In this article you will find 10 banks, where you can get a car loan without SCHUFA and creditworthiness. You will also find out what loan amount depending on your income, the car loan without a Schufa query is included. You can lower your monthly rate by using a down payment perform Conversely means a Car loan without Schufa and down payment a higher monthly rate. In this article you will learn which limits you should not exceed with car loans without a down payment. The car loan without Schufa for self-employed always poses a very special challenge due to the required evidence. In contrast to all other cases, we therefore recommend the self-employed for car loans without Schufa Auxiliary*-Platform. If, on the other hand, you are employed or unemployed, the car loan without Schufa and creditworthiness is over bon credit* easiest to get. Even when receiving sick pay, a bon loan is often an option Credit despite sick pay possible.

What you can learn here

- Car loan without SCHUFA and creditworthiness - 10 banks where it works

- How much car you can afford with a car loan without SCHUFA and creditworthiness

- Car loan with bad credit and a net salary of €1,000

- Car loan with bad credit and a net salary of €1,500

- Car loan with bad credit and a net salary of €2,000

- Car loan with bad credit and a net salary of €2,500

- Car loan with bad credit and a net salary of €3,000

- Car loan with bad credit and a net salary of €3,500

- Car loan with bad credit and a net salary of €4,000

- Car loan without SCHUFA and down payment: risks and consequences

- What minimum income you need to get a car loan with negative SCHUFA and creditworthiness

- Where and how can I buy a car with or without a SCHUFA? – 6 possibilities

- How the loan approval for a car loan works without SCHUFA and creditworthiness

- 1.) Use the car as security to compensate for poor creditworthiness

- 2.) Choose a longer loan term to reduce the loan rate if you have a bad credit rating

- 3) Check your SCHUFA to get a car loan

- 3) With good payment record, you will get a car loan with excellent conditions.

- 4) Plan realistically: Create a budget calculation for a car loan without SCHUFA.

- Credit installments must be smaller than the disposable income

- Can you really afford the car loan without SCHUFA and credit rating?

- 5.) Avoid expensive inquiries about car loans without SCHUFA and ask regular banks at the same time

- 6.) No car loan without Schufa information in the event of impending over-indebtedness

- Buying a car in installments without SCHUFA: Requirements for a car loan with poor creditworthiness

- Finance used cars and new cars with the car loan without SCHUFA and creditworthiness

- Auto loan without Schufa for the self-employed

- How does a car loan affect the Schufa?

- With these 5 alternatives, you can also buy a car with a negative SCHUFA

- Where can I buy a car with or without a SCHUFA? | Short FAQ

- 1. Can you finance a car despite negative credit bureau?

- 2. Who grants car loans despite negative credit bureau? | Where can I buy a car with a negative credit bureau?

- 2.1 Financing through the dealer

- 2.2 Financing through credit intermediaries

- 3. What is more worth leasing or financing?

- 4. Is it possible to finance a car despite a high loan?

- 5. Is it easier to get a car loan?

- 6. Is there a car loan without Schufa and down payment?

- Conclusion: car loan without SCHUFA and creditworthiness

Car loan without SCHUFA and creditworthiness - 10 banks where it works

If you need a car loan without SCHUFA and credit rating, the following banks and credit intermediaries come into question: Bon-Kredit, Smava, Sigma Kreditbank, Creditolo, Ferratum, Maxda, Credimaxx, Auxmoney, cashper or Vexcash. These are banks and intermediaries that even in difficult cases still Grant credits can. The deposit of the registration certificate part 2 (vehicle title) is rarely required. In the case of a car loan with poor credit rating, the interest rates are between 5 and 10 %.

#1: Receipt credit  4,9/5 (eKomi) Interest charges: approx. 8 % at €10,000 & 72 months Loan Amount: 100 to 300,000€ Minimum income: €1,300 net per month Duration: 12 to 120 months To the provider: Bon-kredit.de | |

#2: Smava  4,9/5 (eKomi) Interest charges: -0.4 % at €1,000 Loan Amount: 500 till 120.000€ Minimum income: €601 net per month Duration: 12 to 120 months  To the provider: Smava.de | Speed Costs Smava undercuts offers from other providers with the "You can't get cheaper than this" guarantee seriousness To the provider: Smava.de |

#3: Vexcash  5/5 (eKomi) Interest charges:approx. 14.8 % pa rms. Loan Amount: €100 to €3,000 Minimum income: €700 net per month Duration: 15 - 90 days To the provider: Vexcash.de | Commitment probability Inaccurate data on commitment probability Speed Costs Smart option too expensive To the provider: Vexcash.de |

#4 Auxmoney 4,8/5 (eKomi) Interest charges:approx. 5.24 % pa rms. at €13,300 & 84 months Loan Amount: €1,000 to €50,000 Minimum income: €1,000 net per month Duration: 12 to 84 months To the provider: Auxmoney.de | |

#5 Sigma Kreditbank 4,8/5 (eKomi/Maxda) Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months To the provider: Sigma credit bank | Commitment probability Refusal, without permanent employment Speed Costs Interest expensive To the provider: Sigma credit bank |

#6 Creditolo  4,3/5 (trust pilot) Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months To the provider: Creditolo.de | Commitment probability Refusal, without permanent employment Speed Costs Interest expensive To the provider: Creditolo.de |

#7 Ferratum  4,7/5 (eKomi) Interest charges:10,36 % + installment option Loan Amount: €50 - €1,000 for new customers €50 - €3,000 for existing customers Minimum income: €1,100 net per month Duration: 30 days - 180 days To the provider: Ferratum.de | Commitment probability Inaccurate data, for commitment probability Speed At the end of 2022 there are unfortunately delays in payment up to 48 hours Costs Interest expensive To the provider: Ferratum.de |

#9 DSL Bank  4,5/5 (Proven Expert) Interest charges:4,40 % Loan Amount: 5000 € - 50.000 € Minimum income: unknown Duration: 48 - 120 months Installment loan despite negative Schufa: To the provider: DSLBank.com | Commitment probability Inaccurate data, for commitment probability Speed Costs Favorable interest rates construction financing despite negative Schufa: To the provider: DSLBank.com |

#10 Maxda  4,8/5 (eKomi) Interest charges:8.9 % (for 2/3 of customers at €10,000) Loan Amount: 1.500 € - 250.000 € Minimum income: 1.260 € Duration: 12 - 120 months To the provider: Maxda.de | Commitment probability Inaccurate data, for commitment probability Speed Costs Caution: In some cases, insurance is taken out before the loan is concluded seriousness To the provider: Maxda.de |

#11 Credimaxx  4,8/5 (eKomi) Interest charges:7.9 % (for 2/3 of customers at €4,000) Loan Amount: 500 € - 80.000 € Minimum income: 1.100 € Duration: 12 - 120 months To the provider: Credimaxx.de | Commitment probability Chance of success lower than with other providers Speed Costs seriousness To the provider: Credimaxx.de |

#12 Cashper  4,7/5 (eKomi) Interest charges:0 % for new customers Loan Amount: 100 € - 1.500 € Minimum income: 700 € Duration: 30 - 60 daysTo the provider: Cashper.de | Commitment probability Chance of success very high Speed Costs Free application for new customers To the provider: Cashper.de |

#13 TF Bank  4,4/5 (trust pilot) Interest charges:0 % for up to 51 days Loan Amount: 0 - 10.000 € Minimum income: not known Duration: no limit To the provider: TFBank.com | Commitment probability Chance of success: medium Speed Costs Free of charge for up to 51 days, but high interest thereafter seriousness |

#14 Advanzia  4,5/5 (trust pilot) Interest charges:0 % for up to 7 weeks Loan Amount: 0 - €20,000 for long-term customers. Maximum limit of €2,000 after application, €3,000 after three months and €5,000 after eight months. Minimum income: No minimum income required - application without salary certificates Duration: no limit To the provider: Advanzia.com | Commitment probability Chance of success: good Speed Costs Free of charge for up to 7 weeks, but high interest thereafter seriousness |

#15 Consors Finance  4,3/5 (trust pilot) Interest charges:2,99 % Loan Amount: 500 € - 50.000 € Minimum income: 650 € net per month Duration: 6 - 120 months To the provider: About Consors Finance | Commitment probability Inaccurate data, for commitment probability Speed Costs Very favorable interest rates seriousness To the provider: About Consors Finance |

Vehicle title as security deposit discounted car loan

If you want to finance a car with bad credit, banks often charge an additional interest rate and you have to expect higher costs. Therefore, it is advisable to first check out the banks Vehicle title as security take. Through this security deposit you can still get a loan even if your credit rating is mediocre.

The banks offer the car loan with vehicle registration document Santander* or the Targobank*. You can find more contact points in the article Which bank accepts the car letter as security. But if you have Schufa with negative characteristics, you will probably get a rejection from both banks. Another alternative is car loans, which are granted by specialized banks and credit intermediaries without credit bureau and creditworthiness.

Do not choose a car loan that is too high without a credit bureau or creditworthiness

However, with a car loan without Schufa and credit rating, you should be prepared for higher costs. Therefore, if you have a bad credit rating, you should try to buy a cheaper used car rather than a new one. To give you an approximate guideline: With a net salary of € 2,000, a car loan of about € 17,000 is realistic with a moderate credit rating. At € 1,500 net, a car loan is despite negative credit bureau up to about € 11,000 possible and at € 3000 net you can even take out a car loan of about € 30,000 with a mediocre credit rating.

if you a Car without Schufa on installments, there are other options that you can consider in addition to the car loan without SCHUFA and credit rating. These include, in addition to other options that you will learn in this article the Car leasing without Schufa, that Car subscription without Schufa or one Financing via car dealerships without Schufa. In the article Buy a car on installments despite negative credit bureau However, we found out that you have a loan bon credit* come out cheaper than with financing through car dealerships directly.

How much car you can afford with a car loan without SCHUFA and creditworthiness

When it comes to operating a car, you shouldn't spend more than 25 % of your net salary on a vehicle. Of this, around €150-200 is for vehicle maintenance such as fuel, wearing parts, repairs and inspections. You can use the remaining amount for a loan installment. With a car loan without Credit Bureau and creditworthiness, however, it is necessary to reduce the loan requirement so that banks are willing to approve the loan. The following loan amounts are possible with a car loan without SCHUFA and creditworthiness:

| net salary per month | Maximum possible car loan with bad credit |

|---|---|

| 1.000 € | 5.000 € |

| 1.500 € | 11.250 € |

| 2.000 € | 17.500 € |

| 2.500 € | 23.750 € |

| 3.000 € | 30.000 € |

| 3.500 € | 36.250 € |

| 4.000 € | 42.500 € |

The amounts listed are the maximum possible amounts for a car loan with poor creditworthiness. In order to gradually improve your credit rating, it may make sense not to use these amounts. But we want to show what is possible.

Car loan with bad credit and a net salary of €1,000

If you have a bad credit rating, you can buy a small car for up to around €5,000 for €1,000 net per month bon credit* finance. in the post Which car at 1,000 euros net you will find some ideas, as well as a cost listing of such small cars.

Car loan with bad credit and a net salary of €1,500

At €1,500 net per month, you can buy a new small car for up to around €11,250 or a 5-year-old mid-range car bon credit* finance despite poor creditworthiness.

in the post Which car at 1,500 euros net you will find some ideas, as well as a cost listing of such cars. The linked article, however, focuses more on cars that you can easily afford, while this page is about the maximum possible car loan without Schufa and creditworthiness. Therefore, in the linked article, a car for €6,000 is recommended, which, as a rule of thumb, is no more than 3 gross salaries to spend on a car comes from.

Car loan with bad credit and a net salary of €2,000

With a net salary of €2,000, you can already afford a 3-year-old mid-range car.

Car loan with bad credit and a net salary of €2,500

At €2,500 net per month, you can already afford a lot from the mid-range segment if you fall back on a year-old car. With a car loan without SCHUFA and creditworthiness bon credit* Amounts up to 23,000 euros are possible.

Car loan with bad credit and a net salary of €3,000

At €3,000 net per month, you can afford a high-quality, well-equipped mid-range car, because over bon credit* are up to 30,000 euros possible. A Hyundai i30 could be worth considering because, according to the ADAC, the car is easy to operate, extensive comfort features, many standard assistance systems, a particularly short braking distance and low pollutant emissions.

Car loan with bad credit and a net salary of €3,500

At €3,500 net per month, you can afford a year-old SUV with good equipment, because over bon credit* up to 36,000 euros are possible. A Volvo XC 40 is just one of many options. Because the compact SUV from Volvo competes with the Audi Q3 and the BMW X1, which you can finance for similar prices. The interior and design of the Swede is light and stylish. In the ADAC test, the car impressed with good driving performance, although there was still room for improvement in the Ecotest.

Car loan with bad credit and a net salary of €4,000

If you have negative credit bureau entries with a high net income of €4,000, you don’t have to do without a lot with a car loan. Because about bon credit* up to 43,000 euros are possible. So you could buy a new Tesla, which you can get for just over €40,000 including subsidies.

Car loan without SCHUFA and down payment: risks and consequences

What does a car loan without Schufa and down payment mean? At a car Financing without down payment the financing of the vehicle becomes 100 % through a bank without Equity capital granted. This means that a down payment is not necessary for a car loan without Credit bureau. Instead, the entire purchase price is paid off in monthly installments with a car loan without a credit bureau and a down payment.

As a result, your monthly installments for the car loan without Schufa and down payment accordingly higher are than with a car loan without a credit bureau with a down payment. Therefore, you should first check whether you can afford the higher monthly installments of the car loan without credit bureau and down payment.

Can you afford the higher installments of the car loan without Schufa and down payment?

There is a simple method how you can find out in 6 steps:

- What is your monthly net income? An approximate value is sufficient for the invoice, eg 2,100 euros.

- Divide your monthly net income by 4. In the example 525 euros

- From this amount, deduct 150 euros for the monthly maintenance of the vehicle. 375 euros remain

- Multiply this amount by 100. This corresponds to the maximum possible loan amount for an installment loan with a term of 11.5 years and 6 % interest. A loan amount of 37,500 euros would be possible

- Divide this amount by 2, as car loans without SCHUFA and creditworthiness are only available in smaller sums. With a bad credit rating, a loan amount of €18,750 would be possible

- Finally, you check whether you can afford the monthly costs from step 2 over a period of 11.5 years. If yes, suit one Car loan without Schufa and down payment nothing in the way. If you cannot or do not want to afford the installments, reduce the amount accordingly and then carry out the calculation again from step 2.

Risks of the car loan without Schufa and down payment

A car loan without Schufa and down payment involves additional risks for the borrower

- Due to the lack of a down payment, the residual value of the car could fall below the value of the credit line. This is due to the sharp decline in value, especially of newer car models. If you now crash and need a new car, you will have to continue paying the high installment until the loan is paid off in full. Have you paid off the Vehicle title at the bank as collateral, things get a little more difficult. To deregister the broken car, you need the vehicle registration document. At the same time, however, the bank requires a replacement of equal value. For this purpose, you can send a vehicle registration document of a similarly expensive vehicle model, for example of your parents, to the bank.

- At a Car loan with no down payment rises due to interest rates also rises total load of credit.

In order to minimize the risks of a car loan without Credit Bureau and down payment, it is advisable to increase the repayment. By paying off more, you'll pay off the loan faster and prevent the car's value from falling below the line of credit. A higher repayment also reduces the total cost of the loan over its term.

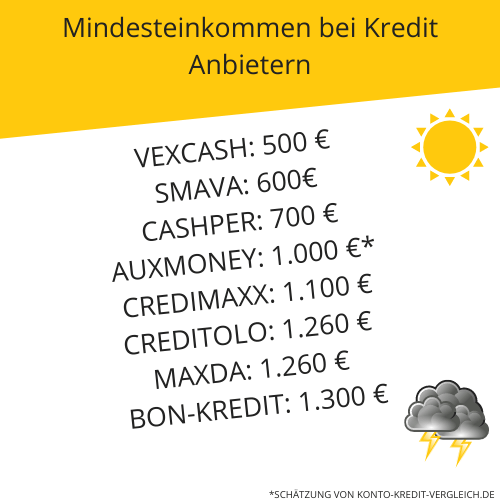

What minimum income you need to get a car loan with negative SCHUFA and creditworthiness

That minimum income for one car loan must be above the garnishment exemption limit in most cases. The garnishment exemption limit is included until July 2022 1260 euros.

In some cases, credit providers can deviate from this minimum income for car loans without and despite negative credit bureau. That's how they bid Ferratum Bench*, Vexcash* and cashper* already Loans for low-income people below 700 euros However, these are mini loans with a short term, which are rather unsuitable for financing a car. If you need a car loan with negative SCHUFA and creditworthiness on a low income, that's the provider Smava* Recommended, which offers loans from an income of €601. in the post Low income loans You will find a few other providers who grant a loan for small incomes. The linked article explains how you with a small income free credit cards can use to get free loan up to 59 days for free.

Discretionary Income also determine the maximum loan amount

But that is also crucial for a car loan without Credit Bureau and down payment discretionary income. This is the money that is still available to you after deducting your fixed costs at the end of the month. Banks and savings banks calculate from the discretionary income the Maximum amount for the monthly installments ea credit. The monthly installments of the loan must be affordable from the disposable income. With a Loan Calculator can you determine whether the Loan rates below disposable income lie. This tells you how much credit you can afford for a vehicle. Keep in mind that the longer the loan term, the lower the rates and you can borrow more money than with a shorter term.

Two examples: That disposable income is 200 euros. With a term of 3 years you can get around 7,000 euros credit obtain. at With a term of 5 years, however, the maximum loan is around 11,500 euros.

Is that disposable income, on the other hand, is 300 euros, the following maximum loan amounts result. Does the loan have a term of 3 years, you can afford around 10,300 euros, with a term of 5 years it is around 17,500 euros possible on credit.

Without proof of income, a mini loan is included ferratum* lockable. More about the credit without income you can find here.

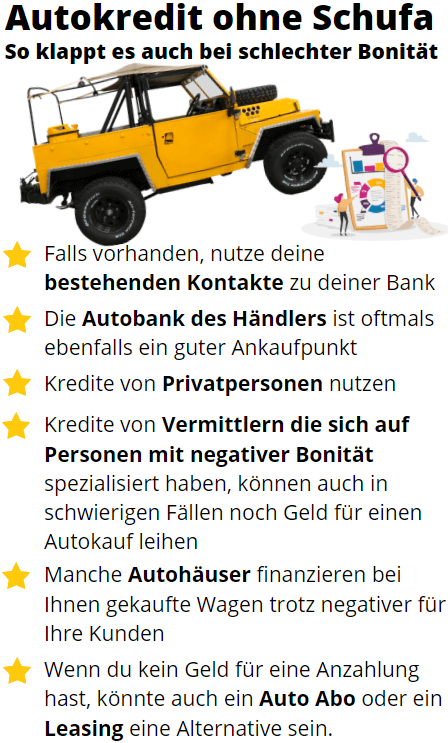

Where and how can I buy a car with or without a SCHUFA? – 6 possibilities

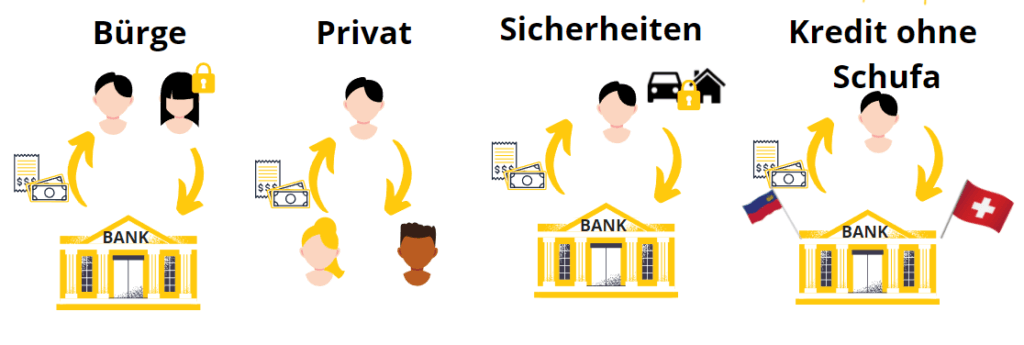

Annoyed by the Schufa, car buyers want to know "Where can I buy a car with a negative SCHUFA?” – Since the car is a valuable item that can be used as security, there is a chance of a car loan even with moderate credit bureau information. For this purpose, a bank is used that Car or the car registration also as security accepted. Hereinafter 6 ways, like you your wheels despite negative entries in the Schufa can buy and finance.

Car loan without Schufa – With these tips, lending works even with poor creditworthiness

- If you are already a customer at a bank and not noticed negatively If you are, chances are good that you can get a car loan from this bank. When making your request, provide your good payment practices through supporting documents to the fore.

- You can also try to convince the dealer's auto bank. The Schufa file is just one feature of many others.

- You can do that Car without SCHUFA personal loan query or finance a bank that specializes in people with poor credit ratings. You will find suitable banks and credit intermediaries on this page.

- Another option is a foreign bank turn on. To finance a car, however, I advise against foreign loans due to the high costs.

- There are a few car dealerships that will finance your car despite negative credit bureau. You can find an overview in the article "Which car dealership finances despite negative credit bureau?”

- You also have the options Car subscriptions without Schufa and also the related Car leasing without Schufa to disposal. With the former, service costs are already included. With car leasing, you are responsible for the service yourself.

For the best conditions and the highest chance of acceptance, our partner can offer you both Bank loan or a personal loan convey. This is how you finance your new or used car on favorable terms. Even with negative SCHUFA information.

How the loan approval for a car loan works without SCHUFA and creditworthiness

It is quite possible to finance a car without a good credit rating. Because a moderate credit rating is usually sufficient for a car loan commitment. With these tips, you can improve a loan approval for a car loan despite a bad credit rating and a negative credit bureau.

1.) Use the car as security to compensate for poor creditworthiness

With bad credit, it's better if that funded car as collateral serves. With this security, the bank is more willing to grant the loan even if the credit rating is poor. There are also more collateral such as one property available, you can also ask your house bank. If you also have a good payment practices have demonstrated in the business relationship with your house bank, you have a chance Car loan without SCHUFA from your house bank to get. This improves it Opportunities to finance a car despite negative SCHUFA significantly.

2.) Choose a longer loan term to reduce the loan rate if you have a bad credit rating

Another lever is the loan term. If a longer term is chosen, the monthly rate will be smaller. This leaves more of the freely disposable income. This also increases the chances of financing a vehicle despite negative SCHUFA. As a last tip, it should be noted here that with a Car loan under 7,500 euros despite negative SCHUFA should stay to get the loan approved. Higher amounts are also rejected by online banks without further collateral such as real estate. Alternatively, there are also some car dealerwho have specialized in people with bad credit bureau.

3.) Check your SCHUFA to get a car loan

Errors happen with SCHUFA entries. Do you have the impression that the bank is unjustifiably refusing you a car loan with a SCHUFA query? It may well be that the SCHUFA score is incorrect. Take advantage of the opportunity once a year Access the SCHUFA score for free. If errors are discovered here, you can arrange for incorrect information to be corrected or for obsolete entries to be deleted.

3.) With good payment practices you get a car loan with excellent conditions.

If a loan request is rejected, it is probably due to an internal review. The bank could insufficient payment practices assume. This could be the case if invoices have not been paid in the past and there is therefore a negative SCHUFA entry. The lender then expects not to get the money back. Therefore, he refrains from granting the loan. You should due to the cause Obtaining SCHUFA information get to the bottom. Thanks to the simple application process and few preliminary checks almost everyone gets a loan these days.

4.) Plan realistically: Create one household bill for a car loan without SCHUFA

A car is an expensive purchase. It is therefore important that you check with a household bill that the new car within the scope of your financial possibilities is. You can get a car loan from most banks if the loan amount is not too high is chosen. That means that Household income must be sufficient to repay the loan installments. Compare your income and expenses. After all expenses are deducted from your income, that is what remains discretionary income. This is based on the maximum rate of the loan.

To make it a little easier for you: Further up in the article you will find maximum possible loan amounts for incomes between €1000 and €4000 net per month.

Credit installments must be smaller than the disposable income

Banks regard the freely disposable income as the maximum amount for the monthly installments of a loan. use one Loan Calculatorto determine how much credit you can get. Keep in mind that the longer the loan term, the lower the rates and you can borrow more money than with a shorter term.

Two examples: That disposable income is 200 euros. With a term of 3 years you can get around 7,000 euros credit obtain. at With a term of 5 years, however, the maximum loan is around 11,500 euros.

Is that disposable income, on the other hand, is 300 euros, the following maximum loan amounts result. Does the loan have a term of 3 years, you can afford around 10,300 euros, with a term of 5 years it is around 17,500 euros possible on credit.

Can you get that Really afford a car loan without SCHUFA and creditworthiness?

Think carefully about whether you can really repay a car loan despite a SCHUFA entry. It is not uncommon for banks to have plausible reasons for rejecting a loan application. Because a vehicle is an expensive purchase, a car loan is a long-term commitment. Think in advance whether you can afford the car loan without a SCHUFA query. Preferably as part of a household bill, as shown above.

5.) Avoid expensive inquiries about car loans without SCHUFA and ask regular banks at the same time

A car loan without a SCHUFA query usually has poorer conditions. This is due to statistical characteristics. In addition, consumers often underestimate their creditworthiness. Therefore, the concern about the negative SCHUFA entries is sometimes unjustified. Maybe your credit rating is good enough for a car loan?

To find out, you can consult a credit expert like SMAVA* turn on. Here, up to 30 banks are queried at once. So you don't have to request the car loan individually from many banks. The advantage of a credit intermediary is that you will be presented with a suitable and cheap loan offer with good or bad creditworthiness. But trying makes wise: A loan request for a car loan with or without SCHUFA costs nothing and brings light into the darkness!

6.) No car loan without Schufa information in the event of impending over-indebtedness

In general, it is advisable not to buy in installments too often. Because even smaller financial contributions quickly add up. Better it is a financial cushion on one cash account to create, so that you can fall back on larger purchases. A car loan without Schufa information should not be taken out if there is a risk of over-indebtedness. You can do this via a household bill, check or turn on a debt counseling service.

Buying a car in installments without SCHUFA: Requirements for a car loan with poor creditworthiness

To apply for a Car loan without SCHUFA information and creditworthiness However, certain conditions must be met. The reason for this is that lenders want to protect themselves against payment defaults. It also protects the customer from excessive loan amounts, which may then no longer be repayable. In principle, each bank has its own credit guidelines. However, they are similar in many respects. These are often the following conditions:

- Residence in Germany

- of legal age

- German bank account

- regular income

- Partly more securities such as car letter. If you have good credit, you can Car loan without submitting your vehicle registration document Eg complete with the ING, which is highly recommended.

- No hard negative entries in the SCHUFA information.

Finance used cars and new cars with the car loan without SCHUFA and creditworthiness

A car loan without SCHUFA and creditworthiness is primarily suitable for used cars. This is because the loan amount is limited if the credit rating is bad. For loans without Credit Bureau, €7,500 is often given as the upper credit limit. This is the maximum amount that the Sigma Bank* is funded. Although you can with providers like bon credit* also get higher car loans approved with bad credit ratings, but it is still difficult to finance a new car such as a VW Golf with a car loan without credit bureau and credit rating.

Example: Volkswagen Golf

A 4-year-old VW Golf 7 with less than 20,000 km is currently available for around €14,000. The successor model, the Golf 8, costs around €30,000 more than twice as much as a new car with comparable equipment. This means that a net income of over €3,000 is required to finance the new Golf 8 with a car loan without Schufa and creditworthiness. On the other hand, you can finance the Golf 7 for €1,600 net per month.

However, a car loan without Schufa and creditworthiness is not excluded per se for new cars. However, the loan amount is of course limited and it is not recommended. Because rules of thumb say that a car is no more than 25 % of your net salary should cost monthly. With a net monthly salary of 2,000 euros, your total costs for the car should not exceed 500 euros. With maintenance costs of around €150, €350 remain usual for a car loan. With a term of 10 years, around €35,000 in credit is possible. With a car loan without SCHUFA and creditworthiness, you should reduce this amount to at least half. This leaves around €17,000 to finance a new car at €2,000 net despite a negative credit bureau. If you want to drive a new car with a negative credit bureau, you should come to terms with a smaller model.

Auto loan without Schufa for the self-employed

A car loan is often much more difficult for the self-employed than for employees. Many lenders expect that the self-employment has existed for at least 3 years. Self-employed people, on the other hand, usually need capital right from the start of their self-employment. After all, the start-up phase is characterized by numerous purchases to get the business up and running. A car loan without Schufa can therefore be a solution for the self-employed in the start-up phase.

A good loan for the self-employed therefore requires Proof of income only for a short period of 6 to 12 years months. provider like Auxiliary* or ferratum* have the fewest hurdles when applying for the self-employed. In the following table are the Requirements for the business activities of different providers for credit for the self-employed contrasted. With this, borrowing for a cheap car should also be possible as a self-employed person.

| Offerer | requirement | valuation |

|---|---|---|

Auxiliary* | If the credit rating is correct, the loan is possible from a private person and without proof of income or proof of salary. | Simple requirement for self-employed |

ferratum* | If the creditworthiness is good, the loan is possible without proof of income or proof of salary. | Simple requirement for self-employed |

bon credit* | Income tax assessments showing your income for the last two or three years. | Medium requirement for self-employed |

Maxda* | Income tax assessments showing your income for the last two or three years. In individual cases, annual financial statements and income tax assessments for the last three to four years are required. | Medium requirement for self-employed |

credimaxx* | Income tax assessments showing your income for the last two or three years. | Medium requirement for self-employed |

Creditolo* | Self-employment of 4 years or more: Income tax assessments from which income and current business evaluation (BWA). Self-employment shorter than 4 years: Additional collateral is required. Suitable collateral is, for example, pension, life insurance, building society contracts or savings. The security must correspond approximately to the loan amount. | Strict requirement for self-employed |

How does a car loan affect the Schufa?

The inquiries about loan conditions and the conclusion of a car loan have different effects on the Schufa. The deletion periods also differ.

Effects when requested by conditions a car loan to the Schufa

None. When you apply for a car loan, you usually get one conditions request posed. This means that you only want to inquire about the terms of the loan at first. Therefore, requests for conditions have no effect on the Schufa score. The request for conditions is with the Schufa a year stored for a long time and must then be deleted. However, the Schufa may the information conditions request just 10 days pass it on to other banks and Schufa partners.

effects at diploma a car loan to the Schufa

Taking out a car loan does not worsen the Schufa score. Schufa sees it as a vote of confidence when the loan is approved. Finally, a bank checked this person and came to the conclusion that this is a debtor with whom they want to do business. Much more important for the Schufa score is yours payment history for existing loans: If you repay your debts quickly and in full, the information does not change. However, as soon as you fall behind on the repayment of the loans and reminders are sent, your information will then deteriorate.

Deletion deadlines for Schufa entries in connection with a car loan

A condition inquiry will follow 12 monthsn deleted from the Schufa. The Schufa is only allowed to pass on this information for 10 days. A car loan, on the other hand, is still available after the last installment has been repaid 3 years long visible in the Schufa information. Only then does the entry disappear completely. In order for the entry to be deleted, the bank must report back to the Schufa that the loan has now been paid in full. Banks often "forget" to submit these reports and the entry remains in the file accordingly. To avoid this, you can check your Schufa file yourself once a year check for free. You then demand the immediate deletion of unauthorized entries.

Improve Schufa score

You can do 3 things so that a more expensive car loan without credit bureau and creditworthiness is not even necessary. Increase your income, reduce your expenses and your credit rating through your Improve Schufa score.

Here's how you can make yours influence SCHUFA score:

- Pay your bills on time. If you have forgotten an invoice, you should never simply ignore the reminders.

- Pay off your debts in full

- Avoid frequent moves

- Terminate bank details and credit cards that are no longer required

- Check whether there are any errors in your Schufa information

- Check whether old loans have been deleted from your Schufa information 3 years after you have repaid them

With these 5 alternatives, you can also buy a car with a negative SCHUFA

1.) Request a car loan without Schufa from the dealer

If you want to finance your new car with a car loan without SCHUFA or despite negative SCHUFA, you can ask your dealer. The car banks that car dealers work with are based on several other criteria when granting loans. You will find several in this post Car dealers who bought vehicles from you despite a Schufa entry and here you will find my assessment of the question "Which autobank finances despite negative Schufa?“.

So can the car dealer prioritize good customer relationships. Were you already a customer of the bank and are you not noticed negatively? Then it may also be possible in individual cases to finance a car without having to present SCHUFA information. If your Schufa score is moderate and you have a Car purchase on installments are striving for, the following points are important for lending:

- revenue (→ see minimum income)

- expenditure

- Discretionary Income (→ see Example of disposable income)

- Employment Type

- collateral

Comparison of car dealership financing despite negative credit bureau and loans despite negative credit bureau from the credit specialist

Car dealership financing despite negative credit bureau

- If the car dealership passes on the loan to the bank, a good credit rating is required

- German banks must check creditworthiness (legal requirement e.g. §505a BGB)

- Therefore, no award with negative Credit bureau possible

- Lending with negative credit bureau is only possible with certain car dealerships that provide the financing themselves

- Locally limited. Only available in some German regions (e.g. NRW)

- You are tied to the car dealership and have to buy a vehicle there that may be a little more expensive

Credit with negative credit bureau only possible from a few car dealerships

Car loan despite negative credit bureau from loan specialist

- Banks and intermediaries like bon credit* or Maxda*, are specialized in lending with bad creditworthiness and negative credit bureau

- Lending possible even with bad credit bureau

- Available throughout Germany

- No commitment to special car dealerships

Credit with negative credit bureau possible independently of the car dealership

2.) Buy a car in installments with a personal loan without SCHUFA

If the car financing has not worked out so far due to a negative entry in the SCHUFA, you can together with a credit broker how bon credit* or Smava* check what other options are available. You can find various on the internet Providers who mediate between borrowers and lenders. Information about the creditworthiness is also often obtained. the However, the requirements are usually much less strict. One of the largest loan portals with experience in car loans with negative entries in the SCHUFA is Smava* . You can submit your loan request for a car loan without taking negative SCHUFA entries into account put online directly.

Would you like to finance a car without having perfect SCHUFA information? this could be a way to set up financing quickly and easily.

3.) Buy a car without SCHUFA on installments with loans from abroad

If you have a bad credit bureau and moderate credit rating credit from abroad is offered, you should be careful. Frequently, these loans come with high effective interest rate of 10 % and more offered. Because the provider can pay well for the risk of granting the loan. The high interest rates make it difficult to repay the loan and encourage financial difficulties. If the loan is in another currency such as US dollars or Swiss francs, the currency risk is added. The reason: when the euro falls. more euros are needed to repay the loan in foreign currency.

Foreign loans are often neither necessary nor useful. Before you take out a loan with over 10 % interest, you had better at bon credit* Have an alternative searched for.

4.) Leasing as an alternative

That Car leasing without Schufa also represents an alternative to the car loan. One advantage of leasing the Cars without Schufa is that you don't have to put up any money for a down payment. Therefore, the leasing model is comparable to a car loan without a down payment. If you are comfortable with car leasing as an alternative to a car loan, you should check out the provider Finn.car* definitely have a look. The provider has in its all-round sorlos leasing are constantly new offers from city runabout until SUV or sports car are sufficient.

5.) Car subscription as an alternative

That too Car subscription without Schufa is an alternative to a car loan without a Schufa for people with a poor credit rating. As with leasing, the car subscription models do not cost you anything. A down payment does not have to be made either. Due to the all-round service with the car subscription, the model is particularly suitable for people with flexible life plans. Finn.car* offers many vehicles in the cheap car subscription. A conclusion is also possible with a negative Schufa entry. Prices start at around €250 per month.

Other alternatives to the Used car financing despite negative credit bureau can be found in the linked article. There you will also find out how you can still finance a used car despite the rejection of the loan.

Where can I buy a car with or without a SCHUFA? | Short FAQ

1. Can you finance a car despite negative credit bureau?

If you follow further above advice, a car despite negative Schufa can be purchased with a credit professional such as. Smava* financed

2. Who grants car loans despite negative credit bureau? | Where can I buy a car with a negative credit bureau?

If you need a replacement for your wheels, there is two ways to solve the problem.

2.1 Financing through the dealer

The first option is one Financing through the dealer. A bad SCHUFA score doesn't play a major role for a car dealer. Because that financed car serves as collateral.

This means that the vehicle remains the dealer's property until the last installment is paid. This is a disadvantage, because it remains the vehicle letter from the financing provider. On the one hand, this makes many things more difficult and restricts your freedom of decision, for example choice of workshop a. On the other hand it will difficult, your vehicle later for sale. On the subject Sell the car when the car registration is at the bank is, there is therefore a separate article.

A third major disadvantage of dealer financing is when the dream car is at a dealer stands, the none good conditions for the loan offers. Therefore, you should definitely ask for a free loan from credit banks.

2.2 Financing through credit intermediaries

the second option taking out a car loan despite negative SCHUFA is to involve a credit broker. Alternatively, if the banks refuse, a credit broker can do one Personal car loan offer. So you are not tied to the dealer and can good conditions for the car loan get independently from the dealer. Furthermore, you are flexible in your choice of workshop and may even find it easier to sell your car later if you can keep the vehicle registration document. Since a loan without Credit Bureau carries a higher risk, it is slightly more expensive. So you should only opt for this if a regular car loan has been rejected. Your advantage with a credit broker like Smava* is that both banks with a SCHUFA query and banks without a SCHUFA query can be mediated.

3. What is more worth leasing or financing?

Since you always have a new car when leasing, it is usually more expensive. Here you will find a detailed comparison on the topic Buy a car in cash, finance or lease it.

4. Is it possible to finance a car despite a high loan?

Like in Tip shown above it is crucial that the disposable income is sufficient to repay the installments of the new loan. If, for example, 200 euros are left over after deducting all expenses in the month, a loan of around 7,000 euros over 3 years or 11,500 euros over 5 years be included.

5. Is it easier to get a car loan?

A car loan is usually easier to get than a free use loan. This is because the car can be used as collateral.

6. Is there a car loan without Schufa and down payment?

At the car banks, one is usually required down payment be done. Not so with a normal loan from a bank or privately. The loan amount for the new vehicle can be fully covered by the lender. The repayment is made in monthly installments. One down payment is not in the case of a car loan without SCHUFA information necessary. Then Advance payments are only made by car banks required, but not by traditional banks or personal loans.

If you have one Car loan without Schufa and down payment as financing, you should increase the repayment. With a higher repayment, you pay off the loan faster and prevent the value of the car from falling below the loan taken out.

Conclusion: car loan without SCHUFA and creditworthiness

Various banks are requested via credit intermediaries from our top 10 list and a loan can be arranged privately or from special credit houses. The credit providers presented here have specialized in people with poor credit ratings and problems with the Schufa. Arranging a car loan without Schufa and creditworthiness is therefore part of the daily bread of these providers. One of the best providers of car loans without Schufa and creditworthiness is bon credit*. In many difficult cases, the provider can offer car loans without Schufa and creditworthiness for small and medium-sized cars.

The providers Auxiliary* or ferratum* have the fewest hurdles for self-employed car loans without SCHUFA. Because they ask Proof of income only for a short period of 6 to 12 years months.

A long relationship with the bank can also help in difficult cases

If, on the other hand, you want to finance with your house bank, it is helpful to have a good connection to the bank. If you have been a customer of your house bank for a long time and not noticed negatively If you are, chances are good that you can get a car loan from this bank. When making your request, provide your good payment practices through supporting documents to the fore. The same applies to financing through a car bank.

With a car loan without SCHUFA and creditworthiness, there are other alternatives available to you:

- Buying a car through dealership financing. Which car dealerships financing despite negative credit bureau You can find out how to offer entries in the linked article.

- In addition, cars can be leased despite negative credit bureau. In this article you will find 6 providers which Car leasing without and despite negative credit bureau offer.

It should be said about both options that they are usually more expensive than financing with a car loan. We therefore advise against it, but would still like to provide information about alternatives.

*Affiliate link: If you get to a provider via one of these links from my website, I may receive a commission. This does not result in any additional costs for you. ❤️ THANK YOU for using these links! ❤️

Disclaimer: This is well researched but non-binding information.