This is about that Car leasing without Schufa and the Car leasing despite Schufa. We look at the options for leasing with a small credit check, and where you can get one. However, leasing without a credit check is not possible from any provider, because of course every lessor somehow ensures that the installments can be paid. Nevertheless, there are big differences between providers when it comes to credit checks for car leasing. Therefore we have 7 credit free car leasing providers on seriousness checked. Many providers of car leasing without Schufa act only as an intermediary and charge you additional fees.

Only one provider in car leasing without Schufa reputable

What you can learn here

- Where can I reputably lease a car without Schufa?

- Leasing without Schufa: 7 providers checked for seriousness

- 1 . Finn Auto - Car leasing without Schufa without intermediary (+ all-round carefree package)

- Finn has one of the largest ranges of vehicles and often undercuts the rate of competitors

- 2. leasmobil - car leasing without Schufa without intermediary.

- Finn vs Leasmobil on car leasing without Schufa

- 4 . Car leasing SH - car leasing without Schufa with intermediary

- 4. mobile leasing 24 - car leasing without Schufa with intermediary

- Conditions comparable with Car Leasing SH

- 5. car yard Ochsman - car leasing without Schufa with intermediary.

- Conditions comparable with Car Leasing SH and Mobilleasing

- 6. AWL Leasing - car leasing without Schufa with intermediary.

- 7. car leasing Gelhart - with intermediary

- Received car leasing rejection without Schufa? - Your alternatives now

- The Schufa: lynchpin of reputable providers of car leasing without Schufa.

- Car leasing without Schufa: Leasing alternative with negative Schufa note

- What to look for when leasing a car without Schufa (to avoid non-reputable providers)

- Car leasing without Schufa: advantages and disadvantages

- Car leasing without Schufa: Conclusion

- Alternatives in case of rejection by negative SCHUFA?

- Better not to consider leasing without SCHUFA

- Is it possible to lease a car despite debts? Is the Schufa or similar credit agencies queried for commercial leasing? Is a leasing contract entered in the Schufa?

A reputable provider that offers car leasing with poor credit rating and despite negative Schufa is Finn*. Although the provider does not completely waive a Schufa query, a bad credit rating with Finn does not immediately lead to the rejection of the car lease. An alternative to Finn for car leasing without and despite negative Schufa is leasemobile. Leasmobil is more expensive than Finn, but at least it discloses its costs, unlike other providers, and does not charge an intermediary fee.

Recommendation: Car leasing without Schufa

Finn is one of the few reputable providers with a bad credit rating

- None Agency commission

- You take over only the fuel costs (Car subscription)

- Included Comprehensive insurance

- No blanket rejection at negative Schufa

Finn.Car

The providers Car-Leasing SH, Mobil-Leasing 24, Autohof Ochsman and AWL all offer car leasing without Schufa from AVL. For this you charge an additional Agent commission. The costs with these providers were very high in requested offers and they are therefore not worth a recommendation. Moreover, you may end up paying the brokerage commission of several hundred euros without actually getting a leasing contract in the end.

if you a Car without Schufa If you want to lease a car, we advise against offers where the provider only acts as an intermediary. In this case, you may end up paying the agency commission in advance without receiving a leasing contract in the end. Therefore, be somewhat skeptical about these offers.

Where can I reputably lease a car without Schufa?

If you need to make a lease without Schufa query, you can resort to offers with an intermediary, which can be slightly more expensive or those without an intermediary. With intermediaries you should be careful when leasing a car. From Advance payments that do not lead to a rental contract and dubious offers you should keep your distance, as in this section explained at the end of the article. We have marked the providers in the list with and without intermediaries accordingly. Hopefully, this will make it easier for you to find a reputable provider of car leasing without or despite negative Schufa.

Provider of leasing without Schufa With mediator

Some of the providers on our list are reputable brokers for car leasing without Schufa contracts. These include Car-Leasing SH, Mobil-Leasing 24 and Autohof Ochsmann. Acts as the actual lessor AVL. This is not necessarily a sign of dubiousness per se, but rather of a division of labor: while AVL takes care of the vehicles, the other party takes care of customer contact. The fact that the aforementioned providers work with the same lessor means that the terms and conditions as well as the vehicles offered by these providers do not differ significantly. What they all have in common is that a placement fee must be paid before it comes to signing the leasing contract.

Therefore, when leasing without Schufa With mediator Absolutely caution appropriate. It is possible that there will be a flop as in the case of Sandra and Frenk M. comes. The two paid the brokerage fee without ever receiving a car. After paying the agent's commission, Sandra and Frenk were suddenly asked to provide an additional guarantee for the value of the vehicle. But they couldn't, because the vehicle cost €15,000. Sandra and Frank never saw the commission and down payment they had already paid again. Nevertheless, they did not receive a car. Due to the case of Sandra and Frenk, we advise against car leasing with intermediaries in principle, and recommend instead serious offers such as Finn*.

Provider of leasing without Schufa without mediator

The providers Finn and leasemobile and steps on the other hand even as a lessor on. The detour via an intermediary is therefore not applicable here for car leasing without Schufa. Finn also eliminates the special payment, as our cost comparison shows below. You pay Finn only the monthly rate and the fuel costs. This covers all costs. The provider pulls a Schufa information, but in contrast to providers such as Sixt, but does not directly reject any request for bad credit. It is therefore a Leasing without real Schufa exam and also without special payment.

But now let's go with the 7 providers who offer car leasing without Schufa exam.

Leasing without Schufa: 7 providers checked for seriousness

1 . Finn Auto - Car leasing without Schufa without an intermediary (+ all-round carefree package)

Car leasing despite Schufa recommendation: With Finn's car leasing, you can choose a car from a huge range even without a spotless Schufa. Finn offers an all-inclusive car leasing. Apart from refueling, you don't have to worry about anything else. Even a delivery to your doorstep is included. Compared to other car leasing without Schufa, Finn offers very competitive prices.

at Finn.Car a negative Schufa entry is not a direct reason for a rejection. The provider also offers a vehicle to customers with poor credit ratings. Finn stands out with another special feature in this list of leasing without credit bureau providers: Finn offers an all-round carefree package. This means that the provider assumes all costs incurred, except for refueling. Many people therefore also speak of one with this model car subscription.

When renting a vehicle, Finn requires a Deposit of 3 monthly installments. The Finn subscription model is available to drivers between 20 and 75 years open minded. If you are under the age of 23, you are considered a young driver at Finn.Auto. The choice of vehicles is then limited to a maximum output of 150 kW (203 hp). The only other requirement is a German registration address.

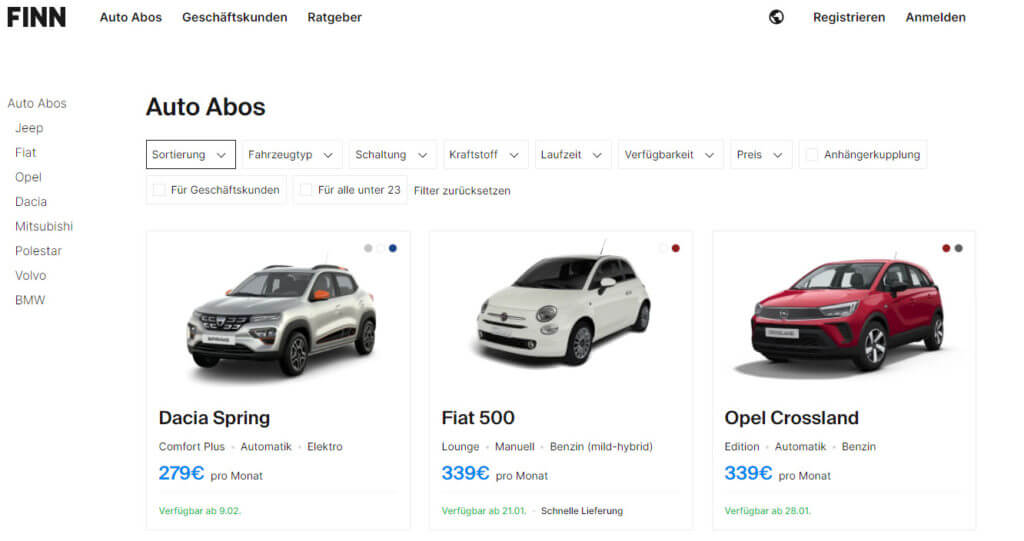

Finn has one of the largest ranges of vehicles and often undercuts the rate of competitors

Finn carO* features high-end vehicles such as BMW 5 Series Touring, Volvo XC 90, Polestar 2 or the BMW X3, which start at around 600 euros. Finn.Auto also offers various cheap cars for customers with poor credit ratings and negative Schufa entries. These include, for example, the Dacia, Spring, Fiat 500 or the Opel Crossland. Customers with a negative credit bureau can rent a car from Finn.Auto for around 250 euros per month. Thus, the provider undercuts many competitors. Especially if you consider the extensive inclusive services such as comprehensive insurance, transfer, vehicle tax, registration and HU. Possible running times begin with Finn with 12 months. Longer rentals are also possible.

If you are looking for a car subscription despite a negative Schufa entry, you should look at the provider Finn.car* definitely have a look. There are always new offers from city runabout until SUV or sports car range. With Finn, for example, you can get the BMW X1 including comprehensive insurance, transfer, vehicle tax, registration, and main inspection for just 589 euros per month. The offer is also available to customers with poor credit ratings.

Example car Finn BMW X1 Advantage (gross list price: €44,700) | Car leasing despite Schufa entry from Finn |

|---|---|

| Kilometer | 12.000 km/ year |

| down payment | 0 € |

| Duration | 12 months |

| Fully comprehensive | Included |

| Transfer, car tax, registration, HU | Included |

| Monthly rate | 589 € monthly |

| total cost (incl. down payment) | 589 € monthly |

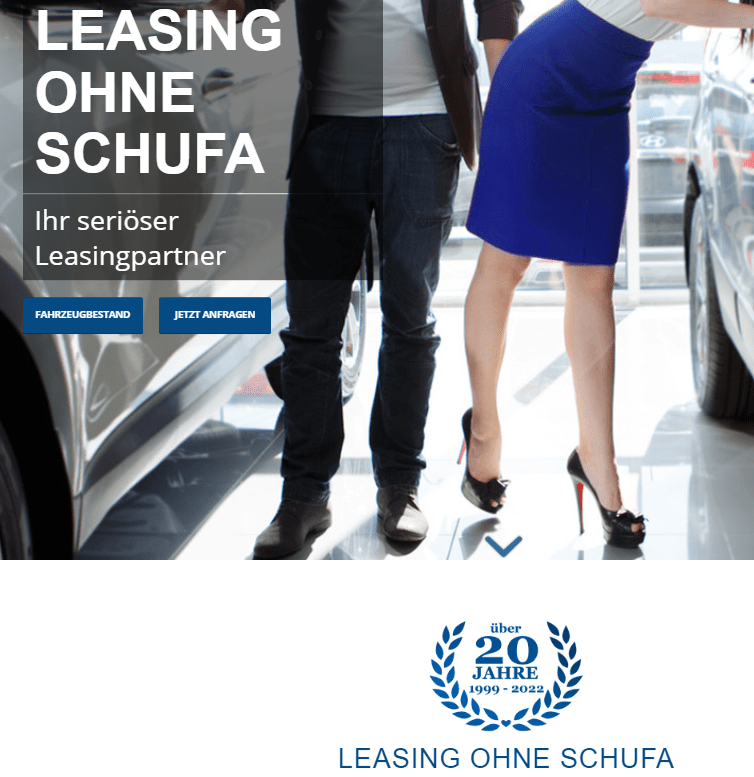

2. leasmobil - car leasing without Schufa without an intermediary

Car leasing despite Schufa from Leasmobil: Car leasing without Schufa from Leasmobil is significantly more expensive and includes fewer inclusive services than its competitor Finn car*. Therefore, when leasing a car with poor Schufa and credit rating, we recommend first to ask the provider Finn. In many difficult leasing cases Finn can make an offer to lease.

Due to the significantly higher costs, we recommend the provider Leasmobil only if you have already received a rejection with Finn as a second choice. Nevertheless, we would like to emphasize that Leasmobil, unlike the other leasing providers without Schufa, does not act as an intermediary and therefore no intermediary fee (often 3 % of the purchase price) is due. The Car lease without Schufa without an intermediary from Leasmobil is therefore somewhat more favorable than providers who only broker leasing contracts.

conditions

The provider leasemobile in contrast to the other providers mentioned, acts directly as a lessor. So it is a Auto leasing without Schufa and without intermediaries. A leasing contract is accepted even if the credit bureau is negative. That's why at Leasmobil you can also get a Car leasing despite negative credit bureau without an intermediary to speak. The contract terms are between 12 and 48 months. Vehicles from a BMW dealership, a VW dealership, a KIA dealership and a Volvo dealership can be accessed. A selection of these cars is immediately available for leasing. A deposit of 10 % of the purchase price is required. The leasing vehicle must not be more than 48 months old when the contract is signed and must not have driven more than 100,000 km.

Compared to Finn's all-inclusive offer, Leasmobil adds further costs to the lease. For example, the credit-free provider Leasmobil charges additional fees for a Fully comprehensive insurance. However, transfer, vehicle tax, registration and general inspection are also included with Finn, but not with Leasmobil. In addition, the provider Finn does not charge a down payment. With car leasing without Schufa via Leasmobil, however, additional costs for the down payment are due. Although you are more flexible with the 12-month contract and have more free kilometers with Finn, you pay significantly more for a comparable car with Leasmobil.

Finn vs Leasmobil on car leasing without Schufa

We have compared the costs of Finn and Leasmobil using a BMW X1 in the Advantage version. While you pay around €750 per month for the BMW X1 at Leasmobil, you'll pay around €550 per month at Finn. Finn* for a comparable offer almost 200 € less due.

Comparison car Finn vs Leasmobil: BMW X1 Advantage (gross list price: €44,700) | Car lease without Schufa from Finn | Car leasing without Schufa from Leasmobil |

|---|---|---|

| Kilometer | 12.000 km/ year | 10.000 km/ year |

| down payment | 0 € | 2.900 € |

| Duration | 12 months | 36 months |

| Fully comprehensive | Included | approx. 50 € per month |

| Transfer, car tax, registration, HU | Included | approx. 100 € per month |

| Monthly rate | 589 € monthly | 520 € monthly |

| total cost (incl. down payment) | 589 € monthly | 750 € monthly |

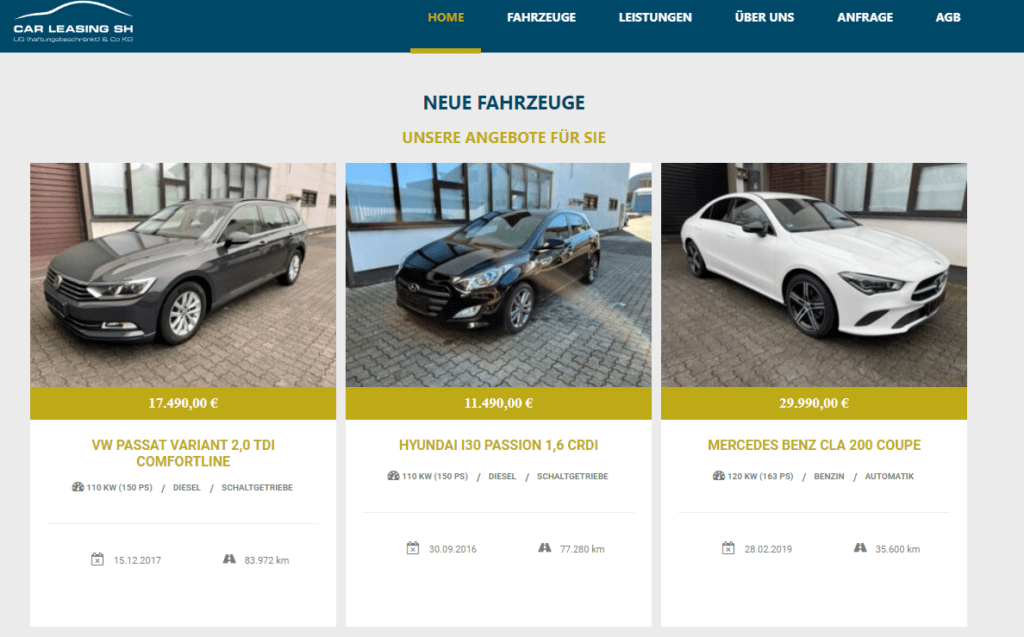

4 . Car Leasing SH - Car Leasing without Schufa With mediator

Because of the higher costs due to additional intermediary fees, we do not recommend the provider Car-Leasing SH. Only when you are at Finn* already received a rejection, Car Leasing SH comes into question as a second choice or third choice for car leasing without Schufa. The provider does not present its costs of car leasing without Schufa transparently on the Internet. As a test, we asked for offers from a used BMW. The leasing rate was similar to that of a new car from Finn.

Car Leasing SH is a provider that works with AVL. Car-Leasing SH puts customers in touch with the lessor AVL. AVL is a large lessor which offers leasing without Schufa. AVL's headquarters are in Reutlingen, Swabia. However, AVL generally has no direct customer contact, but works exclusively with intermediaries such as Car-Leasing SH.

conditions

The vehicle is leased using a short-term operating lease model. The term of the leasing contracts is always at Car-Leasing SH 30 months. An extension of 12 months is then possible. New and used vehicles that are no more than 45 months old and have a maximum of 95,000 km can be leased. As usual with AVL, leasing takes place without a Schufa query. The minimum purchase price is €10,000 gross. Cheaper vehicles are not offered and can alternatively be purchased via a Car loan without Schufa from providers like Smava* or bon credit* financed.

Special payment before signing the contract

You must make the special payment to Car-Leasing SH before signing the leasing contract. The leasing special payment depends on the leasing rate. Car-Leasing SH is primarily aimed at the self-employed with insufficient creditworthiness and negative credit bureau, because the costs of leasing without credit bureau are tax-deductible. The down payment for the vehicle is added to the leasing special payment and is at least 10 % of the purchase price.

The leasing provider AVL has some vehicles from its own stock that you can lease through Car-Leasing SH. The provider also works with car dealerships from well-known brands such as Volkswagen, BMW, Audi and Mercedes-Benz. Therefore, there is a large selection of high-quality new and used cars. In addition to small cars, limousines, convertibles and SUVs, this also includes vans and minibuses. The choice of dealer is left to you as a customer.

4. mobile leasing 24 - car leasing without Schufa With mediator

Due to the higher costs due to additional intermediary fees, we recommend the provider Mobilleasing24 not. Only when you are at Finn* already received a rejection, Mobillleasing comes into question as a second choice or third choice for car leasing without Schufa.

Mobile leasing 24 is a provider who apparently also works with AVL. Like Car-Leasing SH, Mobil-Leasing 24 mediates customers to AVL, which is the actual lessor but generally has no direct customer contact. The vehicle is leased using a short-term operating lease model.

Conditions comparable with Car Leasing SH

The term of the leasing contracts is always 24 with Mobile-Leasing 30 months. An extension of 12 months is then possible. New and used vehicles that are no more than 45 months old and have a maximum of 120,000 km can be entered. As usual with AVL, leasing takes place without a Schufa query. The minimum purchase price here is also €10,000 gross. The special payment must be made in advance and depends on the leasing rate. Like Car-Leasing SH, Mobil-Leasing 24 is mainly aimed at self-employed people with insufficient creditworthiness and negative credit bureau. Self-employed people can claim leasing costs for tax purposes. However, some equity is also necessary for Mobil-Leasing 24: The down payment is 10 % of the purchase price, which is customary in the industry.

Mobil-Leasing 24 can also access vehicles from the AVL inventory. Mobil-Leasing SH can also be used to lease cars from car dealerships with well-known brands such as Volkswagen, BMW, Audi or Mercedes-Benz. Therefore, there is a large selection of high-quality new and used cars. In addition to small cars, limousines, convertibles and SUVs, this also includes vans and minibuses. The choice of dealer is left to the customer.

5. car yard Ochsman - car leasing without Schufa With mediator

Because of the higher costs due to additional agent fees, we recommend Autohof Ochsman not. Only when you are at Finn* already received a rejection, an intermediary with higher fees should be considered.In addition, car leasing without Schufa and without an intermediary is often cheaper.

The family business Autohof Ochsmann offers Car leasing without Schufa and Car leasing despite negative credit bureau at. The leasing service provider works with AVL like the first two mentioned together.

Conditions comparable with Car Leasing SH and Mobilleasing

Therefore, the conditions do not differ significantly from Car-Leasing SH and Mobil-Leasing 24, which means 30 months leasing period, vehicle age maximum 45 months, Mileage maximum 100,000 km. In addition, the minimum purchase price here is €10,000 gross, with a down payment of 10 %. As with Car-Leasing SH and Mobil-Leasing 24, the special payment to the intermediary must be made before the leasing contract is signed and is based on the leasing rate.

6. AWL Leasing - Car Leasing without Schufa With mediator

Due to the higher costs due to additional intermediary fees, we recommend AWL Leasing not. Only when you are at Finn* already received a rejection, an intermediary with higher fees should be considered. In addition, car leasing without Schufa and without an intermediary is often cheaper.

The provider AWL Leasing also offers Car leasing without Schufa and Car leasing despite negative credit bureau at. Here, the leasing service provider works together with AVL. At AWL, lease terms of 25 to 36 months are possible. AWL is the only provider that can lease older vehicles. Leasing contracts can also be leased for 13-year-old vehicles with a mileage of up to 180,000 km. Due to the older vehicles with higher mileage, significantly lower prices can be expected than from other providers. The provider offers leasing without Schufa for cars, vans, buses, trucks and other vehicle types. The special payment to AWL only has to be made when the leasing commitment is made. One-off costs of three to four percent plus statutory VAT are due for this.

7. car leasing Gelhart - with intermediary

The website of Autoleasing Gelhart is currently unavailable.

The provider Car leasing Gelhart has compiled only a few pieces of information on its website. However, it can be assumed that Autoleasing Gelhart will Car leasing without Schufa and Car leasing despite negative credit bureau offers in cooperation with AVL. The brokerage fee is 3.0 percent of the purchase price, but at least €300 plus VAT.

Received car leasing rejection without Schufa? - Your alternatives now

Since car leasing without Schufa is very expensive, it is advisable to look for alternatives. If you want to buy a car with a bad credit rating or if you get a rejection for car leasing without Schufa, you can choose from the following alternatives alternatives at:

- Schufa Obtain self-disclosure and check reason for rejection.

- the financing via a Car loan without Schufawhere you end up owning the car yourself,

- that Auto subscription despite negative credit bureau from Finn*

- and the Financing through car dealerships despite negative credit bureau in installment plan fashionll.

In addition, due to the high cost of car leasing without Schufa is recommended to combine the offer with a favorable financing through a Car loan without Schufa to compare. These are loans from special banks or private individuals, which are also granted to people with poor creditworthiness and negative Schufa. Here it is advisable to compare several offers with each other.

Other alternatives to the Used car financing despite negative credit bureau can be found in the linked article. There you will also find out how you can still finance a used car despite the rejection of the loan.

1. Schufa Obtain self-disclosure information

| Offerer | cost of information | availability of the information | More information |

|---|---|---|---|

Bonify | For free | Right away available online | To the provider: Bonify.de |

| Schufa GDPR information | for free | Delivery within 4-6 weeks by post | To the provider: mySchufa.de |

| Schufa Schufa online credit report: | mySCHUFA compact: €3.95 per month | Right away available online |

If you suspect you've already been rejected due to a bad credit score, you should first get a Schufa self-report to get to the bottom of the issue. In the article What does negative Schufa information look like explains exactly how you can recognize negative entries in the Schufa. In addition, you will also find a tip where you can find a Schufa Information immediately digital and free of charge you receive.

Obtaining a Schufa credit report is an important step in improving your credit rating. All too often people skip this step and look for quicker methods like the Credit despite negative credit bureau searched for. Working on your credit rating is the most successful way to become a debtor who can get a loan anywhere in the long run. With a free Schufa report you can check how good your credit rating really is. With the credit report of Bonify you get your result directly online. If you find incorrect entries, you can also correct them directly in your account.

In other articles we have looked into the question which bank grants loans despite negative credit bureau and where to get one Credit in less than 1 hour on the account without Schufa can get. The financing of your car despite negative credit bureau is a serious one Alternative to leasing represent. Fundamental difference on the subject Buy a car, buy cash or lease you can find in this post.

2. Car loan without Schufa

If you have one Car loan without SCHUFA and credit rating several banks and credit intermediaries come into question, which are listed in the contribution Car loan without Schufa are listed. These are banks and intermediaries who, even in difficult cases, are still Grant credits can. The deposit of the registration certificate part 2 (vehicle title) is rarely required. In the case of a car loan with poor credit rating, the interest rates are between 5 and 10 %.

3. Auto subscription despite negative credit bureau

There are only a few providers who do not carry out a credit check with the Schufa when concluding a car subscription. Car subscription providers who offer a car subscription despite a negative Schufa entry usually require other proof. Examples of other evidence are a sufficient income, a guarantor or one additional deposit. However, many providers generally reject customers with a negative Schufa record. In the article Car subscription without Schufa we show you the 5 best providers if you want a Car subscription without Schufa or despite negative Schufa.

4. financing via car dealerships despite negative Schufa in the installment plan model.

The idea of obtaining financing through a car dealership is obvious when buying a vehicle. After all, you know the people at the dealership personally, which often creates a certain level of trust. But if you have a negative Schufa listing, it is not easy to get a loan - car dealers as well as banks often refuse customers with negative Schufa listings. We have searched for car dealerships that will approve financing for the vehicle despite a negative Schufa listing. To the question "Which car dealership finances despite negative credit bureau?"In the linked article, we present 5 suitable car dealerships in Germany.

The Schufa: lynchpin of reputable providers of car leasing without Schufa.

In Germany, credit bureaus such as Schufa have great power. In addition, the procedure for Schufa scoring opaque. A negative Schufa entry often has serious impact for those affected. These effects continue even after the economic situation of those affected has long since improved.

But the Schufa is cumbersome and sluggish. It can take several years for the credit agency to delete negative comments. If you want to lease a new car in this period of time, it can be difficult.

Schufa is the abbreviation for the "protection association for general credit protection". This is an economic information file that contains information about the creditworthiness collects from companies and individuals. Credit institutes, banks and other contractual partners have the option of querying Schufa data. So they can learn if it was in the past financial difficulties or late payments has given. In short: Schufa provides information about the payment behavior of Germans.

With 66 million data records, Schufa is omnipresent in Germany

The Schufa is omnipresent in Germany. The credit agency has data on the creditworthiness of more than 66 million peoplen saved. Therefore, the question arises as to whether it is even possible to conclude a leasing contract without Schufa. In fact, it's not that simple, which is why the Car leasing without Schufa there are a few things to consider. Because in almost all cases where you want to conclude a contract, you have to expect a Schufa query. This Schufa query can be done by:

- banks

- mobile phone providers

- leasing providers

and some others. The goal of the Schufa query is yours payment history find out in the past. This check will also credit check called. If there have been difficulties and financial bottlenecks in the past, leasing a car becomes difficult. Because bad payment behavior was often reported to the Schufa. The Schufa then makes a negative note in your Schufa file. This note has a big catch in car leasing: you will no longer receive an offer from most major car leasing providers.

Car leasing without Schufa: Leasing alternative with negative Schufa note

However, there are two exceptions to this rule: First, there are leasing providers who do not check your Schufa information. One speaks of Car leasing without Schufa. There are also leasing providers who carry out a Schufa check, but evaluate the entries less strictly than other providers. the term is often used here Car leasing despite negative credit bureau used.

Providers who offer car leasing without credit bureau or car leasing despite negative credit bureau have other criteria to approve the leasing contract. These providers know that Schufa entries are very lengthy. It can take up to 10 years for the negative Schufa note to be deleted. The situation can change significantly during this time. Therefore, when leasing a car without Credit bureau or car leasing despite negative Credit bureau, the following criteria are taken into account instead:

Car leasing criteria without Schufa

- your monthly net income (incl. any additional income)

- your monthly expenditure

- Your discretionary income, which is the difference between your monthly net income (1) minus your monthly expenses (2).

- profession

- Family situation (e.g. maintenance obligations)

However, despite checking these criteria, a higher residual risk remains with the lessor. This has nothing to do with you as a person. Rather, it is a game of probabilities. People with negative Schufa entries often have payment defaults. Unfortunately, the lessor does not bear this residual risk alone. Instead, he simply passes it on to higher leasing rates. This is also the decisive disadvantage of car leasing without Credit bureau or despite negative Credit bureau: The leasing rates are significantly more expensive than a regular leasing contract with a Schufa check!

Therefore, you should always check whether it is not worth buying a car through one Car loan without Schufa from providers like Smava* or bon credit* finance. Firstly, you are much freer in your choice of vehicle. And secondly, you can also avoid the high fees of leasing without Schufa. In the article Buy a car on installments despite negative credit bureau we also noticed that you have a loan at bon credit* come out cheaper than with financing through car dealerships directly. are there serious loans without Schufa are easy to spot if you are careful.

what you at Car leasing without Schufa should pay attention to (to avoid non-reputable providers)

You can lease a car even with a bad Schufa score. To do this, you can use several providers, which are listed above or can be googled. Most of them only act as intermediaries for large lessors such as AVL from Reutlingen and should be treated with caution. You should consider some things if you want to lease a car without Schufa. Because some people have already fallen for offers that sounded too good to be true. For example you can find here negative testimonials from car leasing despite negative credit bureau.

If you encounter any of the following, be sure to decline the offer:

1. pay fees in advance ⚡

Under no circumstances should you prepay any placement or processing fees. You should always hold the contract in your hands before you have to pay.

2. special lease payment should be paid to the dealer ⚡

If the one-time special leasing payment is paid to the intermediary, you should be careful, as your contract can then be rejected later despite the payment having been made.

3. down payment conspicuously low ⚡

A very low down payment is suspicious. If the vehicle is not leased well below market value, it could be a scam. It is also suspicious if you can choose the down payment yourself.

4. commitment with only a few details ⚡

If you receive a commitment to your leasing request despite only a few details about the vehicle, this is suspicious. If necessary, you should be urged to pay a brokerage fee. Whether you really get a car later sometimes remains uncertain. Not serious providers of leasing without Schufa let the contract after payment of the fee burst, because your credit rating is allegedly too bad.

5. leasing without credit check ⚡

If you receive an offer to lease without a credit check, you should reject it, because the providers are not serious, without exception. Leasing without a credit check is a scam that is solely about collecting an agent's commission. You can get a leasing contract or a car at a Leasing without credit check probably never.

With offers that come through an intermediary, it is much more likely to encounter one of these points. We therefore advise against using intermediaries for car leasing without Schufa. In particular, when leasing a car through an intermediary, you may end up paying the intermediary commission upfront without receiving a leasing contract in the end.

Car leasing without Schufa: advantages and disadvantages

If you have a negative Schufa entry, providers who offer leasing contracts without Schufa information are often the only way to get a leasing contract. Another advantage is that you don't burden your Schufa if you use reputable leasing providers without Schufa.

Advantages: Car leasing without Schufa | Disadvantages: Car leasing without Schufa |

|---|---|

In case of bad credit rating or negative Schufa information the only possibility to get a leasing contract | More expensive than traditional providers |

Schufa Score is not burdened by the leasing contract | Not every provider makes you a serious offer |

Often only cars from the premium segment are available |

However, lessors let themselves be well compensated for car leasing without Schufa. Therefore, you can expect higher costs than regular car leasing. Moreover, not all car leasing without Schufa is reputable. Advance payments are uncommon with reputable car leasing providers. However, they still try to take money from their customers. For example, some brokers demand advance payments even before the leasing contract is legally binding. With advance fees, you should take distance from the provider.

Another disadvantage of many providers of car leasing without Schufa is that you can only lease high-priced vehicles. If there are already problems with the credit rating, this quickly leads into the debt trap. A cheap used car, is then possibly the better solution. For this you can use a Car loan without Schufa as financing. This not only saves you money every month, but the car is also yours later on.

Car leasing without Schufa: Conclusion

Although there is no such thing as leasing without a credit check, we were able to identify two reputable providers of leasing without intensive Schufa checks in this post. These are Finn* and Leasmobil. With both providers, a poor credit rating does not immediately lead to rejection from car leasing. In addition, both providers operate without intermediaries and therefore make a reputable impression.

The providers Car-Leasing SH, Mobil-Leasing 24, Autohof Ochsman and AWL all offer car leasing without Schufa from AVL. For this you charge an additional Agent commission. The costs with these providers were very high in requested offers and they are therefore not worth a recommendation. Moreover, you may end up paying the brokerage commission of several hundred euros without actually getting a leasing contract in the end.

In both cases, you should compare the cost of car leasing without Schufa with an alternative like a Car loan without Schufa or one Car dealership direct financing compare. Finally, leasing offers with limited credit checks are expensive and it is therefore important to have a comparison offer up your sleeve.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

To put FINN as the prime has an aftertaste.

As a startup in Germany, it is very difficult to offer company cars to employees, as competitors do. Even a US parent company that has been doing solid business for over 10 years is of little help.

FINN was no solution there either.

No Schufa, as FiNN promises, but then demand proof - if you had that, you would also have a Schufa!

So far I've only gotten on with SiXT - the credit card billing isn't ideal, but at least you have a car.

Hello Martin,

thank you for your comment and your experience with car leasing without Schufa as a startup entrepreneur. It is indeed not so easy to get a lease here.

In addition, the lease without Schufa is not a Leasing without credit check. Therefore, the lessor still requires evidence to assess the creditworthiness of lessees.

However, with Finn, unlike Sixt, the focus of the credit check is not so much on the Schufa. That's the difference and that's why I recommend Finn as a lessor here.

Greetings Sascha