In the Swiss credit ranking you will find the seven best German loan providers for one Credit from Swiss banks despite negative credit bureau and without any upfront costs. The Swiss credit providers can do one credit without mediate to a foreign bank. Alternatively, these providers also offer you a cheaper loan from Germany. This credit will then despite a negative entry in the Schufa forgive. In the overview of Swiss credit providers you will also find an evaluation of the seriousness of the Swiss credit providers.

The most recommended provider for a Swiss loan without Schufa is bon credit. Thanks to its more than 40 years of experience in granting loans in difficult cases, the provider scores with a extremely fast processing your request. In addition, Bon-credit has one of the highest acceptance rates of his credit inquiries from all Swiss credit providers without Credit bureau and also assigns one Credit despite sick pay if you are unable to work for a long time. If you have bad credit, you should bon credit* Definitely consider for your credit needs.

In order to be able to compare conditions better, it can be worth making several inquiries at the same time. It is recommended at 2-3 providers an inquiry and then decide on the best loan offer! The loan request is free of charge and non-binding with all providers.

Swiss credit providers: The best loans without Schufa in the Swiss credit ranking

What you can learn here

- Swiss credit providers: The best loans without Schufa in the Swiss credit ranking

- Seriousness in Swiss loans 🤝

- The requirements for taking out a Swiss loan from the ranking list

- For whom a Swiss loan is suitable

- The providers of the Swiss credit ranking in detail

- #1 of the Swiss credit ranking: Bon-Kredit is the best provider of Swiss loans

- #2 of the Swiss credit ranking: Maxda

- #3 of the Swiss credit ranking: Sigma Credit Bank

- #4 of the Swiss credit ranking: Creditolo

- #5 of the Swiss credit ranking: Ferratum

- #6 of the Swiss credit ranking: Credimaxx

- #7 of the Swiss credit ranking: Auxmoney

| Swiss credit provider or intermediary | seriousness | To the provider | |

|---|---|---|---|

| #1: Receipt credit 4,9/5 (eKomi) |  Interest charges: approx. 8 % at €10,000 & 72 months Loan Amount: €100 to €120,000 Minimum income: €1,300 net per month Duration: 12 to 120 months | Seriousness: 5/5 points 💰 without pre-costs: ✔️ 📞 Availability: free phone number, Whatsapp, Facebook, email ✔️ 👍 No credit and insolvency counseling from a single source✔️ 👍 No sale of expensive additional products:✔️ 💌 No sending the documents with expensive cash on delivery letters ✔️ | To the provider: Bon-kredit.de |

| #2: Maxda 4,8/5 (eKomi) |  Interest charges:approx. 8.9 % pa rms. at €10,000 & 36 months Loan Amount: €1,500 to €120,000 Minimum income: €1,260 net per month Duration: 12 to 60 months | Seriousness: 4/5 points 💰 without pre-costs: ✔️ 📞 Availability: free phone number, Whatsapp, Facebook, email ✔️ 👍 No credit and insolvency counseling from a single source✔️ 👍 No sale of expensive additional products ❌ - Explanation: Maxda sometimes requires residual debt insurance to be taken out 💌 No sending the documents with expensive cash on delivery letters ✔️ | To the provider: Maxda.de |

| #3: Sigma Kreditbank (from Liechtenstein) 4,8/5 (eKomi/Maxda) | Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months | Seriousness: 4/5 points 💰 without pre-costs: ✔️ 📞 Availability: free phone number, Whatsapp, Facebook, email ✔️ 👍 No credit and insolvency advice from a single source ✔️ 👍 No sale of expensive additional products ❌ - Explanation: High interest rates 💌 No sending the documents with expensive cash on delivery letters ✔️ | To the provider: Sigmacredit Bank via Maxda |

| #4: Creditolo 4,5/5 (trust pilot) |  Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months | Seriousness: 4/5 points 💰 without pre-costs: ✔️ 📞 Availability: free phone number, Whatsapp, Facebook, email ✔️ 👍 No credit and insolvency advice from a single source ✔️ 👍 No sale of expensive additional products ❌ - Explanation: High interest rates 💌 No sending the documents with expensive cash on delivery letters ✔️ | To the provider: Creditolo.de |

| #5: Ferratum (from Malta) 4,7/5 (eKomi) |  Interest charges:10,36 % + installment option Loan Amount: €50 - €1,000 for new customers €50 - €3,000 for existing customers Minimum income: €1,100 net per month Duration: 30 days - 180 days | Seriousness: 5/5 points 💰 without pre-costs: ✔️ 📞 Availability: free phone number, Whatsapp, Facebook, email ✔️ 👍 No credit and insolvency advice from a single source ✔️ 👍 No sale of expensive additional products:✔️ 💌 No sending the documents with expensive cash on delivery letters ✔️ | To the provider: Ferratum.de |

| #6: Credimaxx 4,9/5 (eKomi) |  Interest charges:approx. 7.9 % pa eff at €4,000 & 72 months Loan Amount: €500 to €300,000 Minimum income: €1,100 net per month Duration: 48 to 120 months | Seriousness: 5/5 points 💰 without pre-costs: ✔️ 📞 Availability: free phone number, Whatsapp, Facebook, email ✔️ 👍 No credit and insolvency advice from a single source ✔️ 👍 No sale of expensive additional products:✔️ 💌 No sending the documents with expensive cash on delivery letters ✔️ | To the provider: Credimaxx.de |

| #7: Auxmoney (Personal Loan) 4,8/5 (eKomi) | Interest charges:approx. 5.24 % pa eff at €13,300 & 84 months Loan Amount: €1,000 to €50,000 Minimum income: €1,000 net per month Duration: 12 to 84 months | Seriousness: 5/5 points 💰 without pre-costs: ✔️ 📞 Availability: free phone number, Whatsapp, Facebook, email ✔️ 👍 No credit and insolvency advice from a single source ✔️ 👍 No sale of expensive additional products:✔️ 💌 No sending the documents with expensive cash on delivery letters ✔️ | To the provider: Auxmoney.de |

Seriousness in Swiss loans 🤝

Loans without Schufa sticks to something dubious. Even today, this is often not the case without reason: because numerous dubious intermediaries demand horrendous fees and initial costs from potential borrowers with poor creditworthiness. Alarm bells should also ring if the lender also has one Insolvency advice from a single source offers. This insolvency advice is due to the existing conflict of interest untrustworthy. But also offering insurance at the same time leads to further - mostly unnecessary - costs for the borrower. Particularly explosive: Despite taking out insurance, customers do not always get the loan they want.

Reputable loan brokers, on the other hand, do not charge any fees in advance. Instead, they finance themselves through a brokerage commission. If you are part of a credit comparison If you find an offer for a Swiss loan, it is probably a reputable provider.

Reputable credit providers of Swiss loansn...

- give the Swiss credit without upfront costs 💰

- are about one normal or free phone number available 📞

- do not offer Credit and bankruptcy advice from a single source 🔥

- dispense with expensive additional products ✋

- Do not send documents cash on delivery 💌

- have an imprint 📃

The requirements for taking out a Swiss loan from the ranking list

Just because there is no Schufa entry does not mean that foreign lenders do not place any requirements on the borrower. In order to receive a "loan without Schufa" or a "Swiss loan", you have to the following conditions be fulfilled:

- Residence in Germany 🏠️

- German bank details 🏦

- Legal age 🧑

- Income of at least €1,100 📃

- Collateral for high loan amounts 🔐

With the collateral can salary assignments, land charges and other securities come into question. which Advantages and disadvantages of the different loan collateral can be found in the linked article.

Persons with an income of less than €1,100 cannot apply for a Swiss loan. This makes many Loans are very difficult for low earners, housewives, students, part-time workers and pensioners to obtain. But the post "Which bank gives credit for low income?“ shows how and from which bank you can still get a loan as a low earner. And if the credit is not granted, you can still find it at the end of the linked article 7 alternatives, how you can get access to money despite a small income

Schufa-free loans are completely anonymous

the payout of the loan is made anonymously after approval to the German checking account. Since the credit is not on file with credit bureaus like the Schufa, neither your employer, house bank nor landlord or anyone else will know about it.

Schufa-free loans are more expensive than installment loans

As the ranking of loans without Credit Bureau shows, the interest on these loans is also included 8 % and more above installment loans from German banks, as in many credit comparisons are to be found. German banks charge for installment loans about 4 %, for car loans 3 %. The higher interest rates on Swiss loans are due to the fact that the banks take an increased risk with this type of loan.

| credit type | Interest charges |

|---|---|

| Swiss credit without Schufa | 8 % interest |

| Installment loan with free use | 4 % interest |

| Installment loan with use as car loan | 3 % interest |

For whom a Swiss loan is suitable

Reputable Swiss loans are not just for Bad credit consumers suitable. People with a poor credit rating usually no longer receive any money in Germany and come across one when looking for one credit that everyone gets to a Schufa-free loan for Germans from Switzerland. People with poor credit ratings are therefore a large target group for Swiss credit. This often includes due to a lack of income students, Pensioner or people who already have one or more loans running. But a Swiss loan is also suitable for other people.

Because even self-employed have problems getting a loan in Germany due to the unrecognized proof of income. Therefore, many self-employed people are looking for a Swiss loan. But unfortunately, a Swiss loan for the self-employed is not easy to get. Because well-known providers like the Sigma bank grant loans exclusively to permanent employees with at least one year of employment. Therefore, the credit intermediaries mentioned are suitable as a self-employed person, who also bad credit to self employed loans forgive.

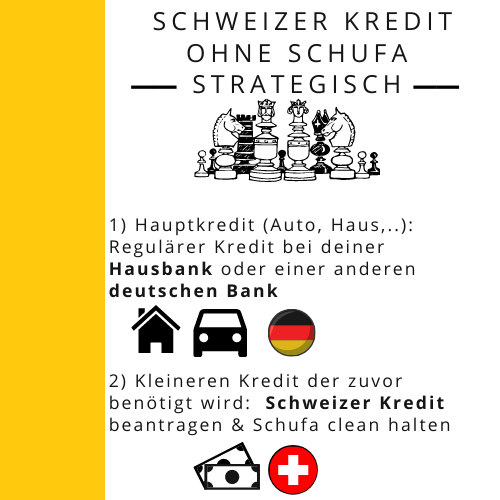

In the article Swiss loans for Germans we have another one third group for the a Swiss loan is suitable. If you have one soon construction financing or car financing But if you need a smaller loan for something else beforehand, it makes sense to contact the Schufa for the second loan not to bother unnecessarily. For this purpose, the Swiss loan is strategically used as a loan on the side deployed. This improves your conditions on the first loan. This strategic use of Swiss credit needs to be planned in advance, and we often do as well anonymous credit by the way designated.

The providers of the Swiss credit ranking in detail

#1 of the Swiss credit ranking list: Bon credit is the best provider of Swiss loans

- Best Provider for the loan without Schufa

- 7,500 euros for a Swiss loan without Schufa, up to 300,000 euros for a regular bank loan

- Bon-kredit arranges one for 95 % customers cheap regular bank loan, even with a negative entry

- Immediate approval within 24 hours

- about 40 years experience in credit brokerage

- Golden seal due to excellent customer reviews eKomi

- Runtimes from 12 to 120 months!

- even with bad creditworthiness and a negative Schufa entry

- credits for freelancers and the self-employed; No permanent position necessary

- Credit without upfront costs!

- Absolute discretion: Employer and house bank do not know anything about the loan

- minimum income: 1.300 €

#2 the Swiss credit ranking list: Maxda

- 7,500 euros for a Swiss loan without Schufa, up to 120,000 euros for a regular bank loan

- Term from 12 to 120 months!

- Credit without upfront costs!

- Absolute discretion: Employer and house bank do not know anything about the loan

- Debt rescheduling of previous loans to a cheaper loan possible

- Loans can sometimes only be concluded with expensive credit insurance

- minimum income: 1.260 €

#3 the Swiss credit ranking list: Sigma credit Bank

- Loan without Schufa from Liechtenstein

- 3 credits available:

- 3.500 €

- 5.000 €

- 7.500 €

- Duration: 40 months

- Fixed employment contract necessary

- At least 1 year for the 3.500 € credit

- At least 3 years for the other two loans

- Side loan for car, apartment, move, hobby & personal needs

- Credit without upfront costs!

- Absolute discretion: Employer and house bank do not know anything about the loan

- Debt rescheduling of previous loans to a cheaper loan possible

- Minimum income:

- 1.600 € for the 3.500 € credit

- 1.650 € for the 5.000 € credit

- 1.700 € for the 7.500 € credit

- When does the Sigma Kreditbank reject? - All 10 causes + explanation / Best alternatives

#4 the Swiss credit ranking list: Creditolo

- 7,500 euros for a Swiss loan without Schufa, up to 100,000 euros for a regular bank loan

- credit in difficult cases possible, credit-free payment, so without Schufa information

- Term from 12 to 120 months!

- Side loan for car, apartment, move, hobby & personal needs

- Credit without upfront costs!

- Absolute discretion: Employer and house bank do not know anything about the loan

- Debt rescheduling of previous loans to a cheaper loan possible

- minimum income: 1.260 €

#5 the Swiss credit ranking list: Ferratum

- Loan without proof of income from Malta

- The provider makes a Schufa request, but also grants a loan if the credit rating is moderate

- Installments and mini loans

- Credit without upfront costs!

- minimum income: 1.100 €

#6 the Swiss credit ranking list: Credimaxx

- 7,500 euros for a Swiss loan without Schufa, up to 100,000 euros for a regular bank loan

- Loans without Schufa from Switzerland and Liechtenstein

- Terms from 48 to 120 months!

- Switch to voucher credit for terms of less than 48 months!

- Side loan for car, apartment, move, hobby & personal needs

- Credit without upfront costs!

- Absolute discretion: Employer and house bank do not know anything about the loan

- Debt rescheduling of previous loans to a cheaper loan possible

- minimum income: 1.100 €

#7 the Swiss credit ranking list: Auxmoney

- credit from individuals

- Personal loan up to 50,000 euros

- Credit received from private individuals despite a negative Schufa score and poor creditworthiness

- Fixed installments and fixed interest over the entire term from 12 to 84 months!

- Absolutely discreet: Employers and house bank learn nothing!

- Credit financing is provided by private investors

- Credit without upfront costs!

- minimum income: 1.000 €