P-Konto Increase allowance - How long does it take?

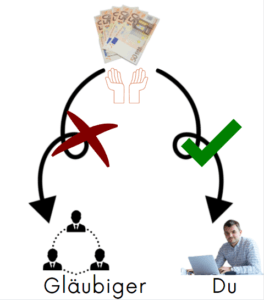

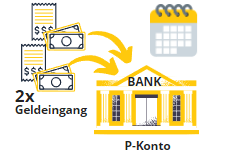

If you have a P-Konto, it is worth checking if you can increase the allowance. While by law the conversion of the account must be done within four business days, such a deadline does not exist for increasing the allowance. Therefore, many corrected rightly ask "How long does it take to increase the P-Konto allowance?". Normally, it is done ... Read more