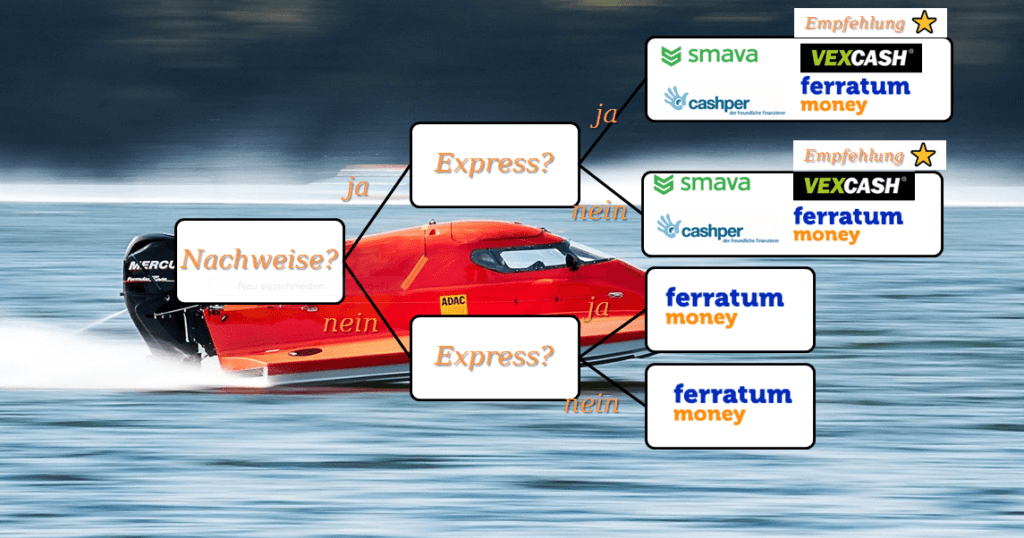

This article is all about Borrow money without proof of income. through special credits can you without proof of income get cash. in the Small Loan Test Has Konto-Kredit-Vergleich.de determined that a Loan without proof of income only at the Ferratum Bank* is available. At Ferratum you can eg 500 euros credit without proof of income or one 1000 Euro credit without proof of income to graduate! Of the Credit is for the self-employed, students and unemployed without proof of income lockable.

However, without proof of income means not without income. You just don't have to prove your income with proof of income. This works online with a loan without proof of income digital account check. The provider also pays attention to this return debits on the bank statement, which worsen the chance of a loan. If you have little or no income, you may also be interested in these 4 options credit without income to obtain.

Do you have bad credit and need a new car? In the guide: Car loan without SCHUFA query you will find an alternative way to get a car loan despite bad credit.

With a special loan you can borrow money without SCHUFA and proof of income

What you can learn here

- With a special loan you can borrow money without SCHUFA and proof of income

- Borrow money without SCHUFA and proof of income

- Loan without proof of income – Even the self-employed, unemployed, students or people in the probationary period can borrow money without proof of income

- Test shows: A "loan without proof of income" is only available from Ferratum Bank*.

- Borrow money without proof of income: At Ferratum Bank* you can get a loan of up to 1,000 euros without proof of income even if you are a student, self-employed or unemployed!

- Loan without proof of income and guarantors

- Your 3 options for credit without proof of income

- Borrow money without SCHUFA information and proof of income: many black sheep on social media!

- A loan completely without credit check or SCHUFA information and proof of income does not exist - But there are alternatives

- If someone offers you a loan via Facebook without SCHUFA information and proof of income, it may be a scammer!

- FAQ: Borrow money without SCHUFA and proof of income?

- What income is required for a loan without proof of income

- Where can I get a loan without proof of income?

- How can I get a loan with no income?

- What do I need to get a loan?

- What are the conditions for a loan without proof of income

- Can I take out a loan online without a printer?

- Which bank gives credit to the self-employed, unemployed or students without proof of income?

- Where are there really credit bureau-free loans?

- Express credit without proof of income: Only 24 hours until the money is in the account

- Borrow up to 1000 euros without proof of income

- Compare mini loans

- Loan without proof of income: what to do if you are rejected

- Why there is no small loan without SCHUFA information and proof of income from reputable banks

- Fraudsters often take advantage of the ignorance of consumers in need: They advertise on Facebook and other media with a small loan without SCHUFA information and proof of income!

- Minimum income of small loans in comparison

- Everything you need to know about borrowing money without Schufa and proof of income

- Loan without proof of income in the test: where to complete it?

- If someone offers you a small loan via Facebook without a SCHUFA report and proof of income, they may be a scammer! It is safer to stick to banks and the reputable providers mentioned here, such as Vexcash*, Cashper*, Ferratum* or SMAVA*! ⚠️

- Loans without proof of income are also suitable for low earners

- Borrow money without proof of income – the overview

- Santander Bank loan available without salary statement?

- Even with easy Credit you cannot borrow money or take out a loan without income!

- Express credit: 300 euros express credit, 500 euros or even 1000 euros immediately: what loan amounts you can get!

Konto-Kredit-Vergleich.de has examined all providers of small loans or small loans, checked and analyzed the conditions. The result of the test: There is currently only one provider where you can actually take out loans without proof of income: Ferratum Bank*. The bank also offers an express option for an additional charge. In addition, the SCHUFA is queried here, but it is also possible to get a loan with a moderate credit rating. For example, if there are small negative features in the SCHUFA file that are not relevant for lending.

Borrow money without SCHUFA and proof of income

the Credit request from Ferratum* will not be sent to SCHUFA reported: That is Borrow money without SCHUFA and proof of income. If you are not sure about your SCHUFA, you can take a test at Ferratum to see if you would get a loan. To do this, fill in your personal data and bank details, as shown in the pictures. The test takes less than a minute and runs in the browser. You don't have to print out any documents or anything like that. Thanks to the simple application process and few preliminary checks almost everyone gets a loan.

If you are looking for a small loan or Loan without SCHUFA information are, you can also get help from the credit experts at Smava* seek advice: proof of income of at least 601 euros is required! Another alternative is Loans for Germans from Switzerland or Liechtenstein.

Loan without proof of income – Even the self-employed, unemployed, students or people in the probationary period can borrow money without proof of income

It is often not too difficult for people with a fixed income to get a loan from a bank. Without a fixed income, however, it is much more difficult to get a loan. A Loan without proof of income is then the drug of choice for the self-employed, the unemployed and students. In contrast to conventional loans, a loan without proof of income does not require verification of salary statements.

A Loan without proof of income is therefore particularly interesting for: self-employed, students and the unemployed. But even people in the probationary period find it difficult to get a loan from a regular house bank: sufficient proof of income is rarely available.

The self-employed face a similar problem: Although they can show sufficient proof of income, these are rarely accepted by house banks. Therefore, the question is also asked in this context: "Is a loan for the self-employed feasible without proof of income?

Small loan test: To solve the problem, Konto-Kreditvergleich.de scanned the market and created a Loan without proof of income sought.

Test shows: A "Loan without proof of income“ is only available at the Ferratum Bank*

If you have little, irregular or no income, you can apply for a reputable loan without proof of income from Ferratum Bank*. But even with Cashper* you can get almost a loan without a credit check and proof of income. The requirements for creditworthiness and income are quite low (700 euros). Vexcash* convinces with low prices and the fastest payment: For an additional charge of 39 euros, you get the small loan with immediate payment!

Borrow money without proof of income: In the Ferratum Bank* you also get as Student, self-employed or unemployed a loan of up to 1,000 euros without proof of income!

Loan without proof of income and guarantors

Ferratum Bank also grants a loan without a guarantor. The bank only carries out a digital account check. You have to pass this in order to get a loan paid out. The bank doesn't really care about anything else. On the other hand, house banks often demand guarantors if the income is not Celebration are. The small loan test at online banks, on the other hand, shows that the self-employed can take out a loan from Ferratum without proof of income and a guarantor.

Your 3 options for credit without proof of income

1) Credit without proof of income with a small loan

the Ferratum Bank* grants a loan of up to 1000 euros without proof of income. It is also awarded if the credit rating is medium. Important to know - The loan request is not reported to the SCHUFA: Therefore you can from Borrow money without SCHUFA and proof of income to speak. As in section Minimum income of small loans in comparison shown require the other providers vexcash*, Smava* and cashper* Low level proof of income. A loan without proof of income is only available in Germany via ferratum*.

2 ) Credit without proof of income from private individuals

There is a realistic chance of getting a low-income loan from private providers. These peer-to-peer (P2P) lending are also for students, trainee or Pensioner suitable.

One of the largest peer-to-peer lending providers is Smava. With Smava you can take out a P2P loan of up to 120,000 euros. For a private loan, an income of over 600 euros is required.

A P2P loan is suitable for the self-employed, students or retirees. The creditworthiness score is determined using over 300 characteristics. One of these features is the SCHUFA information. Therefore, people with medium credit bureau also have a real chance of getting a loan.

To get a personal loan, monthly earnings are from at least 600 € necessary.

In contrast to conventional loans, it is not the bank that decides on lending on P2P platforms, but rather private investors. Therefore, it is important that you describe as precisely as possible what you want to use the money for. The better the description of your loan project, the faster the personal loan will work

3) Request for a loan without proof of income from the house bank

If you are like many people in Germany, your house bank is the first point of contact when it comes to finances in general or a Loan without proof of income specifically goes. Most likely will. Without proof of income, however, the loan request from your house bank is very likely rejected. Normally, banks need proof of income such as a wage or salary slip to assess creditworthiness.

use collateral

It may be advisable to use loan collateral. Even if it is rather unusual to work with loan collateral for small loan amounts, which is the main issue here, it is for larger loans such as a car loan or even one construction financing Common practice. In another article, we identified banks that have one Car loan without loan security, i.e. without a vehicle letter forgive.

| Credit Security | ✅Advantages✅ for borrowers | ❌Cons❌ for borrowers |

|---|---|---|

land charge / mortgage  | property ➕High loan-to-value ratio for hedging automobile ➕Possibility if you don't have your own home ➕In the event of damage, the bank receives compensation from the insurance company. | property ➖ Costs for land charge registration ➖ Not possible if the property is already encumbered with a land charge higher than the lending value. ➖ The bank acquires the right to foreclose on the property if the loan installments are not paid. automobile - Fully comprehensive insurance required ➖ The value of the vehicle must be appraised by an expert. ➖ If the borrower defaults, the car becomes the property of the bank. |

guarantor | ➕ The loan is often approved with a guarantor with a good credit rating. ➕ Your own children or good friends/relatives are suitable as guarantors ➕ Your own children will inherit the debt anyway, resulting in no further disadvantage for you as a guarantor. | ➖ the creditworthiness of the guarantor is also checked. ➖ the citizen is liable for the loan amount. ➖ Spouse cannot be a guarantor. |

second applicant | ➕ The loan is often approved with a second applicant with a good credit rating. ➕ Your own children or spouse are suitable as second applicants. ➕ Your own children will inherit the debt anyway, which means that there is no further disadvantage for you as a second applicant. | ➖ The creditworthiness of the second applicant is also checked. ➖ the second applicant is liable for the loan amount. |

Residual debt insurance (RSV) | ➕ In the event of death, heirs are not burdened by residual debts ➕ high acceptance by the banks | ➖ Credit rates increase |

pledge | ➕In addition to the mortgages on cars or real estate mentioned above, mortgages on other valuables such as jewelery or similar are also possible. | ➖ Little acceptance by credit institutes as special storage is required. ➖ High effort for the bank. |

savings balance | ➕ Liquid security with good bank acceptance ➕ Savings are recognized as security at 90 - 100 % | ➖ Credit may only be partially recognized. ➖ As a rule, the lack of savings is the reason for the loan application |

Wage and salary | ➕ Wages and salaries from permanent employment are one of the best forms of security ➕ Also recognized by foreign banks | ➖ The self-employed find it more difficult to provide proof of salary and usually have to prove 2-3 years of salary |

securities | ➕ Liquid security with good bank acceptance ➕ Securities can be pledged up to 90 % depending on the type ➕ Favorable conditions (see Securities Loan Comparison) | ➖ Dynamic calculation ➖ Margin calls |

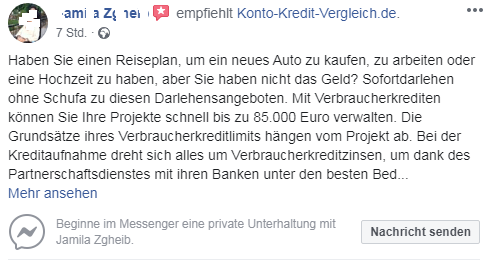

Borrow money without SCHUFA information and proof of income: many black sheep on social media!

I have already seen various ads and posts on Facebook on the subject of “borrowing money without SCHUFA information and proof of income”. In fact, however, Ferratum Bank is the only reputable bank that only checks your SCHUFA score and does not require any proof of income. The SCHUFA information is an analysis of your payment behavior in the past. In addition to other criteria, your credit rating is calculated from SCHUFA. If everything is in order, you will receive a loan approval. If your Schufa score is too low, your loan request may be rejected. In this case, you should not take the rejection lightly, but try to find out the cause. With these tips you are guaranteed to get a loan! They are written from the point of view of credit despite SCHUFA, but can be used in general.

A credit without any credit check or SCHUFA information and proof of income doesn't exist - but there are alternatives

Alternative to the loan without a credit check and proof of income: If you are particularly concerned about a quick payment, you should go to the provider Vexcash* go: Vexcash creates an express payout in 30 minutes. But even without an express option, Vexcash is faster than Ferratum, SMAVA or Cashper. It will then take about 3-4 working days for the money to be in your account. Vexcash also convinces with fair prices. With Vexcash you get a mini loan even with medium creditworthiness. The loan request is SCHUFA-neutral. Another alternative is it one Swiss credit for Germans to consider - Foreign banks also grant a loan with negative credit bureau.

The provider cashper*is even more tolerant in the credit check. However, since Cashper requires an income of 600 euros, it is not a loan without a credit check and proof of income!

If someone offers you a loan via Facebook without SCHUFA information and proof of income, it may be a scammer!

If you need a loan without proof of income, you should contact the Ferratum Bank turn. Otherwise, there are no providers of a loan without proof of income. If someone offers you a loan via Facebook without SCHUFA information and proof of income, it may be a scammer! Better stick to Ferratum, SMAVA, Vexcash, Cashper and Co. Ferratum also has a promotion going on: 50 % discount on the Express credit without proof of income! Only until 30.09.2020!

If you are looking for a loan despite negative credit bureau, you should consult the credit experts at Smava* seek advice. The provider has specialists who specialize in lending despite a credit bureau entry. However, a low minimum income is a prerequisite for Smava. Learn more about the topic Which bank gives credit despite negative SCHUFA.

FAQ: Borrow money without SCHUFA and proof of income?

What income is required for a loan without proof of income

Without proof of income, not without income. At Ferratum, for example, an income of at least €1,100 is required to get a loan. However, you do not have to prove your income with proof of income. This works online with a loan without proof of income through a digital account check. The provider also pays attention to return debits on the account statement, which worsen the chance of a loan.

Where can I get a loan without proof of income?

In the Ferratum Bench* you also get as Student, self-employed or unemployedr a loan of up to 1,000 euros without proof of income!

How can I get a loan with no income?

You can without Income, second borrower or guarantor, a reputable loan at the Ferratum Bank* apply for. Other reputable providers for low-income earners are cashper*, Vexcash* or Smava*. Here, however, income must be proven

What do I need to get a loan?

ferratum* only carries out a digital account check. You have to pass this in order to get a loan paid out

What are the conditions for a loan without proof of income

Of the Ferratum credit without evidence is recorded for a period of 30 or 62 days. New customers can borrow 1,000 euros. Existing customers even 2000 euros. With a term of 30 days, the loan is repaid in one installment. With a term of 62 days, the loan is repaid in 2 installments. With a term of 30 days, up to 600 euros can be borrowed and with a term of 62 days, new customers can borrow up to 1,000 euros without proof of income.

Can I take out a loan online without a printer?

Yes the Ferratum credit* can be completed entirely online. A printer is not necessary.

Which bank gives credit to the self-employed, unemployed or students without proof of income?

In the Ferratum Bench* you also get as Student, self-employed or unemployedr a loan of up to 1,000 euros without proof of income!

Where are there really credit bureau-free loans?

With Smava, you can get a loan even with a negative credit bureau. In addition, Smava offers very favorable credit conditions because the provider can select the best financing for you from a huge pool of financing. The rating portal eKomi also confirms that Smava is a very good choice. Smava receives 5 out of 5 possible stars from over 32,000 customer reviews. If you need money, you should get your loan now Smava apply and benefit from favorable conditions, a fast payout and good service.

Express credit without proof of income: Only 24 h until the money is in the account

There can be many situations in which you need money immediately: If a bill has to be paid immediately and the account is empty, a simple and unbureaucratic express loan without proof of income can help. For this you can book an express service with many providers of mini loans. However, this costs extra. By applying for the express or "Xpress Service' your application has priority. So you get an instant loan. That is a Loan with immediate payment.

If you do not choose the express option, it may take up to 15 working days for your loan application to be processed and the money transferred. However, with Express Option, you can have the money in your account within 24 hours. With or without express option: The Ferratum loan is taken out without proof of income!

Money in the account today? at Vexcash* you will receive the money in your account within 30 minutes. More about the Express credit with instant payment: here

Borrow up to 1000 euros without proof of income

The provider Ferratum offers a 1000 Euro Loan without proof of income. This is a small loan, also known as "Mini Loan". With a mini loan, the loan amount is usually EUR 100 and EUR 3,000. Since the credit is small, the admission process is easy. Nevertheless, Ferratum is the only provider on the market that completely dispenses with proof of income. If you need larger sums, you can use the comparison calculator for mini loans check. Test shows: The 1000 euros credit without proof of income at Ferratum costs 98 euros in fees. Significantly cheaper, on the other hand, is the 600 euros credit: This is available for 5.11 euros.

Other providers of 1,000 euro loans »

Compare mini loans

Loan without proof of income: what to do if you are rejected

First of all, you should know how banks determine your creditworthiness. You can only outsmart them or think of alternatives if you know how the banks tick. But banks do not peddle this information and try to keep the lending conditions largely secret. This is for reasons of competition law.

However, Konto-Kredit-Vergleich.de naturally tries to find out as much information about the credit rating as possible from the credit providers. This makes it more transparent for the readers whether and to what extent a loan is still possible despite a negative SCHUFA and credit rating.

First of all, it should be noted that the creditworthiness of the banks is determined from several variables. So let's look at each of the factors that go into calculating your credit rating.

Why there is no small loan without SCHUFA information and proof of income from reputable banks

Conventional banks use 3 criteria for assessing creditworthiness: income, expenses and credit bureaus such as the Schufa. Modern banks are satisfied with checking your income and expenses as part of a digital account check. They do not check the SCHUFA. at Smava* we can help you here, provided you have 601 euros. regular income.

Fraudsters often take advantage of the ignorance of consumers in need: They advertise on Facebook and other media with a small loan without SCHUFA information and proof of income!

With a loan without SCHUFA information and proof of income, the risk for a bank is too great. After all, she doesn't know if she'll ever see the money again. Fraudsters often take advantage of the ignorance of consumers in need: On Facebook and other media, they advertise a loan without SCHUFA information and proof of income! Scammers then make promises that the loan will be disbursed after paying upfront fees. Better not get involved in this!

Minimum income of small loans in comparison

Also from the minimum income lenders often keep a big secret. In addition, the required minimum income depends on other criteria. The minimum income depends on the amount of the loan, the loan term, the number of dependents and the SCHUFA score. Furthermore, each credit provider uses its own requirements. Nevertheless, I take the test and want to know where there is a loan without proof of income?

Through the test, I find that there is only one provider of a loan without proof of income: The Ferratum Bank!* Nevertheless, the minimum income requirements for short-term mini loans are also low for Vexcash, cashper and Smava. The following table compares the minimum income requirements of different lenders:

| Offerer | minimum income |

|---|---|

| Ferratum Bank* | €0 (up to a loan amount of €1,000) |

| Vexcash* | 500,- € |

| Smava* | 601,- € |

| cashper* | 700,- € |

In the case of mini loans, the Schufa information is checked, but it is not very important because of the small loan amount (up to €2,000) and the short term (up to 2 months). Some providers then do not look so closely.

There is currently no provider that will lend you a loan without proof of income for amounts over €1,000. ferratum* however, does not require any proof of income up to a loan amount of €1,000. If you only have a small, irregular or no income and a small loan of up to 1,000 euros is sufficient for your needs, you can contact the Ferratum Bank* turn.

If you need a higher loan amount, you must also be able to show that you have a net income of between €700 and €1,150 at Ferratum Bank.

Some credit providers want to know the number of dependents in the household. If you have to make maintenance payments for several people, the minimum income requirements increase.

Everything you need to know about borrowing money without Schufa and proof of income

- ferratum* is the only provider of a loan without proof of income in this Test reputable lenders!

- alternatives are SMAVA*, Vexcash* or cashper* if you have a low income

- If you borrow money without proof of income, all reputable providers will ask a SCHUFA query!

- If people on social media promise you a small loan without SCHUFA and proof of income, it is often fraud!

- You can improve your credit rating if the loan doesn't work out

- Pay off the loan in good time to avoid late fees

- If you are looking for a loan despite negative credit bureau, you should consult the credit experts at Smava* seek advice. The provider has specialists who specialize in lending despite a credit bureau entry. However, a low minimum income is a prerequisite for Smava. But also the small loan from cashper* is awarded in the event of poor creditworthiness. Learn more about the topic Which bank gives credit despite negative SCHUFA.

Loan without proof of income in the test: where to complete it?

If you have little, irregular or no income, you can Ferratum Bank* still get a loan. Because at the Ferratum Bank you get a small loan of up to 1,000 euros without proof of income. The provider checks your Schufa, but does not have such high requirements here. If you are an employee and get a salary, you will find on the site Loan without proof of salary More information. If you don't have proof of your salary, or you don't want to go through the trouble of looking for one, your only option is Ferratum as a no-paycheck loan provider.

⚠️If someone offers you a small loan via Facebook without SCHUFA information and proof of income, it can be a scammer! It is safer to contact banks and the reputable providers mentioned here, such as Vexcash*, cashper*, ferratum* or SMAVA* to keep! ⚠️

Loans without proof of income are also suitable for low earners

However, for people with low incomes SMAVA* the best alternative. Here you will receive a suitable offer that is tailored to your personal situation. But also the providers Vexcash* or cashper* are worth a look. After all, Vexcash only requires a monthly income of 500 euros. But even with Cashper you only have to be able to prove monthly income of 700 euros, which is why the provider should not go unmentioned in an article about a small loan without SCHUFA and proof of income. So a loan without a credit check and proof of income? Not quite, because with Cashper you need an income of 700 euros.

Borrow money without proof of income – the overview

In the small loan test I found many small loans without SCHUFA and proof of income on Facebook and Co. Perhaps you have already noticed providers of a loan without a credit check and proof of income in the social media. Keep away from dubious providers and your alleged loan without credit check and proof of income enough.

Established providers are bettersuch as Smava, Vexcash, cashper or Ferratum.. They also have good offers, because you can get a loan without any proof of income at the Ferratum Bank*. The bank grants the small loan even with bad SCHUFA information. If, on the other hand, you want a loan without SCHUFA information, you should contact the credit experts at SMAVA* turn. But the provider Cashper also grants a small loan without SCHUFA! Even if Cashper does not grant a loan without a credit check and proof of income, the requirements for creditworthiness and income are quite low (700 euros).

Santander Bank loan available without salary statement?

There are many requests for a loan without proof of salary from Santander Bank. I can give you the alternative to this as well Ferratum Bank* recommend, because at Santander employment or pension income is required! Therefore, there is no loan available at Santander Bank without proof of salary.

Even with easy Credit you cannot borrow money or take out a loan without income!

There are many inquiries about a loan without income from easy Credit. I can give you the alternative to this as well Ferratum Bank* recommend, because Easy Credit requires proof of income! With easy Credit you don't get a loan without income.

Express credit: 300 euros express credit, 500 euros or even 1000 Euro immediately: What credit amounts you can get!

With mini loan providers, you can get loans up to 1,500 euros immediately as a new customer. Up to 1.000 Euro credit you can get it even if you are a student or unemployed, because Ferratum offers a 1000 Euro credit without proof of income* gives. You can even apply for a small loan of up to 3,000 euros immediately: However, this is only possible if you are already an existing customer Vexcash* are you. But you can also do this without being an existing customer Borrow 1000 euros immediately from Vexcash*.

Small loans from 100 euros – 500 euros

Small loans from 500 euros – 1000 euros

Small loans from 1100 euros – 3000 euros

If you need more than 3,000 euros, you have to switch to an installment loan. You can find the cheapest installment loans via the Installment loan comparison.

Icons made by Freepik from www.flaticon.com

*Affiliate link: If you get to a provider via one of these links from my website and open an account there, I may receive a commission. This does not result in any additional costs for you. ❤️ THANK YOU for using these links! ❤️

Disclaimer: This is well researched but non-binding information. No liability is accepted for incorrect information.