Going to college is usually a big change. Because it is often associated with moving to the place of study. Anyone who receives income from part-time jobs, parental allowances or state subsidies as a student must also systematically manage expenses - including rent, electricity, telephone and Internet. The "control center" for all financial matters today is the checking account. About a Student account comparison you will find numerous free checking accounts for students. There are often special, advantageous conditions for students. In addition to free account management, numerous other services can be included:

- Student account as a special checking account for students

- Free account management

- Management of incoming and outgoing payments

- Additional services such as cards

Especially popular in Student account comparison are there:

- Student account with starting credit or Opening bonus

- A Account for students with a credit card

- Student account with overdraft facility.

You can find these accounts in Student account comparison.

The current account: It is so important in everyday life

What you can learn here

- The current account: It is so important in everyday life

- Free accounts: Not so easy to find without a student account comparison

- Finding the best student account: What matters when comparing student accounts

- Why use a student account comparison?

- Found a student account? After the student account comparison, open an account in just a few steps

- What happens to the student account after graduation?

- Switching accounts after graduation: Uncomplicated and often useful

- Conclusion: With the student account comparison you can save money every month

A student account is a checking account specifically for students up to a certain age. Because a current account is absolutely necessary for economic and social participation in life. The basic account for all everyday payments was created to replace the “wage packet” that was common in the past. However, the original salary account quickly became an all-rounder. Depending on the bank you choose, the following options are associated with a current account:

- Receiving and Making Payments

- Automation of recurring payments through standing orders or direct debits

- Use of Girocard or credit cards

- issuance of cheques

- Linking with payment service providers such as PayPal or IMMEDIATELY

- Linking to mobile wallets

- Convenient management in online banking

As you can see, a checking account is an important aspect when it comes to processing payments Electricity- or telecommunications provider. After all, as a student you don’t want to constantly have to deal with meeting payment deadlines, the course is demanding enough. You can automate such monthly recurring payments via online banking.

Cashless payment transactions via a Girocard, the successor to the earlier EC card, or even a free VISA or MasterCard ensure a high level of security. Students who spend at least a while abroad appreciate the fact that such services are included in the student account and that international money withdrawals are possible without additional costs.

Free accounts: Not so easy to find without a student account comparison

For years, free checking accounts, whether student accounts or for ordinary consumers, were the norm. The banks even outdid themselves with further incentives for acquiring new customers. In addition to the absolutely free account management, there was also welcome money, credit cards, sometimes travel insurance or non-cash bonuses.

Unfortunately, that's over - because the banks are also suffering from the zero interest rate policy of the European Central Bank. They have to pay a “penalty rate” of 0.5% pa on capital they store with the ECB and can therefore no longer afford to accumulate unlimited customer capital. Current accounts are therefore often only free of charge if you meet certain conditions. This often includes a minimum monthly payment of 700 euros or more.

Since 2016, the legislature has seen banks as obliged to offer customers so-called “basic accounts” free of charge, which have all the essential functions but do not offer a credit line. But students want to have a card and overdraft facility if possible, even when they are abroad.

Finding the best student account: What matters when comparing student accounts

Most well-known banks target students with a student account - and they still offer very good conditions. Because, of course, the financial service providers hope for a customer loyalty that outlasts the years of study. This pays off for the bank when students change jobs and use other banking products such as securities accounts or financing solutions.

However, what banks do to retain customers at this early stage varies from case to case. The student account comparison offers an overview of the services and thus shortens the path to the ideal student account. Here is an overview of the most important quality criteria for an account:

1. No account maintenance fees

For students, a checking account should not be associated with account management fees. The best student account is free.

2. Free credit or debit card included

A Girocard is always with you anyway. The successor to the EC card is typically German. Because the card was originally only developed for withdrawing cash from machines. Only later was the Girocard supplemented with additional services. The popular card is still the number one means of payment in stationary retail – but some things only work with VISA or MasterCard. Pay online, for example. For student accounts, such cards are usually designed as debit cards, so that no overdraft is possible, and ideally free of charge when used at home and abroad. Credit cards, on the other hand, have a maximum financial limit, unlike debit cards, payments are not debited immediately, but usually only once a month. Depending on the design of the card, credit cards can be particularly advantageous for stays abroad.

3. No overseas fees

It is important for students who are doing a semester abroad or traveling during the lecture-free period that there are no foreign currency fees when paying or withdrawing money - even outside the euro zone.

4. ATM network for cash supply

You should be able to use the student account card at any ATM or payment terminal – also without any fees. However, this is not a matter of course, because the ATM network is a cost factor for banks, and you are not completely free in your choice of ATM with every account. Students should not have to pay any fees when withdrawing from ATMs of other banks.

5. Online banking and mobile app

It goes without saying that students do not have time to visit a bank branch and prefer to manage their financial transactions online. Customer-friendly, high-performance online banking and a mobile app that is easy to use are therefore a must. An integrated function that analyzes expenses and assigns them to specific areas is particularly good – it makes it easier to keep track of your own expenses.

6. Overdraft facility and interest

It is important for students with a student account that the interest rate, especially for the overdraft facility, is favorable. You hardly get credit interest on credit balances with a current account, and even a call money account is not really worthwhile as long as the zero-interest policy of the ECB does not change. But the bank should charge as little as possible for the so-called debit interest that is applied to the overdraft on the account. In this way, students can occasionally use the credit limit of the account without paying double-digit overdraft interest.

7.No too low age limit

In the student account comparison, accounts in which the age limit for the account holder is not too low stand out. An age of 26, better still 28, is realistic and proves to be useful for students who are considering a doctorate.

8. New Customer Rewards

Bonuses for new customers have become rare, but are still available in one form or another at some banks. They are usually linked to the actual use of the account, i.e. a certain number of incoming and outgoing payments. In a broader sense, such offers also include free cards or ingenious ideas such as the combination of credit cards and student ID cards with international validity. Some ideas are so practical that you just have to grab them. However, the framework conditions must be realistic and coherent.

Why use a student account comparison?

So there are some special quality criteria for a good student account. The advertising that banks and direct banks use to address students online is quite full-bodied in this regard, but does not always reflect reality. In addition, with a choice of two or three really good account models, not all of them are equally suitable for the needs of all students.

In this case, the minimum criterion for the corresponding bank to be included in the comparison is that there is no account management fee for such a student account. Other benefits, savings and benefits are also evaluated. The student account comparison provides an overview. Comparison portals check the offers in detail using fixed categories and evaluate them in a very comprehensible way. This makes it much easier for students to decide in favor of a suitable account.

As a student, you should also be able to answer a few questions before considering the best offers in the account comparison in order to be able to narrow down your selection:

· Is there a regular monthly payment? If yes, in what amount? With minimum deposits from 700 euros, there are many more current accounts to choose from, even beyond classic student accounts, and with attractive additional services.

- Does a direct bank make sense (because it's cheaper), or do you need the services of a branch bank?

- Is the student account managed as the main account, or should it serve as a secondary account?

- Would you also like to use the account abroad?

- Is an overdraft limit required and if so, how much should it be?

- In addition to online banking, is it possible to comprehensively manage all financial matters via smartphone? Desirable because as a student you may not always have your laptop with you.

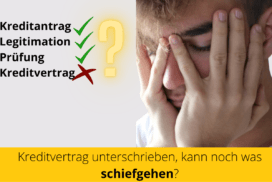

Found a student account? After the student account comparison, open an account in just a few steps

Once the decision for a suitable provider has been made, students can usually set up the new account within minutes and in just a few steps - very conveniently online. Prerequisites include

- the age of majority of the applicant

- a place of residence in the Federal Republic of Germany

- the tax assessment in Germany

You also need a valid ID document, such as an ID card, and a current utility bill to prove your place of residence, and with some banks also a certificate of enrollment. The opening process is usually started directly from the product page on the bank's website. Clicking on a clearly visible button opens a form in which to enter personal information.

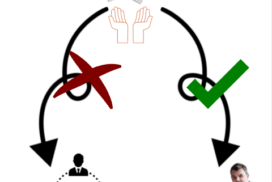

Once the application form has been sent, the applicant usually receives a link by e-mail, with which the wish to open an account can be confirmed by clicking on it. All that is then missing is the so-called legitimacy, i.e. the presentation of the identification documents. With most financial service providers, this can be done through a video call with a service employee. The ID card is held and turned several times in front of the camera on the laptop or smartphone. Alternatively, special verification apps are available for download, and students can also identify themselves at a Deutsche Post counter. Once all information and documents have been checked, you will receive the access data and any debit cards in separate envelopes by post.

What happens to the student account after graduation?

With some account models - but not all - the opening is linked to the submission of a certificate of enrollment. In this case, the validity of the conditions is linked to student status and expires upon completion of the course. Students should contact their financial service provider in good time - there are service numbers for customer service for this purpose, but there are also options for email contact. This way one can find out how the account can be continued and assess whether it is worth it.

If the student account is tied to a maximum age, around 28 years, it may be retained. This also applies to account models where a minimum payment is required at the end of your studies. Anyone who can book the sum of mostly 700 euros per month continues to benefit from the free account, even if it is then transferred to a regular current account. It is only important to clarify this transformation with the provider. If your bank charges high fees, you can find banks in this post which one Free checking account with no minimum deposit offer.

Switching accounts after graduation: Uncomplicated and often useful

Since it is not always advisable to continue the student account, students should consider changing banks if the conditions are unfavorable. Where previously a student account comparison made sense, you can now do one Checking account comparison use. Depending on your starting income, living and travel habits, an account with significantly different benefits may now be a better choice.

The account switch itself should go smoothly. It is important that standing orders and direct debit authorizations are not interrupted by the change. For this purpose, banks provide online forms in which one can specify which regular orders should be accepted. The new bank is then authorized to initiate the transfer. Such account switching services are part of the regular customer service of the banks and are not associated with additional costs.

Conclusion: With the student account comparison you can save money every month

The student account is for most students the first checking account. It is set up to conveniently manage financial matters in this new phase of life. In this way, regular rental and electricity payments can be automated and online purchases can be processed independently. Since such account types are designed to meet the needs of students, they are usually completely free of charge without a monthly minimum payment. The student account comparison also shows which other services banks score points with. These include free transactions abroad, toll-free credit and debit cards, online banking also via app and other services.

All of this can usually be used during the entire course of study or even beyond, up to a specified maximum age. Banks expect customer loyalty from such accounts. In fact, it is advisable to transfer the account to a regular checking account at the end of your studies if you are satisfied. If this is not the case, changing providers is just as worthwhile as it is straightforward. Of the Student account comparison facilitates the selection of an account. Herewith students can monthly Costs and fees save up to 25 euros.

In any case, students with the student account experience for the first time how clearly and conveniently the first income and expenditure can be handled with a current account. Above all, the automation of regular expenses keeps the head free for the organization of more important matters - this includes lectures, possible part-time jobs and housework that has to be done again and again up to the conclusion with the bachelor's or master's thesis. Especially when your studies are in the final round, you want to concentrate on your own research, collecting material and writing the thesis. These demanding activities require all concentration and should lead to good results if possible.

Student account comparison Help with exam stress

Even if the stress of exams gets out of hand, students do not have to despair. With the support of academic ghostwriters, you can delegate some of the work involved. The assistance ranges from finding the topic to the exposé and outline, the collection of data or the writing work. The trained experts also carry out corrections and proofreading. Thus, they make sure that the term paper gets the final touch. Thanks to the savings that a student account brings with it, students can usually also easily handle the expenses for the competent help!