If you want to trade cheap securities, you should neither give away money nor go to a supposedly cheap broker with many indirect and hidden charges put. Instead it is advisable to a cheap depot with excellent performance to put. There are at Securities account comparison not only Favorable conditions for one-time purchases and savings plans decisive. Because many brokers know how to hide their fees and charge for them foreign dividends or for same-day partial executions Fees. You should also use a depot comparison, also check whether on all German stock exchanges can be traded. Because otherwise the supposedly cheap order fees can go through high spreads more than overcompensated. Many readers were interested in the comparison of Smartbroker vs Trade Republic, Justtrade vs Trade Republic, Trade Republic vs Comdirect, Consorsbank vs Trade Republic and Trade Republic vs DKB. Therefore, these 1:1 comparisons have been made separately in the Depot comparison recorded. That's how you find it best portfolio for small investors.

Online depot & securities depot comparison

What you can learn here

- Online depot & securities depot comparison

- Find the best depot with the securities depot comparison

- Smartbroker - The winner from the securities account comparison about himself

- In addition to Smartbroker, other providers were also able to score in the depot comparison

- The Consorsbank Trader account* in a securities account comparison

- Depot comparison: Trade Republic* in securities account comparison

- How does commission-free trading work?

- At Trade Republic, all orders are filled via long and black, which is not an advantage

- Cheap spreads during the day, more expensive at night!

- Trade Republic: OTC trading via HSBC

- Trade Republic's ETF savings plan offer in a portfolio comparison

- Conclusion on Trade Republic

- Trade Republic vs Comdirect: Which broker is ahead in the securities portfolio comparison?

- Trade Republic vs Consorsbank: Which is the better broker in the securities portfolio comparison?

- Trade Republic vs Smartbroker: Battle of the cheap brokers in the securities portfolio comparison!

- Trade Republic vs DKB: Which broker convinces in the securities portfolio comparison?

- JustTRADE vs Trade Republic: The free brokers compete against each other in the securities portfolio comparison!

- The Onvista securities account* in the securities account comparison

- Depot comparison: Onvista* in key points

- Depotvergleich: Targobank* - Still an interesting broker for switchers?

- The online classics in the securities account comparison: ING*, DKB* & Comdirect* - How do you keep up with the new competition in the securities account comparison?

- In the securities portfolio comparison, DKB scores with a good ETF offer! – Extras: landlord package and junior depot

- Depot comparison: DKB* (#1 for Vanguard ETF)

- JustTRADE* in securities account comparison

- Securities account comparison: Which is the best securities account for small investors and beginners?

- Last but not least in the securities portfolio comparison: My criteria for measuring the broker's performance

For successful stock and ETF trading a cheap broker alone is not a sufficient criterion. Reputable and trustworthy top brokers can also use one instead strong range of services score. Therefore I have in this securities account comparison 20 features Are defined. The more of these a broker fulfills, the better!

| brokers | Costs | Services |

|---|---|---|

| Order commission: | Shares: Free depot management Free clearing account without negative interest (see 7 below the table). Flat fee: Favorable conditions for a one-time purchase Free dividends payout Opening as Junior Depot free same-day partial executions (see 8 below the table) Trading on all German stock exchanges ETF: Favorable savings plan conditions Savings plan from 25 euros to 3,000 euros possible At least ETFs from 5 providers can be traded Vanguard ETF tradable More than 300 ETF tradable Surface: Mobile trading via app Modern user interface Safety and tax: German deposit insurance Automatic tax deduction Pros: Securities Loan CFD trading Static order Dynamic order To the provider: consorsbank.de |

| Shares: Free depot management Free settlement account without negative interest 1 Flat fee: Favorable conditions for a one-time purchase Dividend payment free of charge Opening as Junior deposit (see point 2 below the table) free same-day partial executions Trading on all German stock exchanges ETF: Favorable savings plan conditions Savings plan from 25 euros to 3,000 euros possible At least ETFs from 5 providers can be traded Vanguard ETF tradable More than 300 ETF tradable Surface: Mobile trading via app Modern user interface Safety and tax: German deposit insurance Automatic tax deduction Pros: Securities Loan CFD trading Static order Dynamic order To the provider: Smartbroker.de | |

| Order commission: | Shares: Free custody account management (only the first 3 years unconditionally free of charge6) Free settlement account without negative interest 7 Flat fee: Favorable conditions for a one-time purchase Dividend payment free of charge Opening as Junior Depot free same-day partial executions Trading on all German stock exchanges ETF: Favorable savings plan conditions Savings plan from 25 euros to 3,000 euros possible At least ETFs from 5 providers can be traded Vanguard ETF tradable More than 300 ETF tradable Surface: Mobile trading via app Modern user interface Safety and tax: German deposit insurance Automatic tax deduction Pros: Securities Loan CFD trading Static order Dynamic order To the provider: Comdirect.de |

| Order commission: | Shares: Free depot management Free settlement account without negative interest 4 Flat fee: Favorable conditions for a one-time purchase Dividend payment free of charge Opening as Junior Depot free same-day partial executions Trading on all German stock exchanges ETF: Favorable savings plan conditions Savings plan from 25 euros to 3,000 euros possible At least ETFs from 5 providers can be traded Vanguard ETF tradable More than 300 ETF tradable Surface: Mobile trading via app Modern user interface Safety and tax: German deposit insurance Automatic tax deduction Pros: Securities Loan CFD trading Static order Dynamic order To the provider: ING.de |

| Order commission: | Shares: Free depot management Free clearing account without negative interest Flat fee: Favorable conditions for a one-time purchase Dividend payment free of charge Opening as Junior Depot free same-day partial executions Trading on all German stock exchanges ETF: Favorable savings plan conditions Savings plan from 25 euros to 3,000 euros possible At least ETFs from 5 providers can be traded Vanguard ETF tradable More than 300 ETF tradable Surface: Mobile trading via app Modern user interface Safety and tax: German deposit insurance Automatic tax deduction Pros: Securities Loan CFD trading Static order Dynamic order To the provider: en.scalable.capital |

Order commission: | Shares: Free depot management Free clearing account without negative interest Flat fee: Favorable conditions for a one-time purchase Dividend payment free of charge Opening as Junior Depot free same-day partial executions Trading on all German stock exchanges ETF: Favorable savings plan conditions Savings plan from 25 euros to 3,000 euros possible At least ETFs from 5 providers can be traded Vanguard ETF tradable More than 300 ETF tradable Surface: Mobile trading via app Modern user interface Safety and tax: German deposit insurance Automatic tax deduction Pros: Securities loan ( expensive!) CFD trading Static order Dynamic order To the provider: flatex.de | |

| Order commission: | Shares: Free depot management Free clearing account without negative interest Flat fee: Favorable conditions for a one-time purchase Dividend payment free of charge Opening as Junior Depot free same-day partial executions Trading on all German stock exchanges ETF: Favorable savings plan conditions Savings plan from 25 euros to 3,000 euros possible At least ETFs from 5 providers can be traded Vanguard ETF tradable More than 300 ETF tradable Surface: Mobile trading via app Modern user interface Safety and tax: German deposit insurance Automatic tax deduction Pros: Securities Loan CFD trading Static order Dynamic order To the provider: DKB.de |

| Order commission: | Shares: Free depot management Free clearing account without negative interest Flat fee: Favorable conditions for a one-time purchase Dividend payment free of charge Opening as Junior Depot free same-day partial executions Trading on all German stock exchanges ETF: Favorable savings plan conditions Savings plan from 25 euros to 3,000 euros possible At least ETFs from 5 providers can be traded Vanguard ETF tradable More than 300 ETF tradable Surface: Mobile trading via app Modern user interface Safety and tax: German deposit insurance Automatic tax deduction Pros: Securities Loan CFD trading Static order Dynamic order To the provider: onvista.de |

| Order commission: | Shares: Free depot management Free clearing account without negative interest Flat fee: Favorable conditions for a one-time purchase Dividend payment free of charge Opening as Junior Depot free same-day partial executions Trading on all German stock exchanges ETF: Favorable savings plan conditions Savings plan from 25 euros to 3,000 euros possible At least ETFs from 5 providers can be traded Vanguard ETF tradable More than 300 ETF tradable Surface: Mobile trading via app Modern user interface (cell phone only) Safety and tax: German deposit insurance Automatic tax deduction Professional investors: Securities Loan CFD trading Static order Dynamic order To the provider: TradeRepublic.com |

| Order commission: | Shares: Free depot management Free clearing account without negative interest Flat fee: Favorable conditions for a one-time purchase Dividend payment free of charge Opening as Junior Depot free same-day partial executions Trading on all German stock exchanges ETF: Favorable savings plan conditions (see point 5 below the table) Savings plan from 25 euros to 3,000 euros possible At least ETFs from 5 providers can be traded Vanguard ETF tradable More than 300 ETF tradable Surface: Mobile trading via app Modern user interface Safety and tax: German deposit insurance Automatic tax deduction Professional investors: Securities Loan CFD trading Static order Dynamic order To the provider: Justtrade.com |

1 The balance on the clearing account must be less than 15 % of the deposit value so that it remains permanently free. More information at smart broker. | ||

Find the best depot with the securities depot comparison

With the securities depot comparison, it is particularly easy to find a suitable broker for the securities. smart broker* convinces in almost all categories. Not only can shares be bought and stored very cheaply on numerous stock exchanges, the offer for ETF savers is also one of the best. so can ETFs from above 5 providers – including Vanguard – can be bought very cheaply. Of the Smart broker savings plan can of minimum 25 € to maximum 3000 € be created. But professional investors will also get their money's worth with the Smartbroker: A cheap securities loan for 2.25 % interest pa and several dynamic order types (e.g. trailing stop loss) should leave little to be desired. Only the web interface of the smart broker seems a bit old-fashioned, but a remedy is already in sight with a planned app at the beginning of 2021. Therefore, Smartbroker cuts in the securities portfolio comparison with 17 points very well.

Smartbroker performs very well in securities account comparison | |

|---|---|

Favorable trading on all German stock exchanges | To the provider: Smartbroker.de |

Many were interested in how the smart broker performed in comparison to Trade Republic and Justtrade in comparison to Trade Republic. Finally, the three Neo brokers are all very cheap and offer many features. But in my opinion, Smartbroker is the best of the three mentioned. The fact that you can trade so cheaply on a real stock exchange and that you can also create all possible order types (including dynamic) is currently unbeatable. who really knows what he's doing, can also invest at Smartbroker with a cheap cash credit to leverage. Many other brokers simply do not have these extras. But just read the comparison articles yourself, then you will know what I mean:

Smartbroker - The winner from the securities account comparison about himself

In addition to Smartbroker, other providers were also able to score in the depot comparison

The provider Scalable Capital, which through its Robo Advisor became known, now also enables the management of a securities account. And Scalable Capital's depot is also impressive: free trading at gettex, many free savings plans and no depot fees. The interface is more modern than the Smartbroker. An app is also available. On the negative side, it should be noted that trading is not possible on all German stock exchanges. I would therefore prefer Smartbroker to Scalable!

Scalable is also a recommendation in the depot comparison - However, with a small drop of bitterness | |

|---|---|

| To the provider: Scalable. capital |

You can find more about the two newcomer brokers here: Smartbroker vs Trade Republic

That Consorsbank trader account* in the depot comparison

the consor bank* is the German branch of the major French bank BNP Paribas. The bank was founded in 1994 as Germany's first online broker. Until a few years ago, the bank was still called Cortal Consors. The founder of consor bank* Karl Matthäus Schmidt has been CEO of Quirin Bank since 2006 – a private bank that became known through the robo advisor Quirion.

The Consorsbank is for yours Lock offers and uses it to attract new customers from time to time. Unfortunately, the good conditions do not remain, but after 12 months you switch to the existing customer category, which seems to be only category B customers for the bank. So as a New customer for less than 4 euros per trade, which is an excellent offer. After 12 months, however, the same trade costs 10 euros, which is simply too expensive these days.

A savings plan 100 euros costs 1.50 euros. the consor bank* also offers numerous ETFs free of charge in the savings plan. In addition, dividends from distributing funds are reinvested in the savings plan by default. If you don't want that, write the bank a message and the feature will be deactivated.

Consorsbank - Savings plans via Tradegate - Therefore plus points in the "Depot Comparison ETF"

Since the beginning of this year, Consorsbank has no longer had its savings plans executed via the Munich Stock Exchange at 8:00 a.m., but via Tradegate at 9:30 a.m. This reduces "hidden fees" because Tradegate at 9:30 a.m. has much more trading volume than the small Munich stock exchange at 8:00 a.m. This is an interesting point, especially for the "depot comparison ETF", as it reduces costs.

Personal anecdote about Consorsbank

For many years I had an overnight account with Consorsbank and the scam was similar there: as a new customer you received very good interest rates, but they were only paid for the first 12 months. Then there were severe cuts. At that time I wanted to close my money market account with what was then Cortal Consors due to the interest rate cut, which required a phone call to the bank. When I called them, they asked about the background to the cancellation and my answer was truthful that the interest rates were well below the market rate. The customer advisor made himself understandable and offered me to continue my call money account at the new customer conditions. I was surprised and immediately agreed, because the new customer campaigns were already very good back then.

I can't say whether it works the same way with the depot. But it would be conceivable. But now further. Let's take a look at the newcomer below Trade Republic.

Depot comparison: Trade Republic* in the securities account comparison

Trade Republic is an online broker specializing in cheap trading via smartphone. The provider promises to trade for 0 euros direct fees + 1 euro exchange fees. Wow. This is an offer! But stick with it one euro of costs?

How does commission-free trading work?

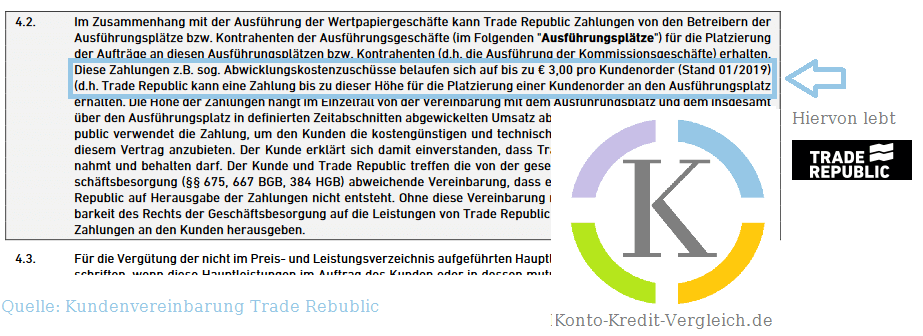

There's no free lunch - From something the provider must Trade Republic* yes live. So - how does it work? First of all, it should be said that the commission-free model is not new, but has existed in the USA for a long time. It works because brokers receive rebates from trading partners in addition to fees paid by clients. At Trade Republic, trading is currently only possible through two trading partners. Via Lang&Schwarz and via HSBC.

First of all, Trade Republic has created an extremely lean cost structure and reduced unnecessary costs in many places. As a result, the broker needs correspondingly less income. But that's not all.

For trading, Trade Republic (like other brokers, by the way) receives reimbursements, so-called settlement cost grants. This amount to up to € 3.00 per customer order. Thus, the broker earns up to 3 euros per trade. That's why Trade Republic relies on active traders. These bring in the fees for financing the broker. And here the circle closes to the motto & concept of the broker. With Tap, tap, trade should make it as easy as possible for customers to trade online.

At Trade Republic, all orders are filled via long and black, which is not an advantage

Lang und Schwarz is a broker from Düsseldorf. The trading venue LS Exchange was launched in 2018 together with the Hamburg Stock Exchange. All securities orders are processed via the Lang & Schwarz stock exchange. Derivatives are settled through HSBC.

6,500 stocks and 500 ETFs can be traded via LS Exchange. The stock exchange is monitored by the Hamburg Stock Exchange. You can trade via Lang & Schwarz between 7.30 a.m. and 11 p.m. The spreads are tied to Xetra and are quite similar, at least during Xetra opening hours. Larger price differences can arise outside of XETRA opening hours and these will be to the detriment of investors due to the low level of liquidity.

So make sure that if possible you only go within the Stock exchange opening hours from Monday to Friday executes orders. If the paper is traded on XETRA, it is from Monday to Friday. from 9.00 a.m. to 5.30 p.m. Then you also get a good spread! When trading in the Trade-Republic app in the evening, no warning is issued about the higher spread, which gives the provider negative points in terms of transparency. Lang and Schwarz commented on the bad spreads in the late evening as follows on his website.

“During the opening of the stock exchanges, we can set a tight spread because we have the opportunity to hedge against price change risks through counter-trades on the stock exchanges. This option is no longer available after the stock exchange closes. In this respect, the wider spread replaces the missing hedging option.”

Long and Black to rising spreads late in the evening

So there is a bit of transparency, you just have to look for the clues!

Trade Republic: OTC trading via HSBC

With its partner HSBC, Trade Republic offers over-the-counter direct trading for derivatives such as certificates, reverse convertibles and warrants. The opening times are from 8:00 a.m. to 10:00 p.m.

Trade Republic's ETF savings plan offer in a portfolio comparison

The provider provides 430 ETFs available to invest in. of that 280 be saved for free. The ETFs are from iShares and WisdomTree. iShares should be known to most as the leading ETF division of the giant BlackRock. WisdomTree, on the other hand, offers various niche ETFs. This includes, for example, investing in cryptocurrencies.

At Trade Republic you can create savings plans from 25 euros up to a maximum of 5000 euros. Creating a savings plan is very easy. You can set your savings amount, the start date and the debit interval of your ETF savings plan in just three taps. As with all providers, your ETF savings plans can be terminated at any time. This means that the provider is also suitable for ETFs, although there are better providers in the "Depot Comparison ETF" (Smartbroker or DKB, for example).

Conclusion on Trade Republic

The Trade Republic concept definitely brings a breath of fresh air into the scene. The provider is breaking new ground in terms of user interface and only offers operation via smartphone. It is aimed at the younger smartphone-savvy generation. Especially for this generation it is also interesting to trade for only 1 euro. As long as you trade within the stock exchange's opening hours, there are no further fees due to the LS Exchange price link to XETRA.

Due to the low trading fee, it is also possible to place a small order over 100 euros without incurring insanely high trading fees (namely in the case of a 100 EUR investment only 1 %), as is the case with the "classic" online brokers à la Consors* (4 %), DKB* (10 %) or ING* (7.4 %) would be the case. A real plus. What we didn't like was that one is tied to the Lang & Schwarz stock exchange and that the risk of illiquidity after the stock market is closed is not pointed out. In any case, I am curious to see how the commission-free model will continue and whether others will take this as an example.

In this article I introduce you Alternatives to Trade Republic in front. Compared to the smart broker, however, Trade Republic cannot keep up. The low fees cannot compensate for the disadvantage of only one stock exchange. Due to the great interest in Trade Republic, some 1:1 comparisons of the broker follow. We let Trade Republic compete against the Comdirect, Consorsbank, Smartbroker, DKB and Justtrade.

Trade Republic vs Comdirect: Which broker is ahead in the securities portfolio comparison?

Both brokers have attractive conditions, which is why a comparison of Trade Republic vs Comdirect is interesting. Trade Republic convinces with very low fees of 1 € per trade. In addition, Trade Republic offers many free savings plans and a very good app at. Comdirect has next to a easy-to-use desktop interface also one trading app in program. In terms of price, however, comdirect cannot keep up with Trade Republic. The broker demands €3.90 per order and after 12 months at least €9.90 per order. However, the advantages of comdirect lie in the significantly larger range of functions and the opportunity to trade on a real stock exchange. At Trade Republic, on the other hand, trading is only possible via Lang&Schwarz. But also the fact that at comdirect a depot transfer is possible and not in the case of the Republic of Commerce is another plus point for comdirect.

Trade Republic vs Comdirect: Execution of savings plans

at comdirect all savings plans from approx. 3:30 p.m. on Xetra executed. Therefore, execution time and location of the savings plans are top at comdirect. Finally, at 3:30 p.m., both US stock exchanges and German stock exchanges opened. This gives the investor the best possible price. This compensates for the somewhat high savings plan fees at comdirect of 1.5 % again a bit. But comdirect has even more features: A securities loan can be taken out for just under 4 % interest and a useful one too Depot opened for Junior will.

Trade Republic, on the other hand, executes ETF savings plans on the electronic stock exchange LS Exchange during Xetra trading hours. The broker does not specify a time. However, according to various reports on the Internet, savings plans are preferably carried out late in the afternoon between 4:30 p.m. and 5:30 p.m.[1, 2]. This is actually a pretty good time. However, it would be desirable if Trade Republic would set a time. That would be more transparent. comdirect does it better.

Recommendation for the decision Trade Republic vs Comdirect

Because of the "better equipment". comdirect* compared to Trade Republic. Compared to comdirect, Trade Republic offers a significantly smaller range of functions. However, the Trade Republic Depot is also available at a cheaper price. But if you are satisfied with iShares ETF and want a cheap entry-level depot Trade Republic In good hands.

To the provider: Comdirect.de |

To the provider: TradeRepublic.com |

Trade Republic vs Consorsbank: Which is the better broker in the securities portfolio comparison?

Now let's see if the young Trade Republic can take on the Consorsbank Depot or not. When it comes to fees, Trade Republic is ahead at just €1 per trade. At the Consorsbank you have to shell out €3.90 per trade. In addition, Trade Republic offers many free savings plans and a very good app at. But the Consorsbank also has a easy-to-use desktop interface also one trading app in program. The advantages of the Consorsbank lie in the significantly larger range of functions and the possibility to trade on a real stock exchange. At Trade Republic, on the other hand, trading is only possible via Lang&Schwarz. But also the fact that at Consorsbank a depot transfer is possible and not in the case of the Republic of Commerce is another plus point for Consorsbank.

at consorbank all savings plans are canceled by approx 09:30 a.m. at Tradegate executed. Xetra has been open for 30 minutes and the liquidity is correspondingly good. But the Consorsbank has even more features: A securities loan can be taken out for 5.4 % interest and also a useful one Depot opened for Junior will. The Consorsbank often offers attractive new customer conditions or "lock offers". The cheap trader account can currently be opened at a very reasonable €3.90 per trade. After 12 months, however, the conditions become noticeably worse.

Recommendation for the decision Trade Republic vs Consorsbank

Because of the "better equipment". consorbank* compared to Trade Republic. Because compared to the Consorsbank, Trade Republic offers a significantly smaller range of functions. However, the Trade Republic Depot is also available at a cheaper price. But if you are satisfied with iShares ETF and want a cheap entry-level depot Trade Republic In good hands.

To the provider: consorsbank.de |

To the provider: TradeRepublic.com |

Trade Republic vs Smartbroker: Battle of the cheap brokers in the securities account comparison!

If you only need a smartphone app for banking, you get it Trade Republic *an unbeatably cheap depot. On the other hand, if you value a fully-fledged broker, you should go to the smart broker* grasp. Smartbroker wins the Comparison Smartbroker vs Trade Republic, namely for almost all defined criteria. Next to one great offer for ETF savers as well as traders the broker was also convincing during the trading-intensive days in March and April 2020 a stable system. For small depots or as a second depot Trade Republic* but well suited in this comparison test despite the setback suffered.

Why so many people want to know whether Trade Republic or Smartbroker performs better in a depot comparison

- The young vendors Trade Republic * and Smartbroker* convince with a clear price structure and fair conditions.

- In terms of price, they leave most other providers behind.

- Both providers bring since fresh wind into the scene and declare war on the established banks

Recommendation to Smartbroker or Trade Republic in one sentence

- Trade Republic: If you only need a smartphone app for banking, you get it Trade Republic *an unbeatably cheap depot.

- smart broker: If you want to avoid the disadvantages of overpriced spreads (accidental trading late in the evening) and value desktop access, Smartbroker* is the right choice.

|

|

| To the provider: Smartbroker.de | To the provider: TradeRepublic.com |

Trade Republic vs DKB: Which broker convinces in the securities portfolio comparison?

Established Broker vs Newcomer: DKB vs Trade Republic! First of all, Trade Republic comes out on top when it comes to fees at just €1 per trade. At the DKB, at least €10.00 per trade must be shelled out. In addition, Trade Republic offers many free savings plans and a very good app at. The DKB desktop interface looks comparatively old-fashioned. And the banking app of the DKB still has no brokerage function. The advantages of the DKB lie in the significantly larger range of functions and the possibility to trade on a real stock exchange. That too DKB Cash current account has been offering excellent conditions for years. At Trade Republic, the customers' funds are managed by the Berlin solaris Bank. Trading at Trade Republic is only possible via Lang&Schwarz. But also the fact that at DKB a depot transfer is possible and not in the case of the Republic of Commerce is another plus point for DKB.

Recommendation for the decision Trade Republic vs DKB

Because of the "better equipment". DKB* compared to Trade Republic. Because compared to the DKB, Trade Republic offers a significantly smaller range of functions. However, the Trade Republic Depot is also available at a cheaper price. But if you are satisfied with iShares ETF and want a cheap entry-level depot Trade Republic* In good hands. The DKB depot, on the other hand, is due to the favorable savings plans for Vanguard ETFs, to the Current account with worldwide free cash availability and other extras such as the Landlord Package* Interesting.

To the provider: DKB.de |

To the provider: TradeRepublic.com |

JustTRADE vs Trade Republic: The free brokers compete against each other in the securities portfolio comparison!

With the discount brokers JustTRADE and Trade Republic Investing on the capital markets has become somewhat easier. Two of the recently introduced first mobile commission-free app and web services in Germany. In the article Smartbroker vs Trade Republic (test & experiences) we have already compared 2 newcomers with each other. Here it goes in a similar style. Because mobile brokers are enjoying increasing popularity on Google search queries and also when comparing securities accounts. Below is a summary of how the two brokers compare. If you want to know more about the comparison of Justtrade and Trade REpublic, you can in the article Justtrade vs Trade Republic read.

|

|

| To the provider: justTRADE.com | To the provider: TradeRepublic.com |

That Onvista Depot* in the securities account comparison

The Onvista depot has a simple structure: an order costs five euros plus two euros for exchange fees. So that's 7 euros. You can get an ETF savings plan from onvista for one euro. Unfortunately, now only up to 500 euros. The fee for a savings plan is then 0.2 % for an investment of 500 euros. If you want to set up higher savings plans, you can set up several savings plans in parallel. You can trade on all German stock exchanges and even on US stock exchanges for a surcharge.

Onvista* offers numerous advantages over other brokers:

- Favorable fees for 7 euros, regardless of the order size,

- savings plans for 1 euro; However, only between 50 and 500 euros

- Price stability: So far, no bait offers that subsequently became much more expensive

- Zero deposit fee

- No penalty interest on the clearing account

- The possibility to buy with the PC

- Direct trading on a real exchange

So, is everything great? Nearly. That's why I like to use the onvista depot myself and have already recommended it to family and friends.

I can overlook minor negative points. But since I want to be as transparent as possible, I mention them of course:

Negative points about onvista

I think the web interface takes some getting used to. For me, the operation is always a bit unintuitive, because I always want to call up a function from the menu and then get the error message that the corresponding function/screen is already open. I didn't know that before. Executing an order is also a bit unusual, as there is no second query, but the order is executed immediately after clicking on buy/sell. So you have to be a bit careful here. It's also a pity that savings plans are limited to 500 euros. So those are pretty minor things compared to Flatex.

Depot comparison ETF: Savings plans are cheap with one euro. However, you can only create savings plans between 50 and 500 euros. In the ETF category, onvista is only average in a depot comparison. The savings plans are very cheap, but the range of 50-500 euros investment per execution is too narrow. Onvista should improve here.

Conclusion to onvista

I have a certain amount of confidence in onvista that your conditions will remain stable. In any case, so far there have been no signs to the contrary. With the disadvantages I can live well with the large bar of advantages. All in all, a great provider that I can recommend with a clear conscience.

Depot comparison: Onvista* in bullet points

Onvista depot at a glance | |

|---|---|

| To the provider: Onvista.de |

Depot comparison: targo bank* – Still an interesting broker for lenders?

Unfortunately, Targobank has worsened your conditions for the exchange bonus. Currently there is the exchange bonus from 0.75 % up to 5000 euros in the free Klassik Depot only for investment funds. For ETFs and other securities, the exchange bonus is only paid out with a Plus custody account, which is subject to a fee. The catch: The plus depot costs at least 1.5 % charges. Unfortunately, the fees are higher than the income. Pity!

The online classics in a depot comparison: ING*, DKB* & Comdirect* – How do you compare to the new competition in the securities portfolio?

The big online banks have the advantage that they can put together an all-inclusive package for customers. checking account with Visa card & deposit are available from a single source and are comparatively affordable. From the online classics is the DKB* my favorite. Orders are here up to 10,000 euros with a fee of 10 Euro the cheapest. The other banks charge percentage fees, which then exceed 10 euros for order sizes of around plus or minus 3,000 euros.

The classics have all been on the market for many years and stand for continuity and clear cost structures. Particularly interesting for small investors: The everything from a single source solution from ING*, DKB* & Comdirect*.

The costs of ING, DKB & Comdirect in comparison

As already mentioned, the DKB* a very simple cost structure. For a one-off investment, the fees are 10 euros up to 10,000 euros, above that a flat rate of 25 euros. The savings plans are also cheap at the DKB. They only cost 1.50 euros and are independent of the amount of the savings plan. The DKB has a wide range of ETFs that are eligible for savings plans. Currently 755 ETFs can be saved via the DKB. This puts the DKB in the top group when it comes to the selection of ETFs that are eligible for a savings plan. The minimum savings rate is 50 euros, the maximum rate is 100,000 euros. This is a huge amount for a savings plan. A plus point for the DKB in the ETF category in the depot comparison.

Vanguard ETFs for a flat rate of €1.50 at the DKB – a plus point in a depot comparison

Currently, the Lyxor and Vanguard ETFs (119 Vanguard ETFs available) can be saved at a reduced fee of €1.50. This makes the DKB very attractive, especially for passive ETF savers. With a Vanguard savings plan for €1.50, the hearts of ETF savers simply beat faster. Therefore, a plus in the depot comparison for DKB!

For the other two banks – ING*, & Comdirect* – the order fee depends on the amount invested. The basic amount lies with both banks at about 5 euros. Trading costs are at 69.90 euros (ING) and 59.90 euros (Comdirect) capped. For the 10 euro fee the DKB* you can at ING*, & Comdirect* Only execute an order of just under 3,000 euros. The latter two banks are therefore significantly more expensive and earn negative points in a depot comparison.

For a savings plan over 100 euros you pay at the Comdirect* as with the DKB* 1.50 euros. In the ING* the price is only slightly higher at 1.75 euros.

In the securities portfolio comparison, DKB scores with a good ETF offer! – Extras: landlord package and junior depot

The DKB also offers a Junior Depot for their own offspring. For landlords, this may be the case DKB landlord account* Interesting. There are several money pots here, so that the money flows can be sorted and reserves can be built up comparatively easily if the parents also have a checking account there.

looking for one Depot for the junior? This way >>

You can get a junior depot from onvista* currently no longer. at smart broker* this is also possible (but not online at the moment, but only on request by e-mail).

Conclusion on the classic online depots ING*, DKB* & Comdirect*

The classic custodian banks are particularly suitable for people who "All from a single source" solution for your finances. Of the three providers, the DKB* with a depot with low fees. When it comes to the number of ETFs eligible for savings plans, DKB leaves the other providers in the shade. Also are Vanguard ETFs can even be invested for as little as EUR 1.50. the DKB* also convinces with a checking account* with which you can withdraw cash worldwide free of charge. Due to the fair conditions, the DKB Girokonto was also test winner at Konto-Kredit-Vergleich.de in the category Best checking account for travelers. Therefore, the DKB in particular can keep up well with the cheaper providers, even if the interface is a bit old-fashioned.

Depot comparison: DKB* (#1 for Vanguard ETF)

- Anyone who likes to use savings plans as a vehicle is with the DKB* Depot well served. Although the savings plan here is slightly more expensive at EUR 1.50 than onvista, you have a selection that is almost five times larger, although the popular Vanguard ETFs are included onvista* and DKB* Are available.

- the DKB* also convinces with features like junior depot, Current account with worldwide free cash availability, long reputation as a fair bank without bait offers and the landlord package.

- If you want everything from a single source, go to the DKB* correctly lifted.

- You are also in good hands with the DKB Vanguard ETF savers.

JustTRADE* in the securities account comparison

Another new broker in the depot comparison is the provider justTRADE. Similar to Smartbroker and Trade Republic, this offers completely free trading on the stock exchange. The broker is more concerned with this active investors. For example, numerous derivatives (> half a million) are available. justTRADE has also launched an app for mobile trading. Unfortunately, currently many standard features such as Deposit transfer, exemption order and even ETF savings plans are not yet available at justTRADE. But it can be assumed that improvements will be made in the near future, and that the Frankfurters still have a few things in the pipeline. Until then, I recommend using the instead smart broker* gain weight. This already has a securities account transfer, an exemption order and many cheap savings plan ETFs.

In another article we have justTRADE compared to Trade Republic.

You are interested in investing with a Lombard loan. in the Securities loan comparison you can find the best providers in comparison

Securities custody comparison: which one is it? best portfolio for small investors and beginners?

Are you a beginner and want to know which is the best depot for small investors? Both beginners and professionals best choose a depot without deposit fee. No minimum deposit should be required for the opening for beginners. Also, the bank should not attach any further conditions to the opening of a securities account. It is also advisable for beginners a cheap depot with excellent performance to put. The Smartbroker offers a wide range of functions so that you are well prepared for later.

Smartbroker is also convincing favorable conditions for one-time purchases and savings plans. Smartbroker does not charge hidden fees. So are for example foreign dividends or same-day partial executions without fees. You trade with the Smartbroker on all German stock exchanges. This avoids fees due to large spreads. Also in comparison of Smartbroker vs Trade Republic Smartbroker was very good. In my opinion, Smartbroker offers that best depot for small investors and beginners.

Incidentally, it is not always possible to have multiple custody accounts with one broker. Because not only banks sometimes do not offer the opening of several accounts at the same time, too several depots with brokers are not always possible, like geldanlage-leicht-machen.de reported.

Smartbroker performs very well in securities account comparison | |

|---|---|

Favorable trading on all German stock exchanges | To the provider: Smartbroker.de |

Never bought a share? Buy shares step by step!

Last but not least in the securities portfolio comparison: My criteria for measuring the broker's performance

For successful stock and ETF trading a cheap broker alone is not a sufficient criterion. Reputable and trustworthy top brokers can also use one instead strong range of services score. Therefore I have in this securities account comparison 20 features Are defined. The more of these a broker fulfills, the better! The online depot comparison from Konto-Kredit-Vergleich.de is therefore more detailed than many broker comparisons from the well-known major providers.

[sp_easyaccordion id="7740″]

To theDepot overview

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

Title picture: Some icons are from monkik from www.flaticon.com

Pedestal: Icon of surang fromwww.flaticon.com