That 1822 direct account in the checking account test. The account offers a high bonus, is without paperwork at the opening but needs one Minimum deposit of €700 (1822 directly) or 0,01 € (1822 mobiles). Overall, is it a recommendation?

What kind of offer does 1822direkt offer?

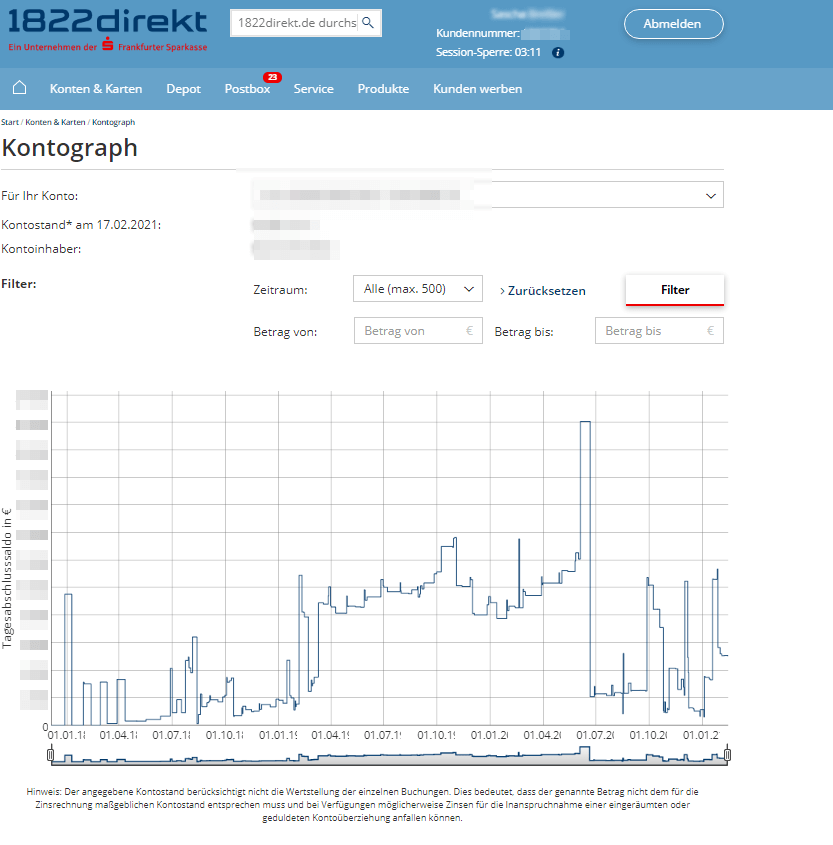

1822direkt is a bank that, in addition to various current accounts, also offers you capital investments, securities accounts, construction financing and loans. It does not differ significantly from other credit institutions in terms of what it offers. A special feature of the 1822direkt test, however, is the option of opening a mobile current account. I myself have been using the 1822direkt account for a little over 3 years.

1822direkt is a bank with history

1822direkt belongs to the Frankfurter Sparkasse, which already in the year 1822 was founded and is a 100 percent subsidiary. 1822direct has been on the market since 1996. The name derives from the founding year of the Frankfurter Sparkasse. In August 2005, the Frankfurter Sparkasse was taken over by the Hessische Landesbank. Since then, the 1822 has also belonged directly to the Landesbank Hessen-Thüringen.

What distinguishes the current account from 1822direkt?

The current account of the 1822direkt was very convincing in the test and is therefore ideal for private individuals. With the 1822direkt current account, fees for the account are only charged if in the billing month no money in the account is. The monthly fee for account management is then EUR 3.90. However, if you regularly draw income and cheap online account are looking for, the 1822direkt account is highly recommended. This is especially true for students and trainees. Up to the age of 27, account management is completely free of charge. It's even possible to have a joint account with two owners: ideal if you live in a flat share and want to use the account for joint expenses.

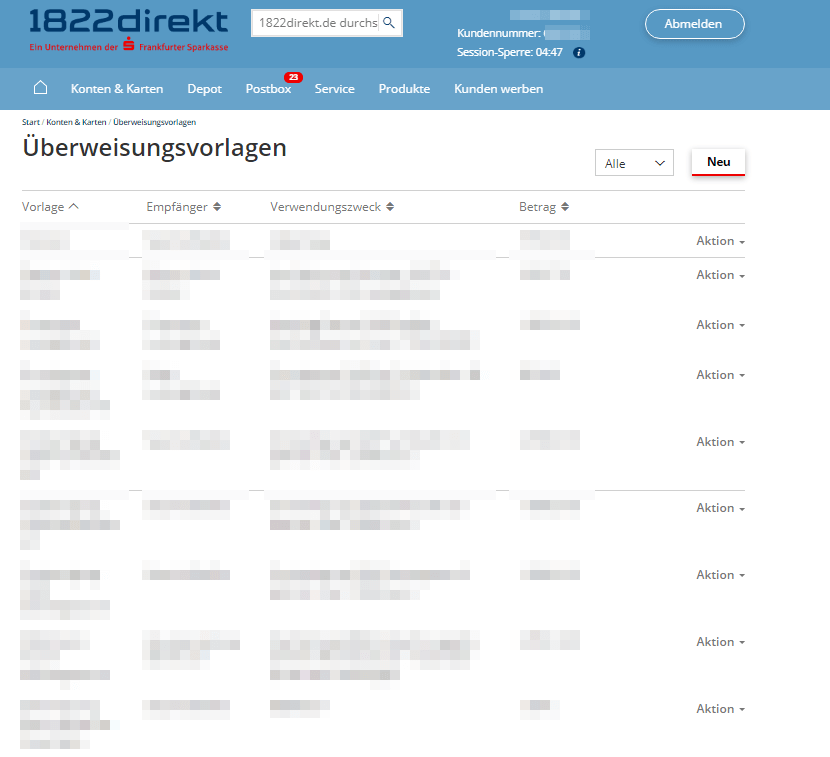

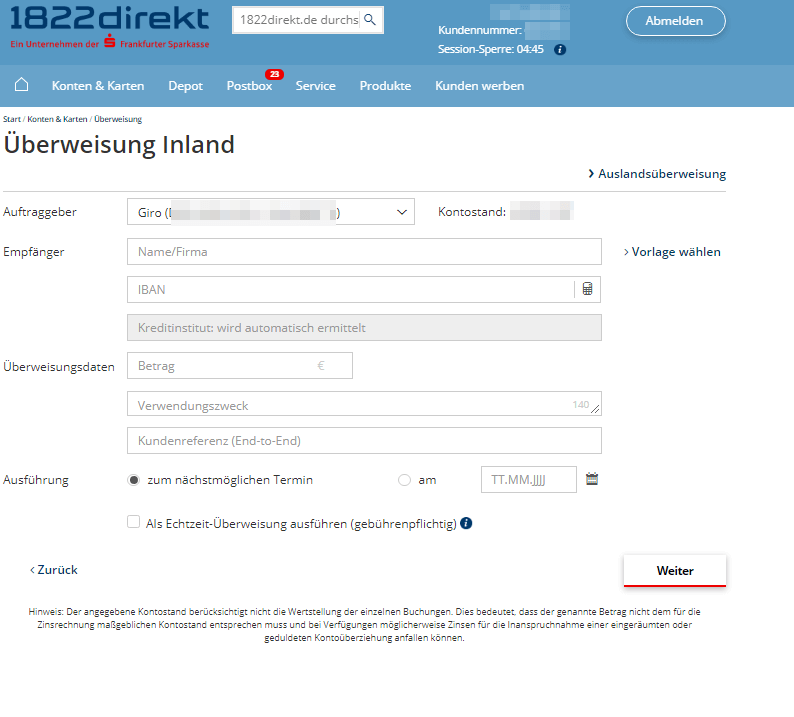

Online transfers are generally free of charge. However, if you would like to order a SEPA transfer by post or telephone banking, you will be charged an amount of EUR 1.50 per transfer. Transfers abroad are also not free of charge. Quite high fees are charged, especially for transfers to Monaco and Switzerland.

An account can also be opened for under 18s. Nevertheless, direct experience in 1822 has shown that it is less suitable for minors is. Up to the age of 18 you definitely need a power of attorney from your legal guardian. Online banking is generally only permitted from the age of 18. 1822direkt does not have a prepaid credit card specifically for young people, which is offered by numerous other banks.

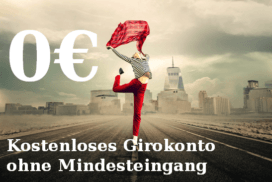

With 1822direkt Sparkasse you can choose from three different checking accounts: mobile*, classic* and Premium*. The model variants Classic and mobile are free; at the model Premium however, a monthly account management fee of EUR 9.90 applies. There are also differences in the monthly payments to be made. At the Mobile account, it's just a dime, which must be credited to the account. That Current account classic on the other hand, requires an incoming payment of at least 700 euros per month so that no account management fees are incurred. If this amount is not reached, you will be charged 3.90 euros.

The premium current account charges the highest account management fees. It has the advantage that the credit card is free of charge and you do not have to pay an annual fee. It's different with the Classic current account: The annual fee here is EUR 29.99. It is only waived if you make purchases of at least 4,000 euros a year. Overall, the 1822direkt current account experiences are consistently positive. I like the fact that there are different variants to choose from for every need.

In addition to current accounts, 1822direkt also offers per diem– and fixed deposit accounts. There is no minimum deposit for the call money account. Also positive: You can make monthly fixed amounts as well as special deposits. Of course, you can dispose of your money on a daily basis. You also have the option of investing in savings plans or precious metals. Precious metals to invest.

Selection help for the right current account on the 1822direkt page

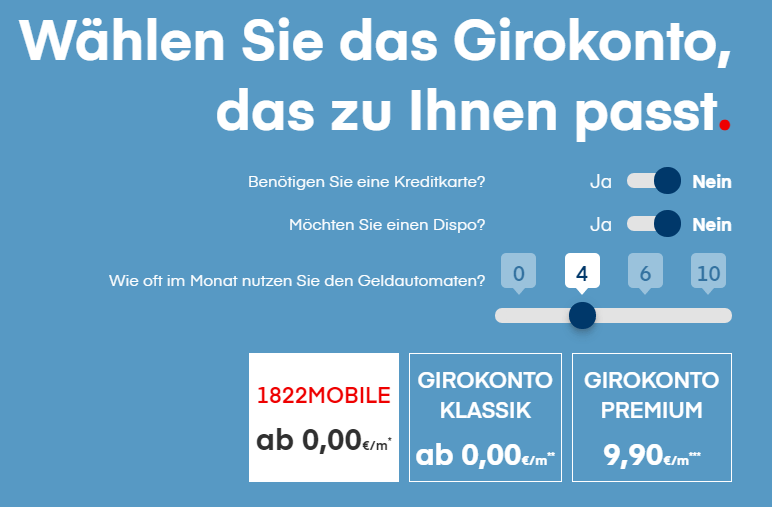

To help you choose1822direct account screenshots from the test

The maps of 1822direct

After you have opened an account with 1822direkt, you will automatically receive a free Sparkasse card. You can use it to make cashless payments at numerous acceptance points. With the 1822direkt Classic Account that is withdraw money up to 6 times a month possible free of charge. That 1822mobile Account allows 4 free withdrawals per month at all savings banks. In principle, the Sparkasse card can be used anywhere in the world. But if you stay abroad more often, it can make sense to get an additional one Credit card to apply. The reason: Worldwide there are more acceptance points for such a credit card than for an ordinary savings bank card. Online shopping is also very easy with a 1822direkt credit card. It is up to you whether you decide to use a Visa or MasterCard credit card. In both cases you can choose between the Classic and the Gold Edition.

The latter includes some useful additional insurance. Positive in the 1822 direct test: you buy with your classic credit card for at least 4,000 euros in year one, you will get those annual fee in the amount of 29.90 euros Reimbursed. This annual fee is also waived if you are under 27 years of age. You can easily apply for the credit card online and also monitor all payments via your online access.

In the test: deposit and withdraw cash at 1822direkt

🇬🇧 : 6x monthly withdraw money for free at all savings banks (1822 mobile: 4x) ✅

Outside of Germany withdraw by credit card (euro and foreign currency): 1,75 %

Deposit money free of charge at Frankfurter Sparkasse✅

1822direkt.de

Is there a share account?

Interested customers have the option of opening a securities account at 1822direkt in order to trade in shares or funds. If at least one action is taken in a quarter, custody account management is free of charge. Otherwise you will be charged 3.90 euros per month. The prices for trading in the 1822 mobile test are below those of classic bank branches. Compared to pure online brokers, however, they are significantly higher.

Shouldn't go unmentioned construction financingwhich 1822 direkt also offers. Simply compare more than 400 credit partners online and select the offer that suits you best. From your application to the payout At 1822 direkt Bank, you will be looked after by a personal contact person. The conditions from 0.52 percent effective interest rate Annual interest rate are very good compared to other providers.

you need one Loan? Even then, the 1822direkt is a reliable partner. Choose a term between twelve and 120 months. You can get a loan from a sum of 2,500 euros apply for. Whether installment, automobile-, overdraft or consumer credit: Here, too, 1822direkt scores with a diverse range.

How are the services of the 1822direkt in the test?

The 1822 mobile test showed that the provider can definitely be recommended. For example, no minimum deposit is required. Ok, that wasn't quite right. With the 1822 mobile account, you must have an incoming payment of €0.01 per month in order to enjoy free account management. Young people up to the age of 27 pay no fees for either account management or their credit card. In addition, you are quite flexible with this savings bank, because you can use both online and telephone banking. You can also find a good overview of the 1822direkt experiences at financial flow.

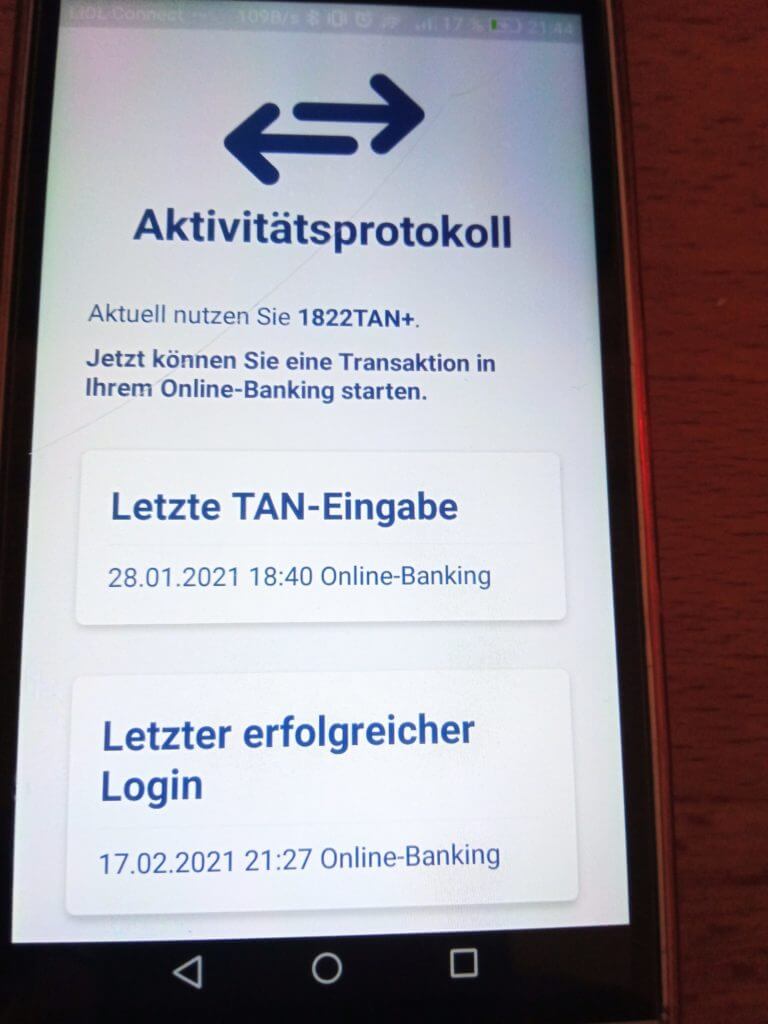

It is recommended to get the 1822direct app to download. Then you can banking transactions also on the go with the smartphone take care of. Creating an account with 1822direkt proved to be easy and uncomplicated in the 1822 direct test. If you have submitted an application to open an account, you must first identify yourself. The bank uses the PostIdent or VideoIdent procedure for this. You can cancel an existing account at any time free of charge and without giving reasons. An informal cover letter in which you state your account number and your new bank details is sufficient.

If you go to the website of 1822 directly, you will find your way around quickly and without any problems. You can quickly recognize all the due Costs and fees. However, the bank could be a bit more transparent about the fees for withdrawing money abroad. The costs are not immediately visible on the site, but are somewhat hidden in the list of prices and services.

1822direkt opening bonus: There are high bonuses for opening a current account

- 25 € opening bonus at 1822mobile Account when at least 1 wage/salary salaries over 1.000 € is received

- 50 € opening bonus with 1822Klassik Account if at least 1 wage/salary over €1,000 is received

- 50 € opening bonus at 1822Premium Account when at least 1 wage/salary over 1000 € is received

1822direkt test: Summary of the most important data

- Wide product range

- free Sparkasse card

- hassle-free and uncomplicated account opening

- normally no account management fees

- €0.01 minimum deposit required for mobile account and €700 for classic account

- different credit cards to choose from

- transparent overview of all costs

- Stock account is offered

- other investment options such as a daily or fixed-term deposit account

The advantages and disadvantages of the 1822direkt account in the video

The video is embedded by Youtube and only loaded when the play button is clicked. The apply Google Privacy Policy.

The conclusion from the 1822direkt test

The account is due to the very 50 € bonus a recommendation for all those who have a cash inflow of 700 euro or have more and with 6 withdrawals get by in a month. In the test have both 1822direct as well as 1822 mobiles cut off very well. The checking account is free of charge if the money is received regularly. With the 1822direkt current account, fees only apply if you cannot show regular receipt of money. only for International transfers as well as for the Credit card a fee will be charged. My experiences after more than 3 years with the 1822direkt current account are good overall. Any service requests were always answered quickly by the bank.

Since the 1822direct now a cash receipt in the amount of 700 euro is necessary, it is no longer in the listing Free checking accounts with no minimum deposit contain. In return, 1822direkt has been offering a high opening bonus for many years. The charging of fees when paying outside the euro zone also attracted negative attention. For globetrotters who frequently withdraw money abroad, this is it DKB Cash here is the better alternative.

Which accounts have still been tested