A Credit line without Schufa is a call credit that is granted without checking the Schufa file. A line of credit is similar to the usually somewhat more expensive overdraft facility with the checking account. This is because overdraft facilities and overdraft facilities are lines of credit that you only draw on when needed. In addition, unlike an overdraft facility, a line of credit is not linked to the Girokonto and can be taken out independently of it. Another advantage: a credit line is generally cheaper than an overdraft facility.

In contrast to an installment loan, there are no fixed repayment installments for a credit line, which means that the borrower remains more flexible, but is also responsible for making their own repayments.

13 facts about the credit line without Schufa

What you can learn here

- 13 facts about the credit line without Schufa

- Where can I get a credit line without Schufa?

- What is a credit line?

- Overdraft facility vs credit line vs installment loan

- How do disbursement and repayment work with a credit line?

- How quickly is the credit line on the account?

- How does a credit line affect the Schufa?

- Which is better: credit line or installment loan?

- What are the disadvantages and risks of a credit line?

- For whom is a credit line worthwhile?

- Conclusion on the credit line

- At the time of retrieval, a negative Schufa entry is irrelevant

- However, if you apply for a credit line, you should not have any negative entries

- Unfortunately, there is not a single credit line without a Schufa query. alternative: Credit despite negative credit bureau

- Credit line interest rates are variable - the bank can adjust them at a later date.

- Framework loans are more flexible than installment loans

- Credit line interest rates are higher than installment loan interest rates

- Framework loans are only paid out when required, whereas installment loans are paid out after application

- In contrast to overdraft facilities, credit lines are not tied to the Girokonto of the principal bank

- Framework loans are flexible in terms of repayment and do not have fixed monthly repayment installments

- In most cases, a small minimum repayment of 2 percent of the loan amount or at least 50 euros is due

- With credit lines, unscheduled repayments are possible at any time and at no extra cost

- Framework loans are more suitable for short-term financial injections to bridge a period of 1 to 12 months. Installment loans, on the other hand, are more suitable for longer-term purchases such as cars, or Furniture where Credit terms of more than 12 months are common.

- Tip: The ING credit line is interest-free for 3 months. Info here*

Where can I get a credit line without Schufa?

If a negative Schufa entry is imminent, you can apply for any credit line, because once set up, there will be no further Schufa query when the money is drawn down. If the negative credit bureau However, if the entry already exists before the application, it will be difficult.

In my research, I could not find a provider of a credit line without a Schufa query. There is no credit line without Schufa. In fact, there are currently only 5 providers that offer credit lines online. There are also offers from some regional savings banks and VR banks. However, none of the providers offer a credit line without Schufa. This is also due to the fact that all German banks are obliged to check the creditworthiness of their customers. Although you can do without the Schufa, you would then have to request a different file such as Crif or Info Score and the result would be exactly the same.

The ING credit line is a particularly favorable offer. ING Bank grants the credit line at fixed conditions. This means that the interest rate is fixed in advance and there are no bait-and-switch offers that later turn out to be costly. In addition, this credit line is interest-free for the first 3 months. Find out everything else here*.

| Offerer | Effective annual interest | line of credit | Credit check upon conclusion | Credit check on call |

|---|---|---|---|---|

| ING [recommendation] >> Further information | 3 months 0 % interest; thereafter 10.29 % APR (irrespective of credit rating) | 2.500 € – 25.000 € | Schufa Query: Yes | Schufa Query: No |

| Cashpresso | 14.99 % (regardless of credit rating) | 20 € – 1.500 € | Schufa Query: Yes Crif query: Yes | Schufa Query: No Crif query: No |

| Easycredit | 4.99 % - 15.99 % (2/3 effective interest rate: 11.39 %) | 1.000 € – 75.000 € | Schufa Query: Yes | Schufa Query: No |

| Ikano Bank | 3 months 6.99 % APR; thereafter 9.99 % APR (irrespective of credit rating) | 1.000 € – 50.000 € | Schufa: Yes Info Score: yes Creditreform: yes (for self-employed persons) | Schufa Query: No |

| Volkswagen Bank | 12 months 8.99 % APR; thereafter 10.49 % APR (irrespective of credit rating) | 2.500 € – 25.000 € | Schufa Query: Yes | Schufa Query: No |

| Oyak Anchor Bank | No more offers for a credit line | |||

| SWK | No more offers for a credit line |

What is a credit line?

A line of credit, also known as a call credit, is a flexible form of financing similar to the better-known overdraft facility that you know from your bank's Girokonto. The line of credit grants you a predetermined credit line that can be used as needed, but does not have to be used. A credit line is therefore a Option for additional moneyThe maximum loan amount and the interest due on it are agreed in advance. Interest is only charged on the amount actually drawn down. The unused portion of the credit line remains available but interest-free.

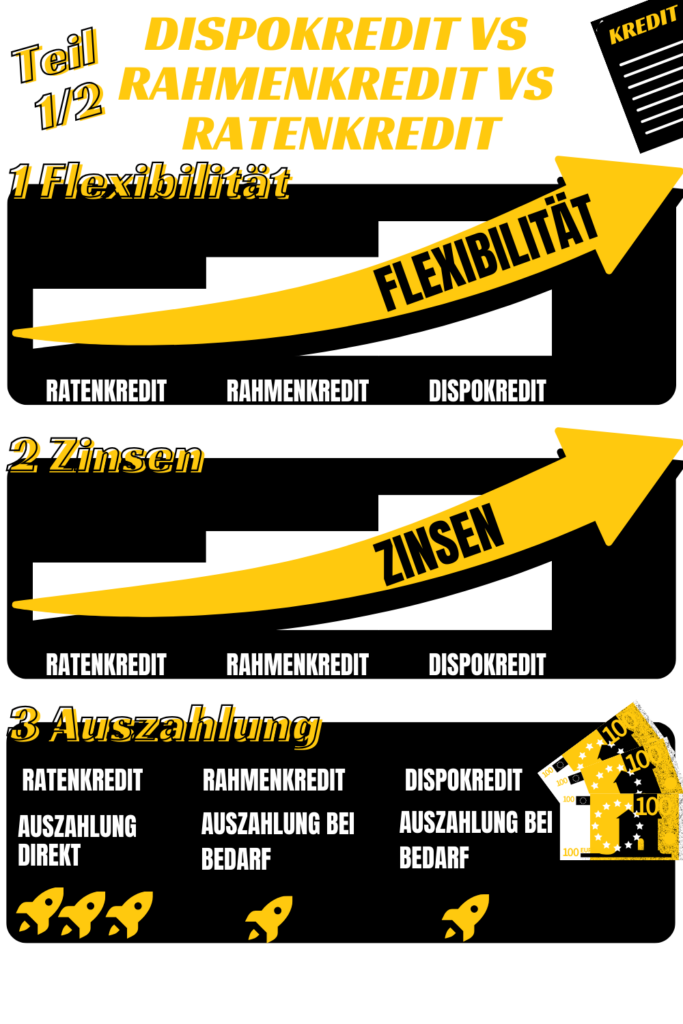

Compared to overdraft facilities, credit lines generally offer lower interest rates. Compared to installment loans however, the interest rates are higher for a credit line. The higher price is due to the more flexible availability of the credit line compared to a traditional installment loan.

Overdraft facility vs credit line vs installment loan

- Overdraft facility interest rates and overdraft facility interest rates are variable - the bank can adjust them at a later date.

- Installment loan interest rates are fixed over the term

- Overdraft and credit lines are more flexible than installment loans

- Installment loans are cheaper than overdraft and credit lines

- Installment loans are paid out directly, overdraft and credit lines only when required

- The overdraft facility is linked to the house bank's Girokonto, the other two loans are independent of the bank.

- Installment loans have fixed monthly repayment rates, while overdraft facilities and credit lines are flexible in terms of repayment.

- Installment loans are suitable for larger purchases such as carsor Furniture. Overdraft facilities and credit lines are short-term financial injections for bridging.

| overdraft facility | Framework loan | installment loan |

|---|---|---|

| Credit line, payout if required | Credit line, disbursement on demand | Payment directly after application |

| bound to Girokonto | Independent of the house bank | Independent of the house bank |

| Interest rates most expensive | Interest rates moderately expensive | Most favorable interest rates |

| Flexibly repayable, without fixed installments | Flexibly repayable, without fixed installments | Fixed rates |

| Short-term demand | Short-term demand | for larger purchases (car, motorcycle, expensive furniture) |

| High risk of over-indebtedness | High risk of over-indebtedness | Low risk of over-indebtedness |

How do disbursement and repayment work with a credit line?

A credit line works like a flexible pot of money that you can use on demand as required. You don't have to draw the entire approved loan amount. You only draw down what you need at the time. The drawdown usually takes place online. So you are flexible and save interestbecause the bank only calculates the interest on the credit line on the amount you have drawn down.

payout

The amount drawn down is paid out to your deposited reference account. The drawdown is made via online banking. With an approved drawdown loan, the drawdown is made No further examination and the bank transfers the Money directly to your reference account. The payout process is therefore much faster than with a classic installment loan. With many banks, there are no fixed drawdown amounts that you have to take out, but you can also transfer small amounts yourself from time to time from your drawdown account to your Girokonto.

repayment

How you repay the installments depends on the bank. Some want 2 % of the sum repaid each month or recommend repaying at least 50 euros a month. Other banks like the ING are more relaxed*, and leave the amount of the repayment entirely up to you.

This means you can pay back significantly more than the banks recommend or even repay the entire loan at once. To do this, simply transfer the amount to your loan account and you're done. Once the money has been credited to your loan account, no further interest or costs will be incurred.

How quickly is the credit line on the account?

With a line of credit, you simply transfer money yourself from your line of credit account to your Girokonto deposited there. Your credit line is available immediately after setting up the credit line account.

If your Girokonto is with the same bank as the line of credit, the payout only takes a few seconds.

If your Girokonto is with another bank, it usually takes one bank working day for the loan amount to reach your account.

Diba credit line: how fast?

The amount called from the Credit line from ING* is within seconds on your deposited Girokonto, if this is also with ING. If the reference account is with another bank, the Diba line of credit will take as long as a regular transfer, i.e. approx. 1 bank working day.

How does a credit line affect the Schufa?

The request for a credit line does not affect the Schufa score, as banks are obliged to make neutral requests for conditions.

If you have serviced your credit line over a longer period of time without any incidents, it can be assumed that the Schufa will rate this positively, as you have proven your reliability by repaying the loan.

Which is better: credit line or installment loan?

The credit line is little known and is often replaced by installment credit or overdraft facilities. But this is partly wrong, because in many situations, a credit line is the best solution. A credit line has the following advantages over an installment loan:

- You can take out a credit line as Financial buffer set up without incurring any costs

- A credit line is for interim financing is particularly suitable as it is cheaper than an overdraft facility and can be drawn down on the same day.

- You can therefore also use a credit line to short-term debt rescheduling use

- at impending negative Schufa entry the credit line is also better, because once a credit line has been set up, there is no further Schufa query when it is called up.

1) With a credit line, you have an additional financial buffer - without set-up costs

If your Girokonto does not have enough money in some months to cover all your bills and debits, you can use the overdraft facility. This happens automatically. The disadvantage: an overdraft facility is usually very expensive and is more profitable for the bank.

It therefore makes more sense to a credit line which you can use to raise the capital you need yourself. This saves you the cost of the more expensive overdraft interest. Ing, for example, charges % 10.99 for overdraft interest, but grants the credit line at 3 months free of charge*, i.e. at 0 % interest. As long as you do not draw down the loan, there are no costs. The money storage option is therefore free of charge and recommended for everyone.

2) A framework loan is ideal as interim financing up to a maximum of 12 months

But even if you need money immediately for a purchase, but only receive money at a later date, a Bridge financing can be used well via a call credit. With a credit line, you can access the amount directly and thus avoid follow-up costs (e.g. reminder fees). You then pay interest on the credit line until the expected money - such as vacation pay, Christmas bonus or a professional bonus payment or birthday present - is received on your Girokonto.

A credit line is usually advantageous if you want to pay for Borrow money for 1 to 12 months would like. An installment loan is usually more advantageous for a term of several years, as the interest rate advantage then outweighs the lower flexibility.

3) A credit line is suitable for rescheduling more expensive overdrafts

If you have already exhausted your overdraft facility and are annoyed by the high interest rates and low amounts, a drawdown loan is the solution. To do this, you draw the money you need to balance your Girokonto from your credit line account. This eliminates the more expensive overdraft interest and you repay the credit line at better conditions instead.

If you use the credit line for debt restructuring, you should use the credit line in fixed installments repay. If you can't repay the installments within 12 months, it's better to take a installment loanas this is even cheaper.

4) In case of imminent negative entry

If there is a threat of a negative entry in the Schufa (e.g. 1st reminder arrives), it may be worth considering a credit line. There is no "credit line without Schufa", which is nonsense.

BUTWhen the loan amount is drawn down, there is no longer a Schufa query, which is why it is advisable to take out a loan if there is an imminent negative entry in the Schufa. This ensures your future solvency. The credit line gives you access to an additional cash buffer from which you can draw money at any time - once set up - even if you have a negative Schufa entry - without any further Schufa check. Your creditworthiness is only checked (via Schufa or another credit agency) when you take out the loan.

What are the disadvantages and risks of a credit line?

Of course, the call credit also has some disadvantages and risks, which are listed here once again.

- Although the interest rates are lower for a credit line than for an overdraft facility, the credit line is somewhat more expensive than an installment loan.

- A Schufa query is made when the credit facility is taken out. There is no credit line without Schufa, which is different for installment loans.

- There is a risk of over-indebtedness as there are no regular repayments

- Interest rates are variable and can rise, which makes planning difficult.

- If you constantly draw on the credit line, you will no longer have a buffer for emergencies and will also pay higher interest than with an installment loan.

- Sometimes you have a minimum repayment of 2% of the initial loan or around 50 euros

A credit line is a loan where the interest rates are not contractually fixed, but remain variable. This means that the bank regularly adjusts the interest rates to the current market interest rates. That's why you don't know exactly how much you'll have to pay in interest at the beginning. This makes it really difficult to plan the total costs in the long term. In addition to the higher interest rates, this is also a reason why you should not take out a credit line for longer than 12 months at a time.

The line of credit can also be quite tempting to keep transferring money from it because it's so easily available. But remember, every time you use it, the bank will charge you interest. This can be quite expensive in the long run.

The bank reports the credit line to Schufa. This can affect your credit rating. A problem with a later construction financing or one car loan is not to be feared. If you don't miss the payment deadlines for the credit line, your credit rating will probably even improve over time. Because from the bank's point of view, you are a reliable debtor.

For whom is a credit line worthwhile?

Credit lines are one of the most flexible financing options. For this reason, credit lines are particularly suitable for entrepreneurs and tradespeople who regularly need short-term money to buy goods. The ability to draw down varying amounts offers these companies the flexibility they need to cope with seasonal fluctuations in business or unforeseen expenses, for example.

However, a credit line can also be a sensible option when it comes to rescheduling overdraft and credit card debt, as the interest rates are generally lower than for these other types of loan. However, it is important that you set yourself clear repayment targets and remain disciplined. You should not have to use the credit line permanently or even increase it.

You should also use the credit line Do not use for longer than 12 monthsas this requires a installment loan is more suitable. Installment loans have fixed installments that can be calculated in advance and lower interest rates. Due to the constant availability of the cash buffer via the credit line, there is a risk of losing track of repayments.

Conclusion on the credit line

In summary, framework loans offer flexibility and spontaneous availability, but have slightly higher interest rates than installment loans. They tend to serve short-term financial needs, while installment loans are more suitable for larger, planned expenses.

Unfortunately, there are no credit lines without a Schufa query. If the Schufa is negative, a Credit despite negative credit bureau from Smava* or bon credit* an.

When it comes to credit lines, the ING credit line* One of the best ways to cover your need for a quick cash injection. With an interest-free phase of 3 months, it is particularly convincing compared to the other options.

Framework loans are more flexible than installment loans and have variable interest rates that can be subsequently adjusted by the bank if interest rates rise. The interest rates for credit lines are generally higher than those for installment loans, but lower than overdraft rates. This is one of the reasons why overdraft facilities are considered a middle ground between an overdraft facility and an installment loan.

In contrast to installment loans, credit lines are only paid out when needed, which allows you to use them particularly spontaneously. In addition, credit lines are not tied to the Girokonto of your bank like overdraft facilities.

Framework loans offer you very flexible repayment options without fixed monthly installments. Some banks have a minimum repayment of 2 percent of the loan amount or 50 euros, which is intended to counteract your over-indebtedness.

An unscheduled repayment without additional costs is of course possible at any time with a credit line. Framework loans are therefore more suitable as a short-term financial solution for bridging, while installment loans are often used for larger purchases such as cars or furniture.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.