Have you found the perfect furniture for your home? With the furniture loan calculator you can find the right financing for your furniture. This way you will receive the amount for your furniture quickly and safely on your account.

Find furniture loan in calculator

What you can learn here

- Find furniture loan in calculator

- The cost of financing furniture depends on your creditworthiness

- You will receive your personal interest rate of the furniture financing after entering your data

- The loan disbursement of furniture financing usually takes place in a few days

- 0 percent financing or installment loan to finance the new furniture?

- Advantages and disadvantages of furniture financing

- Buy furniture on installments in selected online stores

- summary

To compare current loans, enter the required amount into the calculator and select the purpose of use Furniture off. With the help of the term you can influence the amount of the monthly installment. If you finance the furniture over a longer period of time, the monthly installments will be lower and the total cost of the loan will be higher.

In this context, furniture financing via a Credit numerous advantages. This includes the fact that you can largely determine the loan amount and payment terms yourself and are therefore much more flexible. In addition, you can benefit from the cash discount and reduce or increase your installments later by taking breaks in payment or changing repayment installments. Furthermore, the delayed installment payment at the end of the month allows you to test the piece of furniture before paying and to check extensively whether you like it.

Furniture in installments Buying furniture in installments is therefore especially suitable for people who like to test for themselves what they buy before putting money on the table. All too often, photos of furniture are presented more positively through staging and edited photos. If you don't like the furniture, you can cancel the installment purchase and return the furniture without having to wait for your money.

Last but not least, you can get a new look at the Furniture installment purchase the Build Schufa score for future investment. This is because those who pay their installments on time improve their Schufa score. In the future, this may make it easier for them to access more favorable credits facilitate.

Despite these advantages, you should not apply for too many loans at the same time, otherwise this will negatively affect your credit rating and you may experience payment difficulties.

The cost of financing furniture depends on your creditworthiness

Often, banks determine the amount of interest depending on the creditworthiness of the applicant. A better credit rating then means lower interest rates. In the loan calculator you can see the interest rate range for furniture financing. Customers with the best credit rating receive the most favorable interest rate. Customers with a poor credit rating have a hard time, Buy furniture in installments despite negative Schufa. If you have a bad credit rating, it is best to use a personal loan from Auxiliary*, or the mini loan from Vexcash*, when it comes to cheaper furniture of a few hundred euros (maximum you can borrow 1,000 euros for 3 months).

You will receive your personal interest rate of the furniture financing after entering your data

In the second step, you enter your data so that the lenders can check your creditworthiness. You complete your application with the required documents such as salary slips. If the credit check is positive, you will receive a loan offer with a monthly payment schedule and your personal interest rates. During the credit check, lenders also obtain a Schufa report to complete the credit score.

The Schufa check is now non-binding and must not negatively affect your score. After you have two or three credit offers for your furniture financing in your hands, you can decide on the best offer. Keep in mind that not only the amount of interest plays a role, but also the possibilities of the Adjust credit rate or to be allowed to make unscheduled repayments can be important for itself in the future.

To get several credit offers directly with only one request, you can use the Furniture loan also request at Smava*.

The loan disbursement of furniture financing usually takes place in a few days

After you have submitted all documents to the bank, the bank will check your Schufa report and the requested documents. Often, the verification is already automated and digitized. This means that it only takes a few minutes, instead of several days as before.

After a successful check, the lender transfers the requested loan amount to your account. If documents are still missing or the provider finds discrepancies, the bank can improve its offer or cancel the Reject credit application. Refusal of furniture financing is noted in the Schufa and negatively affects the score.

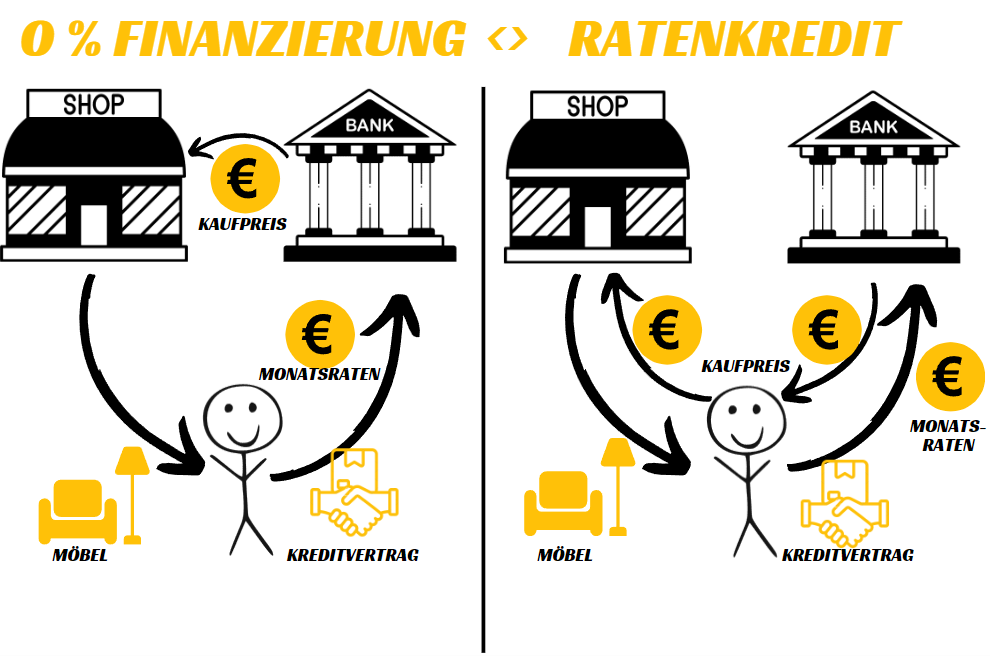

0 percent financing or installment loan to finance the new furniture?

The difference between "0 percent financing" and an installment loan agreement is that the borrower does not receive the money in his own account. Instead, the bank transfers the money directly to the furniture store.

Since the bank does not charge interest, the furniture store compensates for this by increasing sales. There could also be hidden interest costs in that the furniture store raises the price beforehand. The seller compensates for the lack of interest on the one hand by increasing sales and on the other hand by possibly increasing the price.

In the past, 0 percent financing had the disadvantage for the customer that it meant he lost his right of withdrawal. Until 2016, this applied:

Zero percent financing means Zero consumer protection.

However, on March 21, 2016, the law was amended in this respect (§ 514 BGB). Since then, 0-percent financing can also be revoked for 14 days. This means that this difference to the installment loan abolished.

Advantages and disadvantages of furniture financing

The advantages of buying furniture in installments

Financing the complete furnishing of the apartment, means that without waiting for a long time. directly a beautiful home Has.

Because an installment plan allows you to purchase high-priced furniture according to their own taste, without having to choose furniture only by price.

In addition pay the first installment of furniture only a few weeks after receipt and its inspection (usually at the end of the month). So you avoid buying an unsuitable piece of furniture and can easily complain if necessary. So you can buy the furniture buy now and pay later and does not have to wait until you have saved the necessary money.

In contrast to cash purchase can Term and installment amount of the financing flexible be adapted to one's own financial possibilities.

When buying furniture in installments, you can build up your Schufa score for later investments. Because if you pay your installments on time, you improve your Schufa score. This can in the future access to more favorable credits facilitate. However, you should not apply for too many loans at the same time, otherwise the desired effect will not occur.

If you buy the furniture with a loan on installments, you can buy from the dealer of a Cash discount profit, even though you have concluded an installment purchase. Because you already have the money in your account when you buy the furniture, you have a better negotiating position.

Therefore, not only from customers with low budgets buy furniture on installments, but also customers with high Need for security.

In addition, some people prefer to spare your savings and check whether the installment purchase offered may even be cheaper than the current Inflation rate. Thus, you can use your savings for other purposes and still buy the desired furniture for a beautiful apartment.

The disadvantages of buying furniture in installments

Because of the many advantages, one may tend to use its overestimate financial possibilities and overburden themselves with the purchase of furniture. To avoid this problem, you should check whether the loan installments are easily affordable for you over the entire term.

Because if the rates are set too high, the Repayment become a challengeif something unforeseen (prolonged illness, divorce) intervenes. With longer terms, an installment payment can become a long-term commitment that lasts for several years. This reduces the financial scope for other purchases in the future.

Furthermore, due to the additional Interest of the installment purchase, the total cost of furniture slightly higher compared to direct purchase.

If there is a default in payment during the term of the loan, the Balance of loan often due immediately. Often, credit providers also involve collection agencies in the event of payment arrears, which entails high additional costs for the borrower.

Therefore it is important to have a realistic assessment of one's own financial situation to meet before you finance the furniture in installments on installments. In this regard, people with an already negative Schufa information should be particularly careful not to further deteriorate your credit rating.

In addition, people with negative Schufa information often receive worse credit offers at higher interest rates to compensate for the higher risk of default. This makes the cost of an installment payment even higher.

Buy furniture in installments in selected online stores

| Store | conditions | Offerer | Installment purchase despite Schufa? | Installment purchase as New customer possible? | Check offer |

|---|---|---|---|---|---|

| Vexcash + Amazon | Interest charges: 14.82 %, p.a. eff. Duration: 1 - 3 monthly installments Order value: min. 100 € - max. 3.000 € Payment pause: not possible | Provider Funding: Vexcash Provider device: Amazon Installment purchase without Klarna and Paypal | Installment purchase also possible as a new customer, since processing via Vexcash |  (1) Check credit availability at Auxmoney Check financing alternative 1 Examine financing alternative 2 Examine financing alternative 3 (2) View furniture on Amazon | |

| Otto | Interest charges: 12.71 % - 15.70 % p.a. eff. Duration: 3 -48 monthly installments Order value: min. 50 € to max. 2.500 € Payment pauseA payment break of 100 days is possible against surcharge. You then pay the first installment only 100 days after receipt of the goods. | Offerer: Otto Payments | Installment purchase with negative Schufa partially possible | Installment purchase as a new customer only possible with a positive credit check | |

| Baur shipping | Interest charges: 15,79 % p.a. eff. + 0,67 % rate surcharge Duration: 3 - 48 monthly installments Order value: min. 50 € to max. 2.500 € Payment pause: 100 days payment break possible (extra charge) | Offerer: Baur shipping | Installment purchase with negative Schufa partially possible | Installment purchase also possible as a new customer, since processing via financing service provider | |

| source | Interest charges: 9.99 % p.a. eff. Duration: 3,6,12 or 24 monthly installments Order value: min. 99 € to max. 5.000 € Payment pause: not possible | Offerer: Paypal | Installment purchase with negative Schufa partially possible | Installment purchase also possible as a new customer, since processing via financing service provider | |

| Amazon | Interest charges: 9.03 % p.a. eff. Duration: 3 - 30 monthly installments Order value: min. 100 € - max. 3.000 € Payment pause: Financing without interest can be taken for 3 months | Provider Funding: Barclays and VISA Installment purchase without Klarna and Paypal | Rejection likely with negative Schufa | No installment purchase possible as a new customer For the installment purchase an account at least 12 months old is necessary | View furniture on Amazon |

| eBay | Interest charges: 12,9 % Duration: 24 monthly installments Order value: 99 €- 5.000 € Payment pause: not possible ⚠️Überweisung of the installments notwendig⚠️ no direct debit | Offerer: Klarna | Rejection likely with negative Schufa | Installment purchase also possible as a new customer, because processing via Klarna | Check furniture storage (eBay) |

| Alternate | Interest charges: 9.99 % p.a. eff. Duration: 3,6,12 or 24 monthly installments Order value: min. 99 € to max. 5.000 € Payment pause: not possible | Offerer: Paypal | Rejection likely with negative Schufa | Installment purchase also possible as a new customer, because processing via Paypal | Check furniture stock (Alternate) |

| Kaufland | Interest charges: 11,95 % -14,99 % p.a. eff. + 0,45 €/month (installment fee) Duration: 3 - 36 monthly installments Order value: max. 5.000 € Payment pause: not possible ⚠️Überweisung of the installments notwendig⚠️ no direct debit | Offerer: Klarna | Rejection likely with negative Schufa | Installment purchase also possible as a new customer, since processing via financing service provider | |

| Lidl | Interest charges: 6.99 % p.a. eff. Duration: 10 - 72 monthly installments Order value: min. 120 € to max. 5.000 € Payment pause: not possible | Offerer: ConsorsFinanz (Master Card) | Rejection likely with negative Schufa | Installment purchase also possible as a new customer, since processing via financing service provider | |

| Voelkner | Interest charges: 11,95 % -14,99 % p.a. eff. + 0,45 €/month (installment fee) Duration: 3 - 36 monthly installments Order value: max. 5.000 € Payment pause: not possible ⚠️Überweisung of the installments notwendig⚠️ no direct debit | Offerer: Klarna | Rejection likely with negative Schufa | Installment purchase also possible as a new customer, since processing via financing service provider |

summary

In summary, furniture financing through a Credit numerous advantages. This includes the fact that you can largely determine the loan amount and payment terms yourself and are therefore much more flexible. In addition, you can benefit from the cash discount and reduce or increase your installments later by taking breaks in payment or changing repayment installments. Furthermore, the delayed installment payment at the end of the month allows you to test the piece of furniture before paying and to check extensively whether you like it.

Buying furniture in installments is therefore especially suitable for people who like to test for themselves what they buy before putting money on the table. All too often, photos of furniture are presented more positively through staging and edited photos. If you don't like the furniture, you can cancel the installment purchase and return the furniture without having to wait for your money.

Last but not least, when buying furniture in installments, you can use the Build Schufa score for future investment. This is because those who pay their installments on time improve their Schufa score. In the future, this may make it easier for them to access more favorable credits facilitate.

Despite these advantages, you should not apply for too many loans at the same time, otherwise this will negatively affect your credit rating and you may experience payment difficulties.

Because of the many advantages, you might be inclined to use your overestimate financial possibilities and to overburden themselves with the furniture purchase. To avoid this problem, you should check whether the loan installments are easily affordable for you over the entire term. Here you should also consider that your income may decrease in the future.