In this article I will introduce you to my depot model that I have been using since around January 2020. The special thing about this depot model is that I don't have to pay any fees for buying shares and ETFs. Instead, I even get a decent bonus from the broker for having my securities stored with you.

Are you particularly interested in Smartbroker and Trade Republic? Read my article comparing the two newcomer brokers here: Smart Broker vs Trade Republic!

What you can learn here

- You are mainly interested in Smartbroker and Trade Republic? Read my comparison article of the two newcomer brokers here: Smart Broker vs Trade Republic!

- Which brokers are included in my depot model

- With this depot model, you do not have to pay anything for shares through bonuses

- Targobank pays a premium of 0.75 % for securities account transfers over 7,000 euros

- Buy stocks and ETFs with – 0.5 % fees with this depot model

- Is it also possible to make the depot model simpler?

- Vendor Links

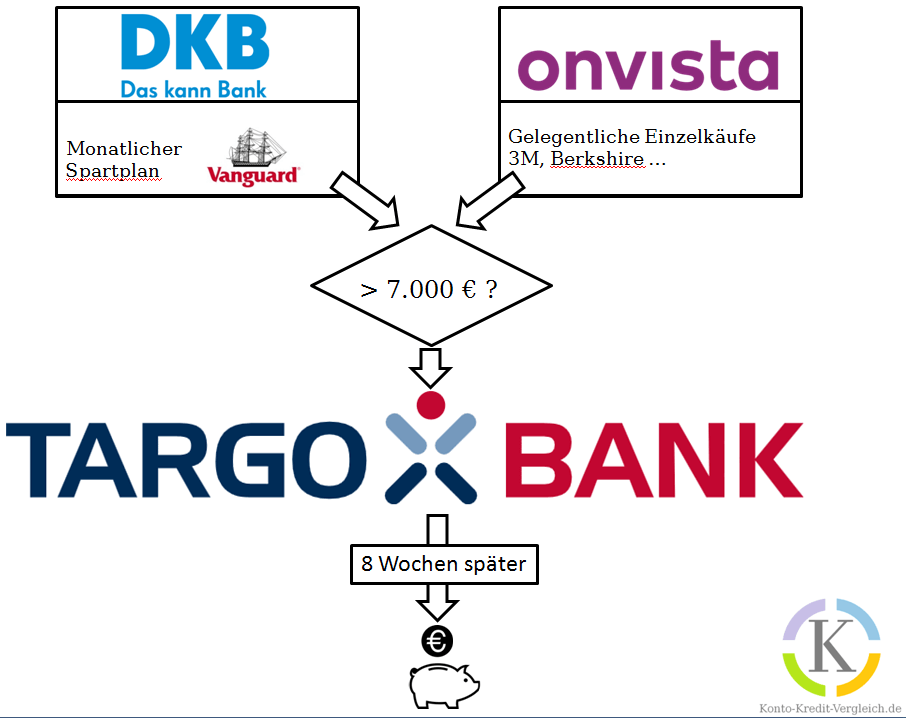

Which brokers are included in my depot model

I use a to run monthly savings plans DKB depot*. What I really like about this is that you can run Vanguard savings plans between 50 - 100,000 euros for 0.49 euros. I'll leave my opinion on that Vanguard World ETF (NASDAQ:VPN).

My collective depot is at Targobank. This is where all positions come together at the end. Since the Targobank* is not the cheapest to buy later, I still maintain a depot at Onvista Bank*, where you can execute an order for 7 euros (or a savings plan for 1 euro, which I no longer need because of my DKB depot). I use the onvista depot for subsequent purchases of one-off investments. For example, I recently joined 3M.

My other depots at consor bank*, comdirect* and flatex* I dissolved because they no longer offer me any added value and I believe that the investment should be structured as simply as possible. If you also have a Flatex depot, I also advise you to move the depot. With the resulting penalty fee on deposits, the provider has once again proven what he thinks of regular customers.

TARGOBANK - top depot actionWith this depot model, you do not have to pay anything for shares through bonuses

As already mentioned, I use the DKB* for the Vanguard World ETF savings plan and the Onvista Bank for one-time purchases. My stocks are with the Targobank.

I then transfer the securities from DKB (World ETF) and Onvista to my collective depot at Targobank. With this depot model I can save a lot of fees and also get good bonuses for the transfers from the Targobank. Below is a brief calculation of the rewards I receive for each stock or ETF purchase.

Targobank pays a premium of 0.75 % for securities account transfers over 7,000 euros

Targobank's premium of 0.75 % is significantly higher than any fees I have to pay to buy and hold an ETF. Targobank pays a total of up to EUR 5,000 in premiums for the transfer of the securities. For each transfer of more than 7,000 euros, you receive a bonus of 0.75 % (⇾ That is 52.50 euros for each 7,000 euros of transferred securities account volume).

You can also transfer several deposits with less than 7,000 euros at the same time and is therefore entitled to a bonus.

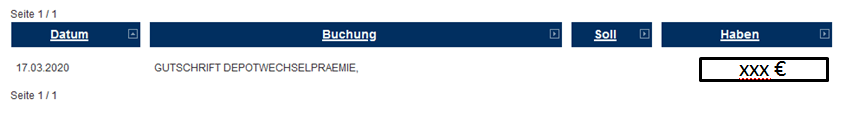

The bonus will be paid out 8 weeks after the transfer. This has worked for me so far without any problems (see screenshot).

Buy stocks and ETFs with – 0.5 % fees with this depot model

For my Vanguard savings plan, I only pay 49 cents per version at the DKB. Additionally, the Vanguard ETF TER charges fees of 0.22 %. Since I get 0.75 % in rewards from Targobank, I get a negative fee of – 0.5 % credited by Targobank. In reality, it should be even more, since Vanguard's World ETF has no tracking difference to the index having. This means that the real cost burden is less than 0.22 %.

The one-off purchases from onvista cost 7 euros, although I only make a few of them a year. With an amount of 7,000 euros, the 7 euros in fees correspond to 0.1 % of the purchase price. This means that every purchase is subsidized by 0.6 % from the Targobank as soon as everything is sealed.

So far I haven't bought anything from Targobank because the fees for Onvista and DKB are simply much cheaper. In addition, I would not get a change bonus if I bought it directly from Targobank. The model is therefore worthwhile in two respects.

Is it also possible to make the depot model simpler?

I am not aware of any depot model that is just as lucrative. But there are also good alternatives that are easier to use and still cheap. Here would be in particular TradeRepublic* as a low-cost smartphone broker and the smart broker* to call. You could also run the one-time purchases through the Smartbroker or the monthly savings plans through TradeRepublic. The easiest, but not quite as lucrative, is to simply do everything through the Smartbroker.

You can find more about these alternatives in the depot comparison.

Vendor Links

Here are the links to the providers again if you want to recreate the depot model.

- Here are the rewards: Link to Targobank*

- For Vanguard ETF savings plans the #1: Link to DKB*

- Very good for one-time purchases: Link to Onvista* Alternatively, you can also use the smart broker* (is even 3 € cheaper)

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

Icons (piggy bank, euro coin) created by Freepik from www.flaticon.com

I find the idea of the transfer to Targobank very exciting. It just doesn't seem to work anymore, at least for new customers, since the bonus for the classic depot only applies to investment funds (no ETF). With the other depot you pay fees of 1.5 % per year!

Hello Tim,

Yes, unfortunately you observed that correctly. The Targobank has worsened your conditions here and unfortunately no longer takes ETFs into account for the free deposit 🙁

There is currently a free depot with a bonus at maxblue.

I am considering moving there as well.

LG Sascha