If your employer pays your wages late, you will have 2 salary payments on your P account - in one month. You will probably exceed the monthly allowance. But, what happens if the allowance is exceeded due to double receipt of payment? This is a special case of too much money in the P account, because it is actually a protected credit. After all, you may have exceeded the allowance through no fault of your own due to the late receipt of your salary payment. Nevertheless, the money above the exemption amount is transferred to the disbursement account delay. This is a separate pot of money that neither the debtor nor the creditor can tap into. In the following month, the bank books the deducted amount back from the payment account. Now you can finally use the transferred amount freely.

However, you will receive a salary again the following month and the game will start over again. This is where the first-in-first-out or FIFO principle comes into play. This protects 2 salary payments in one month on the P account for an unlimited period of time. You can find out how this works in the following section. You can find one at the end of the article Example of double receipt of wages on the P account.

What you can learn here

- 2 salary receipts in one month on the P account: Bank blocks money on the payment account until the following month

- 2 salary receipts in one month on the P-Konto: a simple explanation of what happens now

- Error by the bank with 2 salary payments in one month on the P account

- Example: 2 salary receipts in one month on the P account

- P-account money arrives on the 15th – how is the protection?

- P-account money arrives on the 30th – how is the protection?

- Further account transfers remain protected due to the FIFO principle

- Be sure to withdraw transferred money

- Errors at banks due to double receipt of salary in one month on the P account

- 2 salary payments in one month on the P account have been better protected since December 2021

- What does "First In - First Out" mean for the P account and how does it help with 2 salary payments in one month on the P account?

- Conclusion: The 2-fold salary receipt on the P account means disadvantages for debtors, which can (and should) be compensated by withdrawal

2 salary receipts in one month on the P account: Bank blocks money on the payment account until the following month

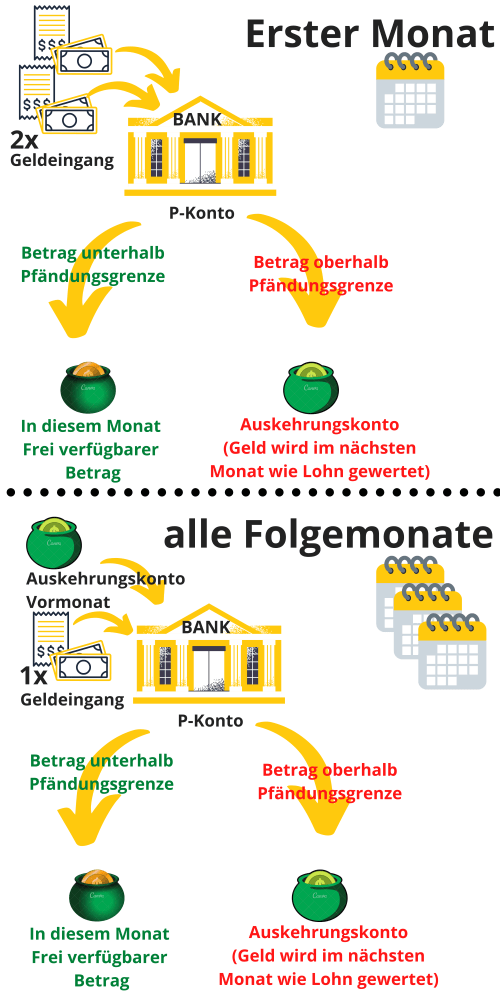

With 2 salary receipts in one month on the garnishment protection account will the incoming money be above the garnishment exemption moved to the payment account. It remains protected, but you can no longer withdraw it yourself. The next month the money will then be in the withdrawal account like receiving money scored. You can now dispose of the blocked money again in the following month.

On your P account, however, two streams of money are now mixed up. First, the money that was previously in the payout account goes in. But at the same time, a new wage payment goes into the P account. If you withdraw money or make transfers, what money do you use?

So that applies here First-in-first-out principle (FIFO) to be able to tell these two funds apart. So when you use money from your account, you always use the amount carried over from the previous month first. So what goes in first, goes out first. Or in short: First in first out.

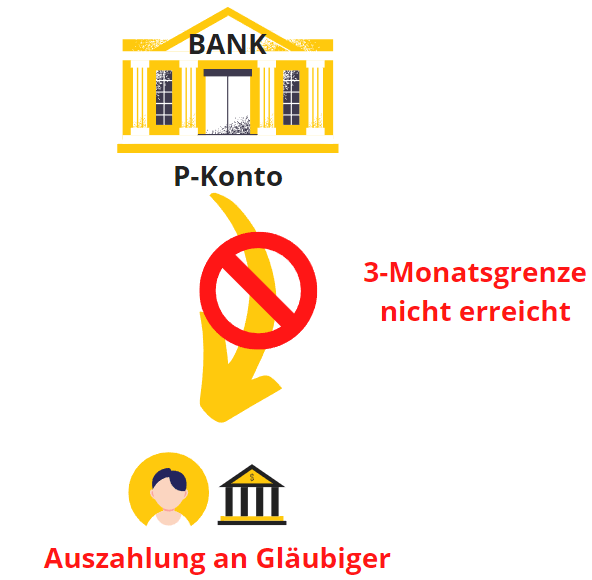

The unused credit that you not spend in the following month you can overall 3 months into the following month transfer. For you, this means that the bank will seize any money that you transfer more than three times in the following month. However, as already mentioned, this does not include the transferred funds from the previous month that you spent in the current month. When the money is available if you have exceeded the P account allowance, you can find out here.

2 salary receipts in one month on the P-Konto: a simple explanation of what happens now

If you have 2 salary payments in one month on the P account, the money above the free amount will be blocked in the payout account. However, the blocked money does not flow to the creditors, but is treated like a wage payment in the next month. if you im second If you spend money every month, due to the FIFO principle, you always spend the money transferred from the previous month first. If you don't do this, the money will be transferred again. After 3 transfers in the next month, it flows to the creditors according to §899 ZPO paragraph 2 - although your salary may be below the exempt amount lies. It is therefore important that you always spend or withdraw the money transferred from the previous month if you receive 2 salary payments in a month on the P account.

Error by the bank with 2 salary payments in one month on the P account

Still errors have already occurred in banks when the FIFO principle was applied correctly. This led to the bank paying out the creditor's assets, which were actually still to be protected, before the 3-month limit. In this case you will find in the post P-account allowance exceeded: "How do I get my money?" In addition to raising money immediately, here are a few more tips that you should definitely know.

Example: 2 salary receipts in one month on the P account

Your employer pays you the salary for January late in February. So the salary only appears on your bank statement for February, although it is your salary for January. At the same time, the salary for February will be credited to your P account on February 28th. This means that you will receive twice your salary in February, whereas in January you will have no receipt of any money at all - although you have worked in both months and received a wage for it - a few days late.

Since you exceeded the monthly allowance in February due to the double receipt of payment, the bank transfers everything that is above the seizure allowance to the payment account. However, the skimmed amount will be transferred to the following month of March and you can use it freely as the account holder. If the late wage payment is €500 or less, you can use the P-Konto Allowance can also be increased once. The Increase of P-Konto allowance lasts usually only a few days.

P-account money arrives on the 15th – how is the protection?

If the money comes into the account on January 15th, what matters is how high the total amount of money received in January is. If you do not receive any further wage payments in January but only get your wages paid out on the 15th, there will be no seizure below the seizure exemption amount.

But if the money on the P account doesn't come until the 15thSince your employer pays the previous month's wages late, the bank transfers the money above the tax-free amount to the sister account. In this case, the bank takes over the skimmed amount in the following month and you can then use it freely. If the late payment of wages is 500 € or less, you can also increase the P-Konto allowance once.

P-Konto Money comes on 30.ten - How is the protection?

The situation here is analogous to the case described above. If you do not receive any further money on the account on the 30th apart from the wage payment, there will be no seizure below the seizure exemption amount.

It is always how high the amount of money coming into the account is in total. exceed test If you pay the P account allowance in a monthly plan, the bank pays out the money. Payout means that the bank pushes the money to the payout account. If you have a smaller cash inflow in later months, you can use the money in the payout account.

P-account money arrives on the 15th or 30th – what is the protection? Garnishment protection is based on the total amount of money received in the account per month. If the Garnishment allowance exceededthe bank will return the money. If the exemption amount is not exceeded, the bank does not return the money. Whether the money on the 15th. 30th or another day comes does not matter.

Further account transfers remain protected due to the FIFO principle

However, you will receive another wage payment in March. So now you have one again double salary (from wages and from the disbursement account, see chart above) and the game continues in April and May. The legislator protects the debtor here by the first-in-first-out principle (FIFO) mentioned above.

The FIFO states that the transferred money is always used up first. So if you withdraw money in March, the withdrawal will be offset against the carryover from February. The salary credited in March initially remains untouched. As long as you spend more money in the following month than you transferred in the previous month, it is just a simple monthly transfer from month 1 to month 2, despite the multiple transfer of your money to the following months. Thanks to the FIFO principle, you always stay below the 3-month limit. As already mentioned, the condition that there is no attachment in this case is that you use at least the transferred money in the following month.

Be sure to withdraw transferred money

However, you should make sure that you spend the transferred money. According to §899 ZPO paragraph 2, all money not spent and transferred in the following months flows to the creditor after the third transfer into the following month. in the post "What happens with too much money in the P account" you will find a graphic diagram for this.

Errors at banks due to double receipt of salary in one month on the P account

Since the correct application of the FIFO principle does not work smoothly at all banks, it is advisable that you always withdraw the money directly if you receive double salary. in the post P-account allowance exceeded: "How do I get my money?" you will find further options for what you can do with 2 salary payments in one month on the P account.

You want to open a new P-Konto and wonder which bank is the most suitable? - If you are wondering which bank you should open a P-Konto with due to negative Schufa entries or a bad credit rating, we recommend the Pay center with the Supremacard*, which can be fully digitally converted into a P account without Schufa. But that too N26 account* can be opened in case of bad credit rating and negative Schufa and can be converted into a P-Konto. The advantages and disadvantages of these two accounts, as well as 4 other current accounts without Schufa connection you will find in the article "Open a P account – which bank?"

2 salary payments in one month on the P account have been better protected since December 2021

The mentioned regulation according to §899 paragraph 2 ZPO for the transfer of credit is new and was issued to better protect debtors on December 1st, 2021. The transfer of attachment-free credit is regulated in § 899 paragraph 2 sentence 1 ZPO. Here it says:

If the debtor does not have a credit balance in the amount of the entire amount that is exempt from attachment in accordance with paragraph 1 in the respective calendar month, this unused credit balance is the three subsequent calendar months in addition to the assets protected under paragraph 1, are not covered by the seizure. Dispositions are to be offset against the credit balance, which is first credited to the garnishment protection account became.

§ 899 ZPO - paragraph 2 (Non-garnishable amount; transmission)

With the old regulation (before 1.12.2021) after § 850k paragraph 1 sentence 3 ZPO was the savings even only possible for the following month. However, this regulation is outdated and no longer valid – even if you still read about her on many sites on the internet.

Which is the better protection

The better protection of double salary receipt in one month on the P account has existed in two ways since December 1st, 2021:

- Extension of payment moratorium: Until the amendment to the law in 2021, the payment moratorium for unused savings credit was only one month. With the new regulation, the legislator has extended this period to 3 months.

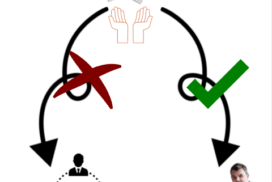

- FIFOThe FIFO principle is now clearly laid down in §899 ZPO. Thus, the text of the law states "Disposals shall be offset in each case against the credit balance that was first credited to the Pfändungsschutzkonto." Even though the FIFO principle was applied even before the amendment of the law, the regulation on this was not clearly stipulated. As a result, Last-In-First-Out (LIFO) was not in violation of the law. The LIFO principle is for debtors who have 2 salary receipts in one month on the P-Konto strongly detrimental. When money rolls over to the following month and you make a withdrawal, you use LIFO to withdraw the newly received money first. The transferred money thus falls directly below the monthly limit, and therefore flows out to the creditors more quickly. You can find out more about the FIFO principle in the next section

What does "First In - First Out" mean for the P account and how does it help with 2 salary payments in one month on the P account?

"First In - First Out" (FIFO) is a calculation rule for the savings balance on the P-Konto. FIFO on the P-Konto means that the money that enters the account first (First in) is also the first to be spent again (First out). The FIFO principle was established by the German Federal Supreme Court (BGH) for P accounts (ruling of October 19, 2017, file number IX ZR 3/17). The legislator anchored FIFO in December 2021 in §899 ZPO. The text of the law states that credit balances that were credited first must be used first for dispositions:

Dispositions are to be offset against the credit balance, which is first credited to the garnishment protection account became.

§ 899 ZPO - paragraph 2, sentence 2 (Non-garnishable amount; transmission)

FIFO therefore means that an action on the P account, such as withdrawing cash or making a transfer, is always deducted from the oldest balance.

FIFO vs LIFO

With the FIFO principle anchored by law for P accounts, you always use up the old savings credit before the newer credits. This means that the protected period of transfers to the following month (max. 3 transfers) always starts anew. Therefore, the FIFO principle will help you if you need to use up the P-Konto-Allowance exceeded and want to get your money. Stressed debtors can therefore ask the question "How do I get my money?" since December 2021 breathe a little easier if you have exceeded the P-Konto allowance. Nevertheless, it is advisable to counteract duplicate salary receipts by immediate withdrawals. Thus, you immediately prevent errors of the bank in the application of the FIFO principle and do not get into trouble.

The opposite of FIFO is the Last-In-First-Out (LIFO) principle. The LIFO principle is for debtors who have 2 incoming salaries in one month on the P account strongly detrimental. LIFO causes the newly received money to be withdrawn first when balances are transferred to the following month. The transferred money would (subjunctive!) thus fall directly below the 3-month limit. So it ultimately flows faster to the creditors.

Conclusion: The 2-fold salary receipt on the P account means disadvantages for debtors, which can (and should) be compensated by withdrawal

If you receive double salary in one month, you as a debtor will suffer disadvantages through no fault of your own, despite the amendment to the law in December 2021. Because the bank initially blocks the money above the garnishment exemption amount and it is only available to you again in the following month. You can do it again next month have full control of the moneyHowever, it is now your responsibility to do so. Because if you do not completely use or withdraw the money transferred to the following month, the bank will transfer it again. However, after 3 transfers the money will flow to the creditors. The situation regarding the 2-fold salary receipt in one month on the P-Konto is regulated in §899 ZPO in the second paragraph.

Therefore, it is still recommended that you become active on the P account yourself if you receive 2 salaries in one month by spending or withdrawing the transferred money from the previous month.

Have a problem have a p kontomein salary has come and salary of son now I come to salary of son not ran what now

Hello Mitchell,but since the garnishment only affects you, it will probably be best if the son-man opens his own account, so that the son's wages are not covered by the garnishment.

If you are a dependent for your son, you can also have this entered for your P-Konto. This will increase the P-Konto allowance. The Opening a new account but is clearly the better solution in this case. All the best!