If you receive (unforeseen) cash receipts on the P-Konto, these payments will count against the allowance and the question may arise as to what to do now, or how to make the P-Konto trick can, to sharpen the formulation a bit.

Finally, there are some tricks how you can maximize the amount of money available on the P-Konto. We have found 7 tricks to trick the P-Konto. We will present them to you in this article.

Tricking P-Konto with the intent to deprive creditors of their money is thwarting and thus not legal. However, no one can tell you to keep working the same hours if you have to pay most of your wages to the creditors..

You should also check whether you can increase the P-Konto allowance and how long an existing P-Konto certificate will last. Furthermore, it is recommended to withdraw funds below the P-Konto allowance at the end of the month and to build up a cash reserve. With these tricks, tricking the P-Konto is also possible in a legal way.

In this post, we'll introduce you to the following tricks that you can use to trick the P-Konto. These are summarized below:

| P-Konto trick through: | Our legal assessment |

|---|---|

| Withdraw unused balance from the allowance | legal |

| Have wages paid out in cash or redirected to a credit-free account at another bank | at least legal gray area |

| Secondary account or cash reserve for non-essential expenses | at least legal gray area |

| increase allowance | legal |

| Reduce revenues and work less | legal |

| Renew certificate | legal |

| Reject double garnishment with application | legal |

| Check own errors | legal |

| Debt relief | legal |

Whether you can morally justify tricking the P-Konto and thereby withholding money from creditors is something you should consider for yourself. In addition, you should make sure that you do not commit a crime when tricking the P-Konto.

Outsmart P-Konto Trick 1: Withdraw unused credit from the allowance.

What you can learn here

- Outsmart P-Konto Trick 1: Withdraw unused credit from the allowance.

- Outsmart P-Konto Trick 2: Have wages paid out in cash or redirect them to a credit-free account at another bank

- P-Konto trick 3: Second account or cash reserve (trick for non-essential expenses).

- Outsmart P-Konto Trick 4: Increase allowance

- Outsmart P-Konto Trick 5: Decreased revenue and work less

- P-Konto trick trick 6: Extend certificate

- Outsmart P-Konto Trick 7: Reject double garnishment of account and wages

- Outsmart P-Konto Trick 8: Check your own errors: Did you include all debits?

- Outsmart P-Konto Trick 9: Seek settlement with debt relief

- Conclusion

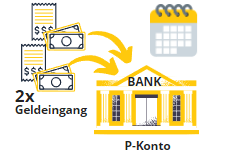

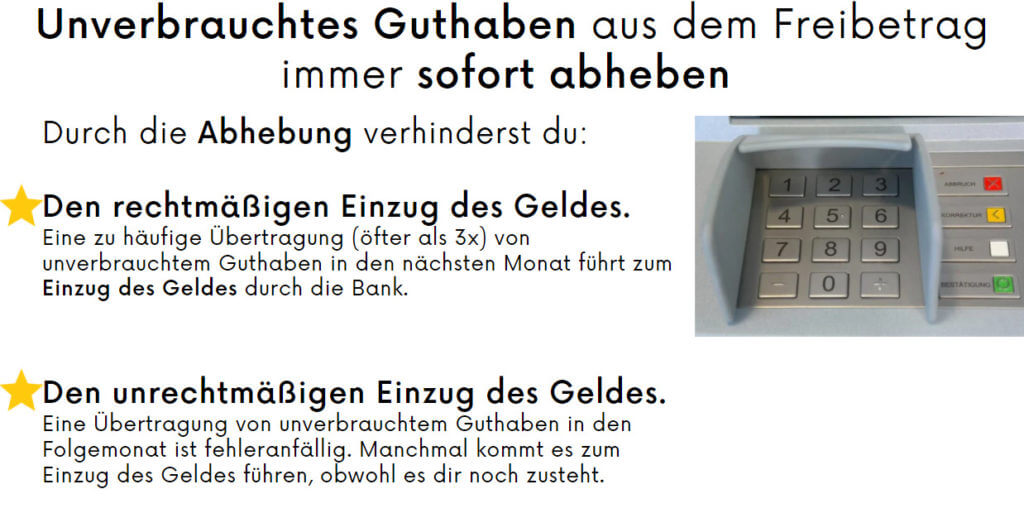

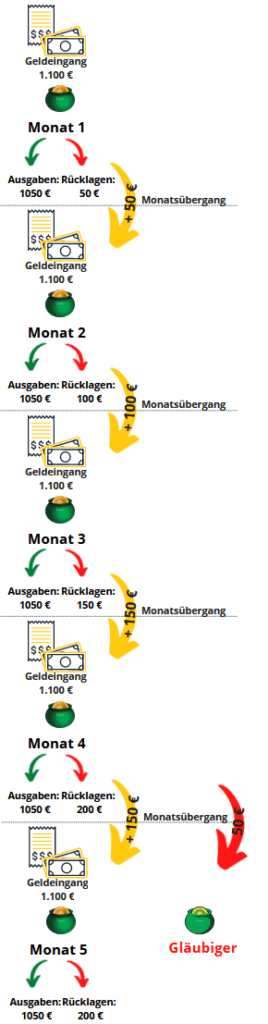

ProblemUnused money on the P-Konto can only be carried over to the following month a maximum of three times. This also applies to balances below the garnishment allowance. If you transfer the money to the fourth month, the bank will garnish it, even though it is a protected balance. The following chart illustrates how there is an outflow of money on the P-Konto in the fourth month. We assume that you earn 1,100 euros. This means that your income is below the allowance. For the unforeseen, set aside €50 every month.

P-Konto trick: Therefore the first trick to trick the P-Konto is withdraw unused credit on the P-Konto. This way it is no longer available in the account and under your control. By withdrawing unspent money you avoid that:

- Unused credit below the exemption limit is transferred more than 3 times and then flows out to creditors, and

- Errors on the part of the bank in the correct (and complicated) application of the cash carryover to the following month according to FIFO happen

This "trick" allows you to better use the tax-free amount and get your money on the P-Konto. However, you should not withdraw too much money from the P-Konto, otherwise you will not be able to make cashless payments (e.g. rent, gas, electricity) and will get into payment difficulties (because the tax-free amount is already exhausted).

Make sure that you have taken into account all payments for the allowance before withdrawing the money. Otherwise, you may run into payment difficulties because the allowance has already been exhausted by withdrawing the money early.

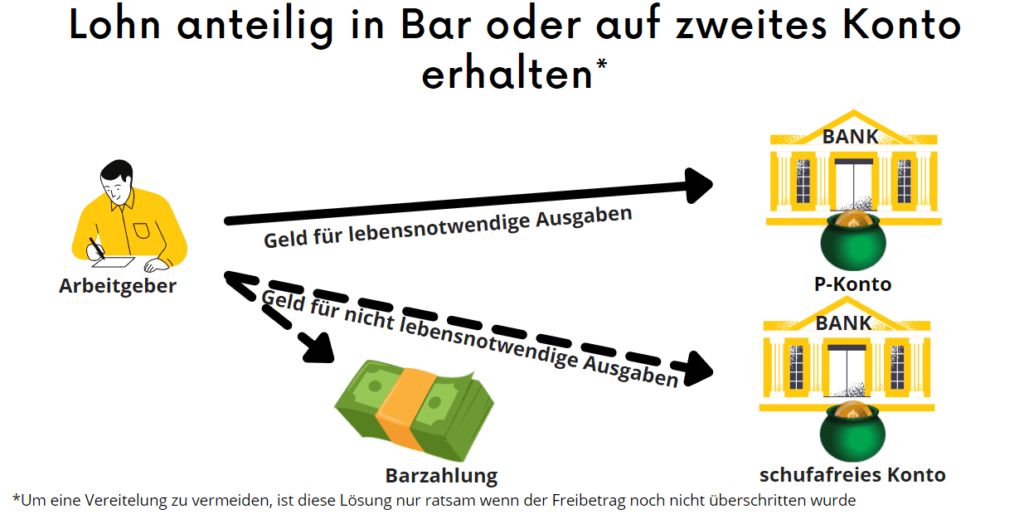

Outsmart P-Konto Trick 2: Have wages paid out in cash or redirect them to a credit-free account at another bank

Another trick, is to take a portion of your monthly salary cash out. This means that the money is not counted towards the tax-free amount if there is an account garnishment. However, this trick falls legally at least into a gray area.

Is it a criminal offense to avoid an account garnishment?

Is it a criminal offense to avoid an account garnishment?

If the trick is used to slip money past creditors, that "trick" is no longer in the legal realm.

Legally, this would be a thwarting, which according to §288 StGB is punishable by law. However, this depends on the individual case. Conversely, a seizure of an account does not result in the obligation to transfer all money to the seized account. A cash payment of wages is therefore not illegal per se.

Here are some more clues as to when it might be a case of thwarting:

When is there a threat of thwarting the transfer of money to a second account

- Thwarting threatens if the detour of income is set up as a permanent solution to set aside money. This could be seen as an attempt to evade enforcement. Moreover, if the diverted income is above the garnishment allowance, a criminal offense is likely.

- If a debtor funnels money out through a disguised trust account or business account, a judge could consider this to be a frustration.

When threatens none Frustration in diverting money to a second account

- There is no threat of frustration, on the other hand, if the diversion of income to other accounts, only an intermediate step to the payout of the income is.

- If the P-Konto allowance has not yet been exceeded and money is diverted through other accounts, thwarting is also unlikely.

Furthermore, in the event of a thwarting much not as hot as it is cooked. In addition, a conviction is rare.

Alternative: Second account

If a cash payment of wages at your employer is not possible, you could also have the wages paid into a second account. You open this second account onls regular account despite the current garnishment. Opening the secondary account as P-Konto would be punishable, as you are only allowed to have a Pfändungsschutzkonto.

The process is described in the article open new account despite garnishment described. By the way, it is not forbidden to open a second account during a garnishment.

If you open a second account, you should keep the bank details as secret as possible. If the creditors get wind of it, they will probably seize the account immediately and you will not be able to trick the P-Konto.

And here's another tip: Because of the secrecy, you should go to an Account without Schufa grasp. There are good accounts without a Schufa query Vivid Money*, nuri* or bunq*. It is also essential that you do not open the account with the same banking group. If you have a P-Konto with the Sparkasse, they will not open a normal second account for you in parallel.

P-Konto trick 3: Second account or cash reserve (trick for non-essential expenses).

The next trick is to build up an additional cash reserve next to the P-Konto. For this you use a second account or a cash reserve. You use this reserve for all non-essential expenses. The employer will transfer a portion of your salary to this account or pay it to you in cash.

The remaining part of your salary will be paid regularly to your P-Konto.

This will allow you to build up a reserve on the secondary account. This reserve protects you somewhat and also helps you to be able to quickly pay money for a later settlement with the creditors in court, as you can read in the article "Open a new account despite seizure" can read.

Caution: The detour of payments via other accounts of, for example, spouses or children could be regarded by a court as thwarting enforcement. This may make the debtor liable to prosecution under Section 288 (1) of the Criminal Code. If a creditor learns of the account, he can seize it in its entirety without exemption limits. In addition, the helper who makes the account available may also be liable to prosecution if he knows the background. This is because a court could interpret his help in circumventing the seizure as aiding and abetting a criminal act.

Outsmart P-Konto Trick 4: Increase allowance

Due to the stressful situation, affected individuals often forget that a higher allowance on the Pfändungsschutzkonto can be released in many cases. In this case, the basic allowanceif you have children or are married. Thus, you can trick the restrictive P-Konto by increasing the allowance (§ 902 ZPO). The Increase of P-Konto allowance lasts usually only a few days after you have submitted the complete application.

Use a Garnishment calculatorto see if you can increase the allowance on the P-Konto.

You can only use the tax-free amount on the account once a month. When the payments are received during the month is not important. Because at the end of the month, amounts that are above the allowance are moved by the bank to a moratorium account and paid out to the creditors after a certain waiting period. The exact payment process is described in the article "What happens with too much money on the P-Konto described“.

When can you use the P-Konto Allowance increase permanently?

You can permanently increase the allowance if you have child support obligations. You can also permanently increase the P-Konto allowance if you receive unemployment benefits or asylum seeker benefits for others on your account. In addition, you can increase the P-Konto Increase allowanceif you are granted more money according to SGB II, XII or AsylbLG. Another possibility to increase the P-Konto allowance is a physical or health damage which means an additional expense for you. The P-Konto allowance is also increased by the child benefit and the child supplement, if the allowance is exceeded.

When can you use the P-Konto Increase allowance once?

Furthermore, you can have the P-Konto allowance increased once if you have a Social benefit you receive an increase in the basic allowance. However, an increase in the basic tax-free allowance is also possible in the event of a subsequent payment of unemployment benefit, asylum seeker's allowance or child benefit/child supplement.

If it is a income from work paid late you can have the exemption amount increased once by up to €500. Higher additional payments may also not be seized if they would not have been seizable if they had been paid on time. Finally, monetary benefits of the mother and child cannot be garnished in order to protect unborn life. Learn more about the increase of the garnishment limit in the article "P account allowance exceeded due to additional payment“.

Outsmart P-Konto Trick 5: Decreased revenue and work less

If you exceed the P-Konto allowance and your job allows it, you can also reduce your income and work less. After all, the excess money is not available to you anyway. In addition, lower income is a viable way to legally circumvent the P-Konto regulations.

P-Konto trick trick 6: Extend certificate

In addition, many people forget that the P-Konto certificate for the increased tax-free amount also expires. In this case, the allowance is reset to the basic allowance. Therefore, it is advisable that you put a note in your calendar as to how long the P-Konto certificate is valid. When the expiry date is approaching, have the P-Konto certificate renewed.

If you are unsure or do not remember the exact validity date of the P-Konto certificate, it is recommended to ask the bank.

P-Konto trick trick 7: Lean a Double garnishment of account and wages from

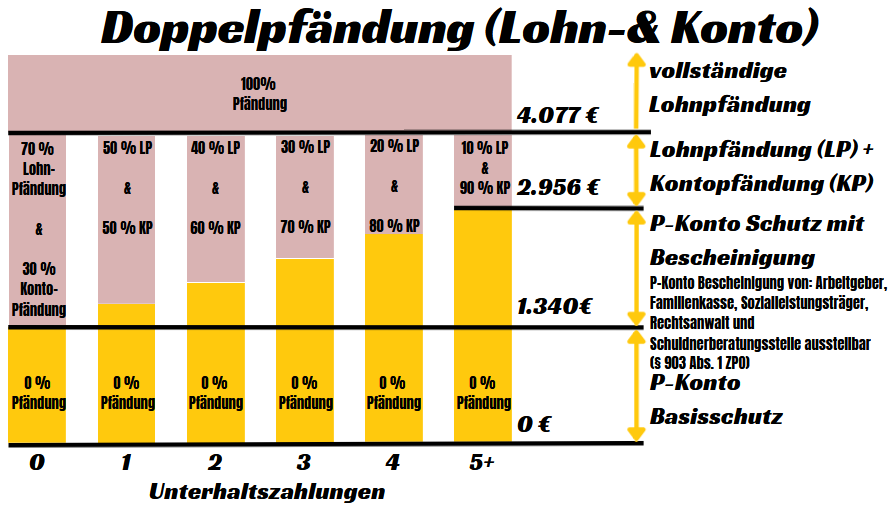

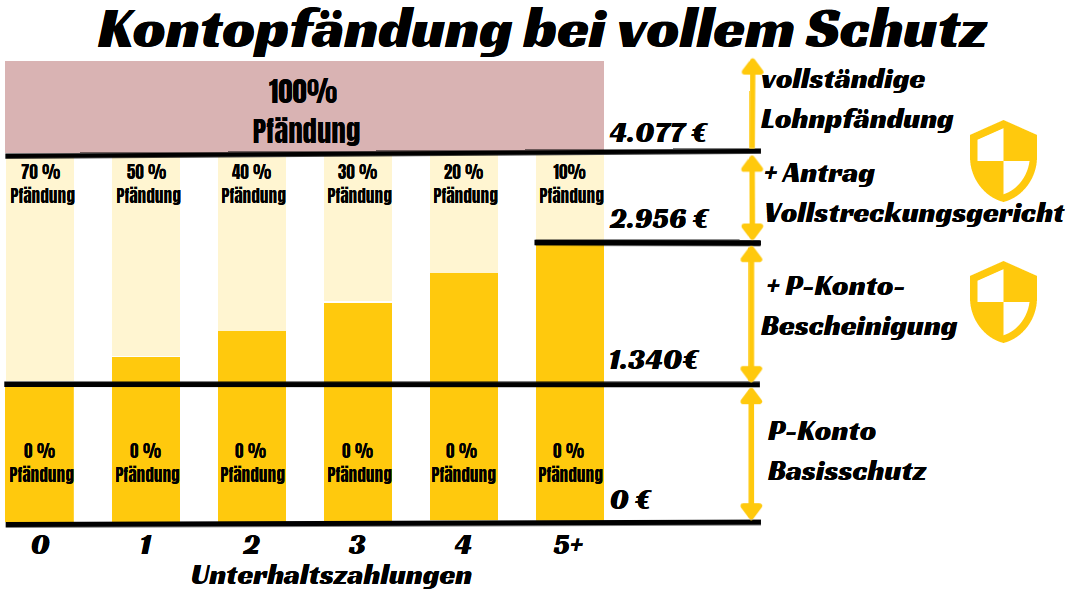

In the Double garnishment of account and wages, there is a wage and account garnishment at the same time. This double garnishment can occur if the income is above the garnishment allowance, in the case of a wage and account garnishment, a double garnishment can occur. As a debtor, you do not have to accept this double garnishment.

In order to avert double garnishment, it is not enough to increase the exemption amount of the P-Konto. In addition, the debtor must file an application with the enforcement court if he wishes to have amounts above the allowances on the Pfändungsschutzkonto protected. Subsequently, the doubly garnished amount can be released. This leaves you with more money to live on.

However, the repayment of the debt is also prolonged, since only a smaller amount is spent on it. A double garnishment therefore has advantages and disadvantages.

With the Garnishment calculator you can check if there is a double garnishment.

Before: Amounts above the allowance are garnished in full. For example, for a person without alimony, amounts above the allowance are first garnished 70 % when the wages are paid. Then, the remaining 30 % of the excess in the account is garnished. Thus, there is a double garnishment of wages and account.

AfterWith an application to the enforcement court, money received above the P-Konto allowance will only be garnished on a pro rata basis. Thus, for a person without alimony, the excess income will be garnished only proportionally to 70 %.

Outsmart P-Konto Trick 8: Check your own errors: Did you include all debits?

Checking your own mistakes is not a trick as such, but often the reason why more money than necessary is paid to creditors. Therefore, it is also important to check your own mistakes.

Many people forget that the P-Konto allowance includes not only withdrawals, but also all debits, transfers and direct debits. A common mistake people make when determining the P-Konto allowance is to consider not only cash withdrawals from the account, but also charges that are debited. These include non-cash rent payments, insurance or payments to the electricity and gas provider.

This is because you have to count all these payments towards the tax-free allowance. Therefore, it may be advisable to withdraw the remaining money from the allowance only at the end of the month, so that you do not get into payment difficulties beforehand.

Outsmart P-Konto Trick 9: Seek settlement with debt relief

Try to obtain debt relief and offer the creditor a sum higher than the amount he would receive in a private bankruptcy but lower than the total amount of the debt.

An out-of-court debt settlement can satisfy the creditor and still be cheaper than paying off the debt completely. The question is how much money you should offer the creditor so that he agrees to the settlement despite incomplete payment.

The amount of the settlement offer depends on the circumstances of the individual case. As a rule of thumb, however, the settlement offer should be higher than the amount the creditor would receive in the event of the debtor's private insolvency.

The Schufa in out-of-court settlement

Many victims are also concerned about how debt relief with a settlement will affect their Schufa information.

But the worries are unfounded. This is because if the creditors agree to the settlement and the debts are settled by installments or a one-time payment, you can request a deletion of the Schufa entry. However, if the installments of the debt settlement remain incomplete, the negative Schufa entry will also remain.

Conclusion

If you are actively funneling money past creditors, that is very likely a thwarting and therefore not a legal option. However, no one can tell you to keep working the same hours if you have to pay most of your wages to creditors.

You should also check whether you can increase the P-Konto allowance and how long an existing P-Konto certificate will last. It is also advisable to withdraw balances below the P-Konto allowance at the end of the month and to build up a cash reserve. In addition, you can also obtain debt relief through an out-of-court settlement with your creditors. To do this, offer the creditor a sum that is higher than the amount the creditor would receive in a private bankruptcy, but lower than the total amount of the debt. This way, both of you will benefit.

With these tricks, tricking the P-Konto is also possible in a legal way, and you don't have to deal with problems like no payout despite credit on the P-Konto annoying.

In this post, we have introduced you to the following tricks that you can use to trick the P-Konto. These are summarized below.

| P-Konto trick through: | Our legal assessment |

|---|---|

| Withdraw unused balance from the allowance | legal |

| Have wages paid out in cash or redirected to a credit-free account at another bank | at least legal gray area |

| Secondary account or cash reserve for non-essential expenses | at least legal gray area |

| increase allowance | legal |

| Reduce revenues and work less | legal |

| Renew certificate | legal |

| Reject double garnishment with application | legal |

| Check own errors | legal |

| Debt relief | legal |