One Used car financing without down payment is available via a Vario financing, a Car leasing, a car subscription or one car loan possible. The monthly installments are calculated with the Vario financingthe car subscription and the car leasing very low. At car loan . With a car loan, on the other hand, the monthly installments are higher. This is because you pay off the car with a car loan. The car therefore becomes your property. On the other hand, with both subscription and leasing models, as well as Vario financing, you only pay for the depreciation of the car. This means that you do not own the car later.

You can get a Used car financing without down payment also build yourselfby financing the down payment of the financing through a loan. For this we recommend Smava* or bon credit*.

What you can learn here

- 5 ways to finance a used car without down payment

- 1.) Vario financing: The classic used car financing without down payment

- 2) A used car financing without down payment with a car subscription.

- 3.) A used car financing without down payment with car leasing.

- 4.) A used car financing without down payment with a car loan.

- Difference owner and owner of a thing

- 5.) Used car financing without down payment with a car dealership financing.

- Vario financing vs. car subscription vs. leasing vs. car loan

- Requirements for down payment free financing

- Used car financing without down payment and final installment

- Used car financing with final installment

- Alternative used car financing with small down payment via car dealer

- Conclusion: Used car financing without down payment

5 ways to finance a used car without down payment

1.) Vario financing: The classic used car financing without down payment

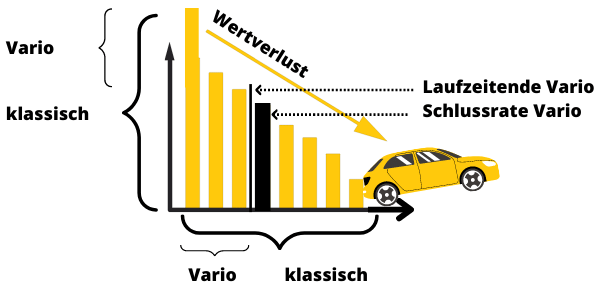

One Vario financing is a Car financing with low rates, which at the same time without a down payment gets by. Vario financing is common for new cars, but is also available to used car buyers. The advantage of low rates and the missing deposit stand the High final installment at the end of the term against.

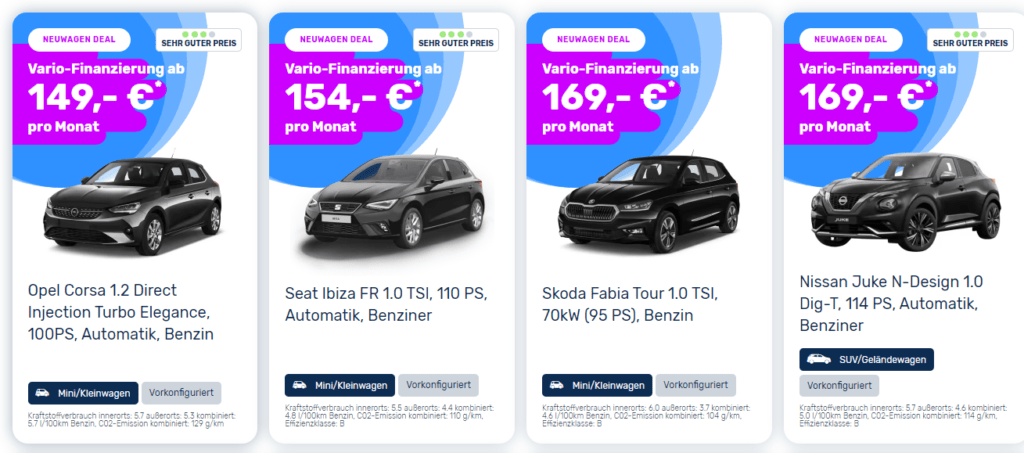

Car dealerships like MyCar* also offer Vario financing without a down payment. Although these are new cars, they are heavily discounted. Therefore the Vario financing from My Car is a good alternative to used car financing without a down payment. At Car dealership24 on the other hand is even Vario financing for used cars possible without a down payment. You should check whether this is worthwhile in view of the high discounts.

When does Vario financing make sense?

Vario financing is aimed in particular at people with flexible lifestyles who like to try out new things. Vario financing is particularly well suited to...

- if you don't have the money for a down payment.

- if you are not yet sure about your dream car.

- if you would like to try out different brands and models without making a long-term commitment.

- but also if you need planning security and want to know the later purchase price in advance.

- especially if you are self-employed and can deduct the cost of the car.

When is a "vario" unsuitable for you?

Vario financing doesn't make sense for you,

- if you don't enjoy trying out new cars.

- but also if it is important to you to get from A to B as cheaply as possible.

- if you want to make any modifications to the car (trailer hitch, new boxes, sleeping accommodation).

- if you want to become the owner of the car.

2.) A used car financing without down payment with a car subscription

Car subscriptions offer several advantages over owning a car and are therefore particularly popular with people who do not want to make a long-term commitment. In contrast to a leasing contract, the lessor takes care of everything for you with a car subscription. In the monthly rate are therefore also Insurance premiumsThe price includes all services, such as tire change, registration, taxes and any maintenance and repairs. Therefore, with a car subscription you can order your car, have it delivered and start driving right away.

Self-employed and entrepreneurs can also save taxes with a car subscription. Because the costs for the car subscription are depreciable.

If you need financing with a bad credit rating or negative Schufa, you can rely on the providers of Finn* or VW* because a bad Schufa is not an exclusion criterion here. Further providers to the Auto subscription despite negative credit bureau can be found in the linked article.

When does a car subscription make sense?

A car subscription financing is aimed at people who only need a car for a short time. But also as a permanent solution, a car subscription is suitable for people who constantly want to try something new. Especially well suited is a car subscription for you,.

- if you want to have an all-inclusive contract.

- if easy and fast progress is important to you.

- as long as you want to stay flexible and buying a car is too inconvenient for you.

- in case you want to change the car more often.

- in the event that you soon move to another city or abroad and therefore a car purchase is out of the question.

- but also if you are self-employed and can deduct the cost of the car.

When is a car subscription unsuitable for you?

However, a car subscription does not make sense for you,

- unless you enjoy trying out new cars.

- if you want to compare rates for insurance yourself.

- especially if it is important to you to get from A to B as cheaply as possible.

- but also if you might want to make modifications to the car (trailer hitch, new boxes, sleeping accommodation).

- last but not least, if you want to become the owner of the car.

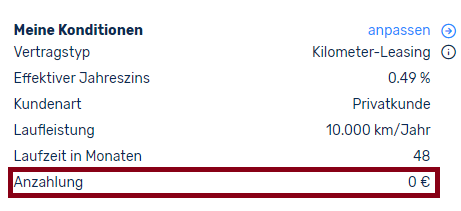

3.) A used car financing without down payment with Car Leasing

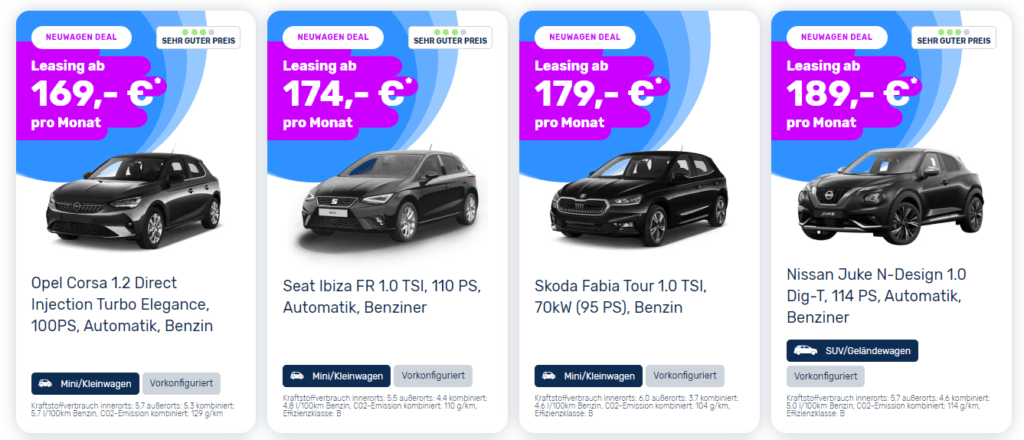

Also a Car Leasing allows you to finance a used car without a down payment. About Car dealership24 or Leasing market you will find many providers who will also finance a used car at a reasonable price. In contrast to the car subscription, you pay with a car leasing insurancetax and registration yourself. However, this also gives you more choices in the selection of providers, which you can use to your advantage.

Another advantage in car leasing is that the Costs tax deductible can be made. Thus, car leasing is particularly worthwhile for the self-employed and entrepreneurs who can take advantage of these opportunities.

If you have a bad credit rating and a Car leasing without Schufa you should be very careful when leasing a car. We looked at a few providers and found that many are not reputable. They often charge too high fees for little or no service.

Car dealerships like MyCar offer car leasing without a down payment. Although these are new cars, they are heavily discounted. Therefore, the leasing offer from My Car is a good alternative to used car financing without a down payment. At Car dealership24 on the other hand is even Vario financing for used cars possible without a down payment. You should check whether this is worthwhile in view of the high discounts.

When does a car lease make sense?

Car leasing is aimed at people who want to try something new more often. Self-employed people appreciate tax structuring options when leasing.

Car leasing is especially good for you,.

- as long as easy and fast progress is important to you.

- if you want to compare rates for insurance yourself.

- as long as you want to stay flexible and buying a car is too inconvenient for you.

- if you want to change the car more often.

- if you are moving to another city or abroad soon and therefore buying a car is out of the question.

- but also if you are self-employed and can deduct the cost of the car.

When is a car lease unsuitable for you?

Car leasing, on the other hand, doesn't make sense for you,

- if you don't enjoy trying out new cars.

- if it is important to you to get from A to B as cheaply as possible.

- but also if you want an older used car.

- if you want to make any modifications to the car (trailer hitch, new boxes, sleeping accommodation).

- in case you want to become the owner of the car.

4.) A used car financing without down payment with a car loan

A Car loan without Schufa is well suited to setting up used car financing without a down payment in difficult cases. However, for this come No classic branch banks in question, as they do not play along with credit without a credit history.

Instead, only specialized financial institutions, which even in difficult cases still Grant credits can.

If you would like more specific information about used car financing without a down payment, we recommend an inquiry at Smava* or bon credit*.

You can find more providers in the article "Car loan without Schufa". The registration certificate part 2 (vehicle title) usually does not have to be deposited with the car loan without Schufa. As with the Car loan without vehicle registration you retain flexibility in the event of a later sale. We advise you to keep the registration certificate part 2 with a car loan and not to assign it to the bank.

We advise to keep the registration certificate part 2 in case of a car loan and not to assign it to the bank.

In the case of a car loan with a poor credit rating, interest rates range from 5 to 10 %, resulting in monthly payments starting at around €200 for financing without a down payment for a cheaper used car.

A big advantage of the car loan in used car financing is that you become the owner of the car. Thus, your monthly installments contribute to the fact that you pay off the car and that it belongs to you in the end. With a car subscription, car leasing or vario financing, you are legally only the owner. The terms owner and owner are used synonymously in everyday life, but legally there is a big difference.

Difference owner and owner of a thing

A Owner of a thing is who can access them. Thereby the thing is thus within the sphere of influence of the owner. In contrast, the Ownership of a thing the right of exploitation and dominion over a thing. With the right of exploitation, the owner may sell the thing. If the owner uses the thing himself, he is the owner at the same time.

When does car financing make sense?

Car financing is aimed at people who know what kind of car they want. The car becomes your property, which significantly reduces costs in the long term. In addition, having your own car gives you more freedom when it comes to choosing a repair shop and making additions and modifications. Car financing is particularly well suited to...

- if you want to avoid a down payment or you simply don't have the money for it.

- if you want to finance a used car without down payment and final installment

- when you yourself Compare rates for insurance would like

- if you want to make additions or modifications (trailer hitch, new boxes, sleeping accommodation)

- if you want to become the owner of the car.

- if it is important to you to get from A to B as cheaply as possible.

- but also if you want an older used car.

When is car financing unsuitable for you?

Auto financing is for people with a longer-term planning horizon. It doesn't make sense for you,

- if you want to have an all inclusive contract

- If you're moving abroad soon

- but also if you want to change the car more often

5.) Used car financing without down payment with a Dealership Financing

One Used car financing without down payment is also possible via car dealership financing. Although we have mentioned in the article Buy a car on installments despite negative credit bureauThe suppliers require a small down payment of between €350 and €750, but there are also ways of circumventing the down payment by constructing the system yourself.

In order to make a used car financing without a down payment nevertheless possible, there is namely the possibility to make the down payment via Smava* or bon credit* to finance. For smaller amounts below € 500 is also suitable free of charge mini loan from cashier*.

These down payments are what car dealerships require for direct financing:

- Your dream car in Lower Saxony: from 350 € deposit

- Auto Scheldt in North Rhine-Westphalia: from 500 € deposit

- Auto Center Rheydt in North Rhine-Westphalia: from 750 € deposit

Other alternatives to the Used car financing despite negative credit bureau can be found in the linked article. There you will also find out how you can still finance a used car despite the rejection of the loan.

Vario financing vs. car subscription vs. leasing vs. car loan

One Used car financing without down payment is available via a Vario financing, a Car leasing, a car subscription or one car loan possible. The monthly installments are very low with Vario financing, car subscription and car leasing. With a car loan, the monthly costs are significantly higher. This is because with a car loan you pay off the car. On the other hand, with both subscription and leasing models, as well as with Vario financing, you only pay for the depreciation of the car.

In the following table you will find the most important differences between a Vario financing, car leasing, a car subscription, as well as a car loan at a bank or the car dealership directly.

| Vario financing | car subscription | Car leasing | Car financing through a bank or credit intermediary | Car financing through a car dealership |

|---|---|---|---|---|

| Vario financing down payment: Financing without down payment | Car subscription deposit: Financing without down payment | Car lease down payment: Financing without down payment | Financing (bank) Down payment: Financing without down payment | Financing (dealership) Down payment: Financing possible without down payment if the down payment is paid via a separate loan |

| Vario financing monthly installments: very low | Car subscription monthly rates: very low | Car leasing monthly rates: very low | Financing (bank) monthly installments: somewhat higher | Financing (car dealership) monthly installments: somewhat higher |

| Vario financing Terms: 12 - 60 months | Car subscription terms: 12 - 36 months | Car leasing terms: 12 - 60 months | Financing (bank) Terms: 12 - 120 months | Financing (bank) Terms: 12 - 36 months |

| Vario financing damages: Damage must be reported to the lessor and can cause high additional costs | Car subscription damages: Damage must be reported to the lessor and can cause high additional costs | Car leasing damages: Damage must be reported to the lessor and can cause high additional costs | Financing (Bank) Damages: The repair of damage is your own responsibility | Financing (car dealership) Damage: The repair of damage is your own responsibility |

| Vario financing tax: Rates for self-employed fully deductible (rates are 100% costs). | Car subscription tax: Rates for self-employed fully deductible (rates are 100% costs). | Car leasing tax: Rates for self-employed fully deductible (rates are 100% costs). | Financing (bank) Tax: Only interest portion of installments deductible for self-employed, car belongs to you and is depreciable | Financing (bank) Tax: Only interest portion of installments deductible for self-employed, car belongs to you and is depreciable |

| Vario financing purchase: Option to purchase at the end of the term | Car subscription purchase: No purchase possible, The car must be returned to the dealer at the end of the contract | Car leasing purchase: No purchase possible, The car must be returned to the dealer at the end of the contract | Financing (bank) Purchase: Loan installments finance the purchase price from day one | Financing (car dealership) Purchase: Loan installments finance the purchase price from day one |

| Vario financing return: Return of the car to the lessor possible at no additional cost at the end of the term, but not obligatory Vario financing planning security: The purchase price is fixed at the beginning, which creates planning security. | Car subscription return: Return of the car to the lessor at the end of the term mandatory | Car lease return: Return of the car to the lessor without additional costs Term obligatory | Financing (Bank) Return: No return possible, but you can sell the car | Financing (car dealership): Return No return possible, but you can sell the car |

| Vario financing total cost: High total cost, as no down payment is made and the installment only covers depreciation. | Car subscription total cost: High total cost, as no down payment is made and the installment only covers depreciation. | Car leasing total cost: High total cost, as no down payment is made and the installment only covers depreciation. | Financing (bank) Total cost: Lower overall cost because you pay off the vehicle with the installment. | Financing (dealership) Total cost: Lower overall cost because you pay off the vehicle with the installment. |

| Vario financing final installment: High final installment when the car is bought off at the end "balloon payment". | Car subscription final installment: No redemption possible | Car leasing final installment: No redemption possible | Financing (bank) Final installment: Used car financing without down payment and final installment | Financing (bank) Final installment: Used car financing without down payment and final installment |

| Vario financing extra kilometers: High surcharge for additional kilometers | Car subscription extra kilometers: High surcharge for additional kilometers | Car leasing excess mileage: High surcharge for additional kilometers | Financing (bank) excess mileage: Additional kilometers are not tracked and are therefore without additional payment | Financing (car dealership) Multimile: Additional kilometers are not tracked and are therefore without additional payment |

| Vario financing dealing with the car: Careful handling of the car is absolutely necessary | Car Abo Handling the car: Careful handling of the car is absolutely necessary | Car leasing dealing with the car: Careful handling of the car is absolutely necessary | Financing (bank) handling the car: The car is yours and you can decide for yourself how to handle it | Financing (car dealership) Handling the car: The car is yours and you can decide for yourself how to handle it |

| Vario financing property: Car is not paid off and therefore it does not become your property | Car subscription property: Car is not paid off and therefore it does not become your property | Car leasing property: Car is not paid off and therefore it does not become your property | Financing (bank) property: Car is paid off and is then your property | Financing (car dealership) Property: Car is paid off and is then your property |

| Vario financing changes: Modifications to the car, tuning or attachments are not possible | Car subscription changes: Modifications to the car, tuning or attachments are not possible | Car leasing changes: Modifications to the car, tuning or attachments are not possible | Financing (Bank) Changes: Modifications to the car, tuning or attachments are possible | Financing (dealership) Changes: Modifications to the car, tuning or attachments are possible |

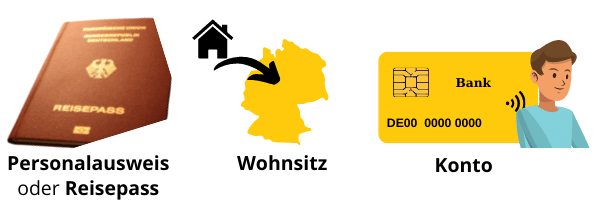

Requirements for down payment free financing

Used car financing, can be done through the options highlighted above. Even if the requirements and conditions differ slightly in each case, you must have a fixed German residence have be of legal age and about a stable income have. Direct car dealer financing has the lowest income requirements. Often pensioners, Hartz IV recipients and people in part-time or Aufstocker with precarious employment are accepted. Of course, the installments for the car must still be affordable and also be afforded.

These are 4 basic prerequisites for used car financing with no down payment in detail:

1.) You need a German identity card, a Residence within Germany and a German account.

2.) In addition, you must of legal age its

3) With a used car financing without down payment, the monthly installments are higher than with a comparable financing with down payment. Therefore you need a stable monthly income.

4. ) Where from you draw the income plays a role in the Financing through a car dealership nur role is of secondary importance. People with Hartz 4 or mini-jobs are also accepted here. But also Self-employed used car financing is available through Autohaus Direktfinanzierungen.

However, if you have a car subscription or a Car Leasing you should have a permanent employment relationship with a company that From 12 months or longer. Here also only workers, employees, civil servants, pensioners and retirees are accepted.

Used car financing without down payment and final installment

You can achieve used car financing without a down payment and final installment if you have a Credit instead of leasing or subscription uses. With a car loan you work Unlike leasing or subscription models already from the first day of paying off the loan.

However, this also has the consequence that the monthly installments with the car loan higher than with a car lease. This is because with leasing, the monthly installments are kept low by the subsequent final installment. Financing a used car without down payment and final installment therefore has a higher monthly rate as a result. Nevertheless, the costs are lower overall, since you reduce the remaining loan amount each month through repayment.

You have the following options for used car financing without down payment and final installment

1) Fully finance the used car through credit.

The easiest way to get used car financing without a down payment and final installment is to take out a loan before going to the dealership. To remain flexible in the event of a later sale, we recommend the Car loan without car registration Deposit with the bank. You can take out this loan before you buy the car. In addition, such a loan gives you more freedom in the event of a possible sale of the car, and avoids a costly release of the registration certificate part II (KFZ letter).

If you have a bad credit rating, even a Car loan without Schufa from bon credit* can be concluded. Here, too, no deposit of the registration certificate part II is required. Compared to financing through a car dealership, you are much freer to choose a car with a loan that you conclude yourself. Often you can also choose much cheaper cars.

In any case, make sure that you are not offered residual protection insurance (RSV). This often has high Protective contributions and little benefit to you.

2) Finance remaining down payment via loan

You can also obtain used car financing without down payment and final installment by using the Installment purchase of a car through the car dealership and the remaining down payment through a Loan cover.

For the credit, the same applies here as under point 1.

3) Leasing for used car financing without down payment and final installment.

Car dealerships like MyCar* offer Car leasing also without down payment and final installment an. However, these are mainly new cars. However, the provider offers high discounts on new cars, which is why leasing can be a good alternative to used car financing without a down payment and final installment.

4) Vario financing for used car financing without down payment and final installment

Car dealerships like MyCar offer Auto Vario financing with no down payment or final installment. These are also mainly new cars, but are worthwhile due to high new car discounts. Therefore, also the Vario financing from My Car* represents a good alternative to used car financing without down payment and final installment.

Alternative used car financing with small down payment via car dealer

Some car dealers also offer financing for cars purchased from them. Here, only very small down payments are required. Therefore, these financings are an alternative if you are looking for used car financing without a down payment. The following dealers require the lowest down payments:

- Your dream car in Lower Saxony: Used car financing from 350 € down payment

- Auto Scheldt in North Rhine-Westphalia: Used car financing from 500 € deposit

- Autocentrum Rheydt in North Rhine-Westphalia: Used car financing from 750 € down payment

Conclusion: Used car financing without down payment

for one Financing a used car is primarily the lower price. After all, a new car loses around a quarter of its value in the first year. A Financing without down payment can be realized in several ways. These include:

- the Vario financing,

- a Car leasing,

- a car subscription

- a car loan

- A combination of car leasing or dealer financing with a down payment, with a loan. In this case, the down payment is financed via the loan taken out in parallel.

With subscription and leasing models and Vario financing, you only pay for the depreciation of the car. This means that you don't own the car later, but the installments are cheaper. With a car loan, on the other hand, you pay off your property with the loan installments. Once the loan installments have been paid, you own the car and there are no further payment obligations. Financing via a loan therefore has a special charm when it comes to used car financing without a down payment.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.