You want one right away 100-500 euros credit to graduate? With a 100-500 Euro instant loan you get more financial leeway and can quickly bridge bottlenecks. In addition, 100-500 euros can also be helpful to fulfill a spontaneous wish. With a 100-500 euros Credit despite negative SCHUFA However, invoices can also be paid quickly, which means that further reminder fees can be avoided. In this article I will show you what you have to do if you have 100-500 euros if possible fast and Cheap want to have on the account. In addition, this article shows where it is 100-500 euros Schufa free gives. For each of the three cases - i.e. quickly, cheaply or despite SCHUFA information - receiving 100-500 euros, we take the providers in question Vexcash*, ferratum*, cashper* and the credit intermediary SMAVA* under the magnifying glass.

100-500 euros credit immediately on the account

What you can learn here

- 100-500 euros credit immediately on the account

- Requirements for the 100-500 euro loan

- 100-500 euros credit despite negative credit bureau and poor credit rating

- 100 – 500 euros credit without proof of income

- What is the monthly installment for a loan of 100-500 euros?

- What you should pay attention to the 100-500 Euro loanAlternative to the 500 Euro loan

- How to proceed if you want to apply for a 100-500 euro loan

- 300 euro loan, 1000 euro loan as a student or a 500 euro loan despite SCHUFA: what loan amounts you can get!

you want yours 100-500 euros have it transferred to your account on the same day if possible? That's with the Instant payout both at ferratum*, Vexcash*, Smava* or cashper* possible. It is best to submit your loan application for 100-500 euros on one working day. Ideally already in the morning. The 100-500 euro credit is then immediately credited to the account against payment of a separate fee. For this purpose, the fee-based immediate transfer is used, which is why the lightning fast credit in approximately 30 minutes already on your account is. If you use the 500 Euro credit immediately to the account Vexcash is the fastest and cheapest provider. The fees for an express loan 500 euroxpress loan over 500 euros range from 39 euros at Vexcash to 149 euros at Ferratum.

| Offerer | Instant payout | interest rate | Duration | Standard payout |

|---|---|---|---|---|

Vexcash | EUR 39 | 14,82% | 15-90 days | 3 days |

cashper | EUR 99.00 | 0% | 30-60 days | 7 days |

ferratum | EUR 149 | 10,36% | 30-62 days | Up to 15 days |

If you need the money immediately, you can use the instant payment at Vexcash* use. For 39 euros you get a 100-500 euro instant loan. payout in about 30 minutes by instant bank transfer!

In order to get 100-500 euros credit immediately on the account you have to dig deep into your pocket

The additional fees to get the 100-500 euro credit immediately on the account are high. The cost of the express option for a 100-500 euro loan ranges from €39 at Vexcash to €149 at Ferratum. Vexcash is therefore the cheapest and also fair: Because even without an express option, you will receive the money here within about 3 working days. Ferratum only guarantees a payout within 2 weeks if you don't choose an express option!

Requirements for the 100- 500 euros credit

Only a few requirements are necessary for the mini loan of 100 – 500 euros.

The requirements for the mini loan are:

- of legal age

- German bank account

- German registration address

- Own income over €500 or more. More on that in the next section.

What income do I have to prove for a 100-500 euro loan?

The following proof of income is required for a 100-500 euro loan:

- ferratum*: No proof of income required

- Vexcash*: Proof of income via 500 euro necessary

- Smava*: Proof of income via 601 euros necessary

- cashper*: Proof of income via 700 euro necessary

100-500 euros credit despite negative credit bureau and poor credit rating

A negative entry in the SCHUFA file can ensure that you no longer receive a loan from a bank. If the credit rating is poor, the providers offer themselves Casher *or the financing professional SMAVA* at. Both providers offer you one 100-500 euros credit despite negative SCHUFA at. This is how you get a loan, even if your credit rating is a bit worse.

However, this does not mean that you will get the 100-500 Euro loan paid out safely. Reputable providers always carry out a credit check: After all, lenders want to get the money back and not lend money to over-indebted people. A 100-500 euro loan without a Schufa check is currently not available in Germany.

If you would like more information about loan providers despite SCHUFA, I recommend the article "Which bank gives credit despite negative SCHUFA"

100 – 500 Euro credit without proof of income

A Loan without proof of income can be requested from Ferratum Bank. At Ferratum Bank you can borrow up to 1,000 euros without having to present proof of income to the bank. Therefore, Ferratum Bank also has a lower rejection rate than other banks. At Ferratum, you can still get a loan of 100-500 euros without proof of income, even in particularly difficult cases.

Borrow 100-500 euros as a trainee and student

Trainees and students often do not have a large income and are therefore often rejected by regular banks due to the lack of proof of income. The cost of living is often high: a lot of purchases have to be made, especially at a young age. The 100 - 500 Euro loan without proof of income from Ferratum can also be taken out by trainees and students be completed. It is surprisingly cheap to borrow 100-500 euros as a trainee or student. The following example illustrates this.

example: You take out a student loan of more than 500 euros and a term of 30 days. This costs from only 4,26 € at. The low interest rates on loans are much less than the fees for a collection letter. The interest on arrears for a missed payment clearly exceeds the cost of the mini loan. It is important that you avoid express payouts and 2-rate options like the devil avoids holy water. Otherwise it will be very expensive to borrow a loan of 100 – 500 euros without proof of income.

Special case: Apply for a 100-500 euro loan for the unemployed and Hartz 4 recipients

Unemployed and Hartz 4 recipients have at low level of debt also a chance of a loan without proof of income up to 500 euros. However, it is cheaper when Jobcenter a loan as an unemployed person to apply for free. This is possible for necessary purchases, but involves some work to fill out the forms. In the guide credit in difficult cases you will find more information about your options as a Hartz 4 recipient to borrow money.

What is the monthly installment for a loan of 100-500 euros?

Mini loans are completed between 15 to 90 days. For amounts between 100 and 500 euros, terms of 30 days are common. With a term of 30 days, the following installments result for a loan of 100-500 euros.

| Offerer | 100 euros credit | 200 euros credit | 300 euros credit | 400 euros credit | 500 euros credit |

|---|---|---|---|---|---|

Vexcash | 101.16 EUR | 202,32 | 303.48 euros | EUR 404.63 | 505.79 euros |

cashper | 100 EUR | 200 EUR | 300 EUR | 400 EUR | 500 EUR |

ferratum | 100.85 euros | EUR 201.70 | EUR 302.55 | EUR 403.40 | 504.25 euros |

What you should pay attention to with a 100-500 euro loan

Alternative to the 500 euro credit

Use a credit card to borrow 100-500 euros immediately

With a credit card you have a payment period of 1-3 months. There are numerous free credit cards with which you can borrow 2,500 euros and more without paying any fees. For example, you can use the Barclay card* Pay up to 8 weeks later with no loan fees. In addition, the credit card again and again used for shopping, purchases and online bookings used immediately will. However, credit cards have higher requirements creditworthiness as mini loans. Unlike mini loans, credit cards can not with negative Schufa entries be given. Another disadvantage of credit cards is the Application time of 1-2 weeks, the high fees at (involuntary) installments as well as fees for other services such as withdrawing money or working abroad.

| Pros and cons of credit cards | |

|---|---|

✔️ Benefits ✔️ High credit limit of €2,500 and more possible | ✗ Cons ✗ Negative entries are difficult to get rid of |

overdraft facility

The overdraft facility or "dispo" is with most free checking accounts contain. The bank grants you a loan for the overdraft on the account. The interest rates for this are between 7-10 % and thus comparable to the mini loan. A disadvantage of the overdraft facility is that it is not automatically repaid. This can make it difficult to get out of debt. In addition, current accounts without Schufa have no overdraft facility.

Ask relatives friends for 100-500 euros

Another possibility to borrow 100-500 euros in the short term is to ask relatives and friends. With a little luck, you can easily get money. Be reliable: Pay your friend back the money in full and on time. Otherwise, the loan can seriously jeopardize the friendship.

Interest-free loan of 100-500 euros at the job center

Unemployed and Hartz 4 recipients also have the option of an interest-free loan from the job center necessary to obtain purchases. In the article credit in difficult cases I have described that the application process is not quite so unproblematic. The job center evaluates whether the purchase to be financed is necessary or not.

How to proceed if you want to apply for a 100-500 euro loan

All providers work fully digitally. So you first register with your smartphone or computer. This is much easier and faster compared to paperwork. This is the only way that you can still get the loan of 100-500 euros paid out today. Since appointments and visits to branches are not necessary, there are no waiting times. Once you have completed the small loan application, you will receive immediate feedback. With a digital account check, this takes less than a minute. This also eliminates the need to search for and upload additional documents such as proof of income or salary.

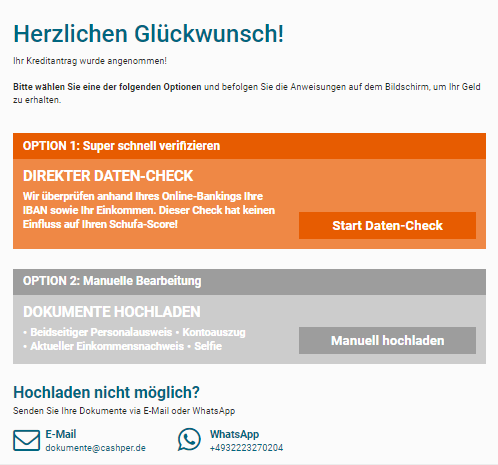

Thanks to the simple application process and few preliminary checks almost everyone gets a loan. The pictures for applying for a 100-500 euro loan are from Cashper. With the other providers, the application is similar.

1. Choose a provider from the mini loan comparison

Due to the good conditions, recommends Konto-Kredit-Vergleich.de the provider Cashper for a loan of 100-500 euros. Here, the loan between 100-500 euros is free of charge. You pay back the same amount of money you borrowed 30 days later. Click to select a provider on the appropriate button in the Mini Loan Comparison.

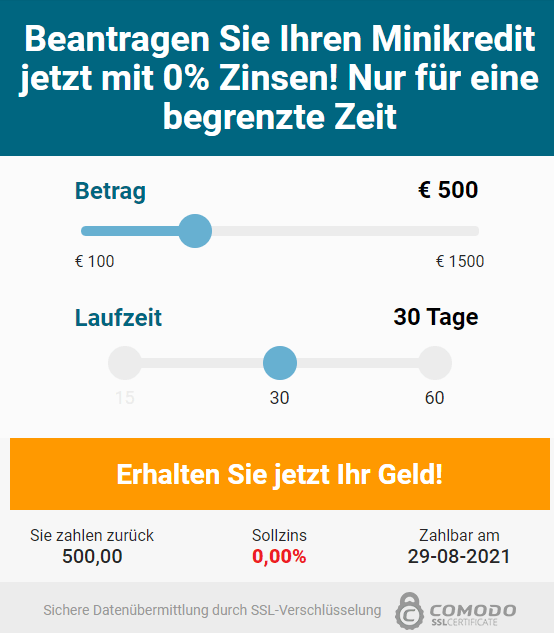

2. Confirm your loan amount on the provider's website

Next, you will be taken to the loan provider’s page. Here you can adjust your loan amount and the term again. Then click the button "Get your money now“.

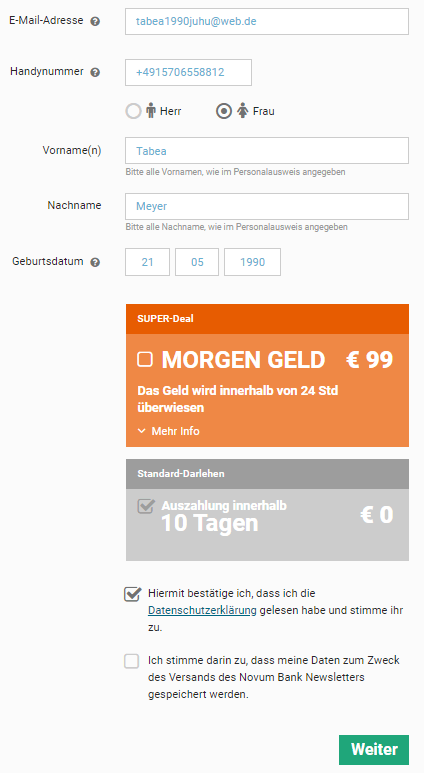

3. Complete the loan form with your personal information.

Now fill out the form with your name, date of birth, email address and cell phone number. You also choose whether you want to receive the money tomorrow or whether you can wait a few days. Since the option "money tomorrow" is very expensive, I advise against it. You also confirm the data protection declaration.

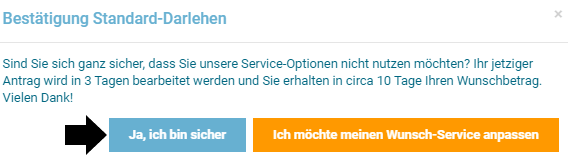

4. Confirm the message

If you have chosen the payout in 10 days, you must close the pop-up message by clicking on "Yes I am sure" to confirm.

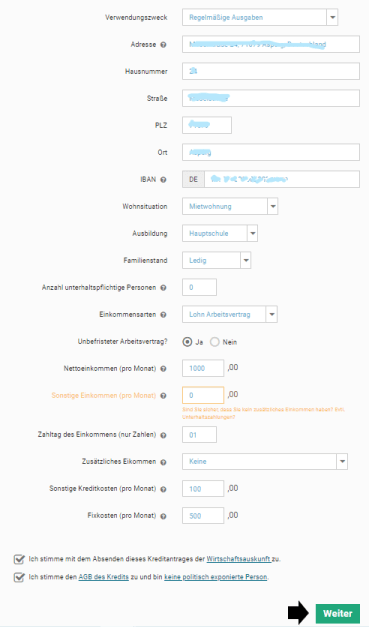

5. Entering further data

Now you enter your bank details, your income, your expenses and all other data in the form. Also have your IBAN number of your checking account ready. The loan will be disbursed later.

5. Data check

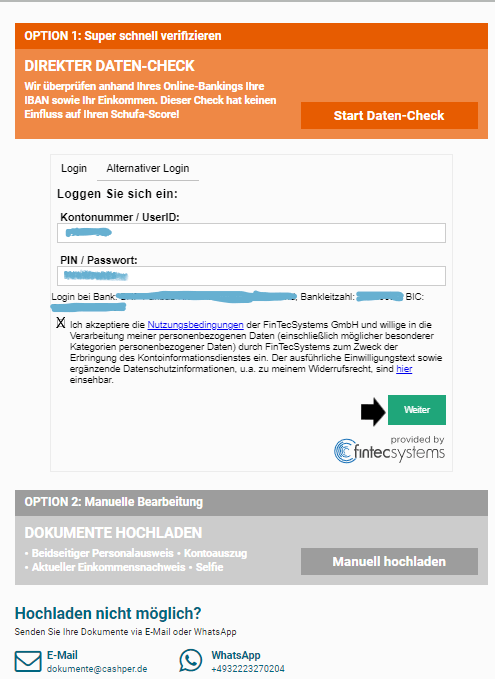

It follows the verification your details in the data check of the provider. Choose the Direct data check. If you have problems with this, you can send a copy of your identity card, statement of account, proof of income and a selfie You can also upload it manually or send it to the provider by email or WhatsApp.

If you have chosen the direct data check, the next step is to log into your account. To do this, enter your access data for online banking in the mask. If you do not want to do this, you can also send the receipts to the provider manually or by email or Whatsapp.

6. Confirm email address

Next, confirm your email address and follow the further instructions.

300 Euro credit, 1000 euros credit as a student or a 500 Euro loan despite SCHUFA: What loan amounts you can get!

With mini loan providers, you can get loans up to 1,500 euros immediately as a new customer. Up to 1.000 Euro credit you can get it even if you are a student or unemployed, because Ferratum offers a 1000 Euro credit without proof of income* gives. You can even apply for a small loan of up to 3,000 euros immediately: However, this is only possible if you are already an existing customer Vexcash* are you.

| Offerer | Instant credit surcharge | More information | Duration until money on account | |

|---|---|---|---|---|

Credit amount: 100 - 3.000 € also for new customers Term: 15, 30 or 60 days term 600 Euro minimum income Express payout in 24 hours Simplified Video-Ident procedure Also suitable for poor credit rating | In order to ensure immediate payment in the event of cashper to obtain the Super deal package required. Up to €199: €39 €200 – €399: €69 400 - 3000 €: 99 € | Recommendation: cashper.de | With super deal: ⚡ Lightning fast payout in 24 h Without super deal: payout in 7 working days 🕐If the application is submitted before 13.00 on working days, payment possible on the same day | |

Credit amount: 100 - 3.000 € (new customers up to 1.000 €) Duration: 15 - 90 days 500 Euro minimum income Express payout in 30 minutes Simplified Video-Ident procedure | In order to ensure immediate payment in the event of Vexcash to obtain the Smart package for €69 per month 30 days: 69 € 60 days: 2 x 69 € = 138 € 90 days: 3 x 69 € = 207 € | To the provider: Vexcash.com | With Smart package: ⚡ Lightning fast payout in 24 h Without smart package: payout in 8-10 business days 🕑If application is made before 14.00 on working days, payment possible on the same day | |

Credit amount: 50 - 2.000 € (new customers up to 1.000 €) Term: 30 or 62 days 0 Euro minimum income Express payout in 24 hours Simplified Video-Ident procedure | In order to ensure immediate payment in the event of ferratum to obtain are the following Acceleration fees to pay. 50-75 €: 29 € 76-99 €: 39 € 100-149 €: 49 € 150-199 €: 59 € 200-299 €: 79 € 300-499 €: 119 € 500-699 €: 159 € 700-999 €: 179 € 1000-1199 €: 219 € 1200-1500 €: 259 € 1501-1699 €: 299 € 1700- 2000 €: 339 € 2001- 2499 €: 379 € 2501- 3000 €: 419 € At Ferratum additional fees from 89 € are due for the 2-rate option. This is obligated from 650 € | To the provider: Ferratum.de | With acceleration fee: ⚡ Lightning fast payout in 24 h Without acceleration fee: payout in 15 working days 🕒If the application is submitted before 15.00 on working days, payment possible on the same day |

Small loans from 100 euros – 500 euros

Small loans from 500 euros – 1000 euros

Small loans from 1100 euros – 3000 euros

If you need more than 3,000 euros, you have to switch to an installment loan. You can find the cheapest installment loans via the Installment loan comparison.

*Affiliate link: If you get to a provider via one of these links from my website and open an account there, I may receive a commission. This does not result in any additional costs for you. ❤️ THANK YOU for using these links! ❤️

Disclaimer: This is well researched but non-binding information.