Bagatelle generally means a small thing or trifle. The word comes from French and literally means: trifle, trifle. So, according to the loan providers, a petty loan is just that: a trifle. The upper limit for a petty loan is usually 200 euros. As a rule, the customer needs only a small, but regular income for the application. Repayment is either in small, fixed installments, or quite flexible in the form of a call loan.

Apply for 200 Euro small loan for under 2 Euro fees

What you can learn here

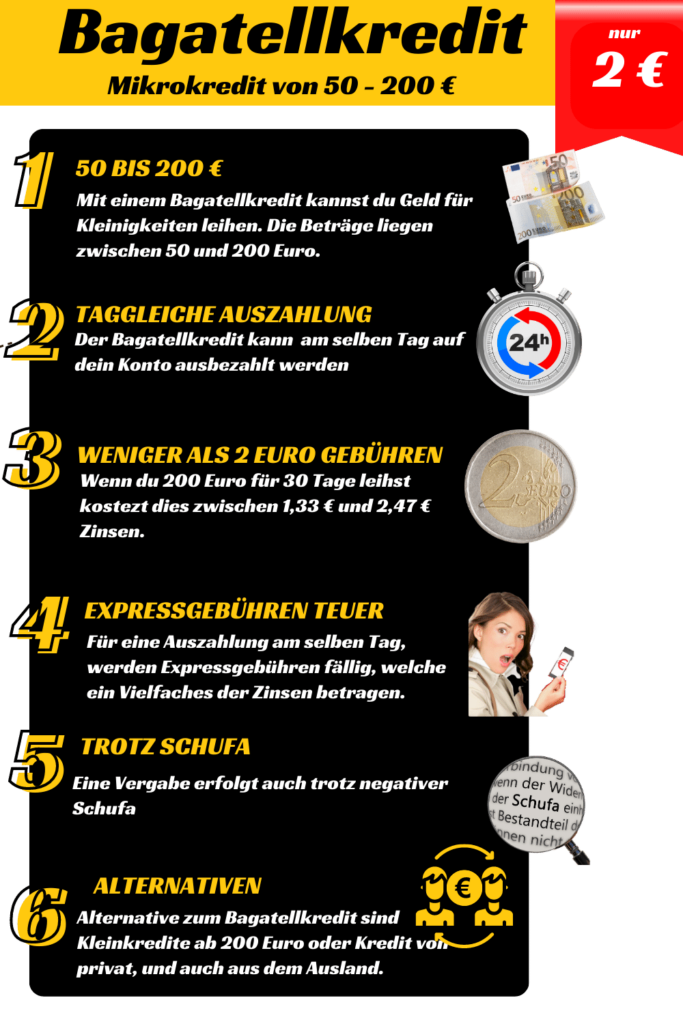

Small loans are Credits up to 200 Euro. For small loans for the application is only one Low regular income of at least 500 euros needed. Otherwise, only minor further requirements are set by the banks for the small loan. Small loans are a special form of mini loans, which is from 100 euros until 3,000 euros Credit amount to be awarded. The provider ferratum* grants the mini loan even from 50 euros, which is the lower limit of petty and mini loans.

Small loan: requirements

Most banks have agreed on the following requirements for the small loan:

- Current wage or salary statement with at least 500 euros of income

legal age

Account and residence in Germany - Positive credit report

Small loan: Even with a negative Schufa, an award is possible

Although personal creditworthiness will always play a role, the small loan can be granted even with a negative Schufa record. Therefore, it depends on the creditworthiness in its entirety, which is not limited to the Schufa. A steady job, with an income of more than 500 euros net, will often be enough for the small loan to be approved by the banks.

History of the small loan

Small loans are generally very short-term loans that are usually taken out for small amounts only. The first small loans were introduced in Germany in the 1970s. Since then, they have been used more and more frequently. They were then introduced in other countries in the 1990s.

Small loans are unsecured loans, which means that they are borrowed without collateral. The risk for the bank is therefore relatively high. Therefore, the interest rates for the small loan are also higher than for the installment loan, which is often taken out with earmarking as a car loan or Furniture loan is used.

Use of the small loan

The small loan can prevent overdraft of the account and thus spans an additional safety net as a second level. The small loan only plays a significant role for small and very small amounts, while in practice the small loan is used for larger amounts. installment loan represents one of the most favorable forms of financing.

Repayment of the small loan

The repayment of the small loan is usually made in small, fixed installments with terms of 30 to 90 days. The amount of the installments depends on the respective credit institution and the agreed loan amount. The provider Ferratum charges additional fees for repayment in several installments. Vexcash, on the other hand, waives this, which is why Vexcash for loans with 60 or 90 days maturity* is clearly to be preferred.

Criticism of the small loan

Criticism of the small loan relates primarily to the fact that the borrower can relatively easily fall into the debt trap can get into trouble. This is because, since the loan amount is relatively low, it is often drawn down again the following month. The result is that the debts add up and in the end a large number of loans remain with small amounts individually, but an overall high residual debt in total.

In addition, the interest rate on the small loan is often relatively high and additional fees are charged for express payouts and multi-installment options.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.