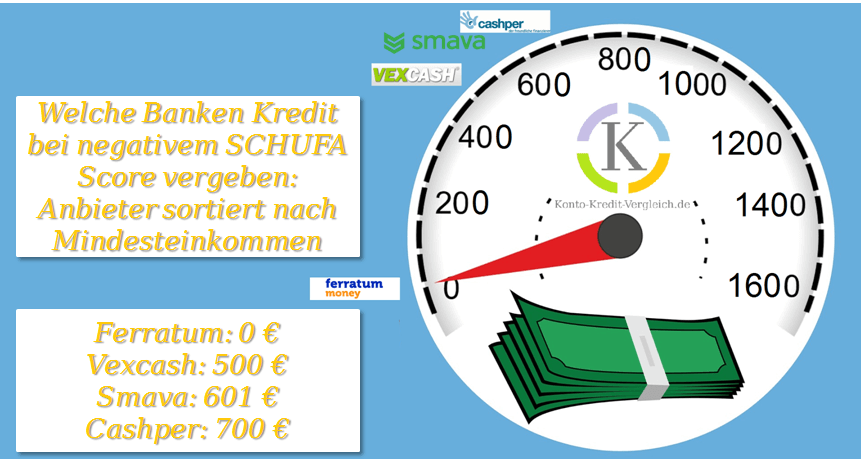

3.) Minimum Income

In order to get a loan for a small income, you should have the following income at least monthly:

- Vexcash*: 500 €

- Smava*: 601 €

- cashper*: 700 €

- Auxiliary: €1,000 net per month

- Fixed income not required, minimum income dependent on other factors

- ferratum*: 1.100 €

- credimaxx*: €1,100 net per month

- Maxda*: €1,260 net per month

- Creditolo*: €1,260 net per month

- bon credit*: €1,300 net per month

3.1) How can I take out a loan without income?

Without a regular income, lending is not possible either in Germany or at Swiss banks abroad. However, if you have a small income, there are still chances Vexcash* get a mini loan. Also the Loan without proof of income from ferratum* will not be awarded without income. There is no obligation to submit proof of income.

4.) Further requirements for loans for small incomes

A good Schufa score and a appropriate loan amount are the most important requirements for taking out a loan for a small income. Both parameters are included:

- of yourself directly influenceable

- essentially about good management of money to prove.

In addition, there are a few more points that are required by German banks when lending:

- legal age

- Permanent residence in Germany

- Account at a German bank

The most important requirements for getting a low-income loan

- You can best compensate for the small income by helping flawless Schufa can wait

- the Loan amount should be 15 times monthly net wages never exceed

- the Loan installments must match disposable income be affordable

- Vexcash* requested with 500 € the lowest income and is therefore well suited to those on a low income

- Low earners should Critically question necessities and loan amount and credit comparisons use to save money.

alternatives, if the bank does not give a low-income loan

In the article 4 ways to get a loan on a low income I have presented the main possibilities and alternatives to get money as a low earner. Here I summarize the article again

If you need money and can pay the loan installments, you have several options for getting cash. Here you will find 4 credit alternatives for low income

1.) Credit alternative for low income: the overdraft facility

Most low-income earners have the option checking account to cover. The overdraft facility is often granted even with a small salary slip up to twice the salary. The stress allows itself to be as simple as possible. The repayment of the overdraft facility, on the other hand, is often not that easy. In contrast to a conventional loan, there is no automatic repayment with the overdraft facility.

the missing repayment is a disadvantage of the overdraft facility, as it is often used longer than is actually necessary. Another disadvantage of overdraft facilities is their high interest rates . Although require some Online banks such as the DKB* now only around 6 % interest. However, double-digit overdraft interest rates are still common at many branch banks, despite the low climate. The Berliner Sparkasse, for example, charges 10.5 % interest, and the Stadtsparkasse Munich also charges 10.36 %.

Therefore, the overdraft facility should only be an emergency option. Because as easy as it is to claim it, it often becomes a burden for those on a low income. If you make use of the overdraft facility, you will often remain in the red for a long time. Even directly after a salary has been received, the account remains in the red when the overdraft facility is exhausted.

However, if something unplanned happens, the dispo is missing as a safety net. The dispo is therefore as Credit alternative for low income only suitable in emergencies.

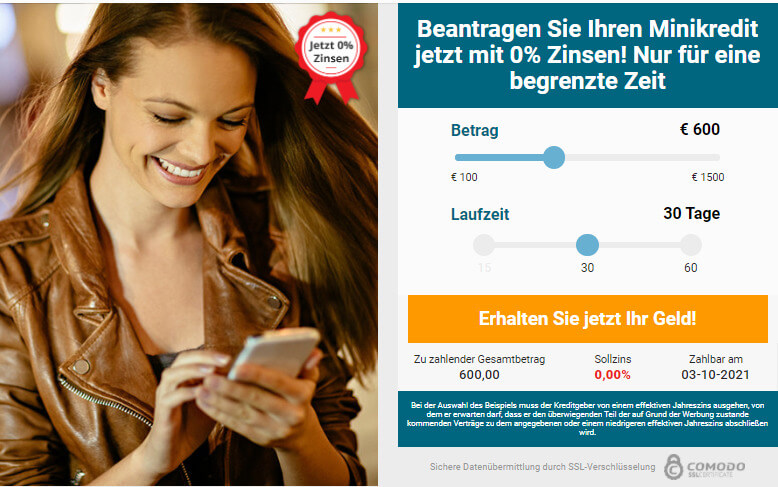

2.) Small or mini loans are another alternative for low income

For people who only have a small income there mini loans, Which already from 100 € and up to the maximum €3,000 loan amount Are available. These mini loans are sometimes also called microcredit, small loan or something unfashionable housewife loan. Small loans can already be in 30 min money in your account be if you are willing to pay appropriate express fees. Mini loans only have low requirements: There is no credit check like there is with other installment loans. The credit is checked and allocated after a brief account check. Here you let the lending bank look at your account online. The bank then assesses whether or not it can allocate the loan. Common providers of mini loans are Vexcash, cashper or ferratum.

What is the best low income mini loan?

Generally suitable cashper as Mini loan for low income in many cases best. Because at cashper* can you Borrow €600 free of charge. In some cases, however, it can make sense Vexcash or ferratum to ask for the mini loan. So requested Vexcash only €500 minimum income, while at Cashper it is €700. Also pays Vexcash *quicker than Cashper and is also significantly cheaper for sums above €600. Above €600 it gets very expensive with Cashper due to the mandatory 2-rate option. Ferratum, on the other hand, is suitable if you cannot show proof of income. Although you should still have an income, ferratum* is the only provider that does not require any wage or salary slips when applying for a loan.

Cashper also offers its mini loan to customers from Austria. More alternatives to Mini loan in Austria can be found online at sites like Tarifgigant.at.

3.) Pay up to 59 days later with a low-income credit card

Credit cards are widely used as a means of payment in the USA. With us, on the other hand, you still lead a niche existence, even though credit cards are becoming more and more popular in this country. And for good reason. A credit card is uncomplicated when paying. In addition, you are comparatively well protected in the event of fraud thanks to a strong safety net. You can usually have unauthorized debits deleted relatively easily. The chargeback is much easier than with a bank transfer. In addition, you can only pay for your purchases at the end of the month by invoice, which gives you a free credit.

The downside to most credit cards is that low-income people tend to be declined. An exception to this is the Barclaycard. The Barclaycard also issues the credit card to people on a tight budget. In addition, sales only have to be settled at the end of the following month. This gives you a credit of up to 59 days. You have to be careful with credit cards like the Barclaycard, however, with the installment option. Amounts are not fully repaid, but only partially. In contrast to the previously mentioned free credit line until the end of the following month, the Unfortunately, the installment option is also very expensive. If you want to know more about the Barcalycard or would like to try out the product, you can go to the Barclaycard website* provide more information.

4.) Get a low-income loan with a guarantor

In some cases, you may not get a loan alone as a low earner. However, you can have another person vouch for you. Do you bring a second person with fixed Salary above the garnishment exemption limit (over €1,260) and with good credit comes into play, the application is usually easy.

With a loan with a guarantor, you should make a statement close person vouch for. You should also check the installments of the loan pay back very reliablyn. If there is a delay in payment, the bank will turn to the guarantor and the relationship between you and the guarantor can suffer greatly or even break the relationship. Furthermore, you should not be tempted by the collateral provided by the guarantor to take out more credit than is absolutely necessary. This can also lead to problems with the repayment and then later with the guarantor.

The principle at credit with guarantors is the same as including a guarantor in the lease and in the contribution Credit with bad credit described in more detail.

5.) If you have a low income, you can also borrow money from private individuals instead of from the bank

If you're on a low income, you don't necessarily need to borrow money from a bank. Alternatively, you could also borrow money from private individuals. With a private loan, you can become active yourself and ask among family and friends, if someone wants to lend you money for a certain period of time. If that makes you uncomfortable or you can't find anyone, you can also contact us intermediary portals how Auxiliary* turn.

As far as the relationship with the lender is concerned, the same applies here as with a loan with a guarantor: Pay back your installments reliably and in full. Avoid calling your known lender or family member "unimportant" just because he doesn't send you collection letters when there's a delay in payment. A broken relationship is usually much worse than the money itself.

6.) A low-income loan is granted through additional collateral

With an installment loan, you basically pledge your future income. If you default on payment, the bank has the security that you at least have a permanent job that secures the loan installments. However, this is often not enough for the bank, especially with smaller incomes. If you earn below the garnishment exemption limit, the bank has no legal way of getting the income. It is protected by the garnishment allowances.

As a result, the bank does not grant credit to people with low incomes. You can counteract this by presenting the bank with additional items that are worth the credit. Loans are particularly popular for real estate or cars as collateral to serve.

There is also the possibility of receiving a small income or sick pay policy loan to complete. Here you pledge a life or pension insurance. The value of this insurance should be at least €1,000 for banks to accept it. We were able to find recommendable policy loans with favorable interest rates at the SWK Bank* Find.

the Pros and cons of loan collateral can be found in a separate article.

You can do that too Protection with material assets combined with a guarantor insert. This creates a further fallback level and double protection. With this combination, you should be able to get a loan from almost all German banks, even if you have a low income.

7.) Borrow items

Another possibility is to lend on your property not only via security but directly in a pawn shop. After all, your possessions themselves represent a sometimes considerable value. The last option is therefore to lend an item of value in a pawn shop for cash.

The advantage of the pawn shop is that the process is quick and unbureaucratic. Neither the Schufa nor your income will be affected. The disadvantage of the pawn shop: You get paid less money than the appraised value. In addition, the objects must be kept, which causes high costs. These are passed on to the customer via corresponding interest rates for longer storage periods.

The pawnbroker is therefore only suitable for short periods of time and small sums.

Conclusion on credit alternatives with low income

Even with a small income, there are many opportunities for you to borrow money. You could:

- if you a checking account with an overdraft facility, you can overdraw your account for a short period of time.

- a regular installment loan for incomes of €600 or more Smava* apply for

- from 500 € income a mini loan for 30 days Vexcash* apply for

- You can get a free credit line of up to 59 days with a credit card like the Barcalycard* to back up

- Borrow money privately instead of from the bank

- Get a low-income loan with a guarantor

- Obtain a loan through collateral

- Combine the two aforementioned options to obtain double protection

- borrow items

mini loans from cashper *or Vexcash* are the first choice for short-term credit needs with low income. But cheap installment loans which are secured by guarantors or valuables are also suitable for people with a small income. The overdraft facility is also a way to get money for a short period of time. However, it is best not to use the overdraft facility to the full to leave a buffer for the unforeseen. Alternatively, you can also get money through private loans. Personal loans have the advantage that they are not normally entered in the Schufa. If you own valuables, you can also pawn them to get a loan despite a small income. With this you avoid the credit risk at a bank. However, in the worst case, you can lose a pawned item to the pawn shop if you can no longer redeem it.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

2 thoughts on “Welche Bank gibt Kredit bei geringem Einkommen?”

Comments are closed.