If you have a long investment horizon of ten or better 15 years, you can use these price discounts to your advantage. If you got on board during the 2020 corona crisis or the 2008 financial crisis, you made a good profit shortly afterwards. Even if the markets have collapsed further in the short term. In 5, 10 or 15 years the world will emerge stronger from every crisis. If you haven't already signed up with the Stock portfolio theme busy, it's now time to quickly learn some basics. Therefore, some basic information about stock portfolios is included in this article. If you want to know which providers I specifically recommend, Look here to. If you already have a depot, you can find an article here how to buy a stock.

Here are a few more facts: There are around 5 million shareholders in Germany. This puts Germany quite far behind in a European comparison. Since 1987, the Dax has delivered a historical average annual return of 7.75 % (including dividends) [source]. This already takes price crashes like the dot-com bubble in 2000 and the financial crisis of 2008 into account.

Share portfolio basics: growth does not equal profit

What you can learn here

- Share portfolio basics: growth does not equal profit

- Share account basics: risk of account in the event of bank insolvency?

- Stock account basics: clearing account

- Stock account basics: open a account

- Depot fees: Keep your eyes open when comparing depots

- Stock account basics: open a account

- Share account basics: close/cancel account

- Stock account basics: My 7 best tips for opening an account

Buying, selling and managing shares costs fees and reduces your return. If you do not want to pay excessive Costs and fees compare offers from direct banks, online brokers and traditional branch banks with each other! Thus, for frequent traders or (monthly) ETF savers, the fee differences over the years can quickly become several thousand euros turn off.

Infographic by boerse.deShare account basics: risk of account in the event of bank insolvency?

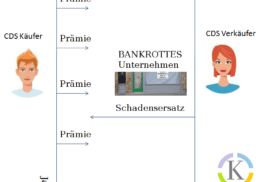

In the event of the insolvency of the custodian bank, the customer's securities assets are not affected. This is because it is managed separately as a special fund. Therefore, a deposit insurance as with accounts with securities is not necessary.

So: The bank manages this special fund on a fiduciary basis for the investors and separate from its own assets. In the event of the bank's insolvency, the deposited securities are therefore protected and do not have to be used to service creditors' claims.

That means: The shares are always yours! Even if the bank goes bankrupt. Incidentally, the same applies if a Robo Advisor manages your depot!

Stock account basics: clearing account

To buy and sell securities, investors also need a clearing account. The money is collected from this account when shares are bought and credited when shares are sold. Most banks will open a free settlement account for you when you open a securities account. Some banks also accept accounts from other banks - this could be your existing account, for example. checking account be. You will find out more details in the opening process of your securities account! By the way: There are only three requirements to be able to invest in the stock market: You must have full legal capacity, own a securities account and of course have some money left to invest. By the way, it is a myth that only wealthy people can buy shares!

Monthly share savings plans can be created with many providers from as little as 25 euros. An example is the very cheap provider Trade Republic*. Of course, your ETF savings plans can also be terminated at any time.

Stock account basics: open a account

Which is the right custody account for you depends on your preferences. Do you value personal contact with your bank advisor? then look for a classic branch bank. However, you usually pay additional fees for this service.

Best conditions: Do you prefer to do all your banking 24/7 online anyway? then you benefit from the more favorable conditions of online brokers. So-called discount brokers also offer custody accounts for private investors. They are often offshoots of larger institutes with a clearly customer-friendly cost structure. A special case is the fund depot: No shares can be bought here, only funds from the corresponding fund company can be bought.

Custody fees: keep an eye out depot comparison

The amount of the fees charged for the depot varies greatly between providers. In principle, the following fees are charged by the brokers:

custody fees

These are fees charged by your custody account provider for holding the securities. They are therefore also called custody fees. Typically, these fees are a "relic" from the offline era. Online banks almost always keep your securities free of charge. In return, branch banks collect twice: once with a fixed portion and on the other hand with an additional variable portion of the fee, depending on the volume of the custody account. Since custody fees also apply without transactions, they are extremely relevant, especially for beginners who only carry out a few trades a year. You can find the custody fees under the Product Details tab.

Order or Transaction Fees

Order or transaction fees are incurred when buying and selling securities. As a rule, they depend on the volume of the purchase/sale. “Flat fee” cost models are increasingly being used here. Regardless of the traded volume, a (usually very small) fee is charged for the purchase or sale (e.g. DEGiro, onvista*Smartbroker, TradeRepublic*). Frequent traders must pay particular attention to these fees.

The exchange fee

The stock exchange fee includes the broker's commission and any costs incurred for using the trading venue for each purchase or sale. It makes a difference whether you buy the security via the Stuttgart, Frankfurt, Munich stock exchange or another trading venue.

additional services

Some brokers charge additional fees for placing limit orders. With a limit order, the customer indicates in advance that he will buy or sell a security when the price reaches a certain level. This fee should also be taken into account when comparing depots. You can find the fees for limit orders under the Product Details tab.

Another tip

Most fees are in comparison calculator already included. I have other hidden fees from some providers here for you to read made transparent.

If you want to have the best depot offer for you, you have to use a customizable and detailed depot comparison. In the comparison calculator, you can use your approximate number of orders per year and your order volume in € or your savings rate and frequency to find the most favorable depot for you.

Stock account basics: open a account

branch banks

For branch banks, the conventional way is to fill out a deposit application at the bank branch. The bank advisor can help with this.

online banks

Opening a depot online is quicker and easier. After you have found the best depot for you by entering your expected number of annual orders and the approximate order volume, one click takes you directly to opening a deposit account with your favorite broker. When opening your new custody account, you must provide information on: name, address, place and date of birth, e-mail address and telephone number. You will also be asked about your experience with securities. Your answer serves to classify you in a corresponding risk class. Depending on the risk class, different investment products are then available. For example, anyone who has been trading in bonds, shares or funds for many years will also be activated for riskier transactions, such as special certificates. The risk classification serves to protect the investor from major losses due to transactions that are too risky.

Opening a securities account with a smartphone: a matter of a few minutes

A new trend is legitimation via webcam or smartphone app: Here you carry out the legitimation directly in the app, which will later also be used to manage your depot. You open the Trade Republic depot by clicking on their website answer a few questions about your name, date of birth, cell phone number and so on and then simply install the app.

Depot opening via the PostIdent procedure

Many providers still use the Postident procedure, which can also have its advantages, since the procedure is not as prone to technical problems. After the custody account application form has been filled out in full, you can take the form and ID to the post office for a personnel check. Swiss Post will then forward your application to the custodian bank. Once you have sent the application, the bank will usually contact you by letter within a few days and will send you all the necessary documents and access data for your securities account in several separate letters.

Share account basics: close/cancel account

The safest way is still the termination by letter with signature. One You can find a free template for terminating your deposit here (Word file). If you want to change, you can also use the exchange service of many banks.

Here you will find more templates for terminating your account (all .docx Word files):

- 1822direkt: free template for terminating your 1822direkt account

- Consors Bank: free template for terminating your Consors Bank custody account

- FlatEx: free template for terminating your FlatEx depot

- ING: free template for closing your ING custody account

- onVista: free template for terminating your onVista depot

Finally, 7 tips for opening a securities account!

Stock account basics: My 7 best tips for opening an account

- Don't put the reins on the horse from behind: First, define your investment goals. What do you want to achieve with your system by when? How much fluctuation (volatility) can you tolerate? Do you stay cool and composed when the markets momentarily drop at 30-40 %? Are you a passive ETF saver or an active trader? Be clear about what you want. Only then does the cost comparison of the brokers come into play. Different brokers cater to different audiences. You can find the best depots of 2020 here.

- For active traders: Try out new strategies in the sample portfolio first: Test your strategies in a sample portfolio before you use real money. You can do this, for example, with a sample portfolio from Cap Trader that you can open without risk and liabilities.

>> Open a free Cap Trader sample portfolio and test your investment strategy <<

- use special promotions: Direct banks and online brokers are in fierce competition with each other: Use special offers when opening. Starting credit and free trades are not uncommon! All currently valid promotions can be found in the comparison table.

- Availability of customer service: At least one hotline and one email should be available. Tip: Everyone calls the hotline in the evening. Try it early in the morning!

- Traveling a lot? Look for a usable app. If you love banking via app, you will arrive TradeRepublic*probably difficult over.

- Fill out self-disclosure: The bank will otherwise classify you as a newcomer to the stock market with years of experience and block you for numerous papers

- Consider Other Opinions & Awards: In the comparison table you will find ratings and test seals listed by many brokers. Simply use the swarm intelligence for yourself!

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.