According to a current survey by the Federal Statistical Office [1], almost 10 % of all employees in Germany are only employed on a temporary basis. What is good for the company has many disadvantages for employees. This also includes taking out a loan for a temporary job. In order to still get a loan with a fixed-term employment contract, guarantors or co-applicants often have to step in. In order for the loan to work despite the time limit, students, young professionals and people with a temporary contract or seasonal workers have to pay attention to a few things. In general it is like this:

Short terms, a guarantor and special providers can usually make a loan with a fixed-term contract possible.🖖

What you can learn here

- Which bank gives a loan with a fixed-term contract?

- Loan with a fixed-term contract – the most important things in brief

- How to go about getting a temporary loan

- Loan with a fixed-term contract? – it works with a guarantor

- The role of Schufa when the bank gives a loan with a fixed-term contract

- Common reasons for a loan with a fixed-term contract

- You need these documents for a loan with a fixed-term employment contract

- Loan without a permanent employment contract: honesty is the best policy!

- Loan with a fixed-term contract - conclusion

Which bank gives a loan with a fixed-term contract?

If your bank asks you because of your temporary employment contract no money lends you bon credit* or Smava* often still give a loan despite the time limit. Credit is granted particularly well for a fixed term if the loan term ends within the time limit of the employment relationship. Given that more than half of all temporary workers have short-term contracts of 12 months or less, preference is given in this case mini loans for use, which already from 0 % interest from cashper* Are available.

Here you will find some other providers and their conditions, which one Credit despite fixed-term employment contract forgive:

#1: Receipt credit  4,9/5 (eKomi) Interest charges: approx. 8 % at €10,000 & 72 months Loan Amount: 100 to 300,000€ Minimum income: €1,300 net per month Duration: 12 to 120 months To the provider: Bon-kredit.de | |

#2: Smava  4,9/5 (eKomi) Interest charges: -0.4 % at €1,000 Loan Amount: 500 till 120.000€ Minimum income: €601 net per month Duration: 12 to 120 months  To the provider: Smava.de | Speed Costs Smava undercuts offers from other providers with the "You can't get cheaper than this" guarantee seriousness To the provider: Smava.de |

#3: Vexcash  5/5 (eKomi) Interest charges:approx. 14.8 % pa rms. Loan Amount: €100 to €3,000 Minimum income: €700 net per month Duration: 15 - 90 days To the provider: Vexcash.de | Commitment probability Inaccurate data on commitment probability Speed Costs Smart option too expensive To the provider: Vexcash.de |

#4 Auxmoney 4,8/5 (eKomi) Interest charges:approx. 5.24 % pa rms. at €13,300 & 84 months Loan Amount: €1,000 to €50,000 Minimum income: €1,000 net per month Duration: 12 to 84 months To the provider: Auxmoney.de | |

#5 Sigma Kreditbank 4,8/5 (eKomi/Maxda) Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months To the provider: Sigma credit bank | Commitment probability Refusal, without permanent employment Speed Costs Interest expensive To the provider: Sigma credit bank |

#6 Creditolo  4,3/5 (trust pilot) Interest charges:11,11 % Loan Amount: 3.500 € 5.000 € 7.500 € Minimum income: €1,260 net per month Duration: 40 months To the provider: Creditolo.de | Commitment probability Refusal, without permanent employment Speed Costs Interest expensive To the provider: Creditolo.de |

#7 Ferratum  4,7/5 (eKomi) Interest charges:10,36 % + installment option Loan Amount: €50 - €1,000 for new customers €50 - €3,000 for existing customers Minimum income: €1,100 net per month Duration: 30 days - 180 days To the provider: Ferratum.de | Commitment probability Inaccurate data, for commitment probability Speed At the end of 2022 there are unfortunately delays in payment up to 48 hours Costs Interest expensive To the provider: Ferratum.de |

#9 DSL Bank  4,5/5 (Proven Expert) Interest charges:4,40 % Loan Amount: 5000 € - 50.000 € Minimum income: unknown Duration: 48 - 120 months Installment loan despite negative Schufa: To the provider: DSLBank.com | Commitment probability Inaccurate data, for commitment probability Speed Costs Favorable interest rates construction financing despite negative Schufa: To the provider: DSLBank.com |

#10 Maxda  4,8/5 (eKomi) Interest charges:8.9 % (for 2/3 of customers at €10,000) Loan Amount: 1.500 € - 250.000 € Minimum income: 1.260 € Duration: 12 - 120 months To the provider: Maxda.de | Commitment probability Inaccurate data, for commitment probability Speed Costs Caution: In some cases, insurance is taken out before the loan is concluded seriousness To the provider: Maxda.de |

#11 Credimaxx  4,8/5 (eKomi) Interest charges:7.9 % (for 2/3 of customers at €4,000) Loan Amount: 500 € - 80.000 € Minimum income: 1.100 € Duration: 12 - 120 months To the provider: Credimaxx.de | Commitment probability Chance of success lower than with other providers Speed Costs seriousness To the provider: Credimaxx.de |

#12 Cashper  4,7/5 (eKomi) Interest charges:0 % for new customers Loan Amount: 100 € - 1.500 € Minimum income: 700 € Duration: 30 - 60 daysTo the provider: Cashper.de | Commitment probability Chance of success very high Speed Costs Free application for new customers To the provider: Cashper.de |

#13 TF Bank  4,4/5 (trust pilot) Interest charges:0 % for up to 51 days Loan Amount: 0 - 10.000 € Minimum income: not known Duration: no limit To the provider: TFBank.com | Commitment probability Chance of success: medium Speed Costs Free of charge for up to 51 days, but high interest thereafter seriousness |

#14 Advanzia  4,5/5 (trust pilot) Interest charges:0 % for up to 7 weeks Loan Amount: 0 - €20,000 for long-term customers. Maximum limit of €2,000 after application, €3,000 after three months and €5,000 after eight months. Minimum income: No minimum income required - application without salary certificates Duration: no limit To the provider: Advanzia.com | Commitment probability Chance of success: good Speed Costs Free of charge for up to 7 weeks, but high interest thereafter seriousness |

#15 Consors Finance  4,3/5 (trust pilot) Interest charges:2,99 % Loan Amount: 500 € - 50.000 € Minimum income: 650 € net per month Duration: 6 - 120 months To the provider: About Consors Finance | Commitment probability Inaccurate data, for commitment probability Speed Costs Very favorable interest rates seriousness To the provider: About Consors Finance |

If the house bank no longer gives you a loan due to the temporary employment, these special loan providers can often still provide one Credit despite the limitation awarded. For example, Bon-Kredit and Smava have granted loans to more than half of all people who have Konto-Kredit-Vergleich.de have requested a credit offer at a fair interest and without additional costs submitted, as described in the article "Where can you really get a loan despite negative Schufa?" was analyzed.

Loan with a fixed-term contract – the most important things in brief

If your bank does not give you a loan because your work is limited, Bon-kredit, Smava or mini loan providers such as Cashper can often still lend money despite the temporary employment. These providers mediate in the question "Which bank gives credit despite a fixed-term employment contract?” Short-term credit agreements. Because with a short loan term, a loan is usually possible despite the probationary period. It is particularly easy to apply for a loan with a fixed-term employment contract if the loan has been repaid in full before the time limit expires.

With a short loan term (preferably within the time limit) is a loan with a fixed-term employment contract mostly possible.

If, on the other hand, you need a loan without a permanent employment contract with a longer term, it can help guarantors or one co-applicant to be included in the loan agreement. As a result, the loan is also approved beyond the time limit of the employment contract. However, you should note that the bank can access the guarantor or the co-applicant if you are in arrears with the loan installments. This can put a strain on the relationship with the guarantor or co-applicant. You should therefore be sure that you can pay the loan installments over the entire term, even if the employment contract is limited.

If you add a guarantor, the loan with a fixed-term employment contract is usually approved well beyond the duration of the limitation.

How to go about getting a temporary loan

First try a loan according to your ideas bon credit* and Smava* without asking guarantors or second applicants. The simultaneous inquiries do not burden your Schufa score and do not worsen your credit chances with the other provider.

First, you should apply for the loan with a fixed-term contract without a guarantor.

If you receive a rejection, you can try to apply for a loan together with a guarantor. People with a permanent job and a good credit rating are suitable for this. For students or young professionals, your own parents are often suitable guarantors.

If you have received rejections from two or more providers without a guarantor, you should consult a guarantor, shorten the term or request a smaller loan. These options drastically increase your chances of getting a temporary loan.

at Mini loan provider how cashper* become Credit terms and the sums so limited that a loan with a fixed-term employment contract is usually approved. Thus, the provider specializes in loans with terms of one or two months.

Most of the time limits are significantly longer, as determined by the Federal Statistical Office. As a result, lending is unproblematic for most people despite the time limit.

![More than 3/4 of all temporary jobs are shorter than 2 years. Source: Federal Statistical Office. See [1]](https://konto-kredit-vergleich.de/wp-content/uploads/2022/07/dauer_befristung_nach_geschlecht-1024x800.png)

In addition, there are always offers from Cashper, where the loan is granted without interest. If you are in the temporary employment 700 € or more per month earn, the application via Cashper is usually unproblematic.

Mini-loans are granted with the least problems in the case of temporary employment. However, their term is limited to 1-6 months and you can do a maximum Borrow € 3,000.

Loan with a fixed-term contract? – it works with a guarantor

If you have a guarantor, you can get a loan on good terms. However, if the installments are not paid, the bank will contact the guarantor. The guarantor is liable for the loan amount and the bank can collect the money from him. This can severely strain the relationship with the sponsor and their trust should not be abused. A guarantor helps in many difficult credit cases and can even do one thanks to his good credit rating (if he has one). Credit after residual debt discharge (with open Schufa negative feature!) allow.

The ideal guarantor should therefore be a good credit have. For this are a permanent employment, a good Schufa and a stable income above the garnishment exemption limit ideal.

Advantages of the guarantee for a loan

- Lending with a guarantor is also possible with a fixed-term employment contract at most banks.

- You can offer the bank collateral if you don't have a permanent job and can't get a loan otherwise.

- The guarantor can support a family member, acquaintance or friend.

Disadvantages of the guarantee for a loan

- The guarantor bears the entire risk.

- A guarantor does not receive compensation for the guarantee.

- You bear a great responsibility as a debtor, because the bank can turn to the guarantor

- Therefore, private relations with the guarantor may be strained.

The role of Schufa when the bank gives a loan with a fixed-term contract

The Schufa is an important basis for banks to ability to pay to consider. If you have ever had a wage garnishment and you are dealing with your money over a P account had to protect, the Schufa knows about it. The Schufa then devalues your solvency. The same applies to late paid bills, loans and especially after a personal bankruptcy. If you know your Schufa score, you can find out with this overview which bank still grants a loan despite negative SCHUFA.

However, the Schufa does not keep any statistics about your employment relationship. So the Schufa doesn't know that you have a fixed-term employment contract.

Nevertheless, the bank includes the fixed-term employment contract in its internal credit rating.

Common reasons for a loan with a fixed-term contract

1) Car financing without a permanent employment contract

Possibilities of car financing without a permanent employment contract

One of the most common reasons for borrowing that people on temporary contracts find themselves in is the car financing. If you have a fixed-term employment contract, you have the following: Auto financing options open despite the time limit:

- Loan with a fixed-term contract and second applicant or guarantors

- you choose the Term of the car financing so shortthat the loan with a fixed-term employment contract is fully repaid within the time limit.

REITs are suitable for a dividend portfolio

A special feature of REITs is that, due to their high distributions, they are often a good dividend yield offer. The dividend yield is the ratio of the profit distribution to the share price and is often more than 5 % per year for REITs. This makes REITs interesting for investors who want to pursue a dividend strategy and build up passive income.

People who live with little money in Real estate investing often have a particularly keen interest in dividends, as these are tax-free up to the saver's allowance of 1,000 euros.

Alternatives to car financing without a permanent employment contract

Otherwise, there are other options open to you when it comes to car financing with a bad credit rating. However, these have the disadvantage that they are usually associated with higher costs. These include the Used car financing despite negative Schufa or car subscription and leasing models which are awarded despite negative Schufa or even without Schufa. You can find out more about this via the following links:

Some car dealerships also offer installment purchases for cars bought from you if your credit rating is bad. You can find more information at Buy a car on installments despite negative credit bureau.

But before that, a tip about these alternatives: If there is an opportunity, you should always first try to choose a provider with a temporary job who can provide you with financing, leasing or a subscription DESPITE a negative Schufa entry forgives. There are also car financing, leasing and subscription contracts WITHOUT Schufa Query, however, due to the unclear creditworthiness, the provider assumes the worst and calculates for you Auto credit without Schufa a decent hit!

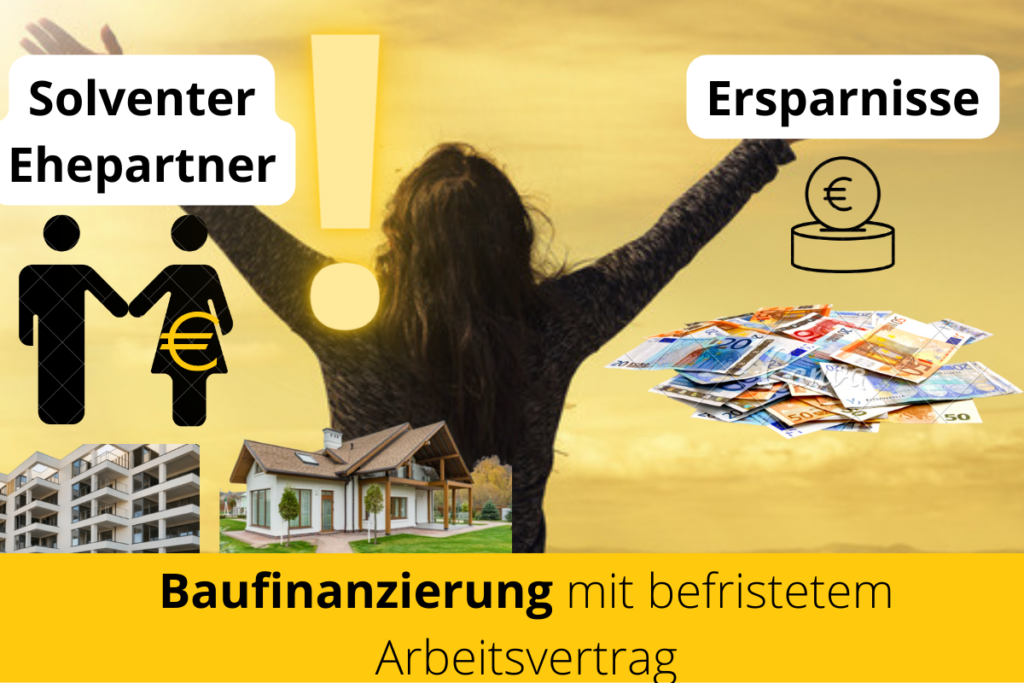

2) Real estate loan or construction financing without a permanent employment contract

Anyone without a permanent employment contract construction financing want to apply for, needs good arguments for the bank. It is better to have a well-paid one Spouse in permanent employment to have. You should also have a fixed-term employment contract high savings and consequently contribute an above-average share of equity to the financing.

If you have a fixed-term employment contract, your search for the right construction financing will be a bit more complex. A Comparison of construction financing and their conditions in detail is essential.

You need these documents for a loan with a fixed-term employment contract

To one Loan with fixed-term employment contract to apply, you need some documents for the conclusion of the loan. These include:

- Proof of income for the last 3 months

- identity card

- The self-employed need an income tax assessment or a business statement for the last 12 months

If it is a construction financing, additional documents are added to the property or the construction project.

Loan without a permanent employment contract: honesty is the best policy!

Can you hide a fixed-term employment contract when taking out a loan?

If you keep the bank secret or knowingly provide false information about your non-permanent employment, there are serious consequences. Because the bank can terminate the loan due to the incorrect information. In this case, the loan must be repaid to the bank as soon as possible.

Can I get a loan without a permanent employment contract?

Most banks will not give you a loan without a permanent contract. Your alternatives are to shorten the loan term to the duration of the time limit, to consult a solvent guarantor, or to switch to special loan providers or personal loans. If you can afford the monthly installments, it is almost always possible to get a loan even without a permanent employment contract.

Loan with a fixed-term contract - conclusion

With a short credit period (preferably within the time limit) a loan with a fixed-term employment contract is usually possible. If you add a guarantor, the loan with a fixed-term employment contract is usually approved well beyond the duration of the limitation. First you should apply for the loan with a fixed-term employment contract, but without a guarantor. Because the relationship with the guarantor can be damaged by borrowing. If you have cancellations from two or more providers without guarantor like Smava*, Auxiliary*, bon credit* and credimaxx* received, you should:

- Consider one guarantors call in

- the shorten runtime, so that the contract ends before the time limit or

- a smaller credit Requests.

These options drastically increase your chances of getting a temporary loan. Nevertheless, mini-loans are granted with the least problems for temporary employment. However, their term is limited to 1-6 months and you can do a maximum Borrow € 3,000.

Loans without Schufa are already on a fixed-term employment contract not recommendable and without negative features also superfluous. The providers charge high interest rates for these loans and sometimes additional costs for residual debt insurance or the like are due. With an expensive loan without Schufa, you can quickly get into the debt trap. Thankfully, vendors like Smava*, Auxiliary*, bon credit* and credimaxx* often much better deals if you have a temporary job and need credit urgently.

Borrowers with good organizational skills use borrowing despite debt to negotiate lower interest rates through debt restructuring and to shake off residual debt insurance that is no longer needed.

[1] https://www.destatis.de/DE/Themen/Arbeit/Arbeitsmarkt/Qualitaet-Arbeit/Dimension-4/befristet-beschaefte.html

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.