You have exceeded your allowance on the P account and are now asking yourself "How do I get my money?“. The frustration with the outflow of money is understandable. Because if the incoming money on the P account is higher than the exempt amount, the money flows on the disbursement account. You can find out when the bank will pay out the money to the creditors in the article "What happens with too much money in the P account?“. Here we also go into detail about the conditions of a payment to the creditors. I also discuss another pitfall in the P account in this post. Because money too below the allowance remains and is not used flows out to the creditors after 3 months.

Therefore, this post is not about when the money will be paid from the bank to the creditors. Instead, we illuminate What options do you have to get your money. You will receive concrete recommendations for action as well as assessments of the risks for the question "How do I get my money?" when the P-Konto Allowance is exceeded. You should check these for yourself and ideally also discuss them with an independent debt counselor who knows your personal situation.

What you can learn here

- "How do I get my money?" if the P-account allowance is exceeded - 5 concrete recommendations for action

- 1. withdraw unused credit from the allowance immediately

- Withdrawal of the money in the fourth month, although the exemption amount was not exceeded according to §899 ZPO paragraph 2

- 2. Have wages paid out in cash or redirected to a non-Schufa account at another bank

- 3. Secondary account or cash reserve for non-essential expenses

- 4. Increase the P account allowance

- 5. Reduce income/ work less

- P account allowance exceeded

- 1. P-account allowance exceeded due to double salary receipt: How do I get my money?

- 2. P-account allowance exceeded due to additional payment

- 3. P-account allowance exceeded due to child benefit

- 4. P-account allowance exceeded with Hartz 4

- Hartz IV, unemployment benefit II and benefits according to the second social code (SGB II) all mean the same thing: a social benefit that cannot be attached

- Better protection of the savings balance on the P account since December 2021

- What does "First In - First Out" mean for the P account and how does it help if you want to get your money on the P account?

- Conclusion: P-account allowance exceeded: "How do I get my money?"

Disclaimer: I am not a lawyer. This post is not legal advice!

"How do I get my money?" when the P-Konto Allowance exceeded is - 5 concrete Action recommendations

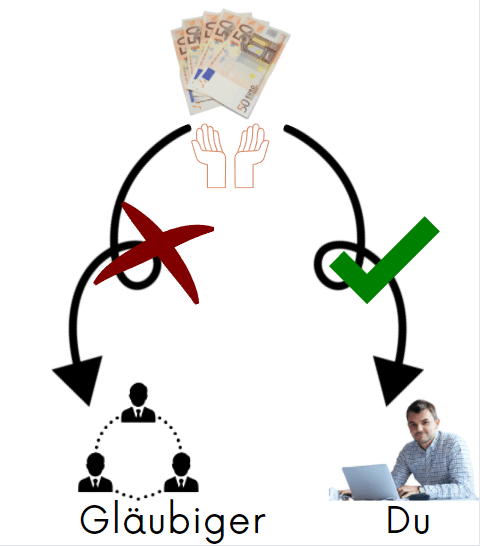

P account allowance exceeded: "How do I get my money?" – To get the money above the allowance, you can withdraw the money before the end of the month. Another possibility is the Diverting partial amounts to non-Schufa checking accounts or you arrange one with your employer Cash payment for part of your salary. However, these possibilities could be judged as frustration in court and you make yourself liable to prosecution. So I definitely advise against it. On the other hand, it is better to make full use of legal options. To avoid exceeding the P account allowance, you can increase allowances or consider yours to temporarily reduce income.

If you have exceeded the P-account allowance and the nagging question "How do I get my money?" leaves you no peace, you could think of the following options to prevent the money from flowing out to the creditors:

1. Unused credit from the allowance take off immediately

You should always try unused credit on the P account immediately to take off. So it is no longer available on the account and remains untouched. Alternatively, according to the law, you can carry over the money for 3 months to the following month. Although your money is now protected in the P account for the following 3 months, it is still advisable to withdraw it immediately. So you can don't forget it later. In addition, transferring money below the allowance and later using it is error-prone. Because in the past, banks repeatedly illegally paid protected money to creditors. You can find out how the FIFO principle, which regulates the outflow, actually works in the P account at the end of the article.

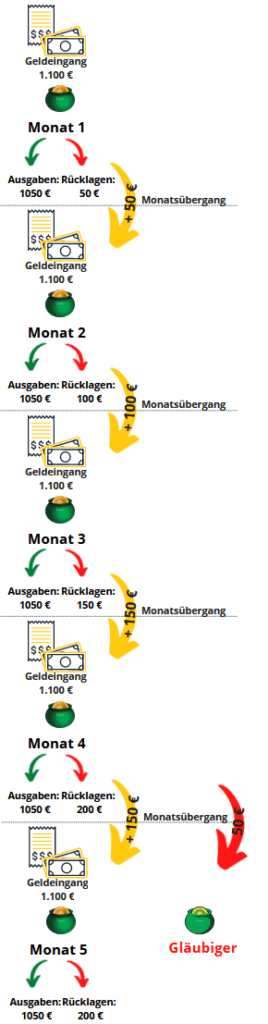

You can only transfer money to the P account for a maximum of 3 months. This also applies to credit below the garnishment exemption. If you carry the money over into the fourth month, the bank will seize it even though it's a protected account. The following chart illustrates how money is drained from the P account in the fourth month. We assume that you earn 1,100 euros. Your income is below the allowance. For the unforeseen, set aside €50 every month.

Withdrawal of the money in the fourth month, although the exemption amount was not exceeded according to §899 ZPO paragraph 2

It is therefore possible to withdraw unused credit immediately below the allowance important to get your money. By taking off immediately, you avoid that

- Unused balances below the exemption limit are transferred more than 3 times and then flow to the creditors and

- Errors on the part of the bank in the correct (and complicated) application of the transfer of money from FIFO to the following month can happen

Consequently you make better use of the allowance and get your money on the P account.

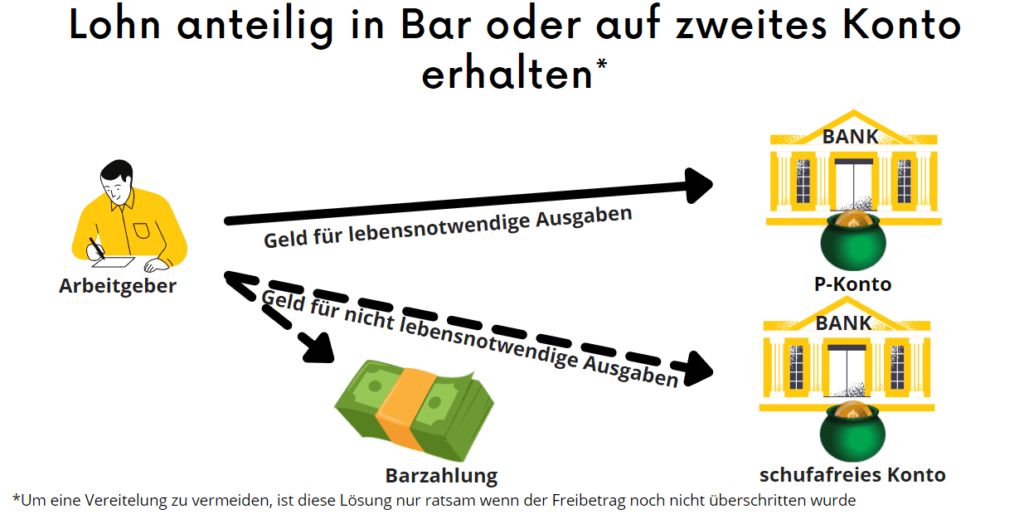

2. Have wages paid out in cash or redirected to a non-Schufa account at another bank

Maybe you can also have part of your monthly salary paid out in cash. If this is not possible with your employer, you could also have the wages paid out to a second account. You open this account as a regular account despite the ongoing attachment. The process is in the post Open a new account despite seizure described. Incidentally, it is not forbidden to open a second account during an attachment. However, you are not allowed to keep this secondary account as a P account. That would make you liable to prosecution.

Also, you should Bank details as secret as possible keep. Because if the creditors get wind, they will probably seize the account immediately. For secrecy, you should go to one Account without Schufa grasp. There are good accounts without a Schufa query Vivid Money*, nuri* or bunq*. It is also essential that you have the account not with the same banking group opened If you have a P account with the savings bank, they will not open a normal second account for you in parallel.

Can I open a second account despite seizure?

When setting aside money through cash payment or a second account, one should ask the question of frustrating enforcement. Because frustration – i.e. getting rid of the money – is after §288 StGB punishable. However, garnishment of an account does not lead to the obligation to transfer all money to the garnished account. Opening a second account despite seizure is therefore not illegal.

When is there a threat of thwarting the transfer of money to a second account

- A thwart threatens, if the diversion of income than permanent solution to putting money away is set up. This could be seen as an attempt to avoid enforcement. In addition, if the diverted income is above the garnishment exemption, a criminal offense is likely.

- When a debtor has money over a disguised escrow or business account out, a judge could see this as a frustration.

When threatens none Frustration in diverting money to a second account

- None threat of thwartingt contrast, if diverting income to other accounts, only an intermediate step to the payout of the income is.

- If the P account allowance has not yet been exceeded and money is diverted to other accounts, a thwarting is also unlikely.

Furthermore, in the event of a thwarting many things are not eaten as hot as they are cooked. In addition, conviction is rare. But if you still unsure you should consult a lawyer you trust.

Open a P account – which bank? – If you are wondering which bank you should open a P account with due to negative Schufa entries or a bad credit rating, we recommend that Pay center with the Supremacard*, which can be fully digitally converted into a P account without Schufa. But that too N26 account* can be opened with bad credit and negative credit bureau and converted into a P-account.

Other banks without a Schufa connection are often unable to provide a fully-fledged P-account, either because they are only developing the interface and solarisbank is actually the bank behind it (Nuri, Bunq, Tomorrow) or because they (in some cases despite the German IBAN) have a foreign banking license ( Open Bank, Bunq). You can find the pros and cons of the best P accounts in the article Open a P account – which bank?

3. Secondary account or cash reserve for non-essential expenses

In a further step, you use what was mentioned in step 2 secondary account or a cash reserve for all non-essential expenses. To do this, your employer will only transfer part of your wages to your P account. You will receive another part in cash or on a second account. This allows you to build up a reserve. This reserve provides you with some security and also helps you to be able to pay money quickly for a later settlement with the creditors in court, as you can see in the article Open a new account despite seizure can read. The diagram explains the principle:

Attention: The diversion of payments via other accounts of, for example, spouses or children could be considered by a court as thwarting the foreclosure. In doing so, the debtor may be liable to prosecution under Section 288 Paragraph 1 of the Criminal Code. If a creditor finds out about the account, he can seize it in full without any exemption limits. In addition, the helper who makes the account available can also be prosecuted if he knows the background. Because his help to circumvent the seizure could be interpreted by a court as an aid to a criminal offense.

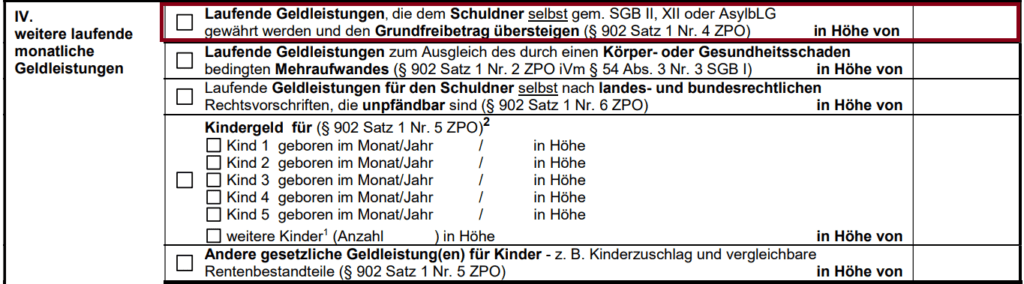

4. P-Konto Increase allowance

Before you exceed the P account allowance, you should check whether you de increase allowance can. This is the most sustainable way to answer the question "How do I get my money?" if you have exceeded the P-Konto allowance. The legal basis to increase the P-Konto allowance is §902 ZPO. To do this, ask your bank for the P-Konto form and fill it out together with a debt counselor. Without increasing the P-Konto allowance, you have the basic allowance at your disposal, which you can this table can take from it. The Increase of P-Konto allowance lasts usually only a few days after you have submitted the complete application.

You can permanently increase the allowance if you have child support obligations. Also, a permanent increase of the P-Konto allowance is possible if you receive unemployment benefits or asylum seeker benefits for others on your account. In addition, you can increase the P-Account allowance increaseif you are granted more money according to SGB II, XII or AsylbLG. Another way to increase the P-Konto allowance is a bodily harm or damage to health which means additional work for you. The P account allowance is also increased by the child support and the child supplement increased if the allowance is exceeded as a result.

Furthermore, you can increase the P-Konto allowance once leave if you have one one-time social benefit you receive. But also with a additional payment If you receive unemployment benefit, asylum seeker's allowance, child benefit or child supplement, you can have the basic tax-free amount increased once. In the case of a delayed payment of wages, you can have the tax-free amount increased once by up to €500. What you can do in case of an additional payment is described in the article "P account allowance exceeded due to additional payment" described.

5. Reduce income/ work less

If you exceed the P account allowance and your job allows it, you can also use your Reduce income and work less. After all, the excess money is not available to you anyway.

P account allowance exceeded

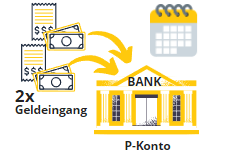

1. P-account allowance exceeded due to double salary receipt: How do I get my money?

If your employer pays your salary late, you will have twice the salary in your account in the following month. You will probably exceed the monthly allowance. But, what happens if the allowance is exceeded due to double receipt of payment? First, the money above the exempt amount is transferred to the payout account. This is a separate pot of money that neither the debtor nor the creditor can tap into. In the following month, the amount deducted from the payment account is transferred back to the P account. Now you can finally use the transferred amount freely.

You can use unused credit, i.e. probably the majority of double the salary, 3 months into the following month transfer. The first-in-first-out principle (FIFO) applies here. So when you use money from your account, you always use the amount carried over from the previous month first. So what goes in first, goes out first. Or in short: first-in-first-out. For you, this means that the bank will seize any money that you transfer more than three times in the following month. Until then, however, no garnishment takes place.

In the post "P account: 2 salary payments in one month' you will find additional graphics. When the money is available if you have exceeded the P account allowance, you can find out here.

2. P-account allowance exceeded due to additional payment

In §904 ZPO, the law distinguishes between two types of additional payments, which are handled differently if the P-account allowance is exceeded:

- Post-payment of wages: If it is an additional payment from a wage payment (income from work), for example because your employer pays the wage late, you have a one-off allowance of up to €500 additional payment. Upon request, this will not be included in the seizure. In order to be able to use the exempt amount, you must apply to a debt counseling service, a lawyer or the enforcement court for a one-off increase in the P-account exempt amount according to Section 903 (1) ZPO. Without an application, it is one double receipt of salary on the P account in a month. The bank then transfers the money above the exempt amount to the payout account managed in parallel.

- Additional payment of social benefits: With the P-account reform on December 1st, 2021, additional payments from social benefits are protected from attachment according to § 904 ZPO. The following additional payments are not taken into account if the P account allowance is exceeded. This Subsequent payments are excluded from attachment according to § 904 paragraph 1

- Additional payments from the basic security

- Additional payments from social assistance (unemployment benefit 2 "Hartz 4")

- Benefits under the Asylum Seekers Act the paid afterwards will

- back payments of child benefit

- Back payments of social benefits for third parties with whom the debtor lives in a community of need

This ruling on subsequent payments was preceded by an action at the Federal Court of Justice. In the ruling of January 24, 2018 - VII ZB 21/17, it is stated that amounts paid in arrears are are attributable to the period for which they were paid. Thus, unlike other cash receipts on the P-Konto, backpaid social security benefits do not count toward the month in which they are received on the account.

This regulation also applies to subsequent payments of Employment incomefor which reason additional payments above €500 are not subject to garnishment if no garnishment would have taken place if the wages had been paid on time.

So if you receive an additional payment for unemployment benefit in August for the months of March to May, the additional payment counts pro rata for the months of March to May. For August, however, the additional payment is meaningless. Further information on the judgment can be found in the corresponding press release.

Don't forget to increase the allowance

In order for these additional payments not to be included in the attachment, a Application for an increase in the allowance be made to a debt counseling service, a lawyer or the responsible district court. The application is made after the certificate according to § 903 paragraph 1 ZPO. Debt advice, a lawyer or the district court then tick the appropriate box in Chapter V of the form arrears payment of ongoing payments or Subsequent payment of other current cash benefits and note the amount of the cash payment.

After debt counseling, a lawyer or the district court has checked that the increase is legal, you then forward the form for increasing the exemption amount to yours Bank continue. The bank then protects the money from the additional payment and does not pay it to the creditors even if the basic allowance is exceeded.

P account allowance exceeded due to additional payments- Additional payments from social benefits such as Hartz IV, basic security, child benefit or asylum seeker benefits are not attachable. If it is a question of back payments from work income, you have an additional allowance of €500 at your disposal. If you exceed the P account allowance once because of an additional payment, you must have the allowance on the P account increased by a lawyer or the competent court. If you receive unemployment benefit, the increase can also be carried out by the job center. The basis for the increase in the allowance is number V of the certificate in accordance with §902 ZPO.

3. P-account allowance exceeded due to child benefit

If you exceed the P account allowance due to child benefit, you can apply for an increase in the allowance. For this purpose, a suitable body or person (e.g. debt counselling, lawyer, local court) will certify the increase in the basic exemption amount in accordance with § 903 Para. 1 ZPO. The child benefit and the number of children are entered in the form. You then send the certificate to your bank, which increases the basic allowance accordingly. ü The child benefit received on the P account also has an increasing effect, so that a corresponding increase in the base allowance can be certified by the appropriate body or person.

P account allowance exceeded due to child benefit – Child benefit cannot be attached. If you exceed the P account allowance because of child benefit, you must have the P account allowance increased by a lawyer or the competent court. If you receive unemployment benefit, the increase can also be carried out by the job center. The basis for the increase in the allowance is Section IV of the certificate in accordance with §902 ZPO.

4. P-account allowance exceeded with Hartz 4

In most cases it is very unlikely that Hartz 4 will exceed the P account allowance. If you still exceed the P account allowance with Hartz 4, you can apply for Increase in allowance place. For this you have your Hartz 4 payments certified by the job center, a lawyer or the responsible court. One of the offices will then certify that your Hartz IV benefits exceed the allowance. After submitting the form to the bank, your allowance will be increased accordingly.

P-account allowance exceeded with Hartz 4 – Hartz 4, social assistance and basic security are not attachable. If you exceed the P account allowance with Hartz 4 funds, you must have the allowance on the P account increased by the job center, a lawyer or the competent court. The basis for the increase in the allowance is Section IV of the certificate in accordance with §902 ZPO. In most cases, however, the protected base contribution to the P account with Hartz 4 is sufficient.

Better protection of the savings balance on the P account since December 2021

The aforementioned regulation on the transfer of credit balances is new and was issued on December 1, 2021 to better protect debtors. The transfer of attachment-free credit is regulated in § 899 paragraph 2 sentence 1 ZPO.

If the debtor does not have a credit balance in the amount of the entire amount that is exempt from attachment in accordance with paragraph 1 in the respective calendar month, this unused credit balance is the three subsequent calendar months in addition to the assets protected under paragraph 1, are not covered by the seizure. Dispositions are to be offset against the credit balance, which is first credited to the garnishment protection account became.

§ 899 ZPO - paragraph 2 (Non-garnishable amount; transmission)

With the old regulation (before 1.12.2021) after § 850k paragraph 1 sentence 3 ZPO was the savings even only possible for the following month. However, this regulation is outdated and no longer valid – even if you still read about her on many sites on the internet.

example for the transfer of unused credit with double receipt of salary (What happens if the allowance is exceeded due to double receipt of payment?)

Your employer pays you the salary for January late in February. So the salary only appears on your bank statement for February, although it is your salary for January. At the same time, the salary for February will be credited to your P account on February 28th. This means that you will receive twice your salary in February, whereas in January you will have no receipt of any money at all - although you have worked in both months and received a wage for it - a few days late.

Since you exceeded the monthly allowance in February due to the double receipt of payment, the bank transfers everything that is above the seizure allowance to the payment account. However, the skimmed amount will be transferred to the following month of March and you can use it freely as the account holder. If the late wage payment is €500 or less, you can use the Increase the P-account allowance once to let.

Further account transfers remain protected due to the FIFO principle

However, you will receive another wage payment in March. So you now have a double salary again and the game continues in April and May. The legislator protects the debtor here by the first-in-first-out principle (FIFO) mentioned above. This principle states that the transferred money is always used first. So if you withdraw money in March, the withdrawal will be offset against the carryover from February. The salary credited in March initially remains untouched. As long as you spend more money in the following month than you transferred in the previous month, it is just a simple monthly transfer from month 1 to month 2, despite the multiple transfer of your money to the following months.

Thanks to the FIFO principle, you always stay below the 3-month limit. As already mentioned, the condition that there is no attachment in this case is that you use at least the transferred money in the following month.

Since the correct application of the FIFO principle does not work smoothly at all banks, it is advisable that you always withdraw the money directly if you receive double salary.

What does "First In - First Out" mean for the P account and how does it help if you want to get your money on the P account?

"First In - First Out" (FIFO) is a calculation rule for the savings balance on the P account. FIFO in the P account means that the money that goes into the account first (first in) is also the first to be spent again (first out). The FIFO principle was established by the Federal Court of Justice (BGH) for P accounts (judgment of October 19, 2017, file number IX ZR 3/17). The legislator anchored FIFO in December 2021 in §899 ZPO. The text of the law states that assets that were credited first must first be used for dispositions:

Dispositions are to be offset against the credit balance, which is first credited to the garnishment protection account became.

§ 899 ZPO - paragraph 2, sentence 2 (Non-garnishable amount; transmission)

FIFO therefore means that an action on the P account, such as withdrawing cash or making a transfer, is always deducted from the oldest balance.

FIFO helps you when you have exceeded the P account allowance and makes it easier for stressed debtors to answer the question "How do I get my money?"

With the FIFO principle anchored in law for P-accounts, you always use up the old savings before the newer credits. As a result, the protected period of transmissions in the following month (max. 3 transmissions) always begins anew. Therefore, the FIFO principle helps you if you have exceeded the P account allowance due to double receipt of payment and want to get your money. Stressed debtors can therefore breathe a sigh of relief when asked "How do I get my money?" since December 2021 if they have exceeded the P account allowance. However, it is advisable to avoid double salary payments by making immediate withdrawals. In this way you prevent the bank from making mistakes when using the FIFO principle and do not get into trouble.

Conclusion: P-account allowance exceeded: "How do I get my money?"

If the P account allowance has been exceeded, the most nagging and pressing question is often this: "How do I get my money?". After all, an outflow of money is imminent.

Prevention is better than aftercare

Before it even gets that far, you should always withdraw any unused credit from the allowance take off immediately. So you have secured further access to the money for the time being. If you withdraw more money than you are entitled to according to the garnishment table is entitled to, this could be construed as frustration. Corresponding convictions are rare.

Another option is to open a secondary account as a regular account. Credit Bureau-free accounts are best suited for this. The reason for this is that seizures are noted in the Schufa and most banks refuse to open a regular account. There are good accounts without a Schufa query Vivid Money*, nuri* or bunq*, which also regularly have good promotions. You can also use this account to make a small cash reserve to save However, you should not exceed the exemption limit for this. Finally, the subject matters frustration when saving money in an account as well.

P account exempt amount exceeded: How do I get my money?: Cash payment of wages, increase exempt amount

Another way to get your money goes in the same direction: Talk to your boss whether a cash payment of your wages is possible in parts. Another approach is to enforce an increase in your allowance. The most common reason why the allowance on the P account is increased is maintenance for the children. There are, however, many other options. For example, many social funds such as ALG 2 cannot be attached and you can apply for an increase in the allowance. Late wage payments from your employer are also protected up to €500 upon request.

If you have exceeded the P account allowance due to double salary payments, the question "How do I get my money?" does not arise anyway. The FIFO principle ensures that you can still use the money you received late in the following months. However, since there have already been incorrect (premature) payments to creditors, it is still advisable to withdraw double salary payments.

Finally, you may be able to reduce your hours at work if you are at risk of exceeding the allowance.

Hello there!So basically i am owner of a company.Both my accounts are blocked (till is verified) so now i have my private account in a P-Konto.Can i deposit money into my P-Konto?I don't have any other resources for leaving

Yes, you can. If the P-Konto has the burden of a seizure, the money might be wired to the debtor, though. This depends on the amount and the time frame the money is deposited there. You might want to check here, what happens if you deposit too large sums to your P-Konto. https://konto-kredit-vergleich.de/en/what-happens-with-too-much-money-in-the-p-account/

Hello,

What happens if the salary is regularly above the basic exemption amount (currently €1339.99)? Does everything above this amount automatically go to the creditor or is it calculated according to the garnishment table as in the case of a wage garnishment and does one have a higher exemption amount?

Thanks and greetings

Hello Jasmin,

take a look at this article, your question is answered there: https://konto-kredit-vergleich.de/was-passiert-mit-zuviel-geld-auf-p-konto/

Greetings Sascha

So a wage garnishment is actually better for the debtor because mér has more money available, right?

Hello dear ones,

I have deposited a large amount of money in my account, money which does not belong to me, did not know that my garnishment is not yet fully paid off and thus the money was now mostly blocked on the withdrawal account. I have to give the money back to the owner as soon as possible. How do I get this money now ? Please help me, I am in trouble :'(

Hello slide,

this is an entanglement. The bank has actually acted correctly, because it cannot know that it is not your money. You now have to provide evidence that it is a third party's money and that it should therefore not be included in the garnishment. In this case, the burden of proof is unfortunately on you.

I wish you much success!

Greetings Sascha

PS: Again, I am not a lawyer and may not advise in individual cases.

I am getting my pension paid in arrears for the last 5 months and have a P Konto. The money will probably be gone, right?

It depends on your allowance and the amount of your pension. It does not have to be all gone. Check the details again using the information provided here.

Hello Sasha

I have a p account and an allowance of 1731 euros. Last month 1500euro were swept out and paid on the 1st of this month back to my account. Today I received 2800 euros salary. The bank has immediately paid 2600. Do I get now on 1.7. the complete money again or only the 1731 euros and what happens with the remaining 900 euros? I can't see through all the comments about saving for 3 months. I would be very grateful for a quick answer. Love greetings kathrin

Hello Kathrin,

You should receive the 1731 euros on 7/1. The remaining amount of 900 euros is blocked as a moratorium contribution. If you exceed the tax-free amount again with the moratorium contributions, the money will finally be paid out.

Greetings Sascha

Hey Sascha,

These pages are very well done and also explained well with pictures. Explained in a few words: If the access of ~ 1250, - € in a month (from - to) is exceeded, the excess money is blocked and parked in a sister account.

Sometimes simpler is better

Thanks for the engagement K10

That's exactly how it is. If the cash receipt exceeds the exempt amount, the excess is blocked on the payment account. Greetings Sasha