In this article we clarify whether the Targobank has a Credit despite negative credit bureau forgives Maybe it's unexpected now:

If you have a negative Schufa entry, the targo bank* an acceptable, but not the best good address. Because Konto-Kredit-Vergleich.de had the following experience: A loan despite negative SCHUFA is not granted at Targobank. However, this was not always the case. Between 2000 and 2008, Targobank was still called Citibank. At that time, the bank was known for granting loans even to people with poor or very poor credit ratings. Nowadays, however, there are good alternatives how you can get a cheap loan even with a negative Schufa. You can find the best providers in the article "Which bank gives credit despite negative credit bureau“.

Does the Targobank grant a loan despite negative SCHUFA?

What you can learn here

There are increasing numbers of inquiries and reports about loans without SCHUFA at Targobank on the Internet. However, it is the case that Targobank - like other German banks - creates an accurate picture of its customers before lending. For this purpose, the creditworthiness is checked on the basis of several criteria and then a decision is made as to whether and to what extent a loan can be granted. Now comes the unexpected part: A SCHUFA query is also part of this credit check at Targobank.

If Targobank finds a negative entry in the SCHUFA, no loan is possible. This puts Targobank in good company with most other banks in Germany. Neither the Sparkasse or Volksbank, nor online banks such as ING, Consors or Comdirect, are able to grant credit. Credit with negative SCHUFA Information to be obtained.

However, this practice was not always the case at Targobank. In the early 2000s, Citibank gave high-interest loans to people with negative Schufa records, with interest rates in the double-digit percentage range not uncommon. Since the bank was badly affected by the financial crisis in 2008, the parent company Citigroup sold Citibank's German private customer business to the French Crédit-Mutuel. In 2010 the name was changed to Targobank. With the renaming since 2010, the granting of credit despite negative SCHUFA has ended.

But luckily there is one here way out, how to get a loan despite negative SCHUFA can get. You can find out which providers are meant and what you should definitely consider in the next section of the article!

Which bank grants loans despite negative credit bureau?

Even if the targo bank* is not a bank that has a Credit despite negative SCHUFA there is a way out. If you have a bad credit rating or a negative SCHUFA entry, you can try a small loan. With a small loan you can plug short-term holes in the household budget. You can often get a small loan despite a bad credit rating. This applies in particular to cashper* to. but also about Smava* you can get money quickly and unbureaucratically despite SCHUFA entry. In addition, the credit experts there will help you with the application for the loan! So even larger purchases can be managed with the right partner. A Car installment plan is next to the Bicycle installment purchase even with negative Schufa often possible.

Another big advantage is that at SMAVA you only have to have a small regular income. So you can already from 601 euros monthly receipt of money get a loan from Smava. Without proof of income By the way, are you coming with one? Ferratum mini loan* in money.

What is also very pleasing: Applying for a loan at Smava is extremely easy. To do this, you first select the use of money from a drop-down menu. Under Use, you can indicate whether you want to buy a new car with the loan, for example, or renovate your home. You can also choose a free use where you can then spend the borrowed money however you want. Furthermore, you only have to indicate which one amount you want to borrow and which ones Duration you wish

After you have also provided your personal details, the desired loan amount is made available. In most cases, the subsequent credit check is unproblematic. Should problems arise, a solution can be found together. The loan is repaid in equal monthly installments until it is fully repaid. Further alternatives to Banks that lend easily you can read in the article: Banks that lend easily: Top 10 tableau

Alternative for loans despite negative credit bureau

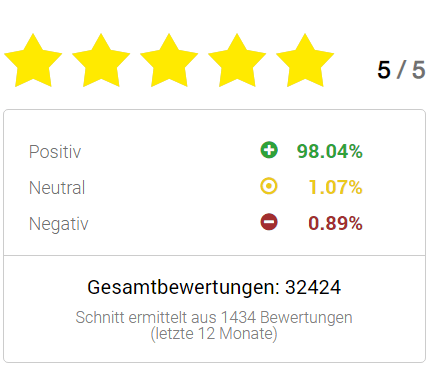

In summary, it is about Smava* to the ideal Alternative to the credit of the targo bank*. Because with Smava you get a loan even with a negative credit bureau. In addition, Smava offers very favorable credit conditions because the provider can select the best financing for you from a huge pool of financing. The rating portal eKomi also confirms that Smava is a very good choice. Smava receives 5 out of 5 possible stars from over 32,000 customer reviews. If you need money, you should apply for your loan from Smava now and benefit from favorable conditions, fast payouts and good service payout and good service to benefit

This is not the only reason why Smava is the ideal Targobank alternative when it comes to a loan despite negative SCHUFA!

An alternative for loans with negative entries is the loan portal bon credit which has been granting loans to people with poor credit ratings for over 40 years.

Credit from Smava

What you should consider when looking for a loan despite negative credit bureau

Banks do not grant credit for negative SCHUFA entries!

With most banks, it is not possible to get a Credit with negative SCHUFA to get. This is also the case for Targobank. A loan despite SCHUFA entry is not possible at Targobank due to bank guidelines.

Credit intermediaries like Smava can arrange loans despite negative SCHUFA loans

It is at Smava to the ideal Alternative to credit despite negative SCHUFA, as is often suspected at Targobank. Because with Smava you get a loan even with a negative credit bureau. In addition, Smava offers very favorable credit conditions because the provider can select the best financing for you from a huge pool of financing. The rating portal eKomi also confirms that Smava is a very good choice. Smava receives 5 out of 5 possible stars from over 32,000 customer reviews. If you need money, you should get your loan now Smava* apply and benefit from favorable conditions, a fast payout and good service.

When it comes to credit despite negative SCHUFA, there are many black sheep

Dubious credit brokers who offer a loan despite negative credit bureau can be found in abundance on social media. Typical tricks of these providers are that you have to pay an expensive agency fee. Usually even if no loan agreement is concluded. With reputable providers such as Smava* There are never any costs before the contract is signed!

Check Schufa Score!

If you were rejected, you should check your SCHUFA score. This is free once a year. You can read this guide, what to do!

Request loans despite negative credit bureau

To the provider:Smava.de

2 thoughts on “Targobank: Gibt die Bank einen Kredit trotz negativer SCHUFA?”

Comments are closed.