If you have already asked yourself the question "Which banks lend easily?” you have come to the right place. In the top 15 tableau, we show you banks and credit brokers that grant easy loans. Easy to apply Loans that anyone can get are either mini loans up to 3,000 euros or an installment loan with a credit line of up to 7,500 euros. The easiest way to get a loan of more than 1,000 euros is with a loan broker like bon credit* or Smava*, which requests numerous banks at once. Even when receiving sickness benefit, Bon-kredit or Smava is often an option Credit despite sick pay possible. Smaller sums up to 1500 euros are over cashper*, Vexcash* or ferratum* (without proof of income) easy to get.

Konto-Kredit-Vergleich.de Konto-Kredit-Vergleich.de explains what you can do to get a loan from most banks. This also includes, for example, that the disposable income must be sufficient to repay the loan installments. With good payment practices and a negative Schufa entry, a Swiss credit for Germans be a way out of the crisis. In this post, you will learn some more tips on how to easily get a loan from many banks.

Banks that lend easily: Top 15 tableau shows which banks lend easily

What you can learn here

- Banks that lend easily: Top 15 tableau shows which banks lend easily

- What you should do to convince banks that lend easily

- Tip #1: No matter which bank - the easiest way to get a loan is to have a good payment record.

- Tip #2: Plan realistically: Make a budget calculation to convince banks to lend easily

- Tip #3: You can easily get a loan from banks if the disposable income is sufficient to pay the loan installments

- Here are two examples: The freely disposable income is 200 euros. With a term of 3 years, you can obtain a loan of around 7,000 euros. With a 5-year term, on the other hand, the maximum loan is around 11,500 euros.

- If, on the other hand, your disposable income is 300 euros, the maximum loan amounts are as follows. If the loan has a term of 3 years, you can afford to borrow around 10,300 euros, and if it has a term of 5 years, you can borrow around 17,500 euros.

- Tip #4: Check your SCHUFA record to get a credit easier at banks

- Tip #5: Which banks lend easily by testing credit neutral requests without risk

- Tip #6: Not too many loans: Avoid over-indebtedness and keep an eye on costs

- Requirements that you must also meet at banks that grant easy loans

- Does Postbank easily grant loans?

- Does Targobank easily grant loans?

- FAQ: to banks that lend easily

- 1. Which bank is the best for a loan?

- 2. At which bank can you get a loan despite a negative credit bureau?

- 3. Is it easy to get a loan?

- 4. what is a good interest rate for loans and what do banks that lend easily charge in interest?

- 5. How do you get cheap loans from a bank?

- 6. Who decides on a loan?

- 7. Banks that lend easily: What do I have to do to get one?

- 8. When do you not get a loan?

- 9. I'm on a low income - which bank is most likely to get a loan?

- 9.1 A mini loan up to 3,000 euros and 62 days is most likely to be available for low-income earners

- 9.2 With a P2P loan there is most likely a loan from 1,000 euros

- 9.3 The house bank is not one of the banks that easily grant loans

- 10. Why are easy loans from banks more expensive?

- 11. Which is better: a loan or an overdraft facility?

- 12. Why is an online loan cheaper than in a branch?

- Looking for banks that give small loans easily? - Get money instantly with mini loans

The easiest way to get a loan is usually with one Credit intermediaries like bon credit* or Smava*. The reason is simple: Instead of approaching numerous banks one by one, a loan broker asks numerous banks at once. This saves you time, nerves and possibly money.

The trade-off Data against good conditions you should know with all credit intermediaries. If that is not the case, you can check here whether you might be better off using the Hands off Smava should leave.

For this purpose, Bon-Kredit works with numerous small credit institutions, which still grant a loan even in difficult cases. These banks have handed over the end customer business to intermediaries such as Bon-Kredit and are therefore not accessible directly. Thereby, some banks that grant easy credit also exist in Germany. A more expensive Swiss credit without Schufa can with bon credit* often avoided.

The loans from the providers recommended here are all at no cost and therefore a good choice when looking for a bank where you can usually get a loan without any problems. Even if you have already been rejected by your house bank.

#1: Receipt credit  4,9/5 (eKomi) Interest charges: approx. 8 % at €10,000 & 72 months Loan Amount: 100 to 300,000€ Minimum income: €1,300 net per month Duration: 12 to 120 months To the provider: Bon-kredit.de | |

#2: Smava  4,9/5 (eKomi) Interest charges: -0.4 % at €1,000 Loan Amount: 500 till 120.000€ Minimum income: €601 net per month Duration: 12 to 120 months  To the provider: Smava.de | Speed Costs Smava undercuts offers from other providers with the "You can't get cheaper than this" guarantee seriousness To the provider: Smava.de |

#3: Vexcash  5/5 (eKomi) Interest charges:approx. 14.8 % pa rms. Loan Amount: €100 to €3,000 Minimum income: €700 net per month Duration: 15 - 90 days To the provider: Vexcash.de | Commitment probability Inaccurate data on commitment probability Speed Costs Smart option too expensive To the provider: Vexcash.de |

#4 Auxmoney 4,8/5 (eKomi) Interest charges:approx. 5.24 % pa rms. at €13,300 & 84 months Loan Amount: €1,000 to €50,000 Minimum income: €1,000 net per month Duration: 12 to 84 months To the provider: Auxmoney.de | |

#5 Sigma Kreditbank 4,8/5 (eKomi/Maxda) Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months To the provider: Sigma credit bank | Commitment probability Refusal, without permanent employment Speed Costs Interest expensive To the provider: Sigma credit bank |

#6 Creditolo  4,3/5 (trust pilot) Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months To the provider: Creditolo.de | Commitment probability Refusal, without permanent employment Speed Costs Interest expensive To the provider: Creditolo.de |

#7 Ferratum  4,7/5 (eKomi) Interest charges:10,36 % + installment option Loan Amount: €50 - €1,000 for new customers €50 - €3,000 for existing customers Minimum income: €1,100 net per month Duration: 30 days - 180 days To the provider: Ferratum.de | Commitment probability Inaccurate data, for commitment probability Speed At the end of 2022 there are unfortunately delays in payment up to 48 hours Costs Interest expensive To the provider: Ferratum.de |

#9 DSL Bank  4,5/5 (Proven Expert) Interest charges:4,40 % Loan Amount: 5000 € - 50.000 € Minimum income: unknown Duration: 48 - 120 months Installment loan despite negative Schufa: To the provider: DSLBank.com | Commitment probability Inaccurate data, for commitment probability Speed Costs Favorable interest rates construction financing despite negative Schufa: To the provider: DSLBank.com |

#10 Maxda  4,8/5 (eKomi) Interest charges:8.9 % (for 2/3 of customers at €10,000) Loan Amount: 1.500 € - 250.000 € Minimum income: 1.260 € Duration: 12 - 120 months To the provider: Maxda.de | Commitment probability Inaccurate data, for commitment probability Speed Costs Caution: In some cases, insurance is taken out before the loan is concluded seriousness To the provider: Maxda.de |

#11 Credimaxx  4,8/5 (eKomi) Interest charges:7.9 % (for 2/3 of customers at €4,000) Loan Amount: 500 € - 80.000 € Minimum income: 1.100 € Duration: 12 - 120 months To the provider: Credimaxx.de | Commitment probability Chance of success lower than with other providers Speed Costs seriousness To the provider: Credimaxx.de |

#12 Cashper  4,7/5 (eKomi) Interest charges:0 % for new customers Loan Amount: 100 € - 1.500 € Minimum income: 700 € Duration: 30 - 60 daysTo the provider: Cashper.de | Commitment probability Chance of success very high Speed Costs Free application for new customers To the provider: Cashper.de |

#13 TF Bank  4,4/5 (trust pilot) Interest charges:0 % for up to 51 days Loan Amount: 0 - 10.000 € Minimum income: not known Duration: no limit To the provider: TFBank.com | Commitment probability Chance of success: medium Speed Costs Free of charge for up to 51 days, but high interest thereafter seriousness |

#14 Advanzia  4,5/5 (trust pilot) Interest charges:0 % for up to 7 weeks Loan Amount: 0 - €20,000 for long-term customers. Maximum limit of €2,000 after application, €3,000 after three months and €5,000 after eight months. Minimum income: No minimum income required - application without salary certificates Duration: no limit To the provider: Advanzia.com | Commitment probability Chance of success: good Speed Costs Free of charge for up to 7 weeks, but high interest thereafter seriousness |

#15 Consors Finance  4,3/5 (trust pilot) Interest charges:2,99 % Loan Amount: 500 € - 50.000 € Minimum income: 650 € net per month Duration: 6 - 120 months To the provider: About Consors Finance | Commitment probability Inaccurate data, for commitment probability Speed Costs Very favorable interest rates seriousness To the provider: About Consors Finance |

What you should do to at Banks that lend easily forgive to to convince

Tip #1: No matter which bank - the easiest way to get a loan if the payment practices it's correct.

It is the business model of lenders to lend as much money as possible. After all, they earn money on every euro lent. Therefore, in principle, lenders have an interest in lending money. This is all the more true in times of low interest rates. If a Offer nevertheless rejected, it is probably due to an internal audit. The bank could insufficient payment practices suspect. This could be the case if bills have not been paid in the past and there is therefore a negative SCHUFA entry. The lender then expects that he will not get the money back. Therefore, he refrains from granting the loan. You should investigate the cause by Obtaining SCHUFA information get to the bottom.

If you are applying for a loan, you should also get the appropriate one payment practices exhibit. in the post credit in difficult cases we pointed out that you with bon credit* often still be able to get money even in muddled situations. However, we also strongly warn against taking out (another) loan if the installments cannot be serviced. You can find out how to find out whether you can service the installments in our next tip on the household bill.

Tip #2: Plan realistically: Create a household bill to convince banks that lend easily

The quickest way to get a loan from most banks is if the loan amount is not too high is chosen. That means that Household income must be sufficient to repay the loan installments. Compare your income and expenses. After all expenses are deducted from your income, that is what remains discretionary income. This is based on the maximum rate of the loan. Keep in mind that not all expenses can always be planned. The Washing machine can suddenly break down, a visit to the car's repair shop will be more expensive than expected or an additional payment of electricity-, gas or telephone costs into the house. For such cases you should plan a buffer.

Tip #3: You can easily get a loan from banks if the disposable income is sufficient to pay the loan installments

Banks regard the freely disposable income as the maximum amount for the monthly installments of a loan. use one Loan Calculatorto determine how much credit you can get. Keep in mind that the longer the loan term, the lower the rates and you can borrow more money than with a shorter term.

Two examples: That disposable income is 200 euros. With a term of 3 years you can get around 7,000 euros credit obtain. at With a term of 5 years, however, the maximum loan is around 11,500 euros.

Is that disposable income, on the other hand, is 300 euros, the following maximum loan amounts result. Does the loan have a term of 3 years, you can afford around 10,300 euros, with a term of 5 years it is around 17,500 euros possible on credit.

Tip #4: Check your SCHUFA entry to make it easier to get a loan from banks

Errors happen with SCHUFA entries. Do you have the impression that the bank is unjustifiably refusing you a loan with a SCHUFA query? It may well be that the SCHUFA score is incorrect. Take advantage of the opportunity once a year Access the SCHUFA score for free. If errors are discovered here, you can arrange for incorrect information to be corrected or for obsolete entries to be deleted.

Think carefully about whether you want to use a Credit despite SCHUFA entry really be able to repay. It is not uncommon for banks to have plausible reasons for rejecting a loan application.

Tip #5: Which banks lend easilyn through non-Schufa inquiries test without risk

Consumers often underestimate their creditworthiness. Maybe your credit rating is better than you think? Fortunately, this concern is often unjustified. Before you apply for a loan from many banks individually, you can consult a loan expert like bon credit* or SMAVA* turn on. Here, up to 30 banks are queried at once. If you previously free SCHUFA self-assessment you can realistically assess your chances and avoid unpleasant surprises. The best thing about it: The inquiry of credit conditions is credit neutral. You can therefore also simply test yourself by 2-3 inquiries "Which banks easily grant loans". For this purpose, you can use our top 15 tableau of banks that grant easy loans.

Tip #6: Not too many loans: Avoid over-indebtedness and keep an eye on costs

While requesting credit terms is credit neutral, too many credits will negatively impact your score. Furthermore, too many credits also cause a loss of overview. In general, it is advisable not to Buy in installments, because even smaller financing contributions add up quickly. It is better to have a financial cushion on a cash account that you can fall back on for larger purchases. If you already have too many individual loans, you can also combine them through a loan restructuring. With a Loan rescheduling in difficult cases The providers in the Top 15 table at the top of this page are also suitable for this purpose.

Conditions that you also with Banks that lend easily have to fulfill

To apply for a loan, certain conditions must be met. The reason for this is that lenders want to protect themselves against payment defaults. It also protects the customer from excessive loan amounts, which may then no longer be repayable. In principle, each bank has its own credit guidelines. However, they are similar in many respects. These are often the following conditions:

- Residence in Germany

- of legal age

- German bank account

- regular income

- good credit

- some additional collateral such as Vehicle letter for a car loan

Since our financing partner requests more than 30 banks, you are most likely to be able to get a loan through them. If all loan requests are rejected, our partner can also help you arrange a loan from private individuals.

Awards the postal bank easy credits?

The Postbank offers the Personal Loan Direct at. This loan has some advantages over other providers: These are: increase, repayment and special repayment are possible at any time. This prevents you from being surprised by hidden costs. the Postbank also offers auto loans* where the registration certificate II (vehicle title) must be deposited. These loans often have better conditions than Car loans where you keep the car registration certificate can. However, the Postbank works together with the Schufa and only grants loans to people with a good credit rating. Therefore, Postbank is not a bank that grants loans particularly easily.

Does Targobank easily grant loans?

Targobank is often mentioned when it comes to Loans with poor credit rating goes. However, the bank is not a good address if you have a negative record. Because Konto-Kredit-Vergleich.de made the following experience: A Credit despite negative SCHUFA is at Targobank not granted. Therefore, the Targobank is not a bank that grants loans particularly easily.

However, that wasn't always the case and that's why people still ask if Targobank lends easily. Between 2000 and 2008 the name was still Targobank citibank. At the time, the bank was known for extending credit even to people with poor or very poor credit ratings. However, the rebranding of the bank put an end to easy lending. Today, Targobank does not lend more easily than other established banks. For people who are looking for a bank that gives easy loans, is bon credit* therefore a better alternative.

FAQ: to banks that lend easily

1. Which bank is the best for a loan?

That always depends on the purpose and the amount of the loan. If you don't want to do anything wrong, you can rely on established providers. These include Postbank, Norisbank, SWK Bank, Targobank, Postbank, Santander Consumer Bank or ING for the flexible one Car loan without vehicle letter submission. You won't go wrong with these providers. To query several banks at the same time, the interposition of a credit intermediary recommended. Such a Credit broker finds the best bank for your loan request, without having to search long.

2. at which bank can you get a Credit despite negative credit bureau?

As before there is banks, the one Credit granted despite negative SCHUFA. These include in particular bon credit* or Smava*. But also the providers Ferratum Bank*, Vexcash* or cashper* grant loans to people despite a negative Schufa entry. However, is also for banks is a credit without a credit history an additional risk, which is why interest rates may be somewhat higher. Therefore, especially if you have a poor credit rating, it is important to choose the loan rate appropriately to avoid over-indebtedness. Often, it is also helpful to check the Request a SCHUFA file and try to clean up negative entries. Further tips and opportunities to the Loan without SCHUFA query you can find in the guide: Which bank gives credit despite negative SCHUFA. In this linked guide you will find everything you need to know about the topic "Which bank with bad SCHUFA?”.

3. Is it easy to get a loan?

To one Loan to get, you must certain requirements, how Residence in Germany, of legal age, a German bank account and a regular income can fulfill. This also applies to banks that still grant loans in difficult cases, such as Bon-Kredit.

If you ask yourself "Is it easy to get a loan?” so keep in mind that a loan is a Pledge of your future wages or salary is. Therefore, it is all the easier for you to get a loan if you have one solid employment have been available for 12 months or more. Nevertheless, in exceptional cases it is also possible for employees in the probationary period to Retiree, students or trainees possible to get a loan.

If only one small sum up to 1,000 euros for one or two months is needed are mini loans suitable to plug your hole in the household budget, which are awarded comparatively easily and under the conditions mentioned at the beginning of the section. On the other hand, if you need more than 1,000 euros or the money for longer than 2 months want to take out, it is easiest to take out a loan with bon credit* or Smava* to obtain.

A credit broker such as Smava sends your credit request to over 30 banks. If no credit comes about, Smava can give you one Credit from private convey. Here you lend money from one or usually several private individuals. In this process, private individuals usually also give loans to people who have already been rejected by banks.

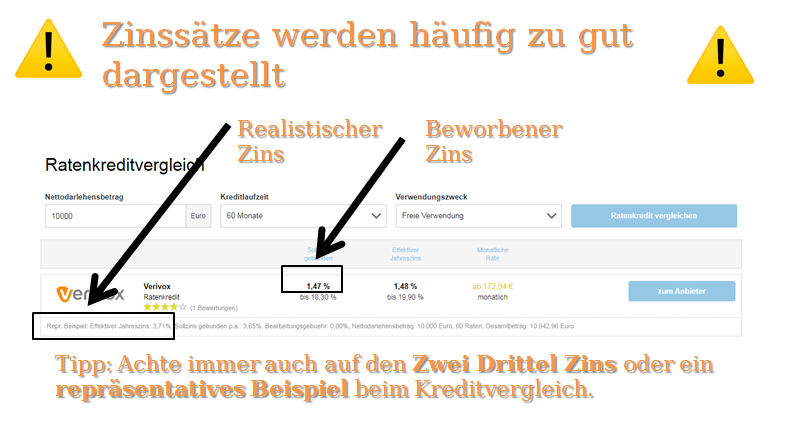

4. what is a good interest rate for loans and what do banks that lend easily charge in interest?

the interest rates are very strong of Term, loan amount, purpose and creditworthiness addicted. In addition, the advertised interest rate is often not the one most people get. See the infobox for an example of how effective interest rate and two-thirds interest rate can diverge. Therefore the question is “What is a good interest rate for a loan?” cannot be answered in general terms. Rather you have to differentiate according to use. Here are a few depending on your intended use Guide values for good interest rates on a loan:

- At a home loan lie good interest rates between 3 and 4 %.

- for car loans you have to with about 3.5 % to 5.5 % calculate.

- installment loans with free use are about between 4.5 % and 6 %.

- Banks that lend easily, on the other hand, charge between 5 % and 9 % interest

- at mini loans become between 8 % to 14 % interest demanded.

5. How do you get cheap loans from a bank?

Around cheap loans to get should compare multiple offersn become For this purpose, comparison calculators on the Internet are a first point of contact. At a credit comparison However, you should always obtain concrete offers for your financial needs. This is the only way that your personal situation as well as the term, loan amount, purpose and creditworthiness can be taken into account. The fastest and easiest way to get multiple quotes in one fell swoop is to work with one of the aforementioned lending professionals. Since he knows the market very well, you can get a cheap loan with little effort.

6. Who decides on a loan?

Ultimately, banks use creditworthiness to decide whether or not to grant a loan. When a Loan is applied for at the house bank, the bank checks the freely disposable income and other characteristics based on the account movements. When deciding on a loan, it is crucial whether the loan can be repaid or not. If you have a permanent job, your chances are usually good. But credit intermediaries can also find a bank without a permanent job. They should Credit installments are below disposable income. Further up on this page, you will find many tips about a loan to get. With the tips you know what you should do to get a loan from banks as soon as possible!

7. Banks that lend easily: What do I have to do to get one?

You find the essentials requirements, to get a loan, earlier in this guide.

8. When do you not get a loan?

A Credit is rejectedif the bank suspects that it cannot be repaid. This is the case if the freely disposable income is not sufficient to repay the loan by the end of the term. Also, a loan amount too high, negative entries, or trial period possible reasons for rejection. A credit professional can often still find a suitable loan for you. Afterwards, however, you should check your SCHUFA for false entries. You could also think about improving your income and expenditure situation. Besides insufficient creditworthiness, this is also a common reason why people do not get a loan. All about the topic Credit request denied earlier in this article.

9. I'm on a low income - which bank is most likely to get a loan?

As a low-income earner, you have three options for getting a loan. how and where you also as low earners are more likely to get a loan you can find out in the guide "Which bank gives a low income loan“.

9.1 A mini loan up to 3,000 euros and 62 days are most likely for low earners

- without income,

- No guarantor

- Without paperwork

- Express credit: money in 30 min on the account within 24 hours

9.2 With a P2P credit there is most likely a loan from 1,000 euros

- From 600 € income

- Without guarantor

- Without paperwork

- Money is often there within 24 hours - loan approval immediately

9.3 The house bank is not one of the banks that easily grant loans

There are several reasons why your house bank is not a "yes bank" that lends easily. House banks such as savings banks often have high requirements for the following criteria:

- High income required

- Loans are only approved with a lot of paperwork

- Long processing times

10. Why are easy loans from banks more expensive?

banks the with minor credit check grant a loan, usually require higher interest rates. This means that the bank's increased credit default risk is borne. The more collateral there is a loan the better the interest. Due to the high security of a property, construction financing, for example, is significantly cheaper than installment loans or even mini loans.

But still: If the interest rate for a loan is significantly higher than the usual values, became dem credit comparison may not be given sufficient attention. If your loan is too expensive, you should try to restructure it as quickly as possible. Alternatively you can find here 4 ways to make your loan payments to lower. A loan professional will help you find a cheap loan that suits your situation. After filling out the inquiry form, a Credit professional a cheap bank, which is most likely to grant a loan.

11. Which is better: a loan or an overdraft facility?

A overdraft facility is suitable for short-term bottlenecks to bridge. Of the Overdraft facility is significantly more flexible than a conventional installment loan. However, an overdraft facility is also expensive. long term should a dispo not be used. For this is a conventional Installment credit more suitable.

12. Why is an online loan cheaper than in a branch?

have online banks lower costs as branch banks and savings banks. Therefore, online banks can offer loans cheaper. A Credit applying online is therefore mostly cheaper than at a branch bank. Furthermore, the Loans from online banks often too faster on the account.

You are looking for banks that easily small loans forgive? – Get instant money with mini loans

With the providers of mini loans, you can borrow up to 1,500 euros immediately as a New customer receive. Up to 1.000 Euro credit you can get it even if you are a student or unemployed, because Ferratum offers a 1000 Euro credit without proof of income* gives. You can even apply for a small loan of up to 3,000 euros immediately: However, this is only possible if you are already an existing customer Vexcash* are you.

Small loans from 100 euros – 500 euros

Small loans from 500 euros – 1000 euros

Small loans from 1100 euros – 3000 euros

If you need more than 3,000 euros, you have to switch to an installment loan. You can find the cheapest installment loans via this inquiry form

*Affiliate link: If you get to a provider via one of these links from my website and open an account there, I may receive a commission. This does not result in any additional costs for you. ❤️ THANK YOU for using these links! ❤️

1 thought on “Top 15: Banken, die leicht Kredite vergeben”

Comments are closed.