The 2020 financial crisis unsettles many. If you're wondering too how to behave in the 2020 financial crisis should, this article will help you. Here you will find an explanation in simple words of what the Corona crash is all about. I also give some easy-to-implement recommendations to emerge as a winner despite the difficult situation of the 2020 financial crisis. At the end of the article I describe what I will personally do in this crisis. A similar post with my assessments from March 2020 you can find here.

Global standstill due to a virus

What you can learn here

- Global standstill due to a virus

- Financial crisis as an opportunity: Strengthen your defenses!

- From the corona virus to the financial crash

- Economic impact of the Corona virus

- Behavior in the financial crisis: thinking in scenarios

- Behavior in the financial crisis: Avoiding stocks is not smart

- Behavior in the financial crash: individual stocks

- Behavior in the financial crash: ETFs and savings plans

- Behavior in the financial crisis: benefit from rising interest rates

- Hold high cash reserves in case there is another slump

- Is the crisis almost over?

- Keep up! The duration of bear markets is 18 months - a bull market lasts 5.5 times as long!

- Conclusion on behavior in the financial crash

- How I personally behave in the financial crash

- Behavior in the financial crisis: secure a low-cost depot

The Corona Pandemic affects us all and we notice the effects every day. As in every crisis, the negative effects stand out in particular. company bankruptcies, the threat of job losses, severe losses in the stock portfolio, Being home alone due to social distancing. In the worst case, infection with the virus or even the loss of a close relative. The virus has largely paralyzed public life.

Financial crisis as an opportunity: Strengthen your defenses!

You probably know the saying that every crisis also has opportunities. Even if you don't believe it, this applies to the Corona crisis. The importance of our healthcare system may have increased for you. At least we were able to contain the pandemic effectively for the time being.

Like our immune system, the burdened economy in the financial crisis also develops new ones immunity. Standing lines due to non-functioning supply chains have shown how vulnerable the industry is. The major German car manufacturers were all forced to temporarily suspend their production because they could no longer procure the parts. In the course of the corona crisis, companies are therefore thinking about how they can Make supply chains more robust be able. The keyword is here insourcing. In addition, numerous companies, schools and universities are now forced to focus more on digitization. Home office, online teaching and telemedicine have become lifesavers during the crisis. We can also benefit from this after the crisis. Because I assume that these achievements will remain with us.

From the corona virus to the financial crash

When the Corona virus broke out in China in December 2019, the stock market initially completely ignored it, which may sound totally amazing these days. Apparently, the danger of an exponential spread was simply totally underestimated at the beginning. Even as yourself The virus spread internationally in mid-February, the stock markets continued to rise. In the western world, people were perhaps simply too naïve: none of us knew any better and, unlike Asian countries, had no experience with a pandemic. It was not until the end of February that prices suddenly dropped and the corona virus began to dominate the news. By then, the virus had long since left China and an explosive spread seemed inevitable by early March at the latest.

Economic impact of the Corona virus

The economy is being burdened by the corona virus on several levels at the same time. Governments around the world are desperate to prevent an exponentially spreading mass infection. After all, an unchecked spread of the corona virus would have dramatic consequences. Since the healthcare system would be totally overwhelmed, the number of fatalities would rise sharply in this scenario.

Firstly, since the virus is very contagious and secondly, there is no vaccine available, the only way to stop direct person-to-person contact from spreading is to prevent it. Social distancing has serious consequences for all of us. The same applies to the economy. After all, workers and employees are no longer allowed to come to the office or the factory to work. This greatly reduces productivity. In addition, there is a lack of intermediate products that companies need to create end products from them, as supply chains are interrupted. After all, companies do not produce everything themselves and are dependent on various intermediate products from international supply chains. Political measures to protect the population, such as border closures, exacerbate the situation.

Sectors such as tourism or the travel industry were hit particularly hard by the epidemic because people simply travel a lot less. It all started when numerous companies imposed travel bans as a precautionary measure. Exit restrictions were later added to further promote social distancing. It's safe to assume that even after lockdowns are lifted, people will travel less as they're not comfortable with the idea. Major events have been canceled worldwide. Even the Munich Oktoberfest has already been cancelled. As a result, the profits of travel and event organizers, airlines, cruise operators and many other industries collapse.

Behavior in the financial crisis: thinking in scenarios

One day after the biggest price crashes to date in the corona crisis, I stayed optimistic and presented two simple rules with which you will always win in the stock market in the long term. In the course of the most recent recovery since the end of March, the stock market seems to be counting on a defeatable corona pandemic, which will enable the economy to restart quickly. A deep recession would be, despite one GDP slump in Germany of over six percent, initially averted. That would be a nice scenario. However, its occurrence is uncertain and it could also turn out quite differently. It is therefore important to be as prepared as possible for different scenarios.

As uncertain as the near future may be, an economic recovery over a longer period of time is certain. So far we have mastered every crisis. Even if the clouds are gray, the long-term chances are good.

Behavior in the financial crisis: Avoiding stocks is not smart

Even in a financial crash, people need products. Some are in much greater demand even in times of crisis. Empty canned goods shelves in supermarkets have been stark examples of this over the past few weeks. In addition, smoking and drinking are likely to increase. Therefore, one also speaks of non-cyclical consumer goods. Cyclical consumer goods, on the other hand, are in much weaker demand in times of a crisis. These include, for example, large capital goods whose purchase can simply be postponed. cars for example.

Behavior in the financial crash: individual stocks

Anyone who has held several individual shares up to now does not have to give up even in the crisis. It is still important to pay attention to quality and growth. This is always important in long-term investing, whether it is the corona crisis or not. Many industries are excellently positioned in the corona crisis and the time afterwards. These sectors are receiving tailwind from the megatrend digitalization which has only been strengthened by Corona. This requires IT infrastructure such as data centers. Increasing demand for information and trading also leads to higher turnover at stock exchanges and brokers. In the case of the Konto-Kredit-Vergleich.de recommended smart broker*, the employees can hardly keep up with the increased volume of applications and now need 3-4 weeks to open new depots. If you want to know more about certain industries and their performance in the corona crisis, I recommend you this article at the share finder.

In addition, shares are considered special assets. This means that in the event of a bank insolvency, they still belong to the investor and are not used as part of the bankruptcy estate. This also applies in the event of a possible euro collapse, as is already feared by some crash prophets. The securities retain their value. If the euro really no longer exists, the company shares will simply be rewritten into another currency. Even in this absolutely blatant scenario, there is no reason to panic when viewed soberly.

Behavior in the financial crash: ETFs and savings plans

I would simply let broadly diversified stock ETFs continue to run. That's how I currently handle it. Portfolios built up and saved for the long term benefit from the cost-average effect. Large indices may also contain some "zombie companies" - to use that word - that hop on a crash. Of course, heavily battered sectors are also included. However, firstly, this effect is diversified away by the breadth of the ETF, and secondly, the upside potential is all the greater in the event of sharp declines.

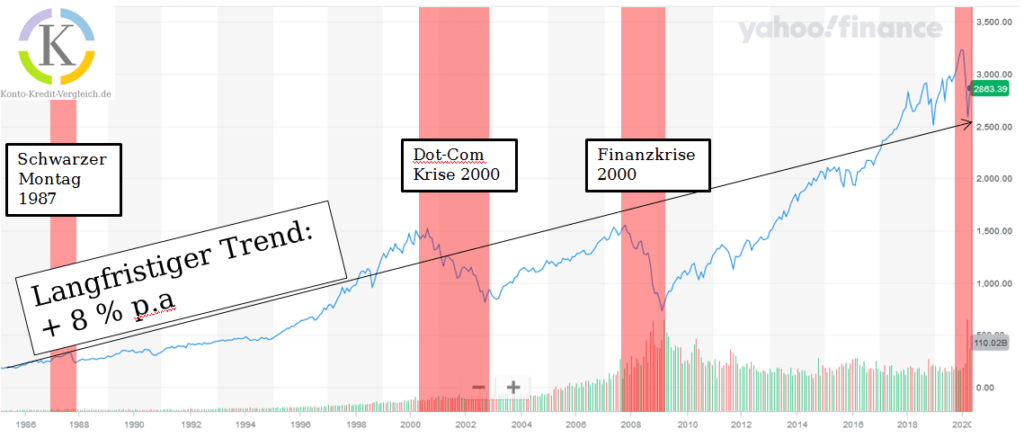

In any case, the long-term value trends since 1985 speak strongly for it: Despite Corona and three other crashes, the average increase in value of the S&P 500 is 8 % pa This does not even take dividends into account.

With this strong 35-year course, is it really smart behavior to get out of your ETFs in the 2020 financial crisis?

Behavior in the financial crisis: benefit from rising interest rates

There is also positive news for savers. In the financial crisis, saving is worthwhile again! Since many investors withdraw your money, the supply decreases. Since the interest rate expresses the price of money, interest rates are now rising. Lush financial injections to stimulate the global economy do of course here your other and fire interest rate level and Inflation further. On the demand side, there is an increased need for credit from small and medium-sized enterprises that cannot sell anything in the current situation. The banks need money to refinance these loans. Accordingly, they are reacting and raising interest rates on overnight and fixed-term deposits in the Corona crisis. The best current offers for call money (flex money) are listed below.

| The current best offers from the Daily money comparison from Konto-Kredit-Vergleich.de | |||||

|---|---|---|---|---|---|

| Bank | Annual Interest | interest guarantee | interest credit | bonus | Example: interest eff. incl. Bonus** |

| filmbank | 0.60 % | no | biweekly | Up to €100* | 0.975 % (incl. €25 bonus) |

| Ferratum Bank | 0.60 % | Yes, 6 months | yearly | ||

| My Money Bank | 0.37 % | no | biweekly | Up to €100* | 0.745 % (incl. €25 bonus) |

| * New customer bonus of €10 for an investment of €5,000 to €9,999, €25 for an investment of €10,000 to €49,999, €50 for an investment of €50,000 to €79,999 and €100 for an investment of €80,000 or more, with a initial investment – detailed bonus conditions inovernight money comparison. ** Calculation: First-time investment of €80,000 with an investment period of 120 days. |

Hold high cash reserves in case there is another slump

Often one reads or hears about the tip to save up higher cash reserves before the crash and then to be able to buy more cheaply if the worst comes to the worst. For example, you could only invest half of the capital and hold the other half as a cash reserve. If there is another stock market crash, you could invest the second half. If that doesn't happen, at least half of the capital has received dividends.

This sounds very simple, but is difficult to implement in practice. Among other things, because of the great panic caused by the media, friends and perhaps also announced short-time work at the workplace, it is emotionally very difficult to invest the remaining money now that everything is in pieces. Maybe you can understand that after the current events. So I would follow Warren Buffett's advice and don't accumulate excessive cash reserves, even in times when a crisis appears to be looming. In addition, a further slump in the capital market is by no means certain. The current numbers of new infections give some hope that the crisis, at least on the stock market, could soon be over...

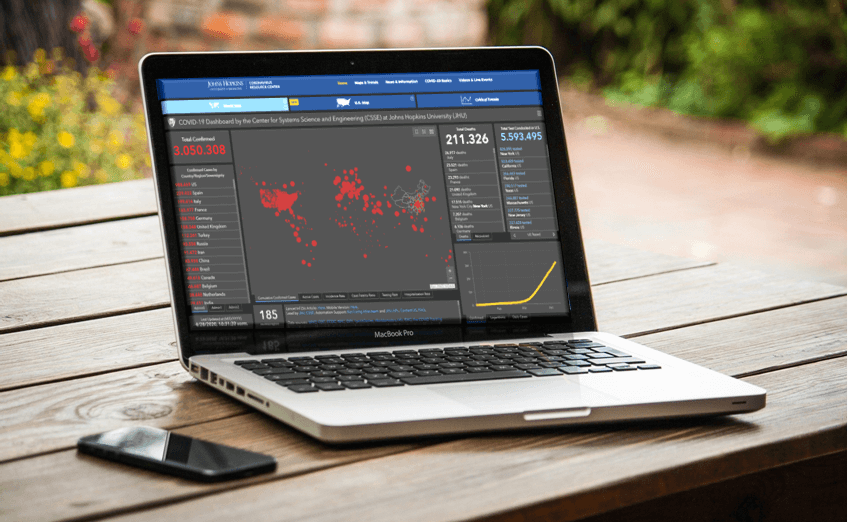

Is the crisis almost over?

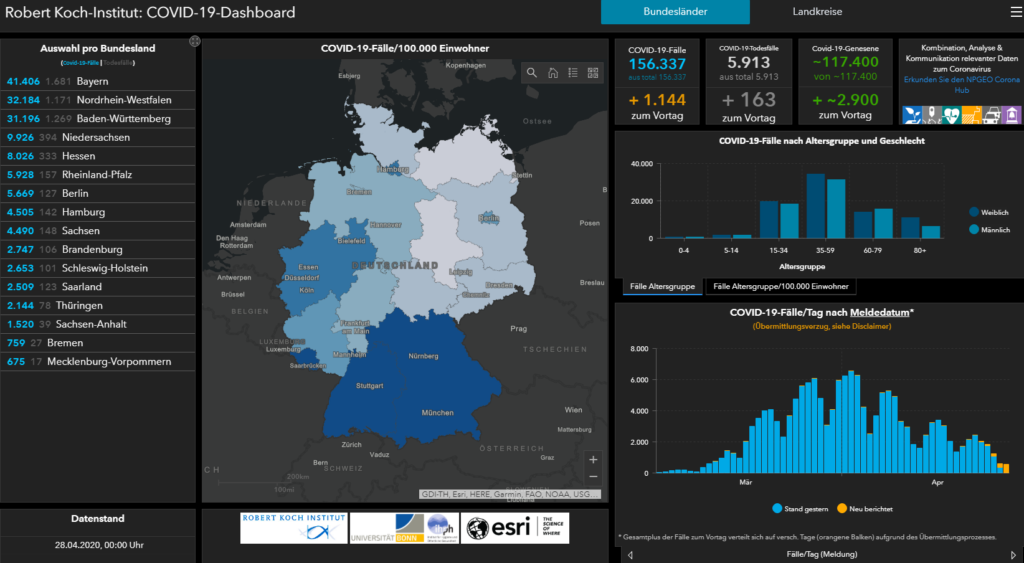

In Germany, according to the RKI, on 28.04. over 156,337 confirmed cases. The good thing: In Germany, the number of new infections is now declining. In this country, the quarantine measures are probably showing their first very positive effects. In the last few days there have been fewer than 2,000 new infections a day. That's less than a third compared to the pandemic's peaks.

[cvct country-code=”DE” style=”style-2″ title=”Germany Covid19 Cases Update” label-total=”Total” label-deaths=”Died” label-recovered=”Healed” label-active=” Active" label-recovered-per="Healed %" label-death-per="Dead %" bg-color="#96c7e5″ font-color="#fff"]Since we all have to stay at home now and are now showing the necessary discipline, I am positive that we will overcome this crisis soon. Every individual must assume their responsibility here and look at the issue with the necessary seriousness.

More hope: Three hospitals in Germany are now taking part in studies with the active substance remdesivir part. According to its own statement, the Düsseldorf University Clinic (UKD) is already using the drug in a few individual cases. The drug was originally developed against Ebola and now has to wait for various study results before it can be used on a large scale on the market. So there is a small glimmer of hope. If the drug actually gets approval, it shouldn't be long before we can get back to our normal lives and the crisis will be over.

Keep up! The duration of bear markets is 18 months - a bull market lasts 5.5 times as long!

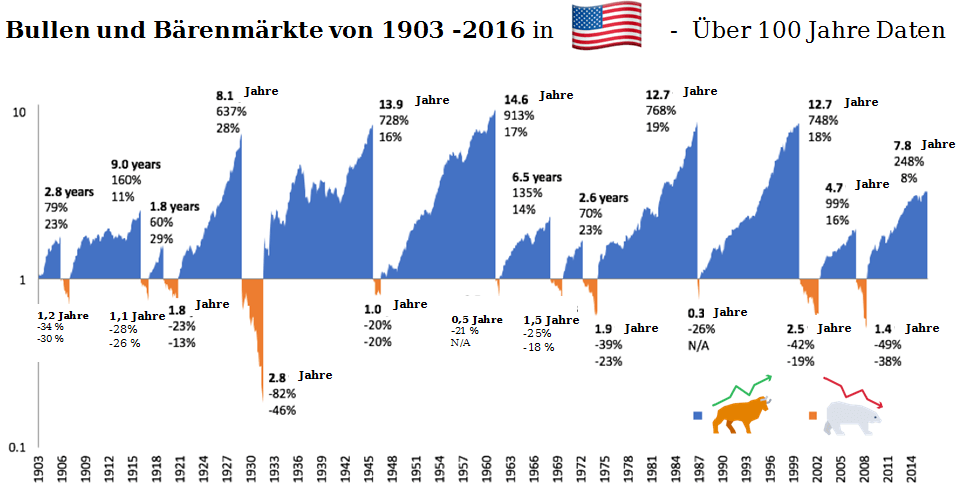

The stock market has recovered strongly since the situation at the end of March. While there is no guarantee that this rapid recovery will continue, it is worth comparing the current situation with other bear markets in the past. For this we look at the US heavyweight - the S&P 500: The shortest bear market in the more than 100-year history lasted a little longer than three months. That was the crisis in 1987. Long crises were the world economic crisis in 1929 with 2.8 years and the bursting of the dot-com bubble in 2000 with 2.5 years. In the following representation of J.Sibers shows the bull and bear markets of the world's oldest stock market - the USA.

Bull markets are highlighted in blue, bear markets in orange. In addition, the annual as well as the total market change are entered in percent in the graphic.

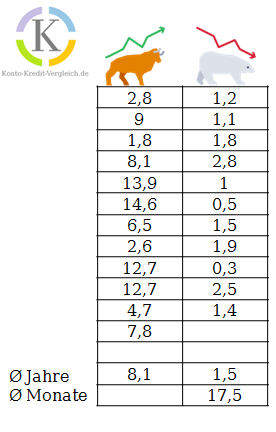

It's easy to see that historically, bull markets have always lasted significantly longer than bear markets. Since it might be interesting for you how long the bull and bear markets lasted on average, I have created a small table. This allows you to make an assessment of what you have to prepare for in the 2020 corona crisis.

#Over 100 years of data

The table shows that bear markets lasted about a year and a half, or 17.5 months, on a long-term average. In contrast, the bull markets ran for an average of 8.1 years. That's 5.5 times longer! That gives hope for the time being, even if there should still be another slump in the current situation.

Conclusion on behavior in the financial crash

In this article you learned why the corona virus led to the financial crash. Good behavior in the financial crisis consists (as always with investing) of two simple steps (You can find a more detailed explanation here):

- Determine your risk tolerance

- Invest regularly according to your risk tolerance

Maybe the financial crisis gave you the opportunity to notice what a 30 or 40 percent drop in your portfolio feels like. If you can't sleep well with it, you should be as honest as them ex-student and invest in less risky ETFs and investments in the future.

If the price drop didn't affect you mentally, you should continue to invest as you have done in the past. I myself can live quite well with the losses of over 30 percent at the moment. So I let my savings plans continue and even increased it drastically in March.

How I personally behave in the financial crash

So I'm not really impressed by the financial crisis and, apart from increasing my savings plan, I'm behaving the way I did before. With the losses of over 30 %, I was able to sleep well at the end of March when the world markets reached their Corona lows. However, I am now considering my cash buffer filmbank* to push. For this I would get a small bonus and significantly more interest than with Consors, Comdirect or ING! Not bad either.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.