Many people are looking for answers to the questions "Which bank gives credit with bad credit?", "Which bank gives credit despite negative credit bureau?" or “Which bank is the easiest to get a loan from?". In essence, it is always a matter of obtaining a loan with a high acceptance rate in the case of poor creditworthiness and despite a negative entry! If the credit rating is bad, a bank must be found that does not check lengthy criteria, but also in more tricky situations loans quickly lends. But beware: There are many black sheep among the providers of loans with poor credit ratings.

Therefore, on this page there is a large collection of warning notices. This ensures that a serious credit despite bad creditworthiness is completed by you. Because also in the article Buy a car on installments despite negative credit bureau we noticed that you had a loan at bon credit* come out cheaper than with alternative financing through car dealerships or dealers directly.

What you can learn here

- Which bank grants a loan with a bad credit rating? - Top 15 providers

- Which bank gives credit with poor credit rating - terminology

- Which bank grants credit with a bad credit rating? - At what SCHUFA score is the end?

- Which bank gives credit with bad credit rating? - Loans from Germany

- With soft negative features, a loan with Smava* and Co is usually no problem.

- In case of hard negative features, a loan is only possible via foreign banks

- Which banks grant loans with soft negative characteristics in the Schufa

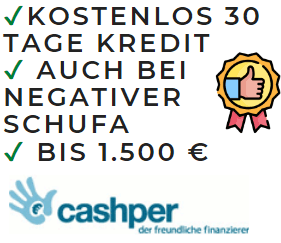

- Credit possible despite negative SCHUFA entry

- €700 income

- 30 days credit over 600 € : 0 €

- €99 express surcharge

- Payout in 24 hours on the account

- 15, 30 or 60 days

- New & existing customers: 100 € to 1500 €

- To the provider: Cashper.com

- Credit possible despite negative SCHUFA entry

- €500 income

- 30-day credit over €600 : €6.95

- €39 express surcharge

- Payout in 30-60 min on the account

- 15, 30, 60 or 90 days

- Existing customers: €100 to €3,000

- New customers: €100 to €1,000

- To the provider: Vexcash.com

- Credit possible despite negative SCHUFA entry

- €0 income

- 30-day credit over €600 : €5.11

- €179 express surcharge

- Payout in 24 hours on the account

- 30, 62, 90 or 120 days

- Existing customers: €50 to €2,000

- New customers: €50 to €1,000

- To the provider: Ferratum.com

- Credit possible despite negative SCHUFA entry

- €600 income

- 30 days credit over 600 €: depending on creditworthiness

- €0 express surcharge

- Payout depending on the credit in 24 hours or a few days on the account

- 12 months to 144 months

- €500 to €120,000

- To the offerer: Smava.com

- Which banks grant loans with hard negative characteristics in the Schufa

- 3 ways to get a loan with bad credit

- Which bank gives credit with bad credit rating? - Special cases

- The advantages and disadvantages of loans without Schufa

- Which bank gives credit with bad credit rating? - Schufa Score

- Which bank gives credit with bad credit rating? - Credit check

- How you can expose a dubious bank, which allegedly gives credit with poor credit rating

- Which bank grants credit with poor credit rating? - Rejection despite credit rating

- Which bank gives credit with poor credit rating? - Difficult cases!

- Which bank grants credit with a bad credit rating with a high acceptance rate? → How much credit do you need right now?

- Which bank gives credit with bad credit - FAQ

Which bank grants a loan with a bad credit rating? - Top 15 providers

#1: Receipt credit  4,9/5 (eKomi) Interest charges: approx. 8 % at €10,000 & 72 months Loan Amount: 100 to 300,000€ Minimum income: €1,300 net per month Duration: 12 to 120 months To the provider: Bon-kredit.de | |

#2: Smava  4,9/5 (eKomi) Interest charges: -0.4 % at €1,000 Loan Amount: 500 till 120.000€ Minimum income: €601 net per month Duration: 12 to 120 months  To the provider: Smava.de | Speed Costs Smava undercuts offers from other providers with the "You can't get cheaper than this" guarantee seriousness To the provider: Smava.de |

#3: Vexcash  5/5 (eKomi) Interest charges:approx. 14.8 % pa rms. Loan Amount: €100 to €3,000 Minimum income: €700 net per month Duration: 15 - 90 days To the provider: Vexcash.de | Commitment probability Inaccurate data on commitment probability Speed Costs Smart option too expensive To the provider: Vexcash.de |

#4 Auxmoney 4,8/5 (eKomi) Interest charges:approx. 5.24 % pa rms. at €13,300 & 84 months Loan Amount: €1,000 to €50,000 Minimum income: €1,000 net per month Duration: 12 to 84 months To the provider: Auxmoney.de | |

#5 Sigma Kreditbank 4,8/5 (eKomi/Maxda) Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months To the provider: Sigma credit bank | Commitment probability Refusal, without permanent employment Speed Costs Interest expensive To the provider: Sigma credit bank |

#6 Creditolo  4,3/5 (trust pilot) Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months To the provider: Creditolo.de | Commitment probability Refusal, without permanent employment Speed Costs Interest expensive To the provider: Creditolo.de |

#7 Ferratum  4,7/5 (eKomi) Interest charges:10,36 % + installment option Loan Amount: €50 - €1,000 for new customers €50 - €3,000 for existing customers Minimum income: €1,100 net per month Duration: 30 days - 180 days To the provider: Ferratum.de | Commitment probability Inaccurate data, for commitment probability Speed At the end of 2022 there are unfortunately delays in payment up to 48 hours Costs Interest expensive To the provider: Ferratum.de |

#9 DSL Bank  4,5/5 (Proven Expert) Interest charges:4,40 % Loan Amount: 5000 € - 50.000 € Minimum income: unknown Duration: 48 - 120 months Installment loan despite negative Schufa: To the provider: DSLBank.com | Commitment probability Inaccurate data, for commitment probability Speed Costs Favorable interest rates construction financing despite negative Schufa: To the provider: DSLBank.com |

#10 Maxda  4,8/5 (eKomi) Interest charges:8.9 % (for 2/3 of customers at €10,000) Loan Amount: 1.500 € - 250.000 € Minimum income: 1.260 € Duration: 12 - 120 months To the provider: Maxda.de | Commitment probability Inaccurate data, for commitment probability Speed Costs Caution: In some cases, insurance is taken out before the loan is concluded seriousness To the provider: Maxda.de |

#11 Credimaxx  4,8/5 (eKomi) Interest charges:7.9 % (for 2/3 of customers at €4,000) Loan Amount: 500 € - 80.000 € Minimum income: 1.100 € Duration: 12 - 120 months To the provider: Credimaxx.de | Commitment probability Chance of success lower than with other providers Speed Costs seriousness To the provider: Credimaxx.de |

#12 Cashper  4,7/5 (eKomi) Interest charges:0 % for new customers Loan Amount: 100 € - 1.500 € Minimum income: 700 € Duration: 30 - 60 daysTo the provider: Cashper.de | Commitment probability Chance of success very high Speed Costs Free application for new customers To the provider: Cashper.de |

#13 TF Bank  4,4/5 (trust pilot) Interest charges:0 % for up to 51 days Loan Amount: 0 - 10.000 € Minimum income: not known Duration: no limit To the provider: TFBank.com | Commitment probability Chance of success: medium Speed Costs Free of charge for up to 51 days, but high interest thereafter seriousness |

#14 Advanzia  4,5/5 (trust pilot) Interest charges:0 % for up to 7 weeks Loan Amount: 0 - €20,000 for long-term customers. Maximum limit of €2,000 after application, €3,000 after three months and €5,000 after eight months. Minimum income: No minimum income required - application without salary certificates Duration: no limit To the provider: Advanzia.com | Commitment probability Chance of success: good Speed Costs Free of charge for up to 7 weeks, but high interest thereafter seriousness |

#15 Consors Finance  4,3/5 (trust pilot) Interest charges:2,99 % Loan Amount: 500 € - 50.000 € Minimum income: 650 € net per month Duration: 6 - 120 months To the provider: About Consors Finance | Commitment probability Inaccurate data, for commitment probability Speed Costs Very favorable interest rates seriousness To the provider: About Consors Finance |

Which bank grants credit with bad credit? – The intermediaries Bon-kredit and Smava are the best recommendationwhen it comes to granting credit with a poor credit rating. In particular, Bon-Kredit has a high acceptance rate when it comes to granting credit with poor credit rating. So can also Loans despite negative credit bureau can be granted. The prerequisite is, of course, that the income is also sufficient to pay the loan installments. At least € 1,300 income is necessary to receive a loan from Bon-Kredit.If the income is sufficient, a loan can be granted at Bon-Kredit up to the Schufa rating level O be assigned. To "Rip-off offers" from Bon-Kredit Nevertheless, you should always obtain alternative offers and refuse credit insurance.

Other banks and intermediaries that, in addition to Bon-Kredit, also grant a loan with a poor credit rating are: the Sigma credit bank from Liechtenstein, Creditolo, Ferratum, Maxda, Credimaxx, Auxmoney, cashper and Vexcash.

The banks and credit intermediaries listed here are on Bad credit loans specialized. Therefore, these providers still have one high acceptance rate, if your credit rating is at the lower end of the rating scale.

Credit intermediaries or small loan providers offer this Loans for every professional group at. Whether it is a Credit for the self-employed, workers, employees, students or retirees with a bad credit rating! Konto-Kredit-Vergleich.de puts you reputable providers and banks in front, the easy loans given a high acceptance rate. Before we get to the question "Which bank grants credit with bad credit?’, we will quickly clarify a few terms relating to loans for people with poor credit ratings.

Which bank gives credit with poor credit rating - terminology

1.) What is the loan without SCHUFA?

With a loan without SCHUFA, there is no query at a credit agency like the SCHUFA. But other credit bureaus such as Crif Bürgel, Creditreform, Boniversum or Infoscore Consumer Data are not queried for a loan without Credit Bureau. The loan will without a credit check by SCHUFA & Co. forgive. Lenders are not interested in bad credit bureau scores. However, loans without Schufa are not possible at a German bank. The German law forbids this. More specifically, financial institutions are obliged to obtain information from a credit agency. Foreign banks are not bound by this law.

Since loans without credit bureau often came from Swiss banks in the past, so do credit bureau-free loans Swiss credit called. The best-known loan without Credit Bureau is the Swiss credit for Germans the Sigma Bank*, which is slightly more expensive, but is paid directly to people in permanent employment without further verification. In our table on the question "Which bank grants a loan with a bad credit rating?" you will find many other loans with a high acceptance rate.

2.) What is the credit despite negative SCHUFA?

For loans that are granted despite negative SCHUFA, banks ignore bad entries in the SCHUFA. For small loans from Vexcash, Cashper, Ferratum or personal loans from Smava or Auxmoney. For the credit despite negative credit bureau is one moderate credit required. The interest rates are cheaper than loans without Credit bureau, The loan despite negative Credit bureau is offered by Smava for amounts over 1000 euros. For sums under 1,000 euros you can switch to Vexcash, cashper or Ferratum. ferratum does not require proof of income, but in many cases it is more expensive than Vexcash or Cashper. The providers all have an express option and can use it Credit already in 30 minutes on the account pay off.

3.) What is the bad credit loan?

Creditworthiness or creditworthiness is the ability to repay debts that have been taken out. The worse the credit rating, the less lenders are willing to grant a loan. With a bad credit rating, you are best off with loan providers from mini loans or consult with providers who specialize in loans in difficult cases. These providers can also help you get a regular loan. In most cases, this is successful and there is no need to switch to the more expensive credit bureau-free loan. In addition to classic bank loans, loans from private individuals are also often used in the event of poor creditworthiness.

4.) Mini loan despite bad credit rating

Of the Mini loan despite bad creditworthiness is a special form of credit that is given to people with poor credit ratings. The mini loan, despite bad creditworthiness, differs by two essential features from other loans with poor credit ratings. That is:

- The lower loan amount from 100 € until 3.000 € is this first distinguishing feature one Mini loan despite bad creditworthiness.

- But also due to the shorter term of 15 to 90 days is a key differentiator of the mini loan despite poor creditworthiness.

- In addition, mini loans can be used despite poor creditworthiness paid faster are considered other loans. The fastest provider Vexcash* pays the Credit to your account in 30 minutes. Other providers also offer such payouts on the same day. However, there is an additional charge for this. In the contribution Which bank gives credit despite negative credit bureau you can find an overview of the costs of express options at reputable Lightning loans despite poor credit rating.

- With a mini loan despite poor creditworthiness, costs can be incurred that do not exist with other loans. So will at Mini loan despite bad creditworthiness Costs for a quick payout are due on the same day or the provider requires it Fees for repaying the loan with an additional installment. The cost of the 2-rate option or the express payout are often dominant in mini loans. While the interest often barely exceeds €5, the additional options sometimes charge more than €100. Therefore, these additional options are not recommended.

Mini loans despite poor creditworthiness are tagged in the table above:

highlighted. Mini loans despite bad creditworthiness are given by these providers:

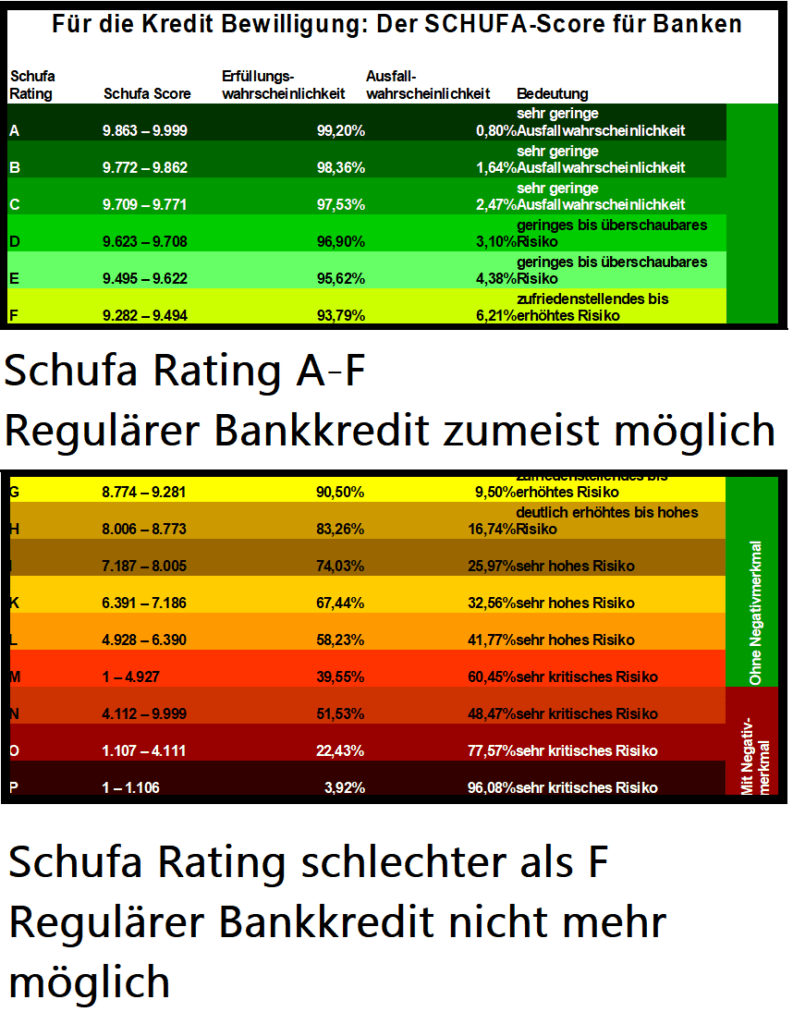

Which bank grants credit with a bad credit rating? - At what SCHUFA score is the end?

The SCHUFA score describes the creditworthiness from the SCHUFA point of view. The score is determined using a formula that is not published. The score is a percentage of the probability that liabilities will be serviced in the future.

Up to a certain Schufa score, almost all financiers go along with it. However, if your Credit bureau score is lower, granting the loan becomes increasingly difficult.

For example, for a loan from a regular bank, a Schufa rating level of A to F necessary to get a loan. With lower rating levels, the risk for the banks increases and it is becoming increasingly difficult to cover the credit requirements. Then there is a way out mini loans and personal loans or the swiss credit, which are still available for an interest surcharge from providers such as Bon-kredit. This means that this credit requirement can often still be covered by providers despite poor credit ratings. However, the prerequisite is a sufficiently high income of at least €1,300 that is sufficient to repay the installments. For this it is necessary that you also have enough in the future free income decree that has not yet been planned elsewhere (e.g. for the repayment of loans from other banks).

The following tableau, however, shows you that not all banks just wave them off just because one bad Schufa rating level present. So can with bon credit* loans can still be granted in the lower rating levels despite a negative credit bureau listing.

Schufa base score over 97.5 % | Credit bureau bank score: 9.772-9.999 | Credit bureau rating: AWAY | Probability of fulfillment: 97,5 % - 100 % | Probability of failure: < 2,5 % | Interest charges: Best interest rates | As possible? Long-term credit history without abnormalities, long-term permanent residence, long-term fixed bank account Due to the required characteristics, the rating levels A and B can only be older age be reached. | If you have a Schufa rating of A or B you have an excellent credit rating and are creditworthy everywhere. We recommend an installment loan with particularly low interest rates such as the SWK Bank*. Recommendation: SWKBank.de |

| Credit bureau bank score: 9.623-9.771 | Credit bureau rating: CD | Probability of fulfillment: 95 % - 97,5 % | Probability of failure: < 5 % | Interest charges: Very good interest rates | As possible? Credit history without abnormalities of a few years, long-term permanent residence, long-term fixed bank account, | Also with one Schufa rating of C or D, you have a good credit rating and are creditworthy with almost all banks. Therefore, an installment loan with particularly low interest rates such as the SWK Bank* Worth a look. Recommendation: SWKBank.de |

90 to 95 % | Credit bureau bank score: 8.774-9.622 | Credit bureau rating: E,F,G | Probability of fulfillment: 90 % - 95 % | Probability of failure: < 10 % | Interest charges: good to acceptable interest rates | As possible? If you don't have a long credit history (over 1 year), you may be in this range, even if you've always paid all your bills. The rating levels E,F,G are therefore typical for young professionals. | With a Schufa rating of E, F or G you also get a loan from some banks. With a Schufa rating of E, F or G, however, you have to accept slightly worse conditions for the loan. In order to still get the best out of your financing, you should in this case get several comparison offers via a comparison portal such as Smava* collect at the same time. Recommendation: Smava.de |

80 to 90 % | Credit bureau bank score: 8,006 - 8,773 | Credit bureau rating: H | Probability of fulfillment: 80 % - 90 % | Probability of failure: < 20 % | Interest charges: moderate interest rates | As possible? If you don't have a credit history and have moved frequently or recently opened many credit cards or accounts, your Schufa score can drop to level H. | With a Credit bureau rating by H you only get a loan from a few banks. One speaks of one moderate creditworthiness and you have to accept poorer loan conditions. In order to still get the best out of your financing, you should in this case get several comparison offers via a comparison portal such as Smava* collect at the same time. If Smava cannot help you further, or for comparison purposes, it is worth making a parallel request to Receipt credit*. Recommendation (1): Smava.de Recommendation (2): Bon-kredit.de |

50 to 80 % | Credit bureau bank score: 1-8.005 | Credit bureau rating: I,K,M | Probability of fulfillment: 50 % - 80 % | Probability of failure: < 50 % | Interest charges: noticeably higher interest rates | As possible?Do you already have some installment loans running and are you still asking for loans? In many cases, this leads to poor credit ratings | With a Schufa rating of I, K or M the credit bureau reports a “very high risk” to the financing bank. Therefore, with a Schufa rating of I-M, one speaks of one bad credit. That's why you only get a loan from a few selected banks and credit intermediaries. What is also possible are smaller mini loans or loans from private lenders. However, you should definitely keep an eye on the risk of possible over-indebtedness, which is further fueled by the now noticeably worse credit conditions. A recommendation for a credit provider with bad credit is Receipt credit*. Because often Bon-kredit can still find financing for you even if you have a bad credit rating. Alternatively, you could also get financing through the Sigma bank* get a loan. The prerequisite for Sigma Bank, however, is permanent employment and an income of at least €1,330. Recommendation (1): Bon-kredit.de Recommendation (2): Sigma credit |

Under 50 % | Credit bureau bank score: 1-9,999 (with negative feature) | Credit bureau rating: N,O,P | Probability of fulfillment: 0% - 50 % | Probability of failure: >50 % | Interest charges: Very high interest premium | As possible? There is a negative Schufa entry. This is the case with: - an ongoing or recently completed dunning procedure - Using an account despite being banned from using it - the non-submission of the asset report or a - Consumer bankruptcy proceedings. But even if the creditors have ruled out satisfaction, you have a negative Schufa characteristic and can therefore no longer achieve a better score than N. | With a Schufa rating of N, O or P Schufa reports a “very critical risk” to the financing bank. At this rating level there is a negative Schufa entry, which only disappears after 3 years. If you need a loan beforehand, this is very difficult. The loan is likely to be rejected in most cases. It is also not necessarily recommended to further burden your financial situation with loans. Because if you actually get a loan, you have to expect high interest rates. When the installments are repaid, there is a risk of over-indebtedness, since the interest is a heavy burden on your budget. About the Sigma bank* However, it is possible to get a loan if you have a permanent job and an income of at least €1,330. However, we do not want to recommend this at this point. |

Traditional banks are often not the answer to the question "Which bank grants a loan if your credit rating is bad?"

The approval of a classic bank loan is in connection with a negative SCHUFA entry is not possible. It is therefore advisable to let professionals search for a loan despite negative Schufa entry. Credit intermediaries such as Smava* or Receipt credit* but grant a loan with poor credit rating to all groups of people. This means that especially self-employed, Hartz 4 recipients, unemployed, students and housewives can get a loan despite negative SCHUFA to bridge bottlenecks. If you have at least 1,300 € income and 3 pay slips as proof, your chances are good that the loan will be approved.

In the guidebook: Car loan without taking negative SCHUFA query into account you will find an alternative way to get a car loan despite bad credit. Financing through a car dealership may also be an option. Because there are a few car dealerships that will finance your car despite negative credit bureau. You can find an overview in the article "Which car dealership finances despite negative credit bureau?“. In addition, you could also use a Car leasing without Schufa lease. It should be said about both options that they are usually more expensive than financing with a car loan. We therefore advise against it, but would still like to provide information about alternatives.

Which bank gives credit with bad credit rating? - Loans from Germany

If the bank has requested a Schufa report, it will credit only with soft negative characteristics still approve. The soft negative SCHUFA entries include termination of accounts, credit cards, etc., dunning notices and debt collection procedures. Lie hard negative traits such as check fraud, arrest warrant, false affirmation in lieu of an oath, ongoing insolvency proceedings or foreclosure measures before the credit is no longer possible in Germany.

In this case, it is still possible in exceptional cases to use a Swiss credit for Germans to complete the risk of over-indebtedness but should not be ignored. Therefore, in really delicate cases, it is better to have one debt advice visit.

at soft negative features is a credit at Smava* and Co normally no problem.

The following can become a soft negative entry in the Schufa file:

- The termination of a accounts

- One credit cards termination

- A dunning notice

- A debt collection procedures

These negative features are therefore also "soft features” called. A loan from a German bank is a little more difficult to get due to the poor credit rating, but in many cases it is not a problem.

Another number is the already mentioned hard negatives

at hard negatives is a loan just over foreign banks possible

To the hard negatives count in the Schufa:

- Scheckfraudwarrant

- false affidavit

- ongoing bankruptcy proceedings (until December 31, 2012 affidavit)

- foreclosure measures

- Failure to provide property information

- Creditor satisfaction excluded

- Satisfaction of creditors not proven

The hard negatives are in the Debtor register registered. The register of debtors is an official register. Here the mentioned hard negative characteristics of debtors are collected. Information from the register of debtors is subject to a fee, but is possible. Loans from providers with a particularly high acceptance rate usually also refuse the loan if there are hard negative characteristics.

Which banks grant loans with soft negative characteristics in the Schufa

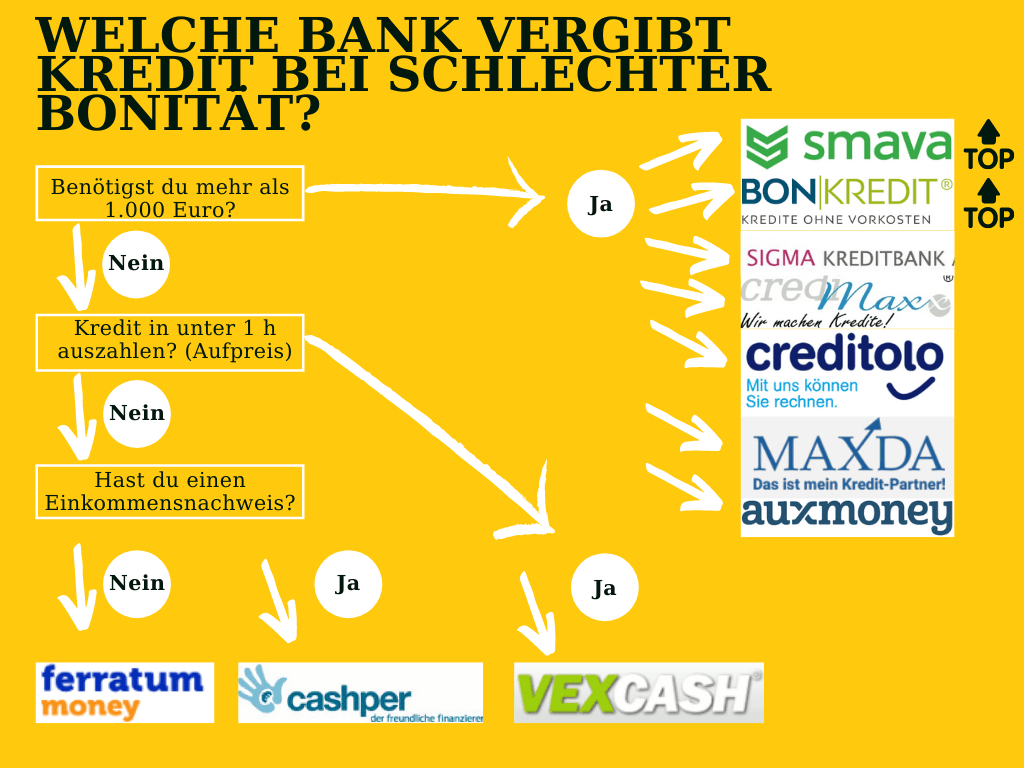

If you know which negative entry is in your file, you can use the following diagram to find out which bank will still give you a loan despite a negative Schufa entry. These providers award at soft negative entries a loan with comparatively high acceptance rate. Especially bon credit* has a high acceptance rate of your credit needs even in difficult credit cases. Even in difficult cases such as receiving sick pay, a Credit despite sick pay possible with bon credit.

Here you will find the conditions of the providers from the diagram above in detail. These providers grant loans at soft negative features in the file.

Offerer | Credit despite negative SCHUFA | minimum income | Costs | Express surcharge (600€ credit) | payout | Duration | loan amount | More information |

|---|---|---|---|---|---|---|---|---|

Credit possible despite negative SCHUFA entry | €700 income | 30 days credit over 600 € : 0 € | €99 express surcharge | Payout in 24 hours on the account | 15, 30 or 60 days | New & existing customers: 100 € to 1500 € |  To the provider: | |

Credit possible despite negative SCHUFA entry | €500 income | 30-day credit over €600 : €6.95 | €39 express surcharge | Payout in 30-60 min on the account | 15, 30, 60 or 90 days | Existing customers: €100 to €3,000New customers: €100 to €1,000 | To the provider: | |

Credit possible despite negative SCHUFA entry | €0 income | 30-day credit over €600 : €5.11 | €179 express surcharge | Payout in 24 hours on the account | 30, 62, 90 or 120 days | Existing customers: €50 to €2,000New customers: €50 to €1,000 | To the provider: | |

Credit possible despite negative SCHUFA entry | €600 income | 30 days credit over 600 €: depending on creditworthiness | €0 express surcharge | Payout depending on the credit in 24 hours or a few days on the account | 12 months to 144 months | €500 to €120,000 | To the provider: |

Which banks grant loans with hard negative characteristics in the Schufa

If you have a hard negative entry, there is almost no way around foreign banks. At a credit without an award is possible in the case of hard negative characteristics. They come as providers Sigma Bank from Liechtenstein* and possibly the credit intermediary bon credit* in question. Nevertheless, you should be aware that it will be very difficult to get a loan if there are hard negative characteristics. If it still works with one of the loan providers mentioned with a higher acceptance rate, you should not let yourself be driven deeper into the debt trap.

However, the best alternative in the event of hard negative entries and renewed need for credit is probably to forgo the credit and take a debt advice visit. Because it is possible that the financial problem cannot be solved in the long term by a loan without Credit Bureau.

3 ways to get a loan with bad credit

With a bad credit rating, finding a loan is often difficult. In this case, it may be advisable to hire professionals to look for a loan. The providers listed in the table offer the possibility of obtaining a loan with a poor credit rating and despite a negative credit bureau. These providers also give out loans self-employed, as well as on students and Pensioner. people with low income can at Smava beautiful from 600 € income get a loan.

If you are rejected on this, you will find in the article "Which bank gives credit for low income?" there are many more options how you can get a loan despite low income. Some of these options and alternatives are available at the low-income credit and the same for loans with a poor credit rating. Here you will learn what options are available when you wonder "Which bank will give me a loan if I have bad credit?"

1. A guarantor or second borrower is the cheapest way to get a loan if your credit rating is bad

If the bank does not give a loan due to negative credit bureau entries or poor creditworthiness, a guarantor respectively. second applicant help. A guarantor is liable for the loan if you get into payment difficulties yourself. In case of doubt, the guarantor would take over the loan installments. The bank therefore does not suffer a default. Therefore, a guarantor is an additional security for the bank. The bank passes this advantage on to the customer in the form of lower interest rates. A loan with a guarantor is therefore a good way to greatly increase the acceptance rate of the loan.

A guarantor or second borrower is the cheapest way to get a loan if your credit rating is bad

In order for someone to vouch for you, a guaranty contract must be signed with the bank. This contract regulates in which case the guarantor will step in for you. For the guarantor himself, nothing jumps out of it. It is therefore advisable to use a guarantor with whom you have a relationship of trust. Parents or children are often taken as guarantors. But a good friend can also vouch for you.

It is important that the guarantor should have a good credit rating. In addition to a good credit bureau, this also includes a sufficient and regular income. Preferably from a permanent position. In addition, the guarantor should be aware that it will be more difficult for him to get his own loan later on. Of course, this depends on the financial possibilities of the guarantor.

With the help of a guarantor with good credit, you can Loans also to the unemployed, students, pensioners or the self-employed be given. The SCHUFA and the income of the borrower themselves hardly play a role with a financially strong guarantor.

What are the advantages and disadvantages of being a guarantor?

Of the biggest advantage is that a loan can be taken out with a good guarantor on extremely favorable terms. installment loans for a car or an apartment can also be taken out together with a guarantor with a very high acceptance rate. There are no extra costs or fees for a loan with a guarantor. Nevertheless, the loan with guarantors also has a disadvantage:

Of the biggest disadvantage when lending with a guarantor is that the relationship can be damaged. Can the relationship cope if the guarantor has to pay the installments, or is Zoff inevitable? These questions should be clarified in advance.

2. loans from abroad: Swiss credit for Germans

Loans from Switzerland have the highest acceptance rates for people with poor credit ratings. In contrast to their German counterparts, the Swiss banks the loan follows different rules: the Schufa entry plays no role in foreign banks. Therefore can Loans from Switzerland even with a negative Schufa entry and a bad credit rating be given.

The name Swiss credit comes from the fact that the credit without Examination used to be offered by banks in Switzerland. Credit bureau-free loans have also been available from Liechtenstein or Malta for a number of years. A permanent position is a prerequisite for Swiss credit. The disadvantage is that Swiss loans are more expensive than regular loans and can therefore lead to over-indebtedness.

Swiss loans for Germans are therefore only after careful consideration of the consequences recommended. A well-known supplier of Swiss loans for Germans is bon credit. The provider can arrange credit bureau-free loans of up to €7,500 from abroad in particularly difficult cases with a high acceptance rate.

Swiss credit for Germans without Schufa

credits until 7,500 euros in difficult cases💰

No Schufa query 📄

Fast payout 💨

What are the advantages and disadvantages of loans from abroad?

We have already touched on it: Swiss loans and other loans from abroad are mostly very expensive. The interest rates are often in the double-digit percentage range. This means that the Swiss loan can be more expensive than the overdraft interest rate of a Girokonto. In addition, a permanent job with at least 1,100 euros net is a prerequisite for applying for the loan.

The maximum loan amount for Swiss loans is capped at €7,500. The providers of Swiss loans are usually not very flexible when it comes to modalities such as term and monthly installment. Before you sign a loan agreement from abroad, you should therefore read the conditions very carefully. In addition, you should be familiar with a household bill check whether you can afford the financial burden of this loan without SCHUFA.

3. P2P Lending/Loans from private individuals

P2P loans (“peer-to-peer”) are loans that are also granted by private individuals. Lenders and loan seekers are linked via online platforms. The platforms provide the credit conditions for both sides. Therefore, no separate negotiation about the conditions has to take place. Private loans are characterized by greater flexibility than bank loans: although proof of credit bureau is required, the lenders can decide for themselves whether to grant the loan even if the credit rating is bad or the credit bureau is negative. often have

Loans from private individuals can be worthwhile for all parties: lenders benefit from high interest rates, which each per diem make look old. Borrowers, on the other hand, can get a loan through the P2P loan even with bad SCHUFA, low or fluctuating income. Therefore, these loans are particularly suitable for the self-employed, traders, students or unemployed. While these individuals are rejected by many providers, you can get one at bon credit* another loan – often with a surprisingly high acceptance rate.

However, the higher interest rates can also make the loan expensive. In addition, additional fees are due for the platforms. One of the largest providers of P2P loans is Auxiliary*, which averages about 3.5 % fees.

But family members, acquaintances or friends can also grant personal loans individually. This allows the conditions to be freely agreed. Platform fees do not apply.

What are the advantages and disadvantages of personal loans?

P2P loans or personal loans from family or friends are a good way to get a loan despite negative SCHUFA. However, you should also read the contracts carefully here. You may incur high costs that are comparable to your overdraft interest. If you cannot service the rate by the end of the term, you should refrain from the offer. Sometimes you get into financial difficulties.

Loans in the circle of friends and family always carry the risk of tensions arising, which can put a heavy strain on the relationship. Be it because you suddenly can no longer service the installments for various reasons, or the lender suddenly wants the money back earlier than agreed.

Which bank gives credit with bad credit rating? - Special cases

The above-mentioned providers usually also grant the loan to the self-employed, students and pensioners “despite poor creditworthiness”. Make an exception Swiss loans for Germans which are only awarded to permanent employees. However, can self-employed, whose income is not recognized by the banks Smava* get a loan. But also students, Pensioner, people with low incomes or short-time workers have due to lack of income or old age poor creditworthiness and usually have to switch to one of the providers mentioned. If you have little or no income, you may also be interested in these 4 ways to get a loan with no income to obtain.

How the self-employed succeed in borrowing with bad credit

The self-employed face the problem that banks only recognize your proof of income after three or four years of business activity. Self-employed people, on the other hand, usually need capital right from the start of their self-employment. After all, the start-up phase is characterized by numerous purchases to get the business up and running.

A good loan for the self-employed therefore requires Proof of income only for a short period of 6 to 12 years months. provider like Auxiliary* or ferratum* have the fewest hurdles when applying for the self-employed. In the following table are the Requirements for the business activities of different providers for credit for the self-employed contrasted. This should also make borrowing possible as a self-employed person.

| Offerer | requirement | valuation |

|---|---|---|

Auxiliary* | If the credit rating is correct, the loan is possible from a private person and without proof of income or proof of salary. | Simple requirement for self-employed |

ferratum* | If the creditworthiness is good, the loan is possible without proof of income or proof of salary. | Simple requirement for self-employed |

bon credit* | Income tax assessments showing your income for the last two or three years. | Medium requirement for self-employed |

Maxda* | Income tax assessments showing your income for the last two or three years. In individual cases, annual financial statements and income tax assessments for the last three to four years are required. | Medium requirement for self-employed |

credimaxx* | Income tax assessments showing your income for the last two or three years. | Medium requirement for self-employed |

Creditolo* | Self-employment of 4 years or more: Income tax assessments from which income and current business evaluation (BWA). Self-employment shorter than 4 years: Additional collateral is required. Suitable collateral is, for example, pension, life insurance, building society contracts or savings. The security must correspond approximately to the loan amount. | Strict requirement for self-employed |

How to get a loan as a pensioner with a bad credit rating

A Credit for pensioners can make many wishes come true in old age. Pensioners with a good credit rating and a pension of more than 1,100 euros can take out a regular one installment loan apply for. If you are over 70 years old, banks often charge Credit Collateral. For this are suitable for pensioners younger guarantors or second applicant.

Alternatively, the Motor vehicle registration certificate or one land charge on the property as security that is readily accepted by the banks. This collateral can make loan rescheduling possible even in difficult cases. provider like bon credit* represent a good alternative to the conservative savings bank for pensioners with low income, basic security or a lack of collateral. bon credit* also helps older people such as pensioners to get a loan largely without problems and without depositing collateral.

Which bank gives credit despite debts?

If your bank won't lend you money because of debts, you can get Smava*, Auxiliary* and credimaxx* often another Credit despite debts give. The banks' offers are often very appealing to debtors, as they want to attract you as a new customer. A rescheduling of the old loans is often particularly worthwhile here.

Nevertheless, debtors with pre-existing debts should act prudently when borrowing to avoid getting into a debt spiral. When the risk of debt spiral is particularly large, you can find out in the guide "Which bank gives credit despite debts?“.

The advantages and disadvantages of loans without Schufa

Is a loan without Credit Bureau just an expensive rip-off or is it more of a last resort? First the negative sides.

Disadvantages of credit bureau-free loans

With a credit bureau loan, there is no check by a credit agency such as SCHUFA. This means that the bank has a greater risk of default when granting the loan. The bank transfers this to higher interest rates. For this reason, loans without Credit Bureau have significantly higher interest rates. The first disadvantage of the loan without Credit Bureau:

However, due to the high cost, loans without Schufa should only be taken out if there are no alternatives. Thus, providers such as bon credit* often also grant a loan despite the negative Schufa entry.

After all, you'll pay significantly more for a loan without Schufa.

Consumers pay about twice more for the loan without Schufa testing than for a conventional installment loan a German bank.

According to the German Bundesbank, the interest rates for bank loans averaged 6 % in 2022. The loan without Schufa costs about double with 11 % interest.

Source: German Bundesbank

The loan without Schufa is comparable in terms of interest rate to an overdraft with the overdraft facility.

The high cost of interest entails another disadvantage of loans without credit bureau:

Anyone who already has to bridge a financial bottleneck can quickly get into a debt spiral with the loan without SCHUFA.

Rejected financing requests from a bank can be an indication that there are already too many liabilities. In this case, you should be critical of taking out the credit bureau-free loan. When there is a lot of debt, it is better to regain control of the financial situation than to take out more loans.

However, there is another disadvantage of loans without Credit Bureau:

Many intermediaries of loans without Credit Bureau are not trustworthy.

Upfront fees or down payments are clear indicators of a dubious offer. You can find other features of a dubious provider of credit bureau-free credit here. On the other hand, the fact that loans without SCHUFA are usually less flexible than regular loans is not quite as serious.

The framework of loans without credit bureau is inflexible.

In most cases, the term, installments and loan amount are not negotiable but specified by the lender. The advantage of this less flexibility is that you are not spoiled for choice, but can get money quickly.

Advantages and disadvantages of credit bureau-free loans with high acceptance rates

If you take a loan without a credit bureau and give yourself time to carefully search for a trustworthy intermediary and carefully compare several offers, the credit bureau-free loan can still be an opportunity. With a trustworthy offer, the loan is granted by a normal, foreign bank. In the Swiss credit ranking or on this page you will find many good offers. A credit bureau-free loan, used correctly, therefore has a decisive advantage over the classic bank loan:

If you have a negative credit bureau entry or a bad credit rating, a loan without credit bureau is a simple financing option

But a loan without SCHUFA has another advantage despite the high interest rates:

A Schufa-free loan contains a repayment.

In contrast to the overdraft facility, which does not have to be repaid, the loan without a credit bureau must be repaid. This planned repayment protects you as a consumer. Because in contrast to the overdraft facility, it cannot happen that the loan is used longer than necessary. The repayment period will be agreed between the bank and you before the contract is signed. This way you know the monthly rate in advance and you know right from the start when you will be debt-free again.

A loan without Schufa can also be taken out as a side loan. Minor purchases like motorcycle, mountain bike or furniture can be purchased without bothering the house bank.

This results in another advantage for consumers with credit without Schufa:

The loan without SCHUFA does not affect the credit line at the house bank or the SCHUFA score in any way.

From this point of view, the loan without SCHUFA is suitable for purchases on the side. Because the loan is very discreet. Since there is no registration with the Schufa, the loan without Schufa does not endanger larger projects such as a planned real estate or car loan. This results in another advantage of the loan without SCHUFA:

No inquiry at the SCHUFA and therefore no report about the borrowing.

Pro-Contra table credit without Schufa

The following is a summary of the named advantages and disadvantages of loans without Schufa.

| Advantages: credit without SCHUFA 👍 | Disadvantages: credit without SCHUFA 👎 |

|---|---|

| 👍 In the case of a negative entry in the SCHUFA information, this is usually the only financing option | 👎 Mostly higher interest rates |

| 👍 No debt longer than planned, through regular repayments | 👎 High interest rates can lead to spiraling debt |

| 👍 No impact on the credit line | 👎 There are many dubious providers |

| 👍 No inquiry at the SCHUFA and therefore no report about the borrowing | 👎 Framework design mostly inflexible: The lender usually determines the term, installments and loan amount |

| 👍 Online conclusion: Simple and quick conclusion via the Internet - no printer required |

Which bank gives credit with bad credit rating? - Schufa Score

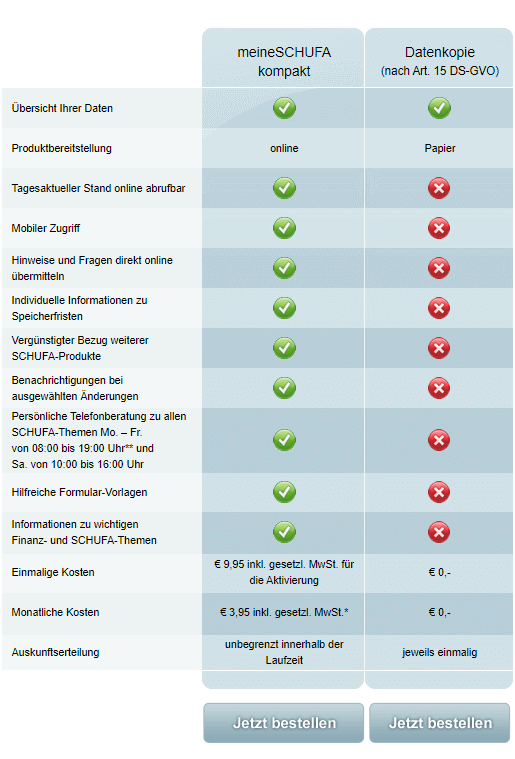

If you want to know what your credit rating is, you can get a free one from SCHUFA SCHUFA self-assessment request. You should receive the information by letter within 1 month. Requesting the data is free of charge once a year and neutral to Schufa. By maintaining your Schufa data, you will also receive a loan with a high acceptance rate from regular banks in the future.

How can I correct my SCHUFA score?

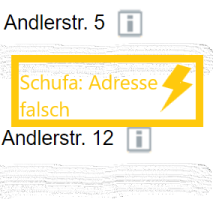

Sometimes it happens that the SCHUFA is sent incorrect entries. In my case, for example, this was an incorrectly transmitted house number on the same street. However, it can also happen that loans that have already been repaid are not deleted, or loans that have been requested but not completed are listed.

Such errors can be reported to SCHUFA by post, online via the meineSchufa portal (subject to a fee) or by telephone. Schufa is obliged to correct errors.

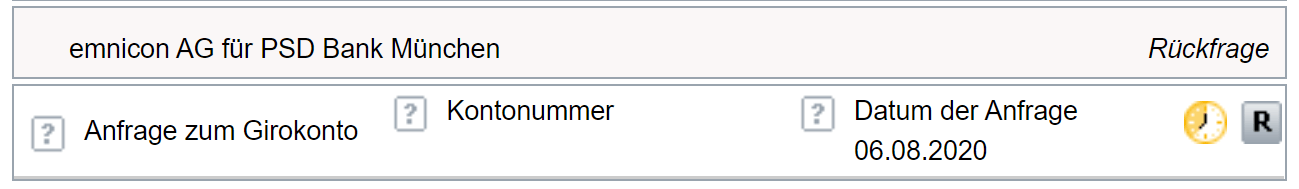

Image: Older entry created when opening a PSD Bank account.

How can I improve my SCHUFA score?

If you want to improve your credit rating, you should not take out too many loans at the same time and have incorrect or outdated information deleted by the Schufa. The following applies to a good credit rating: Fewer entries are usually better than numerous! Here are 6 tips on how to improve your Schufa score. By following the tips, you will get a loan with a very high acceptance rate from the bank

What does a negative Schufa report look like?

If you want to know what a negative credit bureau information looks like You can find some examples and explanations in the linked article. The best way to recognize a negative Schufa information is the rating level, which is only part of the Schufa bank information. A negative Schufa report has a rating of N, O or P.

1. Good payment practices prove

The business model of creditors is to lend as much money as possible. After all, they earn money on every euro lent. Therefore, in principle, lenders have an interest in lending money. This is all the more true in times of low interest rates. If an offer is nevertheless rejected, it is probably due to an internal audit.

The bank therefore suspects poor payment behavior. The lender then expects that he will not get the money back. Therefore, he refrains from granting the loan. Another reason could be that the loan amount was chosen too high. This means that the household income is not sufficient to repay the loan installments. Credit providers with high acceptance rates such as bon credit*, have less stringent payment behavior requirements.

2.household bill create

Compare income and expenses. After all costs have been deducted from your income, you are left with discretionary income. The maximum rate of the loan is based on this. Keep in mind that not all expenses can always be planned. The washing machine can suddenly break down, a visit to the workshop for the car will be more expensive than expected, or an additional payment for electricity, gas or telephone costs will flutter into the house. For such cases you should plan a buffer.

3. SCHUFA entry check

Errors happen with SCHUFA entries. Do you have the impression that the bank is unjustifiably refusing you a loan with a SCHUFA entry? It may well be that the SCHUFA score is incorrect. Take advantage of the opportunity once a year Access the SCHUFA score for free. If errors are discovered here, you can arrange for incorrect information to be corrected or for obsolete entries to be deleted.

Think carefully about whether you can really repay a loan despite a SCHUFA entry. It is not uncommon for banks to have plausible reasons for rejecting a loan application. If you want to take out a loan, whether with or without taking negative SCHUFA entries into account, the following tips will help:

4. Approach the matter positively

Consumers often underestimate their creditworthiness. Maybe your credit rating is better than you think? Fortunately, this concern is often unjustified. Before you take out a loan without taking into account negative SCHUFA entries with possibly very high interest rates, you should ask a conventional bank. If you have previously obtained a free SCHUFA self-assessment, you can realistically assess your chances and are spared any nasty surprises.

5. Avoid over-indebtedness

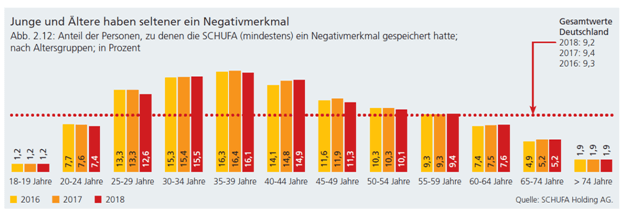

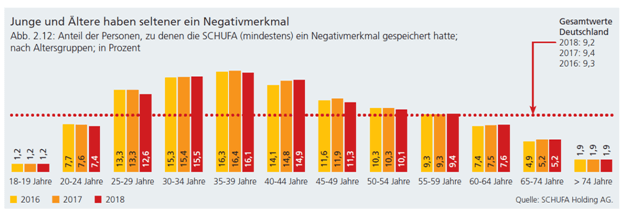

Consumers who need a loan are often concerned about whether the SCHUFA score is bad. According to current data from the Schufa itself, this concern is usually unfounded:

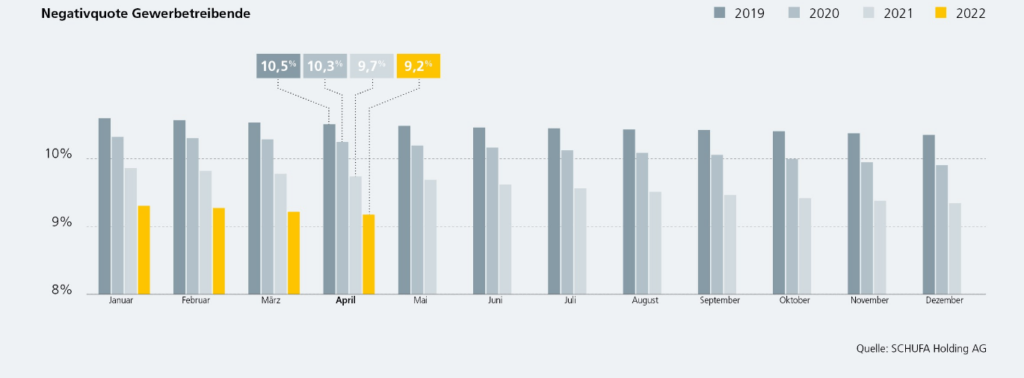

Over 90 % of the Schufa records for tradespeople contained no negative entries between 2019 and 2021.

Therefore, an expensive loan without Credit Bureau is often not even necessary: After all, only 9.2 % of the Credit Bureau data records contained negative entries in 2018. 91 % Germans would have received a cheap installment loan. Younger and older people have particularly good Schufa scores.

If your credit rating is good enough, our Partner Smava* automatically offered a loan with SCHUFA query. In this case, you benefit from significantly better conditions and do not need to worry about anything else. All you have to do is make an inquiry.

| Consumers who need a loan are often concerned about whether the SCHUFA score is bad. According to current data from the Schufa itself, this concern is usually unfounded: Over 91 % of the Schufa data records did not contain any negative entries in 2018. (→ Source: SCHUFA CreditCompass 2019). Therefore, an expensive loan without Credit Bureau is often not even necessary: After all, only 9.2 % of the Credit Bureau data records contained negative entries in 2018. 91 % Germans would have received a cheap installment loan. Younger and older people have particularly good Schufa scores.  If your credit rating is good enough, our Partner Smava automatically offered a loan with SCHUFA query. In this case, you benefit from significantly better conditions and don't have to worry about anything else. So you only have to make one request. | |

|---|---|

In addition, it is advisable not to buy in installments too often, because even smaller financing contributions quickly add up. Better it is a financial cushion on one cash account to create, so that you can fall back on larger purchases. In general, the financing of consumption should remain an emergency.

6. guarantor and collateral use

With a guarantor as a second applicant in the loan agreement, many loans can be made possible - despite a negative entry in the Credit bureau.With a good guarantor, the question "Which bank gives credit despite negative Credit bureau?" can be answered quickly: You should be able to get a loan from almost all banks . Because a guarantor with a good credit rating greatly reduces the risk of default. Therefore, loans with guarantors are approved by most banks, even despite a negative entry. Therefore, a guarantor is an easier way to get a loan despite SCHUFA.

But other securities offered are also included installment loans always a plus and often result in the loan being approved by the bank. It should security worth at least the value of the loan. Real estate or cars can be used as collateral. While a land charge is entered in the land register for real estate, there is one for a car Submission of the vehicle letter. An easier way to get a loan from many banks despite SCHUFA is to apply with a guarantor or second applicant.

Which bank gives credit with bad credit rating? - Credit check

When a loan application is made, the bank carries out a check to see whether it will grant the loan. With this credit check will the credit-worthiness checked. At a installment loan the income of the borrower serves as security. The bank determines the probability of how secure the income is over the loan term. Therefore, the spending side is also relevant. Additionally use banks external rating agencies like the Schufa credit agency. In coordination with the internal evaluation, a decision is then made as to whether an application will be accepted or not.

This means that the Schufa query is only one of several checks. Most banks carry out further calculations.

It is important to know that the credit rating is not uniform. If you receive a rejection from your house bank, this does not have to apply to all banks. Credit intermediaries know the easiest way to get a loan in each individual case.

Non-binding credit request

Smava.de

How you can expose a dubious bank, which allegedly gives credit with poor credit rating

You should be careful with a loan with a bad credit rating. In the comments, I receive various inquiries and spam posts from alleged providers of "reputable" credit-free loans on a daily basis. If you are interested in a loan without consideration of negative SCHUFA entries, you should be careful. The following criteria can help you to unmask dubious providers:

upfront fees

Reputable providers who arrange a loan without taking negative SCHUFA entries into account never demand an advance payment in advance. Even particularly fast processing is not invoiced separately by such providers.

No upfront fees: Neither Konto-Kredit-Vergleich.de nor our partner incur any upfront fees

Expensive hotline

Telephone contact should be possible via a normal number or a free 0800 number. If this is not the case, the provider is not serious.

No expensive hotline: You can reach our financing partner via a toll-free number. You can also give me one Mail write.

Credit and insolvency advice from a single source

If you have problems paying back existing loans, do not take out another loan including insolvency advice from a single source. Instead, get help from a professional and independent debt counselor. the charity, Diakonie and the Red Cross are the first points of contact for this.

No lending in the event of bankruptcy: Please contact independent debt counseling if you are having financial difficulties. Credit and insolvency advice from a single source is strongly discouraged!

Expensive additional products

The alarm bells should also ring if the provider tries to offer you nonsensical additional products such as consulting services and insurance.

No expensive additional products: Neither we nor our financing partner try to sell you expensive and nonsensical additional products

Cash on delivery

Contract documents are not sent by reputable providers as cash on delivery. In general, shipping fees for contract documents do not inspire much confidence. Better keep your distance from such providers.

Without cash on delivery fees: You will receive all documents from our financing partner conveniently by e-mail or post, of course without cash on delivery fees!

No imprint

If the provider does not have an imprint, you should refrain from doing so.

With imprint: You can find my imprint here

Many providers who spam me with advertisements via Facebook probably never pay out the promised money. If you have paid fees in advance to the credit broker or counseling, you have little chance to get your money back in court. It is therefore advisable to scrutinize credit providers beforehand.

Which bank grants credit with poor credit rating? - Rejection despite credit rating

If a bank rejects the loan application even though there is no negative SCHUFA entry, this usually causes a lack of understanding and confusion. Nevertheless, there can be good reasons for this. This includes:

- trial period: The probationary period is no longer a dealbreaker with many banks, but it can still be a reason for rejection.

- Self-employed: If you are less than 3 years you are self-employed, many conservative banks refuse the loan despite good credit rating.

- Loan amount too high: If the loan amount cannot be repaid from disposable income, it is too high. The loan amount depends on the term of the loan. Two examples for 2 % interest.:

- With €150 freely disposable income, you can borrow €5,200 over 3 years or €8,500 over 5 years.

- With €400 freely disposable income, you can borrow €13,900 over 3 years or €21,600 over 5 years.

- Temporary appointment: Permanent employment is no longer required by many banks, but it is still required by some banks. An overview of which banks require a Loan with fixed-term employment contract can be found in the linked article. It is also helpful to choose the shortest possible loan term for temporary employment. If the loan is already repaid within the fixed term, this makes it much easier to obtain the loan.

- overdraft facility: If your overdraft facility has been exceeded

- statement of account: If you have suspicious positions such as return debits or gambling on the statement of account stand.

Which bank gives credit with poor credit rating? - Difficult cases!

A Credit is used in difficult cases only with one guarantors, from Private or as "Swiss credit“ awarded by foreign banks, or rescheduled. If your loan has been rejected by the bank, you may belong to a group of people who consider banks to be difficult cases describe. These include: trainees, students, during the probationary period, with a fixed-term employment contract, as an unemployed person, as a self-employed person, as a single parent, as a Pensioner, on parental leave, with a negative credit bureau or generally with a bad credit rating, it is difficult to get a loan from a bank to get.

What they all have in common is that there is insufficient income that can be pledged. This is only the case above €1,200 per month. In addition, other securities such as real estate or cars are usually missing in difficult cases. Therefore, in difficult cases, guarantors have to serve as security or interest rates rise. The latter is the case in the case of private credit and Swiss credit. Due to the higher fees, a loan with a high acceptance rate can be paid out even in difficult cases.

Which bank grants credit with a bad credit rating with a high acceptance rate? → How much credit do you need right now?

If you have one Credit in less than an hour on the account without Schufa need, you can at Vexcash* request a loan up to a maximum of 3,000 euros. Vexcash pays out the loan on the same day.

Which bank gives credit with poor credit rating? - Small loans from 100 euros – 500 euros

What bank gives credit with poor credit rating?- Small loans from 500 euros – 1000 euros

What bank gives credit with poor credit rating?- Small loans from 1100 euros – 3000 euros

If you need more than 3,000 euros, you have to switch to an installment loan. You can find the cheapest installment loans via the Installment loan comparison.

Which bank gives credit with bad credit - FAQ

How do I get a bad credit loan?

With a bad credit rating and a negative credit bureau, it is difficult to get a loan. The following loans are also granted with poor creditworthiness:

1) Swiss loans

2) Mini Loans

3) P2P lending

4) Loans with a guarantor with a good credit rating

5) Loans where collateral is deposited (e.g. vehicle registration for the car, mortgage on real estate)

Here you have a chance to get a loan

Why do banks reject my loan request?

If you don't get a loan, it can be due to one of the following reasons:

1) No regular or variable income

2) Open other loans that have not yet been paid off.

3) High expenses

4) maintenance obligations (e.g. for children)

4) Low income below the garnishment exemption limit from 1.400 Euro net

5) Trial period not yet expired

6) Less than 3 years self-employed

7) Temporary employment contract → See the article on how to create a Loan with fixed-term employment contract you receive.

8) Visiting Casinos & Gambling Regularly

9) Negative entries in the Schufa (e.g. due to dunning notice, debt collection procedures, credit card cancellation)

If you have been rejected by a bank, this does not mean that the loan request can still be fulfilled. Providers such as Vexcash, Ferratum, Credimaxx and others have specialized in loans in difficult cases and can still make many things possible.

*Affiliate link: If you get to a provider via one of these links from my website and open an account there, I may receive a commission. This does not result in any additional costs for you. ❤️ THANK YOU for using these links! ❤️

Icons created by monkik from www.flaticon.com

Dear Ladies and Gentlemen,

Your comments are very helpful. I've been looking for a loan for a long time. Actually, I "only" need 1500 euros, but a slightly longer term. I'm retiring soon. My son finances my maintenance through the social welfare office. It's easy for me to pay back this loan with 50-60 euros a month.

I have my jewelry at the pawn shop.....very nice pieces.....and if I can't get it out it will be auctioned off and that must not happen under any circumstances. I need the loan urgently. Do you have any advice on how to get such a small loan? I would be very happy. Thanks very much !!!

Hello Coco, 1500 euros is only a small sum for many loan providers and mini loans are often granted in this area.

If you only receive social assistance, this is probably the only way to get a loan of €1500.

However, the rates for the mini loan must be significantly higher than 50 – 60 euros. The loan is usually repaid in full after 30 days.

A comparison of the conditions can be found under the link: 1500 euros credit

If this is not an option for you because you want to repay the loan in smaller installments, the providers recommended here are another alternative.

Greetings Sascha