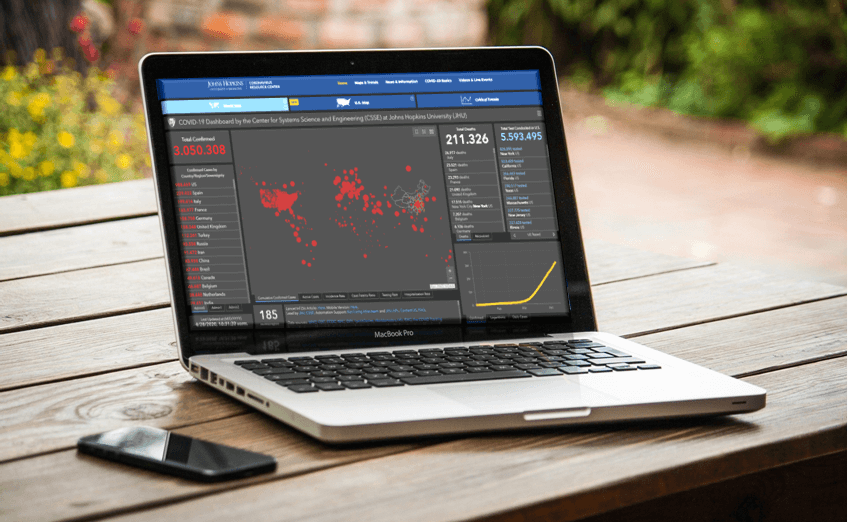

We consider 4 case studies. You can then decide for yourself which one suits you best. Based on these case studies, I give clear advice on whether you should start now in the financial crisis.

In a previous post, I said now is the best time to to buy shares. I still think this makes sense. In general, I look for stock investors viz many chances which are opening up as a result of the current crash. That's why I keep buying more and have more than doubled my savings plan on the Vanguard All World ETF.

As before, the courses on the stock exchanges have been a roller coaster ride in the last few days. How does that make you feel? Do you look forward to the jagged ups and downs that sometimes seem to happen through some kind of news, or sometimes out of nowhere? You may be wondering after reading some my last postswhether you should now invest a larger amount in your portfolio?

Some are afraid to invest in the financial crisis

What you can learn here

- Some are afraid to invest in the financial crisis

- Get in the financial crisis now? – Four different investor types

- Get in the financial crisis now: Marc, employee on short-time work, 8,000 euros available, automotive industry

- Board the financial crisis now: Lisa, civil servant

- Get in the financial crisis now: Stefan, cashier in the supermarket, 1500 euros net

- Get in the financial crisis now: Gerlinde, self-employed, 55 years old

- Course bets and market timing are not investments!

It is not difficult to read from the stock market prices that many people have fears. Otherwise the market would be much quieter. Are you one of them and would you rather sell securities at the moment? A common motive for this is fear that it could go down even further. These worries are understandable and I would like to take them away from you as they are not necessary. I'll show you better ways of doing this now. I assume that you invest long-term and widely with ETFs. The advice is just as valid for people investing in digital money managers or top dividend stocks. However, these tips are not suitable for short-term traders who want to make quick money in 6 months!

Please note: This is not investment advice and does not represent an invitation to buy or sell! I say what I would do myself if I were in the situation of these 3 people. But you have to decide for yourself!

Get in the financial crisis now? – Four different investor types

Whether you should get involved in the financial crisis now depends on your personal situation. For this, consider: Marc, an employee in the automotive industry with a cash buffer that he is considering investing. We also play out a similar situation with Lisa, a civil servant teacher. Stefan has to work hard and receives little wages. We examine the question of whether Stefan should set up an ETF savings plan in the corona crisis with 1,500 euros. Finally, we look at a woman in her mid-fifties, whose depot, which was only recently put on, is now glowing deep red.

Get in the financial crisis now: Marc, employee on short-time work, 8,000 euros available, automotive industry

First, let's consider an employee with $8,000 of disposable cash on the table cash account. Let's call him Marc. Marc's expenses are around 2,000 euros per month. He works in the automotive industry and is unsettled by the short-time work that exists in the industry. He is currently working part-time. He also fears for his job. He could bridge four months with his savings, even if he didn't receive any short-time work benefits at all. Nevertheless, it is risky to use up your cash reserves in such a situation. Since Marc is a reader of Account Loan Comparison, he simply lets his ETF savings plan continue and does not top it up any further.

Board the financial crisis now: Lisa, civil servant

Lisa is a civil servant teacher. Your employment cannot be terminated until you retire in 2045. If Lisa has not yet invested in ETFs or stocks, she now has a unique opportunity to start her portfolio in a crisis, which is a very good opportunity in the long term. Past economic crises bear witness to this. Lisa should definitely go through with it now! You can find a cheap depot for your ETFs online. A detailed one depot comparison can help you get things started. It's even quicker if Lisa takes the Konto-Kredit-Vergleich.de Depository recommendations holds. These include smart broker*, Onvista*, Trade Republic* and DKB*. The three first-mentioned all offer opening using a mobile phone camera (“VideoIdent procedure”). Due to the corona crisis, longer waiting times are currently to be expected at the banks. While there are hardly any restrictions at Trade Republic, it takes up to 4 weeks to open a depot at Smartbroker. At least 14 days can also be expected with the onvista bank.

Get in the financial crisis now: Stefan, cashier in the supermarket, 1500 euros net

Stefan is a cashier at a large supermarket chain. Ever since he Call for savings for low earners at Konto-Kredit-Vergleich.de, he spent many days thinking about his security in old age. Therefore, he is aware that he should also do something and that ETF savings with savings rates from 25 to 30 euros per month are actually not a problem. Since Stefan still has more than 20 years of his working life ahead of him, the ups and downs in the markets don't bother him much. "The cucumber prices change every week," he adds with a shrug. Stefan does not see his job as threatened. Everywhere they look for help in the supermarkets. Business seems to be booming like never before. in the depot comparison he learned that Smartbroker* and DKB* Vanguard ETFs in the savings plan are there. Since Stefan finds the cooperative structure of the Vanguard ETFs a great thing, he quickly opens a depot at DKB and sets up a savings plan of 100 euros a month.

Get in the financial crisis now: Gerlinde, self-employed, 55 years old

Gerlinde is 55 years old and owns a small advertising agency. Since she only entered the stock market at the end of 2019 with a large one-off investment, her portfolio is now blood red. Gerlinde should take a deep breath. Despite the strong pullback, it would be unwise to sell now. So far, the markets have recovered after every setback, no matter how severe. However, that can take a long time. Sometimes several years. If Gerlinde still has some cash in her money market account, she could think about it strike again cheaply now. To be on the safe side, she can buy the positions in small pieces with a savings plan. That spreads the risk a bit.

Course bets and market timing are not investments!

Lisa and Stefan can adjust your monthly savings rate at any time. In addition, excess money can be put into the investment that has now been created at any time by means of a one-off investment. As soon as there are first signs of a calming down pandemic, the stock markets will also calm down again. Much of this has already happened in the past few weeks. Since hopes are always traded, the recovery on the markets will probably take place a little earlier

You won't hit the low point to buy again, even people who don't do anything else during the day than watch the markets fail. Don't waste energy on price betting and market timing. Instead, act promptly and decisively. If it then goes down a little further, it doesn't matter much in the long term: In 15 years, it won't matter to your portfolio. The more decisive question will then be whether you had the courage to take advantage of the opportunities with your hard-earned money to make the best of this crisis.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

1. There has never been a "corona pandemic", only the pipe dream of the same name.

2. The economic damage caused by the "corona measures" is enormous and most people don't even know how gigantic the damage really is:

3. The now inevitable, final crash of the stock exchanges will soon destroy a share capital of approx. 70 trillion (7×10^13) dollars!

So one has to ask: how could such a destructive event of such gigantic proportions actually occur for nothing (there is no doubt about it)?

Any conspiracy theories (regarding business interests in the pharmaceutical industry, stupid Bill Gates, etc.) can be forgotten, because the few billions that can be earned with it are not even "petty cash" compared to the economic damage worldwide.

One can also forget that the event happened “accidentally”. So what is actually going on on this little blue planet?

No matter what one dares to imagine, the truth, as always, will be far more amazing...

http://opium-des-volkes.blogspot.com/2020/05/vater-aller-dinge.html