Managing finances yourself is perceived by many people as too difficult, which is why they leave this topic to bank advisors. Under no circumstances should you give this important topic to others. Making a simple investment isn't difficult as long as you avoid the major mistakes. In the following it is determined which ones they are!

"It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent."

— Charlie Munger, partner of W. Buffett who is worth an estimated $1.8 trillion

Error #1 in investing: Postponing

What you can learn here

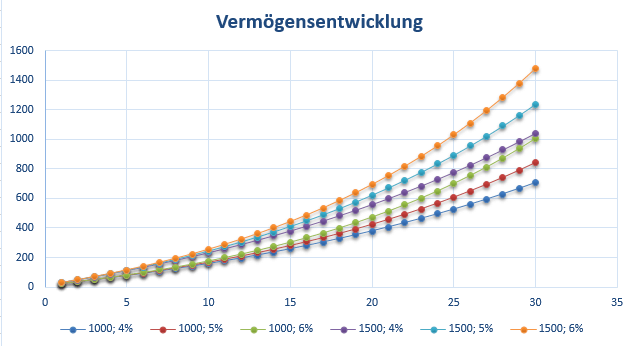

The procrastination, i.e. the postponement of important financial decisions, is expensive. I would like to explain this in more detail using the following image.

The picture shows the power of the compound interest effect: €1000 and €1500 earn interest at four, five and six percent over 30 years. The vertical axis shows the resulting assets in Thousand - €. Starting capital is €10,000.

You can learn many things from the graph. Eg

- If you invest 1,000 euros a month with 4 %s, you will receive around 220,000 euros after 15 years, but after 30 years you will already receive 650,000 euros, i.e. almost 3 times as much, although the period is only twice as long

- If you invest the same amount more lucratively, for example at 6 % percent, you have already accumulated over 1 million euros. By the way, almost 700,000 euros of this is interest

The two examples illustrate C. Munger's opening quote very clearly: It is much more important to stay consistently invested than to try to be very intelligent, for example to use tricks or something similar.

by the way: You can do a bit with the numbers in the Interest Rate Calculator to play.

Error #2 when investing: Incorrectly assessed risk tolerance

Many people have trouble assessing their risk tolerance correctly. This can cost them dearly in a stock market downturn. You panic and sell your securities at rock-bottom prices because you can no longer withstand the pressure exerted by the media, your environment and stock market gurus. This irrational behavior is deeply rooted in our genes (escape when afraid) and it is very difficult for us to defend ourselves against it. The first step is to become aware of the behavior.

Risk appetite is related to age and gender. Young and male are two demographic factors that increase risk propensity. (Source: Handelsblatt)

A thought experiment on risk tolerance and expected value

In a game you have two options:

- Option: Your chance of winning 100 euros is 50 %, if you lose, you get nothing.

- Option: with a probability of 100 % you get 10 euros.

How would you choose? risk affine People probably gravitate towards the first option. If you don't get along well with insecurities, that's what you call it risk averse, you will probably choose the second option and secure a profit of 10 euros. However, the expected value, i.e. the average profit if the experiment is carried out very often, is 50 euros for the first option, i.e. five times as high as for the second.

If you have decided on the first option, the question of how you would decide if the sums were multiplied a thousand times, for example, is also exciting. So it's better to be sure of 10,000 euros than a 50 % chance of 100,000 euros. Would you still choose the risk option. What if the amounts were increased tenfold again?

It is therefore important for you to determine how much loss you can live with. Do you stay cool and casual when your portfolio has fallen by more than half? Also keep in mind that these processes do not usually take place in isolation. This means: If your well-diversified ETF portfolio has lost a lot of value, your own job may be at stake at the same time. This can further aggravate the situation.

By the way: Robo advisors can help you to correctly assess your risk tolerance. Read mine if you're interested Advice article on the digital investment helpers through.

Error #3 when investing: trust stock market experts

People tend to take too much advice from authorities. A principle of investing is critical thinking and reflection. This problem is also called Authority bias. The phenomenon is also widespread in other areas, but many people fall into this trap, especially when it comes to investing. The stock market analysts of the big investment banks are also included. You regularly create forecasts by updating trends. The pricing process is usually far too complex and multi-layered and cannot be reliably predicted by a human being. In addition, the sale of forecasts is an attractive business model.

Error #4 when investing: So-called "megatrends"

Do the following statements sound familiar to you in one way or another:

- "The euro is falling apart" (eg here)

- "Economic crisis due to Brexit" (eg published by RP-online)

- Trade dispute between USA and China: "Bleak outlook for global economy".

- Coronavirus - "Black Swan" for the Global Economy?

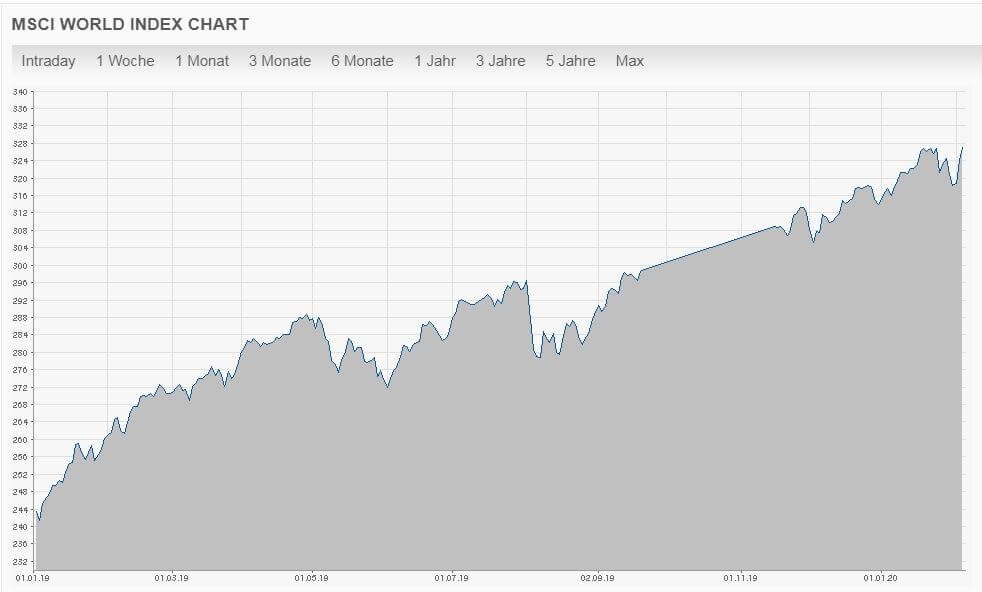

Private investors are often guided by forecasts that initially sound logical and stop investing out of fear. However, it is also a fact that between January 2019 and February 2020 one of the strongest bull markets in history was. For example, the MSCI World rose by an incredible 28.6 percent during this period. Despite all prophecies of doom.

If you would like to continue to deal with financial matters, I can watch the video from Ray Dalio, founder of Bridgewater Associates, which I have embedded below recommend. Here is a clear explanation of why there are regular ups and downs on the stock market. The video manages to explain these complex relationships in simple language that is understandable for everyone.

final word

These were mistakes that you should definitely avoid when investing. Depending on where you are on your financial journey, it is advisable to first replace an expensive overdraft facility with a much cheaper installment loan. With this you can already save 100-200 euros a year. You can find an overview of cheap installment loans here. The next step is to set up a call money account to save up a nest egg. It is advisable to keep around 3 net salaries as a nest egg in a call money account with the best possible interest rate. By the way, you will find the best money market accounts here. If you have successfully mastered the first two steps, it goes to the third step: the investment. You can find an easy way to build a portfolio here. If you don't dare to invest yourself yet, there is no reason to make the mistake #1: Procrastination. Investing money is really easy with one Robo Advisor.