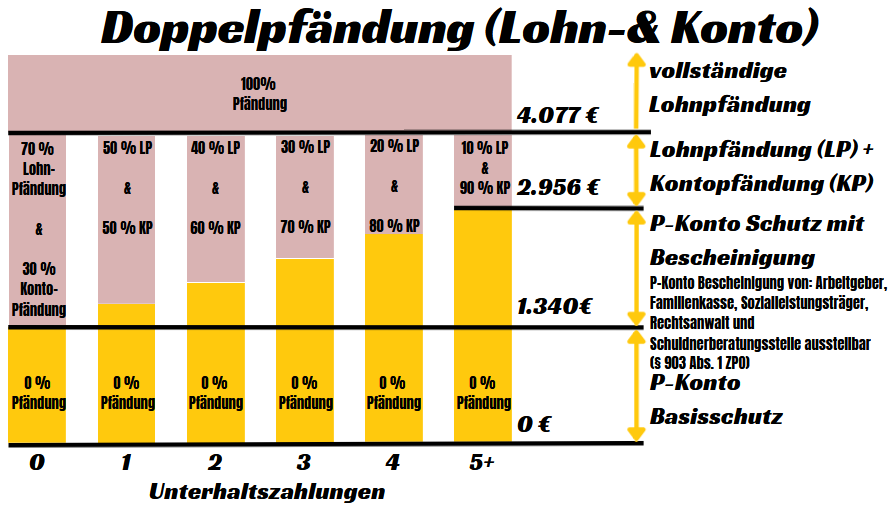

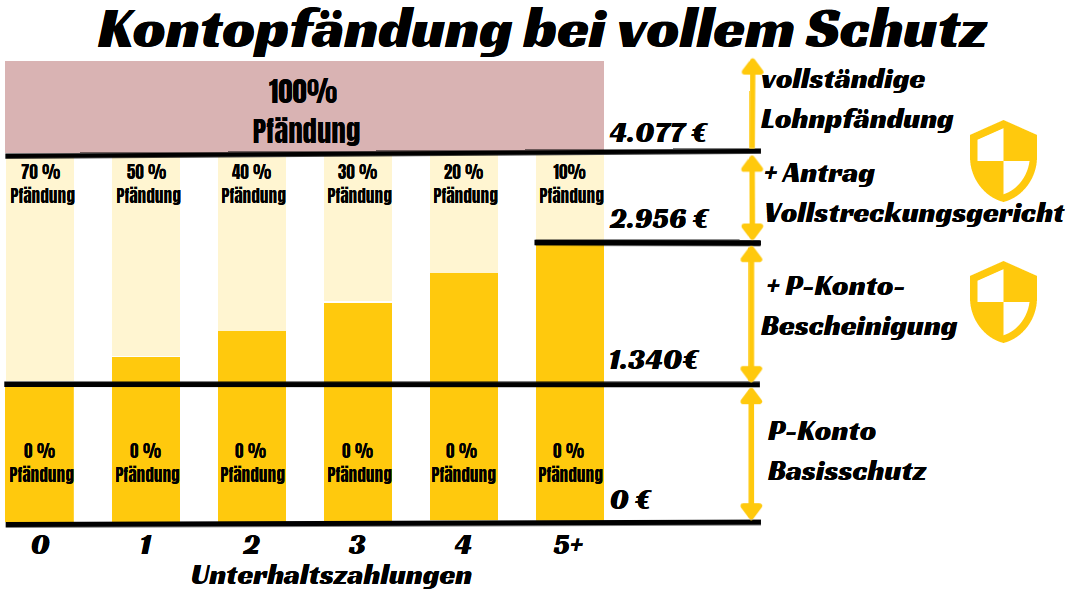

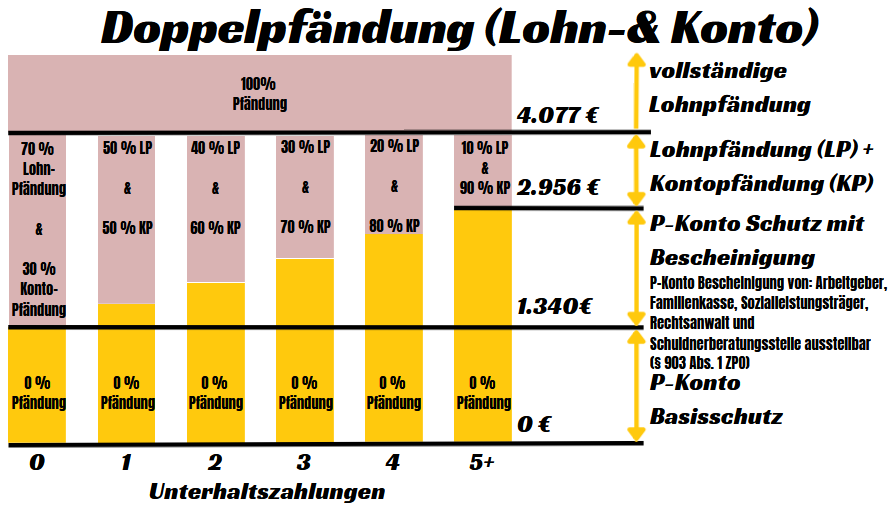

In the case of double garnishment of account and wages, a wage garnishment and an account garnishment exist simultaneously. The risk of double garnishment exists when the statutory garnishment allowance (according to current garnishment table) is higher than the (static basic) allowance protected on the P-Konto.. This is the case when exceeding the static P-Konto exemption limits between € 1,340 (without maintenance obligations) and € 2,956 (with 5 or more maintenance obligations).

Amounts above the exempt amount are not paid in the event of a double garnishment of account and wage garnished in full. For example, the employer of a person without alimony initially garnishes the amounts above the exemption amount at 70 % (at the payout of the wage). Subsequently, the bank transfers the remaining 30 % of the surplus above the exemption amount to the creditor account. Thus, there is a double garnishment of wages and account, which results in amounts above the exemption amount being garnished at 100 %, with the employer and the bank transferring the amounts to the creditor in different proportions.

As a debtor, you do not have to accept this and it is not in line with the regulations of the garnishment table, according to which surplus wages above the unattachable allowance are only garnished on a pro rata basis. You can file an application with the enforcement court and thus oblige the bank to garnish cash receipts above the P-Konto allowance only on a pro rata basis. For example, a person without alimony will only have to garnish the excess amount above the allowance on a pro rata basis of 70 % if your application to the enforcement court is approved. She may keep the remaining 30 %.

Prohibition of double garnishment: May the wage and account garnishment take place at the same time?

What you can learn here

- Prohibition of double garnishment: May wage and account garnishment take place at the same time?

- Example of double garnishment of account and wages

- In the case of a double garnishment, all amounts above the exemption amount are completely seized

- Double garnishment of account and wages must not be accepted

- In detail, the double garnishment runs as follows

- At what income limits is there a threat of double garnishment

- What should you do if you have a double garnishment of your account and wages?

- The enforcement court is your point of contact to prevent double garnishment of account and wages

By garnishing wages and the account twice at the same time, the creditor is more likely to succeed in enforcing his claim. After all, he has access to two garnishment objects. In the case of wage garnishment, the debtor's employer is the third party debtor, which satisfies the creditor's claims. In the case of wage garnishment, the debtor's bank assumes the role of the third-party debtor: The bank then transfers the wage above the exemption amount to the creditor.

Despite the contradiction with the garnishment table, a double garnishment of wages or salary and account may take place at the same time. This makes it easier for the creditor to get the money.

However, a real double garnishment is prohibited

However, a creditor may not garnish the same garnishment item twice. For example, a creditor may not garnish the same account twice in order to receive twice the amount of the garnishment. This would be a real double garnishmentwhich is prohibited by law.

Unreal double garnishment: allowed

This is the simultaneous garnishment of wages or salary and the account. Although both wage garnishment and account garnishment are garnishments via a third-party debtor, they are not referred to as the same object of garnishment. Therefore, the simultaneous Double garnishment of account and wages spurious and therefore not prohibited by law.

Example of double garnishment of account and wages

- Dirk has a Net income of 2295,00 €. Since Dirk is single and does not have to pay alimony, the employer garnishes 229,61 € From his wages.

- If Dirk were to live with or pay alimony to his wife without income of her own, his income would be allowed to be deducted from his income according to the Garnishment calculator only € 72.13 will be garnished. However, with the income above the garnishment exemption limit come to a double garnishment.

Since Dirk's income is above the garnishment exemption amount, a double garnishment may occur in the event of a wage and account garnishment.

First, the employer garnishes portions of wages

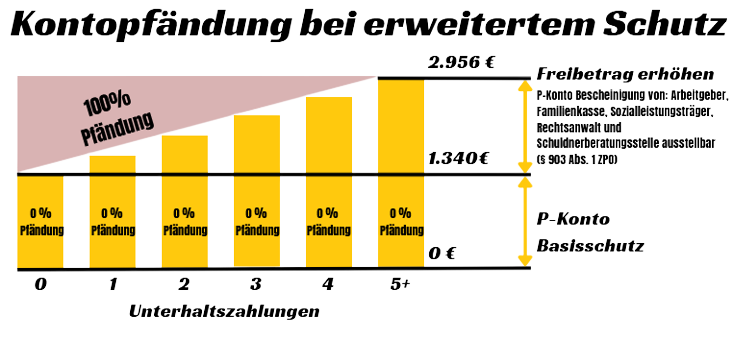

In the case of wage garnishment, amounts above the exemption amount are only garnished proportionally. Depending on your maintenance obligations, you must give between 10 % and 70 % of your excess wages to the creditor.

The purpose of the regulation is to create an incentive so that additional earnings are worthwhile for both the creditor and the debtor. The debtor should not have to hand over all of his additional earnings, but the creditor should still receive more from better-earning debtors without children than from people who have to provide for other people and earn little.

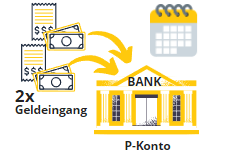

Subsequently, the bank garnishes all cash receipts above the exemption amount

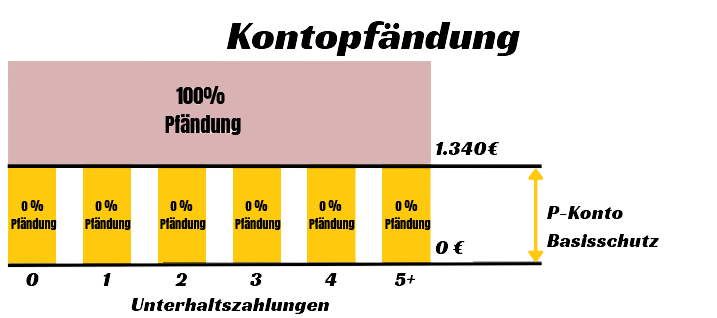

In the case of account garnishment, the legislator allows only lower exemption amounts than in the case of wage garnishment. Even with a P-Konto certificate, the bank will transfer all amounts above the full exemption amount (up to 100 %) to the creditor, resp. returns these to the retirement account..

Attention: If you don't have P-Konto yet, the account will be fully seized in case of garnishment. You can use the Supremacard from Paycenter* Set up a debit card with Pfändungsschutzkonto in just a few steps, through which you will receive your paycheck.

- Mastercard Prepaid Debit Credit Card

- Credit card without international fee

- P-Konto can be created in online banking with a few mouse clicks

In the case of a double garnishment, all amounts above the exemption amount are completely seized

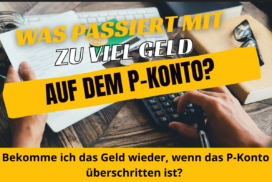

If you have a P-Konto set up, and possibly the Creditors already somewhat tricked by allowance increase the creditor still has the upper hand. Because, if the creditor applies for a double garnishment of the account and the wages at the same time (this is no additional effort for him by an additional cross), the bank and the employer jointly garnish all amounts above the exemption amount.

The complete garnishment of the amounts above the tax-free amount takes place thereby, although these amounts according to the garnishment table only be garnished on a pro rata basis. The first part of the wage garnishment is carried out by the employer when the wages are paid out. The second part of the garnishment is then carried out by the bank when the account is garnished.

Double garnishment of account and wages must not be accepted

However, you do not have to accept a double garnishment of wages and account at the same time. You can avoid a double garnishment by filing an application with the enforcement court so that only the amount of the wage garnishment is paid to the creditor.

In detail, the double garnishment runs as follows

- The employer transfers the attachable share of the employment income to the creditor of the employee. For this purpose, the employer uses a garnishment calculator or the current garnishment table.

- Example Dirk: Dirk earns € 2,295 net per month and has no children and no wife to whom he pays alimony. Dirk's employer transfers € 229.61 from Dirk's wages to his creditors.

- Now the employer transfers the non-attachable portion of the earned income to the employee.

- Dirk himself receives the remaining amount of € 2,065.39 from his monthly net of € 2,295.

- If, in addition to the wage garnishment, the account is also garnished, the bank will garnish the amount above the garnishment allowance of €1,340 (according to the Garnishment calculator 2022/2023) again.

- Dirk then has only €1,340 of his paid-out salary of €2,065.39 at his disposal. The surplus is garnished, which the bank pays to the creditor in addition to the employer's wage garnishment.

At what income limits is there a threat of double garnishment

The risk of a double garnishment therefore always exists if the statutory garnishment allowance (according to current garnishment table) is higher than the (static basic) allowance protected on the P-Konto. This is the case when exceeding the static P-Konto exemption limits, depending on the maintenance obligations. Currently, these are the following limits:

| Number of maintenance obligations (e.g. children, spouse) | Garnishment allowance |

|---|---|

| 0 | 1.402,18 € |

| 1 | 1.929,94 € |

| 2 | 2.224,14 € |

| 3 | 2.518,34 € |

| 4 | 2.812,54 € |

| 5 and more | 3.106,74 |

What should you do if you have a double garnishment of your account and wages?

In the case of a double garnishment of wages and an account, the debtor must file a petition with the enforcement court if he or she has amounts in excess of the exemption amounts on the garnishment protection account would like to have protected. The doubly garnished amount can then be released. This leaves you with more money to live on.

However, the repayment of the debt is also prolonged if you avoid the double garnishment of the account and wages. This is because the elimination of the additional garnishment amount means that you only have to spend a smaller amount on repaying the debt. A double garnishment therefore has advantages and disadvantages for both creditor and debtor.

Therefore, you should consider whether you want to object to the garnishment of your account. If you do not need the money urgently, it is not advisable to do so, so that you can get rid of the debt more quickly.

By the way, it is not a good idea to "cheat" money past the P-Konto by making cash payments from wages or second accounts at home or abroad. This is because a court could consider this as thwarting the money. Thwarting is punishable by law.

The enforcement court is your point of contact to prevent double garnishment of account and wages

If you want to avoid the double garnishment, you have to contact the execution court or the competent Matsgericht. The address of the competent enforcement court can be found in the Attachment and transfer order (PfÜB). The competent enforcement court (local court) is entered there, which can extend the P-Konto protection according to the amount shown in the garnishment calculator.