Once again, an exciting trend is emerging in the world of finance that could change many things. More and more investors are turning away from the stock market and cryptocurrencies to focus their attention on the price of silver. Industry experts are making bold predictions, claiming, "The price of silver is going to explode." By 2025, the price of silver is expected to experience an explosive development and then rise continuously in the coming decades.

The silver price and the Hamas attack in Israel: Since the Hamas attack on Israel on October 7, 2023, the price of silver has risen significantly as investors in search of a safe haven have also turned to the shimmering precious metal. Experts continue to see a number of factors that point to a further rise in the price of silver.

This emerging market is not only eclipsing the long-time highlight, gold, but is also outpacing the hype surrounding bitcoin. "The price of silver is going to explode brutally," are the words of some experts. But what are the reasons for this optimistic outlook? What influence does the Inflation on the price of silver? And why should you invest in silver both physically and online?

In addition, we look at the background of the Silver price explosion from 1980. At that time, the price of silver exploded to 10 times its value within a few years. Are there similar signs on the market today?

Why silver is a wise investment

What you can learn here

- Why silver is a wise investment

- Will the silver price explode?

- #1: Will silver price explode as silver becomes scarcer?

- #2: Silver price will explode as silver has small market?

- #3: At the same time, high monetary demand leads to price increase

- #4: Silver production volumes are limited, causing the silver price to rise

- #5: Industry heats up demand at an increased rate

- #6: Silver price is too low compared to gold price by 33 %

- #7: Silver price rises with inflation

- #8: Silver is in an uptrend due to the strengthening global economy

- #9: Silver is a green metal, further fueling demand

- #10: States import silver in increasing quantities

- #11: Silver price will explode brutally if digital euro comes early

- #12: Silver price set to explode as bitcoin flight continues to gain momentum

- What influences the price of silver?

- What should you look for when investing in silver?

- The silver price had already experienced several price explosions

- Why the silver price exploded in the past

- Silver price will explode? - A conclusion!

Silver is a wise investment not only because of its industrial applications (expansion of photovoltaics) and its scarcity, but also because of its function as a hedge against inflation. When real interest rates rise, the value of silver also rises, as demand for safe investments increases.

Do you want to dive into the fascinating world of commodities like silver and gold? Or are you interested in stocks, ETFs, cryptocurrencies and more? Then eToro, one of the most popular trading providers, is the right place for you!

Discover the world of online trading now and open a silver position with eToro*. There are already more than you 6.6 million opened silver positions on the social trading platform.

Why should you choose eToro? Here are some advantages that will convince you:

- Huge range of trading opportunitiesAt eToro you can choose from a wide range of options, including precious metals, commodities, stocks, ETFs, cryptocurrencies and much more. Explore the world of markets and find the asset classes that fit your goals.

- Trust and experience: With over 20 million users worldwide, eToro has been in the market since 2007. The company has earned an excellent reputation and offers a solid platform for online trading.

- Free trade: At eToro you do not pay custody and order fees. You can freely manage your investments without fear of additional costs. Take full advantage of your capital and maximize your chances of winning.

- Quick and easy online depot openingYou want to start trading immediately? No problem! At eToro you can open an online account in less than 3 minutes. Becoming part of the financial markets has never been easier.

- Diversity of cryptocurrencies: eToro offers trading in over 60 digital currencies and coins. Whether you want to trade the standard cryptos like Bitcoin, Ethereum, Ripple and Cardano or are looking for up-and-coming meme coins like Dogecoin and Shiba Inu Coin, you can find it all in one place at eToro.

- Bet on falling prices: At eToro you not only have the opportunity to bet on rising prices, but you can also profit from falling prices. Use different trading strategies and make profits in any market environment.

What are you waiting for? Start your trading adventure with eToro today and benefit from the wide range of trading options, user-friendliness and attractive conditions. Click on the link to the popular trading provider* now and open your online account with eToro!

Yet silver is generally a volatile metal. The silver market is about five times smaller than the gold market, which allows for market-dominating speculative investments by large players who use mantras like the Silver price will explode fuel. But could there perhaps be something to the optimism surrounding the silver price? Let's take a look at what speaks for and against an explosion of the silver price.

Will the silver price explode?

Yes, the price of silver will explode

The price of silver will explode by 2025, as silver becomes scarcer, has a small market (prone to price explosions), high monetary demand exists and production volumes are limited.

the Industry is continuing to fuel demand for the metal, and the price of silver has risen sharply in the Comparison to gold price quite low. At the same time, the price of silver rises with the Inflation, which has reached the highest levels in the postwar period as a result of the Ukraine war.

At the same time, on another level, silver is additionally in an uptrend due to the recovering global economy. As Green metal it is gaining in importance and states are beginning to Import of silver in extreme quantities. The silver price could also rise sharply if the digital euro is introduced prematurely or the Escape from Bitcoin continues to increase.

The silver price is also strongly dependent on the development of the US dollars which is considered to be very stable in the long term, which additionally supports the silver price.

These factors point to a promising future for the silver price.

No, the silver price will not explode

Geopolitical uncertainties and the potential for weakened global economic growth could affect the Dollar price despite its stability, which would slow the rise in the silver price.

From a chart perspective, the 20 dollar mark a decisive role. A Breaking through this support could lead to a further fall in the price, but this is not currently foreseeable.

Energy raw materials such as Oil and gas, make silver strong competition on the commodities market, as they are also extraordinarily scarce.

In addition to oil and gas are also bonds Due to the increase in interest rates, this is currently an attractive investment that investors are willing to make. Hereby decrease demand and the price of silver. Therefore, the price of silver quotes significantly below its highs from August 2020.

the World Bank expects the price of silver to rise in the long term, but initially predicts a sideways market until 2025.

My opinion

In general, the positive mood currently prevails with regard to the silver price. Analysts and stock exchange traders are still optimistic and forecast an explosion of the silver price. Thus, silver could be a useful addition to your portfolio, as it will establish itself on the market in the long term.

The World Bank did forecast in a 2021 report that the price of silver would fall. However, the last few months have shown a different picture and the more optimistic forecasts of analysts and stock market traders were correct. In the long term, however, even the World Bank expects a rising silver price.

Silver offers lucrative profit opportunities and also a protection against inflation. Therefore, investing in silver could be a profitable way to invest money without fearing permanent depreciation. Let's now look in detail at why the price of silver could soon explode.

#1: Will silver price explode as silver becomes scarcer?

Silver will become scarcer because demand in various sectors has increased significantly in 2022. In particular in the area of Photovoltaics (+12 % Source: World Bank), the Consumer Electronics (+7 % Source: World Bank) and the Silverware (+25 % Source: World Bank), consumption of silver already rose sharply in 2022.

#2: Silver price will explode as silver has small market?

Because the silver market is with much smaller than the gold market. According to estimates, on the silver market in London (London Bullion Market). 18 times less monetary value than is turned over annually on the gold market. The price of silver will explode if large investors buy up large shares of the available silver as they did in 1980. The price of silver will also explode if several speculators make leveraged investments in silver. However, speculators can also drive the price down.

#3: At the same time, high monetary demand leads to price increase

There is also a high monetary demand for silver, in the form of ETFs, silver bars as well as silver coins. Silver is often seen as a hedge in financial crises and has the reputation of being the "poor man's gold".

#4: Silver production volumes are limited, causing the silver price to rise

Many silver mines have limited reserves and resources. Since silver is largely a by-product of the extraction of other metals such as copper, lead, zinc or gold, production cannot be increased immediately, even if prices rise.

Although the high price of silver in 2022 has led to increased investment in the expansion of mines, even the conservative World Bank expects silver prices to continue to rise in the long term. This is because the industrial use of silver in solar cells, the automotive industry and electronic components is increasing in parallel. The limited production volumes will thus lead to a higher price, as the mines will probably not be able to meet the strong demand.

#5: Industry heats up demand at an increased rate

Silver is increasingly in demand due to its wide range of industrial applications. It is used in industry for its superconducting and antibacterial properties. While average Chinese consumption of silver per person has been low to date, this is expected to change in the future.

Unlike gold, silver is a consumable material. Unlike gold, silver used in products is not recycled. Gold, on the other hand, is hardly ever consumed and is mainly used as a financial investment.

The industry is about 51 % (source: Metals Focus) is one of the largest consumers of silver. It is used in a wide range of applications, from electronics to renewable energy. Increasing demand for these applications will continue to drive the price of silver.

Silver is an excellent electrical conductor. It has one of the highest electrical conductivities of all elements, which makes it ideal for electronic applications. In the electronics industry, silver is used for conductive tracks, contacts and switches. The increasing demand for electronic devices and the growing need for high-performance electronics are therefore driving the industrial demand for silver.

Secondly, silver has antimicrobial properties. It has the ability to inhibit the growth of microorganisms and thus improve hygiene. For this reason, silver is used in the medical and healthcare industry for medical devices, implants, antibiotic treatments and wound dressings. Increased awareness about hygiene and infection control has increased the demand for silver-based products in this field.

In addition, silver plays an important role in the Solar energy. It is used in photovoltaic modules to convert solar energy into electricity. The Increasing demand for renewable energies and the legally forced expansion of the solar energy industry contribute to the increased demand for silver.

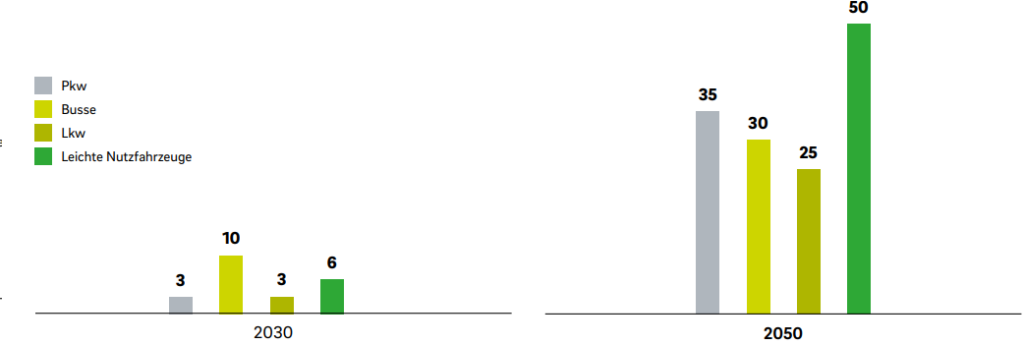

But the automotive industry is also contributing to the growing demand for silver. Silver is used in catalytic converters and exhaust gas purification systems to reduce emissions. But hydrogen fuel cells, too, only work with silver as a catalyst. The Hydrogen Council forecasts a strong growth rate for fuel cell-powered vehicles. By 2050, half of all light-duty vehicles are expected to have a fuel cell. Silver is needed for this, which further supports the price.

In addition, silver is used in electrical components, such as the electronics of hybrid and electric vehicles. The growing demand for environmentally friendly vehicles and the need to comply with emissions standards are increasing the demand for silver in this sector.

Finally, silver also plays an important role in the jewelry and silverware industry. The popularity of silver jewelry and decorative items continues unabated. Demand for high-quality silverware has been rising strongly since the Corona crisis (2022: +25 %).

The silver price will explode if demand from the long-term industry continues to pick up, conclude industry experts from Metal Focus and Gold.de magazine.

#6: Silver price is too low compared to gold price by 33 %

Although the price of silver has risen in recent years, it is still comparatively low compared to the price of gold. Experts believe that the price will rise in the next few years and that it is a good time to invest in silver. This can also be seen by comparing the price of silver with the price of gold. In May 2023, the ratio of gold price to silver price was: 84. But in the long term, the average value of the last 50 years is only 61.3. The silver price will explode when the long-term gold-silver price ratio of 61 returns. Because the silver price has about 33 percent catch-up potential.

- Calculation of the gold-silver ratio: gold price divided by silver price

- The price ratio is an aid in deciding whether to buy gold or silver

- If the gold price is more than 80 x higher than the silver price → Buy silver

- If the gold price is less than 40 x higher than the silver price → Sell silver

- The average value over the last 50 years is 61

- A high gold-silver ratio is only one of several signs that the silver price will explode. But there is no guarantee.

#7: Silver price rises with inflation

Inflation protection is essential to preserve the value of your assets over the long term. Inflation causes the purchasing power of the money you have saved to decrease continuously as the prices of goods and services rise. By investing in silver, you have inflation protection to compensate for this decrease in value.

Silver is a popular hedge against inflation. When inflation rises, the value of silver also rises as demand for safe investments increases. It is a wise choice to invest in silver to hedge your portfolio against inflation. In times of rising inflation, the price of silver automatically rises with it.

The chart shows that silver has kept pace with inflation and higher interest rates. So if the price of silver doesn't explode after all, at least the money is protected against inflation.

#8: Silver is in an uptrend due to the strengthening global economy

Despite the weak economy, the silver price remained stable. When the global economy picks up again, this will also drive the silver price. Silver is used in industry for a variety of applications that benefit from an upturn in economic growth. The silver price is expected to rise further if the global economy continues to grow.

#9: Silver is a green metal, further fueling demand

Silver is often referred to as the "green metal" because it plays an important role in green energy generation, especially in photovoltaic modules. Silver is used in these modules because of its excellent electrical conductivity. Silver thus enables efficient transport of the generated electricity within the module. Thus, silver plays an important role in the generation of clean energy from sunlight. There are several other metals besides silver that also contribute to the energy transition. The picture gives an overview:

#10: States import silver in increasing quantities

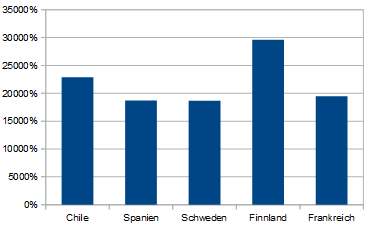

Many countries around the world have been buying more and more silver in the recent past to secure their supplies for their industries. The table shows the largest silver importers. In particular, Chile, Spain, Sweden and Finland bought much more silver in 2021 than they did in 2019. In Chile, the increase in silver imports was 22860 %.

So far, silver has not played a role as a currency reserve, but this could soon change due to turbulence on the financial market. Then powerful central banks will step on the floor in addition to industry and private investors. The bombastic liquidity of the central banks will lead to a shortage of silver. The silver price will explode, because the central banks would simply buy up everything.

| Country | Additional silver imports in 2021 compared to 2019 | Difference in percent |

|---|---|---|

| Chile | 4502508 | 22860% |

| Spain | 2534663 | 18684% |

| Sweden | 2128580 | 18668% |

| Finland | 1916073 | 29612% |

| China | 1397958 | 98% |

| France | 158958 | 19460% |

| EuropeanUnion | 39553 | 17% |

| Korea,Rep. | 38551 | 15% |

| Netherlands | 30116 | 27% |

| Bulgaria | 25890 | 70% |

| Japan | 2786 | 2% |

| Other Asia | 180 | 27% |

#11: Silver price will explode brutally if digital euro comes early

The digital euro is imminent, and is set to replace cash. The 500-euro bill has already been banned. Other bills will follow. The introduction of the digital euro will bring drastic changes and cash will be completely replaced. Silver benefits from this trend, as more than half of the population is skeptical about the abolition of cash. Silver is ideal for paying small and medium-sized amounts and is easily divisible in coin form.

Popular silver coins like the Krugerrand and the Maple Leaf will therefore remain in high demand in the future. The price of silver will explode brutally if the digital euro and thus the abolition of cash comes prematurely. Because not everyone wants to become a transparent citizen. This is also confirmed by a Survey commissioned by the savings bank: More than 40 % spoke against the abolition of the 500 euro bill.

#12: Silver price set to explode as bitcoin flight continues to gain momentum

The price of silver will explode as the weakening Bitcoin flows into tangible assets like silver. Bitcoin is considered a controversial investment, and critics fault both its everyday viability and the environmental damage caused by mining, especially in China, where dirty coal is used for the large server farms. Major investors like Elon Musk are already pulling back from the speculative investment, possibly due to profit-taking.

With the decline in Bitcoin prices, billions of dollars could shift from Bitcoin to safer forms of investment in the future, especially to tangible assets such as silver, gold, and osmium. Precious metals traders claim that the crash of Bitcoin will thus also lead to a price increase in tangible assets. This is not a specific silver situation, but silver benefited because of its role as the logical equivalent of Bitcoin.

The fact is that the silver price was more stable than bitcoin in 2021-2023. While bitcoin lost more than 50 % of its value, the silver price remained stable at more than 20 euros per troy ounce.

Anyone who has already had negative experiences with Bitcoin in 2021 may have lost interest in this digital risk investment. Moreover, the price loss is not the only risk when investing in Bitcoin. In addition, Bitcoin exchanges can be hacked and the hard drives with the Bitcoin assets can be broken. Precious metals traders in particular then argue that the Bitcoin story may therefore soon come to an end and billions will be redeployed in the near future. What is clear is that the price of silver will explode if this scenario occurs. Personally, however, I doubt it, as there are sufficient alternative investment opportunities for bruised Bitcoin investors besides tangible assets such as silver.

Do you want to dive into the fascinating world of commodities like silver and gold? Or are you interested in stocks, ETFs, cryptocurrencies and more? Then eToro, one of the most popular trading providers, is the right place for you!

Discover the world of online trading now and open a silver position with eToro*. There are already more than you 6.6 million opened silver positions on the social trading platform.

Why should you choose eToro? Here are some advantages that will convince you:

- Huge range of trading opportunitiesAt eToro you can choose from a wide range of options, including precious metals, commodities, stocks, ETFs, cryptocurrencies and much more. Explore the world of markets and find the asset classes that fit your goals.

- Trust and experience: With over 20 million users worldwide, eToro has been in the market since 2007. The company has earned an excellent reputation and offers a solid platform for online trading.

- Free trade: At eToro you do not pay custody and order fees. You can freely manage your investments without fear of additional costs. Take full advantage of your capital and maximize your chances of winning.

- Quick and easy online depot openingYou want to start trading immediately? No problem! At eToro you can open an online account in less than 3 minutes. Becoming part of the financial markets has never been easier.

- Diversity of cryptocurrencies: eToro offers trading in over 60 digital currencies and coins. Whether you want to trade the standard cryptos like Bitcoin, Ethereum, Ripple and Cardano or are looking for up-and-coming meme coins like Dogecoin and Shiba Inu Coin, you can find it all in one place at eToro.

- Bet on falling prices: At eToro you not only have the opportunity to bet on rising prices, but you can also profit from falling prices. Use different trading strategies and make profits in any market environment.

What are you waiting for? Start your trading adventure with eToro today and benefit from the wide range of trading options, user-friendliness and attractive conditions. Click on the link to the popular trading provider* now and open your online account with eToro!

What influences the price of silver?

The formation of the silver price arises on the commodity exchanges through a Equilibration of supply and demand. In particular, precious metals traders see the price of silver rising sharply in 2023-2025 as demand increases and supply decreases. The silver price will explode if your estimates are correct. These aspects will contribute:

- Demand for silver increases. Silver is of great importance in the real economy. Many future technologies such as solar cells, fuel cells, electronic circuits need silver. In addition, as with other metals, there are many people who buy silver as an investment and thus additionally fuel the demand.

- The supply of silver decreases. The global production volume of silver is falling, in contrast to demand, which continues to climb. Thus, in 2019, about26,500 tons of silver were mined. In 2020 and 2021, on the other hand, only about23,500 tons of silver could be mined, i.e. about 10 percent less (Source: usgs.gov). The tight supply is one reason why the silver price could climb further in the future.

- Uncertain times are additionally fueling demand: In uncertain times (trade conflicts, Ukraine war,..) investors tend to put their money in safe havens. Silver and gold as tangible assets are preferred here. This creates an excess demand, as private investors want to buy silver in addition to the industry, which catapults the price upwards.

- Central banks could buy silver: So far, silver has not played a role as a currency reserve. If that changes due to turbulence on the financial market, powerful central banks will step onto the floor in addition to industry and private investors. What will happen then? The silver price will explode, because the extreme liquidity of the central banks will lead to an empty market and high silver prices.

What should you look for when investing in silver?

If you want to invest in silver, you can find the most important information here:

- Learn and understand the silver market: By combining thorough research, reading news articles, and getting independent advice, you can get to know and understand the silver market better. After all, when the price of silver skyrockets, the best-informed investors are the first to profit.

- Set goals: For example, if you want to make quick profits, leveraged silver investments that target short-term price fluctuations might be suitable for you. On the other hand, long-term investments in physical silver or silver ETFs might be better for you if you want to build long-term wealth. With our provider recommendation*, you will find silver positions that suit you.

- Diversify your investmentThe silver price will explode, or not. Diversifying your portfolio protects you because your portfolio is based on other assets besides silver. By spreading your money over different investments, you can reduce the impact of individual bad performances and cushion possible losses. At the same time, you increase the chances that some of your investments will produce good returns and thus improve the overall result of your portfolio. You can invest in other precious metals such as gold or platinum for diversification. Furthermore, investments such as stocks, bonds, real estate or ETFs are also possible.

- Choose the right form of investment: You can invest in physical silver, in ETFs, or in mining company stocks.

- If you physical silver you are actually buying silver coins, bars, or other forms of physical metal. The advantage of this is that you physically own the silver and can access it directly. However, there are also storage and insurance costs, and selling it can be a bit more involved.

- Another possibility is the Buying silver ETFs (Exchange Traded Funds). With ETFs, you invest in a fund that has silver as its underlying asset. This allows you to profit from the price movements of silver without having to own physical metal. ETFs usually offer good liquidity and ease of trading, but fees and tracking errors can occur.

- You can also use in Mining company shares invest in companies that specialize in the mining of silver. This can be a way to indirectly profit from rising silver prices. However, it is important to note that shares of mining companies are also subject to other risks such as operational problems, political uncertainties or fluctuating commodity prices.

- Pay attention to qualityBefore you purchase silver coins, bars or other forms of physical silver, you can order a test of the purity of the silver from special providers. These tests will help you detect counterfeits and ensure that you are getting a high quality and authentic product.

The silver price had already experienced several price explosions

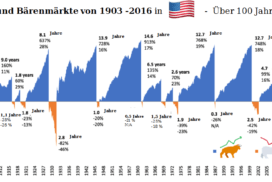

The silver price is historically known for its volatility and can be subject to significant fluctuations. The biggest price explosions of the silver price occurred in 1980 and 2011-2013. In 2020, however, the silver price shot up again with the beginning of the Corona pandemic.

A comparison with gold and platinum shows that the silver market is more susceptible to explosive price outbursts. In January 1980, the price shot up from $22 to over $50 within a few days. A price increase of over 100 percent in less than 30 days.

Why the silver price exploded in the past

The price explosions in the past are due to the fact that the silver market is about five times smaller than the gold market. This makes it more vulnerable to speculators, who often fuel each other and "the silver price will explode" parrot blindly.

Both the silver price explosion of 1980 and the explosion from 2011 to 2013 were driven by speculative exaggerations characterized, which led to a rapid increase in the price of silver due to the tight market. There were large speculators bought the market empty. Thus, in the biggest silver price explosion in 1980, there were the following reasons for the steep price increase:

1. the gold standard is lifted

In the 1970s, political events such as the end of the Bretton Woods system, the Watergate scandal, the defeat of the U.S. in the Vietnam War, and economic problems such as recessions and high inflation led investors to become unsettled and search for investments that would hold their value. The 1973 oil price shock further exacerbated this uncertainty. In response, investors, including Bunker Hunt and its brethren, began buying more silver in 1973 to hedge their assets and protect against the expected economic apocalypse.

2. bunker Hunt proceeded aggressively

Bunker Hunt was one of the first speculative players in the futures market and soon became one of the biggest players. By actually delivering much of the silver they bought, Hunts created a shortage in the market, which drove up the price of silver. In January 1974, a potential shortage became apparent when the price of silver rose from about 2.90 $s per ounce to over 4 $s, reaching 6.70 $s in February.

Bunker Hunt's first attempt to dominate the market fails, but he remains optimistic and promotes silver. Silver investment gains momentum by attracting wealthy Arab partners and interest from Swiss Volksbank.

3. ingots are procured to Switzerland:

Geopolitical events such as the Islamic Revolution in Iran, the hostage-taking at the U.S. Embassy in Tehran, the occupation of the Great Mosque in Mecca, and the Russian invasion of Afghanistan create increased uncertainty and cause the silver price to explode. By the end of 1979, the price of silver reaches 32 $ per troy ounce, an increase of 430% compared to the beginning of the year. Bunker Hunt and its partners control over 200 million ounces of silver, more than half of the world's supply. On January 18, 1980, the price of silver reaches an all-time high of 50 $ per ounce. Market participants expect the upward trend to continue.

4. the high silver price brings the silver industry to the abyss

High silver prices are weighing on companies like Tiffany & Co, causing sales to slump and job losses in the U.S. silver industry of around 6,000 employees. At the same time, demand for silver is decreasing while supply is increasing as people sell their silverware. Regulators are responding to the price excesses by tightening regulation on commodity exchanges. The New York Commodity Exchange declares a state of emergency and allows only liquidation sales, causing prices to plunge by 15% on January 21, 1980 and another 7.5% the next day.

5. the bubble bursts

Bunker Hunt and its partners are under pressure, as they have made the majority of their purchases on Loan have transacted. Paul Volcker, Chairman of the Fed, is further impairing their situation by encouraging banks to not Lending more for commodity speculation.

A group of U.S. banks grants the Hunt brothers an emergency loan of 1.1 billion to stabilize the situation and meet the margin call. Despite this, the price of silver continues to fall. By May 1980, it stands at only $, down 80% from its peak in January. The Hunts suffer losses of over 1 billion $ and are forced to pledge much of their assets. It takes nearly a decade for them to sell their assets and settle all creditor claims. In August 1988, they are convicted of an alleged conspiracy to manipulate the silver market, and a month later the Hunts file for bankruptcy. Since 1980, the price of silver has not surpassed its then-peak to this day.

Silver price will explode? - A conclusion!

There are clear signs of a rising silver price. Nevertheless, buzzwords like "silver price will explode brutally" or "silver price will explode" are overdone.

The market anticipates trends and prices developments up or down into today's prices. Although the silver price has put in a very solid performance since the Corona pandemic in March 2020 (as of May 2023) and gained about half of its value, there have also been negative development trends.

This is because the May 2023 silver price is well below its August 2020 highs, even though the trend is currently positive. If the arguments for a rising silver price have convinced you, you can here a silver position with eToro* open. The provider also offers short positions, if you think to yourself that this article was complete bullshit! 😉

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.