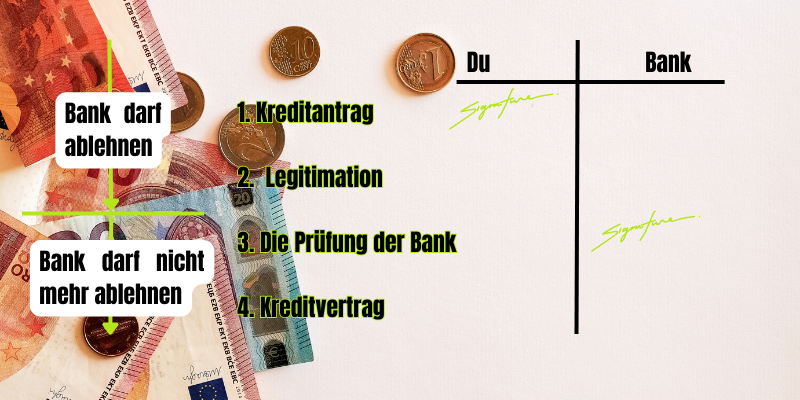

Once both the bank and you den Credit agreement have signed it, it is legal. However, a legally valid and binding contract is only concluded by the Agreement of both sides is established. If both the bank and yourself have Credit agreement signed therefore nothing can go wrong.

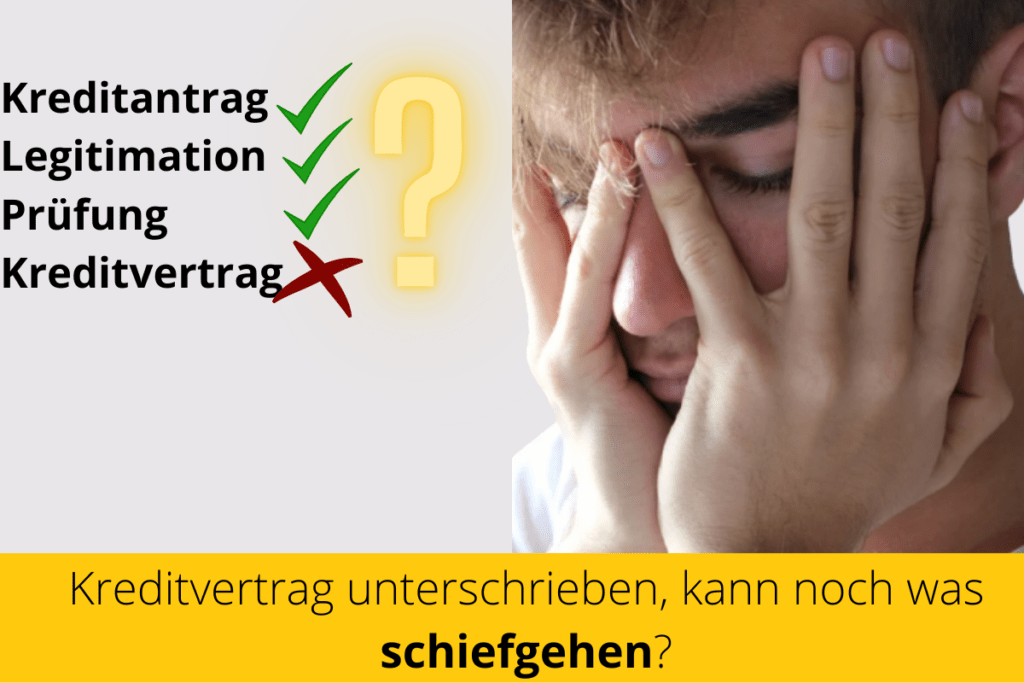

Loan agreement signed, can anything still go wrong? Yes, if the bank's signature is still outstanding, it is only a matter of a credit application. A credit application is in contrast to the credit agreement NOT binding and the bank can therefore still back out. The bank makes use of this right to withdraw if the internal review is negative. Therefore it can still come to a refusal. So that you do not have to worry further, you will find in the article 'Loan agreement signed: When will the money come??' the duration of the payout of the most popular 20 banks and credit intermediaries.

How to avoid rejection from the start. To ensure that nothing goes wrong when you apply for a loan, it is important that your credit rating matches the bank's risk profile. In fact, most banks reject people with negative Schufa or too bad credit rating. In order to no longer have to wait for a presumably to wait for payment that no longer takes place, you can read in the article 'Which bank gives credit despite negative credit bureau?' check whether your bank is one of the banks that do not throw in the towel even in difficult cases.

How does a loan agreement come about and what can go wrong?

What you can learn here

1. The creditapplication - Here is the creditcontract not signed yet and things can still go wrong

If you have one installment loan wish, you hand one first credit application at a financial institution. The loan application is a document signed by you, but not cross-checked by the bank. In addition, most direct banks and credit intermediaries carry out a preliminary check during the application phase. This creates the fallacy that the bank has already checked the application and can no longer go wrong. The actual examination of the bank is yet to take place.

If you want the payout to be quick, the bank you apply to must match your credit rating. This is because banks often reject applications with the slightest abnormality in the Schufa. But in the article 'Which bank grants credit with bad credit?' you will find providers who still grant credit in difficult cases. Because the credit providers listed there pay out quickly and unbureaucratically even in the case of a negative Schufa.

Depending on what you need the loan for, there are specific ones car loans or modernization loans. These earmarked loans have, due to the deposited collateral (e.g. registration certificate II at the car loan) a lower interest rate than a loan for free disposal. At the same time, collateral such as the Zulassungsbescheinigung II (vehicle registration certificate) is not accepted by all banks. After all, checking and keeping this important document also causes extra work for the bank. In the article 'Which bank accepts car as collateral?' you will find out which banks accept the registration certificate II as security. But also which banks want nothing to do with it.

2. The legitimacy

After you have submitted the loan application, the next step is the Legitimation. Your identity will be checked here. The quickest way to do this is via a video call where you show your ID. The bank will send you a special link for this.

3. The actual examination of the bank

Following will more documents, how payslips or the registration certificate part II car loan, required. Provided that Bank takes the vehicle title as security. Many banks offer online services such as portals for uploading PDF documents or a digital account check. This saves a lot of time and paperwork. The bank then reviews the loan application. In addition to checking proof of income, this usually also includes a query in the Schufa database. If the bank or intermediary has digitized these processes, the payment only takes about two working days after the application has been submitted.

4. The credit agreement

After passing the test, a specific and personal loan agreement is concluded. Only now can the question "Loan agreement signed, can something still go wrong?" clearly deny. The loan agreement expresses the positive decision of the bank to allocate the money. In addition, the loan agreement specifies the terms of the loan. Which includes:

- Duration of the credit as well

- the Interest charges of the loan and

- the Monthly Rate. But also

- information about special repayments,

- residual debt insurance and to the

- revocation must not be missing in the loan agreement.

In the loan agreement, however, you will first find detailed information about yourself. These include:

- an eventual title,

- your address,

- your account details,

- the exact amount of the loan,

- the interest rate

- the amount of the monthly installments

- as well as the period and

- the amount of the remaining debt.

As soon the Bank (as lender) and you (as the borrower) have signed the loan agreement, it is legal. From this point on, nothing can go wrong. But if the bank's signature is still missing, something can still go wrong during the credit check. For example, during the final credit check, the bank can determine that your income too low is, your credit rating is too bad or the height of Credit too high is.

Details to be agreed special repayments or any residual debt insurance are also listed. You will also find the legally required information on revocation in the loan agreement. If all the information is correct, the loan agreement is signed and is therefore legally binding. After the bank has received the signed contract, the money can be transferred to you. This takes about 2-3 business days.

Right of withdrawal for the loan agreement even after signature

If you change your mind after signing the loan agreement, the law states that you can revoke the agreement within 14 days. basis is § 355 paragraph 2 of the Civil Code.

(2) The cancellation period is 14 days. It begins with the conclusion of the contract, unless otherwise specified.

Civil Code (BGB) § 355 Right of withdrawal for consumer contracts - paragraph 2

A revocation serves to protect consumers in the event of a sudden financial change. The cancellation period must be offered to you by every bank.

You can revoke the loan agreement informally, but in writing to the bank. No reason has to be given for revocation. However, you should state your customer number, the amount of the loan and the date of the conclusion. The cancellation period begins on the day you receive the cancellation policy. You will usually receive the cancellation policy together with the loan agreement.

If you haven't received any money from the bank yet, you don't have to do anything after confirming the revocation. However, if you have already received money, you can pay it back within the stipulated period. In addition, you have to pay the bank the interest that has accrued in the short time between payment and revocation.