Many loan providers lure you with false promises of a loan without Credit bureau social media - perfidious scams for Rip-off applied. Thereby, loans with upfront costs, notary or cash on delivery fees are not legal in Germany. Nevertheless, these and similar fees are charged for loans without Schufa. Because by no means all providers who give loans without Schufa connection and credit check are reputable. How can you tell whether the loan without Credit Bureau is a serious offer or whether the alleged loan without proof of creditworthiness is just a rip-off? - Here we clarify how you can tell whether a Credit without Schufa serious is or is not. In doing so, we also criticize Schufa, which badmouths credit-free loans for economic interest.

What you can learn here

- 12 points that scream that the credit without Schufa is not serious

- 1. financial rehabilitation is offered instead of credit

- 2. prepaid credit card instead of credit without Schufa

- 3. advance fees are to be paid

- 2. Loans without and despite negative credit bureau are not serious if contract documents are sent cash on delivery.

- 3. A loan without and despite negative credit bureau is not serious if insurance has to be taken out to improve the credit rating

- 4. Loans despite negative credit bureau are not serious if consulting contracts have to be paid for

- 5. Loans despite negative credit bureau are not serious if expenses are claimed that are not proven.

- 6. Loans despite negative credit bureau are not serious if expensive advice hotlines have to be used.

- 7. Loans despite negative credit bureau are not serious if the costs are driven up by home visits

- 8. Loans despite negative credit bureau are not serious if debt advice is offered from a single source

- 9. Loans despite negative credit bureau are not serious if the over-indebted are promised insolvency advice from a partner company

- 10. Loans are not serious if mediated on social networks such as Facebook, Instagram or Pinterest.

- What you should do if the loan without Credit Bureau doesn't seem serious

- How you can unmask loan offers without Credit Bureau as not serious

- 1. Contact via mail or social media

- 2. Conditions too good to be true

- 3. The provider charges other fees besides interest

- 4. The loan can only be approved by an alleged notary or lawyer

- 5. Misspellings

- 6. Use of free e-mail addresses and private telephone numbers for communication

- 7. Many new Facebook friends with very good feedback

- 8. The "bank clerk" wants to show you his ID and similar documents

- 9. Dubious online portals

- After contacting them, you will recognize non-reputable loans without credit bureau by these characteristics

- 1. Immediate replies even when banks are normally closed

- 2. non-serious providers use peculiar and colorful contracts for the loan without Schufa

- 3. You should log into your online banking during the conversation or install a program for remote maintenance on your computer

- 4. Time pressure

- 5. Fees

- 6.) Dubious providers require access data to the bank

- If you have fallen victim to a non-credit bureau loan, the best thing to do is to do the following

- Is a loan without Schufa serious, or not?

- What does Schufa say about the seriousness of loans without Schufa

- Criticism of the Schufa study

- Loans without Schufa

- Reputable providers of credit without Credit bureau

- How can a reputable provider of loans without Credit Bureau be identified?

- Conclusion: Credit without Schufa - serious or not? – Use this checklist!

- You recognize non-serious providers of loans without Credit bureau:

- A loan without Credit Bureau is often serious if you can check these points:

- Healthy distrust does no harm in order to get a serious loan without Credit Bureau

- Not sure yet? Use the checklist for credit without credit bureau to avoid being taken in by dubious providers

12 points that scream that the credit without Schufa is not serious

1. financial rehabilitation is offered instead of credit

People report that instead of the promised "SCHUFA-free" loan, they only receive an offer of financial restructuring for a fee from Internet providers. If they want to apply for a loan of 1,500 euros, for example, they are charged a fee of 270 euros for supposed assistance. Whether these consumers will actually receive a loan anyway is uncertain. For the consumer, the financial restructuring often has no benefit and the situation looks questionable.

2. prepaid credit card instead of credit without Schufa

Some providers also try to arrange a prepaid credit card instead of the credit they actually want. These offers are often expensive for the consumer. The prepaid credit card often costs up to 100 euros in the first year. In addition, the prepaid card is useless for people who are looking for a loan. The credit that you can use with the credit card must be loaded in advance. So there is no credit.

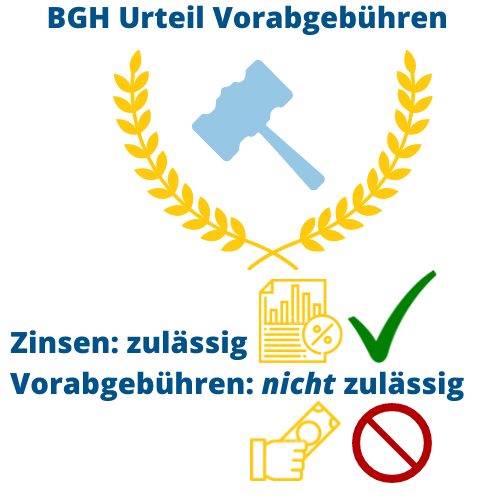

3. advance fees are to be paid

Processing fees for loans without Credit bureau in 2022 are actually a thing of the past. The well-known credit brokers from Loans without Schufa all no longer charge upfront fees. However, this also has to do with the fact that the Federal Court of Justice (BGH) declared preliminary fees to be inadmissible in two judgments dated May 13, 2014 (Az. XI ZR 170/13 and XI ZR 405/12). The BGH recognized a violation of § 307 Para. 3 Sentence 1 BGB in advance fees. For a loan without Credit Bureau, you only have to pay the previously agreed interest rate. If the provider has additional costs for the loan, he must include these in the interest. Because an additional fee or upfront fees are not legally permitted for loans. Thus, a loan without or despite negative credit bureau is completely safe not reputable if there are upfront fees to pay.

You can also subsequently request a refund of processing fees for a loan in writing. The limitation period is 3 years.

How to easily identify hidden fees from dubious loan providers without Credit Bureau.

If the debit interest rate differs significantly from the effective interest rate (e.g. 8 % pa and 10 % pa eff ) this is an indication of hidden charges. All costs are included in the effective interest rate, which is why it is always slightly higher. However, a small deviation such as 8 % pa and 8.3% pa eff is normal due to the calculation method and is not an indication of upfront fees. The interest rate differential should not exceed 0.5 percentage points.

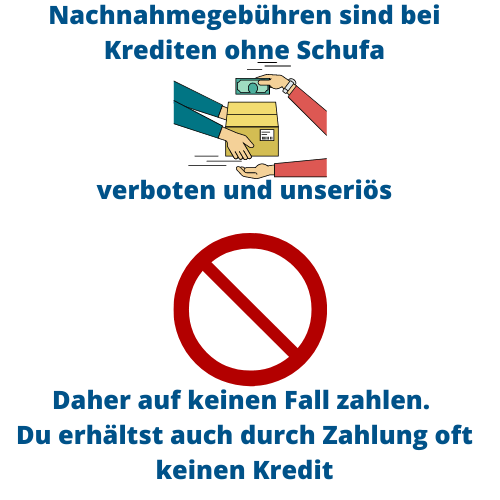

2. Loans without and despite negative credit bureau are not serious if contract documents are sent cash on delivery.

With dubious providers, sending documents cash on delivery is a common scam. As a result, the intermediary fee is collected immediately and the borrower hopes for a quick approval and willingly pays the cash on delivery fee.

However, with the cash on delivery shipment often only worthless documents sent. the Consumer Center reports that borrowers have already paid a finder's fee for documents for a financial restructuring, even though the customer wanted to apply for a loan. The money was gone and the credit was gone. Cash on delivery fees also fall under the aforementioned BGH judgments. The collection of cash on delivery fees for a loan without Schufa is therefore against the law and not practice reputable provider of loans despite negative credit bureau, which you can find in the linked overview.

3. A loan without and despite negative credit bureau is not serious if insurance has to be taken out to improve the credit rating

By taking out additional insurance through subsidiaries, non-serious providers of loans without Credit bureau can circumvent the two BGH judgments mentioned at the beginning. It is often advertised that insurance is necessary if the borrower has a bad credit rating in order to make lending possible. But that is nonsense and the statements are often not tenable and fictitious. There are some banks that do Loans even with bad credit can forgive without a residual debt insurance or comparable nonsense being demanded.

Because residual debt insurance often only generates fees and dubious credit providers try to involve the consumer in the credit default risk. Bearing the risk of default is the commercial risk of the lender. In addition, that risk is often more than well compensated for by the higher interest rates on loans without Credit Bureau.

Residual debt insurance thus only benefits the providers. They neither significantly improve the creditworthiness of the borrower nor do they guarantee a loan agreement. Therefore, insurance that is taken out together with a loan is not reputable and you should look for a reputable one Credit despite Schufa Keeping an eye out.

4. Loans despite negative credit bureau are not serious if consulting contracts have to be paid for

Loans must be able to pay for themselves through interest alone. If a provider wants to be paid for consulting contracts for financial restructuring from a loan without Credit Bureau, that is absolutely dubious. Because interest is the sole payment in BGB § 488 paragraph 1 sentence 2 BGB for a loan. Therefore, loan sharks are forbidden to pass on their internal costs to their customers by creating consulting contracts. Therefore, do not fall for this illegal scam of dubious providers.

5. Loans despite negative credit bureau are not serious if expenses are claimed that are not proven.

Loans must be able to pay for themselves through interest alone. If a provider wants to be reimbursed for other expenses from a loan without Credit Bureau, that is absolutely dubious. Because interest is the sole payment in BGB § 488 paragraph 1 sentence 2 BGB for a loan. If the provider's expenses are not even proven, that also leaves a stale aftertaste. Therefore, do not fall for this illegal scam of dubious providers.

6. Loans despite negative credit bureau are not serious if expensive advice hotlines have to be used.

Reputable providers of loans without Credit Bureau can be reached via normal or free 0800 numbers. Paid advice hotlines and 0190 numbers are not a sign of seriousness.

7. Loans despite negative credit bureau are not serious if the costs are driven up by home visits

In the case of home visits, dubious insurance policies, contracts for capital-forming benefits or dubious financial investments are offered. The loan sharks urge you to sign, pointing out that the bank needs collateral. This leads to growing obligations as you now have to bear additional costs. Sometimes this even reduces the chance of getting a loan because your disposable income is lower. The insurance agent will probably not give you this information. After all, he earns a lot from the brokerage commission for superfluous insurance for home visits.

8. Loans despite negative credit bureau are not serious if debt advice is offered from a single source

Lending and financial restructuring from a single source is a strong conflict of interest. While many intermediaries are looking for the highest possible loan amount when lending (maximum turnover!), it is necessary to reduce liabilities as much as possible in the context of real financial restructuring. Therefore, your interests will not be well represented when lending and debt advice from your hand.

Independent debt counseling provides far better services here. In addition, government debt counseling is often free of charge and actually represents your interests.

If you are offered debt advice from a single source including a debt restructuring loan, the only thing that matters to the intermediary is to inflate the loan as much as possible in order to maximize his commission. This will only slide you deeper into the spiral of debt and your finances will by no means be "rehabilitated".

9. Loans despite negative credit bureau are not serious if the over-indebted are promised insolvency advice from a partner company

Due to the conflict of interest between maximizing credit on the one hand and insolvency advice on the other hand, a partner company is not a good choice for insolvency advice. Instead, contact a state debt counseling center in your area.

10. Loans are not serious if mediated on social networks such as Facebook, Instagram or Pinterest.

Criminals create fake profiles on Facebook. Then they send lots of friend requests or write lots of comments in Facebook groups. Dubious providers of loans without Credit Bureau lure with high amounts of money, low interest rates and loose conditions for lendinge. It is often advertised that the loan is Schufa-free. In the end, many of these providers make a lot of money in upfront fees but never actually give out a loan to needy borrowers.

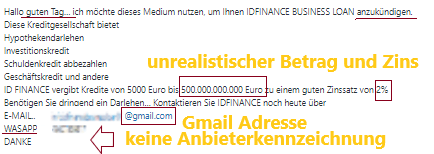

Here are a few examples of dubious offers for loans without Schufa. The posts come from Facebook comments or comments on WordPress. Details such as name, phone number and email have been changed.

Many thanks to Susan James who helped me get this loan. I will be forever grateful to you, Madame, I will forever bear witness to your good company. I will advise anyone needing credit to contact Miss Susan James's credit society for help. This is her direct email via: (susanjameskredit@gmail.com) Or WhatsApp: +1 (716) 939-9848.

Example of a dubious loan offer

I would like to use this medium to remind all loan seekers to be very careful as there are scams everywhere. A few months ago I was financially tight and due to my desperation I was scammed by several online lenders. I had almost given up hope until a friend referred me to a very reliable lender named Karin Sabine who lent me an unsecured loan of EUR 390,000.00 within 24 hours hassle free. If you are in need of a loan, contact them now via email: unerioserkredit@gmail.com or WhatsApp +1 (579) 247 6562.

Example of a dubious loan offer

Do you need an urgent loan to pay off your debt or do you need an equity loan to improve your business? Have you been turned down by banks and other financial agencies? Do you need a loan consolidation or mortgage? Look no further because we are here to make all your financial woes a thing of the past. Contact us by email:

dubiouscredit@gmail.com

This is Ocean Finance Mortgages. We offer loans to interested parties at a favorable interest rate of 2%. The bandwidth ranges from 5,000.00 euros to a maximum of 100,000,000.00 euros

Example of a dubious loan offer

What you should do if the loan without Credit Bureau doesn't seem serious

If you receive an offer for a non-Schufa loan from a dubious source, your Alarm bells are ringing. In the case of the following points, you should immediately stop all further communication and throw the supposed loan into the wind:

1. You receive a loan offer from social media like Facebook, WhatsApp or Instagram. It is a scam that is often committed even by spam bots. No reputable bank offers customers an offer for a loan via social media.

2. Never answer questions about your personal circumstances, your income or other existing financial obligations with dubious providers of loans without Credit Bureau. If you are prompted for a reply by email, look carefully at the email address. Does the bank only have a Yahoo or Gmail address and a reputable sounding name? Anyone can create such an address online in 2 minutes.

3. Never pay upfront fees or express fees with services like Western Union or Money Gram. But even if you are asked to pay with vouchers, you should stop the communication immediately.

4. Google the bank and look in the imprint where the lender is based. What impression does the bank's website make on you? Is there one at all? Listen to your gut feeling to see if everything is going right here.

How you can unmask loan offers without Credit Bureau as not serious

1. Contact via mail or social media

If contact is made via Whatsapp or only social media Whatsapp or e-mail are used. Reputable credit providers have a website with an imprint. This always shows the place of business.

2. Conditions too good to be true

When unusual promises are made. Loans without Schufa always have higher interest rates than regular installment loans. If a provider offers you a particularly low interest rate or does not require a credit check, the offer is not serious

3. The provider charges other fees besides interest

If again and again new and different fees are required, they probably just want to rip you off. A loan without Credit Bureau should only charge interest as a fee. You don't have to pay any taxes, administration fees, activation codes, money laundering certificates, insurance or travel expenses according to the law. If these or similar fees are demanded of you, you can expose the provider as not serious. Reputable providers of Loans without Schufa follow this rule!

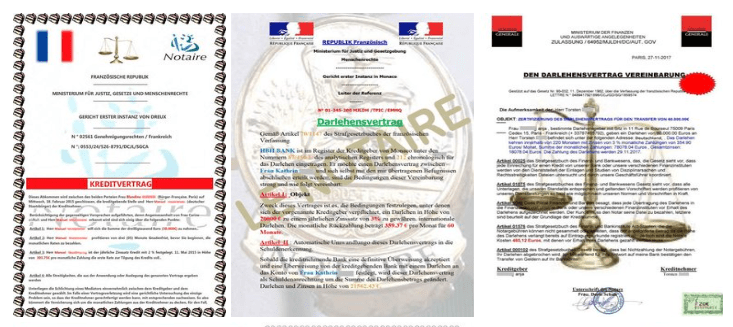

4. The loan can only be approved by an alleged notary or lawyer

If the loan provider uses a lawyer or notary to process the loan.

5. Misspellings

Spelling mistakes and clumsy German in advertisements, comments and fake profiles is a clear sign of a dubious provider.

6. Use of free e-mail addresses and private telephone numbers for communication

Using a private email address or phone number for communication

7. Many new Facebook friends with very good feedback

But it's also suspicious when new Facebook friends report alleged success stories about the loan. These are often fake accounts, or the Facebook comments are only faked with the Facebook interface.

8. The "bank clerk" wants to show you his ID and similar documents

If seriousness is feigned to you and the identity card copy of the alleged clerk is sent, that is also not really serious. Real banks do not show their employees' ID cards or similar documents. At reputable banks, personal details are only determined by the borrower.

9. Dubious online portals

Even if you receive access data to an online portal on which you are supposed to start the loan approval, this can be dubious. Internet sites are not checked for fraud by the Bafin or other official bodies. If anything seems unusual to you, you should stop the process immediately.

After making contact you will recognize non-reputable loans without Credit Bureau on these characteristics

1. Immediate replies even when banks are normally closed

Many dubious providers of Credit Bureau-free loans usually respond very quickly. They are often available at times when regular banks are not normally open. If you still receive messages from the provider late in the evening or in the middle of the night, this is more of a warning signal than a sign of fast and good communication

2. Use non-reputable providers strange and colorful contracts for the loan without Schufa

But also strange and colorful contracts are an identifying sign of dubious providers of allegedly creditworthiness-free loans. The European Consumer Center Germany has presented some examples of dubious loan agreements online. These often contain symbols reminiscent of law and order should remember like that scale. Also flags and coins are often used symbols of these dubious loans without Credit Bureau.

3. You should log into your online banking during the conversation or install a program for remote maintenance on your computer

If an attempt is made to install a remote maintenance program such as Teamviewer and they want to "help" you with transfers, this is fraud. You also never have to log into your online banking and reveal information from it during a telephone conversation with a bank and credit broker. If a provider asks you to do something similar, it is almost certainly some kind of scam.

Your computer is remotely controlled by the fraudster and money is transferred from your account. Do not use TeamViewer or similar remote maintenance programs if you want to apply for a loan.

4. Time pressure

If the loan provider puts you under time pressure, it is a sign of bad business conduct. Reputable providers of loans despite a Schufa entry are not dependent on you accepting the loan immediately. Instead, reputable banks and loan brokers know that getting a loan is a serious commitment for you and you need some time to think. If a provider puts you under time pressure or even threatens that the loan will not be approved otherwise, you should distance yourself from the provider.

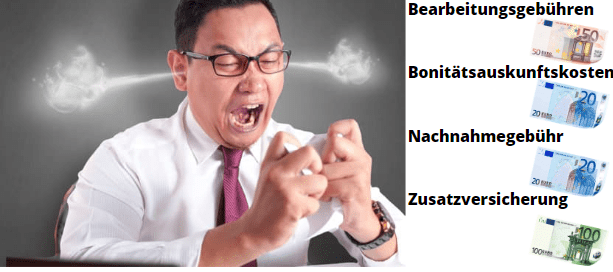

5. Fees

However, many providers continue to drive people in difficult financial circumstances to insanity with ever new fees. This is how dubious providers of loans without credit bureau demand Fees for processing, credit check, cash on delivery, additional insurance and more.

If the provider of the loan without Credit Bureau charges additional fees in addition to the interest, this is a sign that he is not serious. The BGH (Az. XI ZR 170/13 and XI ZR 405/12) recognized a violation of § 307 Para. 3 Sentence 1 BGB in advance fees.

That means: You only have to pay the previously agreed interest rate for a loan without Schufa.

If the provider has additional costs for the loan, he must include these in the interest. Because an additional fee or upfront fees are not legally permitted for loans. Thus, a loan without or despite negative credit bureau is completely safe not reputable if there are upfront fees to pay. When you hit one of the best Swiss credit provider without Schufa luckily you will be spared these dubious tactics.

6.) Dubious providers require access data to the bank

Another scam by non-serious providers of credit without Schufa is that you should open an account with a bank using the videoident procedure. You then transfer money for the provider's fees. The provider now invents an excuse why he needs access to the account. For example, to pay off the loan. However, there is not a single case where it is necessary for you to transmit the access data to a lender. It is therefore a scam by non-serious credit bureau-celebratory loan providers.

If you have fallen victim to a non-credit bureau loan, the best thing to do is to do the following

1.) Block profile

A looming social media loan scam is not something to be taken lightly. Block any fake profile immediately. These are all profiles that try to offer you a loan without Schufa via social media. In addition, you should always report such profiles to the platform.

2.) File a complaint

You can also report the fraud to the police by filing a report. If you have some information about the provider that is useful to the police, it is worth reporting immediately. This can be done at any police station. Many federal states also allow advertisements to be placed online. You can find an overview of where you can file a complaint at Online criminal complaint.

You can report (attempted) fraud. If other crimes have been committed, further reports are possible. It would be conceivable to report identity theft if the provider wanted a copy of your ID and you had a reasonable suspicion.

3.) Block providers

Block the email sender and phone numbers on your devices. If the provider uses changing telephone numbers and blocking is not possible, you can report it to the Federal Network Agency. Write down as much information about the call as possible. This includes: date, phone number, names of credit provider and caller. Then report it to him Federal Network Agency. You can do this using the Bundesnetzagentur's online form or by sending an email to rufzahlenus@bnetza.de.

4.) Report identity theft to Schufa and apply for a new ID card

If you sent the perpetrators a copy of your ID or passport, you should discard that document as soon as possible and apply for a new one. A new card has a new sequential number, making it difficult for scammers to continue using the old card. Besides, you can Also report identity theft to SCHUFA. This allows you to maintain your credit rating. However, SCHUFA contractual partners will then receive a notification that your data has been stolen. This can lead to them triggering additional checks.

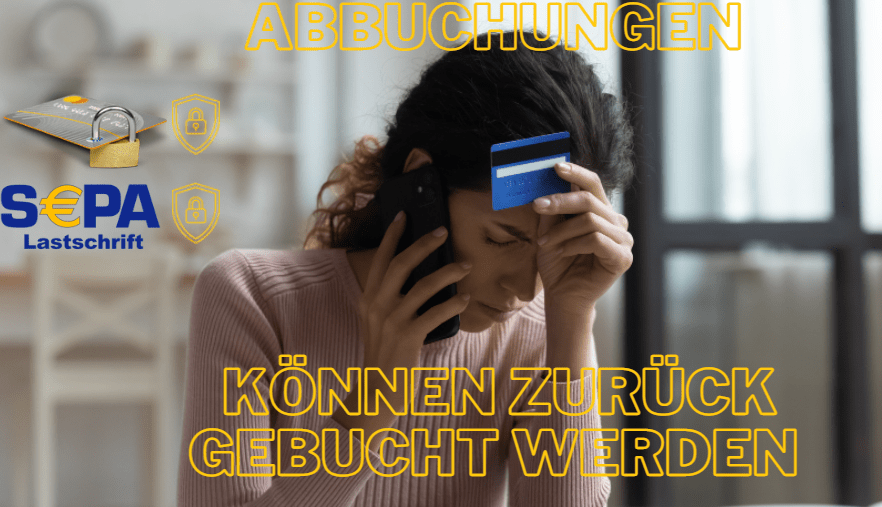

5.) Watch the account closely

Keep a close eye on the movements on your account when you enter your data checking account or yours Credit card revealed. You can report debits to your credit card or direct debit to your bank. This allows you to have the money booked back in many cases.

6.) As a borrower, fend off usury interest on dubious loans without Credit Bureau

Loans without Schufa can often be revoked in 2020 thanks to groundbreaking judgments by the European Court of Justice. The basis for this are the file numbers: C-66/19, C-33/20, C-155/20 and C-187/20. This means that consumers can now revoke contracts for loans without Credit Bureau even years after the contract was concluded.

Right of withdrawal incomplete, default interest not specific, some contracts even immoral

Many older loan agreements are teeming with invalid clauses. This is because information on right of withdrawal and the late payment interest many credit agreements did not stand up to scrutiny by the European Court of Justice. The usual clause "Default interest: five points above the base rate" is invalid because the information is not specific enough. The information about the right of withdrawal is often incorrect and the contract is therefore invalid.

Furthermore, some contracts are invalid anyway due to usury or immorality. Therefore, the legal situation is now particularly favorable for borrowers. Many non-reputable loans can be revoked.

Revocation of dubious loans often possible: According to the latest judgments of the European Court of Justice, unreliable loans with usurious interest rates can often be revoked many years later. The revocation is based onLoss of information on the right of withdrawal, interest on arrears or even immorality.

Reversal often possible

If you don't want to reverse non-serious loans without Credit Bureau, you can seek help from a lawyer. With the BGH judgments, consumer lawyers can declare many installment loan agreements invalid. But debt counselors and consumer advice centers can also help. Stiftung Warentest lists some spectacular cases in which even interest already paid had to be reimbursed in full by the banks.

Is a loan without Schufa serious, or not?

Loan without Schufa – serious or not – Serious loans despite negative Schufa are actually quite simple to recognize. A healthy level of distrust will help you. For example, reputable providers of loans without credit bureau require no other insurance "to improve your credit rating" or upfront fees. Of course, reputable providers of loans do the same despite negative credit bureau no home visits or send documents by cash on delivery. Instead, reputable providers of loans without Credit Bureau have one imprint, which can be used to identify the provider.

Reputable credit providers always give all the costs of the loan through you effective Annual interest rate at. If you specify a effective annual interest "% pa eff.So this is a good sign for loans without credit bureau. Credit providers are legally obliged to include all costs in this interest rate. If the borrowing rate "% pa“ only slightly dated effective annual interest "% pa eff.“ Everything is probably fine with the credit bureau-free loan.

Reputable loans without Credit Bureau differ by a maximum of 0.5 percentage points between the borrowing rate and the annual percentage rate. For example, if the provider charges 8 % pa interest, the effective annual interest rate for serious loans without Schufa is a maximum of 8.5 % pa eff. If the effective annual interest rate is greater than 8.5 % pa eff, they are trying to foist hidden fees on you.

What does Schufa say about the seriousness of loans without Schufa

A study by Stiftung Warentest and the Schufa comes to a bad judgment for many providers of Schufa-free loans. Credit bureau criticizes low placement rates and a lack of transparency in loans without Credit bureau.

Schufa study, together with Stiftung Warentest, examines reputable loans without Schufa

The Schufa commissioned a study on this and came to a devastating conclusion for loans without Schufa.This is not surprising - after all, loans without Schufa undermine the existence of this institution as such. Nevertheless, a certain level of caution still essential if Loans without Schufa and credit check be given. The Schufa complains that less than 1 % of the loans without Schufa actually came about. These loans were requested by test subjects. Unfortunately, there is no more detailed information on the creditworthiness of the test subjects. This is not transparent reporting on non-Schufa loans.

Criticism of the Schufa study

Contrary to what the Schufa study suggests, loans without Schufa are not necessarily dubious. Rather, it is not a sign of a serious test to keep secret the conditions under which it was carried out. This means that experts cannot evaluate the results and have to trust the study blindly. The employment relationship, income and debt situation of the Schufa test subjects remain completely unknown.

Schufa study: Missing information on borrowers

As a result, the result of the study cannot be classified seriously. You should know that the Schufa study was of course designed in such a way that the result Credit bureau-free loans are dubious had to come out. It was criticized that the loans were only very rarely approved. There are clearly communicated requirements for credit bureau-free loans that the applicant must meet. This includes a fixed income above the garnishment limit of at least €1,300 net.

Schufa study: the result may be distorted

The result of the study can now be distorted as desired by selecting people who do not meet this criterion.

If the Schufa now commissions a study that deals with products that your Business conduct deprived of the basis, and also does not provide any information about the sample, the study is not verifiable.

Serious Provider of loans without Schufa and preliminary costs how bon credit according to my own data, have significantly higher acceptance rates than stated in the Schufa study. If you are not over-indebted and can afford the loan installment, a loan approval is available bon credit* namely often nothing against. In another post I checked whether Bon credit a rip-off is and came to a mixed conclusion.

Schufa study checked: allocation rate for Bon credit significantly higher

In an experiment lasting several months, 172 customers asked for a loan from Bon-kredit. In 19 cases, a loan was granted. This corresponds to an award rate of 11 %. This also seems comparatively low, but one should consider that customers often only want to find out about conditions and do not want to take out a loan at all. In this case, there is no lending, although the loan has been approved. Despite this circumstance, the allocation rate for Bon-kredit is significantly higher than in the Schufa study.

| Number of credit requests | Number of credits granted | award rate |

|---|---|---|

| 172 | 19 | 11 % |

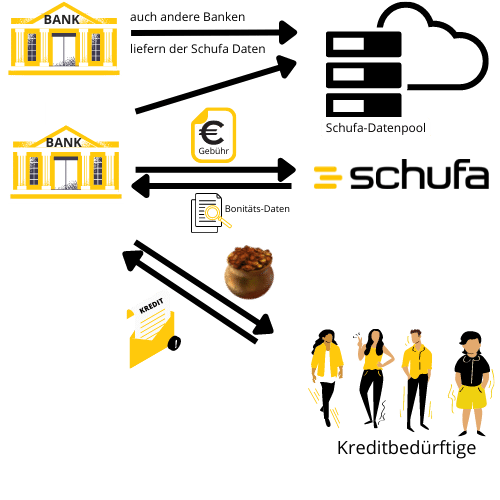

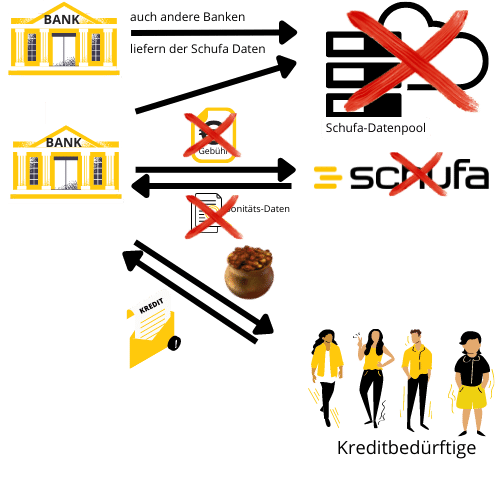

At the Credit with Schufa information Schufa is an important player who earns a lot of money for little work. Due to its machinations, the Schufa is as popular with the population as the radio station (GEZ) or the tax office. Schufa collects the data from all banks on the creditworthiness of people in need of credit and saves it in a data pool. If a loan request is made, the Schufa sends the person's data record to the bank and collects a fee for this. Since the Schufa has a huge data pool of almost 70 million data sets, there is a million-dollar business behind it. The loan without Schufa makes this business model superfluous, which is why the Schufa study was not written from a neutral point of view. No one saws off the branch they are sitting on.

Loans without Schufa

Of the "Credit without" and the "Credit despite Schufa“ are loans aimed at people with poor creditworthiness. Loans that are said to be granted without proof of creditworthiness have an effect on the one hand brilliant move against the unpopular and overpowering institution Schufa. On the other hand, loans without Credit Bureau sometimes have very high interest rates – such an offer is therefore not necessarily serious. But as we have already established: the Schufa does not have a clean record either.

Schufa works with banks, insurance companies, lessors, mail order companies, energy suppliers and telecommunications providers. This gives her incredible power, as she has a decisive influence on the conclusion of contracts for loans, insurance, leasing contracts, mobile phone and DSL contracts. Even with online mail order, Schufa queries are made (e.g. when purchasing on account). In the event of data errors, the power of Schufa is often a source of suffering for the people concerned.

In addition, Schufa resells data for a profit and when people want to see their own data pay fees again. In addition, Schufa has great power: Schufa often decides whether an applicant will receive a loan from a bank, and this information can then destroy plans.

Tip: You can request a free Schufa information from Bonify. You will immediately receive your result online. In addition, no fees are due. An alternative is the GDPR information from the Schufa, which, however, only comes a few days later by letter.

| Offerer | cost of information | availability of the information | More information |

|---|---|---|---|

Bonify | For free | Right away available online | To the provider: Bonify.de |

| Schufa GDPR information | for free | Delivery within 4-6 weeks by post | To the provider: mySchufa.de |

| Schufa Schufa online credit report: | mySCHUFA compact: €3.95 per month | Right away available online |

The most important thing about loans without or despite SCHUFA

- Although each bank has different criteria for lending, the decision as to whether the loan will be granted is heavily influenced by the Schufa score.

- A negative entry at the Schufa leads to a bad Schufa rating

- Most banks conclude from the bad rating that there are payment problems with the loan

- Most Banks therefore refuse loans despite negative Schufa from

- Applicants with an urgent need for a loan now have the loan without Credit bureau as an alternative

- The conditions are worse for loans without or despite negative credit bureau.

- According to the German Federal Bank, banks demanded interest of 5.41 % pa eff in February 2022.

- At the provider Receipt credit* about 8.29 % pa eff. due. This corresponds to an additional cost of 12 euros per month with a credit of 5,000 euros.

- Reputable credit institutes do without preliminary costs or additional fees

- For loans without or despite credit bureau, we only recommend providers from the credit without panel

Reputable providers of credit without Credit bureau

A reputable seller of Credit in difficult cases is bon credit*. With a free request from the provider, you will receive a loan on fair terms. Bon-credit does not require any upfront costs. The provider has been working in the credit business for almost 50 years and knows every difficult credit case like the back of his hand. Loans are regularly offered at Bon-kredit people with poor credit ratings approved. Lending without credit bureau is also possible with Bon-kredit. In this tableau you will find other providers from Credit without credit bureau and the credit despite negative credit bureau.

This is at serious providers of loans without Credit bureau either to banks from Switzerland or from Liechtenstein. Some smaller German banks or financiers on P2P platforms like auxmoney* make a Schufa query, but also grant the loan despite negative credit bureau. Also Mini loans up to €3000 can be awarded despite negative credit bureau.

The difference with a loan without Credit bureau is that financial institutions from Switzerland or Liechtenstein do not have to check a credit agency like Credit bureau. In contrast, German banks have a legal obligation to check the Schufa or another credit agency. Of course, foreign banks also get an idea of the creditworthiness of the loan seeker. To do this, they mainly use the payroll.

This test is therefore often much easier to pass than with German banks. Therefore, these loans fail more often and banks therefore raise the interest rates on loans without Credit Bureau significantly.

How to do it

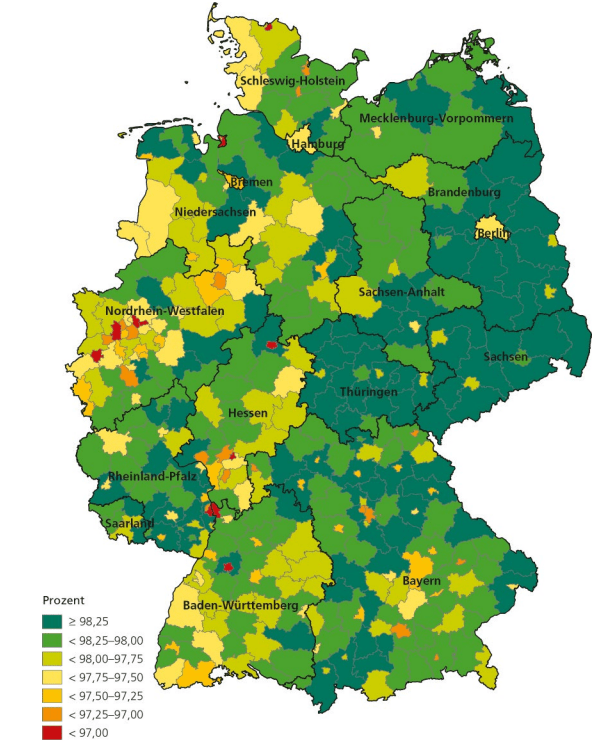

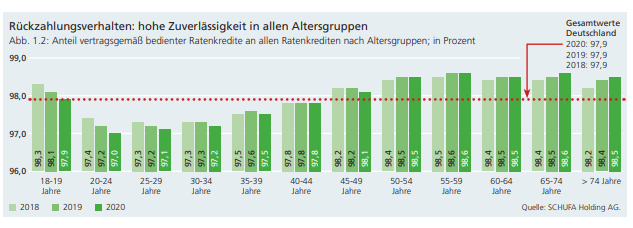

A credit without should not be applied for prematurely due to the high costs. The fear of a negative entry in the Schufa is often unjustified. According to the Schufa risk and credit compass 2021, the repayment behavior is over 98 % in almost all age groups and districts. The Schufa thus certifies that the Germans have excellent creditworthiness.

Therefore, an expensive loan without Credit Bureau is usually not necessary. Rather, it is advisable to ask several banks at the same time and to decide on the best offer. provider like bon credit* are specialized in these cases and can create the right offer for every credit rating from a pool of banks. For this purpose, the credit broker will ask up to 20 banks for a loan for you in a neutral manner. The provider only offers the loan without Credit Bureau if he sees no other alternatives. Often, however, Bon-kredit finds a better offer and you can do without the expensive loan without Schufa. This allows borrowers to save a lot of fees and also get a loan much faster – despite poor creditworthiness.

How can a reputable provider of loans without Credit Bureau be identified?

Undoubtedly, for loans without Schufa are many Rip-off on the road. A few simple rules and a healthy dose of distrust, however, helps immensely not to fall for rip-offs. So should no additional contracts for residual debt insurance or similar simply signed. So should you Always reject fees in advance. Also home visits are not required to approve a loan. Instead, such methods are a sure sign that it is a dubious offer. Also a quick look at it imprint is recommended for loans without Credit Bureau to exclude dubious providers. We will now present you with more details of other signs of non-serious loans without Credit bureau.

Conclusion: Credit without Schufa - serious or not? – Use this checklist!

If borrowers are dependent on a loan without Credit Bureau, they must be careful not to become a victim of unreliable providers.

You recognize non-serious providers of loans without Credit bureau:

- It will Financial restructuring mentions

- It is from Prepaid credit cards the speech

- contact via mail or social media

- conditions too good to be true

- The provider charges other fees in addition to interest.

- Fees for processing are not permitted (§ 307 Para. 3 Clause 1 BGB)

- Fees for information on creditworthiness are not permitted (§ 307 Para. 3 Clause 1 BGB)

- Fees for cash on delivery are not permitted (§ 307 Para. 3 Clause 1 BGB)

- Fees for additional insurance are permissible, not reputable

- The credit can only be granted by an alleged notary or lawyer be approved

- spelling mistake

- use free E-mail addresses and private telephone numbers for communication

- When lending is done through social media, many are new friends and followers with very good feedback dubious

- The “bank clerk” wants his ID and similar documents of themselves

- Dubious online portals

- Instant replies even at times when banks are normally closed

- Use non-reputable providers strange and colorful contracts for the loan without Schufa

- Thou shalt thou Log into your online banking during the call or install a program for remote maintenance of your computer

- time pressure

- Dubious providers demand Access data to the bank

A loan without Credit Bureau is often serious if you can check these points:

- The provider has one imprint, which can be used to identify him.

- Reputable credit providers always give all the costs of the loan through you effective annual interest rate at.

- There are no other fees apart from the annual percentage rate.

- The annual percentage rate of charge serious loans despite negative credit bureau ranges from 6 to 12 % interest per year.

- Lower interest rates are suspicious, as reputable banks have to reckon with the risk of default on the loan

- Higher interest rates, on the other hand, border on usury. in a usual range for Loans despite poor credit rating When you specify a effective annual interest "% pa eff.So this is a good sign for loans without credit bureau. Credit providers are legally obliged to include all costs in this interest rate. If the borrowing rate "% pa“ only slightly dated effective annual interest "% pa eff.“ Everything is probably fine with the credit bureau-free loan.

- Small difference between debit interest and annual percentage rate

- Reputable loans without Credit Bureau differ by a maximum of 0.5 percentage points between the borrowing rate and the annual percentage rate. For example, if the provider charges 8 % pa interest, the effective annual interest rate for serious loans without Schufa is a maximum of 8.5 % pa eff. If the effective annual interest rate is greater than 8.5 % pa eff, they are trying to foist hidden fees on you.

Healthy distrust does no harm in order to get a serious loan without Credit Bureau

A healthy level of distrust helps you to identify reputable loan providers. This is how reputable providers of loans without credit bureau require no other insurance or upfront fees. Reputable providers of Loans despite negative credit bureau and Loans without Schufa do of course no home visits or send documents by cash on delivery.

Nevertheless, loans without Credit Bureau can still be granted in many cases. If you can afford slightly higher interest rates, you can get them from reputable providers Loans despite negative credit bureau often a loan.

Not sure yet? Use the checklist for credit without credit bureau to avoid being taken in by dubious providers

If you are unsure whether the provider is reputable, you can check this with the checklist for credit without Schufa. Go through all the points during the application process and make a note of any deviations from the checklist.

The graphics on this page were created and licensed with Canva Pro.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.