How should you ideally finance your car? Is cash best to buy, finance or lease? This article will give you some advice on whether you should buy, finance or lease an Auto Bar. In the table below you will find an overview of the advantages and disadvantages of financing, leasing or buying cash.

In the past, cash payers could get great benefits when buying a new vehicle. However, new cars are increasing in price. This makes it more difficult for many to raise the full amount. Even if that were possible, it doesn't necessarily have to be the best solution.

Loans used to be expensive and cars cheaper

Credit used to be expensive and cars cheap by comparison. So you bought cash. For this one has saved on the new car. Sometimes for years. The car was then picked up at the dealership together with the family as part of a small celebration: suitcases of money for car keys. Today, only a good third of new car buyers pay for the car in cash. Most people lease or finance their vehicle. But there are a few things to note here.

What you can learn here

- Loans used to be expensive and cars cheaper

- Basic principles and parties involved

- The advantages and disadvantages of a cash purchase

- Benefits of cash purchase

- Disadvantages Cash purchase

- The advantages and disadvantages of financing (versus cash payment)

- Benefits of car loan

- Disadvantages car loan

- The advantages and disadvantages of leasing (versus cash)

- Benefits of leasing

- Disadvantages leasing

- Loss of value in finance leasing and cash purchase

- Conclusion

Basic principles and parties involved

1. Pay for the car in cash

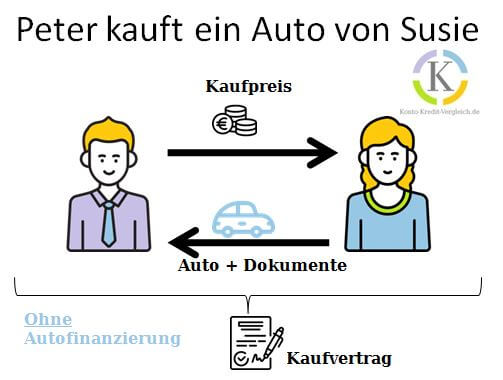

When paying with cash, the car is yours immediately after paying the purchase price. For you, future ones will be omitted installments and you can look into the future debt-free. From a financial point of view, however, it is also doing well depreciation directly reflected in your wealth. You are also responsible for regular maintenance and all repair costs incurred for the vehicle.

In addition to the vehicle, the seller hands over to the buyer all accompanying documents such as the vehicle registration document, vehicle registration document, service booklet and keys. In return, the seller receives the purchase price paid by the buyer. The procedure should be recorded in a purchase contract. When I bought my own car, I used the ADAC sales contract. From my point of view, this contains all the necessary information. Here is a link. The following image shows the schematic process for buying a car without financing.

2. Financing

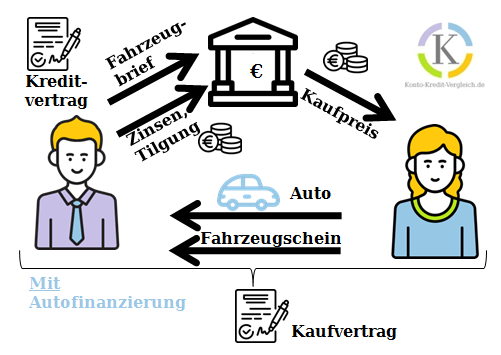

When financing your set of wheels, the bank lends you the money to pay the purchase price. The money must be repaid with the loan installments over the agreed period. In order for the bank to lend you the money, they need collateral. This is usually the vehicle registration document that you have to deposit with the bank. There are additional costs for the service of the loan in addition to the pure purchase price: the interest. As with cash purchases, you also own the car and are responsible for repairs and maintenance yourself. If the credit rating is bad, there is even a Car loan without and despite negative credit bureau from providers like Smava* or bon credit* possible. In the article Buy a car on installments despite negative credit bureau we also noticed that you had a loan at bon credit* come out cheaper than with financing through car dealerships directly.

During the financing period, you are the borrower Vehicle's owner. You are not the owner. Most banks require as Secure the vehicle registration document, giving the bank control of the car. The lender can sell the car if the loan installments are not paid. As soon as the loan has been repaid, the banks give the borrowers the vehicle registration document. This turns borrowers into legitimate ones owner of the vehicle.

This process is now too time-consuming for some online banks. Therefore, there are some banks that offer a car loan offer, in which the borrower can Keep the car registration can. This gives the borrower additional flexibility.

2.a Financing via manufacturer's bank

Financing through the manufacturer's bank is primarily convenient. Buy a new car and take out financing directly on site without going to the bank. In addition, you still have opportunities for discounts through the dealer even when financing. So there are often special offers for certain models.

However The installment loan from the car banks is not without disadvantages: car dealerships usually require one down payment at least 20 percent of the price. Other disadvantages are the rigid terms and the high closing rate of mostly thousands of euros. The final installment must be saved alongside and in addition to the loan installments. Although there is also the possibility of financing the final installment later, the conditions for this are usually poor.

If the loan is terminated prematurely or revoked, the purchase contract is also void. Because financing via the Autobank is a "related business".

2.b Financing via regular bank

When financing through a normal bank or savings bank, your newly purchased car often also serves as security. However, some banks do not this security.

An RSV or residual debt insurance that kicks in if you can no longer pay the installments (e.g. accident, disability) is usually not worthwhile with a car loan. The risk is covered by other insurances such as disability insurance or term life insurance (if available). In addition, RSV are usually too expensive, like financial tip has researched.

Regular banks usually charge for a car loan no deposit. Hence their name "Car loan with no down payment“. However, the interest rates are usually a bit more expensive. If you choose a longer term for the loan, the total cost of the loan will continue to increase.

2.c Financing via car dealership

A rather rare alternative to cover the credit requirement is financing through direct financing through the car dealership. This financing option is particularly suitable for people with poor credit ratings and negative credit bureau. There are a few car dealerships that will finance your car despite negative credit bureau. You can find an overview in the article "Which car dealership finances despite negative credit bureau?“.

Choose manufacturer bank or house bank?

Whether the manufacturer's bank or the house bank is cheaper depends on the individual case. The best thing to do is to get an offer from both of them and then compare. It's a bit of work, but you can quickly save several hundred euros in interest.

Basically, however, one can say: With a high down payment, the loan installment is lower and you have to pay back less interest. Calculating the car loan with foresight is a must - even more so when it is your most expensive possession.

Is the cash purchase worth it for you? Take the test here

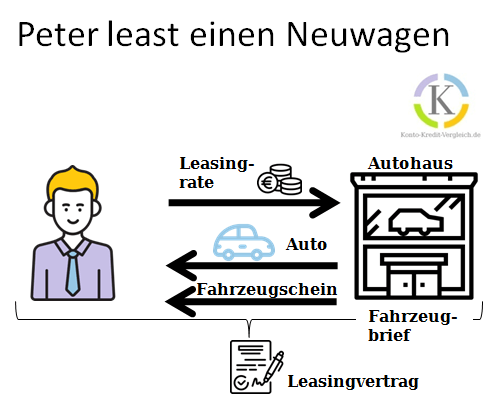

3. Leasing

In contrast to the other two variants, with leasing you are not the owner of the car. You only rent the car for the agreed period of time, the leasing period. This is usually two to three years. The leasing rate, which is ultimately nothing more than the rental fee, is made up of the loss in value of the car and the lessor's profit. Since lessors usually finance themselves through bank loans, the profit also depends on the interest rate level. Here, too, the vehicle registration document usually remains with the car dealership or the lessor. After the leasing period has expired, you can buy the car at the residual value or lease a new one. There are different contract constellations for replacing the car. If you have bad credit, you will find here 6 providers which Car leasing without and despite negative credit bureau offer.

The advantages and disadvantages of a cash purchase

Cash purchase is the cheapest way to buy a car. Because what is the profit of the lessor in the case of leasing, is the interest in the case of a loan. Only fall when buying cash no further costs at. Therefore, a cash purchase means peace of mind in the future: after all, the car is paid for and a no future financial burden. In addition, cash purchase makes it easier to get a price advantage from the dealer. Of course, when choosing a car, you are limited to your own financial means. High-priced cars are therefore only affordable after sufficient savings. If the car is used professionally, it can be depreciated through the AfA tables. In case of leasing there are greater possibilities of taxation. Depreciation

The advantages and disadvantages of financing (versus cash payment)

Basically one can Financing advantages compared to cash payment to have. become like this higher priced models more affordable for people with lower incomes. Usually only a small amount of cash is required for a deposit. However, at least 20 % or more are recommended. But financing can also be an option for higher earners due to the low interest rates worthwhile: If you can earn more through other investments than the car loan costs, you make a plus. In addition, with terms of 60 months and more, the financial burden more evenly. With three-way financing, you also remain flexible.

Furthermore, in the case of bank financing via the house bank, a price advantage is possible with the dealer. As with cash purchases, the retailer receives the money immediately. In addition, the end of the financing is unproblematic (in contrast to leasing): The car becomes your property after complete financing, without any renegotiation or "looking for scratches". Compared to leasing, there are no restrictions on the permissible annual kilometers.

The disadvantage of car financing are the higher overall costs because of the Interest charges.

The advantages and disadvantages of leasing (versus cash)

When you lease the car, you have to pay a little more overall than when you buy it in cash. After all, when leasing, the profit of the lessor must also be paid. Leasing cars are usually only given out as new cars and are therefore usually not very cheap.

Other disadvantages are Restrictions on workshop selection and car care such as uncertainties when returning of the vehicle. The repurchase value is not determined in advance and is reduced by scratches. Businesses in particular can take full advantage of the advantages of leasing: Good depreciation opportunities and little tied-up capital make leasing attractive.

Loss of value in finance leasing and cash purchase

You can't avoid the loss of value. In the case of a cash purchase or car financing, the loss in value goes directly into your assets. After all, you are the direct owner of the vehicle, i.e. the object of value. The valuable car is subject to a decline in value, which you can read about in various tables.

In the case of leasing, the depreciation initially affects the lessor, since the vehicle is on the books there. However, since a leasing company cannot live by paying more, it passes this loss in value on to the customer via the leasing rate. So it makes no difference whether you buy the vehicle in cash, finance it or lease it: The loss in value must always be paid for.

Loss of value of typical passenger cars

The loss in value is greatest after the purchase of the car and then turns into a linear curve from about 3-4 years. Surely you have heard the saying that the car has already lost a lot of its value once it has left the dealer's yard. Well, there is some truth to the saying if you look at the depreciation of a typical car over its useful life (source: ADAC).

The graphic also contains the repair costs for a car with an annual mileage of around 15,000 km. While the value of the vehicle falls, the cost of a repair increases with age.

If you are now wondering whether the repair of your perhaps older car is still worthwhile, you can proceed as follows:

- If the repair costs are still below the residual value of the car, it usually makes sense to have this repair carried out and then continue driving the car to the bitter end.

- If the repair costs are in the range of the residual value or even higher, a repair is no longer economical and scrapping is the better alternative.

The chart also shows that a new car is a heavy drain on your assets and is in fact a money-wasting machine. Since leasing offers are usually only available for new cars and are therefore the most expensive option for private individuals, leasing is ruled out at this point.

I can't say anything about the accuracy of the data collected by ADAC. Ultimately, however, comparing the repair costs after an offer from the workshop with the residual value of the vehicle is definitely a sensible strategy for saving costs.

Research depreciation and repair costs beforehand

You can inform yourself in advance about loss of value and expected repair costs. You can greatly reduce the loss in value if you buy a 3-4 year old used vehicle instead of a year-old car. After this period, the depreciation is far less severe. A car is most economical between the third and tenth year of operation. You can get an indication of low maintenance costs from the ADAC breakdown statistics derive This statistic lists which cars are the most reliable and which have broken down the most.

Conclusion

Of the cash purchase is the cheapest way to buy your own car. There are no additional costs for interest or surcharges for leasing. In addition, investing the money initially saved through leasing, for example, is generally not a good idea.

If you do not have the wherewithal, it is advisable to finance a cheaper car (3-5 years old) with a car loan. In another article we have 11 cheap used cars which you can also afford with less than 1000 € net. This saves you a lot of money in the long term compared to leasing. In addition, the car becomes your property after you have paid off the last installment. You can lower the rates further by as much as possible as your own deposit bring in

When you decide to get a car loan, you should compare loans to get a good deal. For this you can use this Loan Calculator use. After entering your data, the cheapest offer will automatically appear at the top.

| Bank | loan amount | Duration | Financing without vehicle registration | Interest rate independent of creditworthiness | |

|---|---|---|---|---|---|

norisbank car loan* | 1.000 € until 50.000 € | 12 months until 96 months | ✅ | ❌ | To offer: norisbank.de* |

ING car loan* | 5.000 € until 65.000 € | 24 Months until 84 months | ✅ | ✅ | To offer: ING.de* |

Do you even need your own car?

So far we have only dealt with how you should best buy your car, i.e. whether it is better to buy, finance or lease an Auto Bar. First of all, however, there is the question if you should buy a car at all. There are regions in Germany where the question does not arise as it is not possible to do without a car at a reasonable cost. The majority of the German population (about 75 %) lives in cities (source). In addition to the car, there are often many other ways to get around here. In addition to public transport, there are often numerous providers of car sharing available. In addition, the bicycle is often a viable alternative for many inner-city routes, which we can probably all use a little more.

Since I rarely drive my car myself, I registered it with Getaround (formerly Drivy) for the neighbors to use. From my point of view, that's a good thing, since neighbors who don't have their own car can also do spontaneous errands with our vehicle. If you Sign up for Getaround using the link below, you will receive a starting credit of 15 euros for your first rides. I also get a commission if you rent through the link. So thanks if you use it! ❤️

Icons from www.flaticon.com

Car, person, bank: by Freepik; Euro:by Kiranhastry Contract: by wanicon Credit Card: by monkik; Car dealership:smalllikeart

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

3 thoughts on “Auto Bar kaufen finanzieren oder leasen?”

Comments are closed.