Can it happen that a Credit agreement signed was made and then still rejected by the bank? In this article, we clarify some common misconceptions between credit application and the actual Credit agreement on. These misunderstandings repeatedly lead people to think that their loan agreement has still been rejected despite their signature. In many cases this is not the case, but rather there is a confusion between the credit application and the actual credit agreement. The credit application is only signed by you as Borrower signed. The actual loan agreement, on the other hand, is signed by you as the borrower. and the bank signed as the lender. Once both parties have signed the credit agreement, rejection or cancellation by the bank is no longer possible according to the law.

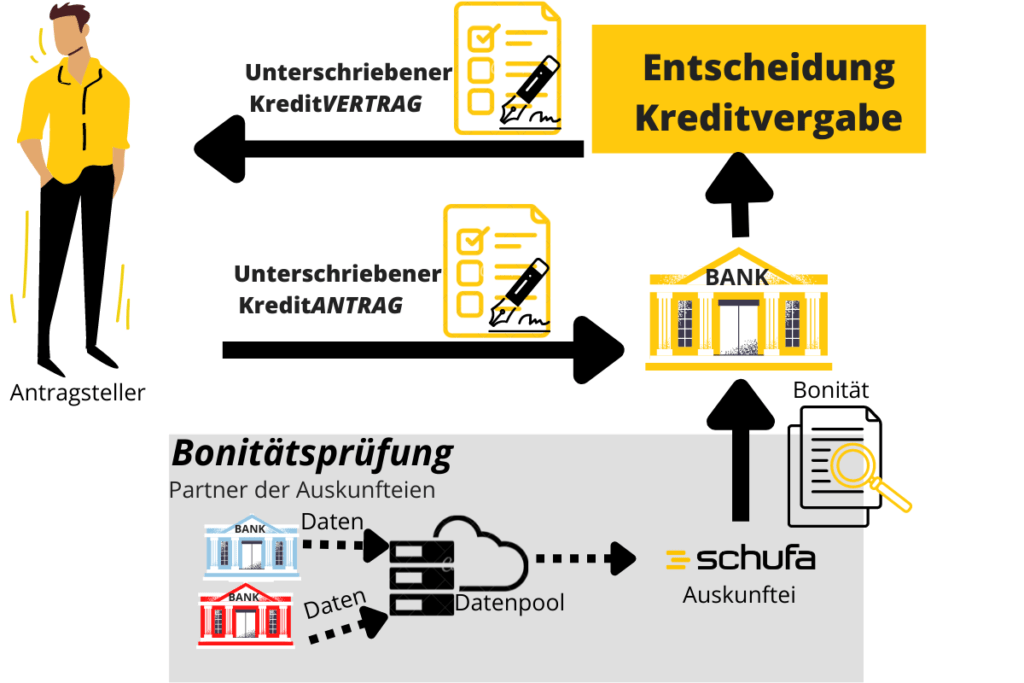

When you request a loan from a bank or an intermediary, there are several steps to the payout of the loan.

- In the credit request you specify the amount of the loan and enclose other supporting documents. Then you sign the loan application and send it to the bank. Since the bank has not yet approved the application, this is more of a "pre-contract".

- The bank now checks whether it accepts your loan application. The main criterion is your creditworthiness and your disposable income.

- If the bank's review is positive, it comes to a Credit agreement. In contrast to the credit request have at the Credit agreement both parties agreed.

Can the bank refuse a signed loan agreement?

What you can learn here

No, the bank may no longer refuse a signed loan agreement. The bank is obliged to pay out the credit according to § 484 paragraph 1 of the German Civil Code (BGB) if the credit agreement has been signed. However, if it is only a loan application, the bank has the right to reject the loan application.

The bank has only the right to reject a unilaterally signed application for a loan. Once there is a loan agreement signed by both parties (the bank and you have signed), the bank must disburse the loan. The loan agreement is considered legally binding when it has been signed by both parties (the bank and you). This obligation to disburse the loan is described in Section 488 (1) of the German Civil Code (BGB).

Through the loan agreement, the Lender obliged to provide the borrower with an amount of money in the agreed amount.

The borrower is obliged to pay an interest owed and to repay the loan provided when due.

Loan agreement pursuant to Sec. 488 (1) BGB (Link to the text of the law)

When may a bank cancel a loan?

The Bank may only terminate the loan agreement for cause. The bank has no ordinary right of termination in the case of loan agreements.

1.) If you fall behind with the installments

at Credit agreements in the private sector, the bank is allowed to terminate the loan if you are in contact with the Installments in arrears come. If you are more than 2 installments in arrears, the bank may reclaim the money and terminate the loan (§ 498 BGB). Also, if the delay of the installments is greater than 10 % of the loan amount for a term of up to 3 months, the bank is allowed to terminate the loan. Thus, at least 10,000 euros in arrears for a 100,000 euro loan. In the case of loans with a longer term than 3 years, termination is possible already at 5 % of arrears. So at least 5,000 euros in arrears on 100,000 euros loan. of an extraordinary termination included. This si Thus, it is not possible that the loan agreement is signed and still rejected, if there is no delay in payment.

2.) For real estate loans: When the house is worth much less

at Real estate loan a termination is also permissible if the mortgaged property has significantly decreased in value. Evidence can be provided in the form of an expert opinion. However, this is not sufficient for termination. The bank must also prove that repayment is actually at risk. (§ 490 BGB).

3) For real estate loans: If your financial circumstances deteriorate

at Real estate loan In addition, termination is permissible if the financial circumstances deteriorate significantly. It is also sufficient if the deterioration is only imminent. However, the bank must be able to prove this. The prerequisite for termination is therefore that the financial circumstances have deteriorated significantly since the conclusion of the loan agreement (Section 490 BGB).

Where a signed credit agreement is not simply rejected

if you one poor creditworthiness or negative credit bureau you often have to fight hard for a loan. Often you have to ask several providers one after the other. This can be very frustrating and cost you an incredible amount of time.

The provider bon credit* does most of this work for you.

One is there on difficult cases due to credit rejection specialized. In addition, compared to the competition, Bon Kredit has a high acceptance rate, when it comes to the allocation of Credit with bad credit goes. So can also Loans despite negative credit bureau (alternatives to Bon Kredit behind the link).

However, you should be familiar with the "data for good conditions" deal with all credit brokers such as Bon-Kredit or Smava. If that's not the case, you can check here whether you can get a loan on the basis of these data. 4 reasons maybe it is better to stay away from Smava should.

Conclusion: Credit agreement signed, nevertheless rejected

In most cases, a rejection of a signed contract is merely a credit application. The following Credit agreementThe bank may no longer refuse a loan that has been signed by both parties. There are some exceptions for larger loans, but these play a role primarily in construction financing (§ 488, § 490 and § 498 BGB). Also, unlike the customer, the bank cannot cancel a loan that has already been approved before it has been disbursed. This is because a loan cancellation is only possible on the part of the bank in the case of installment loans if there is a default of at least two monthly installments or 5 % (term: >3 years) or 10 % (term: <3 years) of the loan amount.