Did you get a seizure order? If you now ask the question "Can I open a new account despite seizure?' is going through your head, maybe we can make it easier for you. Because you can Open a second account despite P-Konto and your Accelerate debt relief. However, there is at Opening a garnishment protection account some things to consider. In these instructions, you will find out when you should open a new account despite the garnishment. We'll also show you the individual steps that you should consider before opening a P-Konto.

- If you open a new account despite seizure proceed as follows:

- Step 1: First try your existing checking account convert to a P-Konto

- Step 2: Open a new account despite garnishment if the bank does not want to convert your account into a P-Konto. Suitable for this are current accounts without Schufa, such as the free Girokonto of the openbank*.

- Step 3: Stop payment to carry out debt relief without personal insolvency

You can use a Current account without Schufa open as a second account. When you use your new account to Debt relief without personal bankruptcy you also need to have a payment stop to the creditors plan and carry out as described in the third step of the instructions. At the end of the article you will find 6 recommended accounts without Schufa, which you can use for this.

With this instruction it is also possible to create a Attachment account despite debt with providers like pay center*to open. However, it is advisable that you first try your Convert account to P account.

Open second account despite P-Konto - When does it make sense?

What you can learn here

- Open second account despite P-Konto - When does it make sense?

- Open second account despite P-Konto Step 1: First try to convert your existing Girokonto into a P-Konto

- Open a second account despite P-Konto Step 2: Open a new account despite garnishment, if the bank does not want to convert your account into a P-Konto

- Open second account despite P-Konto Step 3: Stop payment to perform debt relief without personal bankruptcy.

- Which current accounts without Schufa are recommended if you want to open a second account despite P-Konto

- Advantages and disadvantages of a second account despite attachment

- Procedure for P-Konto conversion

- Where can I open a P account despite debt?

- Open a second account despite P-Konto: Use a fully independent bank!

- Summary: Can I open a new account despite being garnished?

- Open second account despite P-Konto: the 6 best banks

- Related questions on the topic Can I open a new account despite garnishment?

Has your account been garnished or is an account garnishment imminent? We know this time is stressful. In this situation, it is often particularly difficult to think about the future. That's why we want to help you by giving you some advice on what steps you should take after or immediately before an account is garnished.

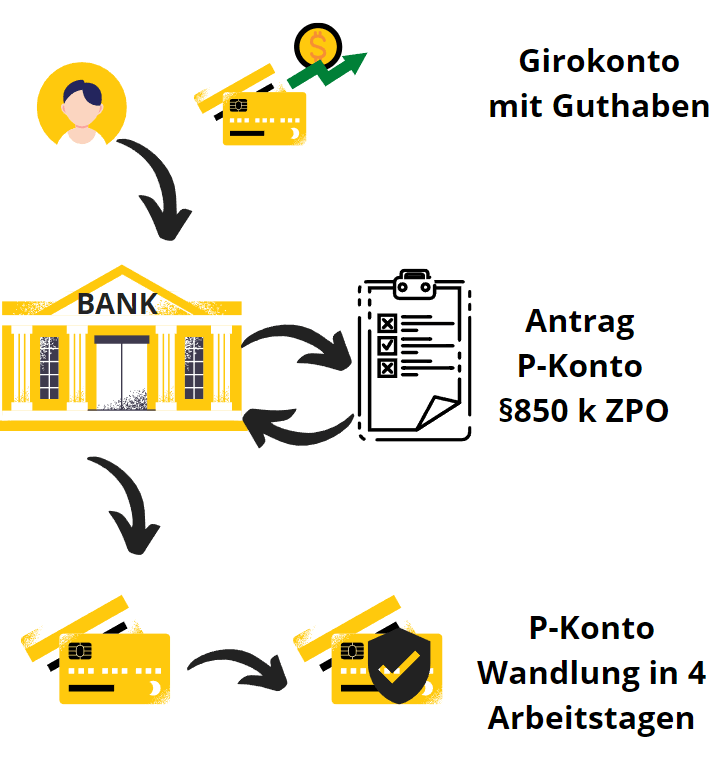

Account garnishment: By pledging an account, the creditor tries to claim his money. A seizure order will result in your account being blocked. The account is thus blocked by the bank up to the amount seized. The account is then completely frozen. For this reason, functions such as transfers, standing orders and withdrawing money are no longer available. In addition, there is no automatic protection of your subsistence level in the event of a seizure. In order for you to be able to secure your existence from a garnishment protection, you must first open your account Seizure protection account (P account) convert. According to the law (§ 850k ZPO), a P account conversion must be carried out by each bank.

Open second account despite P-Konto Step 1: First try to convert your existing checking account into a P-account

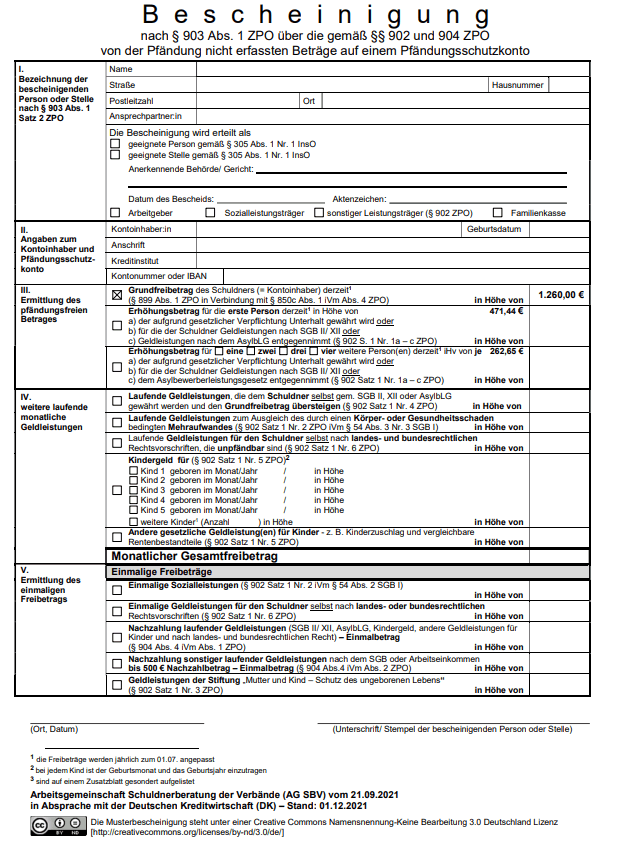

So that you have everything you need to survive, such as rent, electricity and groceries can pay despite seizure, the current account can be opened Seizure protection account (P account) convert. This gives you a protected legal allowance of at least 1,260 euros per month to disposal. If you have maintenance obligations, the amount can be adjusted according to the garnishment protection table increase. The corresponding form for increasing the allowance for maintenance obligations is called "Certificate according to § 903 paragraph 1 ZPO“. You get the form here for free download (PDF) or ask your bank.

The P account conversion takes a maximum of 4 working days and provides permanent protection

After conversion, the P account protects the monthly allowance permanently. Therefore, you do not have to withdraw the money on the P account immediately after the money has been received. You can continue to use the checking account instead. Direct debits, transfers and standing orders are also carried out regularly up to the exemption amount. The conversion of the P account takes time if successful 4 working days or less. This is required by law (§850k ZPO).

Procedure P account conversion

If you receive social benefits (ALG I, ALG II, old-age pension, social assistance, etc.) and only want to protect the basic allowance, it is sufficient only the notification of performance to show to the bank. For additional allowances, you must submit an application to the district court using the 850k form above and enclose relevant evidence (e.g. birth certificate)

"If the credit balance of the current account has already been seized, the debtor can request management as a seizure protection account at the beginning of the fourth business day following his declaration"

"P-Account Paragraph" Section 850k ZPO - The legal basis for opening a seizure protection account

If you exceed the allowance after converting the account into a P account, the money will first be held in a separate disbursement account parked. The money will only be paid out to the creditors if the payment account exceeds the exempt amount again. The withdrawal process is in the article “What happens with too much money on the P account" described.

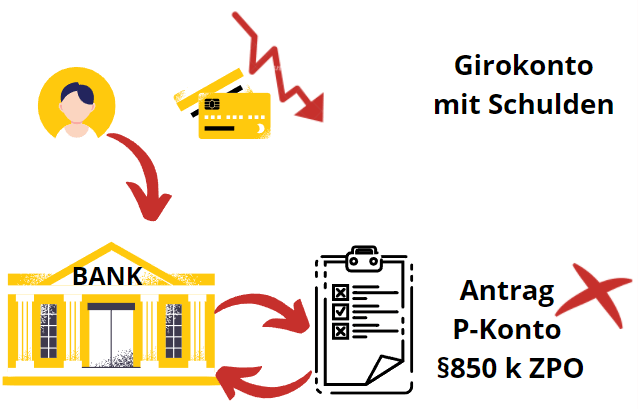

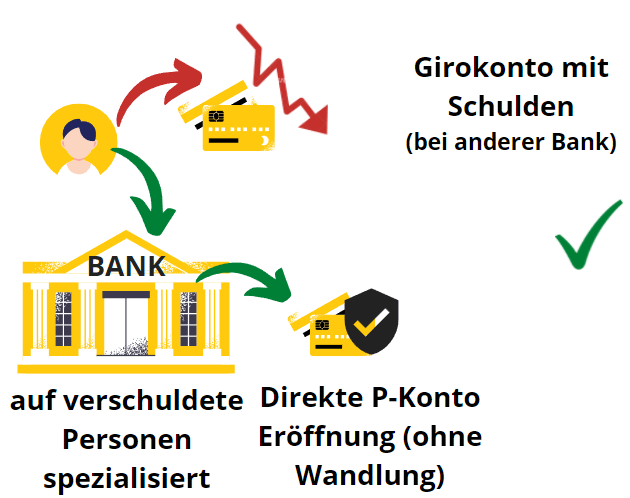

However, in many cases the conversion of the current account into a P account does not always go smoothly and it is advisable to take further steps on your part. The conversion to a P account will only be carried out by the bank if your account is not overdrawn. An account with overdraft facility cannot be converted into a P account. An obvious thought is the question that now arises "Can I open a new account despite the attachment?". And indeed it is possible. In the next section, you'll learn how.

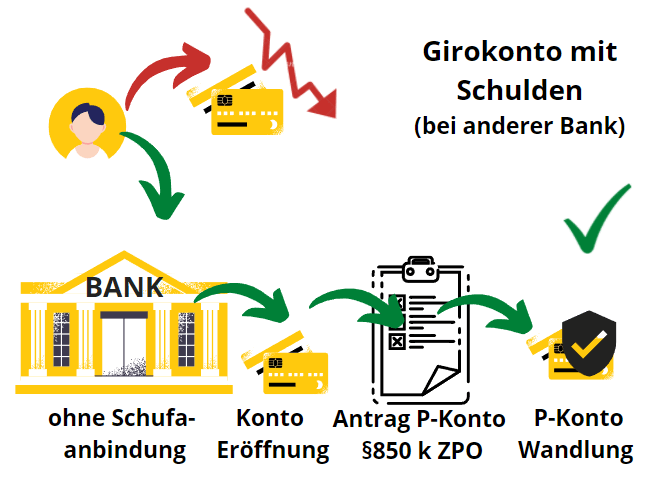

Open second account despite P-Konto Step 2: Open a new account despite garnishment, if the bank does not want to convert your account to a P-Konto

Basically everyone has one Entitlement to a P-Konto (§ 850k ZPO). However, the bank may refuse to convert the existing account into a P-Konto if the account is already overdrawn. Often in this constellation it will happen that the bank will not convert the account into a P-Konto before it is cleared.

This can quickly threaten your existence, since the bank blocks your account for any account movements and you now no longer have any subsistence level to live on. In this situation, it is therefore advisable to act quickly and decisively and to open a garnishment protection account as quickly as possible in one of the ways described below.

Open a garnishment protection account despite debt: Your options

If the bank refuses to convert your account, you have two other options to keep the money safe from creditors to maintain a subsistence level:

- You open a checking account without Schufa from a provider such as Vivid* and submit a P-account conversion request

- Open a P account directly: Despite existing debts, you open a seizure protection account directly from a provider such as pay center*.

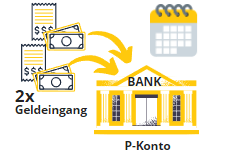

Redirect all earnings to new account

You can use this new bank account for yours from now on revenue. So inform your employer of your new bank details for the current account immediately after opening it. If you receive other sources of income such as pension, ALG I or II or allowances such as child benefit, housing benefit or similar, you should inform the paying office about your new bank details as soon as possible.

If you have decided on a current account without a Schufa, you can have the new account converted into a P account a few days after it is opened, so that the allowance is protected. With the P account from Paycenter, however, no further application for conversion is necessary. The conversion shouldn't take place at the opening, but really only a few days later. Otherwise there is a risk that the bank will refuse to open the account. You can now use the new bank account for everything necessary for survival to pay. This includes, for example: rent, electricity, cell phone and internet and groceries. If it is possible, you can also use the checking account for building society contracts, life insurance or buying a car.

From now on, all income should go exclusively to this account.

Open second account despite P-Konto step 3: Stop payment to carry out debt relief without personal insolvency

Your new account is now set up as a P-account and all important incoming and outgoing money such as income, rent, electricity, gas and internet providers run exclusively through the new account? Then it is now time to take a deep breath and close all further account payments to other creditors to stop immediately and run into the void.

According to an insolvency lawyer, this is legally unobjectionable. From now on, you will only pay receivables that are essential for your basic needs. So only rent, gas, electricity, internet etc. will continue to be paid. Thereby you give a clear warning shot for your creditors. This puts the creditors under pressure and Debt relief without personal bankruptcy is possible through skilful negotiation with the creditors.

For the following debt relief measure, it is advisable to consult a lawyer specializing in bankruptcy law. This allows you to approach your creditors with the necessary seriousness. The lawyer will make a settlement offer to the creditors, which often means that the creditors waive a large part of their claims.

Which current accounts without Schufa are recommended if you want to open a second account despite P-Konto

To open a second account despite P-Konto, only current accounts without Schufa are eligible. If the bank makes a Schufa request, it will refuse the second account due to the garnishment or the P-Konto.

The following banks offer one Current account without Schufa at

Open a P account – which bank? – If you are wondering which bank you should open a P account with due to negative Schufa entries or a bad credit rating, we recommend that Pay center with the Supremacard*, which can be fully digitally converted into a P account without Schufa. But that too N26 account* can be opened with bad credit and negative credit bureau and converted into a P-account.

Other banks without a Schufa connection are often unable to provide a fully-fledged P-account, either because they are only developing the interface and solarisbank is actually the bank behind it (Nuri, Bunq, Tomorrow) or because they (in some cases despite the German IBAN) have a foreign banking license ( Open Bank, Bunq). You can find the pros and cons of the best P accounts in the article Open a P account – which bank?

Advantages and disadvantages of a second account despite attachment

| advantages: A new account despite seizure | Disadvantages: A new account despite seizure |

|---|---|

| ✔️ You can put some money aside with a separate checking account. | ❌ Slightly increased effort for asset information |

| ✔️ Faster deleveraging possible as you can save money for a down payment in case of a settlement | |

| ✔️ Get out of debt without personal bankruptcy by stopping payments | |

| ✔️ More money for the unforeseen | |

| ✔️ No report to Schufa if you open a checking account without Schufa | |

| ✔️ No additional costs | |

| If you're wondering "Can I open a new account despite the garnishment?" you can use this table to weigh up the pros and cons of your decision. | |

Procedure for P-Konto conversion

Note: You can skip the conversion if you directly buy a Pfändungsschutzkonto from pay center* open.

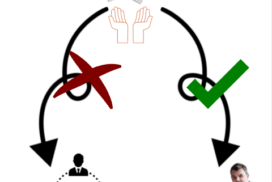

When you open the new account, you don't mention the planned conversion into a P account for the first time. Because you only have a legal right to "conversion of an existing account". However, there is no legal entitlement to the direct opening of a P account. Legally, this is written down in § 850k paragraph 7 of the Code of Civil Procedure (ZPO). In short, what this means for you in practice is that the bank can still reject you if you mention the P account before opening the new account.

Therefore, it is wiser to wait for the account opening documents and then instruct the bank to convert the account into a P account. Alternatively, you can also use the expensive premium providers such as pay center* evade. While the fees at Paycenter are higher than at other providers, you can open your account here directly as a P-account (without the risk of being rejected due to ongoing seizure) and thus save yourself a second trip to the bank

Where can I open a P account despite debt?

There are also providers with whom you can open a P-account despite debt. With these providers, no P account conversion is necessary. You will also receive a debit card to withdraw money from your account. The advantage of these providers is that they are well versed in the area of garnishment protection accounts for people with negative Schufa entries, as they have specialized in this. The disadvantage of these providers is that they are slightly more expensive than regular bank accounts.

- pay center*. While the fees at Paycenter are higher than at other providers, you can open your account here directly as a P-account (without the risk of being rejected due to ongoing seizure) and thus save yourself a second trip to the bank. This makes the offer interesting for people who want to avoid a second trip to the bank. Activating the account costs €39.50. In addition, there are monthly costs of €6 for account management and €5 for each cash withdrawal.

- N26 Flex* The N26 Flex account is an N26 smartphone account managed on a credit basis. The Flex account is offered to you, if you have a bad credit rating or a negative credit bureau have. You can first try to open a regular N26 account. If the bank does not accept your application, you will receive an opening offer via N26 Flex. You cannot select the N26 Flex account manually. The costs are moderate compared to Paycenter's offer. Monthly fees are €6. In addition, there is a fee of €2 per withdrawal.

Open second account despite P-Konto: Use a completely independent bank!

If you open your new account at a bank that is related to your old bank, the bank may repeat their own claims with a settlement. This danger primarily threatens when money has been paid into the new account and the bank is a creditor.

If you already have a P account with the Comdirect, you should not open the second account with Commerzbank. In both cases, Commerzbank is behind it. In order to remain as independent as possible, it is not advisable to open a second account with banks from the same ATM network.

For example, Commerzbank, the German Bank, postal bank and HypoVereinsbank have a joint ATM network via the Cash Group. But there is also a connection between the fintechs Bunq, Vivid and Tomorrow. They all use Solarisbank to process their transactions and you should therefore avoid the network if you already have an account there.

In the following table you will find other banks that are connected via an ATM network. If you want to open a new account despite the garnishment, you should choose a bank that is not connected to the first bank via an ATM network or in any other way

Secondary account in case of garnishment: Avoid banks connected via networks

Banks in Germany connected via networks, have an exchange of information, which is a hindrance in the case of a second account in the event of garnishment.

| participants of the network | type of network |

|---|---|

| Savings Bank Association: All banks of the Sparkasse | vending machine network |

| Association of cooperative banks: Volksbanks and Raiffeisenbanks, PSD banks | vending machine network |

| Cash Group: Deutsche Bank, HypoVereinsbank, Comdirect, Commerzbank, Postbank | vending machine network |

| cash pool: BBBank, National Bank, Santander Consumer Bank, Sparda Banks, Targobank and others* *Other cash pool banks: Bank für Sozialwirtschaft Aktiengesellschaft, Bankhaus Bauer AG, Bankhaus CL Seeliger, Bankhaus Gebr. Martin AG, Bankhaus Hafner, Bankhaus J. Faisst OHG | vending machine network |

| Solaris bank: Bunq, Vivid, Tomorrow | All providers use the Solarisbank to process transactions |

| Schufa: About 80% of all German banks. Banks that do not initiate a Schufa entry after opening a current account: 1.) Vivid Money 2.) Nuri 3.) Bunq 4.) Insha 5.) Monese 6.) N26 -Flex 7.) Open Bank 8.) Tomorrow 9.) Wise 10.) vimpay | credit reporting agency |

To open a new account despite a garnishment, you should choose a bank without links to your old bank. In addition, it is often only possible to open a Account without Schufa open. However, there are now some good free current accounts without a Schufa query. Some of them can also score points with a functional app and free account management.

In the table for free checking accounts without a Schufa query you will find many good banks without a Schufa connection to open a new account despite seizure. With such an account, you can bring your financial situation back under control and accelerate the deleveraging of key creditors.

Summary: Can I open a new account despite being garnished?

In summary, it is important to open a new account in the event of a seizure if your bank refuses to convert your account to a P account due to an existing overdraft. This only works if you have either a non-Schufa checking account from providers like Vivid* or Tomorrow* opened or to specialized P-account providers like pay center* fall back. Other banks will refuse to open a current account if the seizure is ongoing due to a negative Schufa feature.

If you also want to get rid of your debts without private insolvency, you can also do this with the P-Konto. To do this, it is important to initiate a hard payment stop for everything that you do not immediately need to live. With this you stop all payments to creditors who cannot endanger your existence. These creditors are forced into action by this warning shot. Thus, a debt relief without private insolvency is possible through skillful negotiation. It is advisable to seek the advice of a lawyer.

In the post "P-Konto trick", we have presented you some tricks that you can use to trick the P-Konto a bit so that you have the maximum amount of available money in the account at the end of the month.

Open second account despite P-Konto: the 6 best banks

In this table you will find the 6 best banks to open a garnishment protection account.

1st option: Have a regular account converted

Most banks refuse to open a garnishment protection account directly. Therefore, it is usually necessary to open a regular account first. Later you can convert this into a P-Konto. However, you should follow the instructions on this page, otherwise the account conversion may fail. Unfortunately, banks are not obliged to open garnishment protection accounts. The law only requires banks to convert an existing account into a P-Konto within 4 days.

2nd option: open a P account directly

The only provider I know of where you can open a garnishment protection account directly without prior conversion pay center with the Supreme card.

|

Related questions on the topic Can I open a new account despite seizure?

What happens if I open several P accounts at the same time?

It is not forbidden to open a second account in case of an ongoing garnishment. However, this second account may not be managed as P-Konto. Therefore, you can only open a garnishment protection account. When you open a P-Konto, the bank will ask you during the opening process whether you have any other P accounts. You must confirm to the bank that no other P-Konto already exists.

If you provide false information and thus try to open several P accounts at the same time, this can have criminal consequences. Therefore, you should refrain from trying to open multiple P accounts at the same time. The legal basis for this is the "P-Konto paragraph" § 850k para. 8 p. 2 ZPO. This excludes the opening of a regular second account, which the providers are obliged to do from the comparison table suit.

Can I cancel a P account and open a new one?

If you are not satisfied with your bank, you can open a new P-Konto at another bank. You should choose a bank that offers Girokonto without Schufa. There you open a new account and have it converted to a P-Konto. The latter have higher fees, but a simpler opening process. It is also important that the new bank is not connected to the first bank through a parent company.

Because if the bank finds out that you already have a P-Konto, they will probably reject you as a customer. Alternatively, you can also switch to banks that specialize in opening P accounts.

What options are there for withdrawing money despite seizure?

In order to be able to withdraw money despite the seizure, you have to convert your account into a P account. Protection against garnishment only exists on a P account. An alternative would be a special one Seizure protection account without conversion directly from a provider like pay center* to open which specializes in people with poor credit ratings. In both ways, you have the option of disposing of the money in the account up to the exemption amount despite the seizure. You can withdraw the money despite the garnishment, send it to another account by standing order or transfer, or settle a card payment or direct debit as usual.

What can I do to have more income after the garnishment?

To have more income, you can open a second account without Schufa. This way you will be equipped with the necessary money in case of unexpected events. In addition, with a second account you can save money for a down payment in case of a later settlement. You can lay the foundation for this with a separate account without Schufa, where you can save some money.

However, a second account without Schufa is also particularly important if your current bank has restricted the use of your credit card due to previous financial problems. In order to continue participating in social life, it is important to open a garnishment protection account at an independent bank.

In our comparison table you will find the best free checking accounts without Schufa. By using them for free, you can discreetly save something to have more income after the seizure and accelerate your debt relief. However, you should not hide your credit bureau-free account when reporting assets in order to avoid further problems. Alternatively, you can also open a Paycenter garnishment protection account directly.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

1 thought on “Trotz P-Konto zweites Konto eröffnen? – in 5 Schritten”