While in Germany the withholding tax is smoothly deducted from the interest income and dividends above the saver's lump sum and is paid directly to the tax office, a complex maze of withholding taxes and double taxation agreements opens up in the case of foreign investments.

In 2023, Germany will have 95 countries a double taxation agreement (DTA) completed.

Unproblematic are Dividend payments from countries without withholding tax such as Ireland, United Kingdom, Singapore, Liechtenstein and some others.

But also for countries that less than 15 % Withholding tax and have a DTA with Germany, there is often no double tax burden, since withholding taxes up to 15 % are usually credited in full against the final withholding tax in Germany.

Withholding tax refunds are costly, which usually become necessary from 15 % withholding tax. This is the case with countries such as Austria, Switzerland, Spain or Italy. Especially Spain and Italy have bureaucratic and very lengthy modalities to refund the double paid tax. In Austria and Switzerland you get your money back after a few weeks, but you still have to deal with the paperwork.

In some other countries, the withholding tax cannot be refunded at all. These include Armenia, Bulgaria, Bosnia-Herzegovina, Tunisia, Montenegro, Serbia, China, Norway and Belgium. And Brazil has had no DTA with Germany at all since 2005, which also means a double tax burden for investors.

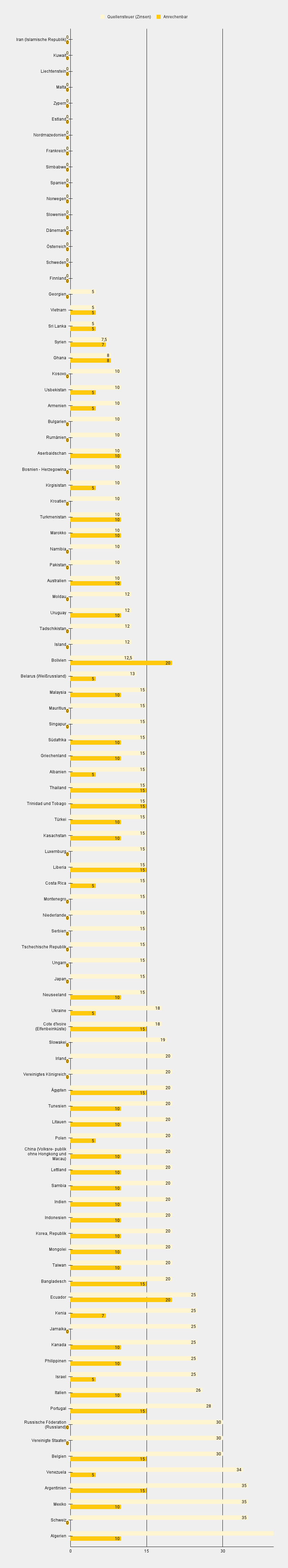

Withholding tax overview countries dividends

What you can learn here

- Withholding tax overview countries dividends

- Withholding tax overview countries interest

- Withholding Tax Overview Countries 2023: These 95 DTAs exist with Germany

- The 10 most important facts about withholding tax on investment income

- What is a withholding tax?

- What is the purpose of a double taxation agreement?

- How much is the withholding tax?

- Withholding tax Germany

- Withholding tax Switzerland

- Withholding tax USA

- Withholding tax France

- Withholding tax Norway

- Withholding tax Canada

- Withholding tax Netherlands

- Withholding tax Denmark

- Withholding tax Austria

- Withholding tax Ireland

- Withholding tax Sweden

- Withholding tax Finland

- Withholding tax Australia

- Withholding tax Italy

- Withholding tax Spain

- Withholding tax Japan

- Withholding tax Luxembourg

- Withholding tax Great Britain

- Withholding tax China

- Countries without withholding tax

- What does no withholding tax mean?

- When do I have to pay withholding tax?

- How do I get the withholding tax back?

There are different withholding taxes for dividend and interest payments.

Here you will find the maximum withholding tax on dividends according to double tax treaty 2023 and how much of it is credited against the final withholding tax in Germany:

You will find the withholding taxes for interest payments in the next chapter.

This is how much withholding tax Germans will have to pay on dividends in the 95 countries in 2023

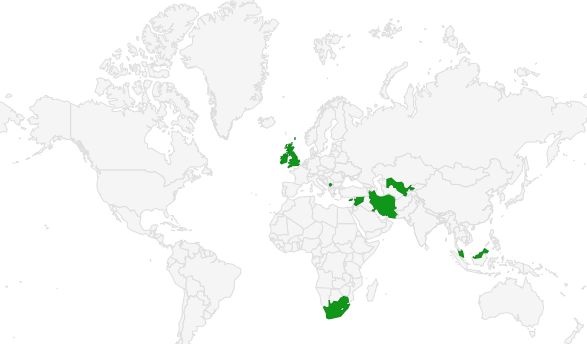

Green countries require less withholding tax than red countries. White countries do not have a DTA with Germany.

In these countries the withholding tax is fully creditable

In green countries, the withholding tax is 100 % creditable against the German KESt. In red countries this is only partially possible or not possible at all. D

Note: The USA are marked in red here, as they levy 30 % withholding taxes, of which only half are credited in Germany (15 %). However, the other 15 % are also offset by almost all brokers through the QI agreement. See Withholding tax USA.

Withholding tax overview countries interest

Here you will find the maximum withholding tax on interest according to double tax treaty 2023 and how much of it is credited against the final withholding tax in Germany:

Withholding Tax Overview Countries 2023: These 95 DTAs exist with Germany

How much you can get back from the foreign withholding tax you can find out in the following table. Use the search function for a quicker overview.

| DBA state | Eligible dividends (in %) | Chargeable interest (in %) | Dividends (in %): a) national withholding tax b) maximum creditable withholding tax under DTAs c) Notional creditable withholding tax according to DTAs | Interest (in %): a) national withholding tax b) maximum creditable withholding tax under DTAs c) Notional creditable withholding tax according to DTAs | Notes on the national Withholding tax collection (letter a ) | Notes on DBA regulations, also special provisions in the DTA (letter b) | National designation of the income or withholding tax | ||

|---|---|---|---|---|---|---|---|---|---|

| Egypt | 102 | 15 | a) 0 / 5 / 10 b) 15 | a) 20 b) 15 | Dividends: 5 % Withholding tax on distributions by listed companies | Right of the source state to subject dividends alternatively to the general income tax levied on total net income. However, the general income tax may in no case exceed an average of 20 % of the net amount of dividends paid (Art. 10 (3) DTA). | |||

| Albania | 8 | 5 | a) 8 b) 15 | a) 15 b) 5 | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 4 to Articles 10 and 11) | taksa individuale e të ardhurave | |||

| Algeria | 15 | 10 | a) 15 b) 15 | a) 10 / 50 b) 10 | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 2 to Articles 10 and 11) | l'impôt sur le revenue global | |||

| Argentina | 20 | 15 | a) 7 b) 15 c) 20 | a) 0 / 15,05 / 35 b) 15 c) 15 | impuesto a las ganancias | ||||

| Armenia | 0 | 5 | a) 0 / 5 b) 10 | a) 10 b) 5 | Dividends: Shareholders who reinvest dividends received in the capital of the distributing company will be refunded the withholding tax withheld upon request. | full taxation right of the source state on dividends and interest from rights or claims with profit participation, if these can be deducted when determining the profits of the debtor of the dividends and interest (Protocol to the DTA, para. 8 to Articles 10 and 11) | |||

| Azerbaijan | 101 | 10 1 | a) 0 / 10 b) 15 | a) 0 / 10 b) 10 | Dividends and interest: no withholding tax on dividends and interest from investment securities (until January 31, 2023) no withholding tax on dividends/interest from shares/bonds issued for trading on the regulated market within five years from February 1, 2023 no withholding tax on dividends from companies producing agricultural products | ||||

| Australia | 151 | 10 1 | a) 0 / 30 b) 15 | a) 0 / 10 b) 10 | Dividends: Certain dividends (e.g. franked dividends and conduit income) are not subject to withholding tax. Interest charges: certain interest payments (e.g. interest from certain public bonds) are not subject to withholding taxation | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these can be deducted when determining the profits of the debtor of this income (Pro- tokoll to the DTA, No. 6 to Articles 10 and 11) | Income tax | ||

| Bangladesh | 15 | 15 | a) 30 b) 15 c) 15 | a) 0 / 20 b) 10 c) 15 | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these can be deducted when determining the profits of the debtor of this income (Pro- tokoll to the DTA, No. 2 to Articles 10 and 11) | ||||

| Belarus (Byelorussia) | 132 | 10 1 | a) 9 / 13 b) 15 | a) 0 / 13 b) 5 | Dividends: 9 % Withholding tax on dividends from companies of the "High Technologies Park" special economic zone Interest charges: Interest on state, municipal or bank bonds and on bonds issued by other Belarusian entities after April 1, 2008 is tax exempt | Full taxation right of the source state on income from rights or claims with profit participation, if these are deductible in the determination of the debtor's profit (DBA Art. 10 No. 3) | |||

| Belgium | 0 | 15 1 | a) 5 / 20 / 30 b) 15 | a) 0 / 15 / 30 b) 15 | Dividends: Tax exemption for dividends up to EUR 800, first withholding tax deduction and subsequent refund procedure Interest charges: 0 % on interest from certain debt securities and bonds; 15 % on interest from government bonds subscribed between November 24, 2011 and December 2, 2011 | Impôt des personnes physiques / per- sonenbelasting (Income tax) | |||

| Bolivia | 12,5 | 20 | a) 12,5 b) 15 | a) 12,5 b) 15 c) 20 | Dividends and interest: the withholding tax of 25 % is levied only on 50 % of the dividends and interest received, so that the effective withholding tax is 12.5 % | Impuesto sobre la renta | |||

| Bosnia - Herzegovina | 0 | 0 | a) 0 / 10 b) 0 | a) 0 / 10 b) 0 | Continuation of the Agreement with Yugoslavia | ||||

| Bulgaria | 0 | 0 | a) 0 / 5 b) 15 | a) 0 / 10 b) 5 | Dividends and interest: a tax assessment and a refund of withholding tax can be applied for in order to take income-related expenses into account | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 4 to Articles 10 and 11) | Данък върху дивидентите и доходите на чуждестранни лица (withholding tax); Закон за данъците върху доходите на физическите лица (income tax). | ||

| China (People's Republic of China excluding Hong Kong and Macao) | 0 / 10 | 10 1 | a) 0 / 10 / 20 b) 10 | a) 0 / 20 b) 10 | Dividends: For the crediting of withholding tax levied on distributions of Chinese shares, see BMF letter dated March 31, 2022 (BStBl I p. 328). Interest charges: No withholding tax on interest from government bonds | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of profits of the debtor of the dividends or interest (Protocol to the DTA, No. 4 to Articles 10 and 11). | |||

| Costa Rica | 15 | 5 | a) 15 b) 15 | a) 15 b) 5 | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of profits of the debtor of the dividends or interest (Protocol to the DTA, para. 2 to Articles 10 and 11). | El impuesto sobre la renta | |||

| Cote d'Ivoire (Ivory Coast) | 152 | 15>2 | a) 10 / 15 b) 15 / 18 | a) 0 / 1 / 18 b) 15 | Dividends: the withholding tax for distributions of listed companies is 10 %, otherwise 15 % Interest charges: no withholding tax on interest from treasury bonds 1 % Withholding tax on interest from long-term government bonds | an increased rate of 18 % applies to the withholding tax levied in Côte d'Ivoire on dividends of tax-exempt or reduced-tax companies (Protocol to the DTA, No. 1 to Art. 10) | Impôt général sur le revenu | ||

| Denmark | 15 | 0 | a) 15 / 27 b) 15 | a) 0 b) 0 | Dividends: 15 % withholding tax if the recipient is domiciled in a country with which an intergovernmental information exchange agreement exists and holds less than 10 % of the distributing company's share capital. | Taxation right of the source country on dividends from rights or receivables with profit participation up to a maximum of 25 % of the gross amount of the income, if they are deductible there when determining the debtor's profit (DBA Art. 10 para. 5). | Indkomstskat til staten | ||

| Ecuador | 10 | 20 | a) 10 b) un- Restricted | a) 25 b) 15 c) 20 | Dividends: 25 % Withholding tax on 40 % of distributed dividends (i.e. effective tax rate of 10 %) | Impusto sobre la renta | |||

| Estonia | 71 | 0 | a) 0 / 7 b) 15 | a) 0 b) 10 | Dividends: Corporation tax is not already levied on retained earnings, but only at the time of profit distribution (in the amount of. 20 % and 14 %, respectively). This "profit distribution tax" represents the corporate income tax of the distributing company; it is none withholding tax creditable to the shareholder. 7 % Withholding tax only applies to dividends subject to 14 % distribution tax. | full taxation right of the source state on dividends and interest from rights or for- ders with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Protocol to the DTA, No. 5 to Articles 10 and 11) | Tulumaks | ||

| Finland | 15 | 0 | a) 30 / 35 b) 15 | a) 0 b) 0 | Dividends: 35 % Withholding tax on dividends from nomi- nee-registered shares if the foreign custodian bank is not registered with the Finnish tax administration or does not report the information on the beneficial owner Interest charges: in principle no withholding tax, only interest from thin capitalization (i.e. interest on a long-term loan granted in lieu of an equity investment) is subject to a withholding tax of 30 % | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 1 to Articles 10 and 11) | valtion tulovero/statlig inkomstskatt | ||

| France | 12,8 | 0 | a) 12,8 b) 15 | a) 0 b) 0 | full taxation right of the source state on income from rights or shares with profit participation, if these are deductible in the determination of the debtor's profit (Art. 9, para. 9 DBA) | Impôt sur le revenue des personnes physiques (IRPP) | |||

| Georgia | 5 | 0 | a) 5 b) 10 | a) 5 b) 0 | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 3 to Articles 10 and 11) | ||||

| Ghana | 81 | 81 | a) 0 / 8 b) 15 | a) 0 / 8 b) 10 | Dividends: no withholding tax on dividends from companies in free trade zones Interest charges: No withholding tax on interest from government bonds | Income tax | |||

| Greece | 5 | 101 | a) 5 b) 25 | a) 0 / 15 b) 10 | Interest charges: Withholding tax exemption for interest from government bonds and certain listed corporate bonds | Φόρος εισοδήματος φυσικών προσώπων (in Latin script: Foros Eisodimatos Fysikon Prosopon) | |||

| India | 10 | 102 | a) 10 / 20 b) 10 | a) 0 / 4 / 5 / 10 / 20 b) 10 | Interest charges: No withholding tax on interest from certain government bonds, 4 % or 5 % withholding tax on interest from certain bonds. Interest/dividends: Income from so-called "Global Depository Receipts" is subject to a withholding tax of 10 % - regardless of whether it qualifies as interest, dividends or capital gains. | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 4 to Articles 10 and 11) | Income tax | ||

| Indonesia | 152 | 10 | a) 10 / 20 b) 15 | a) 10 / 20 b) 10 c) 10 | Dividends: 10 % Withholding tax on dividends from companies investing in certain regions or economic sectors | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 3 to Articles 10 and 11) | Pajak Penghasilan | ||

| Iran (Islamic Republic of) | 0 | 0 | a) 0 b) 20 | a) 0 b) 15 | Mozoué ghanouné maleiat bar dara- mad (income tax incl. surtaxes) | ||||

| Ireland | 0 | 0 | a) 0 b) 15 | a) 0 / 20 b) 0 | Dividends: no withholding tax for EU citizens and for residents of DTA countries | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 3 to Articles 10 and 11) | Income tax | ||

| Iceland | 15 | 0 | a) 22 b) 15 | a) 0 /12 b) 0 | Tekjuskattur til rikisins | ||||

| Israel | 10 | 51 | a) 15 / 20 / 25 / 30 b) 10 | a) 0 / 15 / 25 b) 5 | Interest charges: No withholding tax on interest from government loans | full right of taxation of the source state on dividends and interest from rights or claims with profit participation, if these are deductible when determining the profits of the debtor of the dividends or interest (Pro- tokoll to the DBA, para. 5 to Articles 10 and 11) | |||

| Italy | 15 | 101 | a) 26 b) 15 | a) 0 / 26 b) 10 | Interest charges: Tax exemption of interest on certain loans deposited with a domestic bank or other authorized intermediary, due to the existence of an information exchange agreement between Germany and Italy. | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of profits of the debtor of the dividends or interest (Protocol to the DTA, para. 8 to Articles 10 and 11). | Imposta sul reddito delle persone fisi- che | ||

| Jamaica | 15 | 0 | a) 25 b) 15 | a) 0 / 25 b) 12,5 | Interest charges: a tax assessment and a refund of withholding tax can be applied for in order to take income-related expenses into account | Income tax | |||

| Japan | 15 | 0 | a) 15 / 20 b) 15 | a) 0 / 15 b) 0 | Dividends: 15 % on qualified dividends from listed companies Interest charges: no withholding tax on interest from certain fixed-income securities | Gensenbun (withholding tax) Shotokuzei (income tax) | |||

| Canada | 15 | 101 | a) 25 b) 15 | a) 0 / 25 b) 10 | Interest charges: 25 % Withholding tax only on interest from certain non-fixed income bonds | full taxing right of the source state on income from rights or claims with profit participation, if these are deductible in the determination of the debtor's profit (Protocol to the DTA, No. 3 to Article 10) | Income tax | ||

| Kazakhstan | 152 | 101 | a) 0 / 5 / 10 / 15 b) 15 | a) 0 / 15 b) 10 | Dividends: no withholding tax on dividends from shares listed and actively traded on domestic stock exchanges (KASE, AIFC) 5 % Withholding tax on dividends from companies that are members of the Astana Hub Inter- national Technology Park 10 % Withholding tax on dividends under certain conditions (e.g. holding period of three years) Interest charges: no withholding tax on interest from government bonds and from listed securities | Full taxation right of the source state on income from rights or claims with profit participation, if these are deductible in the determination of the debtor's profit (Art. 10, para. 3 DBA) | |||

| Kenya | 151 | 7,52 | a) 0 / 15 b) 15 | a) 5 / 7,5 / 25 b) 15 | Dividends: no withholding tax on dividends of companies from special economic zones Interest charges: 7.5 % Withholding tax on interest from bearer bonds with a maturity of at least two years 5 % Withholding tax on interest from companies in special economic zones | Income tax | |||

| Kyrgyzstan | 101 | 5 | a) 0 / 10 b) 15 | a) 10 b) 5 | Dividends: no withholding tax on dividends - Of certain companies that have made major investments - from profits not subject to corporate income tax | ||||

| Korea, Republic of | 15 | 101 | a) 20 b) 15 | a) 0 / 14 / 20 b) 10 | Interest charges: no withholding tax on interest from government and currency stabilization bonds | Right of the source state to tax income from rights or receivables with profit participation up to a maximum of 25 % of the gross amount of the income, if these are deductible when determining the debtor's profit (Art. 10 (4) DBA). | |||

| Kosovo | 0 | 0 | a) 0 b) 0 | a) 0 / 10 b) 0 | Continuation of the Agreement with Yugoslavia | Porez iz dohotka | |||

| Croatia | 10 | 0 | a) 10 b) 15 | a) 0 / 10 b) 0 | full taxation right of the source state on dividends and interest from rights or claims with profit participation, if these are deductible when determining the profit of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 3 to Articles 10 and 11) | Porez iz dohotka | |||

| Kuwait | 0 | 0 | a) 0 b) 15 | a) 0 b) 0 | no income tax / withholding tax for individuals | full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the debtor's profits from such income (Protocol to the DTA, para. 5 to Articles 10 and 11) | |||

| Latvia | 151 | 102 | a) 0 / 20 b) 15 | a) 0 / 5 / 20 b) 10 | Dividends: no withholding tax on dividends already subject to 20 % corporate income tax, 20 % Withholding tax on distributions of profits arising before January 1, 2018 Interest charges: no withholding tax on interest from bonds issued by the government or a municipality in Latvia or a state of the EEA, as well as from listed financial instruments 5 % Withholding tax on interest from certain non-publicly traded financial instruments paid by investment service providers to non-independent persons resident in the EEA | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 5 to Articles 10 and 11) | iedzivotaju ienakuma nodoklis | ||

| Liberia | 152 | 152 | a) 5 / 15 b) 15 | a) 0 / 5 / 15 b) 20 | Dividends and interest: 5 % Withholding tax on dividends and interest of certain companies (e.g. mining) Interest charges: No withholding tax on interest from government bonds | Income tax | |||

| Liechtenstein | 0 | 0 | a) 0 b) 15 | a) 0 b) 0 | Full taxation right of the source state on income from rights or claims with profit participation, including income of a silent partner or from participating loans and profit bonds. (Art. 11 para. 2 DBA) | ||||

| Lithuania | 15 | 101 | a) 15 b) 15 | a) 0 / 15 / 20 b) 10 | Interest charges: numerous exemption provisions for interest from certain sources | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 5 to Articles 10 and 11) | Fiziniu asmenu pajamu mokestis | ||

| Luxembourg | 151 | 0 | a) 0 / 15 b) 15 | a) 0 / 15 b) 0 | Dividends: No withholding tax on dividends from certain sources | Impôt sur le revenu des personnes physiques | |||

| Malaysia | 0 | 101 | a) 0 b) 15 | a) 0 / 15 b) 10 | Interest charges: numerous exemption provisions for interest from certain sources | full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the debtor's profits (Protocol to the DTA, para. 5 to Articles 10 and 11) | |||

| Malta | 0 | 0 | a) 0 b) 35 | a) 0 b) 0 | For column A letter b) cf. Art. 10, para. 3 DTA and Maltese tax law | taxxa fuq l-income | |||

| Morocco | 151 | 101 | a) 0 / 15 b) 15 | a) 0 / 10 b) 10 | Dividends: No withholding tax on distributions from companies in free trade zones Interest charges: No withholding tax on interest from government bonds | ||||

| Mauritius | 0 | 0 | a) 0 b) 15 | a) 0 / 15 b) 0 | full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the debtor's profits from such income (Protocol to the DTA, para. 5 to Articles 10 and 11) | Income tax | |||

| Mexico | 10 | 102 | a) 10 b) 15 | a) 0 / 4,9 / 21 / 35 b) 5 / 10 | Interest charges: 4.9 % on interest from certain exchange-traded debt securities no withholding tax on interest from bonds | full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 6 to Articles 10 and 11) 5 % for interest from bank loans | Impuesto sobre la renta | ||

| Moldova | 6 | 0 | a) 6 b) 15 | a) 12 b) 5 / 0 | Continuation of the DTA with the USSR of 24.11.1981; If no withholding tax is levied in Germany on interest paid to non-residents, it is also not subject to tax in Moldova (reciprocity principle). | ||||

| Mongolia | 10 | 10 | a) 20 b) 10 c) 10 | a) 20 b) 10 c) 10 | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of profits of the debtor of the dividends or interest (Protocol to the DTA, para. 2 to Articles 10 and 11). | ||||

| Montenegro | 0 | 0 | a) 15 b) 0 | a) 15 b) 0 | Continuation of the Agreement with Yugoslavia | Porez iz dohotka | |||

| Namibia | 151 | 0 | a) 0 / 20 b) 15 | a) 0 / 10 b) 0 | Dividends: in individual cases, national exemption regulations may be relevant | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of profits of the debtor of the dividends or interest (Protocol to the DTA, para. 3 to Articles 10 and 11). | Normal tax and non-resident share- holders' tax | ||

| New Zealand | 15 | 101 | a) 15 / 30 b) 15 | a) 0 / 15 b) 10 | Interest charges: No withholding tax on interest from bonds participating in the Approved Issuer Levy (AIL) program | full taxing right of the source state on income from rights or claims with profit participation, if these are deductible when determining the profits of the debtor of the income (Protocol to the DTA, para. 4b to Articles 10 and 11) | Income tax | ||

| Netherlands | 15 | 0 | a) 15 b) 15 | a) 0 / 15 b) 0 | Inkomstenbelasting Dividendbelasting | ||||

| North Macedo- nia | 10 | 0 | a) 10 b) 15 | a) 0 b) 5 | full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the income (Protocol to the DTA, para. 3 to Articles 10 and 11) | Personal danok na dohot | |||

| Norway | 0 | 0 | a) 0 / 25 b) 15 | a) 0 b) 0 | Dividends: Shareholders domiciled in the EEA can apply for a full or partial refund of the withholding tax ("shielding deduction"), see BMF letter dated November 15, 2011 (BStBl I p. 1113). | full taxing right of the source state on income from rights or claims with profit participation, if these are deductible in the determination of the debtor's profits (Protocol to the DTA, No. 3b to Article 10) | Inntektsskatt til staten | ||

| Austria | 15 | 0 | a) 27,5 b) 15 | a) 0 b) 0 | Full taxation right of the source state on income from rights or claims with profit participation, including income of a silent partner or from participating loans and profit bonds. (Art. 11 No. 2 DBA) | Income tax | |||

| Pakistan | 152 | 0 | a) 7,5 / 15 / 25 b) 15 | a) 0 / 10 b) 20 | Dividends: 7.5 % on dividends from independent power producers under certain conditions Interest charges: Income tax assessment with possibility of withholding tax refund | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 4 to Articles 10 and 11) | Income tax | ||

| Philippines | 15 | 101 | a) 25 b) 15 | a) 0 / 25 b) 10 | Interest charges: no withholding tax on interest from foreign and foreign currency investments | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these can be deducted when determining the profits of the debtor of this income (Pro- tokoll to the DTA, No. 4 to Articles 10 and 11) | Income tax | ||

| Poland | 15 | 51 | a) 19 b) 15 | a) 0 / 20 b) 5 | Interest charges: No withholding tax on interest from certain government and corporate bonds | full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the debtor's profits from such income (Protocol to the DTA, para. 2 to Articles 10 and 11) | Podatek dochodowy od osób fizycznych | ||

| Portugal | 15 | 15 | a) 0 / 28 b) 15 c) 15 | a) 0 / 28 b) 15 c) 15 | full taxing right of the source state on income from rights or claims with profit participation, if this income can be deducted in the determination of the debtor's profits (Protocol to the DTA, para. 4 to Articles 10 and 11) | Imposto sobre o Rendimento das Pes- soas Singulares | |||

| Romania | 8 | 0 | a) 8 b) 15 | a) 0 / 10 b) 0 / 3 | Interest charges: no withholding tax on interest from state and municipal bonds | the maximum withholding tax rate is reduced to 0 % if no withholding tax is levied in Germany on interest paid to non-residents (Art. 11 para. 4 DBA) Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 2 to Articles 10 and 11) | Impozitul pe venitul obtinut de per- soanele fizice Impozitul pe dividende | ||

| Russian Federation (Russia) | 15 | 0 | a) 15 b) 15 | a) 0 / 30 b) 0 | full taxation right of the source state on income from rights or claims with profit participation, if these are deductible in the determination of the profits of the debtor of such income (Protocol to the DTA, No. 5 to Articles 10 and 11) | ||||

| Zambia | 151 | 101 | a) 0 / 20 b) 15 | a) 0 / 15 / 20 b) 10 | Dividends: no withholding tax on dividends from certain companies, e.g. listed companies (Lusaka Stock Exchange), car production Interest charges: no withholding tax on interest from green bonds listed on the Zambia Stock Exchange with a minimum term of three years 15 % Withholding tax on interest from government bonds and debt securities | Income tax | |||

| Sweden | 15 | 0 | a) 30 b) 15 | a) 0 b) 0 | Full taxation right of the source state on income from rights or claims with profit participation, if these are deductible in the determination of the debtor's profit (Art. 10, para. 5 DBA) | Statlig inkomstskatt | |||

| Switzerland | 15 | 0 | a) 35 b) 15 / 5 / 30 | a) 0 / 35 b) 0 | Dividends paid by a company operating a cross-border power plant between Lake Constance and Basel are subject to a maximum tax of 5 % (Art. 10 para. 2 letter a DBA); Right of taxation of the source state on income from profit participation rights, from profit participation bonds or profit participation loans up to a maximum of 30 % of the gross amount of the dividends, if these amounts are deductible in the determination of the debtor's profits. (Art. 10 para. 2 letter b DBA) | Withholding tax | |||

| Serbia | 0 | 0 | a) 15 b) 0 | a) 0 / 15 b) 0 | Interest charges: No withholding tax on interest from savings and government bonds denominated in dinars. | Continuation of the Agreement with Yugoslavia | Porez iz dohotka | ||

| Zimbabwe | 152 | 0 | a) 5 / 10 / 15 b) 20 | a) 0 b) 10 | Dividends: 5 % or 10 % withholding tax on dividends from securities traded on domestic stock exchanges ("Victoria Fall Stock Exchange", "Zim- babwe Stock Exchange"). | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of profits of the debtor of the dividends or interest (Protocol to the DTA, para. 3 to Articles 10 and 11). | Income tax; Non-resident sharholders' tax; Non-residents' tax on interest | ||

| Singapore | 0 | 0 | a) 0 b) 10 | a) 0 / 15 b) 0 | Income tax | ||||

| Slovakia | 7 | 0 | a) 7 b) 15 | a) 0 / 19 b) 0 | Interest charges: No withholding tax on interest from government bonds | Continuation of the Agreement with Czechoslovakia | dan z prijmov | ||

| Slovenia | 15 | 0 | a) 25 b) 15 | a) 0 b) 5 | Interest charges: Interest payments to residents of EU member states are tax-exempt | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 3 to Articles 10 and 11) | Dohodnina | ||

| Spain | 15 | 0 | a) 19 b) 15 | a) 0 b) 0 | Taxation right of the source state on dividends and interest from rights or claims with profit participation up to a maximum of 15 % of the gross amount of interest and dividends, if they are deductible when determining the profits of the debtor of the income (Pro- tokoll to the DTA, No. V. to Articles 10 and 11) | Impuesto general sobre la renta de las personas físicas; Impuesto sobre las Rentas del Capital | |||

| Sri Lanka | 15 | 51 | a) 15 b) 15 c) 15 | a) 0 / 5 b) 10 c) 0 / 5 | Interest charges: no withholding tax on interest from certain bonds | Dividends/interest: the notional credit provided for under the DTA is limited to the tax levied by Sri Lanka under national law (instead of the 20 % or 15 % provided for in principle under the DTA) | Income tax | ||

| South Africa | 153 | 101 | a) 0 - 20 b) 15 | a) 0 / 15 b) 10 | Dividends: Dividends from a non-resident company whose shares are also listed on the Johannesburg Stock Exchange (JSE) are subject to South African withholding tax in addition to any foreign withholding tax to the extent that the standard rate of foreign withholding tax is less than the standard rate of South African withholding tax (20 %). Non-resident recipients may receive a refund of or exemption from the additional South African withholding tax upon request no withholding tax on dividends from certain small companies Interest charges: No withholding tax for exchange-traded debt securities | Dividends tax | |||

| Syria | 0 | 7,5 | a) 0 b) 10 | a) 7,5 b) 10 | full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the income (Protocol to the DTA, para. 3 to Articles 10 and 11) | ||||

| Tajikistan | 12 | 0 | a) 12 b) 15 | a) 12 b) 0 | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 2 to Articles 10 and 11) | ||||

| Taiwan | 10 | 10 | a) 21 b) 10 | a) 15 / 20 b) 10 / 15 | full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the income (Protocol to the DTA, para. 3 to Articles 10 and 11) Interest charges: 15 %, if the distributed income is from a real estate investment trust or a real estate asset trust to which the provisions of the Real Estate Securitization Act apply and whose profits are fully or partially exempt from tax or which may deduct the distributions in determining their profits (Art. 11 (4) DTA). | ||||

| Thailand | 10 | 151 | a) 10 b) 20 | a) 0 / 15 b) 0 / 25 | Interest charges: Exemption of certain interest e.g. from pension funds | Dividends: A prerequisite for the application of the rate of 20 % is that the paying company is a "industrial company" in the sense of Art. 10 para. 4 letter b DBA operates Interest charges: Exemption of interest from debentures of the Thai government | |||

| Trinidad and Tobago | 10 | 15 | a) 10 b) 20 | a) 15 b) 15 | Income tax | ||||

| Czech republic | 15 | 0 | a) 15 b) 15 | a) 15 b) 0 | Continuation of the Agreement with Czechoslovakia | daň z přίjmů fyzických osob | |||

| Turkey | 10 | 102 | a) 10 b) 15 | a) 0 / 3 / 7 / 10 / 15 b) 10 | Interest charges: No withholding tax on interest from Turkish government bonds and other debt securities issued before January 1, 2006. The following maturity-dependent tax rates apply to interest on bonds issued by resident companies abroad and to Islamic bonds (sukuk) issued by resident companies abroad: 0 % with a term of at least three years, 3 % for terms between one year and three years, 7 % with term of up to one year | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 3 to Articles 10 and 11) | Gelir Vergisi | ||

| Tunisia | 0 | 101 | a) 0 / 10 b) 15 | a) 0 / 20 b) 10 | Dividends: Tax exemption for dividends up to 10,000 TND, first withholding tax deduction and subsequent refund procedure. Interest charges: No withholding tax from interest on securities in hard currency | Impôt sur le revenu des créances, dé- pôts, cautionnements et comptes courants (I.R.C.) | |||

| Turkmenistan | 10 | 10 | a) 10 b) 15 | a) 10 b) 10 | Full taxation right of the source state on dividends and interest from income from rights or receivables with profit participation, if these are deductible in the determination of the debtor's income (Protocol to the DTA, No. 3 to Articles 10 and 11). | ||||

| Ukraine | 5 | 51 | a) 5 b) 10 | a) 0 / 18 b) 5 | Interest charges: No withholding tax on interest from government bonds | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 2 to Articles 10 and 11) | |||

| Hungary | 15 | 0 | a) 15 b) 15 | a) 0 / 10 / 15 b) 0 | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the income or if the distributing company is a real estate investment trust or a similar legal entity that is exempt from corporate income tax (Protocol to the DTA, No. 4 to Articles 10 and 11). | Személyi jövedelemadó | |||

| Uruguay | 7 | 102 | a) 7 b) 15 | a) 0,5 / 2,5 / 5 / 5,5 / 7 / 10 / 12 b) 10 | Interest charges: Tax rates depending on various preconditions/holding conditions | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 2 to Articles 10 and 11) | Impuesto a las rentas a los no resi- dentes (IRNR) | ||

| Uzbekistan | 0 | 5 | a) 0 b) 15 | a) 10 b) 5 | full taxation right of the source state on income from rights or claims with profit participation, if these are deductible in the determination of the profits of the debtor of such income (Protocol to the DTA, No. 5 to Articles 10 and 11) | ||||

| Venezuela | 151 | 51 | a) 0 / 34 b) 15 | a) 0 / 34 b) 5 | Dividends: no withholding tax if the distributing company was already subject to taxation with its profits Interest charges: only 95 % of the income is taxable if the loan is used to generate income in Venezuela Tax exemption for certain savings | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 3 to Articles 10 and 11) | Impuesto sobre la renta | ||

| United Kingdom | 0 | 0 | a) 0 b) 15 | a) 0 / 20 b) 0 | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 2 to Articles 10 and 11) | Income tax | |||

| United States | 151 | 0 | a) 0 / 30 b) 15 | a) 0 / 30 b) 0 | Dividends: Tax exemption for certain dividends from regulated investment companies | full taxing right of the source state on income from legal relationships conferring a right to share in profits (in the U.S. including interest, the amount of which is not measured in a fraction of the capital and which is not portfolio interest ("contingent inte- rest"), if the income is deductible as business expenses when determining the profit of the paying person (Art. 10 (6) DTA)) | Federal income tax | ||

| Vietnam | 5 | 51 | a) 5 b) 15 | a) 0 / 5 b) 10 | Interest charges: Tax exemption for interest from government bonds | Full taxation right of the source state on dividends and interest from rights or receivables with profit participation, if these are deductible in the determination of the profits of the debtor of the dividends or interest (Pro- tokoll to the DTA, No. 4 to Articles 10 and 11) | Thuế thu nhập cá nhân | ||

| Cyprus | 0 | 0 | a) 0 b) 15 | a) 0 b) 0 | Φόρος Εισοδήματος (in Latin script: Foros Eisodimatos) | ||||

Source: German Federal Central Tax Office - Creditable foreign withholding tax 2023 | [1]: if no exemption | [2]: max. national set | [3]: if distribution of a resident company u. if no exemption |

The 10 most important facts about withholding tax on investment income

- Withholding tax is the capital gains tax on interest and dividend payments abroad. The recipient of the payment is the foreign tax authority, which, in contrast to the German tax authority, is involved in the Source of revenue Sits.

- Withholding tax is not automatically covered by an exemption order.

- Germany levies additional final withholding tax on interest and dividends

- The withholding tax creates a double burden for savers.

- Germany has double taxation agreements with 95 countries to avoid double taxation.

- Under these agreements, the withholding tax withheld abroad can be credited against the German final withholding tax and Refunds will.

- In many countries, withholding taxes are credited up to a maximum of 15 % in Germany

- Higher withholding taxes must be reclaimed by form via the foreign tax office.

- Withholding tax does not apply to price gains, but only to dividends and interest

- Overall, savers can sometimes pay less tax on foreign interest and dividend payments than in Germany despite withholding tax, as the soli is reduced compared to German interest and dividend payments.

Withholding tax is a tax deducted at source in the case of Interest and dividend payments abroad directly at the source, i.e. abroad, is retained. The payee is the foreign treasury. It is therefore not possible to pay the withholding tax by applying for an exemption order to reduce or circumvent.

Nevertheless, the German tax authorities require additionally its final withholding tax on interest and dividends a.

This creates a Double burdens for savers. To avoid this, Germany has Double taxation agreement with 95 countries. This allows you to partially or even fully offset withholding tax paid abroad against the German final withholding tax.

In the case of securities, withholding tax is levied only on dividends. Price gains, on the other hand, are taxed exclusively at the German capital gains tax rate. Whether you bought the share on a foreign or German stock exchange makes no difference.

The lower final withholding tax also reduces the solidarity surcharge, so that you can save on foreign interest and dividend payments sometimes even less tax in total despite withholding tax than in Germany.

What is a withholding tax?

Withholding tax is a tax on capital gains such as interest or dividends. It is supplied directly from the foreign bank retained, which pays out this income, and to the Tax office abroad (source country).

In the European Union, there are common rules for the taxation of interest income, but the Withholding tax rates are not harmonized. Thus, each state can determine the tax rate of the withholding tax itself.

If you as an investor receive interest income from abroad, you can get a partial refund of the withholding tax. The amount of the refund depends on the Double taxation agreement that Germany has concluded with the respective source country. These agreements are intended to ensure that you are not taxed twice on the same income, once abroad and once in Germany.

In the Withholding tax overview of countries you can find out which agreements Germany has concluded with other countries.

What is the purpose of a double taxation agreement?

Double taxation treaties (DTAs) are international treaties that prevent the same taxpayer from taxed twice for the same income from several countries is generated. This can occur when income from interest and dividends is generated outside the country of residence. Double taxation treaties also serve this purpose, tax a person who is a resident of two countries at the same time only once.

Without a double taxation agreement, each of the two states could claim taxes. This would put foreign investors at a disadvantage, which one would not want, since the economies are dependent on foreign capital.

The main principles regarding double taxation are:

- Country of residence principle: A person is liable to pay tax in the country in which he has his domicile or habitual residence.

- Source Country Principle: A person is liable to pay tax in the country from which the income originates.

- World Income Principle: The taxpayer is taxed on his entire world income.

- Principle of territoriality: The taxpayer is assessed only on the income earned in the territory of the state concerned.

The principles in Germany

In Germany, the Country of residence and world income principle for residents. For foreigners, on the other hand, the source country and territoriality principle applies [Source: BMF]. For example, a person who resides in Germany and has a foreign savings account will generally be taxed in Germany on the interest income from that account.

Example Taxation of Foreign Interest Income

A person who resides in Germany and has a foreign savings account, in principle, taxed in Germany on the interest income from this account

The respective double taxation agreement determines whether the interest income may be taxed by Germany or the foreign state.

DTAs are individual bilateral treaties

The precise provisions for avoiding double taxation are set out in each individual double taxation treaty between the two countries involved. Thus, DTAs are individual bilateral treaties.

To assist the countries involved, organizations such as the OECD and the United Nations develop model agreements. Nevertheless, DTAs are negotiated in individual negotiations between the countries involved, as they each have different policies and legal traditions.

In Germany, a negotiating basis is used for all double taxation agreements, which is adapted as necessary to efficiently implement the objectives of the individual agreements and to use uniform wording.

How much is the withholding tax?

Depending on the country and DTA, the withholding tax is between 0 and 35 percent. In the following chapters you will find information on the most important withholding taxes.

Withholding tax Germany

In Germany, a final withholding tax of 25 % has been levied on dividends and interest since 2009. Your bank can offset foreign withholding taxes against the German final withholding tax. This reduces even your Soli, which is payable only on the German withholding tax and not on the foreign withholding tax. Here is an example:

Excluding withholding tax: 26.375 % Tax on interest and dividends

- Final withholding tax: 25 %

- Solidarity surcharge: 25 % x 5.5 %

- Total taxes German interest and dividends: 26.375 %

With withholding tax: 25.55 % Tax on interest and dividends

With foreign withholding tax, the total tax burden can even be reduced by Reduced by almost 1 percentage point will:

- Withholding tax: 15 %

- Final withholding tax: 10 %

- Solidarity surcharge: 10 % x 5.5 %

- Total taxes foreign interest and dividends: 25.55 %

Withholding tax Switzerland

DividendsIn Switzerland, 35 percent withholding tax is due on dividend payments. Of this, 15 % is credited against the German capital gains tax, the remaining 20 % can be deducted. reclaim directly from Switzerland.

Interest charges: In the case of interest payments from the Switzerland is not credited to the German Final withholding tax. You can claim back the entire withholding tax of 35 % of the interest payment from Switzerland. Some Swiss securities are also directly exempt from withholding tax on interest and you do not need to apply for a refund.

See also: How do I get the withholding tax back from Switzerland?

Withholding tax USA

DividendsIn the USA, 30 percent withholding tax is due on dividend payments. Of this, 15% is credited against the German capital gains tax, the remaining 15 % can be reclaimed directly from the USA.

In most cases, however, it is not necessary to apply for a refund of US withholding tax. This is because the withholding tax is often already reduced to 15 percent in advance. This is the portion that you can have refunded. For this, your bank must be part of the so-called "QI Agreement". This agreement regulates the cooperation of your bank with the US authorities.

Fortunately, most banks in Germany are part of the "QI Agreement". These include, for example:

- ING

- DKB (German Kreditbank)

- comdirect

- consorsbank and DAB Bank acquired by Consors

- German Bank and Deutsche Bank maxblue

- Flatex (BIW Bank)

- onvista

- SBroker

- Baader Bank

- Merkur Bank

If the bank is part of the cooperation, you don't have to do anything else. Because the tax is paid at the payout automatically reduced to the billable portion of 15 %.

There is only one exception to this: you are considered to be a person with a foreign connection. You have a foreign connection if:

- you are liable for tax abroad.

- your residence is abroad.

- you make a regular standing order abroad.

If you have a foreign connection or your broker is not part of the QI agreement (example: eToro) you have to fill out a form of the US authorities. This form can be found on the IRS website under the name "Form W8BEN".

Interest chargesIn the case of interest payments from the USA, there is no credit against the German final withholding tax. You can claim back the entire withholding tax of 30 % of the interest payment from the USA. Some US securities are also directly exempt from withholding tax on interest and you do not need to apply for a refund.

See also: How do I get the withholding tax back from the USA?

Withholding tax France

DividendsIn France, a withholding tax deduction of 25 % is made on dividends. Of this amount, 12.8 % is credited against the German capital gains tax. The remaining 12.2 % can be reclaimed via a form from France.

Interest charges: There is no withholding tax on interest in France.

Withholding tax Norway

DividendsIn Norway, dividends are subject to a withholding tax deduction of 25 %. Of this, 0% is credited against the German capital gains tax. The remaining 25% you can reclaim via a form from Norway.

Interest charges: There is no withholding tax on interest in Norway. An exemption for this is not necessary.

Withholding tax Canada

DividendsIn Canada, a withholding tax deduction of 25 % is made on dividends. Of this amount, 15 % is credited against the German capital gains tax. The remaining 10% you can reclaim via a form from France.

Interest chargesThere is no withholding tax on interest in Canada if you have an exemption. Without exemption, the withholding tax on interest in Canada is either 0 or 25 percent. A maximum of 10 % of this can be credited against the German final withholding tax.

Withholding tax Netherlands

DividendsIn the Netherlands, a withholding tax deduction of 15 % is made on dividends. Of this, 15 % is credited against the German capital gains tax. This is exactly the rate that is creditable against the German final withholding tax according to the double taxation agreement with Germany and therefore you do not have to do anything further.

Interest charges: There is 0 % or 15 % withholding tax on interest in the Netherlands. Of this, no credit against the German final withholding tax is possible.

Withholding tax Denmark

DividendsIn Denmark, a withholding tax deduction of 15 % is made on dividends. Of this, 15 % is credited against the German capital gains tax. This is exactly the rate that is creditable against the German final withholding tax according to the double taxation agreement with Germany and therefore you do not have to do anything further.

Interest charges: There are no withholding taxes on interest in Denmark.

Withholding tax Austria

DividendsIn Austria, a withholding tax deduction of 27.5 % is made on dividends. Of this, 15 % will be credited against the German capital gains tax. However, you have the possibility to claim back the remaining part of the withholding tax of 12.5% from the Austrian tax authorities. To do this, you must submit the application "ZS-RD1" and send it to the Austrian authorities.

Interest charges: There are no withholding taxes on interest in Austria.

Withholding tax Ireland

DividendsIn Ireland, no withholding tax is deducted on dividends. The Irish withholding tax for dividends is therefore 0 percent.

Interest charges: There is no withholding tax on interest in Ireland for German persons.

Withholding tax Sweden

DividendsIn Sweden, a withholding tax deduction of 30 % is made on dividends. Of this, 15 % is credited against the German capital gains tax. The remaining 15% can be reclaimed via a form.

Interest charges: There is no withholding tax on interest in Sweden. An application for exemption is not necessary.

Withholding tax Finland

DividendsIn Finland, dividends are subject to a withholding tax deduction of 30 % or 35 %. Of this amount, 15 % is credited against the German capital gains tax. The remaining 15 % or 20 % can be reclaimed via a form.

Interest charges: There is no withholding tax on interest in Finland. An application for exemption is not necessary.

Withholding tax Australia

DividendsIn Australia, dividends are subject to a withholding tax deduction of 0 % or 30 %. If the dividends have already been fully taxed in Australia, they are "franked dividends" which are exempt from withholding tax. If the dividends are not franked dividends, the Australian withholding tax is 30 %. Of this amount, 15 % is credited against the German capital gains tax. The remaining 15 % must be paid to Australia as withholding tax.

Interest chargesThere is a withholding tax on interest in Australia above 10 %. However, there are many exceptions to this and the Australian withholding tax on interest is thus often 0 %.

Withholding tax Italy

DividendsIn Italy, a withholding tax deduction of 26 % is made on dividends. Of this amount, 15 % are credited against the German capital gains tax. The remaining 11 % can be reclaimed in Italy. A process that can not only take a lot of time, but can also drag on for years. The request for refund must be made within four years. Until repayment is made, further four years passuntil the overpaid withholding tax flows back. Welcome to the world of Italian withholding tax - a maze where patience becomes the most valuable currency.

Interest chargesThere is no withholding tax on interest in Italy if the investment fund is regulated in the EU or Switzerland. Otherwise, 26 % withholding tax is due in Italy, of which 10 % can be credited against the final withholding tax. The remaining 16 % can be reclaimed from the Italian authorities by means of a residence certificate.

Withholding tax Spain

DividendsIn Spain, a withholding tax deduction of 19 % is made on dividends. Of this amount, 15 % are credited against the German capital gains tax. The remaining 4 % can be reclaimed in Spain. However, reclaiming the tax from the Spanish tax authorities is a complicated and lengthy process. A lot of patience is required if you want to avoid the withholding tax in Spain completely.

Interest charges: There is no withholding tax on interest in Spain.

Withholding tax Japan

DividendsIn Japan, dividends are subject to a withholding tax deduction of 15.315 %. This percentage consists of 15 % withholding tax for non-residents plus a surcharge of 2.1 %.

Of this amount, 15 % is credited against the German capital gains tax. The remaining 0.315 % can be reclaimed in Japan. However, the effort is not worthwhile due to the low percentage.

Interest charges: There is no withholding tax on interest for many fixed income securities in Japan. Otherwise, interest is taxed at 15.315 %. Japanese withholding tax on interest payments, unlike dividends, cannot be offset against German final withholding tax. To reclaim it, an application must be filed with the Japanese tax authorities.

The withholding tax in Japan is called Gensenbun.

Withholding tax Luxembourg

Dividends: In Luxembourg for dividends a withholding tax deduction of 15 %. These are credited in full amount of 15 % against the German capital gains tax. In other words, the withholding tax of 15 % reduces the current final withholding tax of 25 % (+ solidarity surcharge and church tax) to 10 %. As the German tax legislation allows the full credit of the Luxembourg withholding tax, it does not make sense to reclaim the Luxembourg withholding tax.

Interest charges: In Luxembourg, the withholding tax is namely reduced to 0 % for all non-residents. In Luxembourg, unlike in some other EU countries, no additional tax burden arises from a Luxembourg withholding tax on interest payments. Thus, interest paid in Luxembourg for per diem and fixed deposit are only taxed in Germany with the final withholding tax.

The withholding tax is called in Luxembourg Impôt sur le revenu des personnes physiques.

Withholding tax Great Britain

DividendsThe withholding tax in the UK is 0 % in both the UK and Ireland. Thus, the United Kingdom and Ireland are among the countries without withholding tax, which are particularly popular with investors due to the elimination of paperwork.

Interest charges: In the UK, interest payments for non-residents are exempt from withholding tax.

Withholding tax China

Dividends: The withholding tax in the People's Republic of China (Withholding Tax = WHT) is 0, 10 or 20 %. Which withholding tax applies depends on the type of dividend allowance. Certain dividends are tax-exempt. The German-Chinese double taxation agreement (DTA) states that a maximum of 10 % of the Chinese withholding tax is creditable in Germany. Unfortunately, you cannot reclaim the remaining 10 % of Chinese withholding tax from the Chinese tax authorities. The Chinese withholding tax thus leads to a real additional burden and is due in the amount of 10 % of the dividend income in addition to the German final withholding tax.

Interest charges: The withholding tax on interest is 0 or 20 % in China. Which tax rate applies depends on the type of interest allocation. For example, while on Chinese government bonds no withholding tax In many other cases, 20 % withholding tax must be paid. You can offset 10 % of this against the German final withholding tax. As with Chinese dividend payments, the Chinese withholding tax thus often leads to a real additional burden for investors in the case of interest income (exception: Chinese government bonds).

Withholding tax in China could be reduced in the future: Over the last few years, China has signed new double taxation agreements with some European countries, including Malta and Finland. These countries now pay only 5 percent withholding tax on their investments in China.

It is therefore possible that Germany and the People's Republic of China will renegotiate their double taxation agreement again in the foreseeable future. In doing so, the Federal Republic will press for similar conditions to apply to German investors as to investors from Malta and Finland.

Until now, German investors often still pay Chinese withholding taxes, which are practically non-refundable. Until now, investors can therefore often save themselves the effort of refunding the Chinese withholding tax and hope for an improvement in the situation.

Countries without withholding tax

This 14 countries do not levy any withholding tax at all for German dividend payments and are therefore real Countries without withholding tax. Countries without withholding tax include major financial marketplaces such as Ireland, Liechtenstein, Malaysia, Singapore, or the United Kingdom (UK).

- Iran (Islamic Republic of)

- Ireland

- Kosovo

- Kuwait

- Liechtenstein

- Malaysia

- Malta

- Mauritius

- Singapore

- South Africa

- Syria

- Uzbekistan

- United Kingdom

- Cyprus

However, there are some other countries where the withholding tax is de facto not applicable. These include, for example, the USA, which levy a withholding tax of 30 %, but 15 % of this is automatically offset against the German capital gains tax. The remaining 15 % are also not charged by almost all brokers via the QI agreement. See the capital Withholding tax USA for more information.

Therefore you can find here another list of 36 Countries where withholding tax is not applicable at all for certain investments. In the Withholding tax overview of all countries you will find more information about the individual countries, when these countries are without withholding tax for German investors:

- Egypt

- Armenia

- Azerbaijan

- Australia

- Bosnia - Herzegovina

- Bulgaria

- China (People's Republic excluding Hong Kong and Macao) - Only Chinese government bonds are without Withholding tax in China.

- Estonia

- Ghana

- Iran (Islamic Republic of)

- Ireland

- Kazakhstan

- Kenya

- Kyrgyzstan

- Kosovo

- Kuwait

- Latvia

- Liechtenstein

- Luxembourg

- Malaysia

- Malta

- Morocco

- Mauritius

- Namibia

- Norway

- Portugal

- Zambia

- Singapore

- South Africa

- Syria

- Tunisia

- Uzbekistan

- Venezuela

- United Kingdom

- United States

- Cyprus

What does no withholding tax mean?

Foreign interest and dividends are tax-free abroad!

Investments in United Kingdom, Ireland, Liechtenstein and Singapore are attractive from a tax point of view, since in these countries no withholding tax on dividends is levied.

However, as an investor, you must keep in mind that German custodian banks continue to pay flat rate tax, solidarity surcharge and, if applicable, church tax to the German tax authorities, even if no withholding tax is payable abroad.

But also in Countries with a maximum of 15 % Withholding tax and have a double taxation agreement with Germany, there is in fact no additional tax burden. This is because most of the double taxation agreements that Germany has concluded provide that 15 % of the withholding tax paid abroad is automatically credited against the final withholding tax in Germany.

In addition, banks automatically carry out the offsetting of foreign withholding tax and the German final withholding tax. Thus, these countries are de facto on an equal footing with countries without withholding tax.

Some examples of such countries are the Netherlands, Luxembourg and Russia.

Some countries even levy less than 15 % withholding tax. These include Mexico and Greece. Due to the creditability of up to 15 % in Germany, this does not result in any advantage for you, but your investment is spared from withholding taxes.

These are all 40 countries levying up to 15 % withholding tax, which, however, is fully refundable:

- Egypt

- Albania

- Algeria

- Argentina

- Belarus (Byelorussia)

- Bolivia

- Costa Rica

- Cote d'Ivoire (Ivory Coast)

- Ecuador

- Estonia

- France

- Georgia

- Ghana

- Greece

- India

- Indonesia

- Kazakhstan

- Croatia

- Liberia

- Lithuania

- Mexico

- Moldova

- Netherlands

- North Macedonia

- Pakistan

- Romania

- Russian Federation (Russia)

- Zimbabwe

- Slovakia

- Sri Lanka

- Tajikistan

- Thailand

- Trinidad and Tobago

- Czech republic

- Turkey

- Turkmenistan

- Ukraine

- Hungary

- Uruguay

- Vietnam

For more details on the refund of withholding tax, please refer to the Withholding tax overview of the countries a little further up in this article.

When do I have to pay withholding tax?

You only have to pay withholding tax if more than 15 % withholding tax is levied or there is no double taxation treaty that allows a refund in full.

In Finland, Canada and Sweden, for example, the withholding tax is significantly higher than 15 percent. As a result, the withholding tax can only be offset against the final withholding tax on a pro rata basis.

In such situations, it is often necessary to make an elaborate reclaim from the tax authorities of the respective country. Before you invest in these countries, you should consider in the return that the process of reclaiming the withholding tax is often associated with considerable effort.

In some countries, such as Finland, Canada and Sweden, the withholding tax is significantly higher than the 15 % that can be credited in Germany.

In such cases, it is often necessary to make a costly recovery from the authorities of the respective country.

When investing in these countries, the return should be carefully considered, as the recovery effort can be significant.

In these 31 countries you have to pay withholding taxes. However, a refund is often possible:

| Country | Withholding tax on dividend | Of which refundable | Notes | ||

|---|---|---|---|---|---|

| Australia | 0 %, 30 % | 15 % | Dividends: Certain dividends (e.g. franked dividends and conduit income) are not subject to withholding tax. Interest charges: certain interest payments (e.g. interest from certain public bonds) are not subject to withholding taxation | ||

| Bangladesh | 30 %, 0 % | 15 % | |||

| Denmark | 15 %, 27 % | 15 % | Dividends: 15 % withholding tax if the recipient is domiciled in a country with which an intergovernmental information exchange agreement exists and holds less than 10 % of the distributing company's share capital. | ||

| Finland | 30 %, 35 % | 15 % | Dividends: 35 % Withholding tax on dividends from nomi- nee-registered shares if the foreign custodian bank is not registered with the Finnish tax administration or does not report the information on the beneficial owner Interest charges: in principle no withholding tax, only interest from thin capitalization (i.e. interest on a long-term loan granted in lieu of an equity investment) is subject to a withholding tax of 30 % | ||

| India | 10 %, 20 % | 10 % | Interest charges: No withholding tax on interest from certain government bonds, 4 % or 5 % withholding tax on interest from certain bonds. Interest/dividends: Income from so-called "Global Depository Receipts" is subject to a withholding tax of 10 % - regardless of whether it qualifies as interest, dividends or capital gains. | ||

| Indonesia | 10 %, 20 % | 15 % | Dividends: 10 % Withholding tax on dividends from companies investing in certain regions or economic sectors | ||

| Iceland | 22 %, 0 % | 15 % | |||

| Israel | 15 %, 20 %,25 %, 30 % | 10 % | Interest charges: No withholding tax on interest from government loans | ||

| Italy | 26 %, 0 % | 15 % | Interest charges: Tax exemption of interest on certain loans deposited with a domestic bank or other authorized intermediary, due to the existence of an information exchange agreement between Germany and Italy. | ||

| Jamaica | 25 %, 0 % | 15 % | Interest charges: a tax assessment and a refund of withholding tax can be applied for in order to take income-related expenses into account | ||

| Japan | 15 %, 20 % | 15 % | Dividends: 15 % on qualified dividends from listed companies Interest charges: no withholding tax on interest from certain fixed-income securities | ||

| Canada | 25 %, 0 % | 15 % | Interest charges: 25 % Withholding tax only on interest from certain non-fixed income bonds | ||

| Korea, Republic of | 20 %, 0 % | 15 % | Interest charges: no withholding tax on interest from government and currency stabilization bonds | ||

| Latvia | 0 %, 20 % | 15 % | Dividends: no withholding tax on dividends already subject to 20 % corporate income tax, 20 % Withholding tax on distributions of profits arising before January 1, 2018 Interest charges: no withholding tax on interest from bonds issued by the government or a municipality in Latvia or a state of the EEA, as well as from listed financial instruments 5 % Withholding tax on interest from certain non-publicly traded financial instruments paid by investment service providers to non-independent persons resident in the EEA | ||

| Mongolia | 20 %, 0 % | 10 % | |||

| Namibia | 0 %, 20 % | 15 % | Dividends: in individual cases, national exemption regulations may be relevant | ||

| New Zealand | 15 %, 30 % | 15 % | Interest charges: No withholding tax on interest from bonds participating in the Approved Issuer Levy (AIL) program | ||

| Austria | 27,5 %, 0 % | 15 % | |||

| Pakistan | 7,5 %, 15 %, 0,25 % | 15 % | Dividends: 7.5 % on dividends from independent power producers under certain conditions Interest charges: Income tax assessment with possibility of withholding tax refund | ||

| Philippines | 25 %, 0 % | 15 % | Interest charges: no withholding tax on interest from foreign and foreign currency investments | ||

| Poland | 19 %, 0 % | 15 % | Interest charges: No withholding tax on interest from certain government and corporate bonds | ||

| Portugal | 0 %, 28, % | 15 % | |||

| Zambia | 0 %, 20 % | 15 % | Dividends: no withholding tax on dividends from certain companies, e.g. listed companies (Lusaka Stock Exchange), car production Interest charges: no withholding tax on interest from green bonds listed on the Zambia Stock Exchange with a minimum term of three years 15 % Withholding tax on interest from government bonds and debt securities | ||

| Sweden | 30 %, 0 % | 15 % | |||

| Switzerland | 35 %, 0 % | 15 % | |||

| Slovenia | 25 %, 0 % | 15 % | Interest charges: Interest payments to residents of EU member states are tax-exempt | ||

| Spain | 19 %, 0 % | 15 % | |||

| South Africa | 0 %, 20 % | 15 % | Dividends: Dividends from a non-resident company whose shares are also listed on the Johannesburg Stock Exchange (JSE) are subject to South African withholding tax in addition to any foreign withholding tax to the extent that the standard rate of foreign withholding tax is less than the standard rate of South African withholding tax (20 %). Non-resident recipients may receive a refund of or exemption from the additional South African withholding tax upon request no withholding tax on dividends from certain small companies Interest charges: No withholding tax for exchange-traded debt securities | ||

| Taiwan | 21 %, 0 % | 10 % | |||

| Venezuela | 0 %, 34 % | 15 % | Dividends: no withholding tax if the distributing company was already subject to taxation with its profits Interest charges: only 95 % of the income is taxable if the loan is used to generate income in Venezuela Tax exemption for certain savings | ||

| United States | 0 %, 30 % | 15 % | Dividends: Tax exemption for certain dividends from regulated investment companies | ||

How do I get the withholding tax back?

The possibility to reclaim withholding tax depends on an existing double taxation treaty (DTA) between Germany and the country where you earned capital income. These agreements stipulate the tax rates that foreign investors must pay on their investment income. There are the following different constellations:

| Category-1 Country | The country in which the income was generated does not levy a withholding tax (e.g. Ireland, United Kingdom). | No withholding tax and you don't have to do anything |

| Category-2 Country | The country in which the income was generated incurs withholding tax, but your investment falls under an exemption (e.g. Chinese government bonds). | No withholding tax and you don't have to do anything |

| Category-3 Country | The country levies withholding taxes of less than 15 % and has a DTA with Germany through which the withholding tax is fully refundable. | The broker will settle the withholding tax for you. You do not have to do anything. |

| Category-4 Country | The country levies withholding tax of more than 15 % and has a DTA with Germany through which the withholding tax is partially refundable. | You must reclaim the withholding tax to get the difference refunded. The USA also falls into this category, but is an exception with the QI agreement. |

| Category-5 Country | There is no DTA with Germany | The withholding tax is effective in full and results in a double tax burden. |

If you have income from countries with a double taxation treaty, and the recovery is not handled through the broker, it is possible to reclaim the overpaid difference. This concerns countries of the Category 4 in the above table of withholding tax overview of countries.

The recovery process for category 4 countries can be very complex and lengthy and is handled very differently from country to country. Countries like Austria or Switzerland refund the difference within a few weeks. Other countries, such as Spain or Italy, often take several years to refund the withholding tax. In Italy in particular, according to reports from those affected, the refund forms are often lost, which means that the claim can become time-barred if the Italian authorities are not followed.

Reclaiming withholding tax can therefore be very time-consuming and labor-intensive. It is important to consider this when investing abroad. Those who shy away from the effort are often better advised with an investment in a category 1-3 country.

How do I get the withholding tax back from Switzerland?

Switzerland collects 35 percent withholding tax on investment income. The Swiss withholding tax is credited against the German final withholding tax of 15 %. You can reclaim the remaining 20 percent in the refund procedure.

Swiss withholding tax: Every 3 years is sufficient

You do not have to reclaim Swiss withholding tax every year. The application only has to be made every three years and then also includes the two previous years.

You can only reclaim the difference online from the Federal Tax Administration (FTA). They have a fancy free tool called "Snapform Viewer" for download. You can use it to apply for a refund of Swiss withholding tax.

Use this link to go directly to the Federal Tax Administration.

Do not forget to include all the necessary documents, including the so-called tax voucher.

Note fees: The Swiss authority normally retains a processing fee. The tax credit is in Swiss francs and processing usually takes between two weeks and six months.

How do I get the withholding tax back from the USA?

You have to pay 30 % withholding tax on US dividends. Of this, 15 percent is offset against the German final withholding tax. The remaining 15 percent can be refunded by the IRS. With most German brokers, however, application for a refund is not necessary, as they do not have the QI Agreement convert and automatically refund the difference. See also Withholding Tax USA.

How do I get back other foreign withholding tax?

In many cases, it is not necessary to reclaim foreign withholding taxes, as the withholding taxes are often less than 15 percent and are automatically offset by the brokers against the German final withholding tax.

However, there are also many countries that require more than 15 % withholding taxes. These include Switzerland and Austria, Spain or Italy. If there is a double taxation agreement (DTA) between Germany and the country where you receive the dividend or interest, you can reclaim the difference. In countries like Spain or Italy this can take a long time, whereas in Austria and Switzerland the refund of the withholding tax often takes only a few weeks.