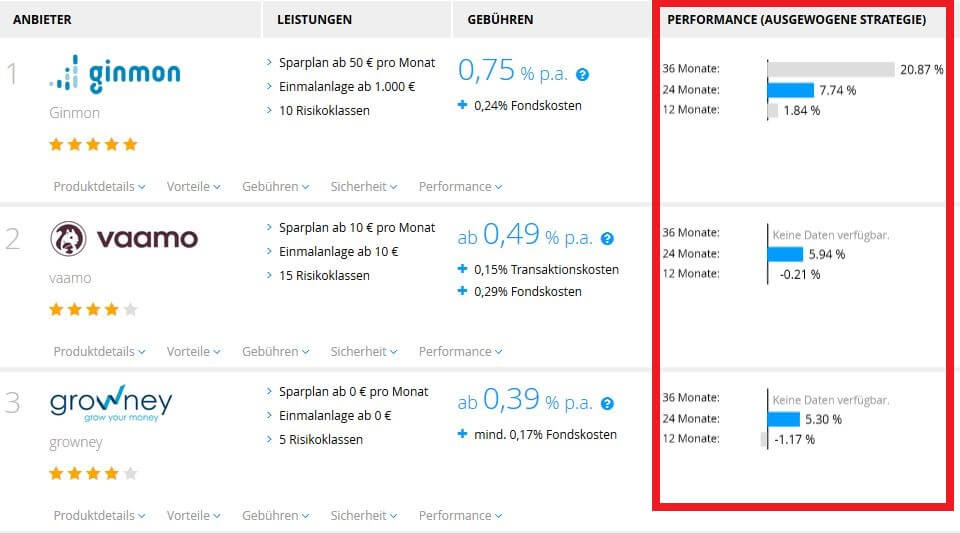

Of the Robo advisor comparison allows you to quickly and easily compare the performance of different robo advisors and perform yield tuning! So performed ginmon with 7.74 % return over 24 months 2.44 % above that of the robo advisors growney. With an investment sum of 10,000 euros, this already corresponds to 244 euros in additional profit. You see – an easy-to-perform Robo Advisor comparison on the Internet is worth it!

!! Image linked to the provider ginmon. All providers can be found in the comparison above on this page !!

A roboadvisor comparison is worthwhile

What you can learn here

- A roboadvisor comparison is worthwhile

- Worth knowing about the Roboadvisor comparison

- Robo advisor: What are the advantages?

- And what are the disadvantages of investing with robo advisors?

- Roboadvisor comparison: how safe is investing with a roboadvisor?

- Robo advisor comparison: active or passive risk management

- Conclusion: Should You Invest With Robo Advisors?

- Check whether investing with a robo advisor is an option for you

- Have the advantages of a robo advisor convinced you? Then let's get down to business: Compare the providers!

- Decide on a provider and open a custody account at the partner bank.

- That's it. Now let the robo advisor work for you with a regular savings plan!

- Robo advisor – answers at a glance

Taking a closer look at the fees, services and returns offered by robo advisors is worthwhile. That's why the Roboadvisor comparison enables you to compare product details, advantages, security and performance data in a clear, quick and easy way. This makes it easy for you to find the right roboadvisor for you.

Worth knowing about the Roboadvisor comparison

Regardless of the above Robo Advisor comparison, Robo Advisors (in German: robot advisors) take a lot of work off the investor's shoulders thanks to their algorithm. Another advantage of the investment program is the automated risk assessment. This means that only shares that match the risk profile of the investor are placed in the portfolio. Accordingly, stock selection is not influenced by emotions. A big advantage, as emotions often lead to hasty buy or sell decisions, which can severely reduce your returns due to fees.

Robo advisor: What are the advantages?

A robo-advisor is the ideal solution if you don't want to worry about your investments. Finally introduces you the provider puts together a portfolio that suits your risk profile and takes care of the administration.

Another advantage of robo advisors is their speed. Since they are fully automated, they can react immediately to what is happening in the market. They are therefore usually faster than human advisors. Another advantage of a robo advisor is the low minimum investment amounts and savings plan amounts. Savings plans can be concluded from as little as 10 euros. Most robo advisors have a user-friendly software interface. The installation is possible with just a few mouse clicks. In addition, robo advisors have transparent cost structures, making it easy to see what costs to pay.

And what are the disadvantages of investing with robo advisors?

A robo advisor is rather unsuitable for people who are well versed in the field of financial investments. This group of people often already owns one cheap depot and uses it gladly and extensively for trades. By not using a robo-advisor, you can save some fees. But also consider that the losses due to mistakes can be many times higher than the saved fee. In addition, it is often better to do something that is not perfect than to succumb to perfectionism and in the end not to be able to implement it at all.

Robo advisors work according to an algorithm based on criteria previously defined by the investor. As a result, there are clear decisions as to whether to invest or not. Due to the standardized investment decisions of the program, a piece of the individuality of the investment is lost. After all, a highly efficient investment algorithm is not a chat with the bank advisor. In my opinion, however, this disadvantage is outweighed many times over by the significantly lower costs. Furthermore, it is important to keep an overview of the costs, especially with small investment amounts. The reason for this is as follows: With most advisors, the percentage fee increases the smaller the investment amount. However, even for small amounts, the fee is well below the expected return. In the long term, investing with robo-advisors is worthwhile even for small deposit volumes and savings. But don't worry: All fees are clearly listed in the "Fees" tab in the comparison calculator.

| TIP:Even with the best risk management of the robo-advisor, the investment in shares is always subject to certain fluctuations. This form of investment is therefore not suitable for short-term investments. Take for money that you need in the short term better cash account. Recommendation: In order to avoid negative returns, investors should invest their money in the stock market with a time horizon of at least five years. |

Robo advisor: where did the term come from?

The word roboadvisor comes from the English words robot and advisor. A robo-advisor is therefore a robot advisor. The spellings robo-advisor and robo-advisor are also common and are used interchangeably in this article.

Roboadvisor comparison: how safe is investing with a roboadvisor?

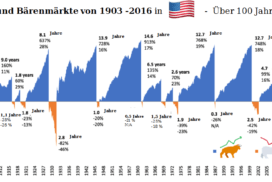

When investing with robo advisors, you become a co-owner of numerous companies through securities. Since these companies are constantly being revalued on the stock exchange, the current price is constantly falling and rising. As with any stock investment, it is also essential with robo advisors not to follow the herd blindly, but to question the causes and reasons for the fluctuations. Under no circumstances should a long-term investment strategy based on your risk profile be thrown overboard immediately after the first fluctuations.

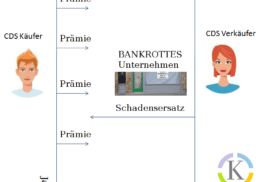

The majority of the providers invest the money of the investors in a custody account with a German partner bank. This bank is monitored by the Federal Financial Supervisory Authority (BaFin). In the event of bankruptcy of the robo-advisor, the money is protected as the bank is independent from the robo-advisor. Furthermore, securities in Germany are considered special assets (of the partner bank). This means that the assets are protected even if the bank becomes insolvent.

Robo advisor comparison: active or passive risk management

The issue of risk management is controversial among providers. On the one hand there are active robo advisors such as the German market leader scalable capital, and on the other hand there are passive advisors such as growney. Read more about active versus passive fund providers here.

Conclusion: Should You Invest With Robo Advisors?

Here is my conclusion and a recommended course of action for investing with robo-advisors. After all, you want to know: what further steps are advisable!

Total Time:

Check whether investing with a robo advisor is an option for you

The article provides some basic information about investing with robo-advisors. You are of course welcome to use this information for your decision! A robo advisor is particularly suitable for people who want support with investing but shy away from classic advice.

Have the advantages of a robo advisor convinced you? Then let's get down to business: Compare the providers!

Compare with that Comparison calculator on this page the providers with each other. What costs are incurred? What returns has the product generated in the past? What advantages does the provider offer? What is the minimum investment amount? At Scalable Capital, for example, investors can become customers with a minimum investment of 10,000 euros. With Gro

wney, on the other hand, does not even require a minimum deposit.

Decide on a provider and open a custody account at the partner bank.

This step is also very easy, because the providers are all linked in the comparison calculator above.

That's it. Now let the robo advisor work for you with a regular savings plan!

Relax with it. The stock market is a roller coaster ride. Don't let price losses discourage you. They offer a great opportunity to replenish your portfolio at a reduced price.

Robo advisor – answers at a glance

What is a robo advisor?

A robo advisor is a computer program that invests customers' money in securities (usually index funds, ETFs). You can find many of the popular roboadvisors in our cost comparison.

How is the process?

After opening your Robo advisor accounts you must first answer questions about your willingness to take risks. What is the worst loss you can handle? Based on this information and taking your financial background into account, the robo invests your money for you or just gives you suitable suggestions.

What are the next steps

After the Robo Advisor If you know about your financial situation and your risk profile, you do not have to do anything else. The algorithm manages the depot and takes care of buying and selling the securities.

What can a good robo advisor cost?

The robo advisor does a lot of the work for the less financially savvy. This service is not free. Still make it good providers keep the total costs under 1 percent of the investment sum per year.

Who is a robo advisor suitable for?

A robo-advisor is the ideal solution if you don't want to worry about your investments. Finally introduces you the provider puts together a portfolio that suits your risk profile and takes care of the administration. See also: Benefits of robo advisors.

Who is a robo advisor not suitable for?

A robo advisor is rather unsuitable for people who are well versed in the field of financial investments. This group of people often already owns one cheap depot and uses it gladly and extensively for trades. By not using a robo-advisor, you can save some fees. But also consider that the losses due to mistakes can be many times higher than the saved fee. In addition, it is often better to do something that is not perfect than to succumb to perfectionism and in the end not to be able to implement it at all. See also: Disadvantages of robo advisors.

Which robo advisors do you recommend?

Easy-to-use and cheap robo advisors with sufficient risk classes are used by Quirion or Growney are offered. You can find a test report for Growney here.

If you already have more concrete ideas about your investment, the provider world invest Worth a look. (Weltinvest is currently offering a bonus of up to 100 euros. Conditions for this on the provider side).

Final note: This guide article is objectively researched and independently created. In order to be able to operate the website, some links to providers are remunerated under certain circumstances. Important to know: There are no extra costs for you!

Image Sources:

Exclamation mark "pro tip": Pixabay.com. User: Maklay62. CCO Crative Commons license

Robot: Pixabay.com. User: Clker-Free-Vector-Images CCO Creative Commons license