With Bon-kredit, check quickly and anonymously which bank you can get a loan from if your credit rating is bad | To the provider: Bon-kredit.de |

Loans received even though others have already declined | |

Granting credit even with bad credit bureau and completely without credit bureau - by banks at home and abroad | |

In many difficult cases, Bon-Kredit can get your desired loan from one of the 20 partner banks - 100 % without any preliminary costs. |

Many people with a bad credit rating or a negative entry at the SCHUFA urgently need money. Hence the question of a "credit that everyone gets" in the room. If you just want to get a loan, you have to find a bank that checks as few criteria as possible when it is awarded. After all, he should credit for everyone be paid out quickly without days of credit checks.

Aber Attention: Under the catchphrase credit that everyone gets, there are many black sheep among the providers. Therefore, there is a large collection on this page warning notices. This ensures that a serious credit despite bad creditworthiness is completed by you. Credit intermediaries or small loan providers offer this Loans for every professional group at. Whether it is a Credit for the self-employed, workers, employees, students or retirees with a bad credit rating! Konto-Kredit-Vergleich.de puts you reputable providers and banks in frontwho borrow easily given to almost everyone.

With a negative credit bureau and an income of at least €1,000, a Swiss credit for Germans be requested.

Which bank gives credit to almost everyone? - Receive one Small loan without taking into account negative SCHUFA entries and without proof of income at the Ferratum Bank*

What you can learn here

- Which bank gives credit to almost anyone? - Get a small loan without consideration of negative SCHUFA entries and without proof of income at Ferratum Bank*.

- Credit everyone gets: Which bank gives credit to everyone?

- Now check with Smava which bank still grants a loan

- The self-employed, students, retirees and people on low incomes are often looking for an easy-to-apply loan that everyone can get

- Credit everyone gets - your options

- Non-binding credit request

- The creditworthiness of each loan is checked – but if you stay within your means, you get a loan

- Non-binding credit request

- If you want to know "How does everyone get a loan" I have a few tips for you

- ⚠ A loan that everyone gets without ifs and buts is not serious⚠

- Non-binding credit request

- FAQ on the easy-to-get credits

- Which banks lend easily?

- Get a bad credit loan from SMAVA, Ferratum or Vexcash

- Which bank grants credit with bad credit in the form of a mini loan?

- Get a loan as a small loan immediately

Credit everyone gets: Which bank gives credit to everyone?

With a bad credit rating, finding a loan is often difficult. In this case, it may be advisable to hire professionals to look for a loan. About ours financing partner* there is the possibility of getting a loan despite bad creditworthiness. This means that people with poor credit ratings can also get a loan. This also works for self-employed, or people with low income. Even if you are affected by short-time work, the chances of getting a loan are good. Mini loan providers such as cashper, Ferratum or Vexcash can take up to 3,000 euros given to almost everyone. New customers can have up to 1,500 euros via a mini loan obtain.

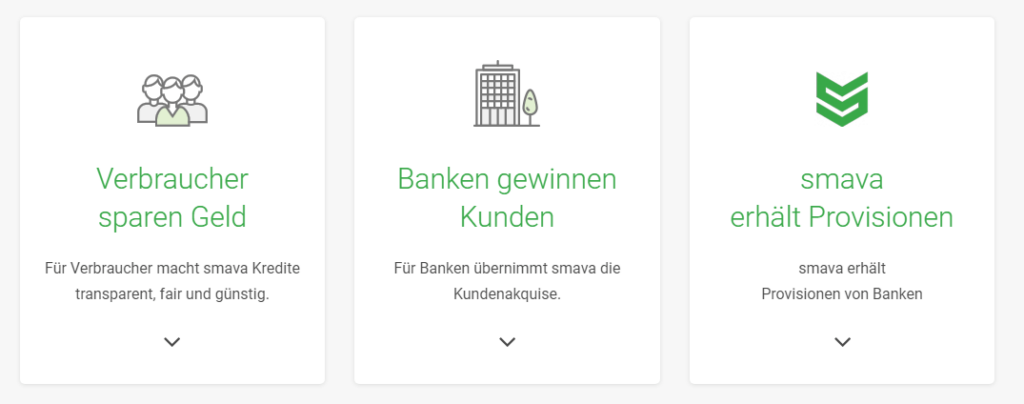

But even if one larger sum is needed, you can via Smava check which bank still grants a loan. This provider works with almost all banks. Personal loans can also be granted. In the case of the latter, negative entries in the Schufa no longer play such a decisive role. Thus, a loan can be granted to almost anyone. However, a medium credit rating and an income of 600 euros net is a prerequisite for Smava.

Now check with Smava which bank still grants a loan

Related inquiries on the topic credit that everyone gets, are common answers to the following questions:

- Which bank gives credit despite negative SCHUFA

- Which bank is most likely to get a loan from? and

- Loan without SCHUFA and proof of income.

Do you have bad credit and need a new car? In the guide: Car loan without taking negative SCHUFA query into account you will find an alternative way to get a car loan despite bad credit.

The self-employed, students, retirees and people on low incomes are often looking for an easy-to-apply loan that everyone can get

Especially self-employed, whose income is not recognized by the banks Smava* get a loan. But also students, Pensioner, people with low incomes or short-time workers have due to lack of income or old age a poorer credit rating. This means that these people often have no chance of getting a loan from their house bank. If you have a low income, one is available Request via SMAVA nothing in the way. But even if you have already been turned down due to poor creditworthiness, you should ask a professional to look for a loan. You're welcome to do that inquiry form use on this page. The ones shown on this page will also help Tips to get a loan.

Credit everyone gets - your options

Many people often find it difficult to get a bank loan from their house bank because the bank does not recognize the income. But Konto-Kredit-Vergleich.de shows 2 options how almost everyone can get a loan.

Option 1: Go through one of the mini loan providers

If you as Self-employed with bad credit only an amount of less than 1,000 euros up to a maximum of 62 days need a mini loan from ferratum* record, tape. Since Ferratum does not require proof of income, you can also apply for the loan as a self-employed person with a bad credit rating. until 600 euros and 30 days is the credit for only about 5 euros fees to have.

Above 600 euros Unfortunately, Ferratum only offers the mini loan with an expensive 2-rate option (149 euros). But watch out: The fee for the 2-rate option can be avoided if you and a person close to you (e.g. spouse) each Record 500 euros separately for 30 days.

There are alternatives for mini loans of up to €1,500 cashper* and vexcash*. at cashier can you €600 for 30 days free Rent. For this, the self-employed must have a minimum income of €700. Vexcash, on the other hand, only requires a minimum income of €500 and is therefore also a good alternative to get a short-term loan as a self-employed person with a bad credit rating.

Option 2: Go through a credit broker

If you more than 1,000 euros If you want to finance with a loan, a credit broker will help you to find a suitable loan. A non-binding inquiry to a credit intermediary is also recommended if you loan for longer than 2 months or 62 days need In this case The small loan providers Ferratum, Vexcash and Cashper separate namely out of. You can use the button below to start a non-binding loan request with the credit broker smava. If you are self-employed and your credit rating is bad, you should also consider the other tips on this page to get a loan anyway.

non-binding credit request

The creditworthiness of each loan is checked – but if you stay within your means, you get a loan

When a loan application is made, the bank carries out a check to see whether it will grant the loan. With this credit check will the credit-worthiness checked. At a installment loan the income of the borrower serves as security. The bank determines the probability of how secure the income is over the loan term. Therefore, the spending side is also relevant. Additionally use banks external rating agencies like the Schufa credit agency. In coordination with the internal evaluation, a decision is then made as to whether an application will be accepted or not.

It is important to know that the credit rating is not uniform. If you receive a rejection from your house bank, this does not have to apply to all banks. Credit intermediaries know the easiest way to get a loan in each individual case. So make your non-binding inquiry using the button below.

non-binding credit request

If you want to know "How does everyone get a loan" I have a few tips for you

If you want to take out a loan, whether with or without taking negative SCHUFA entries into account, the following tips will help:

Tip #1: Are crucial payment practices and expected solvency

It is the business model of lenders to lend as much money as possible. Because they earn with every euro lent. So, in principle, lenders have an interest in lending money. This is all the more true in periods of low interest rates. If an offer is rejected anyway, it is probably due to an internal review. The bank suspects poor payment behavior. The lender then expects not to get the money back. Therefore, he refrains from granting the loan. Another reason could be that the loan amount was too high. This means that the household income is not sufficient to repay the loan installments. With good payment behavior, your loan will usually be approved.

Tip #2: Plan realistically: Create a household bill

Compare income and expenses. After all costs have been deducted from your income, you are left with discretionary income. The maximum rate of the loan is based on this. Keep in mind that not all expenses can always be planned. The washing machine can suddenly break down, a visit to the workshop for the car will be more expensive than expected, or an additional payment for electricity, gas or telephone costs will flutter into the house. For such cases you should plan a buffer. EA household bill will help you enormously.

Tip #3: Check your SCHUFA entry

Errors happen with SCHUFA entries. Do you have the impression that the bank is unjustifiably refusing you a loan with a SCHUFA entry? It may well be that the SCHUFA score is incorrect. Take advantage of the opportunity once a year Access the SCHUFA score for free. If at the Examination of your SCHUFA mistakes are, you can have incorrect information corrected or outdated entries deleted.

Think carefully about whether you can really repay a loan despite a SCHUFA entry. It is not uncommon for banks to have plausible reasons for rejecting a loan application.

Tip #4: Give it a try: A loan request from a normal bank costs nothing

Consumers often underestimate their creditworthiness. Maybe your credit rating is better than you think? Fortunately, this concern is often unjustified. Before you take out a loan without taking into account negative SCHUFA entries with possibly very high interest rates, you should ask a conventional bank. If you have previously obtained a free SCHUFA self-assessment, you can realistically assess your chances and are spared any nasty surprises.

Tip #5: Not too many loans: Avoid over-indebtedness and keep an eye on costs

In addition, it is advisable not to buy in installments too often, because even smaller financing contributions quickly add up. Better it is a financial cushion on one cash account to create, so that you can fall back on larger purchases. In general, the financing of consumption should remain an emergency.

⚠ A loan that everyone gets without ifs and buts is not serious⚠

Be careful with a loan that everyone gets without ifs and buts. On my site I receive various inquiries and spam posts from alleged providers of "serious" credit bidders every day. The following criteria can help you to expose dubious providers:

upfront fees

Reputable providers who arrange a loan never require an advance payment in advance. Even particularly fast processing is not invoiced separately by such providers.

No upfront fees: Neither Konto-Kredit-Vergleich.de nor our partner incur any upfront fees

Expensive hotline

Telephone contact should be possible via a normal number or a free 0800 number. If this is not the case, the provider is not serious.

No expensive hotline: You can reach our financing partner via a toll-free number. You can also give me one Mail write.

Credit and insolvency advice from a single source

If you have problems paying back existing loans, do not take out another loan including insolvency advice from a single source. Instead, get help from a professional and independent debt counselor. the charity, Diakonie and the Red Cross are the first points of contact for this.

No lending in the event of bankruptcy: Please contact independent debt counseling if you are having financial difficulties. Credit and insolvency advice from a single source is strongly discouraged!

Expensive additional products

The alarm bells should also ring if the provider tries to offer you nonsensical additional products such as consulting services and insurance.

No expensive additional products: Neither we nor our financing partner try to sell you expensive and nonsensical additional products

Cash on delivery

Contract documents are not sent by reputable providers as cash on delivery. In general, shipping fees for contract documents do not inspire much confidence. Better keep your distance from such providers.

Without cash on delivery fees: You will receive all documents from our financing partner conveniently by e-mail or post, of course without cash on delivery fees!

No imprint

If the provider does not have an imprint, you should refrain from doing so.

With imprint: You can find my imprint here

Many providers who spam me with advertisements via Facebook probably never pay out the promised money. If you have paid fees in advance to the credit broker or counseling, you have little chance to get your money back in court. It is therefore advisable to scrutinize credit providers beforehand.

Our financing partner offers the possibility of obtaining a loan despite poor creditworthiness. In this case, borrowing money without SCHUFA does not work through a bank, but through the mediation of a loan by private individuals.

non-binding credit request

FAQ on the easy-to-get credits

If you are looking for a loan, it is often difficult to get past the SCHUFA, because banks are obliged to get information about your creditworthiness. Ain Loans that are brokered, for example, by private individuals, offer a way out. You can get a loan even if you have bad credit. Just try it. The request is Schufa-neutral and free of charge. If you like the offer, take it, if not then don't!

Whether the loan is approved depends on the credit rating.So you get with good credit rating at all banks a Loan. With bad credit, small loans like vexcash*, Casher* or ferratum *one way its easy to get a loan. Another easy way to get a loan is a credit service provider turn on.

Credit despite negative SCHUFA at Targobank?

There are increasing numbers of inquiries and reports about loans without SCHUFA at Targobank on the Internet. Basically, Targobank - like other German banks - creates an accurate picture of its customers before lending. For this purpose, the creditworthiness is checked on the basis of several criteria and then a decision is made as to whether and to what extent a loan can be granted. A SCHUFA query is also part of this credit check at Targobank. It's much easier to get over that Form from our partner money quickly and unbureaucratically. We have that in more detail in the article Targobank: credit despite negative SCHUFA? shown. On the subject Which bank grants credit despite negative SCHUFA there is also a detailed guide.

Many banks will withdraw from a loan despite sick pay. This is because bank sick pay cannot be seized so easily. Honest and reliable debtors are therefore faced with a problem when they need credit in the event of illness. However, there are still a lot of options Credit despite sick pay to obtain.

Which banks lend easily?

If you had trouble getting a loan or any other reason Bank is looking for easy loans awards, it is best to apply to amounts up to 1,000 euros ferratum*. At Ferratum Bank they charge up to one sum of 1,000 euros no proof of income. Other banks that offer easy-to-give loans are Vexcash*or cashper*. Cashper offers the 600 euros credit even free of charge for 30 days at. If you want to borrow more than 1000 euros easily, it is best to contact a credit broker via the provided one Form* at the beginning of this page. You can also find our article about Banks that lend easily you a top 10 tableau, about banks that are particularly easy to Grant credits ("Yes Banks").

The two ways above small loans on the one hand and credit intermediary other hand, answer the question “Which banks lend easily?"Hopefully for the first time. A a notice, which should not be missing in the context of easy-to-give credit is this many dubious providers also indicate easy lending. Therefore, also note the warnings and tips on this page and don't fall for their tricks!

With the providers mentioned on this page, however, you are protected from dubious "banks" that supposedly easily grant loans!

Get a bad credit loan from SMAVA, Ferratum or Vexcash

If you are looking for a Loans with bad credit are, you should consult the credit experts at Smava* seek advice. In particular, if you are looking for a loan without taking negative SCHUFA entries into account, you should consult the credit experts at Smava* seek advice. Read more about "Which bank gives credit despite negative SCHUFA?"

- Smava* → without taking into account negative SCHUFA entries and in particular for loan amounts above 1,000 euros

- ferratum* → Borrow up to EUR 1,000 without proof of income

- Vexcash*→ Lightning credit in 30 min! Fastest loan in Germany!**

- cashper* → SPECIAL: Borrow 600 euros for 30 days free of charge!

**Write a comment if you know a faster one!

However, Smava does not offer one Loan without proof of salary at. With Smava, a regular income of 601 euros is required. Therefore, the self-employed, students, unemployed and people in the probationary period are better off at Ferratum. ferratum* does not require any proof of income! There is also a 24-hour express credit for an additional charge. More on the subject "1000 euros express credit“ without taking into account negative SCHUFA entries and proof of income!

There is a faster express loan within 30 minutes Vexcash*. The provider convinces with low fees, fast payout and a high level of customer satisfaction. You need money today? Go to Vexcash! More on the subject "24-hour express credit without proof of income with immediate payment“ you can read here.

Which bank grants credit with bad credit in the form of a mini loan?

You can get a loan even if you have bad credit. For example as mini loan. With the mini loan providers you can Loans up to 1,500 euros immediately as a new customer. Up to 1.000 Euro credit you can get it even if you are a student or unemployed, since it is available at ferratum* a 1000 euros credit without proof of income*. You can even apply for up to 3,000 euros as a small loan immediately: However, this only works if you are already an existing customer at Vexcash* are you.

Get a loan as a small loan immediately

Small loans from 100 euros – 500 euros

Small loans from 500 euros – 1000 euros

Small loans from 1100 euros – 3000 euros

If you need more than 3,000 euros, you have to switch to an installment loan. You can find the cheapest installment loans via the Installment loan comparison.

*Affiliate link: If you get to a provider via one of these links from my website and open an account there, I may receive a commission. This does not result in any additional costs for you. ❤️ THANK YOU for using these links! ❤️

1 thought on “Kredit den Jeder bekommt – Die besten 2 Optionen”

Comments are closed.