In the case of a new or Used car financing without down payment plays the Vario financing a crucial role. With this financing you can buy a car without making a down payment. But what exactly is Vario financing? What does the term mean Vario financing and is Vario financing only available for one car?

What you can learn here

Summary of important things

- Vario financing is a vehicle leasing with a later option to buy the car

- There is contrast to leasing though no deposit

- Nevertheless, they are monthly installments low, since you only only the loss of value of the car and not its total value

- With a Vario you can test several cars and compare the performance. Therefore, a Vario is suitable if you short term need a car or you are not sure which car you want.

- In addition, as with leasing, a Mileage limit per year fixed

- While the funding is running, the owner of the lessor's car.

- However, in contrast to classic leasing, you have At the end of the lease term, the right das car to buy

- A is suitable for follow-up financing car loan

In summary, Vario financing is a car Financing without down payment with low rates. The advantage of the low rates and the missing deposit stand the High final installment at the end of the term against.

Car dealerships like MeinAuto offer Vario financing* also without a deposit. If a deposit is still required, an alternative is to pay the deposit with a cheap Loan easy to fund yourself.

The terms Vario financing, 3-way financing and balloon financing are used synonymously Due to your final installment, Vario financing is also called balloon financing designated. Another common name for the Vario financing is 3-way financing. The term 3-way financing makes it clear that the borrower has three different options for the final installment. You can either return the vehicle, buy it directly from the lessor, or buy the vehicle from the lessor, but use a car loan. In this case, the new financing bank then becomes the legal owner of the vehicle.

What is Vario financing?

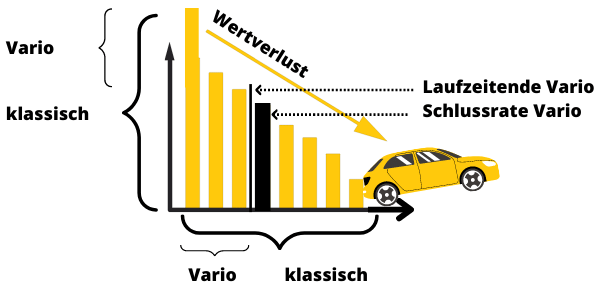

With Vario financing, you only finance that depreciation of the car. Since, in contrast to the classic car loan, the total value of the car is not financed, the installments are at one Vario lower. Thus acts is one Vario a hybrid off Car Leasing and car loan.

At the end of the funding will be a final installment due, which corresponds to the residual value of the vehicle. When the final installment is due, you can decide whether you want to return car or drive on want. If you return the car, there are no further costs. If you want to continue driving the car, you have to pay the final installment. Here you replace the car for a previously defined purchase price. Alternatively, you can also pay the purchase price with a cheap one Loan finance.

When returning the vehicle, the lessor may not charge any additional fees for traces of use. Excluded from this, however, are wear and tear that does not correspond to typical wear and tear.

Both used and new cars can be financed via 3-way financing. However, this type of financing is more common when financing new cars. It is often offered directly by the car dealership in conjunction with a car bank. As with leasing, 3-way financing starts with one Mileage limit per year fixed. During the 3-way financing, the owner of the lessor's car.

Legally, a Vario financing is a operational lease, and thus comparable to renting an apartment. The lessor assumes financial risks by assuring the lessee a fixed purchase price at the start of the contract.

Vario financing for used cars

the Vario is often used by car dealerships to make new cars affordable for customers with low rates. Meanwhile, there is also Vario financing for used cars. In contrast to new car financing, this financing is significantly cheaper. After all, a car loses around half of its value in the first 3 years. With a used car Vario, you do not have to pay this amount yourself, but pass it on to the previous owner.

With a reliable and stylish used car, the desire for a new car often fades into the background. Vario financing for used cars gives you more money for the finer things in life. Nevertheless, used car financing also has all the advantages of the Vario. No down payment is required for this either, which makes the Vario one of the most attractive options Used car financing without down payment power.

When does a Vario–financing Sense?

One Vario–financing makes sense especially if you are not yet sure about your dream car. In addition, no down payment is required for this financing. That's easy on the wallet. With a Vario you can try out different brands and models without making a long-term commitment. If you are satisfied with the car, you can buy it after the end of the term. A cheaper one Loan will help you. However, if you don't like the car, you can test another one without any problems. Vario financing is therefore particularly aimed at people with flexible life models who like to try new things.

When is a "vario" unsuitable for you?

Vario financing makes no sense for you if you don't enjoy trying out new cars and instead want to get from A to B as cheaply as possible. But also for individualists who like your Convert car into a place to sleep want or maybe one more later trailer hitch want to assemble, this financing is unsuitable. If it is also important to you to be the owner of the vehicle, you should also get a cheap one Loan instead of using the Vario. Because only with a loan does the car belong to you in the end.

An alternative to Vario financing could also be one Used car financing despite negative credit bureau be.

Vario financing advantages and disadvantages

Vario financing is vehicle leasing with a later option to buy the car. Since only the loss in value is financed, the monthly installments are low. However, there is one limitation of kilometers. Many customers appreciate that it is a Financing without down payment suitable. This is often very difficult, especially with poor creditworthiness, and alternatively via Car leasing without Schufa, Car subscription without Schufa or special Auto loans without Schufa possible.

Overview advantages and disadvantages

| advantages | Disadvantages |

|---|---|

Without deposit | High closing rate |

Flexible terms | High total cost |

Low monthly rates | Surcharge for more kilometers |

Option to purchase at the end | Vehicle does not become property |

planning security | No changes |

Low repair costs | Disputes in the event of damage |

Advantages of Vario financing

1. Without deposit: One of the few options Financing without down payment for used cars or to move new vehicles

2. Flexible: The terms of financing can be flexible between 12 and 60 months to get voted

3. Cheap rates: the monthly installments are lower than with alternative financing, as only the loss in value is paid for

4. Options at the end: At the end of the term you can do what you love Buy or return the carif you didn't like it

5. Easy to plan: The purchase price of the car is fixed in advance. so you have you planning security.

6. No repair costs: With a new car or young used car you always have a well-functioning car with low maintenance and very little or no repair costs.

Disadvantages of Vario financing

Of course, Vario financing also has some serious disadvantages compared to a classic car loan. The costs can skyrocket due to more kilometers and the vehicle does not become your property, unlike with a car loan. Here you will find all the disadvantages of the Vario loan for car financing.

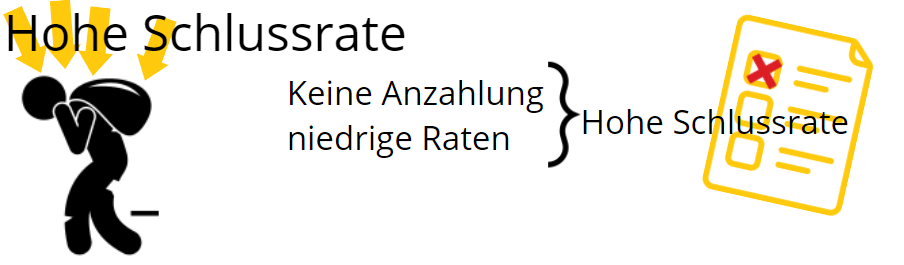

1. High closing rate: The missing down payment in connection with the low rates inflates the final rate. The term balloon financing sums it up: At the end of the financing, you will face a large block of costs that you have to deal with if you don't want to be left without a car

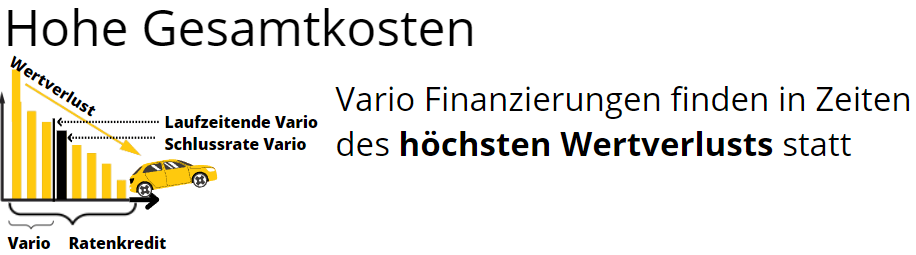

2. High total cost: With Vario financing, you lease the vehicle as a new vehicle or recently used vehicle. The disadvantage of this is that the loss in value is greatest during this time. The depreciation of new cars in the first year is about 25 %. Used cars that are 3 or 4 years old, on the other hand, only lose about 5 % in value annually.

3. Surcharge for additional kilometers: There is a fixed Mileage in kilometers per year. If your mileage increases, you will incur additional costs. Conversely, however, you are not entitled to a refund if your mileage is lower.

4. Vehicle does not become property: The legal owner of the vehicle is the lessor. This means that you do not own a proportion of the car just because you have paid the leasing installments.

5. No changes: You cannot make any changes to the car.

6. Disputes in the event of damage: Damage and wear and tear at the end of the term can lead to disputes with the lessor.