Digitization has revolutionized securities trading. Whereas stock exchange traders on the trading floor used to be regarded as a privileged species of people who gained or burned entire fortunes within a short period of time, securities trading is now freely accessible to every adult. Traders trade millions of dollars directly on their notebook or PC using the appropriate software. But trading is still surrounded by a nebulous aura. This is to be removed with this Trading lexicon Article to be somewhat thinned out.

A trader's dream is to gain a fortune in the shortest possible time! (Image: Pixabay )

The basics of trading for beginners

What you can learn here

Online trading is not a teaching profession. At universities, digital trading is addressed only marginally. Therefore, the prospective trader must acquire the basic knowledge needed for successful securities trading largely on his own. The following options are available:

- Videos, webinars and tutorials on the Internet

- Professional articles dealing with the topic of trading

- Relevant groups in social networks

Earn money with trading

If you earn money with trading you should have the right mindset and a firm grip on your emotions. Then with a deposit of 100,000 euros 10,000 euros profit per year and more are feasible. The tips shown in the linked article give you the right mindset to make money with trading in the long term.

What is online trading

The term "trading" comes from the English language and describes the Trading with financial products on the stock exchange. While hobby traders occasionally allow themselves to set one or the other position after work, professional traders operate a full-time job. There are several categories of traders, which are divided into different types on the time line.

- Position trading: This refers to trading that can best be described by the catchphrase "buy and wait". Securities are bought and often sit dormant in the investor's portfolio for months or years in order to profit from a long-term positive trend. As a rule, this type of trader is called an "investor".

- Swing Trading: The swing trader usually stays invested in a position for a few days to a few weeks.

- Day Trading: The day of the day trader begins in the morning of each working day with the opening of the stock exchange. In the afternoon, shortly before the close of the stock exchange, he closes all open positions.

- Scalping: This type of trading is the most hectic type of stock market trading. The trader tries to profit from short-term trends and often buys and sells a security within a few minutes.

Fundamental analysis and chart analysis

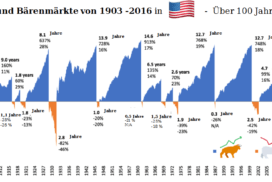

Every trader follows the trend. It is considered optimal if he enters at the beginning of a positive trend, follows it until the trend reverses and then sells his position at the peak. In the case of negative trends, it is exactly the opposite. When the said paper has been sold, the trader waits until the low is reached to buy back in.

However, this only works in theory, because a trend reversal can rarely be predicted exactly. Long-term oriented traders (Investors) rely in their actions on the Fundamental analysis. Priority is given to the examination of business data and the economic environment of the company. The price-earnings ratio and the dividend yield also play an overriding role.

Traders interested in short-term profits follow the Chart analysis. Only the historical development of a security is taken into account. According to this assumption, all other developments are already included in the price. The trader tries to discover a formation in the chart that gives indications of the beginning of a new trend. Ideally, both forms of analysis complement each other to form a picture that indicates a profitable commitment.

Choose the right broker

In order to trade on the stock exchange, a stock exchange license is required from BaFin (Federal Financial Supervisory Authority). This is issued only to brokers. A broker can be a house bank or an independent company specialized in stock exchange trading. In online exchange trading, the broker is a platform that mediates between the exchange and the trader without using its own funds. This platform is used to buy and sell on behalf of the client.

In addition, the broker manages the Deposit accountthrough which all cash flows from stock exchange trading flow. Good brokers provide a demo account with which the New customer can practice and internalize the stock market without investing capital. The broker's costs must be kept transparent and low so that the return is not eaten up. There is also the option of using a Securities Credit leverage the return on investment.

Conclusion

In a nutshell, trading refers to various forms of stock market trading. To learn this in all its forms, a lot of time, discipline and patience is necessary. It is recommended to study the subject in depth, so that the first trade is not the last.