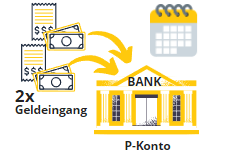

If you want to make a back payment of Social benefits or child support the increased income in the month of the additional payment often results in the protected allowance on the P account is exceeded. This will result in the bank paying out the additional payment and you will no longer be able to dispose of the money. If you are expecting an additional payment, you must therefore act quickly and set up garnishment protection for the additional payment in advance. We will show you what to do so that the additional payment does not count towards the regular tax-free amount.

What back payments can you protect from garnishment?

What you can learn here

- What back payments can you protect from garnishment?

- What protection is there for an additional payment if the P-Konto allowance is exceeded?

- Which offices can I contact for the P-Konto certificate?

- What to do if the P-Konto allowance was exceeded due to an additional payment?

- § 904 ZPO protects the additional payment if the P-Konto allowance was exceeded

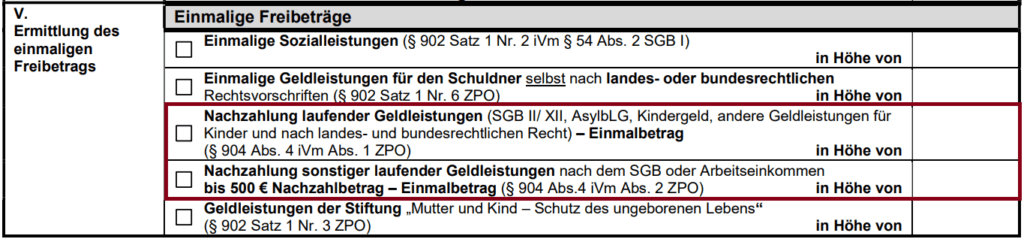

- If the account has already been blocked

The certificate according to § 903 para. 1 ZPO lists all additional payments which are not covered by the garnishment. In detail, the following additional payment can protect if the allowance on the Pfändungsschutzkonto was exceeded:

- Back payments from Citizen's Income (Payments of basic security for jobseekers according to SGB II)

- Back payments from Basic security (Social assistance according to SGB XII)

- Back payments from child support

- Back payments of the Child supplement

- Future: Back payments of the Basic child allowance (this combines child allowance and child supplement from 2025)

- Back payments from social benefits for asylum seekers in accordance with the Asylum Seekers' Benefits Act

- Back payments from earned income or social benefits according to SGB up to 500 €

- But also additional payments from Employment income or social benefits according to SGB over 500 €if the wages would not have been attachable if they had been paid on time.

What protection is there for a back payment if the P-Konto-.Allowance exceeded will?

If the allowance is exceeded due to an additional payment on a P-Konto, you can have an additional allowance set up once. The bank will set up the allowance for the additional payment if you have a P-Konto certificate (Section 903 (1) of the Code of Civil Procedure).

Which offices can I contact for the P-Konto certificate?

The P-Konto certificate can be issued by in the case of citizen's allowance by social benefit institutions. In the case of back payments of child benefit, the family benefits office issues a corresponding P-Konto certificate. In the case of subsequent payment of earned income up to 500 euros, the employer may issue a P-Konto certificate of subsequent payment. In addition, lawyers and recognized debt counseling centers can also issue a P-Konto certificate.

However, if it is a back payment of earned income of more than €500, you must submit a Application to the enforcement agency provide to protect the back payment from garnishment.

What to do if the P-Konto allowance was exceeded due to an additional payment?

First, you should check whether the additional payment will exceed the tax-free amount on your P-Konto. Use a calculator to determine your personal P-Konto allowance.

Case 1: Income and back payment below of the allowance: consume the additional payment within 3 months

If your income including the additional payment is below the garnishment exemption limits, the additional payment is available to you for three months. After that Takeover amounts paid out to creditors in the following month.

Case 2: Income and back payment not below of the allowance: consume the additional payment within 3 months

If the allowance on the P-Konto is not sufficient, you should act quickly and have an additional allowance for the additional payment set up via a P-Konto certificate. We have listed the offices you can contact for this purpose. above in the post held.

§ 904 ZPO protects the additional payment if the P-Konto allowance was exceeded

In the event of an attachment of an account, section 904 of the Code of Civil Procedure protects, inter alia. Back payments of social benefits, earned income and child benefits.

If current cash benefits are paid at a later date than the month to which the benefits relate, they are not covered by the attachment of the credit balance on the Pfändungsschutzkonto if they are cash benefits pursuant to § 902 sentence 1 number 1 letter b or c or number 4 to 6.

§ Section 904 (1) ZPO

However, you must become active yourself for this in accordance with Section 903 (1) sentence 1 of the German Code of Civil Procedure (ZPO).

The bank may make payments from credit balances to the creditor with discharging effect vis-à-vis the debtor insofar as the credit balance is unseizable as an increase amount, until the debtor proves to the credit institution that the credit is not subject to seizure under section 902. Proof shall be provided by presentation of a certificate.

§ Section 903 (1) sentence 1 ZPO

The tax-free amount is therefore not automatically increased by the bank when an additional payment arrives on your account. Instead, you must submit a P-Konto certificate to the bank before the additional payment arrives. Also keep in mind that the increase of the P-Konto allowance on the part of the bank a few days processing time. required. The P-Konto certificate can be issued by a state agency such as the family benefits office, the social benefits agency or the employer in accordance with section 903 (1) sentence 2 of the German Code of Civil Procedure (ZPO), but debtor counseling or lawyers are also suitable persons to issue a P-Konto certificate in accordance with section 305 (1) number 1 of the German Insolvency Code.

The proof is to be provided by presenting a certificate

§ Section 903 (1) sentence 2 ZPO

- of the family benefits office, the social benefits agency or an institution concerned with the granting of cash benefits within the meaning of the first sentence of Section 902,

- of the employer or

- a suitable person or body within the meaning of section 305 (1) no. 1 of the Insolvency Code.

The income is attributed to the month for which it was paid. Thus, one may not have any disadvantage from the late payment. If the income would not have been subject to garnishment if it had been paid on time, the additional payment may not be either. The BGH ruled in the judgment of 24.01.2018 - VII ZB 21/17.

If the account has already been blocked

If the account has already been blocked, you need to act quickly. In this case, you should contact your bank immediately to try to clarify the matter. A retroactive increase of the tax-free amount is no longer possible for amounts that have already been blocked, but the additional payment is not immediately gone once the tax-free amount has been exceeded. In the article "What happens to too much money on the P-Konto?" you will find an explanation of what exactly happens to the money outside the allowance.

To stay within the allowance in the future, you can use the Outsmart P-Konto through clever behavior and thus improve the situation in your favor. However, you should stay away from legal gray areas or illegal practices to avoid getting into deeper trouble.