Do you already know one of the simplest investment strategies? It is an ETF portfolio which you can easily create yourself in just a few steps. Stiftung Warentest calls it the slipper portfolio. Others speak of a broadly diversified passive investment strategy. The video summarizes the essential facts in just under 3 minutes:

The video is embedded by Youtube and only loaded when the play button is clicked. The apply Google Privacy Policy.

Getting started: depot selection

What you can learn here

- Getting started: depot selection

- The simple basic slipper portfolio

- Slipper portfolio: what variants are there?

- How long is the investment horizon for an ETF portfolio?

- What percentage of my wealth should I put in my ETF portfolio?

- Is there a recommended minimum investment amount?

- Build up an ETF portfolio with small monthly installments using a savings plan

- What do I still have to do after setting up the ETF portfolio?

Before implementing the slipper portfolio strategy, you need the cheapest possible depot. If you don't have a depot yet, I recommend that you take a look at the depot comparison. In 2020 in particular, two exciting providers came onto the scene. I'm talking about Trade Republic*. But more about that here.

If you've never bought a stock or other security, find Here is a step-by-step guide to buying your first share.

In addition, you should keep a small percentage of your assets in a flexible cash account have. Don't invest all your savings in the stock market! This way, you can react flexibly in case of sudden purchases such as a new Washing machine or similar should be necessary.

The simple basic slipper portfolio

The basic variant, which is easy to implement, consists of just two components:

- A stock ETF on the world stock index and

- A bond ETF on a euro government bond index (alternatively, a call money account with good interest rates)

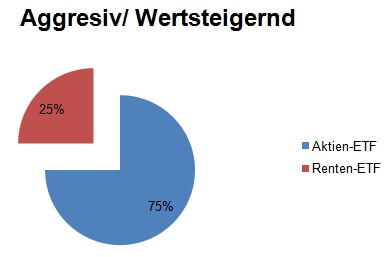

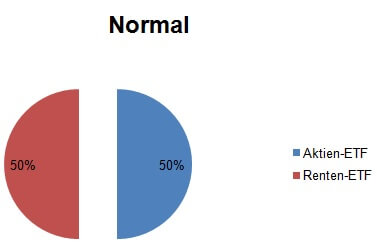

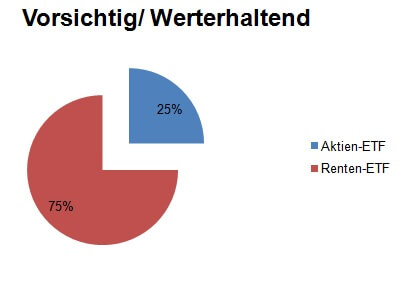

Depending on your personal preferences, you can mix stocks and bond ETFs in such a way that the focus is on maintaining or increasing value. In general, the chance of higher profits is always accompanied by the risk of higher losses.

Slipper portfolio: what variants are there?

The slipper portfolio is flexible. You can vary both the composition of the stock ETF and bond ETF and the corresponding ETFs themselves. For example, you can choose an ETF on a European index instead of a stock ETF on the world stock index. Another variation is to add ETFs from emerging markets or commodities such as gold. Due to the broad diversification of the world stock index, however, these variations are not necessary and do not necessarily increase returns. If you want it simple and good, start with the basic slipper portfolio

How long is the investment horizon for an ETF portfolio?

Investing in stocks is long-term. Due to the short-term ups and downs in stocks, plan with an investment period of at least seven, preferably ten years. With equity funds, you invest in volatile markets. The current depot balance can therefore clearly get into the red. In the long term, however, equity funds offer better return opportunities than safe investments.

Read more here: Actively or passively managed funds?

What percentage of my wealth should I put in my ETF portfolio?

The slipper portfolio is your vehicle for long-term wealth accumulation. Accordingly, it is advisable to only invest money there that is not needed in the short term. I recommend about two to three months' salary as a nest egg available at short notice on a giro (to compare the best checking accounts) or money market account (to compare the best money market accounts) to keep available. Furthermore, it is advisable not to invest money for planned purchases such as a new car in the stock market in the short term. By the way: The slipper portfolio can also be easily built up with a monthly savings rate through a savings plan.

Read more here to compare the best checking accounts or to the best money market accounts

Is there a recommended minimum investment amount?

Not really. You can set up savings plans from as little as 25 euros. For example, this is at the consor bank possible. However, the fees decrease with the traded fund volume, especially for one-off purchases. From my point of view, however, this does not represent an obstacle to starting to build up the portfolio at an early stage, even with small amounts.

Open savings plans from as little as 25 euros at the Consorsbank

Build up an ETF portfolio with small monthly installments using a savings plan

It is also possible to build up a portfolio through small savings installments. Thus, from monthly savings installments of 25 euros after 20 years at an assumed average interest rate of 5 % after Inflation already a fortune of 10,188.45 euros. That's enough for a used mid-range car.

If you need more information on building your ETF portfolio, you can also check out this guide to building your first ETF portfolios use from Northern Finance. The guide contains further information about the classic 70/30 world portfolio but also to smarter combinations like that factor portfolio and many other combinations (asset allocations).

What do I still have to do after setting up the ETF portfolio?

It is advisable to check the depot about once a year. Here you can see to what extent your goal of, for example, 50 % equity and 50 % bond ETFs is still up to date. For example, if the stocks have risen significantly more than the bonds, your share is now over 50 %. In fact, because of the fees and taxes involved, you shouldn't switch unless the ETFs deviate more than 20 percent from their initial weighting. An example: If you have decided on a 50-50 mix of equity funds and bonds, you only have to adjust (rebalance) when the share of the equity fund in the portfolio rises above 70 % - or falls below 30 %. It may not be necessary for years. After major market corrections, a rebalance also makes sense during the year.

2 thoughts on “ETF Portfolio einfach selbst erstellen”