What happens if you have too much money on the P-Konto? What options are left for you to have enough money in the month? In this article we will address these questions in detail. The article is worth reading because if you have exceeded the P-Konto, there are some cases when you can use the money ...

What happens with too much money on P-Konto? - Short explanation

What you can learn here

- What happens with too much money on P-Konto? - Short explanation

- What is a P account?

- When should you do an account conversion?

- When does the seizure of the account take place?

- How much money do you have available on the P-Konto?

- What happens to too much money on the P-Konto?

- What happens if the P-Konto money input is higher than the allowance?

- No more garnishment available? - What happens to too much money on P-Konto without garnishment?

- What happens to the credit balance on the P-Konto if it is below the garnishment allowance?

- What can you do if the money on the P-Konto is above the allowance?

- Conclusion: What happens with too much money on P-Konto?

- Any questions?

What happens on the P-Konto with too much money depends on whether you use the P-Konto-Allowance exceeded have (moratorium amounts) or whether it is the multiple Carryover of unused credit to the following month acts. Both are considered as too much money on the P-Konto, although the allowance is exceeded only in the first case.

Case 1: P-Konto Allowance exceeded: What happens?

If you have exceeded the P-Konto allowance, the Money on the disbursement account blocked and paid to you again in the following month. So you always use the money from the withdrawal account before your actual income. Only when the amount on the withdrawal account exceeds the tax-free amount and you do not use the surplus in the following month.the bank transfers the money to the creditor. If the P-Konto is not exceeded regularly, you will get the money back from the withdrawal account.

More in chapter "What happens to too much money on the P-Konto?"

Case 2: Carryover of unused credit to the following month

You can carry over unused credit on the P-Konto to the next month. The transmission is possible up to three times. In the following month, the money will be available at the beginning of the month. After the fourth transfer of saved funds, the money is no longer protected and is seized. Although the P-Konto has not been exceeded, you will not get back unused money after the fourth transfer.

More in the chapter: unused credit on the P account below the garnishment exemption carried over to the following month

Confused? That was me at the beginning too! If you've exceeded your P-Konto and want to know if you'll get the money back, you can also use allowance, income and expenses to into this calculator, in order to obtain a quick evaluation.

What is a P account?

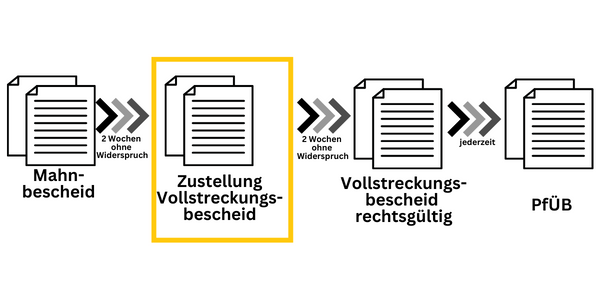

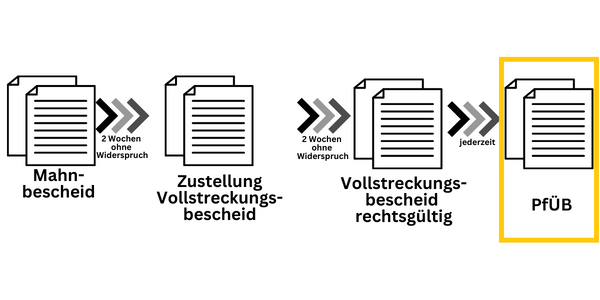

If you have debt and are worried about having your account garnished, there is an option you should consider. It is called P account and it helps you to protect your money from seizure. Thus, you can continue to make a living. If you have received a reminder, a P-Konto is not yet necessary. However, once you receive an enforcement notice, your account can be garnished at any time.

If you have received a garnishment and transfer order (PfüB), a creditor has seized your account. Once the bank receives a garnishment and transfer order, it is prohibited by law from paying out account balances to the debtor. Thus you can no longer freely dispose of the account. Thus, neither the withdrawal of money nor transfers are possible anymore. In the event of an account garnishment, you will no longer be able to access your money overnight. An account garnishment can therefore threaten your existence, especially if you still have a spouse or children to support.

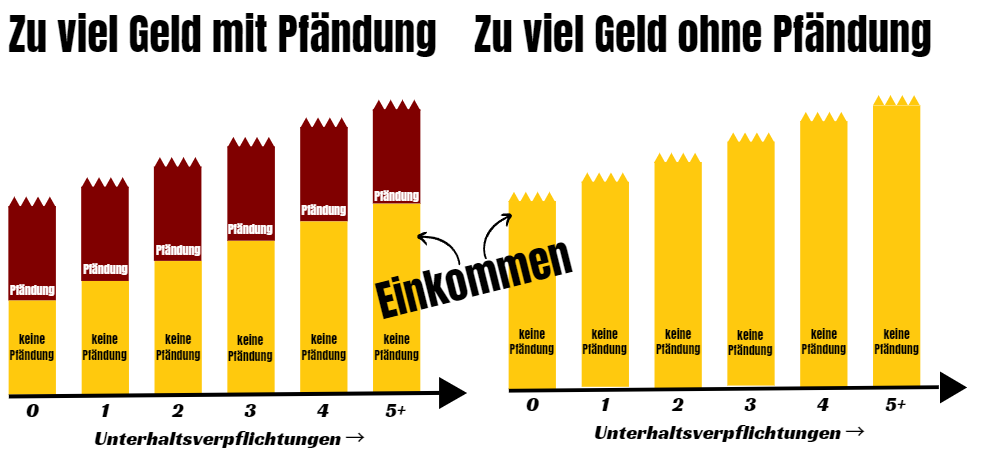

A P-Konto helps you in this situation. It simply ensures your survival, as a basic amount cannot be transferred to the creditor. You can use any checking account into a P-Konto, or you open a new account. This is also despite already occurred garnishment still possible. The more other people you have to support from your income, the higher the protected allowance on the P-Konto. The bank is not allowed to transfer this amount to the creditor. With a Garnishment calculator you can easily calculate the protected allowance for your individual situation.

When should you do an account conversion?

If you've received an enforcement notice, you should seriously consider taking your Account before a garnishment to protect. Through a Enforcement notice the creditor's claim is legally valid and he can now garnish wages or the account at any time. The enforcement notice follows the dunning notice and is therefore the second of three steps in the process of garnishing the account. If you do not object to the enforcement notice, it is valid for 30 years and the creditor can apply for a garnishment and transfer order at any time.

However, even after receiving the enforcement notice, it is still possible to agree on payment by installments with the creditor. If this is successful, the account will not be seized and conversion of the account will no longer be necessary.

When does the seizure of the account take place?

If you do not take action after you have been served with the enforcement notice, the enforcement notice will become legally valid after 2 weeks. With a legally valid enforcement notice, you are directly threatened by the seizure of the account, because the creditor can now apply for a seizure via a PfüB at any time.

However, you have to Conversion of the account to a P-Konto still 1 month after receipt of the garnishment. Time. However, it is advisable to take action as soon as possible, as the bank needs up to four working days to convert the account. If your account is in the negative, you should convert it immediately. You can find out why in the info box.

Account in the negative? - Have it converted before receiving the next income!

If your account is in the negative, you should before the receipt of the next income into a P-Konto. Because after the conversion to a P-Konto you have the following options all credits up to the amount of the allowance available without the income being offset against the minus amount in the account. This is also recommended by the consumer advice center.

How much money do you have available on the P-Konto?

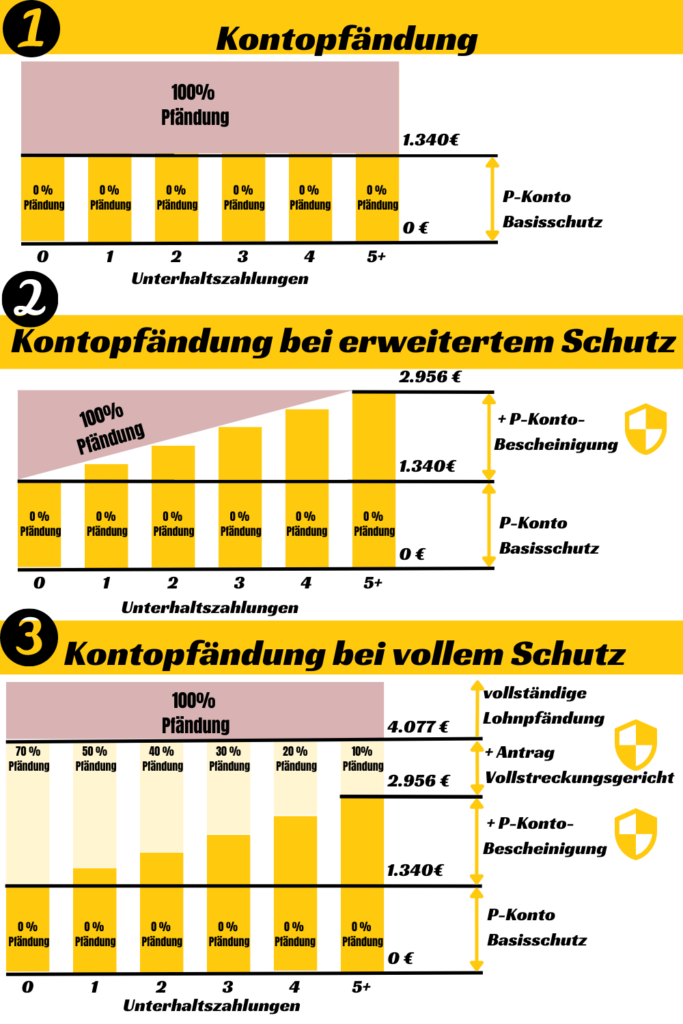

After the account conversion, the P-Konto will be entitled to the rounded-up basic tax-free amount of 1.340 € available. The tax-free amount is valid from July 1, 2022 to June 30, 2023 and will be increased on July 1, 2023. If you still have children or a spouse to support, you can have the tax-free amount adjusted accordingly. Child benefit will also be counted in full towards the tax-free amount. Back payments from overtime up to 500 €. To increase the allowance, you need a P-Konto certificate. With this you can get up to 2.956 € monthly from garnishment. With an application to the enforcement court, you can, depending on your personal situation, receive up to 4.077 € to be protected from seizure.

The infographic gives you an overview of the Allowances on the P-Konto:

What happens to too much money on the P-Konto?

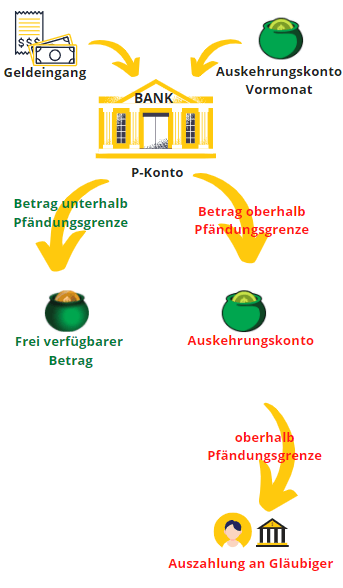

If you have exceeded the allowance on the P-Konto, the bank does not send the money directly to the creditor. Instead, the money above the allowance is put into a separate pot - the disbursement account - paid out. Here, the money is still protected from the access of creditors. However, as a debtor, you cannot access it either. The bank will pay out the credit balance of the distribution account as income to the P-Konto again the next month.

If you use money in the following month, the transferred credit from the previous month is used first (FIFO: first-in-first-out). The FIFO principle is now explicitly regulated (§ 899 ZPO) and ensures that credit that is used up in the next month is not paid out. This is because surplus amounts can only be transferred once. Thus, a premature distribution of the money is avoided, since the transferred credit is not transferred several times due to FIFO, if it is spent in the following month.

If you exceed the tax-free amount again with your income in the following month, the bank will retain the difference again via the distribution account. If you can no longer fully use the transferred credit in the following month, the distribution account will also exceed the tax-free amount at some point. In this case, the surplus will be transferred twice to the following month. According to § 900 ZPO, this is considered "too much money on the P-Konto" and therefore the bank then pays out the surplus to the creditors.

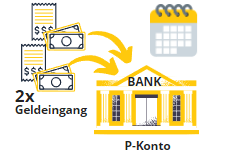

P-Konto exceeded: What happens? - If you have exceeded the P-Konto allowance, the money on the withdrawal account will be blocked and paid to you again in the following month. Only when the amount on the withdrawal account exceeds the allowance and you do not use the excess in the following month, the bank will transfer the money to the creditor. In summary, this means: If the allowance on the P-Konto is exceeded 2x, the bank transfers the money to the creditor!

Here is the relevant legal text from Section 900 of the Code of Civil Procedure on the moratorium on payment of excess amounts on the P-Konto:

§ 900 Moratorium on transfer to creditor

(1) If future credit on a Pfändungsschutzkonto is garnished and transferred to the creditor, the third-party debtor may (Note: The bank is the third party debtor). make payment to the creditor or deposit the amount only after the end of the calendar month following the respective crediting; [...].

(2) Credit from which no payment may be made to the creditor or which may not be deposited by the end of the period in subsection 1 is credit within the meaning of Section 899 subsection 1 sentence 1 in the calendar month following the credit entry.

Source: ZPO § 900 - dejure.org

A simple example of what happens with too much money on the P-Konto

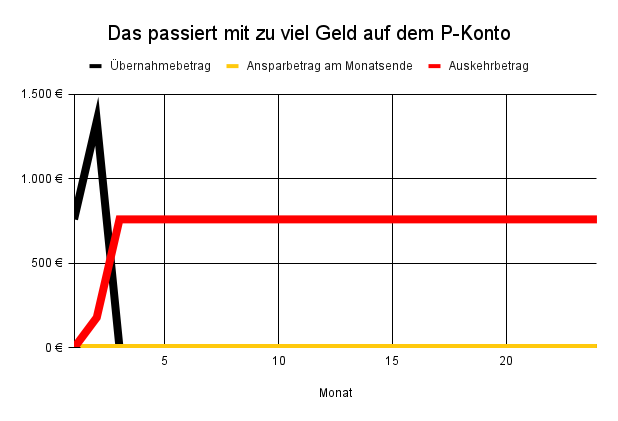

For example, if you have an allowance of €1,340 and an income of €2,100 net, €760 will flow into the withdrawal account in the first month. The bank will then only pay out the tax-free amount of €1,340 to your P-Konto.

- Income: 2.100 €

- Allowance: 1.340 €

- Expenditure: The tax-free amount is used up completely (€ 1,340)

In the second month, with the same earnings, another €760 flow into the payout account. You will again receive €1,340 on the P-Konto for your living expenses. However, there is now a total of €1,520 (2 x €760) on the payment account, which is above the allowance of €1,340. Therefore, the bank pays the difference of 180 € (1.520 € – 1.340 €) to the creditor.

In the following months, the surplus above the allowance is transferred in full to the creditor, as surplus amounts can only be transferred once to the following month. Thus, the Creditor then henceforth € 760 of your income of 2100 € transferred. You will then only have the garnishment allowance of 1340 € available for spending.

Here you will find the amounts spent for the example.

| Month | Disbursement amount |

|---|---|

| 1 | 0 € |

| 2 | 180 € |

| 3 | 760 € |

| 4 | 760 € |

| 5 | 760 € |

| 6 | 760 € |

Example calculation of the amount of money paid out with € 2,100 net and an allowance of € 1,340

Calculate what counts as too much money on the P-Konto

It is not easy to understand what is considered as too much money on the P-Konto according to § 899 and § 900 of the Code of Civil Procedure. This is because there are different allowances and grace periods for the money that is blocked on the sweep account. Therefore, we have created an easy-to-use calculator with which you can calculate the amount swept out to the creditor with only 3 pieces of information.

After entering your allowance and income the calculator calculates Transfer amounts in the following month and the to the Amount paid to creditor. You can additionally pay your monthly expenditure to enter a possible amount saved to calculate on the P-Konto. The use of the calculator is possible without registration.

Start computer(opens in new tab)

What happens if the P-Konto money input is higher than the allowance?

If the P-Konto-Gelde input higher than the exempt amount, the money initially flows into a separately managed money pot. this is that disbursement account. The bank does not seize the excess money immediately. Instead, the bank first accumulates the money in the separate money pot. Only when this pot of money exceeds the allowance does the bank seize the money.

The money on the payout account is initially from creditor access protected. However you can don't even have access to it. Instead, it is "paid out" to you as income the following month. If you are below the allowance in the following month, your income will be offset by the money from the payout account increased up to the exempt amount. The remainder remains in the distribution account.

If, in the following month, you again receive money above the garnishment allowance on the P-Konto, the amount on the withdrawal account will increase until the amount of money exceeds the allowance. The bank pays this excess to the creditor. Thus, the double allowance (on the P-Konto as a monthly protected cash receipt + the buffer on the distribution account) is protected from the access of creditors. However, you yourself can only dispose of the single allowance, as neither debtors nor creditors can withdraw money from the distribution account. The connection is regulated since the P-Konto reform 2021 in § 899 and 900 ZPO.

You can work with check this calculator itselfwhether your income is no longer protected on the P-Konto. In addition, the calculator shows you when a payout to creditors will take place and in what amount.

No more garnishment available? - What happens to too much money on P-Konto without garnishment?

If there is no garnishment on the account, you can go through the P-Konto fully dispose. So if you have set up your P-Konto as a precaution, and it has not (yet) come to a garnishment, so nothing happensIf too much money flows into your P-Konto and you have exceeded the exemption amount. Therefore, you can set up a Pfändungsschutzkonto as a precaution to be prepared when the garnishment occurs. Nothing will happen with too much money on the P-Konto if your creditors are already satisfied and therefore there is no garnishment anymore.

With too much money on the P-Konto nothing happens without seizure when exceeding the allowances. You can dispose of the account normally and are prepared for the emergency, so that you can secure your existence.

What happens to the credit balance on the P-Konto if it is below the garnishment allowance?

If you have a high tax-free allowance that you do not fully use with your income, you can also carry over the tax-free allowance to the following months. However, there are a few things to keep in mind so that the money is not transferred to the creditors. Contrary to what one might expect, the garnishment protection on the P-Konto does not fully apply to income below the garnishment allowance. You must also consume the money so that it is not paid to the creditors.

You can carry over unused credit on the P-Konto to the next month. The transmission is possible up to three times. In the following month, the money will be available at the beginning of the month. In the fourth transfer of saved funds, the money is no longer protected and is seized, even though your P-Konto was not exceeded once.

Section 899 of the Code of Civil Procedure states as follows:

If the debtor has not had credit balances in the amount of the total amount exempt from garnishment pursuant to paragraph 1 in the respective calendar month, such credit balance shall be unused credits in the three subsequent calendar months in addition to the credit balance protected under paragraph 1 shall not be subject to seizure. Disposals shall in each case be offset against the credit balance that was first credited to the Pfändungsschutzkonto.

Source: § 899 ZPO - dejure.org

Therefore, if you do not use up the allowance completely by the end of the month, even if your income is below the allowance, money will be moved to the distribution account and transferred to creditors starting with the fourth transfer in the following month.

This means that you have too much money on the P-Konto even though you earn less than the allowance.

If you're planning a major purchase, you can think about withdrawing the money at the end of the month so it doesn't get swept out.

The term allowance is somewhat misleading with the P-Konto because the money is not "freely" available to you, but can be garnished if you do not spend the transferred amounts.

On the other hand, the faster seizure of the money allows you to get out of debt faster.

In the case of garnishment without exceeding the P-Konto allowance, the legislator assumes that you do not necessarily need money transferred several times to live. Therefore, it has given higher priority to the satisfaction of creditors than to the accumulation of further credit on the P-Konto.

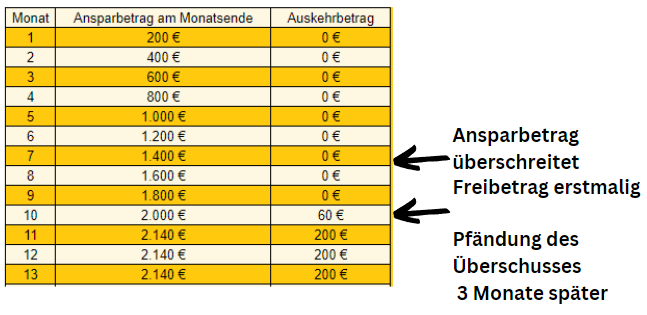

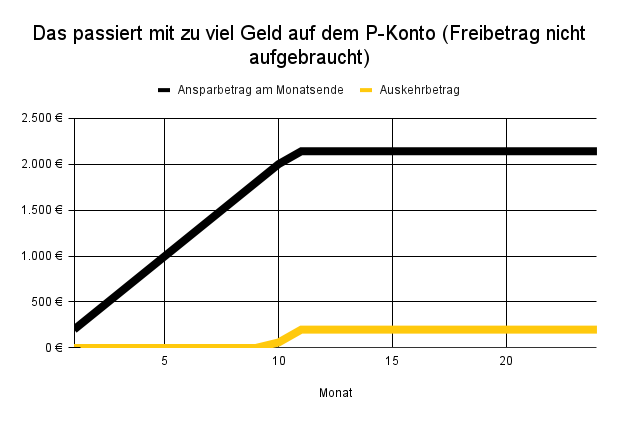

The graph and table in the next section illustrate what happens to unused credit on the P-Konto.

Example: unused balance on the P-Konto: disbursement of the money although income < allowance

For this purpose, let's assume a person with the following data:

- Allowance: 1.340 €

- Income: 1.000 €

Expenditure: 800 €

So you save 200 euros a month due to the low expenses. The calculation shows that in the seventh month the saved amount exceeds the tax-free amount for the first time. Three months later (month 10), the payout of 60 euros begins, since this is now the third time the allowance has been exceeded (in months 7, 8 and 9). In the further months, the monthly savings amount of 200 euros is then paid out in full to the creditors (§ 899 ZPO).

What can you do if the money on the P-Konto is above the allowance?

If you exceed the allowance, the money is not transferred directly to the creditors. The bank will make the surplus available to you again in the following month. The bank will only transfer the money to the creditor if you can no longer use the carryover in the following month and transfer it again. Transferring money to creditors will help you eventually become debt free again. This positive aspect should also be considered before you start looking for ways to P-Konto trick can.

If you still want to garnish as little as possible, you have the following options:

Withdraw unused credit below the allowance: If your personal allowance is greater than your expenses, you can withdraw the remaining amount at the end of the month. But be careful: Before withdrawing the money, you should definitely make important transfers in advance, otherwise they will be blocked. These include, for example: rent, gas, electricity, internet and cell phone. Also think about direct debits to avoid subsequent problems..

Increase allowance: You can increase the regular tax-free amount if you have to pay maintenance for children or spouses (living separately or together). You can also have the tax-free amount increased once if you receive additional payments. But even if you work overtime, the money will not be seized upon application, or at least only on a pro-rata basis.

Reduce revenue and work less: If you reduce your hours at work, less will be garnished from your account or wages.

Renew certificate: Often P-Konto certificates expire after 2 years. Remember to renew in time!

Double garnishment Reject with motion: You can avert a wage and account garnishment by filing an application with the enforcement court.

Seek settlement with debt forgiveness: Try to obtain debt relief and offer the creditor a sum higher than the amount he would receive in a private bankruptcy but lower than the total amount of the debt.

Conclusion: What happens with too much money on P-Konto?

What happens on the P-Konto with too much money depends on whether you have exceeded the P-Konto allowance (moratorium amounts) or whether it is the multiple carryover of unused balance to the following month. Both are considered as too much money on the P-Konto, although the allowance is exceeded only in the first case.

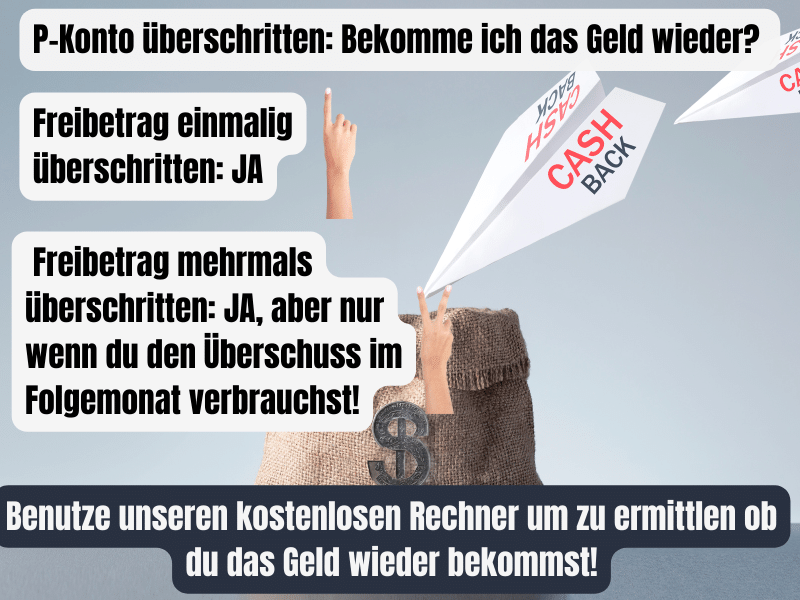

P-Konto exceeded: Can I get the money back?

If you exceed the P-Konto allowance, the money in the withdrawal account will be blocked and paid out to you in the following month. So you always use the money from the distribution account before your actual income. Only when the amount on the distribution account exceeds the allowance and you do not use the surplus in the following month, the bank transfers the money to the creditor. So, if the P-Konto is not exceeded regularly, you will get the money back from the withdrawal account.

What happens to unused credits on the P-Konto? - You can carry over unused credit on the P-Konto to the next month. The transfer is possible up to three times. In the following month, the money will be available at the beginning of the month. At the fourth transfer of saved balance, the money is no longer subject to protection, and will be seized. Although the P-Konto has not been exceeded, you will not get back unused money after the fourth transfer.

If you've exceeded your P-Konto and want to know if you'll get the money back, you can also enter your exemption amount, income, and expenses into this calculator for a quick evaluation.

Start computer(opens in new tab)

Any questions?

Write a comment describing your situation or find answers here to common questions from other people who had problems with too much money on the P-Konto and didn't know exactly if the allowance has already been exceeded.

What happens to money in excess of the exempt amount in the P account?

If, in the following month, you again have an incoming payment above the garnishment exemption amount on the P account, the sum on the payment account increases until the amount of money exceeds the exemption amount. Only this surplus is paid out to the creditor. In this way, the double allowance is protected from access by creditors. However, you can only dispose of the simple tax-free allowance yourself.

P account allowance exceeded: How do I get my money?

If the exemption amount for P-Konto is exceeded, the money flows into the distribution account. Neither you nor the creditor has access to it. You can only dispose of the money from this account when your monthly income is below the tax-free amount. Alternatively, you can apply for an increase of the tax-free amount in order to get your money from the distribution account in the following month.

How much money can you have on a P-Konto?

You are allowed to save as much money on the P-Konto until you can't use up the entire balance carried over from the previous month. The amount depends on your income, expenses and allowance. You can save with this computer calculate how much money you are allowed to have on your P-Konto.