To the question "When does the money in the P account go to the creditor?“ the cases have to be answered Carryover of moratorium amounts such as Transfer amounts in the following month be distinguished. at moratorium amounts if your receipt of money is higher than the exemption amount, whereas in the case of amounts transferred to the following month, your exemption amount has not yet been exhausted and you would like to take a savings contribution over to the next month. In each of the two cases, the money goes to the creditor at different times. The list shows you when the money goes to the creditor:

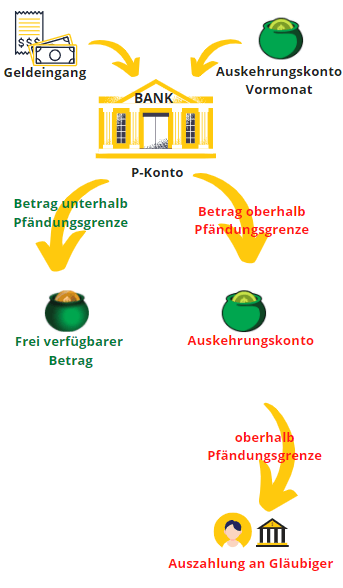

- Carryover of moratorium amounts: Your income on the Pfändungsschutzkonto is higher than the tax-free amount. For example, you have 1900 € income and an allowance of 1,340 € (allowance 2022 for singles without maintenance obligations). In this case, the surplus above the tax-free amount will first be credited to the disbursement accountwhere it is parked temporarily. The money only goes to the creditor if the payment account exceeds the exempt amount. These are moratorium amounts pursuant to Section 900 (1) and (2) of the Code of Civil Procedure.

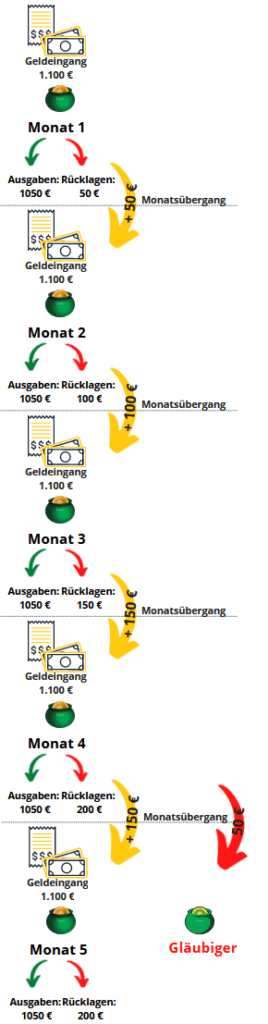

- Transfer amounts in the following month: But even if you unused credit on the P account below the garnishment exemption transfer to the following month, you have to be careful if you don't want to pay any money to creditors. Then on the fourth carryover to the following month the transferred money in the P account goes to the creditor. An example of this: A person with an income of €1,100 saves €50 per month. If this person starts leaving €50 in the P account in January, the amount will not be attached in February, March and April. However, if she takes the €50 with her into May, the money goes to the creditor. From a legal point of view, these are takeover amounts according to Section 899 (2) ZPO.

What you can learn here

- 1st case: When does the money go to the creditor if the money received on the P account is higher than the allowance? (moratorium amounts)

- 2nd case: When does the money go to the creditor if there is unused credit on the P account? (transfer amounts)

- Conclusion to the question When does the money in the P account go to the creditor?

1st case: When does the money go to the creditor if the money received on the P account is higher than the allowance? (moratorium amounts)

If you have exceeded the allowance on the P account, the money does not go directly to the creditor. Instead, the bank parks the money above the exempt amount in a separate pot - the payment account – between. The money on the payment account is still protected from access by creditors. However, as a debtor, you cannot access it either. The balance of the payment account is paid out as income to the P account in the next month. If the income in the following month is again above the tax-free amount, the bank keeps the difference via the payment account. If your income does not decrease, the payout account will eventually exceed the allowance. Only then does the money in the P account go to the creditor.

Paying off the money can be frustrating for people in emergency situations. In the article "P-Konto trick"Therefore, we have presented some tricks that you can use to trick the P-Konto a bit so that you have the maximum amount of available money in the account at the end of the month.

Legal basis for the transfer of moratorium amounts to the following month:

From a legal point of view, these are moratorium amounts if the money received on the P account is higher than the exempt amount. The deferral of payment by accumulating the moratorium contributions before the money goes to the creditor is regulated in §900 ZPO. The corresponding legal text for the moratorium contributions reads:

(1) If future credit is attached to a seizure protection account and transferred to the creditor, the third-party debtor may only pay the creditor or deposit the amount after the end of the calendar month that follows the respective credit; this does not result in an extension of the period referred to in Section 899 (2). At the request of the creditor, the enforcement court may issue an order that deviates from the first half of sentence 1 if otherwise, taking into account the debtor's need for protection, unreasonable hardship would arise for the creditor.

(2) Credit from which no payment may be made to the creditor or which may not be deposited by the end of the period in subsection 1 is credit within the meaning of Section 899 subsection 1 sentence 1 in the calendar month following the credit entry.

§900 ZPO

2nd case: When does the money go to the creditor if there is unused credit on the P account? (transfer amounts)

You can transfer unused credit on the P account to the next month. But not arbitrarily often. Despite the fact that the regulation has been relaxed since 2021, it is still a thorn in the side of the legislator if debtors put some money aside. Therefore you can You can only transfer unused credit on the P account amount to the following month a maximum of 3 times. The transferred money is then available at the beginning of the following month. If you transfer the money to the following month for the fourth time, the bank attaches it - even though your income was below the attachment allowance. It is therefore advisable to withdraw money from the P account immediately.

In the diagram you see a person with an income of €1,100 who saves €50 per month. The money saved will not be seized until the third month. Only when the money is transferred to the fourth month - or the third transfer to the following month - does the money go to the creditor. In this case, the €50 from the transfer from month 1 to month 2 goes to the creditor in the transfer from month 3 to month 4.

If you use the P-Konto Allowance exceeded your possibilities to access it are limited. There are nevertheless as you can see in the article P-account allowance exceeded: "How do I get my money?" find out When the money is available if you have exceeded the P account allowance, you can find out in the linked article.

New regulation since December 1st, 2021

This regulation has been in effect since December 1st, 2021 and is in im § 899 paragraph 2 sentence 1 ZPO to find. With the old regulation (before 1.12.2021) after § 850k paragraph 1 sentence 3 ZPO it was only possible to save for the following month. The new regulation makes it easier for debtors to save up a reserve. In addition, as a debtor, you are better protected if you receive double salary in one month (e.g. due to late payment). You can now transfer twice the salary for 3 months instead of just one month. Nevertheless, it is advisable to withdraw the money, as the bank has often made mistakes when transferring it to the following months.

Legal basis for the transfer of unused credit to the following month:

From a legal point of view, these are transfer amounts if the money received on the P account is lower than the exempt amount and you want to save something from it. The takeover in the three following months is regulated in §899 ZPO. The corresponding legal text for the takeover amounts reads:

(1) If credit is attached to the debtor's seizure protection account, the debtor can dispose of an amount from the credit balance by the end of the calendar month, the amount of which increases to the next after rounding up the monthly allowance pursuant to Section 850c subsection 1 in conjunction with subsection 4 full 10 Euro amount; in this respect, the credit is not covered by the attachment. Sentence 1 applies accordingly if credit is attached to a payment account of the debtor, which is converted into a seizure protection account within one month of the delivery of the transfer order to the third-party debtor. § 900 paragraph 2 remains unaffected.

(2) If the debtor has not had a balance in the amount of the entire amount that is exempt from garnishment in accordance with paragraph 1 in the respective calendar month, this unused balance will not be included in the garnishment in the three subsequent calendar months in addition to the balance protected in accordance with paragraph 1. Disposals are to be offset against the credit that was first credited to the garnishment protection account.

899 paragraph 1 and 2 ZPO

Example of transferring credit on the P account below the garnishment exemption in the next month

Petra Keller is single and has no other child support obligations. She owns a P-Konto and would like to set aside reserves for a new Washing machine form, since the old one already makes strange noises when spinning. According to garnishment table standing Petra 1.340 € to allowance. Petra works at a building cleaning. Your monthly income is €1,100. Petra is thus below the garnishment exemption and does not have to cede any income to creditors.

If Petra now wants to buy a washing machine, she can put some money aside for it every month. However, Petra should not wait too long with the purchase. Because if the money is taken over more than three times in the next month, the bank seizes it. From the graph above, it can be seen that with a monthly saving of €50, Petra can save a maximum of €200 in washing machine credits. Because everything about it is seized by the bank. Therefore, according to both the old and the new regulation, it is advisable to withdraw the money immediately at the end of the month in order to avoid problems with the accumulation of credit on the P account. This is the only way Petra can save the money for an urgently needed washing machine. If she doesn't do that, from the fourth month €50 a month will go to the creditors and Petra cannot afford a new washing machine despite her best efforts.

Conclusion to the question When does the money in the P account go to the creditor?

When the money goes to the creditor depends on whether it is moratorium amounts according to §900 ZPO or transfer amounts according to §899 ZPO.

moratorium amounts

To one Carryover of moratorium amounts It is when your income on the Pfändungsschutzkonto is higher than the allowance. For example, you have 1900 € income and an allowance of 1,340 € (allowance 2022 for singles without maintenance obligations). In this case, the surplus above the tax-free amount first goes to the distribution account, where it is parked temporarily. The money only goes to the creditor if the payment account exceeds the exempt amount.

When this is the case depends on your income situation. If your income decreases in the future, the moratorium contribution will be used to supplement your income up to the garnishment limit and no money would go to the creditors at all. However, if we assume that your income remains at 1900 €, you will be 560 € above the exemption amount of 1,340 € every month. This means that you already exceed the tax-free amount with 2 savings amounts and in the third month 340 € will go to the creditors (3×560 € - 1,340 € = 340 €). In the following months, the savings amount of €560 will be transferred in full to the creditors.

transfer amounts

On the other hand, these are takeover amounts in the following month the transferred money goes to the P account on the fourth carryover to the following month to the creditor. An example of this: A person with an income of €1,100 saves €50 per month. If this person starts leaving €50 in the P account in January, the amount will not be attached in February, March and April. However, if she takes the €50 with her into May, the money goes to the creditor.

I have the following question I have on 12.4. received an account garnishment despite p account, I was below the with my income every month

garnishment-free border, I receive 486 € monthly basic security and 189 € income from the workshop for disabled people, which I do not understand on 13.4. I had my wage receipt of €189, but €81 was still reserved, I don't understand that, I have an account balance of €300, which is probably below the exemption limit, what did I do wrong? I have on.14. 4 still withdrawing money the seizure of the account was on 12.4.22. Apparently I have a p account, since I can still get money, I assume that I'm still in the garnishment protection. I ask for feedback. With best regards

maximilian colbatzky

That might be a mistake on the part of the bank. Try to explain the situation there.