At present, crises of international proportions are taking place all over the world. The effects can be seen in the currently very high Inflation which reduces consumers' purchasing power and melts away wealth.

On top of that, it is to be expected that the government could soon take measures to restructure the highly indebted national budget by accessing citizens' assets. This raises the question of how assets can best be protected from devaluation and the tax authorities.

Record national budget debt puts private assets at risk

What you can learn here

For some time now, rising public debt has been causing savers and investors to fear for the assets they have accumulated over the course of a life of privation.

Since the 2008 financial crisis, institutions like the European Central Bank (ECB) have been opening their coffers to bail out failing banks and keep economies afloat. The result has been a creeping demonetization that is now being felt. Only recently have interest rates been raised again and spending cut back.

During the pandemic, Berlin made hundreds of billions available to cushion the negative economic impact on Germany as a business location. At the outbreak of the Ukraine war, Chancellor Scholz promised to provide another hundred billion to completely renew the equipment of the German armed forces.

The last subsidy package of the traffic light government refers to the energy crisis, for which 200 billion euros were allocated from state funds to protect citizens from the consequences of exorbitant energy prices.

These measures seem more than necessary in view of the previous government's sluggish will to reform. However, many financial experts are wondering how the responsible Minister Lindner intends to shoulder this expenditure. As a result, many insiders expect Berlin to push for an increase in various property taxes or even the introduction of compulsory levies for the better-off. One of the things being discussed is the so-called equalization of burdens, which is to be introduced in 2024.

Efficient asset protection measures

The increasing loss of value and unwanted state access to private assets can be countered by effective initiatives. As a rule, these work best when they are not applied as individual measures, but are effective as a bundle.

Establish residence outside of Europe

A preferred asset protection measure is seen as changing residency and creating a Open foreign account. The choice of destination should be a country that is outside the catchment area of the European Union (EU) and has a low tax rate.

With this solution, it remains to be noted that the move may not be faked, but must be carried out in reality. Consequently, this means for the persons concerned that they may not stay within German borders for more than 182 days per year. Only then will the local tax liability cease to apply.

Invest in real estate

Real estate is not called "concrete gold" for nothing. After all, they generate a steady increase in value, even if this is slowed down somewhat by rising interest rates. Nevertheless, real estate will remain a profitable form of investment in the future. Prices are rising steadily and can help to offset the negative effects of inflation.

It becomes problematic when the state budget is tight and the government tries to participate directly in this increase in value by introducing compulsory levies or new taxes. This fact cannot be dismissed out of hand, because there are enough examples. Greece, for example, introduced a compulsory mortgage in the course of the financial crisis in order to put its public finances in order. As a result, the trend here is also toward investments involving real estate outside Europe.

Shares

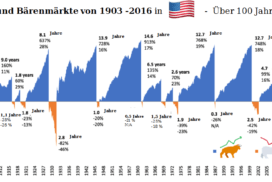

The stock markets have been in growth mode for several decades. True, there have been repeated rapid crashes, as with the dotcom crisis at the turn of the millennium, the financial crisis and at the beginning of the Corona pandemic. But the losses were balanced again within a few monthsas institutional investors in particular use these setbacks to buy additional shares.

Precious metals like gold and Silver

Gold has been used since time immemorial as a crisis currency viewed. The Precious metal is tradable worldwide and can be easily transported. Unlike other forms of investment, gold does not generate foreign exchange and high returns can be expected. On the other hand, the price regularly rises when a crisis comes up that threatens monetary values such as the euro or the dollar. But an investment in silver could also be worthwhile.

Protect assets from loss of value and state access

At present, crises of international proportions are taking place all over the world. The effects can be seen in the currently very high inflation, which is reducing consumers' purchasing power and melting away assets.

On top of that, it is to be expected that the government could soon take measures to restructure the highly indebted national budget by accessing citizens' assets. This raises the question of how assets can best be protected from devaluation and the tax authorities.

Record national budget debt puts private assets at risk

For some time now, rising public debt has been causing savers and investors to fear for the assets they have accumulated over the course of a life of privation.

Since the 2008 financial crisis, institutions like the European Central Bank (ECB) have been opening their coffers to bail out failing banks and keep economies afloat. The result has been a creeping demonetization that is now being felt. Only recently have interest rates been raised again and spending cut back.

During the pandemic, Berlin made hundreds of billions available to cushion the negative economic impact on Germany as a business location. At the outbreak of the Ukraine war, Chancellor Scholz promised to provide another hundred billion to completely renew the equipment of the German armed forces.

The last subsidy package of the traffic light government refers to the energy crisis, for which 200 billion euros were allocated from state funds to protect citizens from the consequences of exorbitant energy prices.

These measures seem more than necessary in view of the previous government's sluggish will to reform. However, many financial experts are wondering how the responsible Minister Lindner intends to shoulder this expenditure. As a result, many insiders expect Berlin to push for an increase in various property taxes or even the introduction of compulsory levies for the better-off. One of the things being discussed is the so-called equalization of burdens, which is to be introduced in 2024.

Efficient asset protection measures

The increasing loss of value and unwanted state access to private assets can be countered by effective initiatives. As a rule, these work best when they are not applied as individual measures, but are effective as a bundle.

Establish residence outside of Europe

A preferred asset protection measure is seen as changing residency and creating a Open foreign account. The choice of destination should be a country that is outside the catchment area of the European Union (EU) and has a low tax rate.

With this solution, it remains to be noted that the move may not be faked, but must be carried out in reality. Consequently, this means for the persons concerned that they may not stay within German borders for more than 182 days per year. Only then will the local tax liability cease to apply.

Invest in real estate

Real estate is not called "concrete gold" for nothing. After all, they generate a steady increase in value, even if this is slowed down somewhat by rising interest rates. Nevertheless, real estate will remain a profitable form of investment in the future. Prices are rising steadily and can help to offset the negative effects of inflation.

It becomes problematic when the state budget is tight and the government tries to participate directly in this increase in value by introducing compulsory levies or new taxes. This fact cannot be dismissed out of hand, because there are enough examples. Greece, for example, introduced a compulsory mortgage in the course of the financial crisis in order to put its public finances in order. As a result, the trend here is also toward investments involving real estate outside Europe.

Shares

The stock markets have been in growth mode for several decades. True, there have been repeated rapid crashes, as with the dotcom crisis at the turn of the millennium, the financial crisis and at the beginning of the Corona pandemic. But the losses were balanced again within a few monthsas institutional investors in particular use these setbacks to buy additional shares.

Precious metals like gold and silver

Gold has been used since time immemorial as a crisis currency viewed. The precious metal can be traded worldwide and is easy to transport. Unlike other forms of investment, gold does not generate foreign exchange and high returns can be expected. On the other hand, the price regularly rises when a crisis comes up that threatens monetary values such as the euro or the dollar. But an investment in silver can also be worthwhile. Silver is much more volatile than gold and therefore tends to strong price explosions (or break-ins).