For many people, buying a house or real estate is a long-cherished dream. Buying a property is a big project and represents a decisive turning point in life. In any case, it should be carefully considered financing of the property, because there are a few things to consider and mistakes to avoid.

who more bring equity when buying a home, has to take out less credit and, of course, also pay off less. For the bank, on the other hand, equity means simply more safety. The risk decreases because the loan amount is lower. The bank often rewards this with lower interest rates.

Those who contribute more equity to the purchase of a house therefore save money every month - that's actually a very simple calculation. Families with children can even hope to receive child construction subsidies from the state. But what counts as equity?

Equity – the more, the better

What you can learn here

Basically, it is never too early to put money aside for your own home - even if the purchase is several years away. It is recommended by most savings banks and banks between 15 and 40 % equity to save up before buying a property. Others speak of 10 to 20 percent of the purchase price plus the sideline costs, which should be available as cash. Under no circumstances should these have to be financed by a loan. Current conditions

Either way, that's quite a lot of money. So it is better to start saving early. Unfortunately, there is no patent remedy for the optimal form of saving.

Without any equity, only those who have a loan will get a loan really good and above all stable income Has.

equity property

Equity is the first thing most people think of of cash in the account. However, it does not necessarily have to be cash: Land can also be considered equity because the bank considers it to be an asset that is included as equity in the construction financing can be included in the calculation. However, there is one prerequisite for this: the property must be paid off. Otherwise it must be classified as land charge be entered in the land register and serves the bank in case of default.

shares as equity

Any assets available will be accepted as collateral by the bank. This also includes stocks. So if you don't have that much cash at your disposal, you might be able to deposit existing shares with the bank as security. However, banks never accept stocks at 100 % because the risk would be far too great. When stocks are deposited as collateral, they are frozen, which means they are marked as blocked so that the borrower can no longer access them.

Money from a gift or inheritance

Maybe that is also a possibility: money from a heritage or one donation can represent a financial basis that can be used as equity. Here, however, the current statutory allowances must be observed. Some even have their inheritance paid out during their lifetime. There is no entitlement to this, but it is possible. Another option would be donation. This makes it possible to have a sum of money not only available in the event of a death.

Security from relatives

Not enough cash to take out a loan? Then this option might be helpful. Perhaps the parents or other relatives are willing to deposit a certain asset with the bank. This also includes not only cash, but it can also, for example the parents' house be entered as security. If there are defaults, i.e. the borrower can no longer repay the loan, a foreclosure is imminent. This allows the bank to compensate for the financial loss incurred.

life insurance

It is also possible to have one life insurance fully or only partially lend. However, it must be clarified beforehand exactly what kind of financing is involved and which conditions were exactly regulated in the contract. However, it is a disadvantage in this case that the pension may be lost if the money is paid out in advance by the insurance company. In case of doubt, whether it is really worth canceling the life insurance for a loan from the bank must be clarified beforehand with the advisor.

Mortgaging the life insurance policy is also a way to get a Credit despite sick pay or one Credit as a pensioner despite basic income support to get.

The savings book

It is also possible to deposit a savings book with equity at the bank in the classic way. The bank accepts this as security for the loan, since there is no loss of value.

home savings contract

A home savings contract is also a way of increasing equity. Money is paid in here over a period of several years and then the building society offers the rest of the building savings as a cheap loan. If the money is needed immediately, a home savings loan could also be an option. The home savings sum is paid out immediately and at the same time the monthly payment begins. It is always worth taking out a home savings contract when interest rates are low. This is because tomorrow's interest rates are secured today.

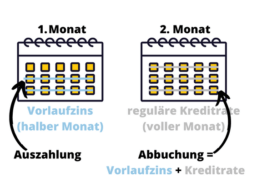

Final tip: Stay through credit agreements Repayment rate change flexible. With this you can Repayment change during the term.

This is a gas particle by Kerstin Schmidt - content manager and experienced ghostwriter at housework agency. Thank you for the article!